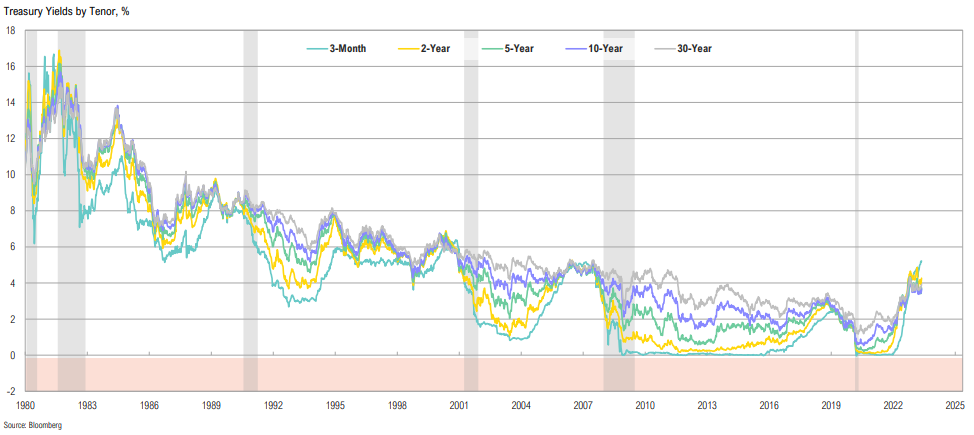

Treasury Yields

Nominal

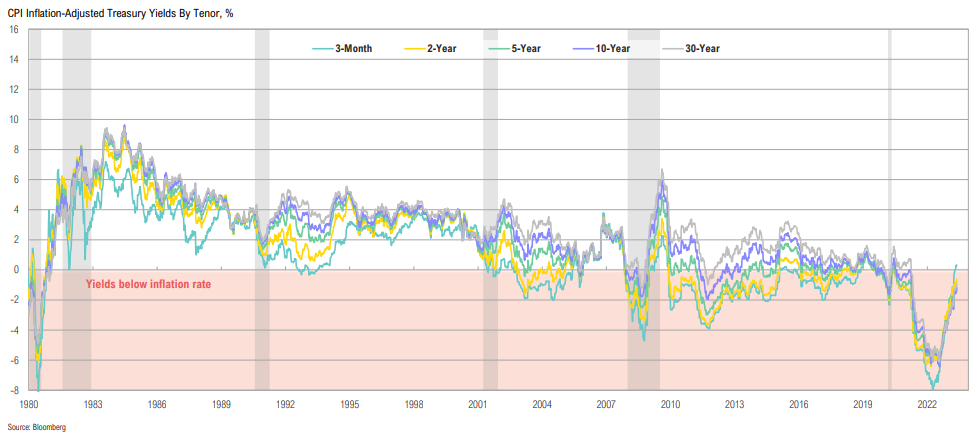

Treasury yields of all maturities had been declining since the early 1980s, but the emergence of inflation has triggered a potential regime change

An inverted yield curve means short-term bonds offer a material yield pickup relative to longer-term; 2-year Treasury now yields 4.3%

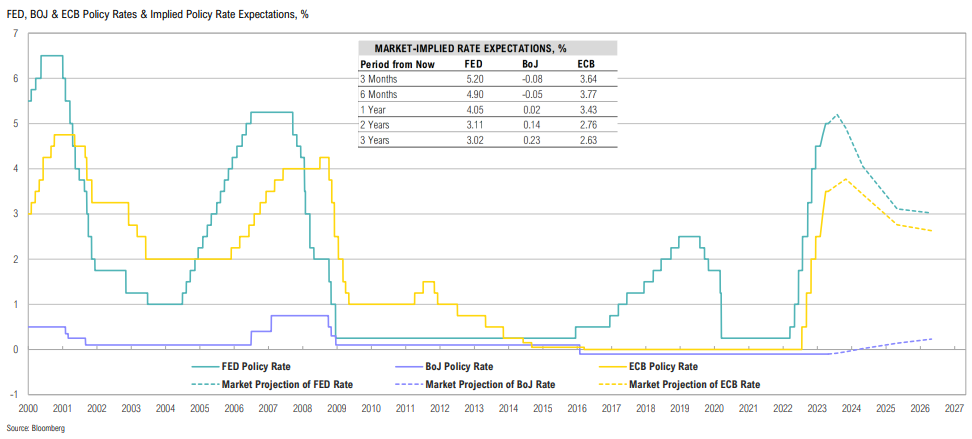

Policy Rates

Expected developed market rate differentials have come down substantially, removing a major tailwind for the U.S. dollar; Japan remains a substantial outlier

