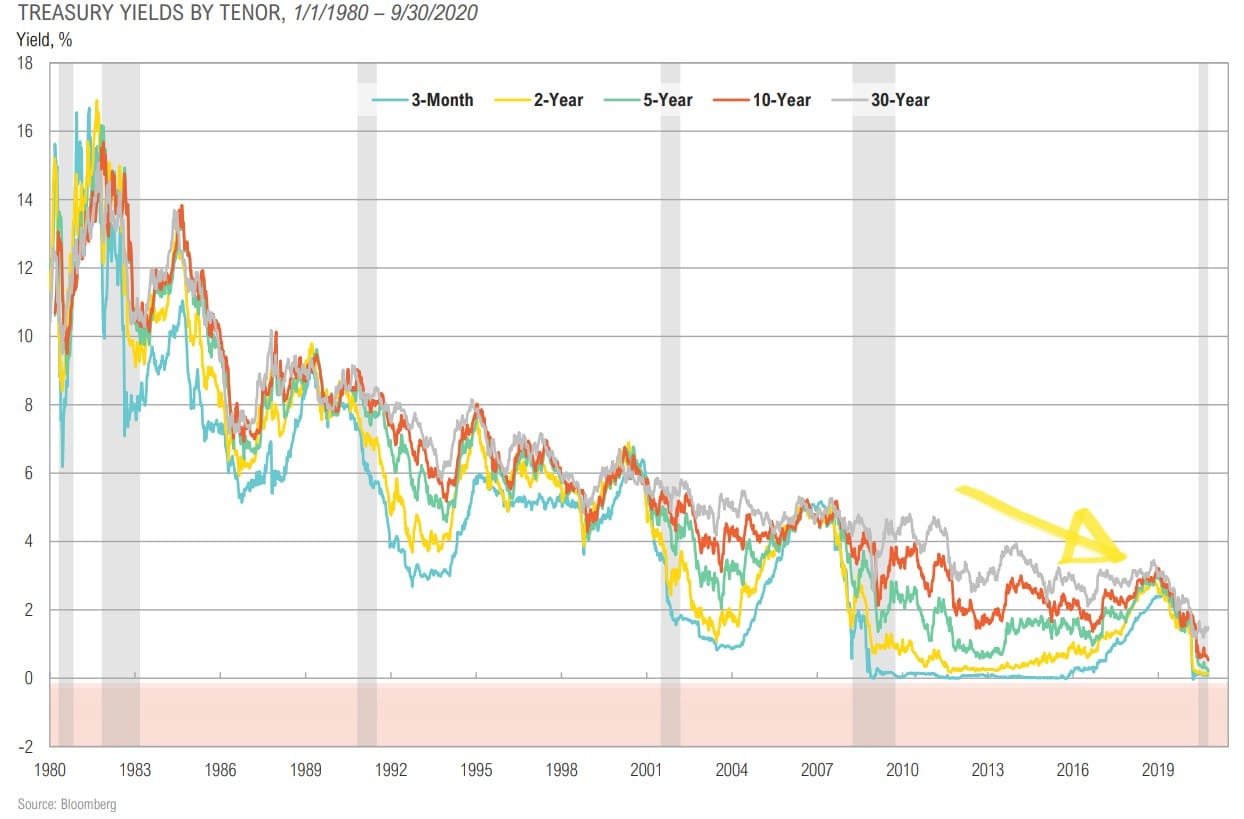

Treasury Yields of All Maturities Have Been Declining Since the Early 1980s & Have Recently Converged with Zero

