Market Commentary – Q4, 2025

U.S. markets faced a turbulent first quarter in 2025, with large-cap stocks down 4% and small-cap stocks declining nearly 10%. Amid aggressive trade policies and

U.S. markets faced a turbulent first quarter in 2025, with large-cap stocks down 4% and small-cap stocks declining nearly 10%. Amid aggressive trade policies and

U.S. markets faced a turbulent first quarter in 2025, with large-cap stocks down 4% and small-cap stocks declining nearly 10%. Amid aggressive trade policies and

U.S. markets faced a turbulent first quarter in 2025, with large-cap stocks down 4% and small-cap stocks declining nearly 10%. Amid aggressive trade policies and

U.S. markets faced a turbulent first quarter in 2025, with large-cap stocks down 4% and small-cap stocks declining nearly 10%. Amid aggressive trade policies and

U.S. markets faced a turbulent first quarter in 2025, with large-cap stocks down 4% and small-cap stocks declining nearly 10%. Amid aggressive trade policies and

U.S. markets faced a turbulent first quarter in 2025, with large-cap stocks down 4% and small-cap stocks declining nearly 10%. Amid aggressive trade policies and

U.S. markets faced a turbulent first quarter in 2025, with large-cap stocks down 4% and small-cap stocks declining nearly 10%. Amid aggressive trade policies and

U.S. markets faced a turbulent first quarter in 2025, with large-cap stocks down 4% and small-cap stocks declining nearly 10%. Amid aggressive trade policies and

U.S. markets faced a turbulent first quarter in 2025, with large-cap stocks down 4% and small-cap stocks declining nearly 10%. Amid aggressive trade policies and

In February 2025, U.S. markets experienced mixed results as large-cap stocks fell 1.3% and small-cap stocks dropped 5.3%, while intermediate-term bonds gained 2.2%. Amid rising

In January 2025, U.S. large-cap stocks surged by 2.8%, while a new player in the AI arena, DeepSeek, launched a groundbreaking model that challenges established

In 2024, U.S. large-cap stocks soared, achieving over 50 new all-time highs and ending the year up 25%. Despite persistent inflation and rising interest rates,

U.S. equities experienced a significant rally following the 2024 presidential election, with large-cap stocks rising 6% and small-cap stocks soaring by 11% in November. The

As inflation showed signs of slowing in the fourth quarter, both stocks and bonds recovered some of their losses from previous quarters, and most assets

In the third quarter of 2024, U.S. large-cap stocks soared 5.9%, while small caps outperformed with a 9.3% gain. The Federal Reserve’s unexpected 50 basis

As we bask in the “lazy, hazy, crazy days of summer,” August 2024 brought unexpected twists to the markets. U.S. large cap stocks rebounded to

U.S. small cap stocks delivered a remarkable 10% gain in July, outpacing large cap stocks by the widest margin since February 2000. This shift in

U.S. markets experienced a mixed bag in Q2 2024, with large cap stocks rising 4.3% while small caps fell 3.3%. Despite expectations for interest rate

May 2024 proved to be a remarkable month for U.S. equities, with both large cap and small cap stocks rising 5%. As inflation pressures eased,

In April 2024, the stock market faced significant pressure from rising bond yields and geopolitical tensions, leading to notable declines in both large and small

Equity markets wrapped up Q1 2024 on a high note, with the S&P 500 reaching new all-time highs and U.S. large cap stocks soaring 10.6%.

Equity markets experienced a remarkable rally in February, with U.S. small cap stocks leading the charge, up 5.7%. The S&P 500 reached new highs, marking

As we dive into 2024, the U.S. economy showcases surprising resilience, with a robust 3.3% growth in Q4 2023 and rising consumer confidence. However, the

As we close the chapter on 2023, the market has shown remarkable resilience amidst recession fears and geopolitical tensions. U.S. large cap stocks surged 26.3%,

In November 2023, both stocks and bonds experienced a remarkable upswing, with U.S. large cap stocks soaring 9.1% and the Bloomberg U.S. Aggregate Bond Index

In October 2023, financial markets faced significant challenges, with the Bloomberg Aggregate Bond Index marking its longest stretch of negative returns since the 18th century.