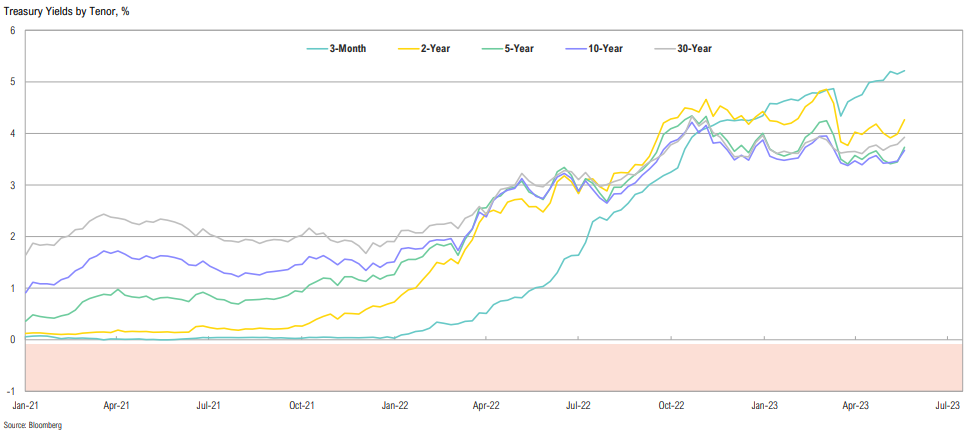

Treasury Yields

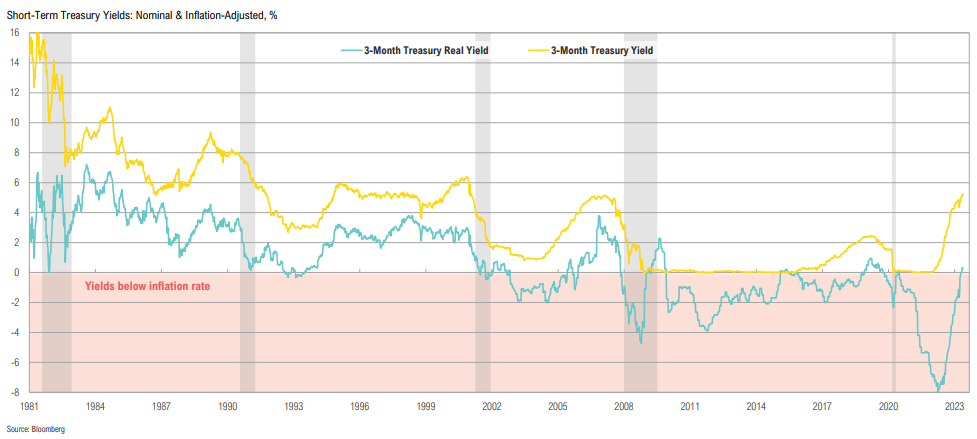

Treasury yields were negative in real terms (after inflation) for most of the last 15 years; in late April they moved into positive/potentially restrictive territory for the first time in this hiking cycle

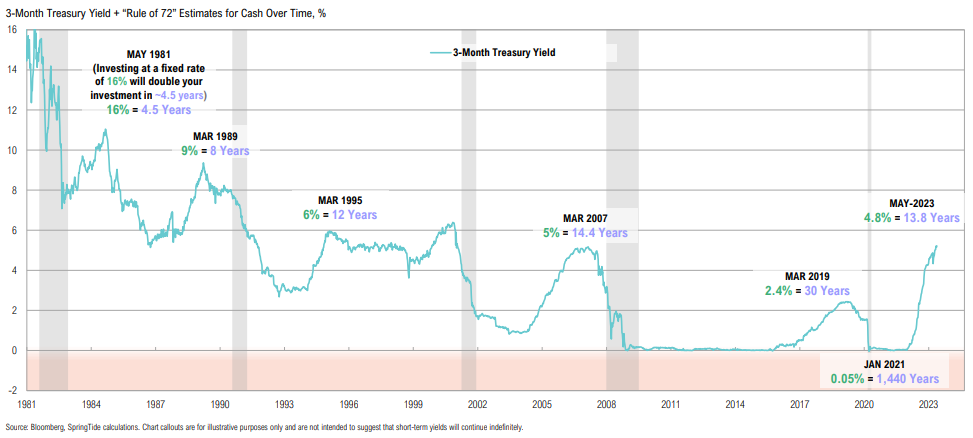

Finally getting paid to wait—yields on short-term Treasuries are up substantially in nominal terms and above the rate of inflation

