SUMMARY

“The worst pandemic in modern history was the Spanish flu of 1918, which killed tens of millions of people. Today, with how interconnected the world is, it would spread faster.”

Bill Gates, 2014

1Q, 2020 Market Review

GROWTH, INFLATION & POLICY

“The Coronavirus is very much under control in the USA. We are in contact with everyone and all relevant countries. CDC & World Health have been working hard and very smart. Stock Market starting to look very good to me!”

Donald Trump, February 24, 2020

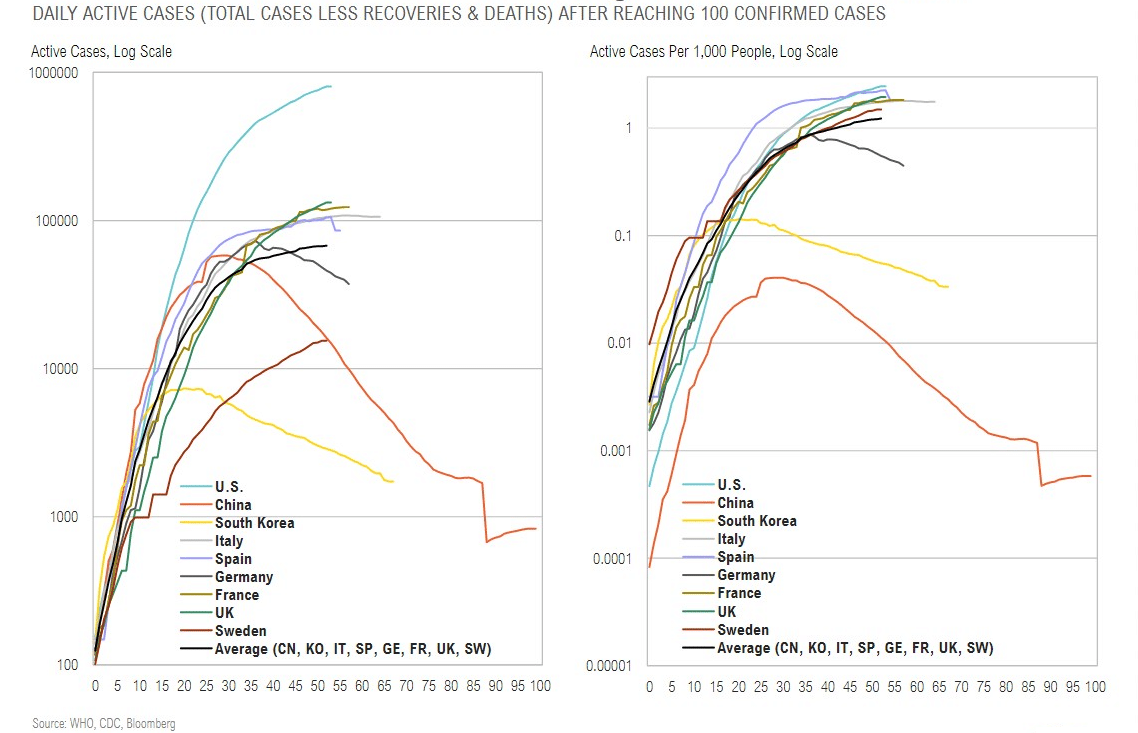

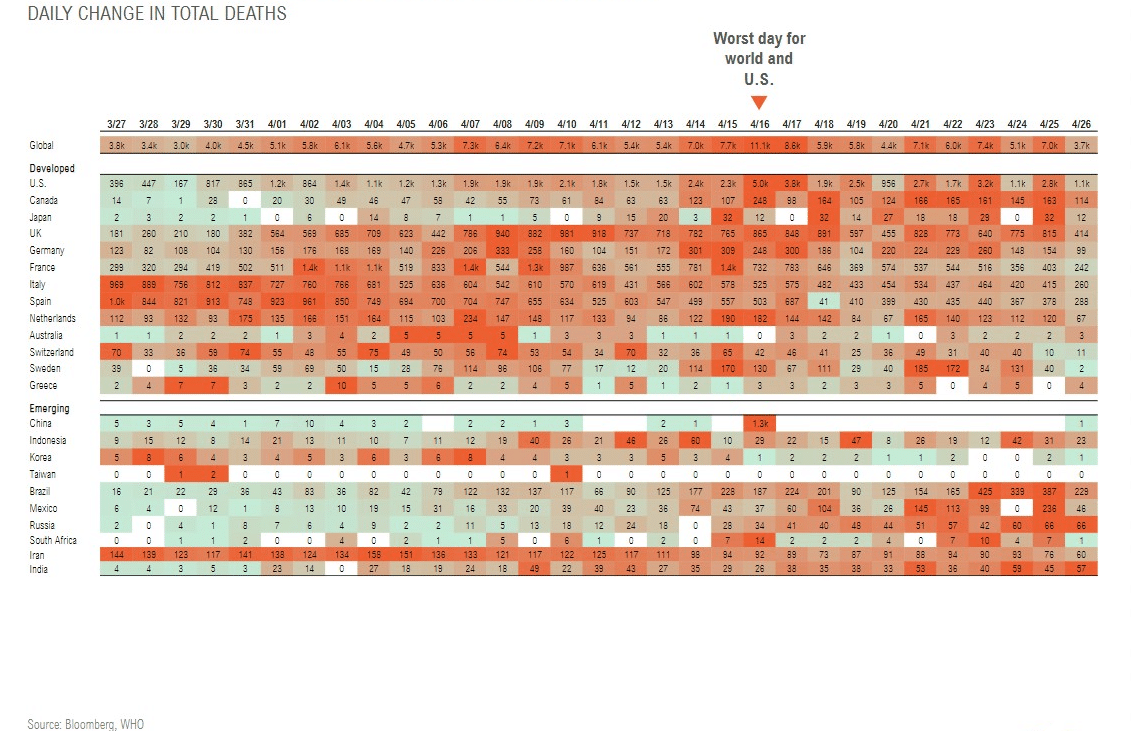

Lockdowns & Other Containment Working: Broad-Based Plateauing