As the S&P 500 closed September down 3.3%, the market faces significant challenges ahead. With the Bloomberg U.S. Aggregate Bond Index experiencing its largest three-year

In August 2023, the S&P 500 faced a 1.6% decline, yet it remains an impressive 18.7% higher year-to-date. As the Federal Reserve maintains its “higher

Markets continued their hot streak in July, with the S&P 500 posting its fifth consecutive month of positive returns, ending the month up 3.2%. However,

The first half of 2023 has been anything but ordinary, marked by a banking crisis, a near U.S. debt default, and a surge of excitement

May 2023 was a month of significant economic shifts, marked by the Federal Reserve’s interest rate hike and the suspension of the debt ceiling until

U.S. equity markets have shown impressive gains this year, with year-to-date returns exceeding 9%. However, the backdrop is fraught with challenges, including a looming debt

As we navigate the complexities of Q1 2023, the financial landscape has been anything but stable. The dramatic collapse of Silicon Valley Bank and Signature

As inflation continues to outpace the Federal Reserve’s 2% target, the U.S. economy faces a perplexing challenge: the “money illusion.” While nominal earnings and retail

As we kick off 2023, markets are showing remarkable resilience, with both stocks and bonds delivering positive returns. The NASDAQ Composite celebrated its best January

As inflation showed signs of slowing in the fourth quarter, both stocks and bonds recovered some of their losses from previous quarters, and most assets

Two of the most powerful economies in the world, the U.S. and China, are both facing critical decisions, and their choices will create ripple effects

The reversal of FAANG stocks’ long-term dominance has loomed large over markets this year. The FAANG stocks ended October with year-to-date losses of more than

In the first half of the quarter, stocks and bonds rallied on the hopes of a Fed policy pivot, but a sharp reversal in the

Terrible global conflict continues with Ukraine resolutely defending itself against Russia, Russia dealing with severe sanctions, and western Europe bracing for a winter marked by

Though second-quarter S&P500 earnings were up overall, excluding the energy sector, earnings are expected to decline 3.7% relative to the same quarter last year.

The past six months have been the worst start to a year for a traditional“60/40” portfolio since 1932 when the U.S. economy was in the

Equity markets remained volatile in May as a late-month rally erased losses, pushing most indexes to slight gains for the month.

Energy prices continued

Global markets have been roiled by a succession of blows in April – higher bond yields, lingering post-pandemic supply chain imbalances, a commodity price shock

The global economy was hit with not one, but two crises in Q1 2022 – first the pandemic and then Russia’s invasion of Ukraine. As

In February 2022, the world was shaken by the news that Russia had invaded Ukraine. The conflict had a ripple effect on global markets, with

As inflation showed signs of slowing in the fourth quarter, both stocks and bonds recovered some of their losses from previous quarters, and most assets

The S&P 500 Index had its best month of the year in October, rising 7% and bouncing back from September’s 4.7% loss, its worst month

Following its best month of the year, the S&P 500 Index cooled off in November, falling 0.7%. Volatility increased across markets due to a new

As inflation showed signs of slowing in the fourth quarter, both stocks and bonds recovered some of their losses from previous quarters, and most assets

The U.S. stock market rallied for the seventh consecutive month in August, adding to an unusually impressive – and relatively calm – year thus far

During July, fears of impending inflation declined, sparking a positive response in yield-sensitive assets and mixed results in other markets. Regulatory crackdown in China, combined

Most asset prices rose during the quarter amidst continued economic reopening and extraordinary levels of policy accommodation. Bonds rallied during the quarter, reversing a portion

Real assets were the top performers for the month of May due to the continued reopening of the U.S. economy and historic levels of stimulus

The majority of asset classes rose for the month, and most have generated year-to-date returns that would be considered attractive for an entire year. Policymakers

At the end of the quarter, investors enjoyed the robust returns of riskier asset classes and policymakers’ continued commitment to extraordinary accommodation. The celebratory mood

Are you curious about the current state of the US equity market? Look no further than this month’s market commentary, which examines the ongoing cycle

A budding economic recovery and the hopes of additional stimulus drove strong returns for U.S. small cap stocks, emerging market stocks, commodity futures, and midstream

As we cross the one-year anniversary of the WHO’s formal declaration of the COVID-19 pandemic, the market’s attention has shifted from rampant excitement over stimulus

Redefining Normal ■ While COVID-19 remains a critical health issue, positive vaccine developments and abundant liquidity provided in 2020 boosted the prices of risky assets.