Finally getting paid to wait—yields on short-term Treasuries are up substantially in nominal terms and above the rate of inflation

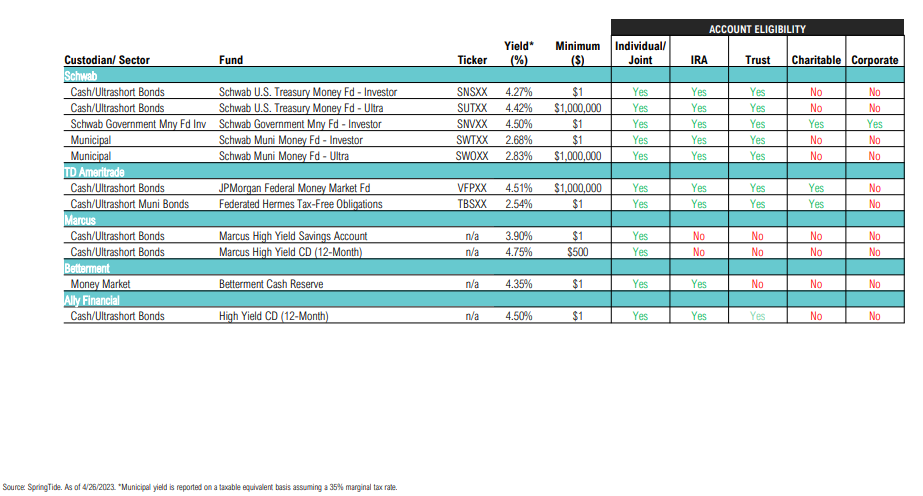

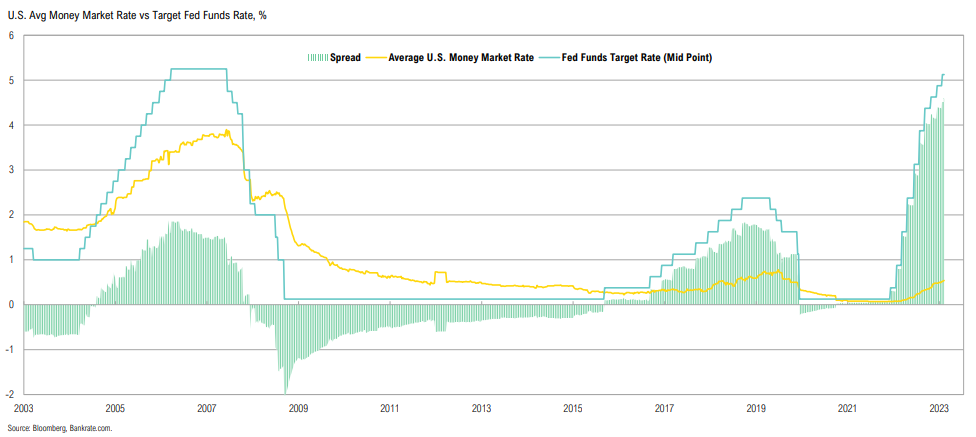

Bank Savings Rates

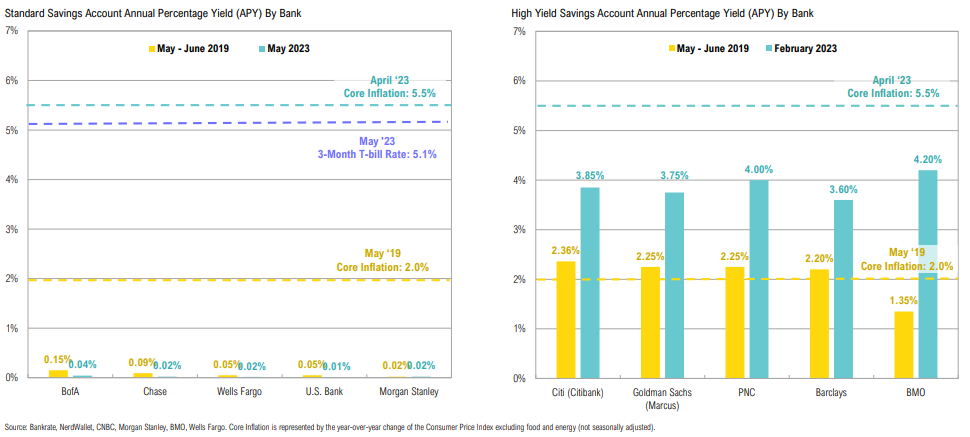

Yields on many high yield savings accounts have increased substantially, but are still low relative to inflation, while yields on many standard savings accounts remain near zero

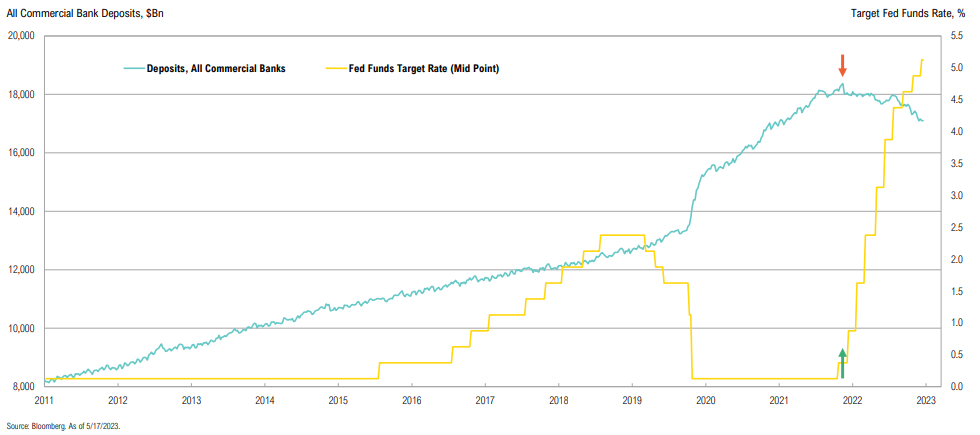

