SUMMARY

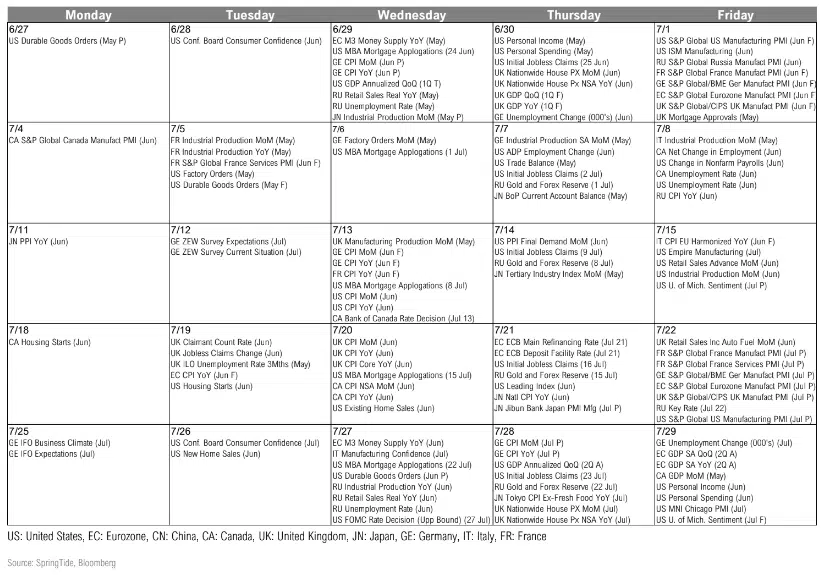

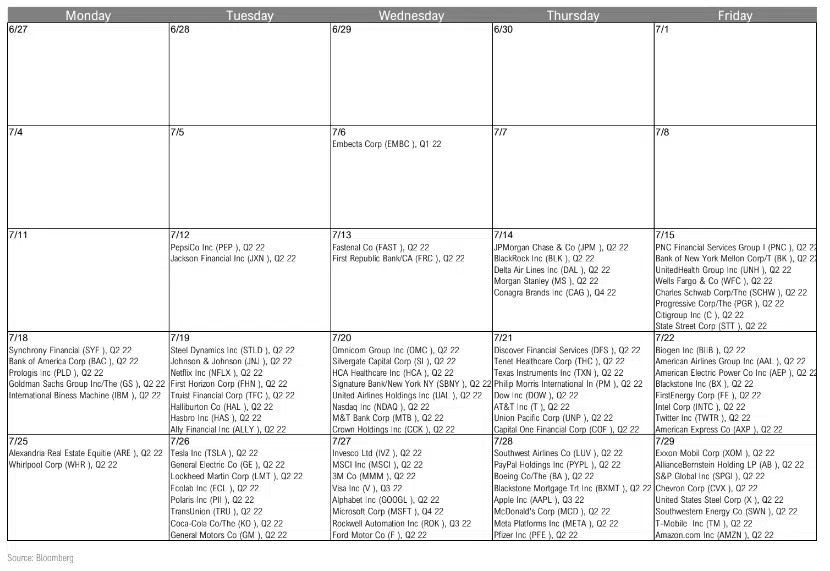

ECONOMIC CALENDAR

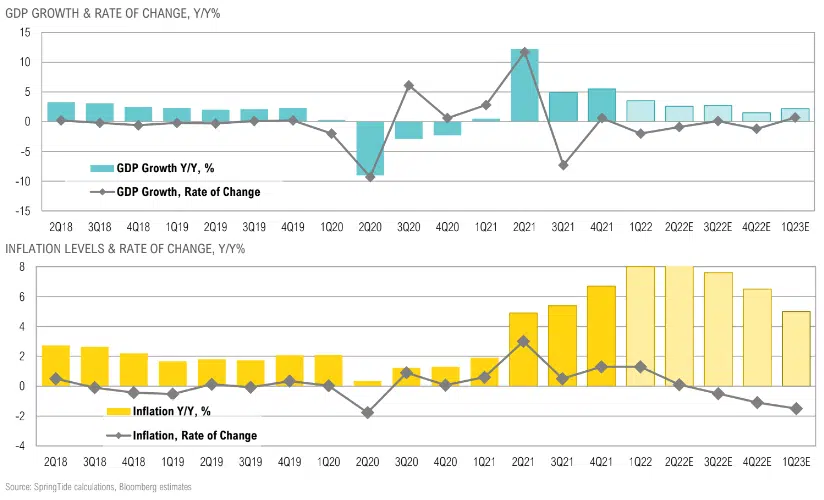

GROWTH, INFLATION & POLICY

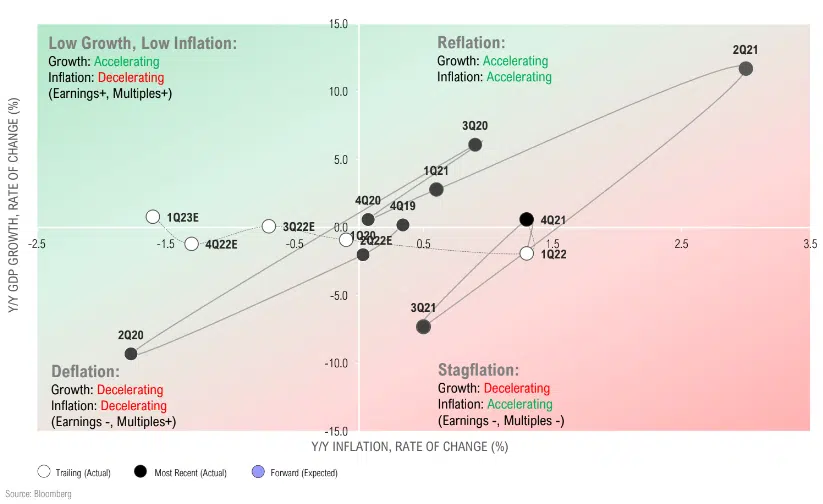

GROWTH & INFLATION CYCLE

Consensus expected growth and inflation to decelerate in 2022; however, persistent inflation has driven the U.S. economy along a stagflation knife’s-edge

Consensus expected growth and inflation to decelerate in 2022; however, persistent inflation has driven the U.S. economy along a stagflation knife’s-edge

SUMMARY

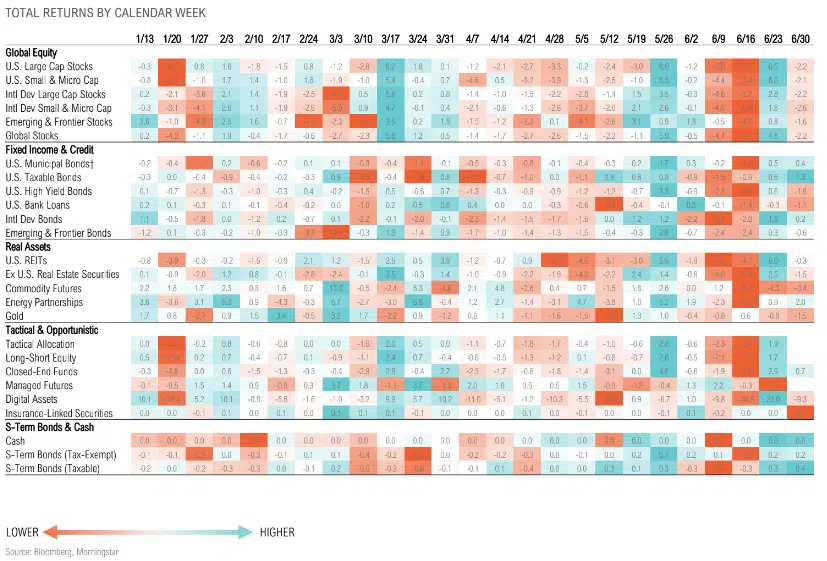

WEEKLY ASSET CLASS RETURNS

GROWTH, INFLATION & POLICY

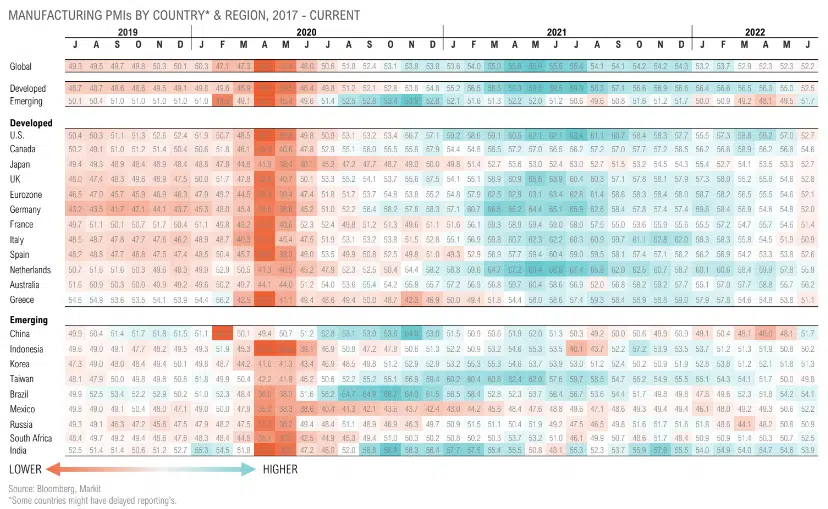

Global manufacturing activity stalled in June; emerging markets rebounded modestly but developed markets slowed further