Developments during the month of November, particularly election results and vaccine news, served to remove uncertainties, and as a result, asset prices increased substantially across

Record voter turnout resulted in a divided federal government, pending Georgia Senate runoff. Divided government tends to be viewed more favorably by equity markets and

COVID-19 remains a critical health issue that is creating an uneven recovery across the U.S. economy and capital markets. The Federal Reserve, Treasury, and federal

Markets continued their impressive run through August and into early September before pulling back modestly. At its “Jackson Hole” Economic Policy Symposium, the Federal Reserve

Risky assets rallied through July and into August amid a gradual reopening of the economy and persistent market support by the Federal Reserve. Federal support

The current environment represents a unique episode in investment history, combining aspects of the Great Depression, the tech bubble, and the great financial crisis of

As the economic, political, and social costs of lockdowns increased, segments of the U.S. economy gradually reopened in May. By contrast, the rebound in markets

The coronavirus outbreak is a humanitarian crisis first and a financial crisis second. Our thoughts are with those directly affected by COVID-19 and those involved

The economic fallout from the coronavirus crisis ramped up in April. Since the start of the crisis, the U.S. has lost over 27 million jobs,

Given the fluidity of the problem and the daily changes in the population affected by the disease, the economic impact associated with coronavirus Covid-19 is

Not that the job of capital market forecasting and portfolio management is easy by any stretch, but 2020 sets up as an environment that is

Not that the job of capital market forecasting and portfolio management is easy by any stretch, but 2020 sets up as an environment that is

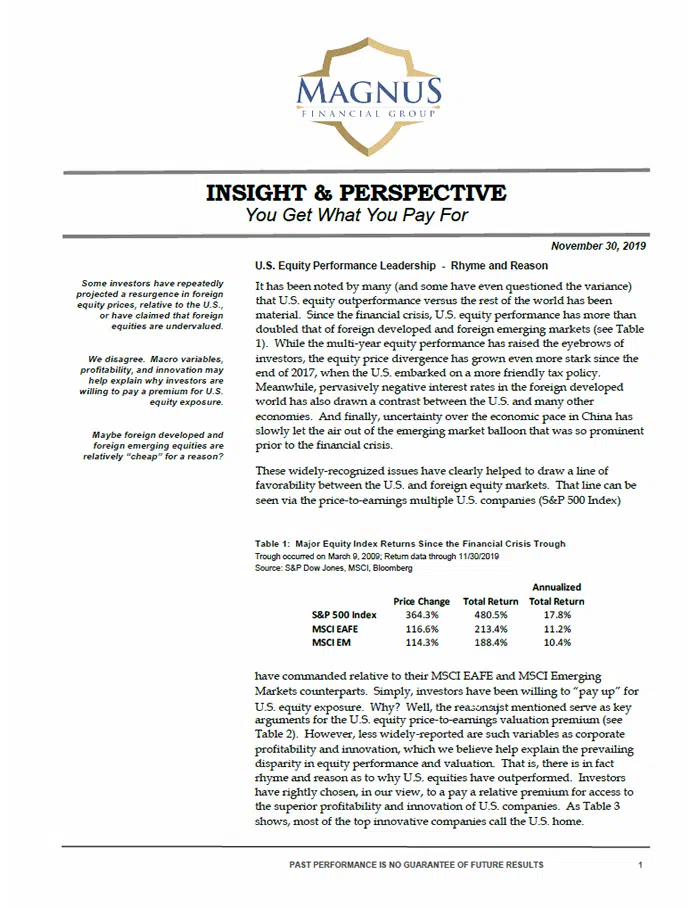

It has been noted by many (and some have even questioned the variance) that U.S. equity outperformance versus the rest of the world has been

