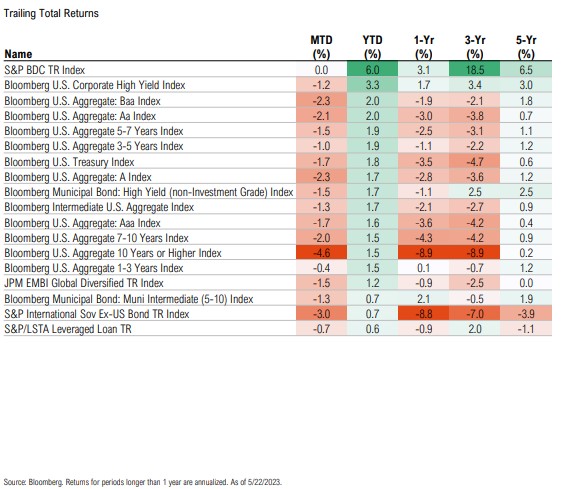

Credit Markets

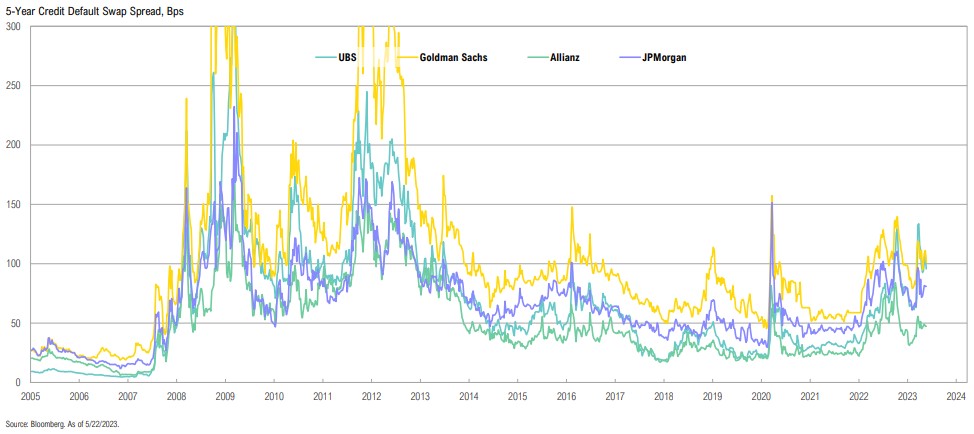

Perceived credit risk of large asset managers spiked higher following collapse of SVB and Credit Suisse but have since moderated and remain more contained relative to regional banks

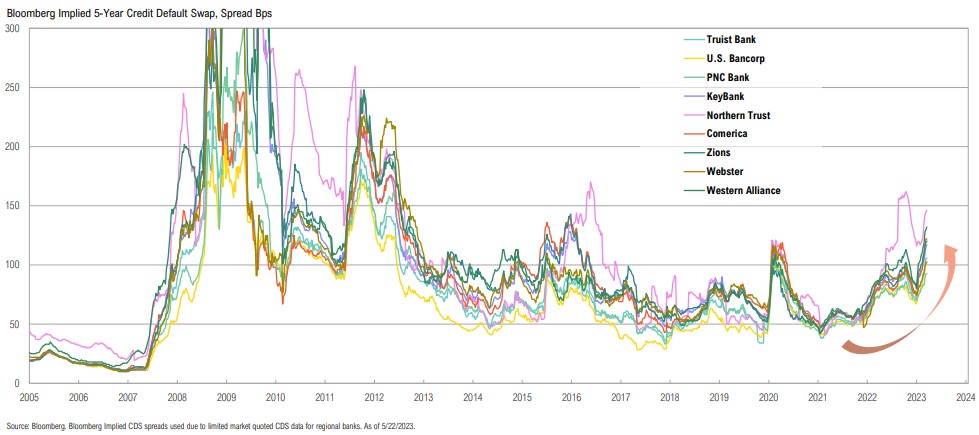

The cost to insure against regional bank defaults has risen steeply, but remain well below GFC levels; implied CDS spreads provide real time insight into banking sector stress