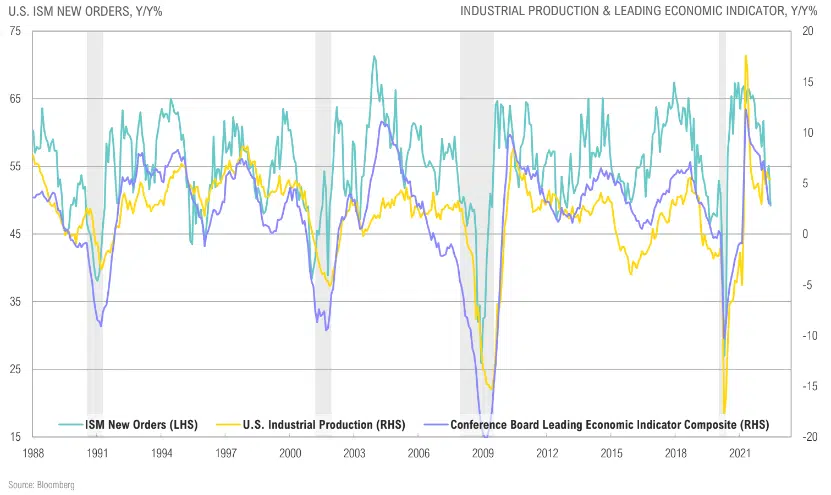

Industrial production and leading indicator growth peaked a year ago, have been slowing since; forward-looking indicators continue to trend lower

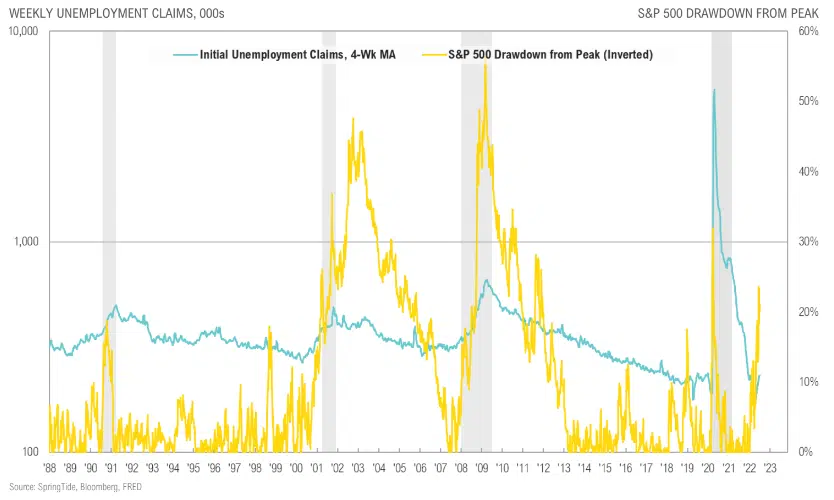

Here we go again? Stocks dropped around 20% from all-time highs signaling potential slowdown; unemployment, which is a lagging indicator, remains low

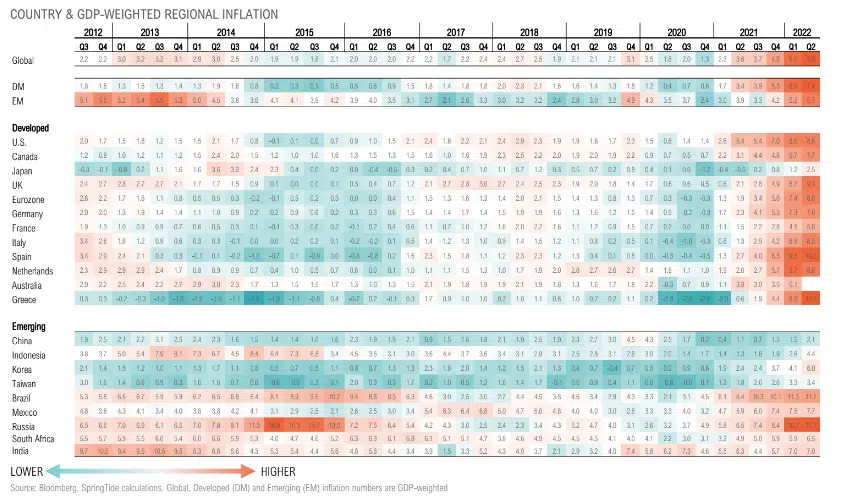

Pre-Russian invasion, inflation was already at a decade-high due to commodity input costs, labor tightness, housing prices, supply chain bottlenecks, etc. Question now becomes how much does it roll over if some/ all of those issues clear?

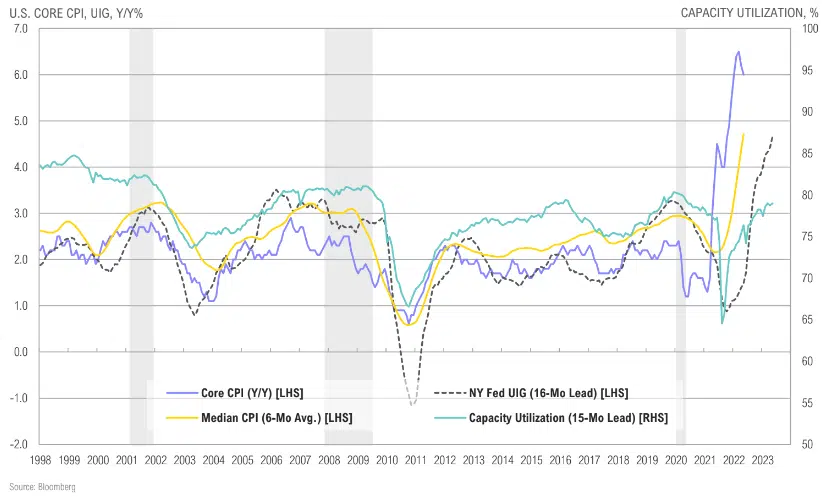

Inflation appears to be peaking on a year-over-year, expected to moderate towards the end of the year; but price pressures remain, we’re are likely not headed back to 2% any time soon

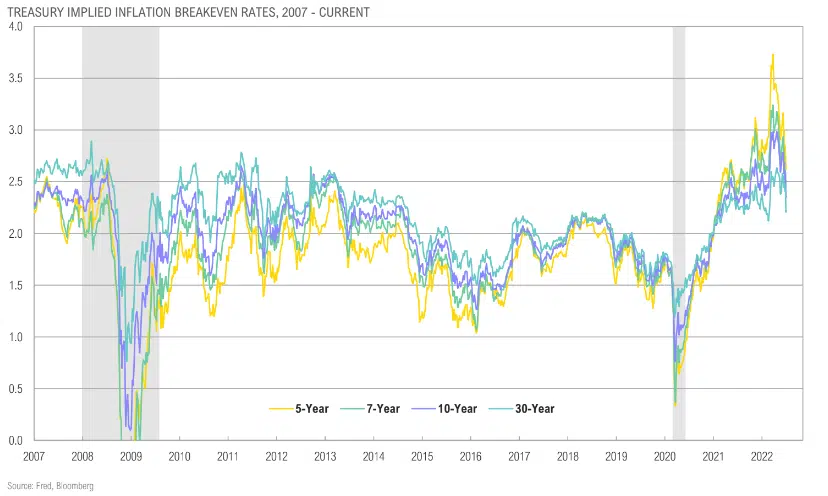

Intermediate-term inflation expectations have eased after breaking out to multi-decade highs

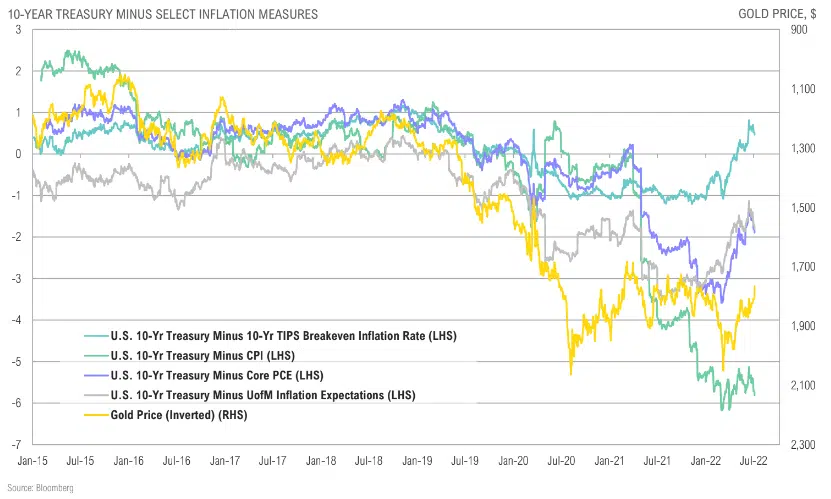

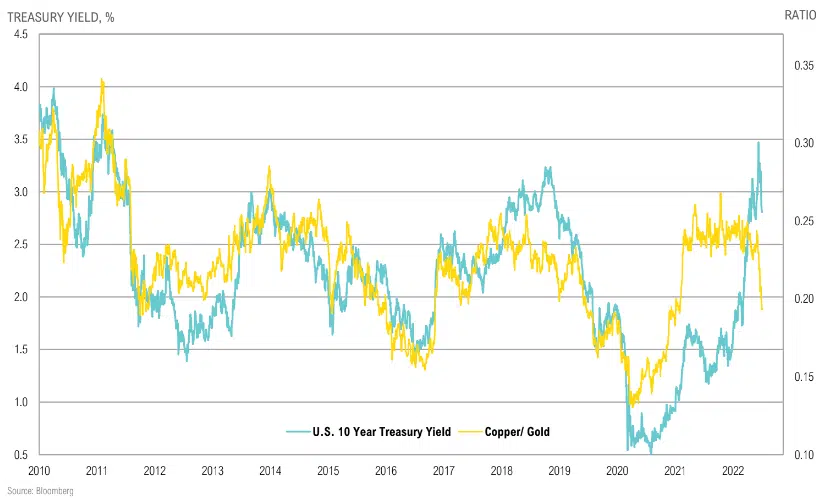

Real yields have remained deeply negative; gold declined in June as interest rates stayed relatively high, but question now becomes can rates rise further without something breaking