Hopeful Signs that the Curve is Flattening

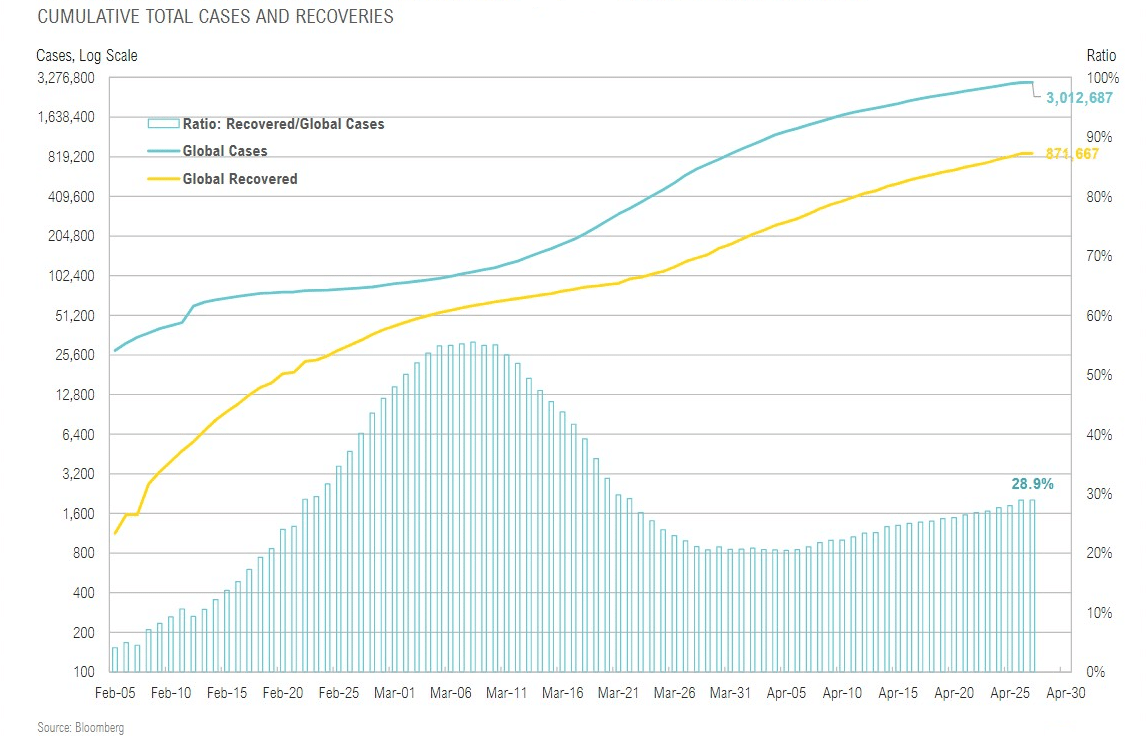

Global Recoveries Are Now Keeping Pace with Cases

Total Shutdowns, Partial Shutdowns & Some Increases

U.S. GDP Estimates

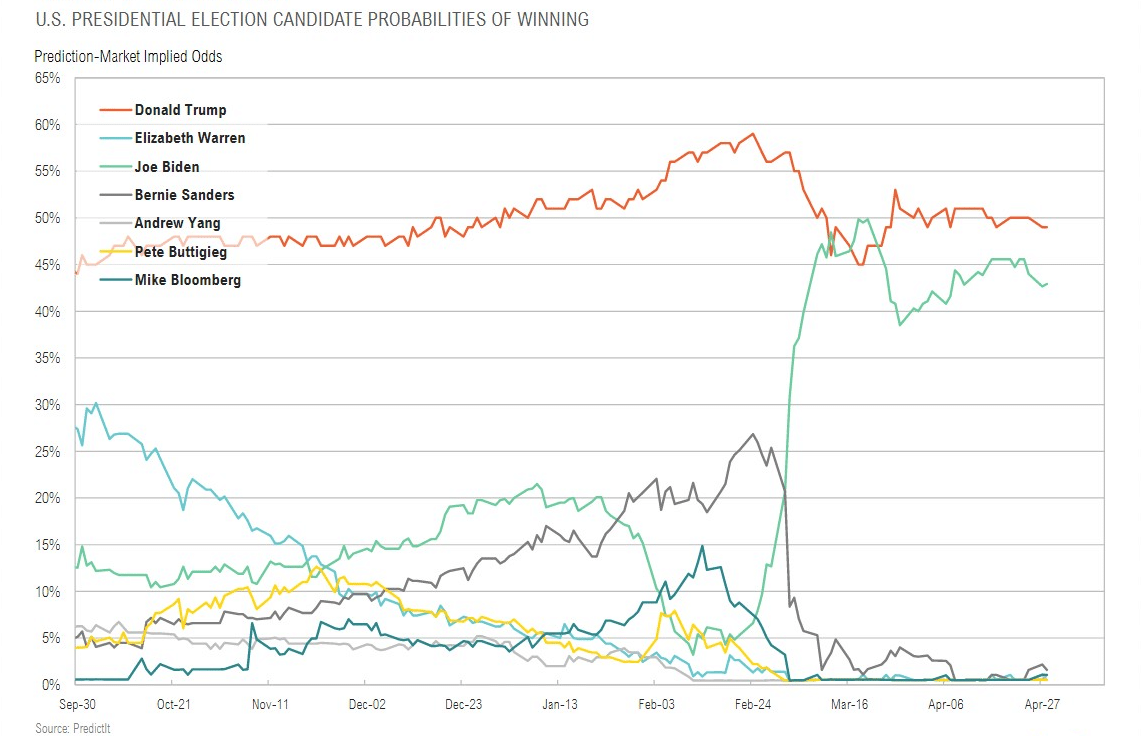

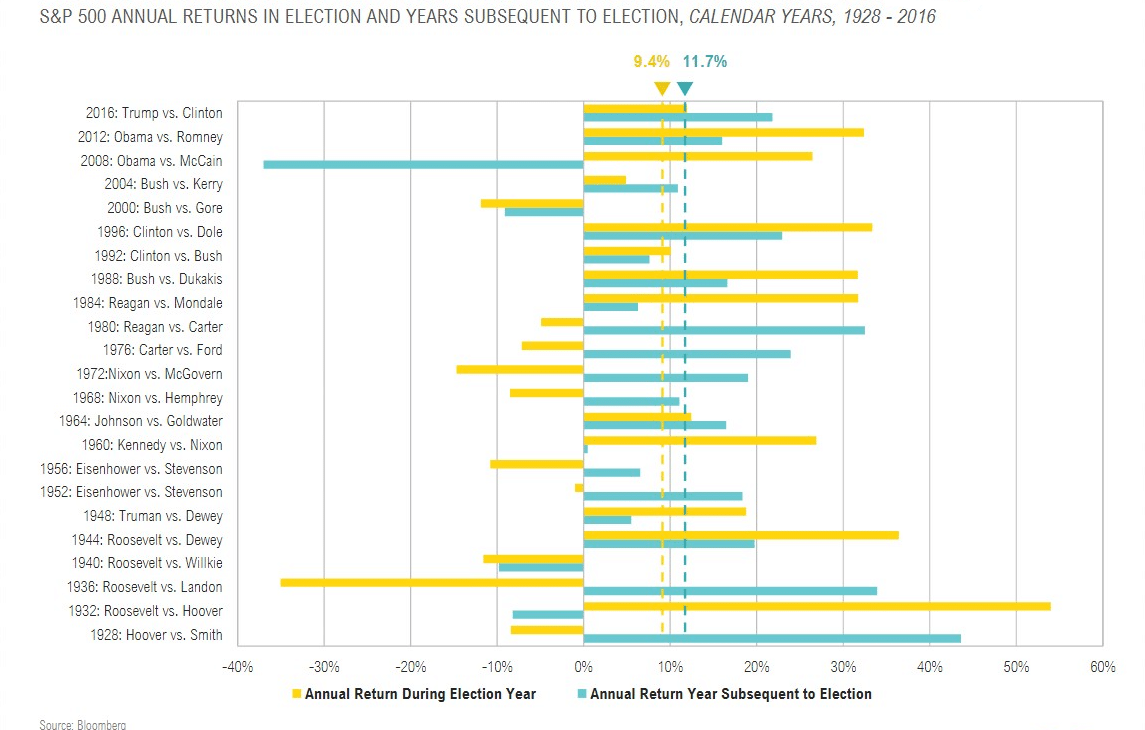

Trump vs. Biden

Election and Post Election Year Annual Returns for Large Cap

