Summary:

Higher nominal rates and an inverted yield curve mean short-term bonds offer attractive real yields, especially relative to longer maturities. Given the relatively unattractive deposit yields paid by many banks, these higher yields continue to drain bank deposits, potentially undermining the health of the banking sector.

Key Themes:

01. Higher nominal rates (2-year at 4.5%) and an inverted yield curve mean short-term bonds offer attractive yields, especially relative to longer maturities.

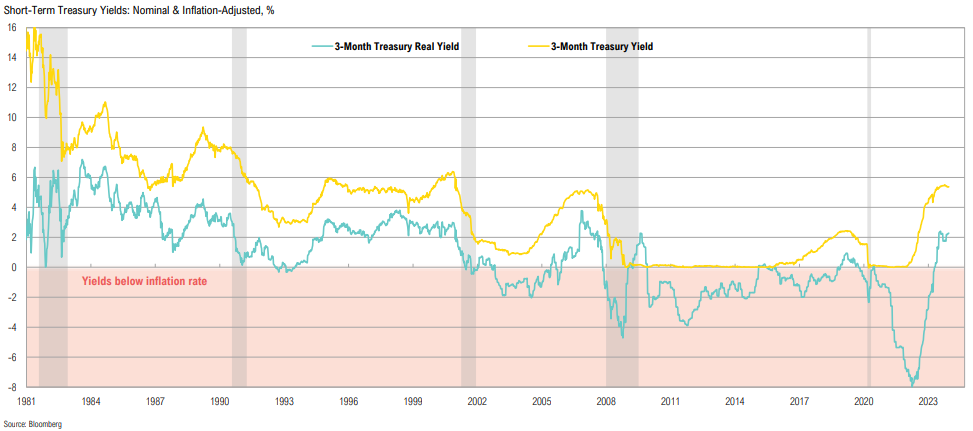

02. As inflation has trended lower, real short-term bond and cash rates have skyrocketed from -8% to over 2%, reaching some of the highest levels of the last 30 years.