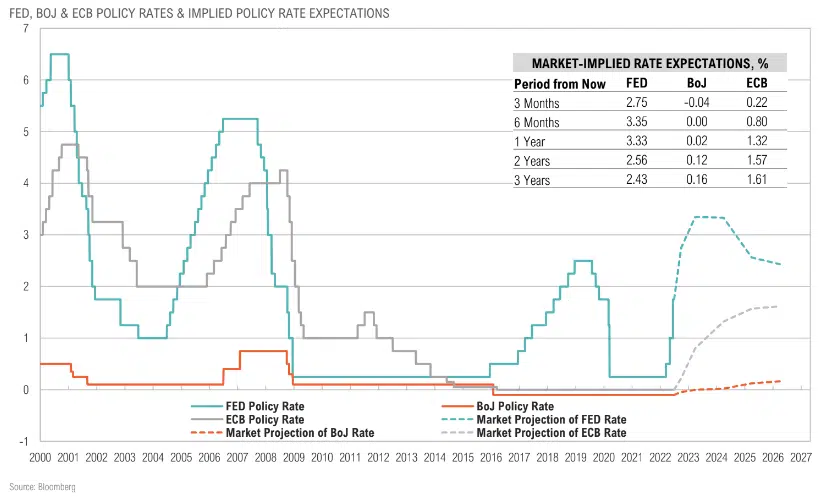

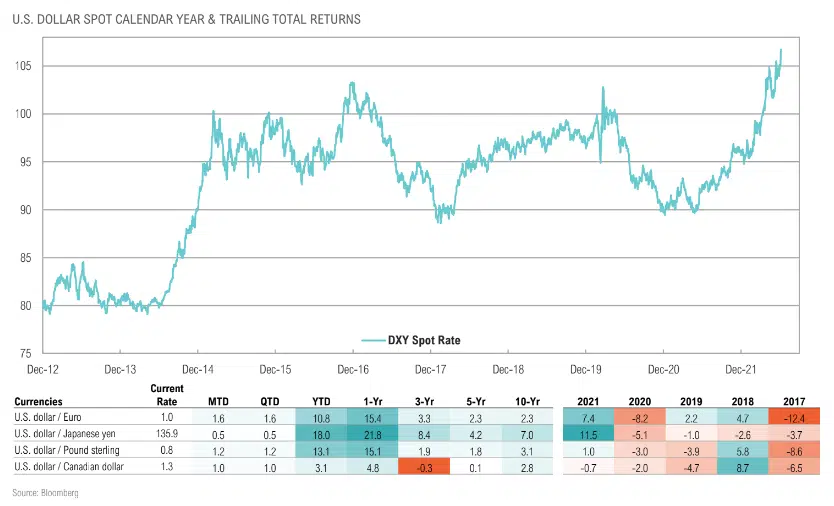

Relative rate expectation differences of U.S. vs. Europe and Japan are still dramatic, supporting the U.S. dollar, but note how market now pricing in rate cuts after 2023

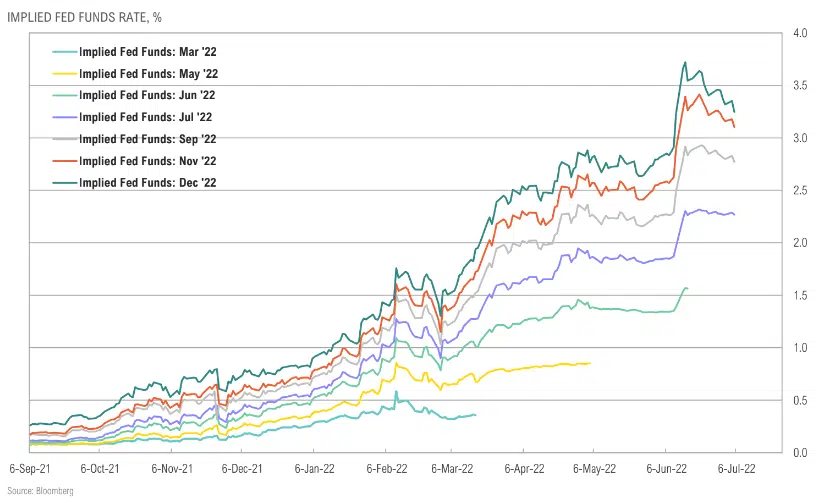

Despite the sell-off in risky assets, the market is still expecting a Fed Funds rate of over 3.0% by the end of the year

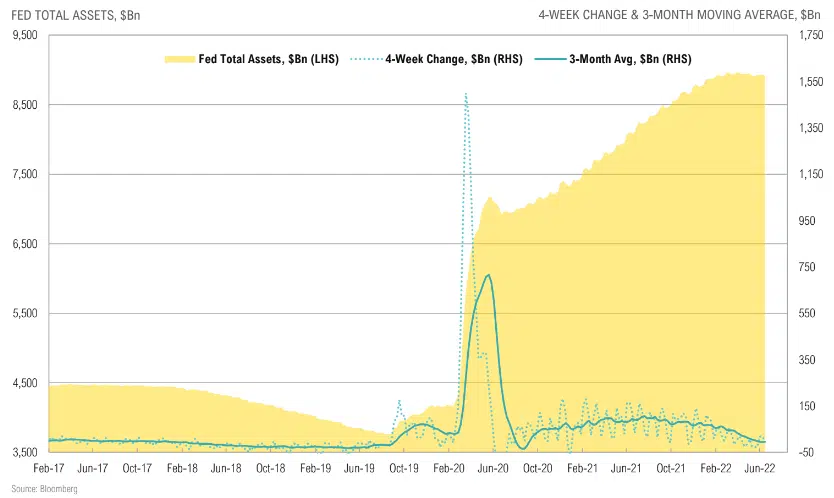

Fed’s planned bond sales ($45 billion/month starting in June) yet to translate to any meaningful reduction in the size of the balance sheet

EQUITY

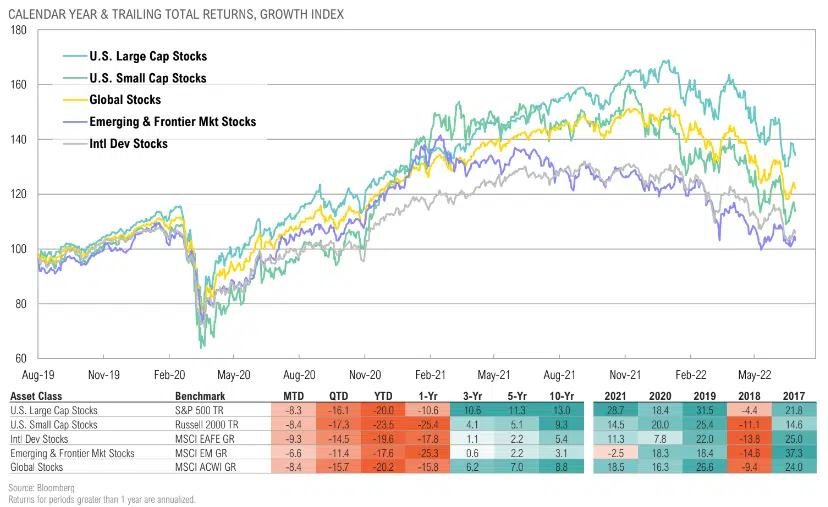

Despite dropping into bear market territory, U.S. stocks have outperformed their international peers over the last year; emerging markets have outperformed YTD