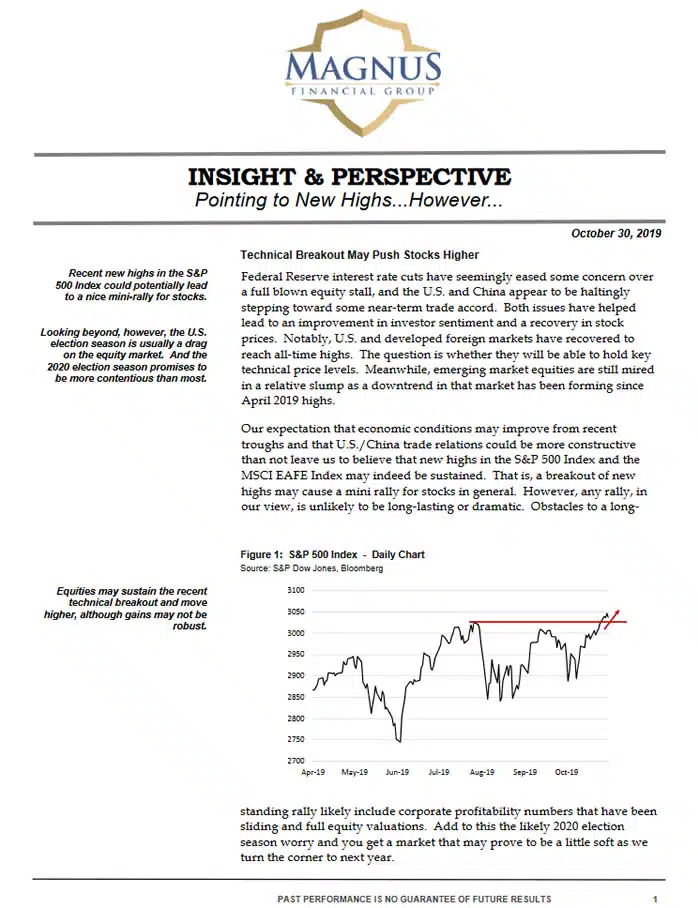

Federal Reserve interest rate cuts have seemingly eased some concern over a full blown equity stall, and the U.S. and China appear to be haltingly

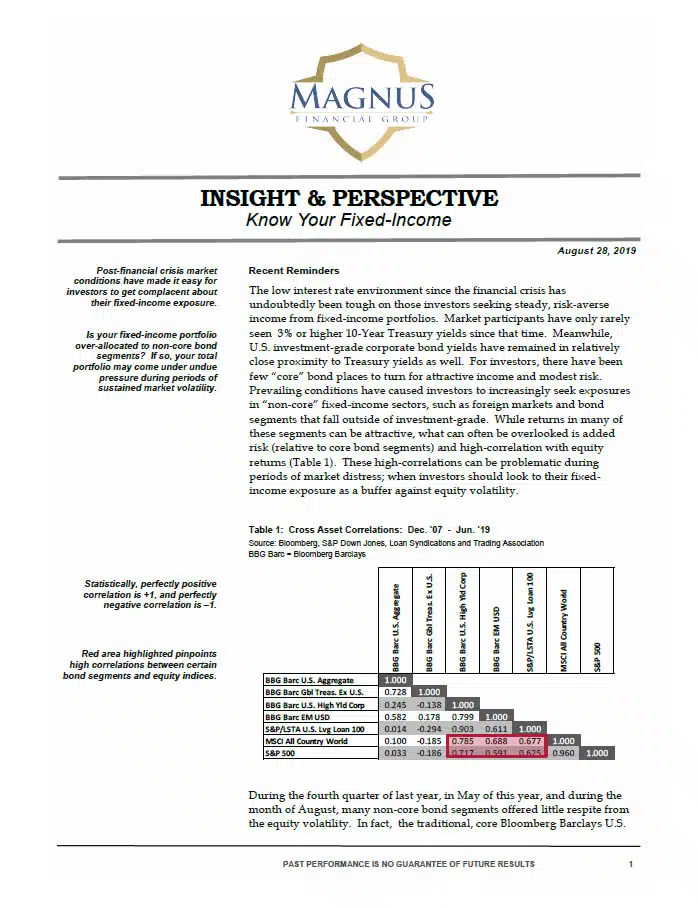

Post-financial crisis market conditions have made it easy for investors to get complacent about their fixed-income exposure.