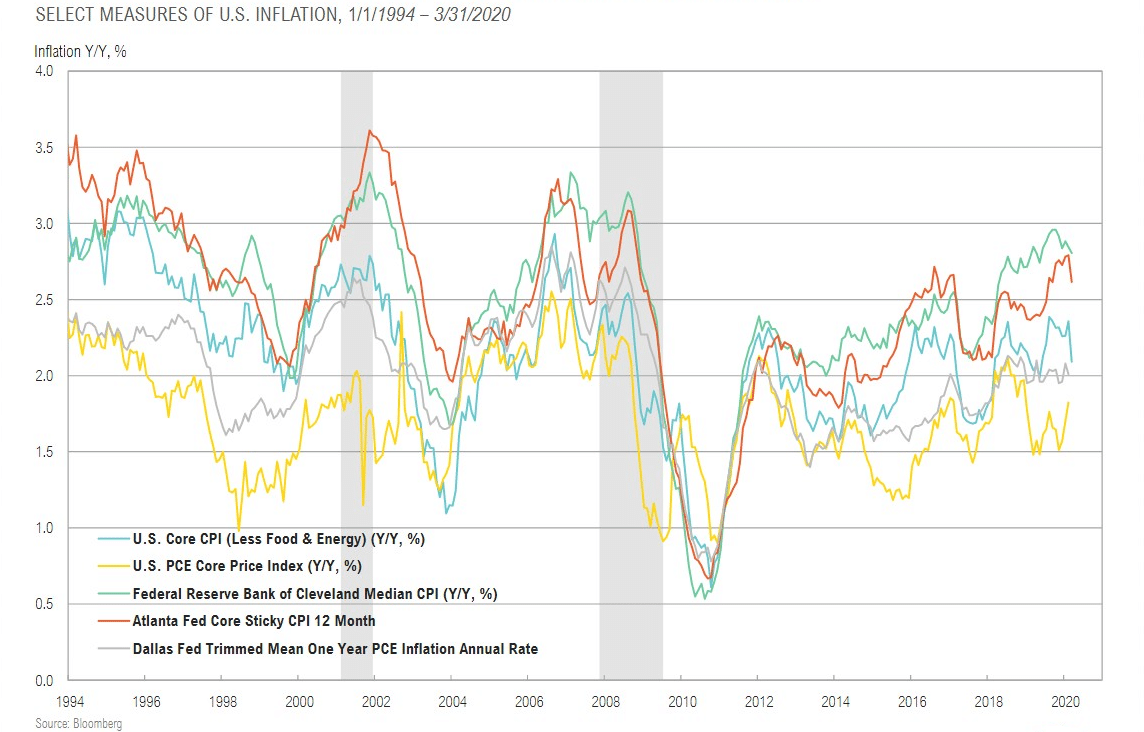

Most Measures of Core Inflation Have Come Down

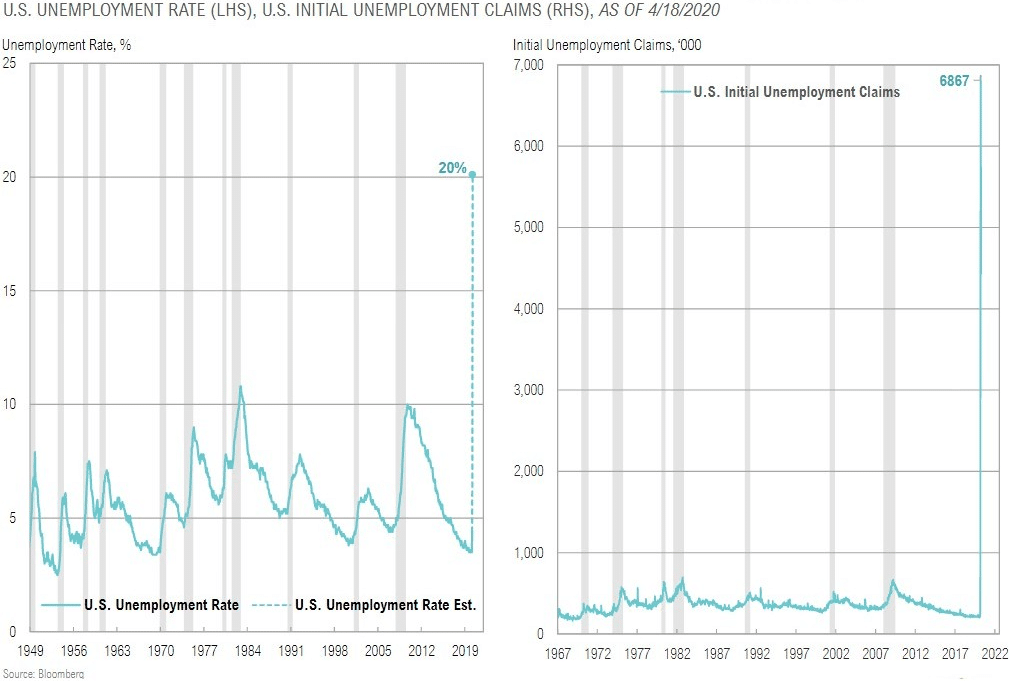

Per Economists, Unemployment Rate Could Approach 20%

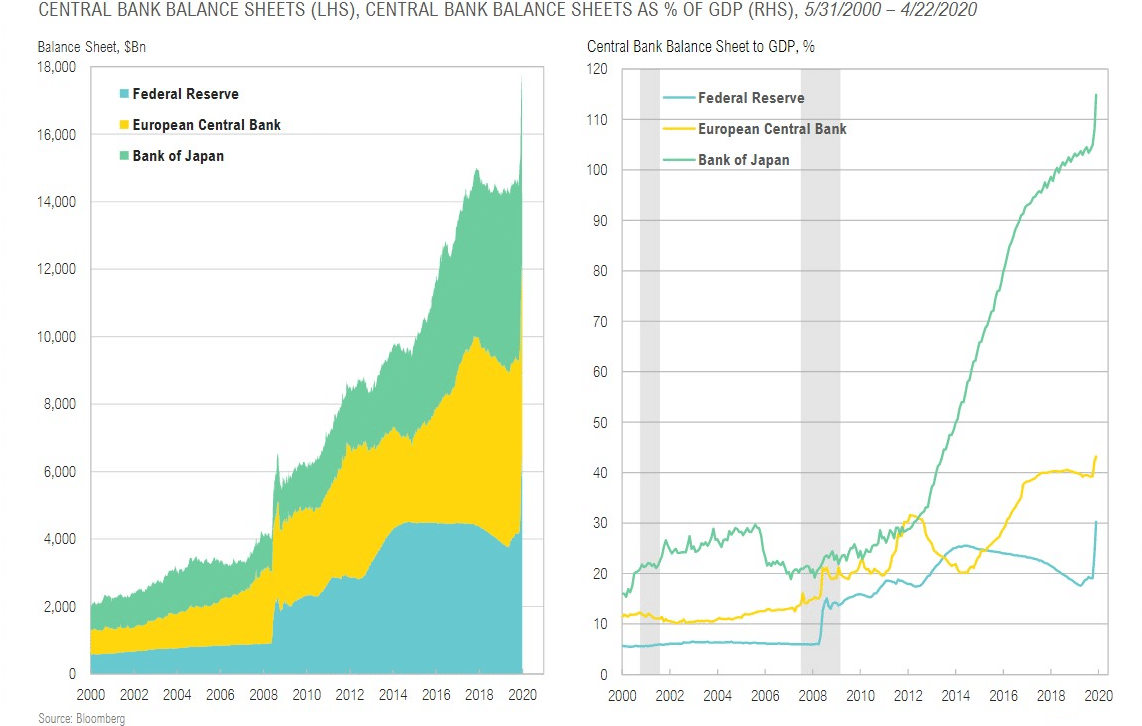

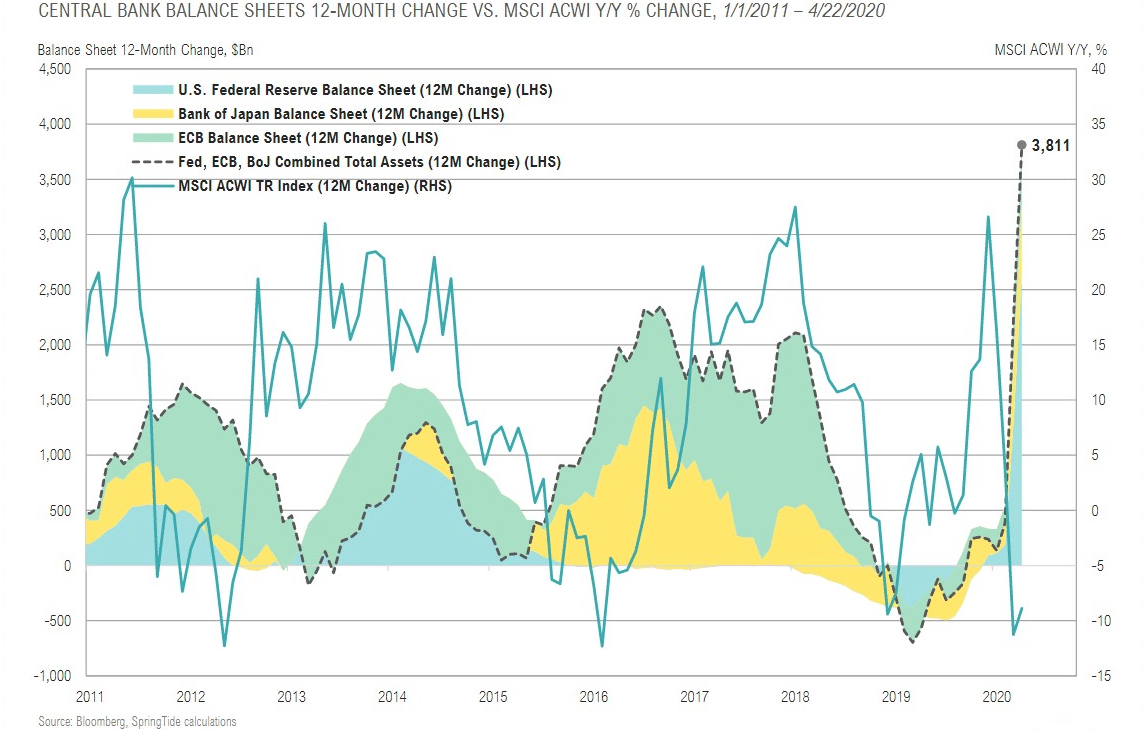

Unprecedented Central Bank Balance Sheet Expansion