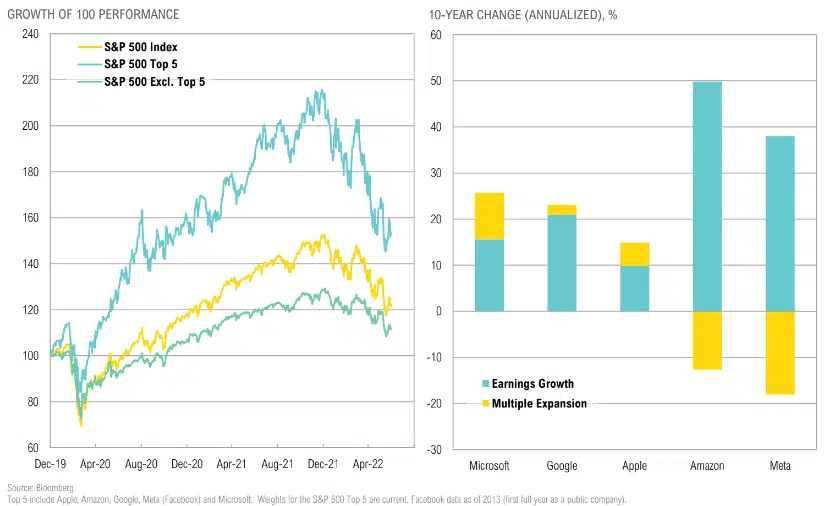

GAMMA (formerly FAAMG) has underperformed S&P 500 ex-GAMMA by over 14% for the year-to-date

GLOBAL EARNINGS CALENDAR

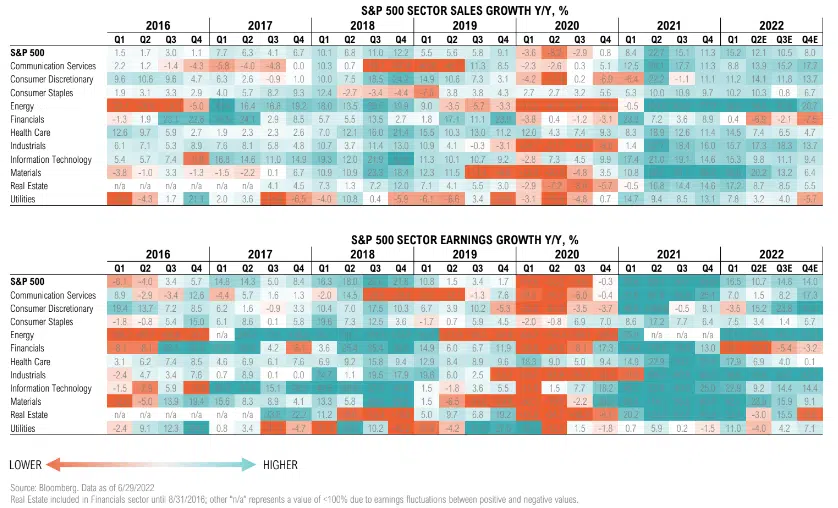

Sales and earnings growth expected to decelerate but remain healthy in 2022; impact of inflation and potential recession is a new wild card

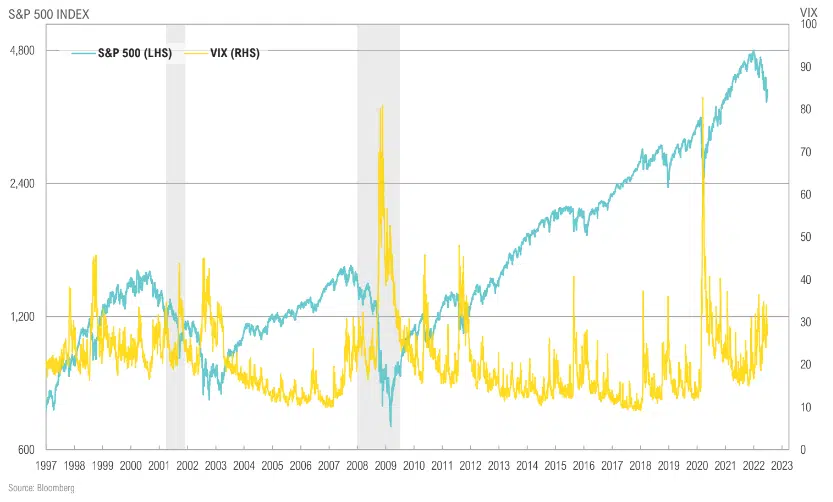

Lower stock prices and still-high earnings estimates, which admittedly lag, have helped ease valuations; although below quarter peak of 35, implied volatility remains elevated at around 30

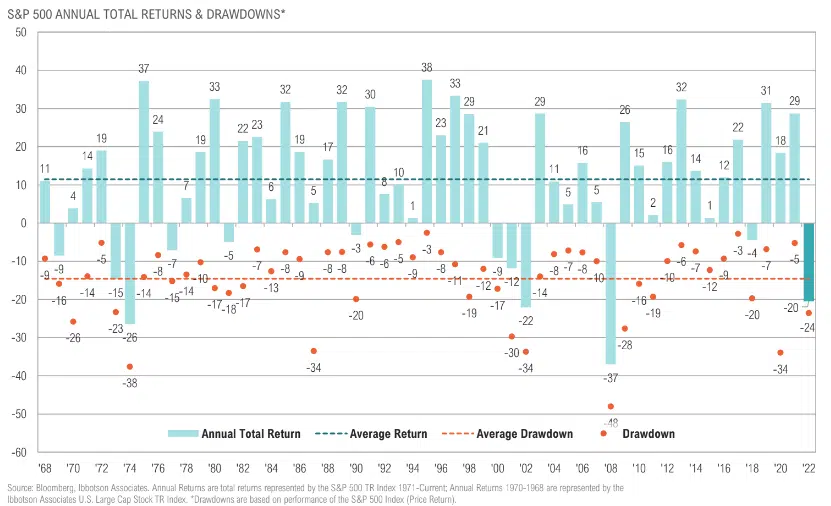

The S&P 500 is currently 20% from its all-time high, marginally worse than the average drawdown of 15% over the last 50 years

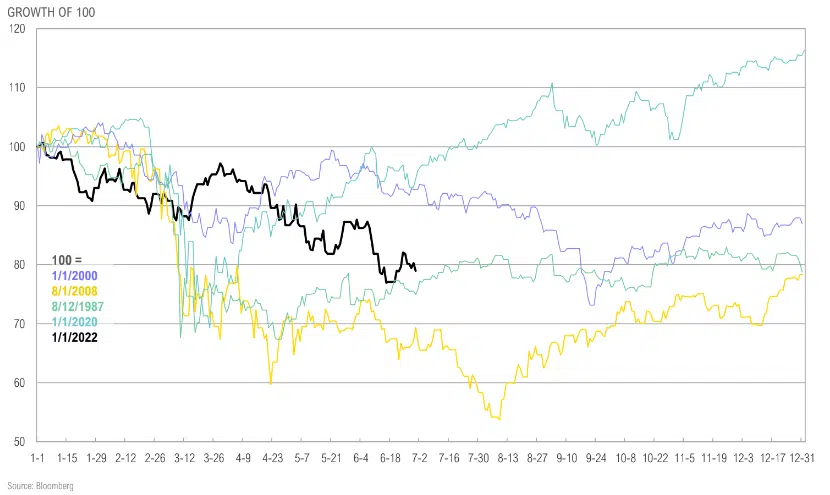

Current drawdown vs. historic bear markets

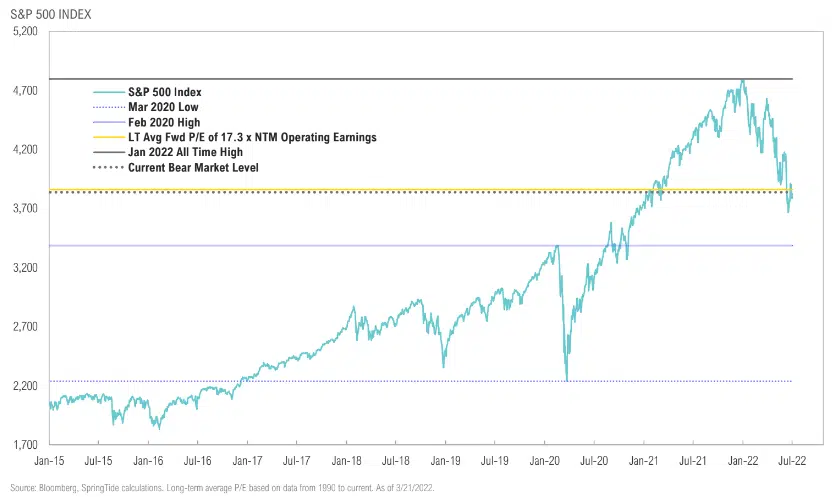

Markets have pulled back from ATH’s, currently in bear market territory; interestingly bear market level is inline with long-term avg. valuations