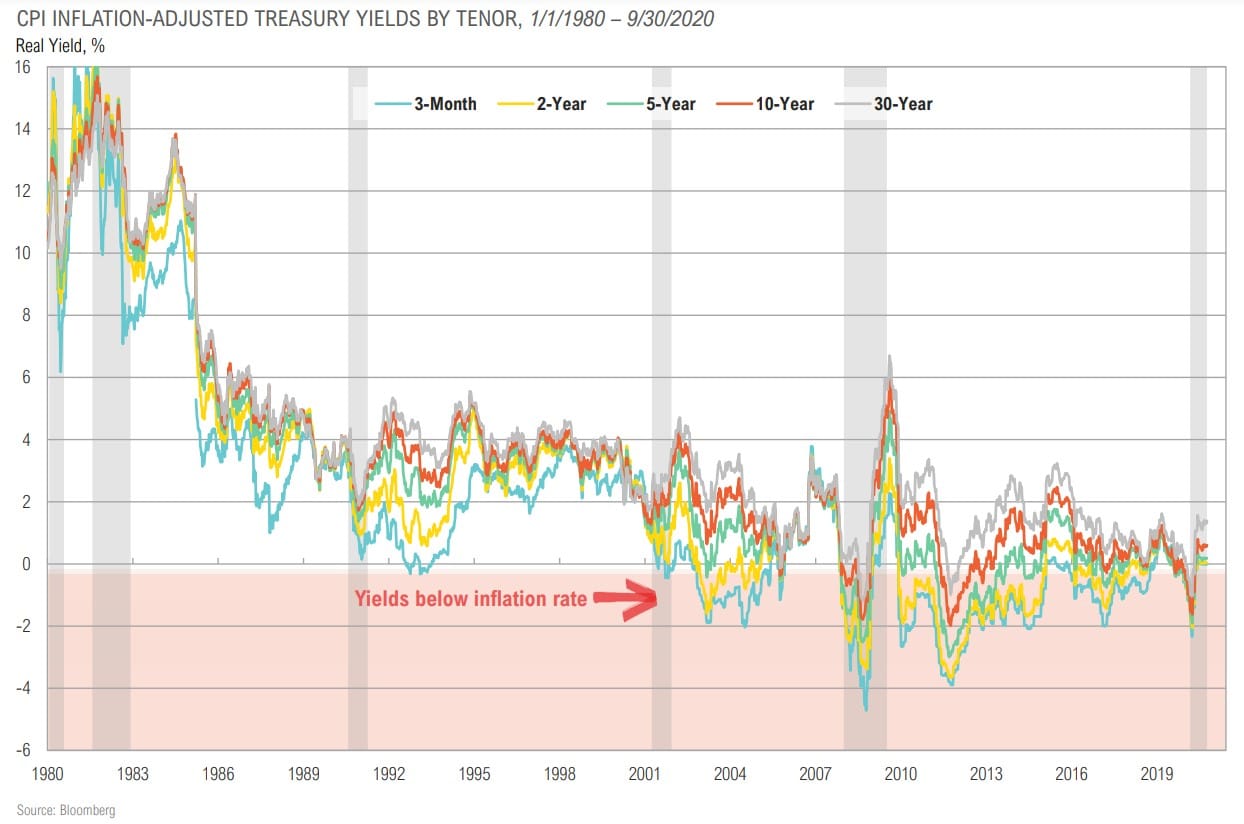

Treasury Yields May Not Protect Investors for the Loss of Purchasing Power From Even Modest Inflation

In Efforts to Spur Growth, Developed Market Policymakers Have Pushed Rates to Near or Below Zero & Plan to Keep Them There for Foreseeable Future