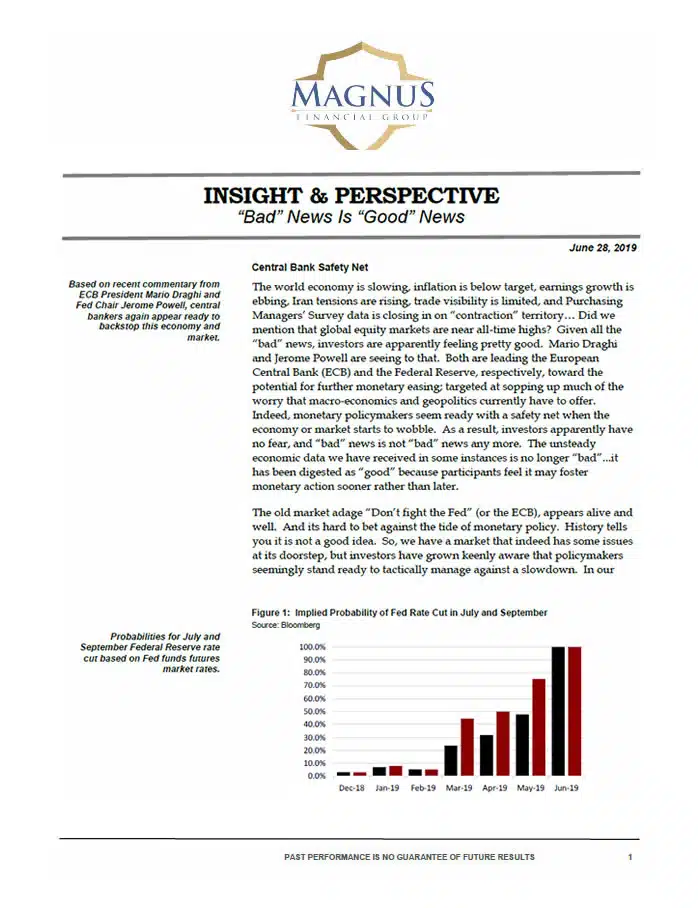

Based on recent commentary from ECB President Mario Draghi and Fed Chair Jerome Powell, central bankers again appear ready to backstop this economy and market.

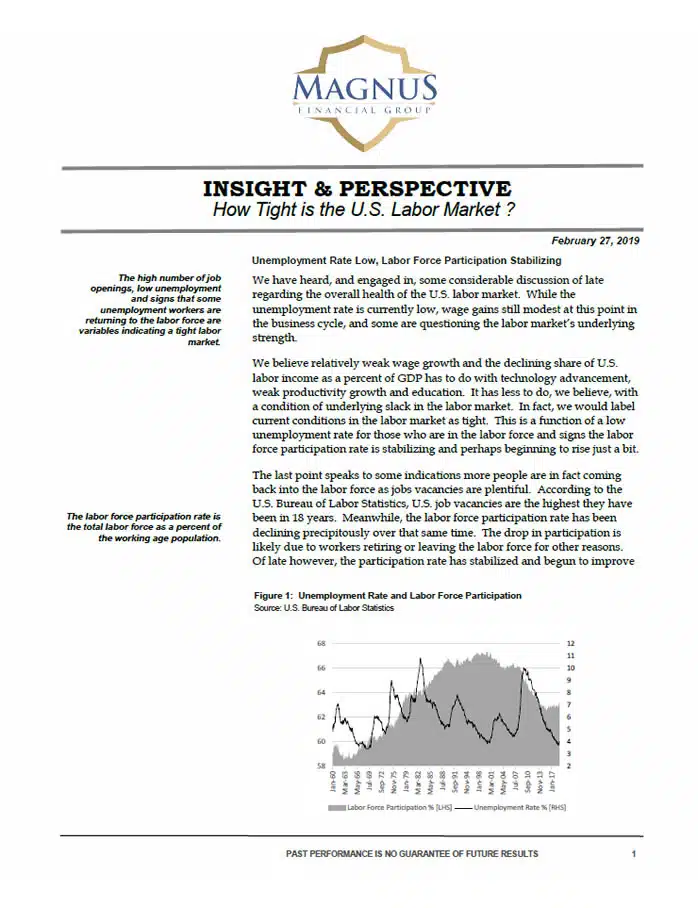

Unemployment Rate Low, Labor Force Participation Stabilizing

You are now leaving the Magnus Financial Group Website and will be entering the Charles Schwab & Co., Inc. (“Schwab”) Website.

Schwab is a registered broker-dealer, and is not affiliated with Magnus Financial Group or any advisor(s) whose name(s) appears on this Website. Magnus Financial Group is/are independently owned and operated. Schwab neither endorses nor recommends Magnus Financial Group. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Magnus Financial Group under which Schwab provides Magnus Financial Group with services related to your account. Schwab does not review the Magnus Financial Group Website(s), and makes no representation regarding the content of the Website(s). The information contained in the Magnus Financial Group Website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.