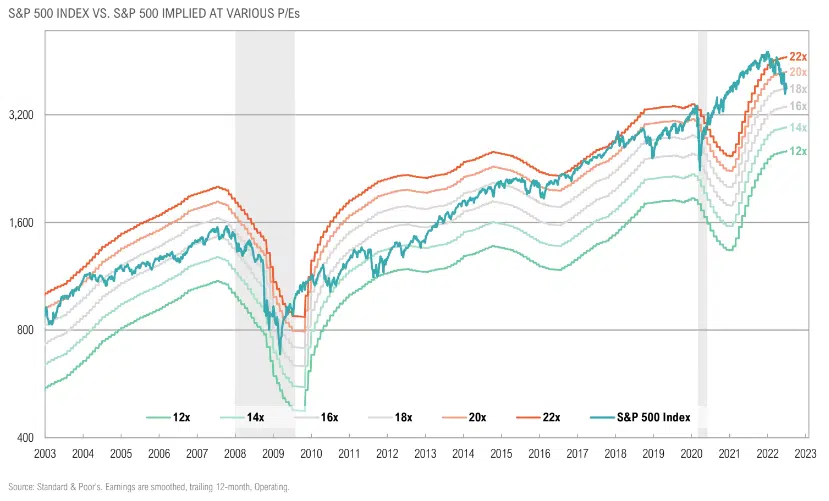

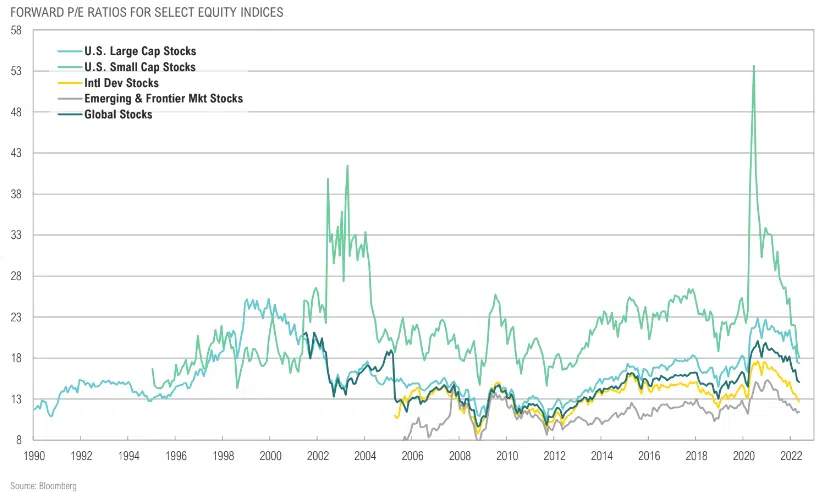

U.S. equity valuations approach longer-term average, as strong earnings growth and current bear market drawdown dramatically helped valuations

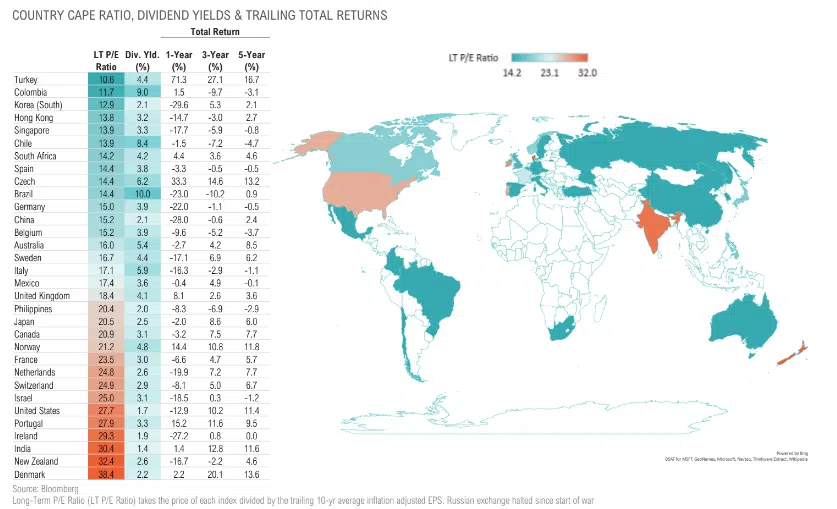

Cyclically-adjusted P/E (CAPE) multiples by country; >5% yields in Colombia, Brazil, Chile, and Italy; Russian markets are effectively closed for offshore investors

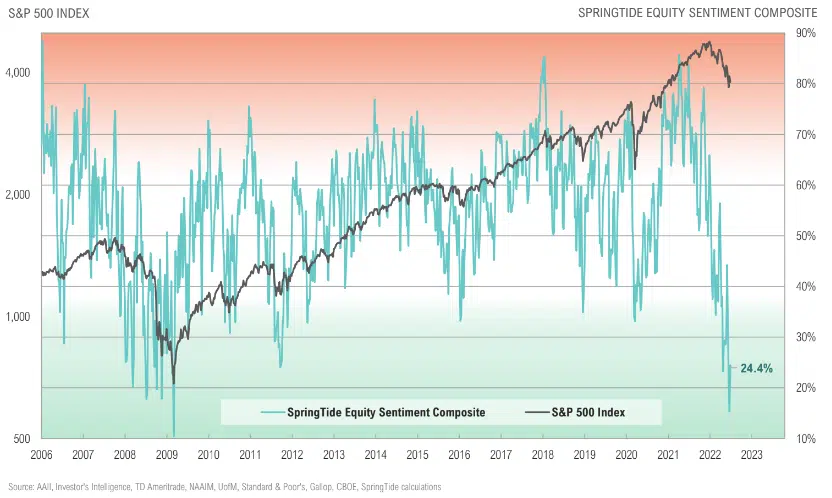

U.S. equity sentiment has rebounded after dropping to the lowest level since 2011; readings below 30 have often presented good buying opportunities

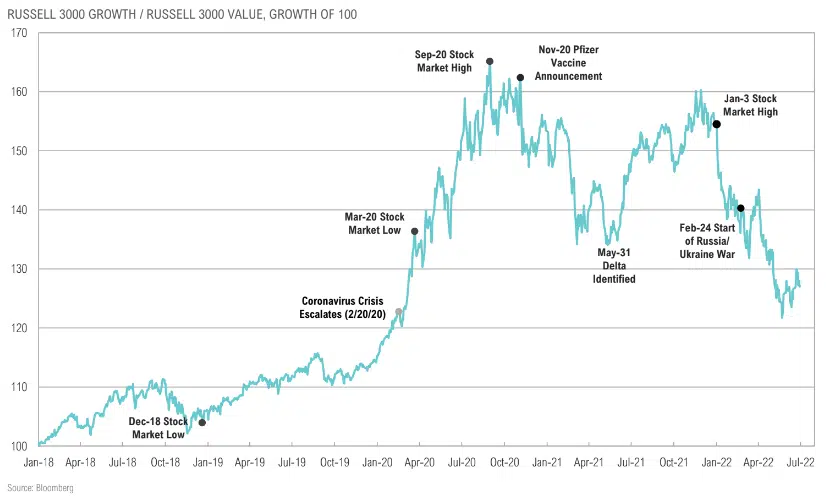

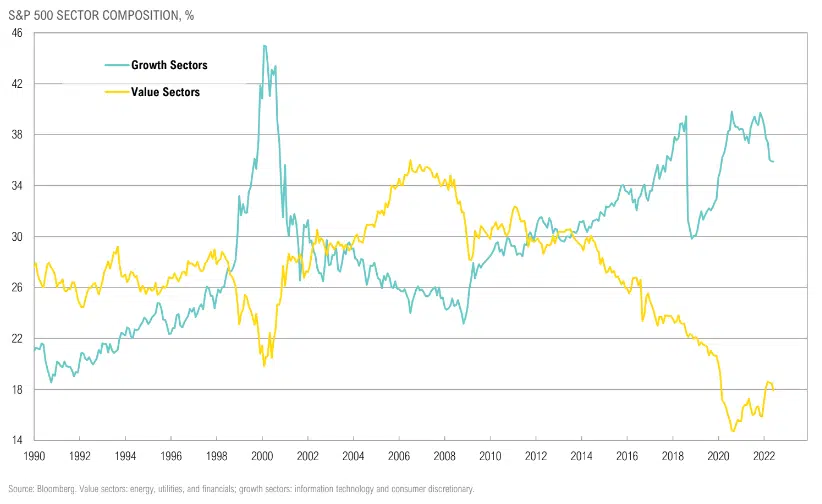

Value outperformed growth post vax announcements; growth’s 2H21 outperformance nearly retraced that lost ground but has since rolled over as rising rates take over as primary driver

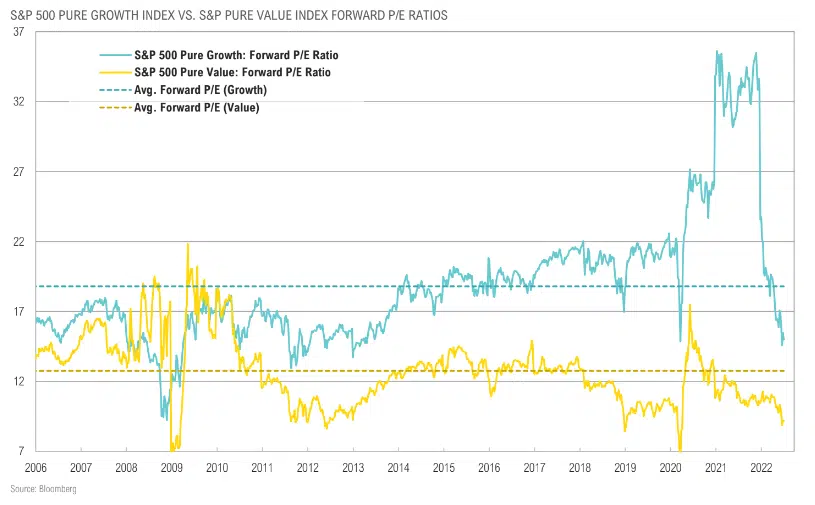

Forward-looking valuations have improved dramatically, but earnings estimates will now come into question given potential margin pressure; value still looks relatively cheaper