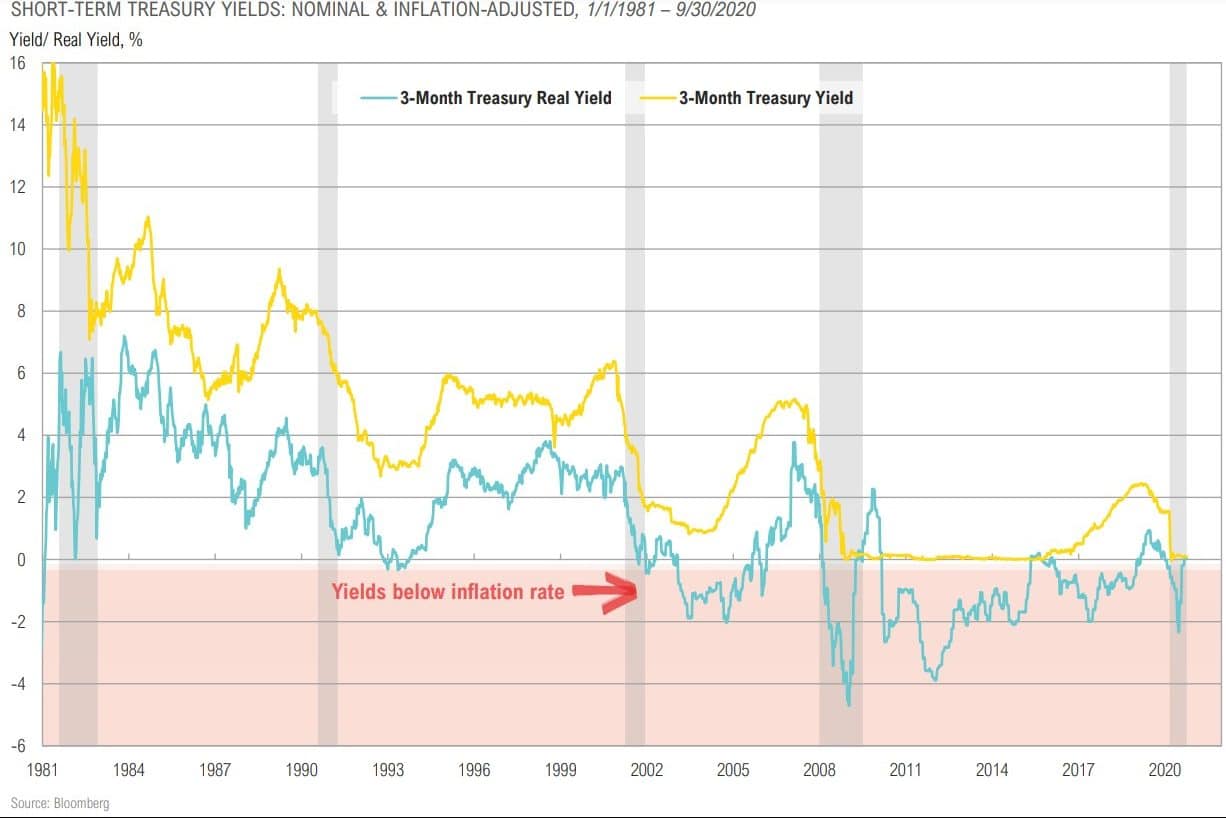

Nowhere to Hide: Yields on Risk-Free Short-Term Government Bonds Are Back at Zero & Have Trailed Inflation for Most of The Last Two Decades