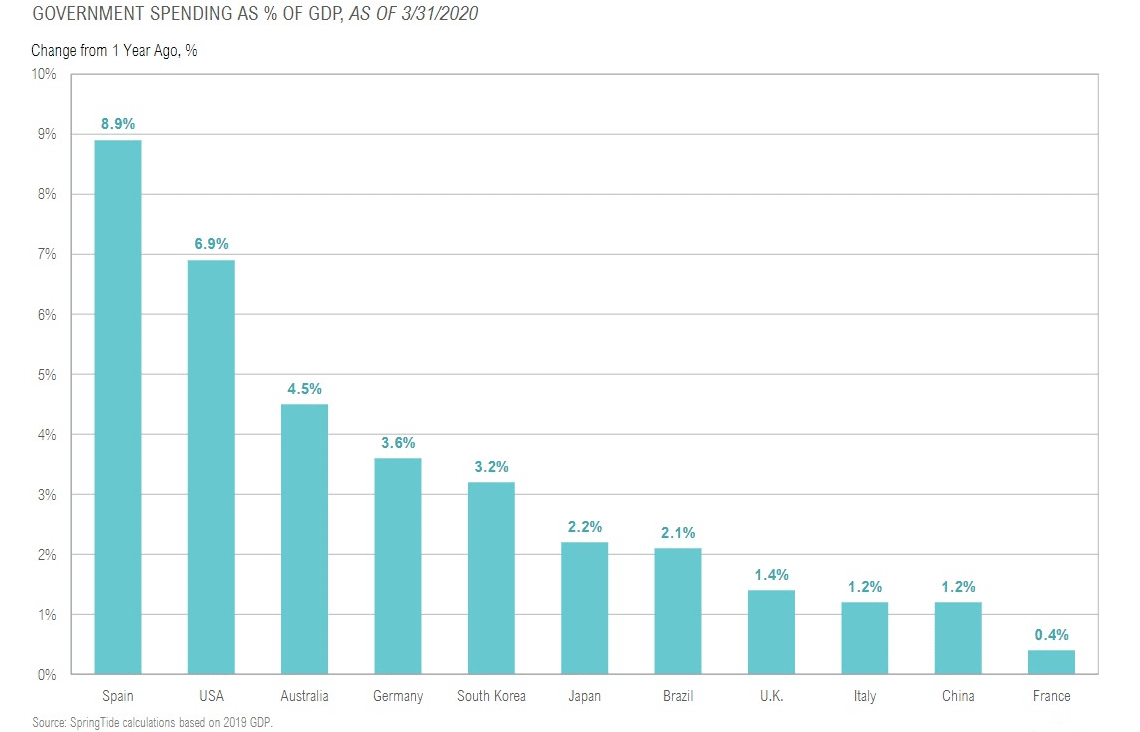

Global Policy Response to COVID-19

EQUITY

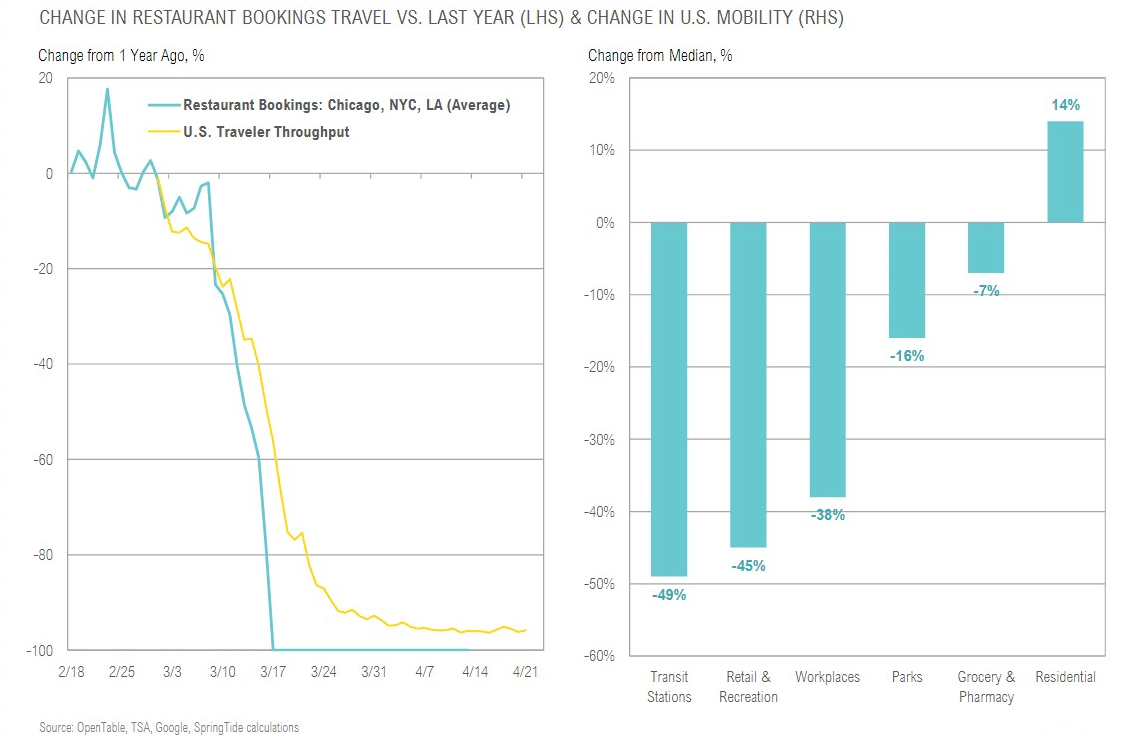

“One of the things that we’re hearing a lot from business contacts and leaders in the community is our concerns that even as the pandemic passes, even as the restrictions are relaxed gradually over time, people may take quite a while before they’re willing to get back on airplanes or trains or go to the theater or go to concerts and things like that. So, I think there are some risks that it takes longer to get that recovery for the economy than just what happens in terms of the formal restrictions that are in place.”