EM equities remain relatively cheap vs. developed markets, but “value trap” risk remains due to geopolitics, global food and energy crisis

Still a long way to go? The weight of technology and consumer discretionary stocks in the S&P 500 has dropped to 36% but still near historical highs

FIXED INCOME & CREDIT

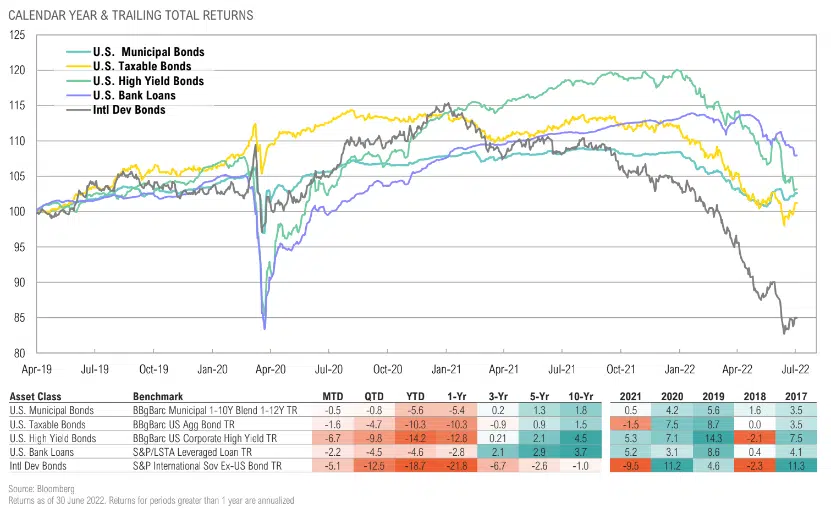

All U.S. fixed income and credit asset classes were down over the quarter; international developed bonds faired the worst, are now down over the last decade

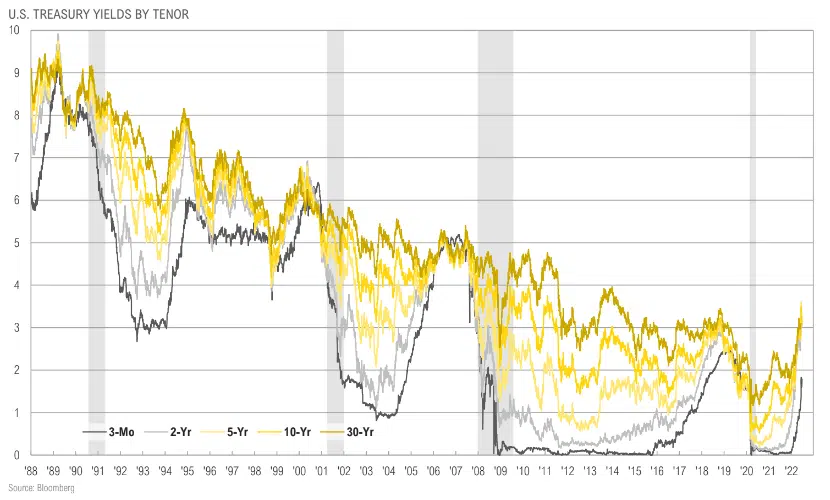

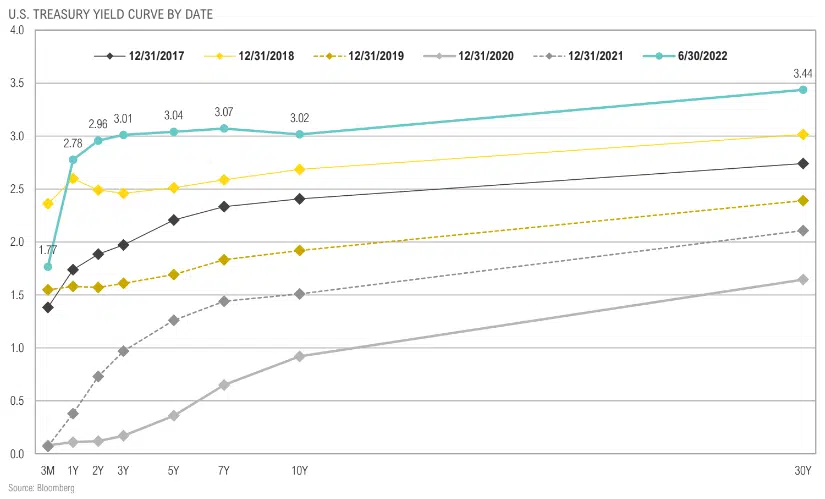

Parts of the Treasury yield curve remain inverted as inflation and rate hikes have started to take their toll on growth

Parts of the Treasury yield curve remain inverted as inflation and rate hikes have started to take their toll on growth

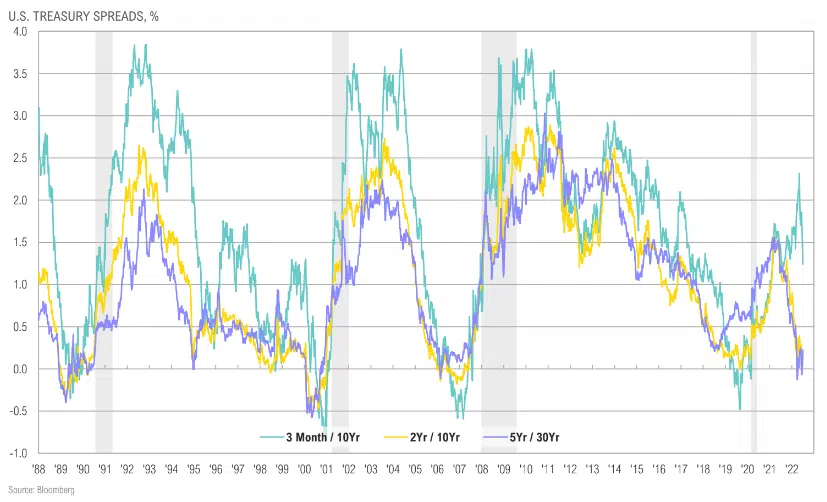

2-year/ 10-year Treasury spread cratering on rate hike > subsequent slowdown expectations; currently right around 0%

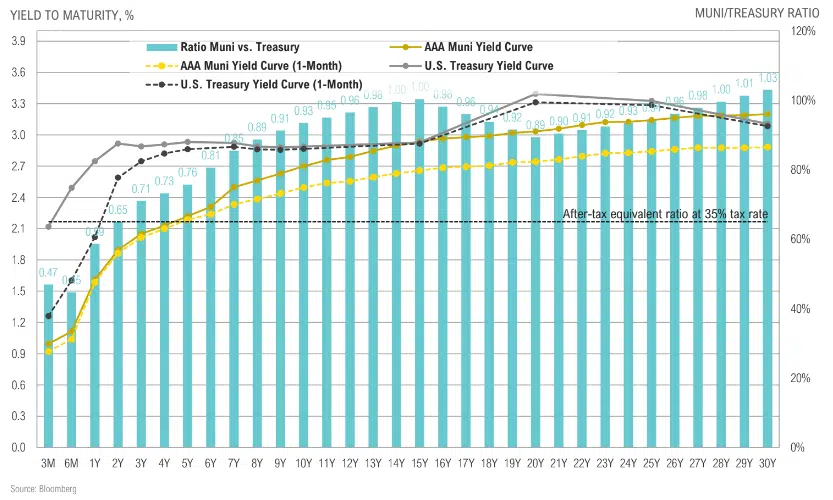

Muni-Treasury ratio: no value in the muni bond curve inside of 5 years; any yield pickup requires taking on credit and duration risk

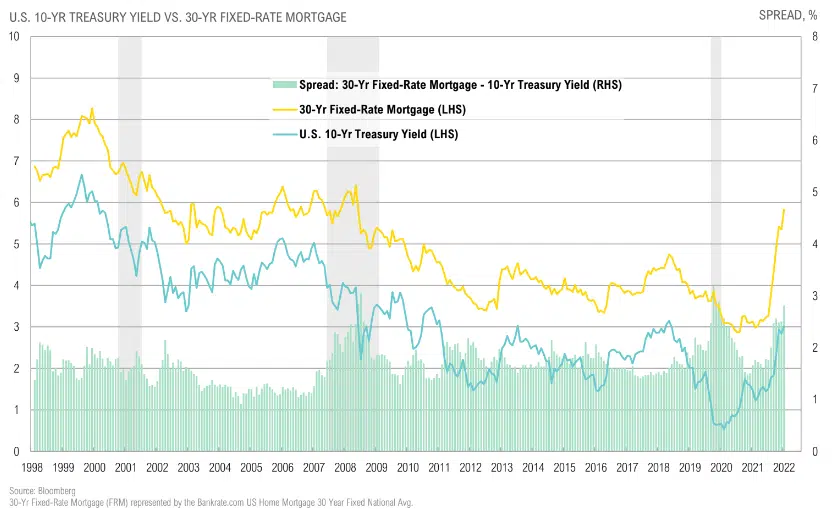

30-year fixed mortgage rates again spiked in June as mortgage rate spreads vs. 10-year Treasury widened; will have negative impact on housing and consumer with a lag