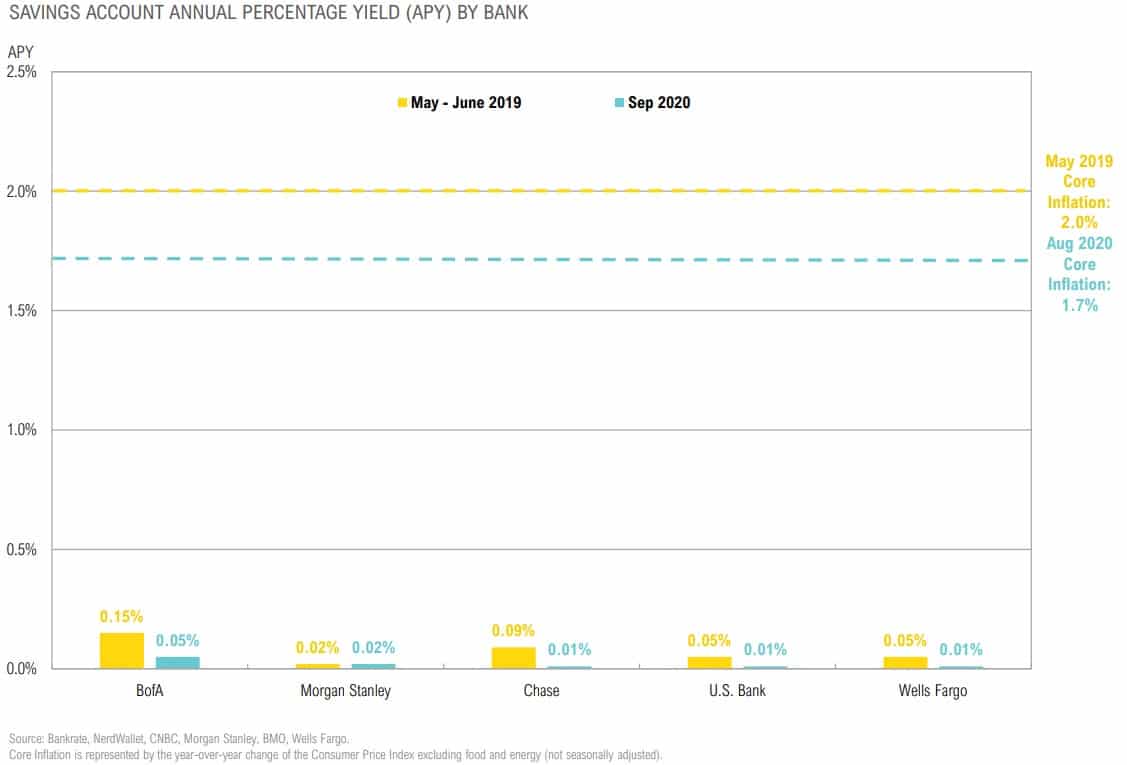

Yields on Many Standard Savings Accounts Are Near Zero

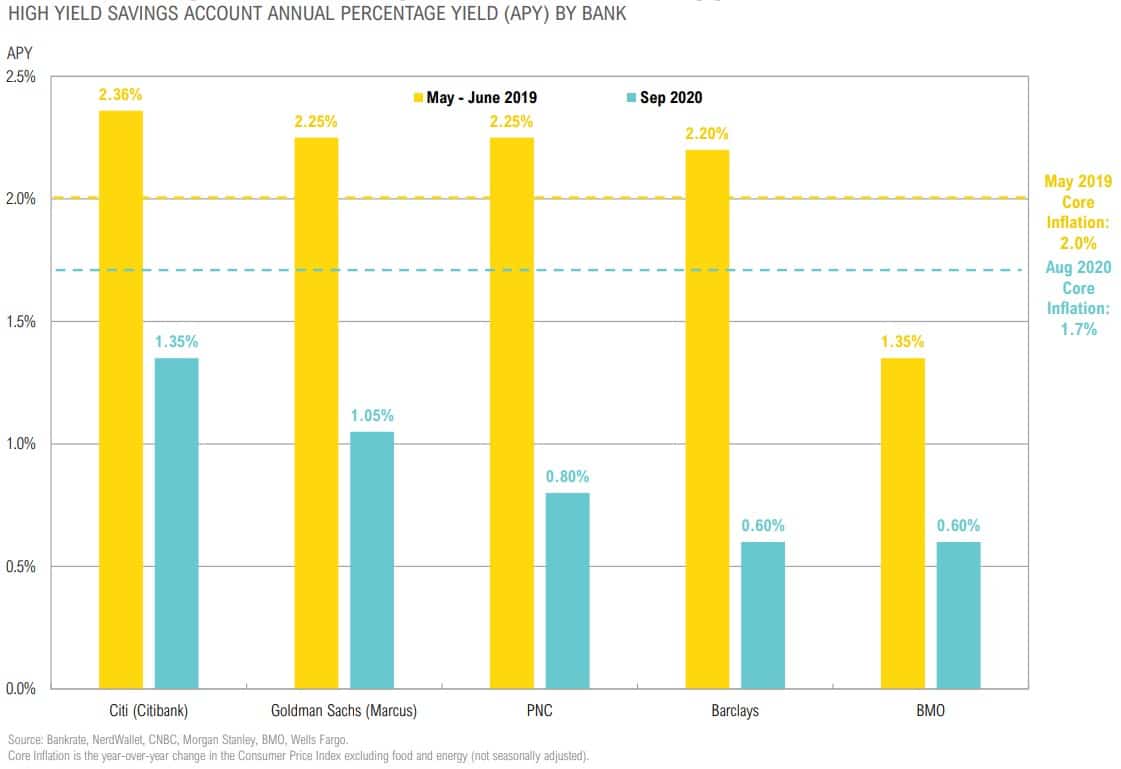

Yields on High Yield Savings Accounts Have Dipped Below Inflation

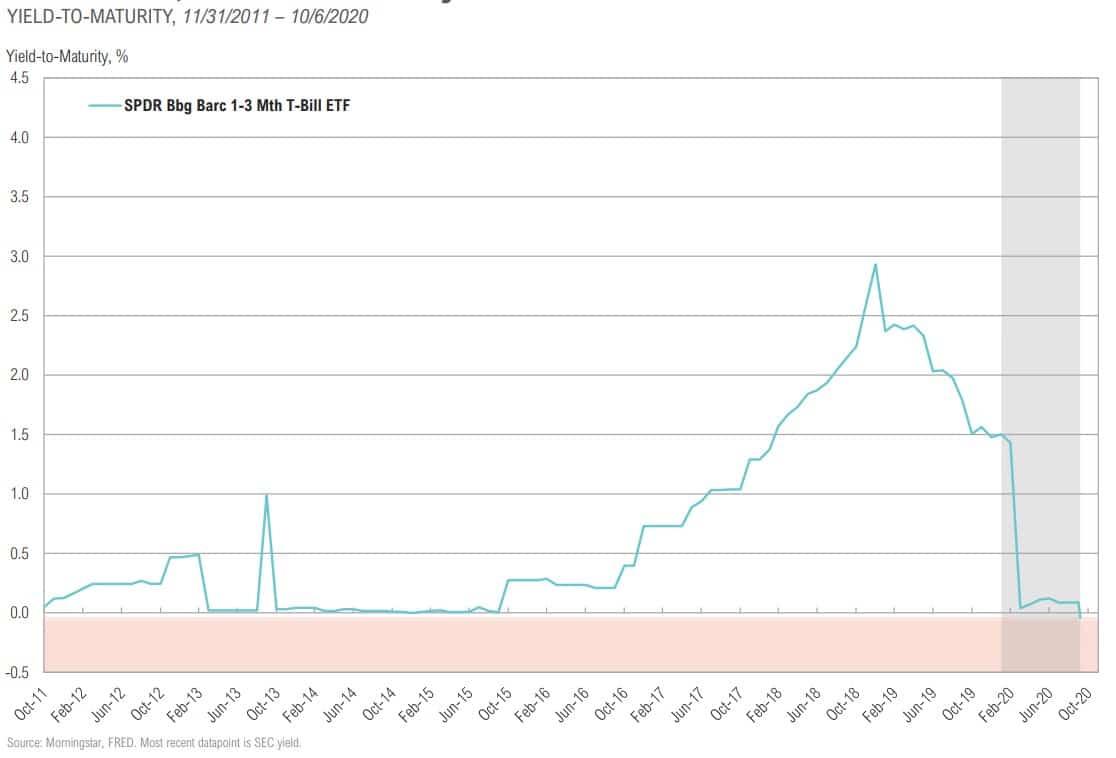

Net of Fees, Common Treasury ETFs Now Yield Less than Zero

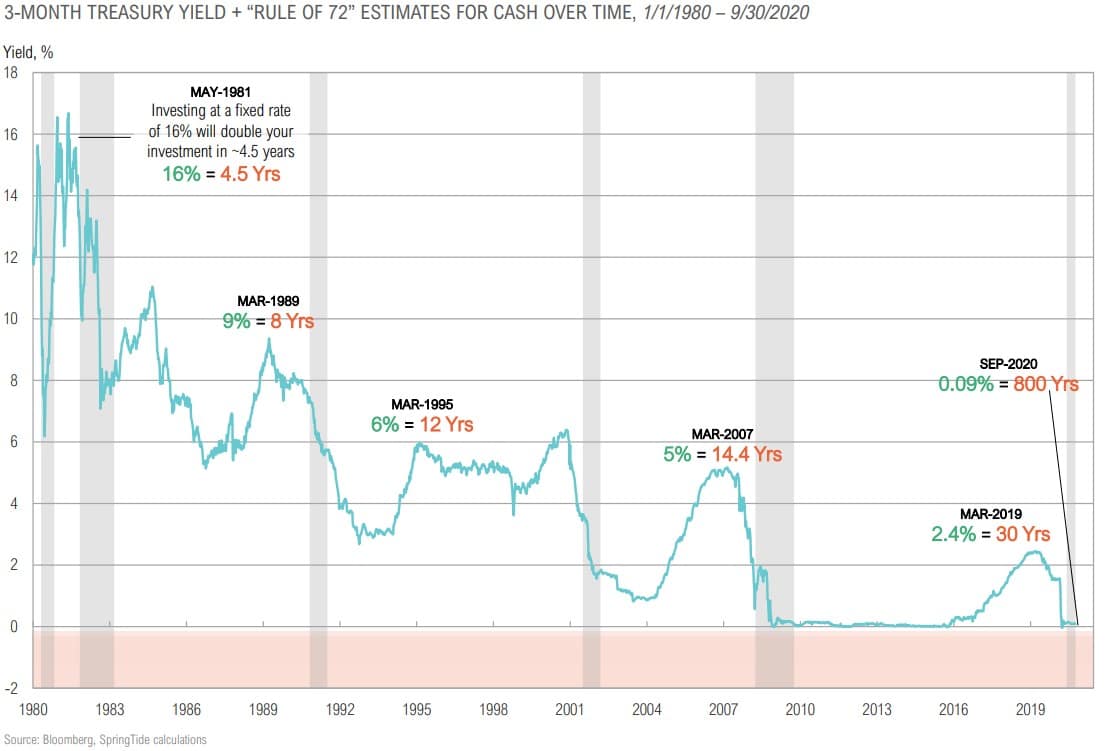

The Long-Term Implications of Zero Rates: No Compound Interest

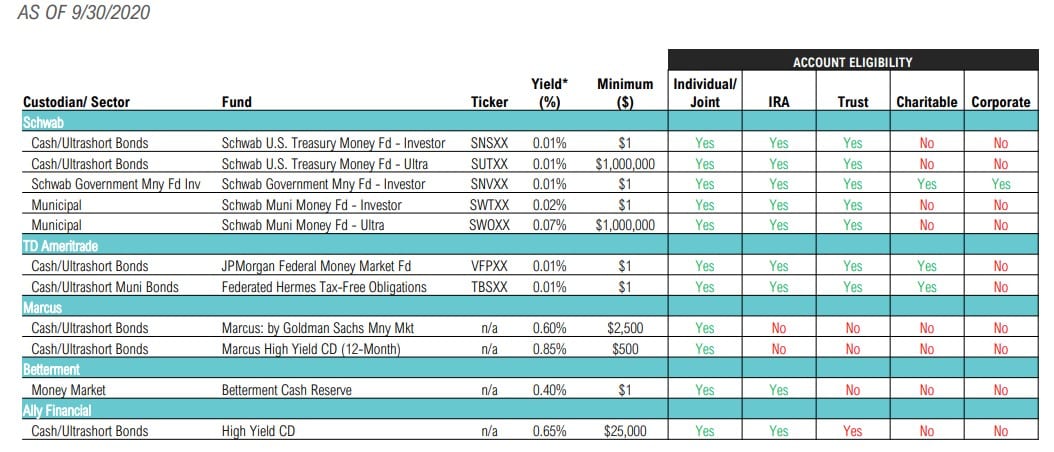

Cash & Liquidity Reserve Implementation Cheat Sheet

DISCLAIMER

Past performance is no guarantee of future performance. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward-looking statements, however, due to numerous factors, actual events may differ substantially from those presented. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases. Additionally, please be aware that past performance is not a guide to the future performance of any manager or strategy, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be inferred that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. While we believe this information to be reliable, we bear no responsibility whatsoever for any errors or omissions. Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. Index results assume the reinvestment of all dividends and interest. Moreover, the information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s accounts should or would be handled, as appropriate investment decisions depend upon the client’s specific investment objectives.

TERMS OF USE

This report is intended solely for the use of its recipient. There is a fee associated with the access to this report and the information and materials presented herein. Re-distribution or republication of this report and its contents are prohibited. Expert use is implied.