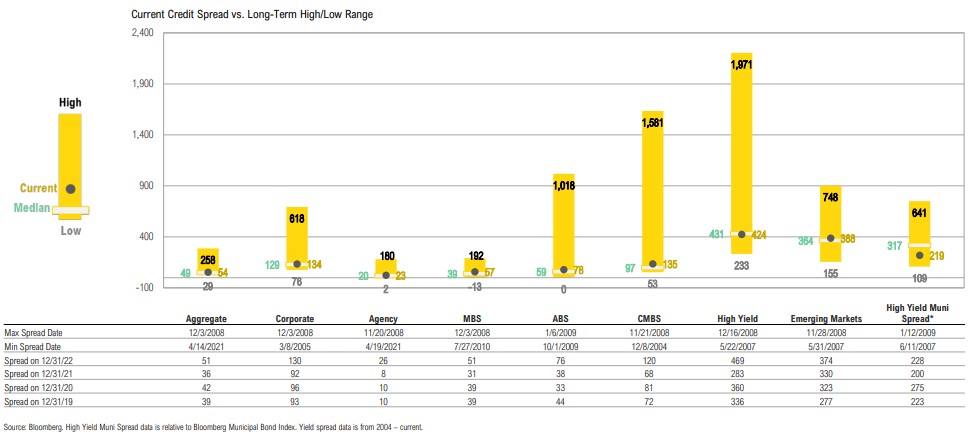

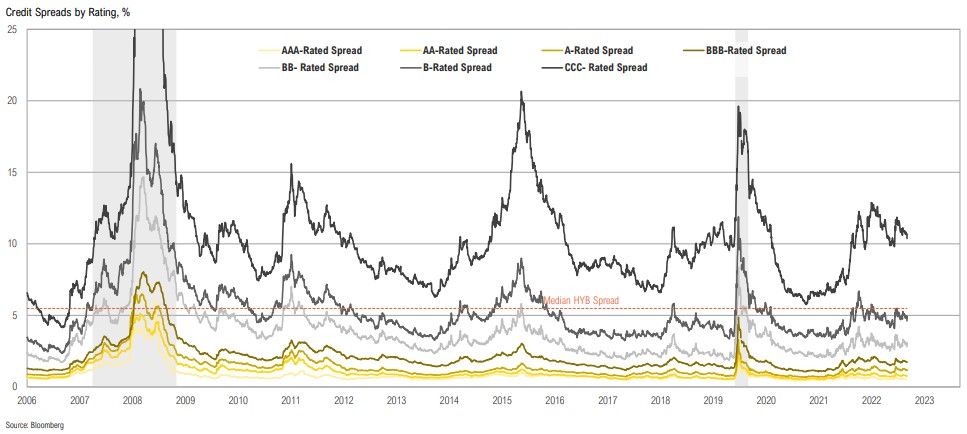

Credit spreads are in line with average levels across most sectors; while a recession still seems probable, spreads where they currently are point to a mild/shallow slowdown

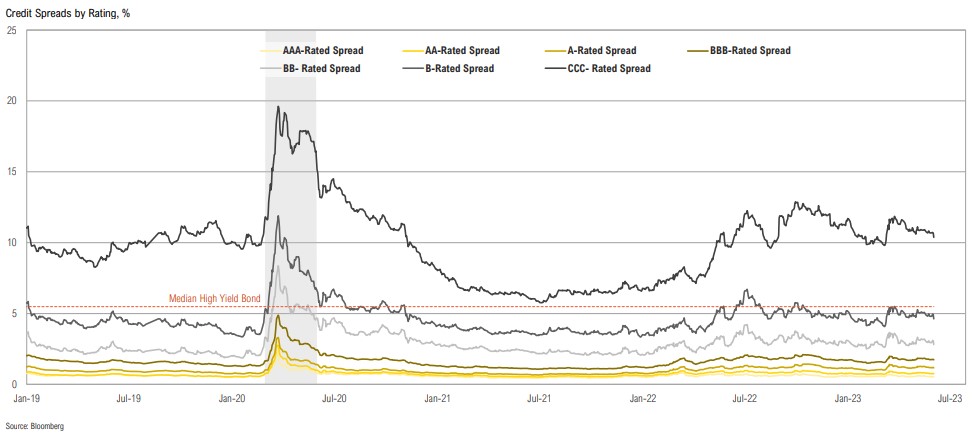

Credit spreads initially widened over the month, but narrowed as risk appetite returned last in May; notably, B-rated bond yields are 65bps below May’s peak and 209bps below July ‘22 peak

Zooming in: despite the very recent narrowing, wider spreads layered on higher base rates are bound to create issues if they persist