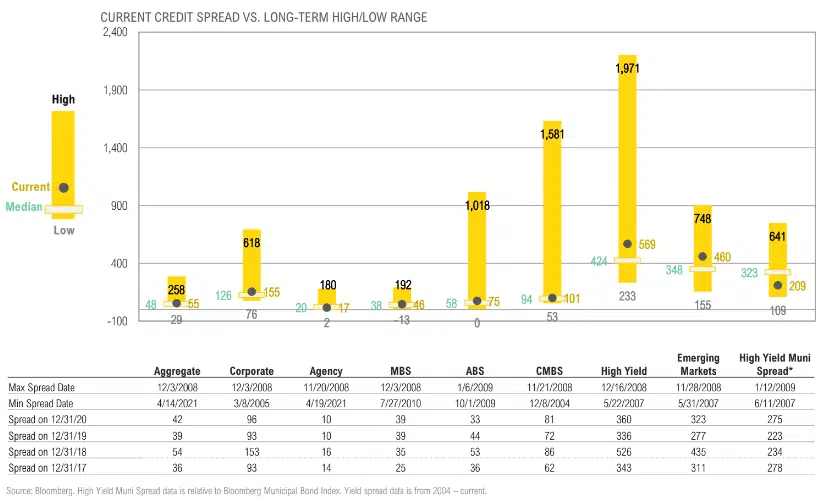

Credit spreads only modestly higher than median across most sectors as recession fears start to cause spread widening

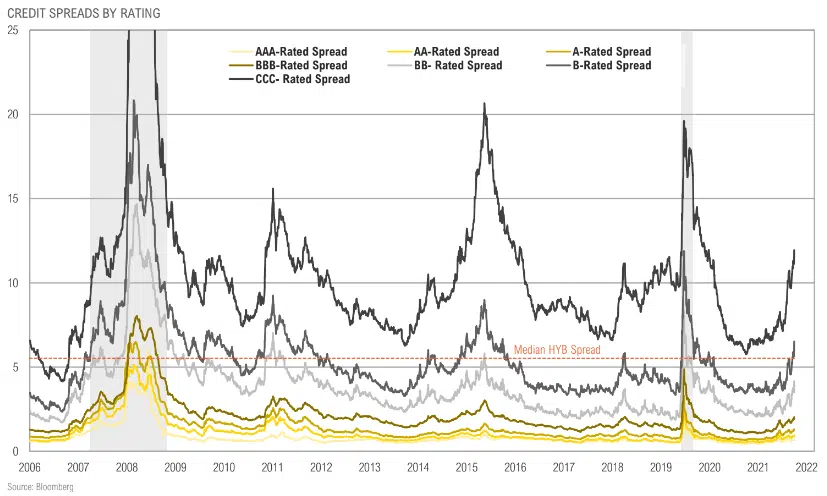

Credit spreads widened in June; notably, CCC-rated bonds widened 211 bps in June and 516 bps since the start of the year

High yield-to-investment grade muni spreads near tightest levels since 2007

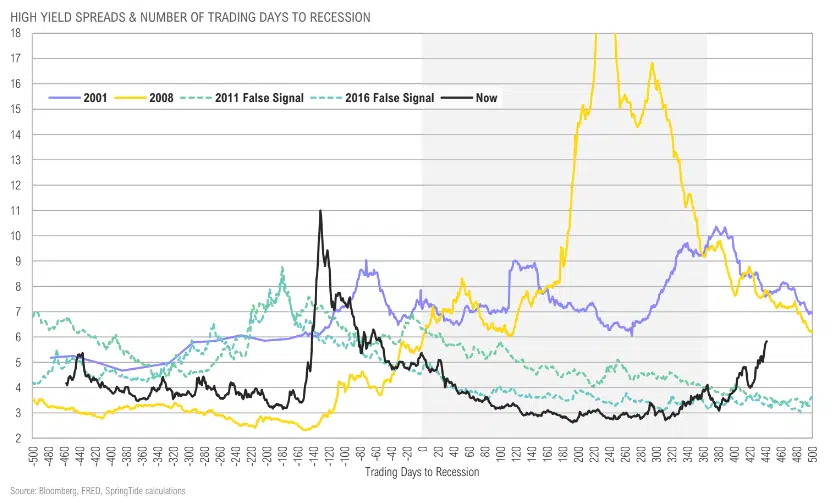

High yield spreads through the COVID-19 crisis highlight the episodic nature of volatility with an active Fed put, which may not be in place during next crisis

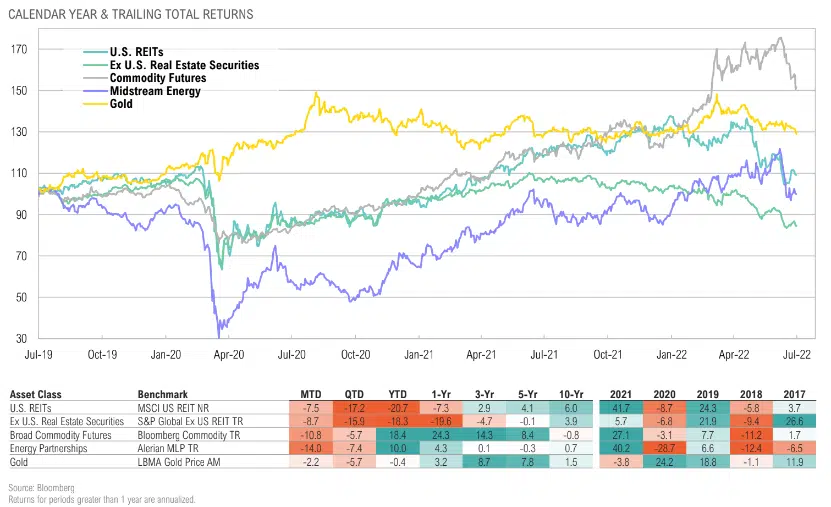

REAL ASSETS & INFRASTRUCTURE

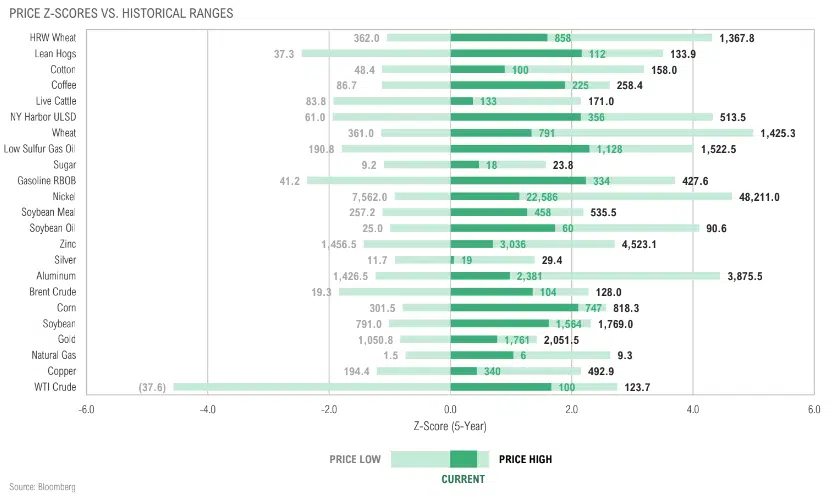

Most commodities sold off in June; industrial metals were down -26.4% QTD, while energy was still up 7.0% QTD, even after losing 14.6% in June

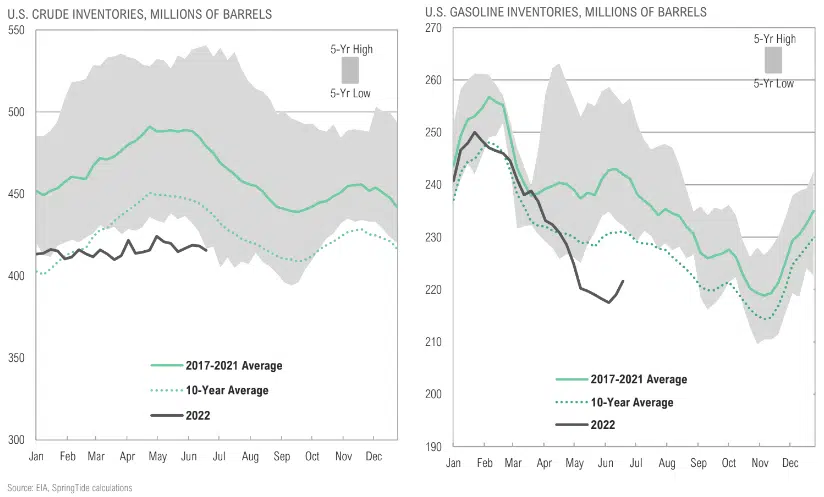

Crude oil and gasoline inventories remain well below long-term averages

As expected, snapback in energy consumption is outpacing production; production expected to match consumption later in 2022 per EIA, but this remains to be seen

Several commodities hit new all-time highs following Russia’s invasion of Ukraine given their importance to global supply of energy and food; recent correction is modest in context