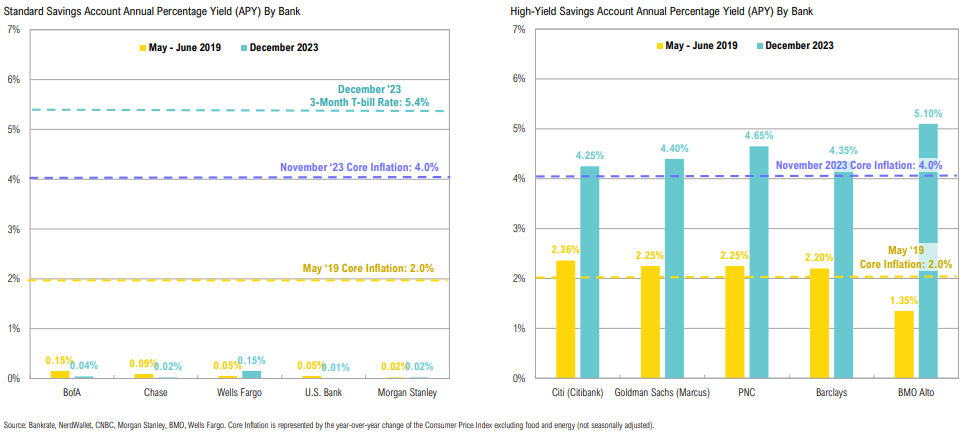

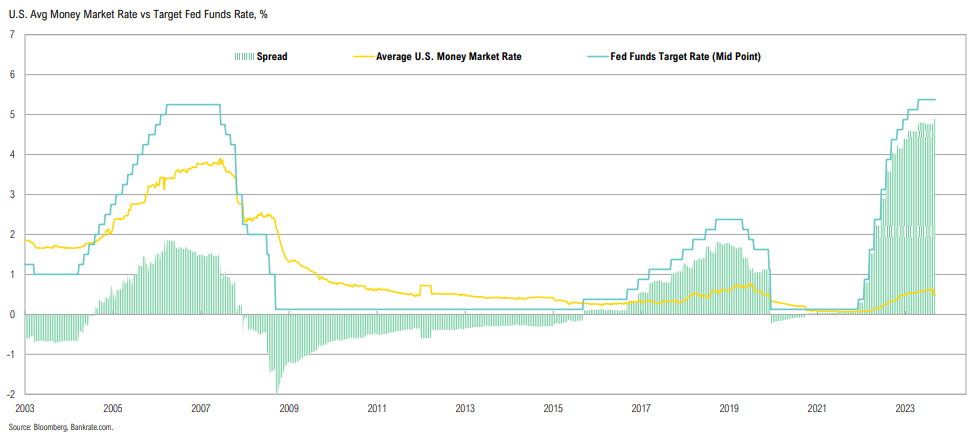

03. While yields on Treasuries and many high-yield savings accounts have increased substantially and now outpace inflation, yields on many standard bank savings accounts remain near zero.

04. Big banks continue to lend to the Fed (i.e., earn) at rates significantly higher than what they are paying on deposits, predictably causing a deposit exodus.

05. U.S. money market funds saw $200bn of inflows in November, bringing the total flows for the year to date to over $1.1 trillion.

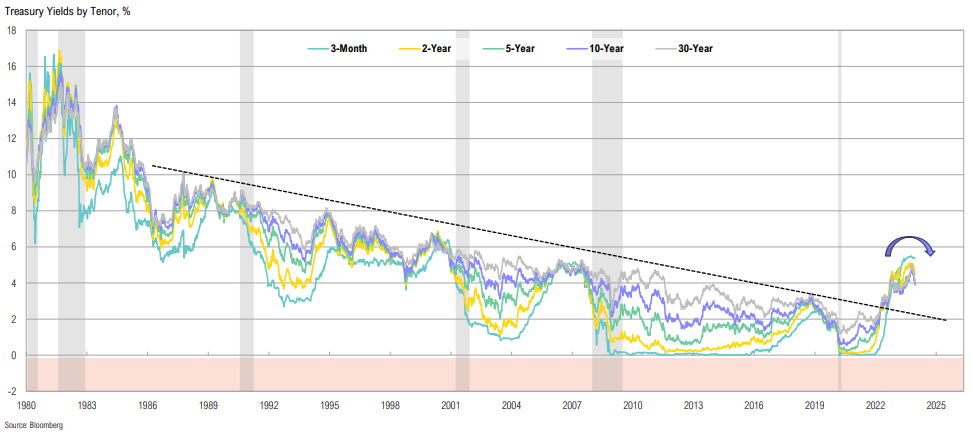

Treasury Yields

Nominal

With the post-COVID rate shock behind us, markets will need to find equilibrium between unsustainable fiscal policies and some stubborn aspects of services inflation holding rates up, but lower growth/inflation pulling them down

An inverted yield curve means short-term bonds offer a material yield pickup relative to longer maturities; 2-year Treasuries yield around 4.5%