Total U.S. bank deposits increased by $2.9 trillion in 2020 (or 21.9%); it was easy for banks to retain and build deposits at 0% interest rates, but this is no longer the case

Big banks continue to lend to the Fed at rates that dwarf what they pay on deposits, which has resulted deposits leaving banks

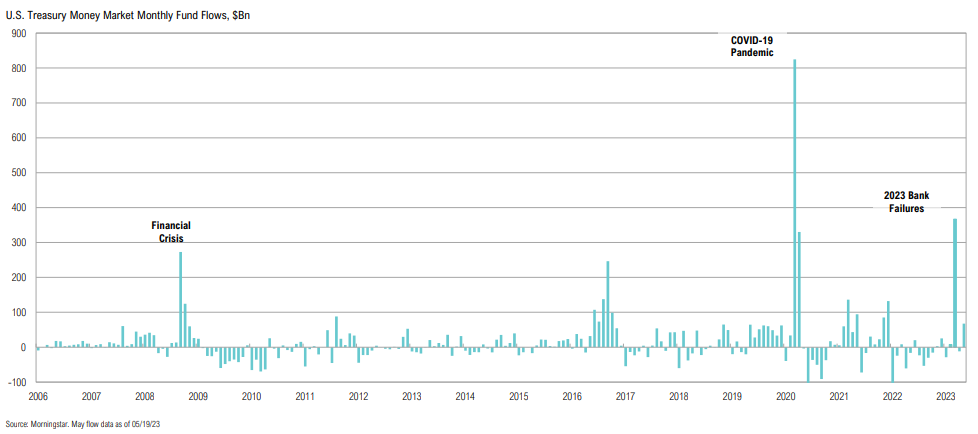

Money Market Flows

U.S. Treasury money market funds have seen $67bn of inflows over the first three weeks of May, bringing the YTD flows to $400Bn

Cash & Liquidity Reserve Implementation Cheat Sheet