John Williams, New York Fed President, April 2020

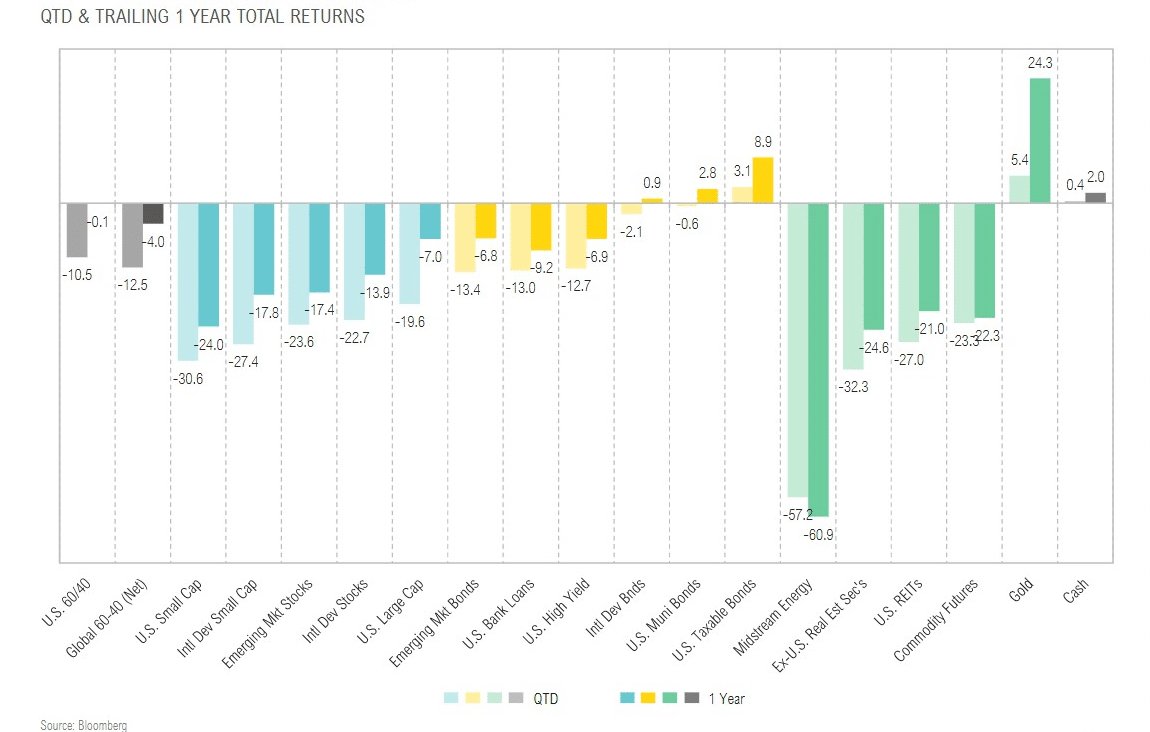

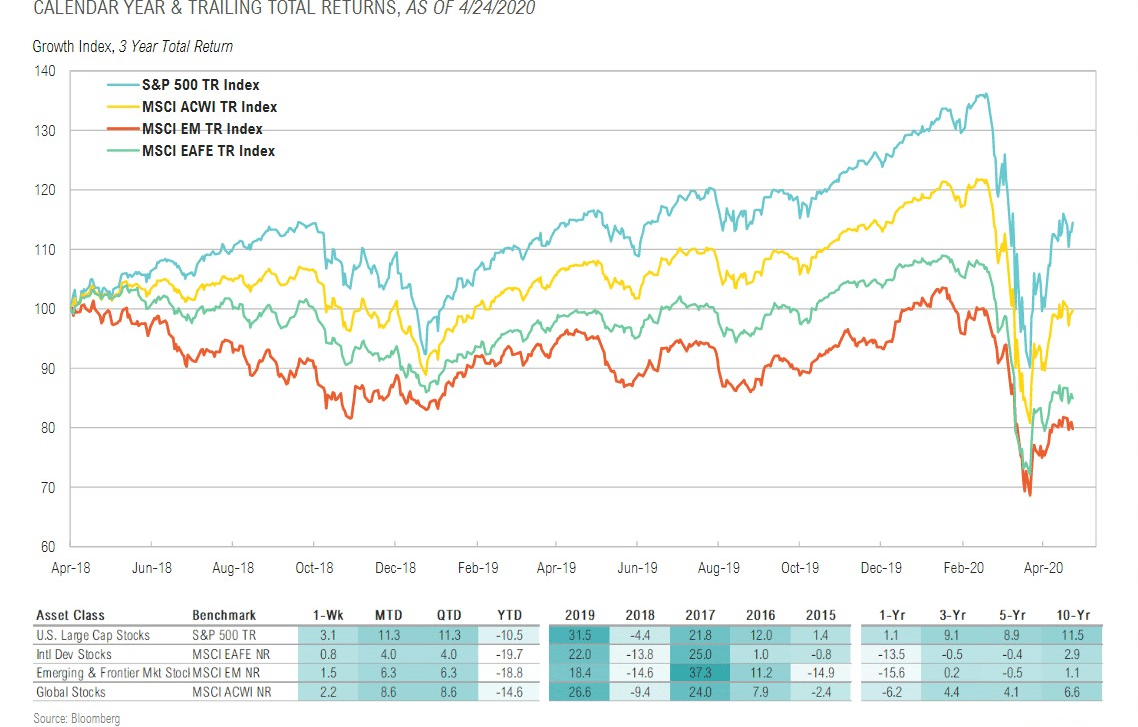

Equity Returns

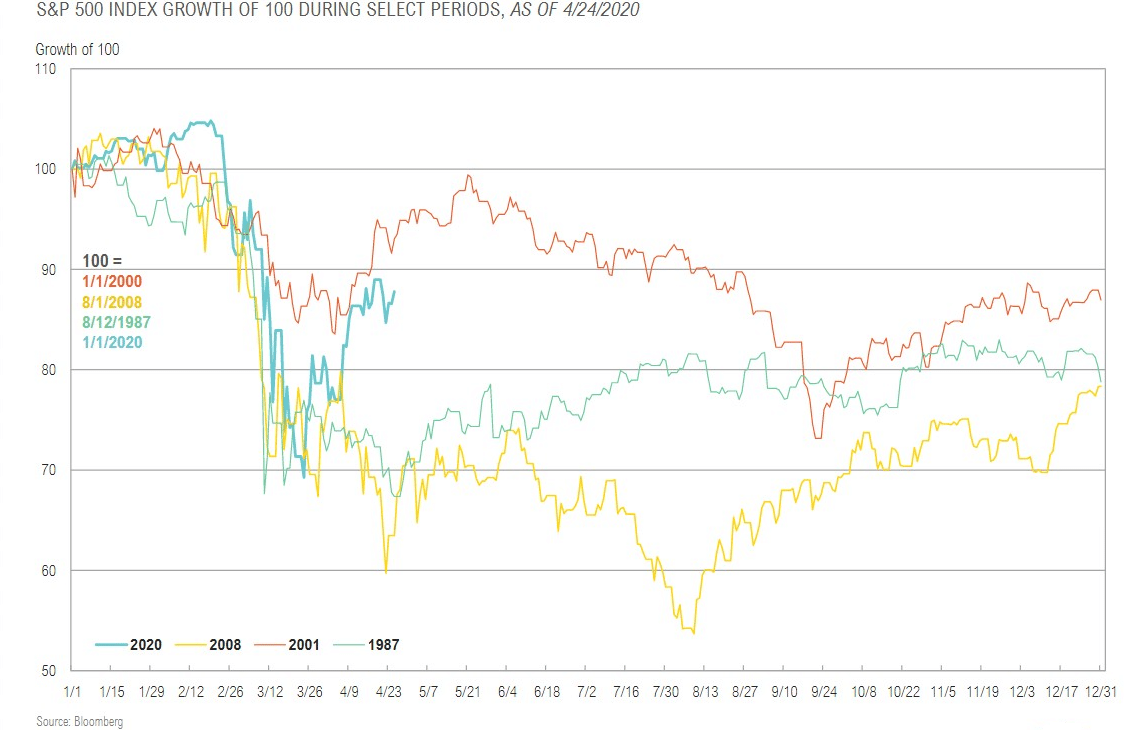

Coronavirus Crisis vs. Major Bear Markets of History