Policy Rates

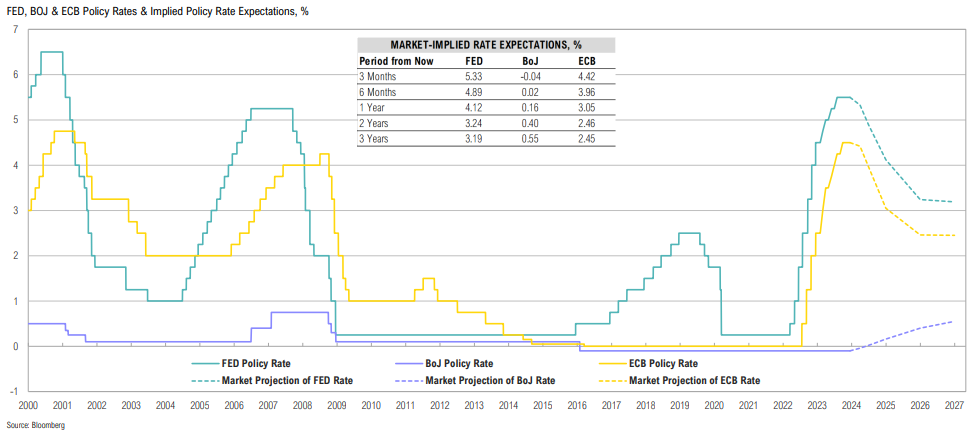

Expected developed market rate differentials have converged in recent years, but remain substantial; Japan’s implied rates have moved higher for the first time in many years

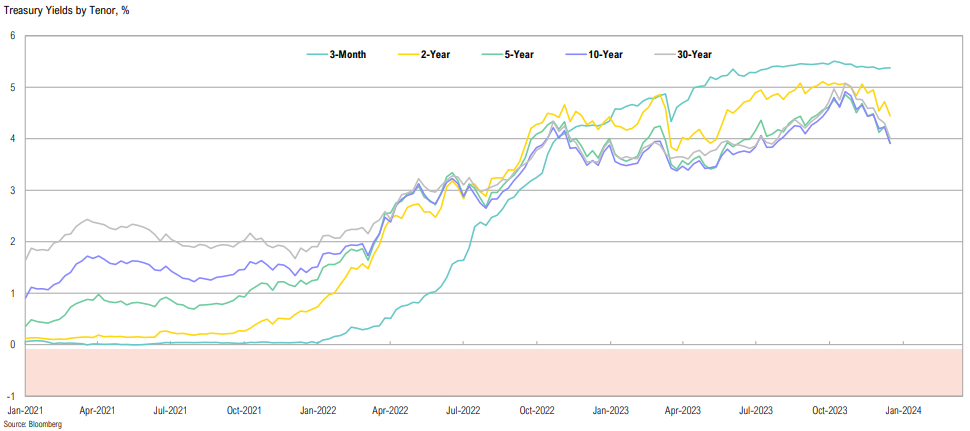

Treasury Yields

Finally getting paid to wait—yields on short-term government bonds have increased in nominal terms and, with inflation having rolled over, are attractive in real terms too; these yields will decline if the Fed cuts rates

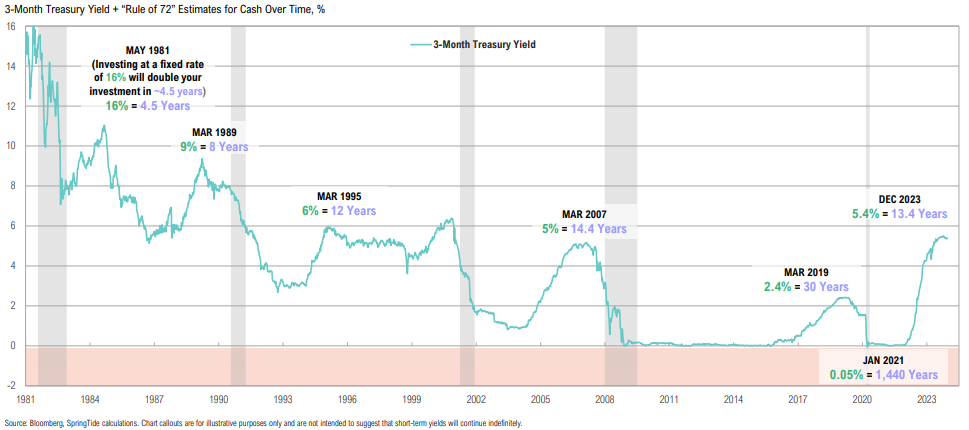

Thought experiment: given the increase in yields, investors could theoretically double their money risk-free in 13 years vs. 1,440 years if yields from 2021 prevailed