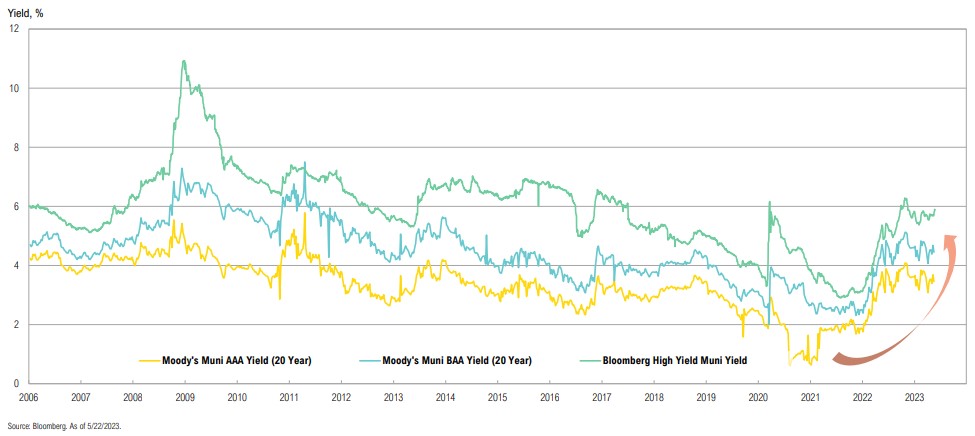

Yields on municipal bonds are also trending higher; now above pre-pandemic levels