Real yields popped into positive territory (using TIPS implieds); gold may only catch a bid if and when the Fed needs to back away from rate hikes

OPPORTUNISTIC

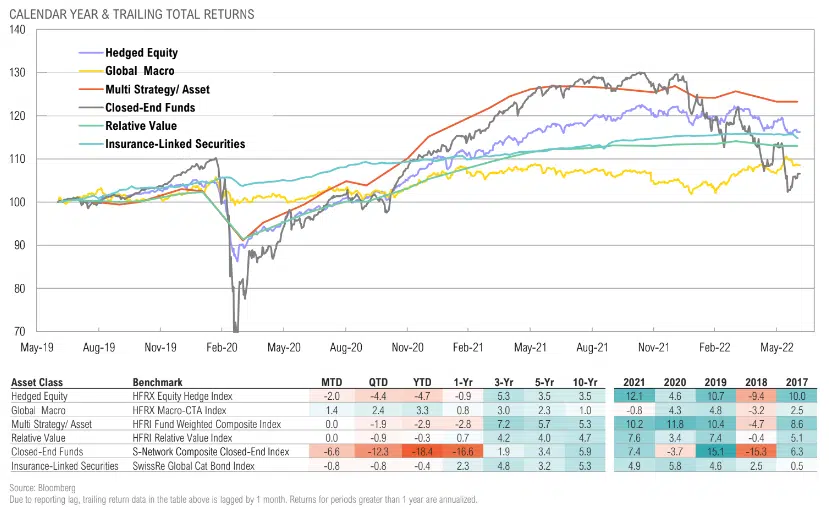

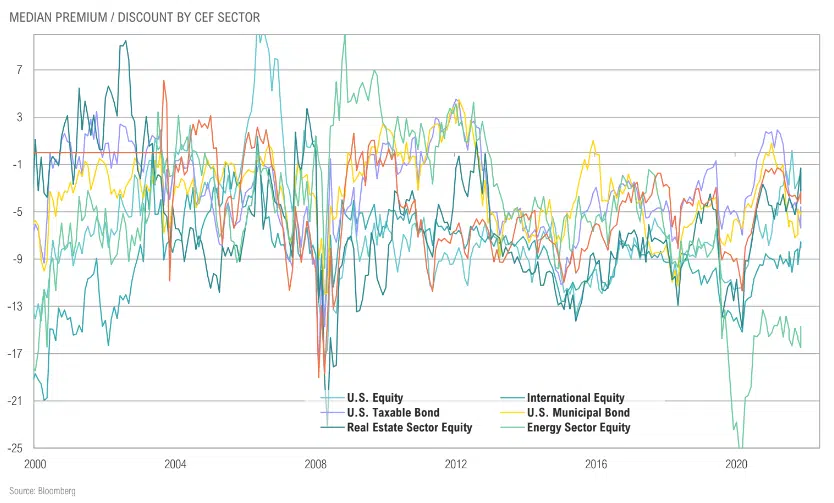

Closed-end funds continued down a further 12.3% during the second quarter while global macro returned 2.4% for the quarter

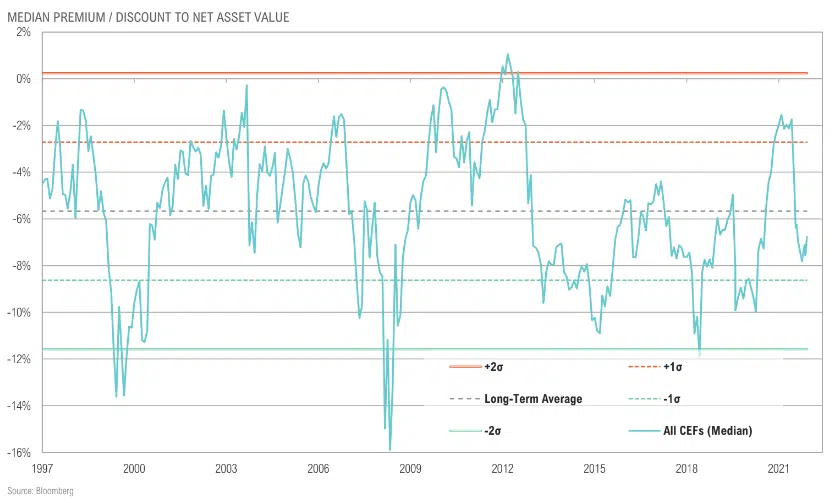

CEF discounts narrowed slightly from -7.2% in May to -6.8% in June

CEF discounts mixed by sector; taxable bond CEFs still no longer trading at a premium while energy sector discounts remains stubbornly wide

ASSET ALLOCATION

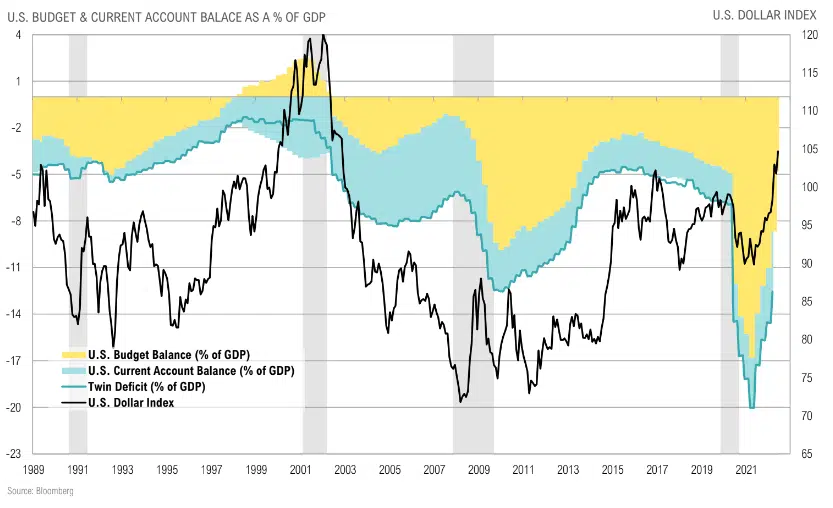

Dramatic U.S. Dollar strength driven by safe-haven bid, relative yields

U.S. Dollar strength driven by safe-haven bid, relative yields; potentially helped by brief respite in deficit situation

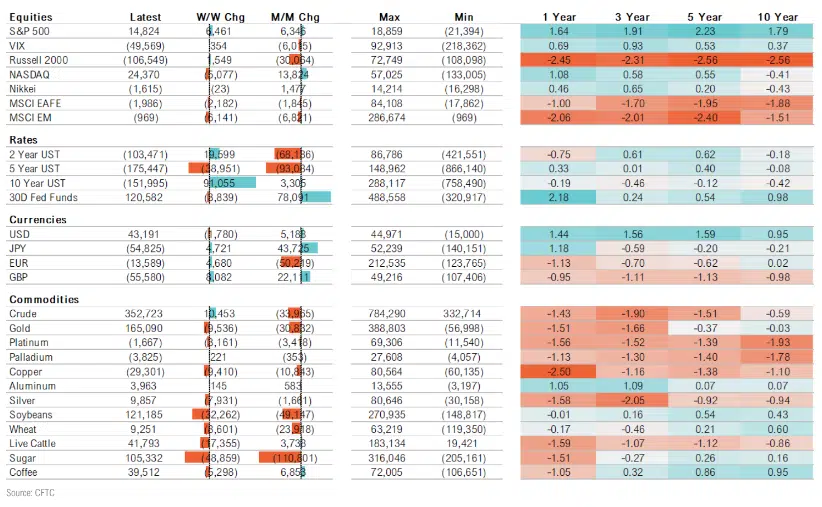

Futures spec positioning shows bullish positioning in USD, S&P 500 and short-term rates

Copper/gold ratio plunging suggests the peak in rates may be in the rear-view mirror

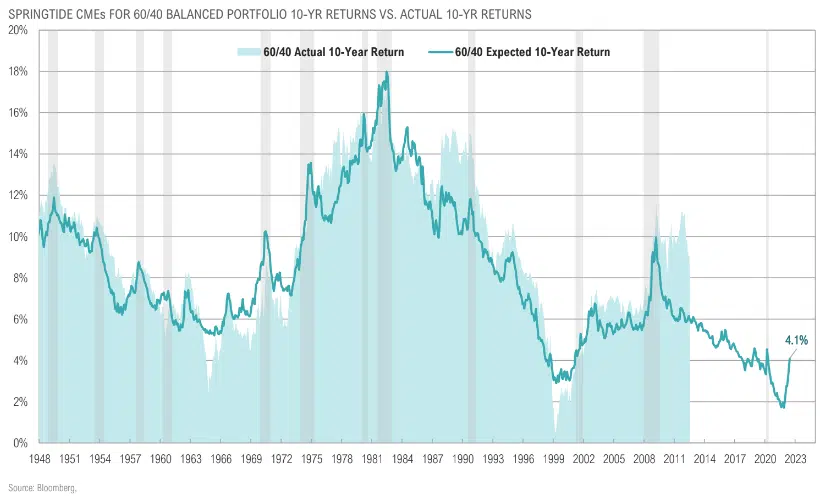

Expected returns for passive 60/40 portfolio picked up modestly, but still remain low relative to history