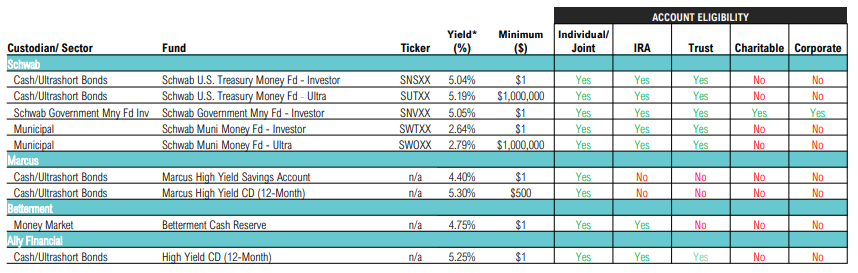

Bank Savings Rates

Yields on many high-yield savings accounts have increased substantially, with several now outpacing inflation; yields on many standard savings accounts remain near zero

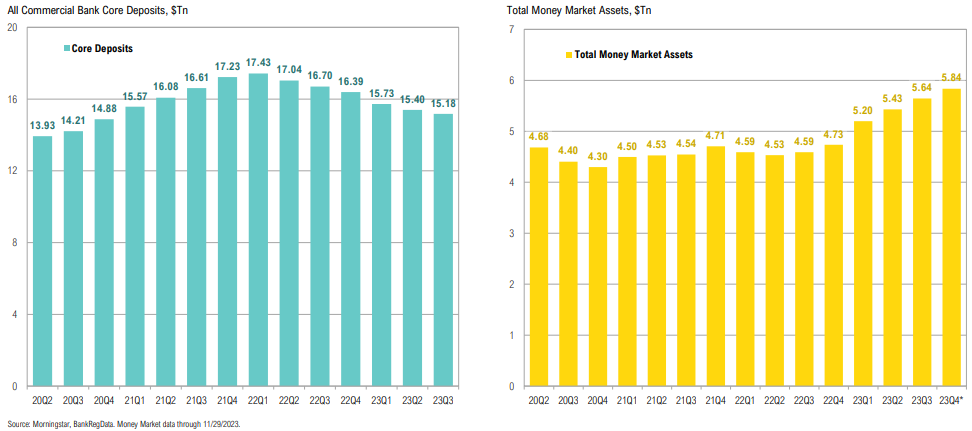

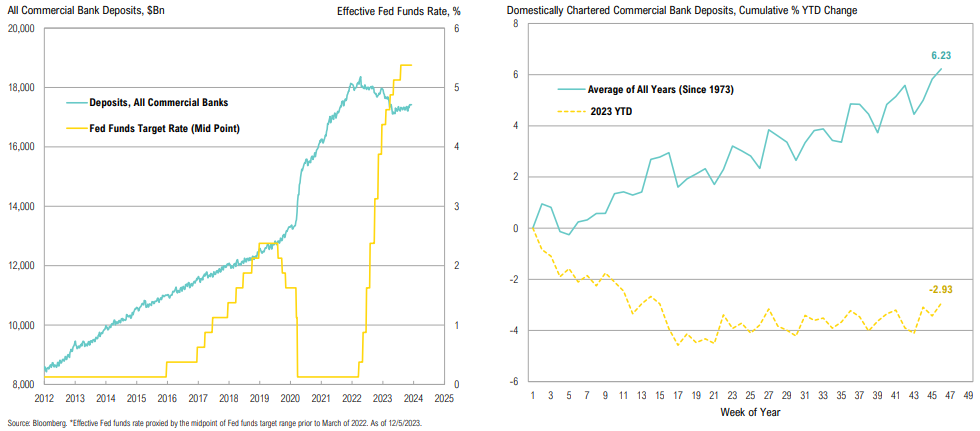

U.S. bank deposits have dropped by about 6%, to 17.4 trillion, since their peak of $18.4 trillion in April of 2022

Big banks continue to lend to the Fed at very high rates relative to what they pay on deposits, which has predictably resulted in a deposit exodus

Money Market Flows

U.S. money market funds saw $200bn of inflows over November, bringing flows for the year to date to over $1.1Tn