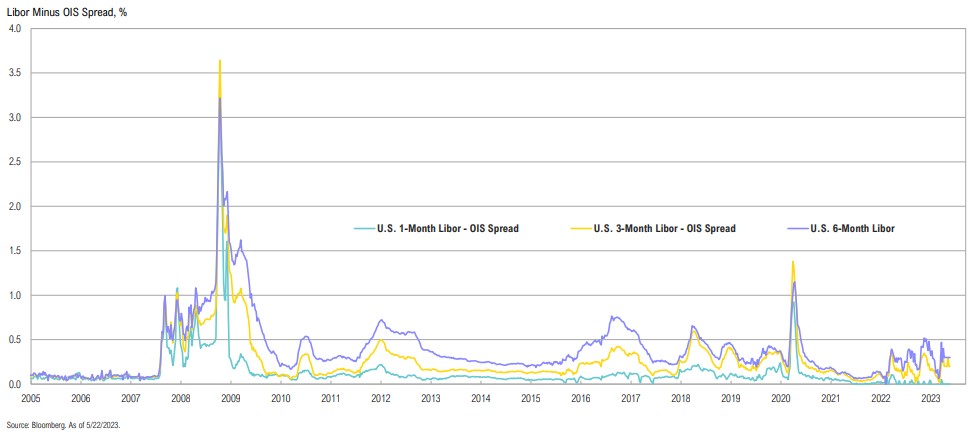

Bank stress proxies have spiked higher, but remain relatively contained

ETF Trends

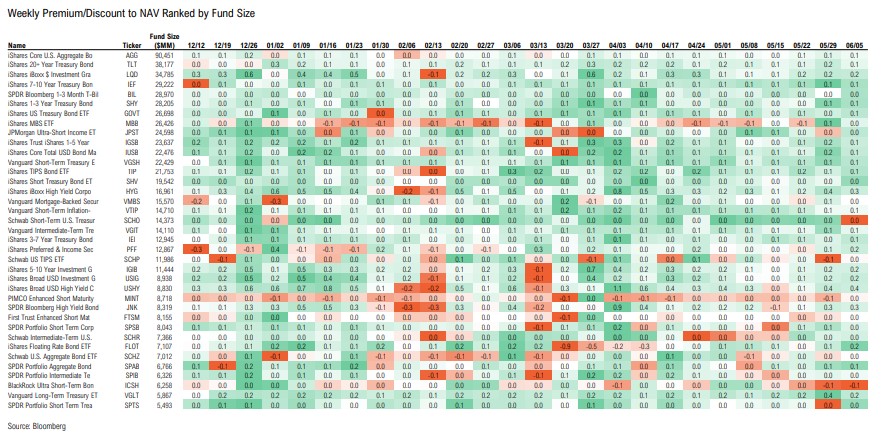

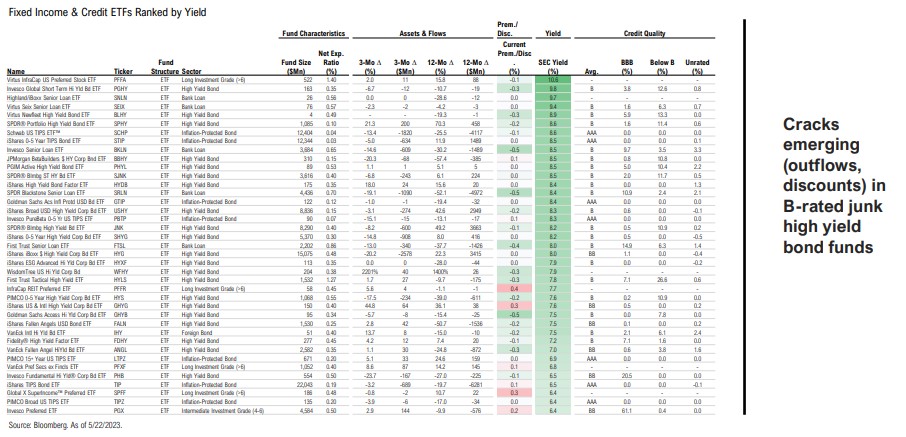

Outflows from high yield ETFs have started to put pressure on prices; however, nothing compelling in terms of yields or discounts so far

In terms of yields, some high yield portfolios are getting interesting, but not near levels that would make sense for a potential “hard landing”

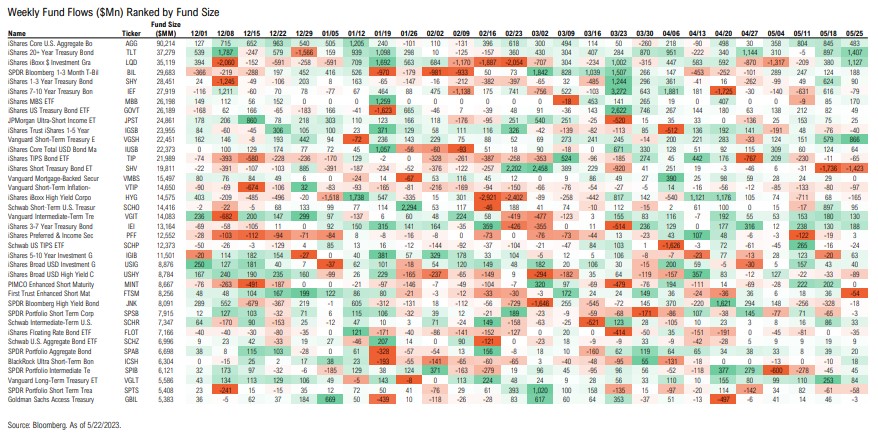

High yield funds flipping to outflows, benefiting Treasuries; TLT has had $9.7bn of inflows YTD; SHV has had $3.2bn outflows in May as short-duration products fall out of favor

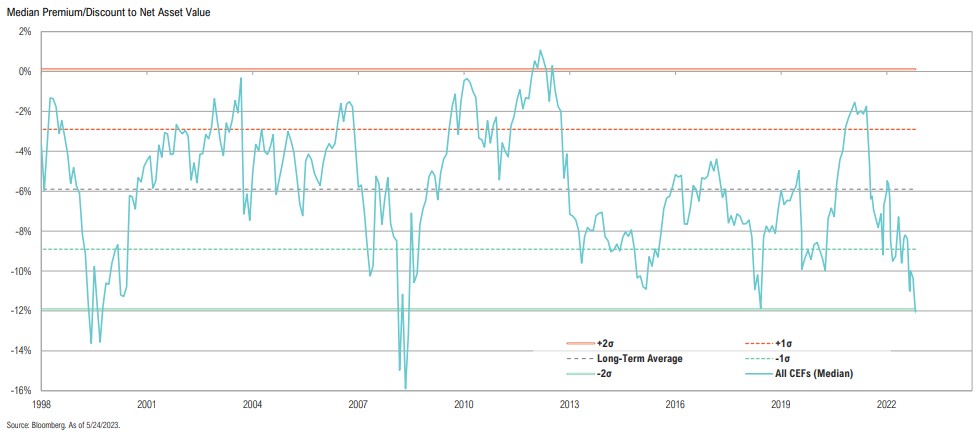

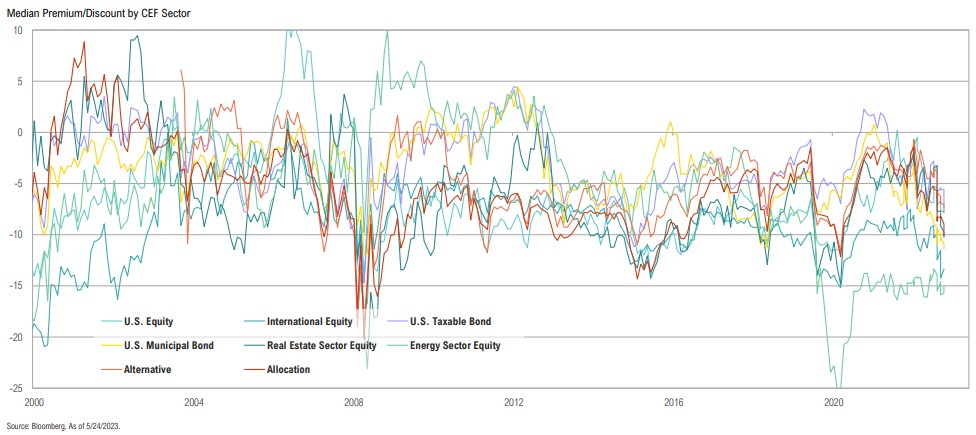

CEF discounts widened over the month and are currently at -12.1%; notably U.S. taxable bond discounts widened by 1.8% to -7.3%, while U.S. muni bond discounts widened 1.1% to -11.4%

CEF Trends

CEF discounts widened over the month and are currently at -12.1%; notably U.S. taxable bond discounts widened by 1.8% to -7.3%, while U.S. muni bond discounts widened 1.1% to -11.4%

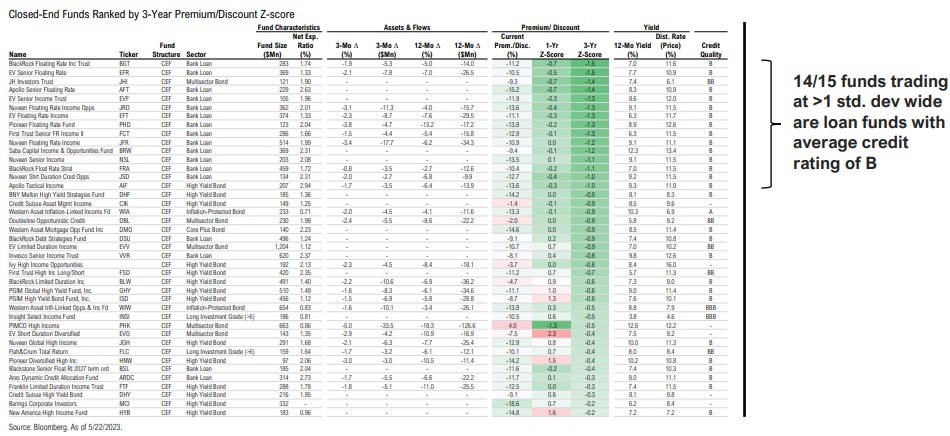

Largest discounts in below investment-grade loan funds given expectations of double hit from declining rates (not helping floating rate) and potential credit losses

BDC Trends

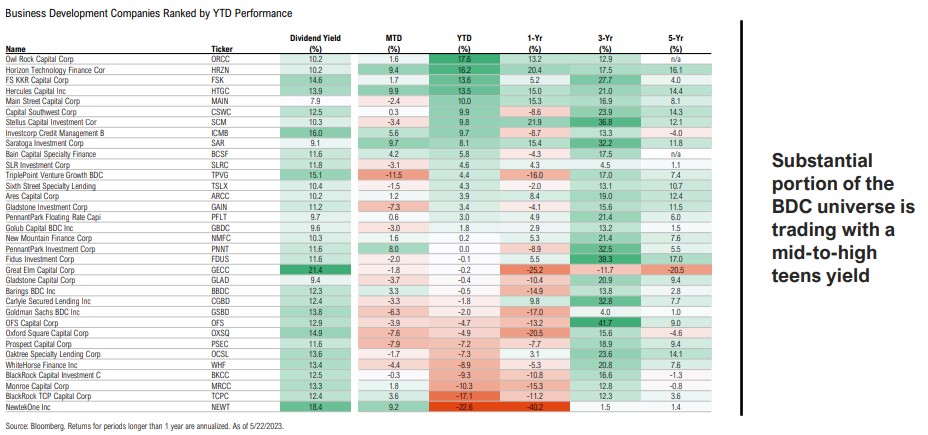

BDCs were a top performer in the credit space in 2021 as credit markets responded well to policy support, performance breaking down on liquidity withdrawal; pockets of value emerging

Appendix 1: Fixed Income & Credit Returns