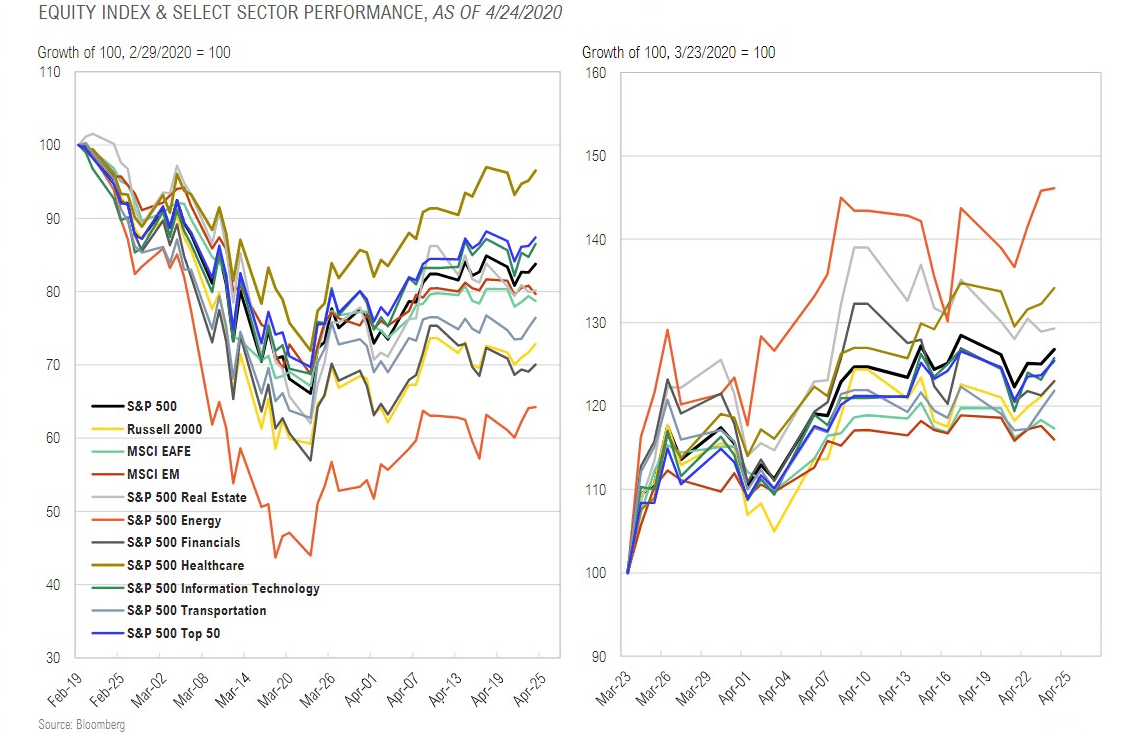

Equity Market Internals: Decline & Rally

Higher Unemployment Generally Means Lower Equity Prices

The Great Battle of the Economy vs. Markets

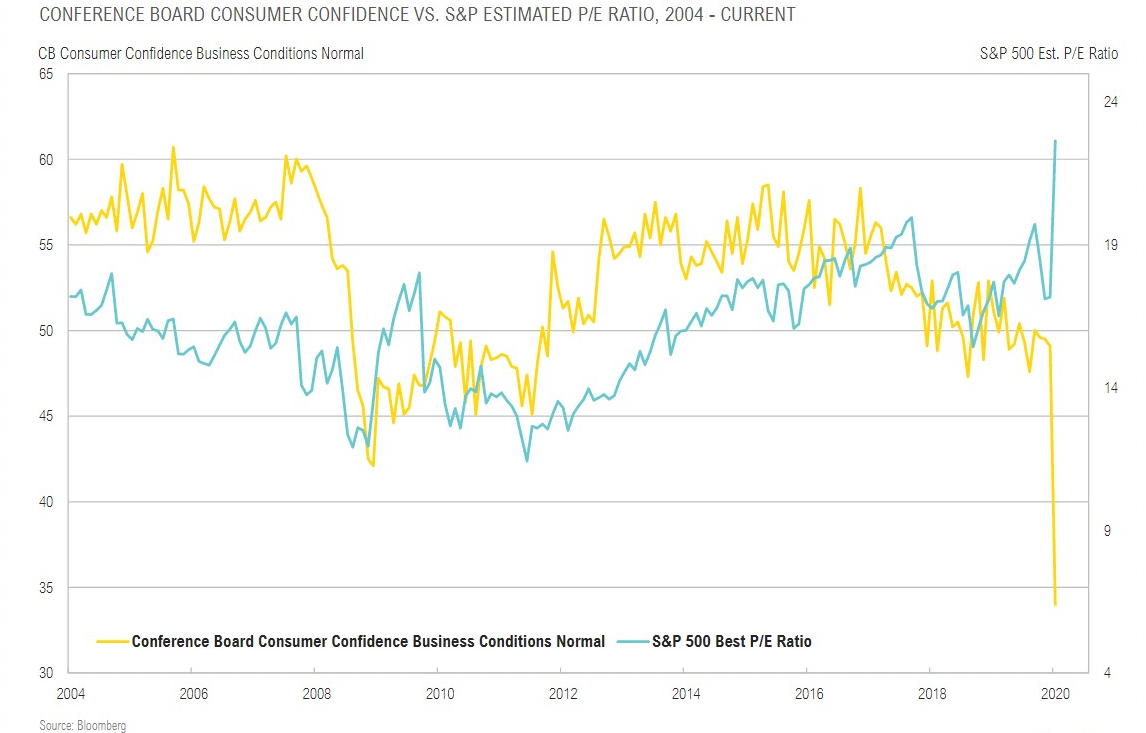

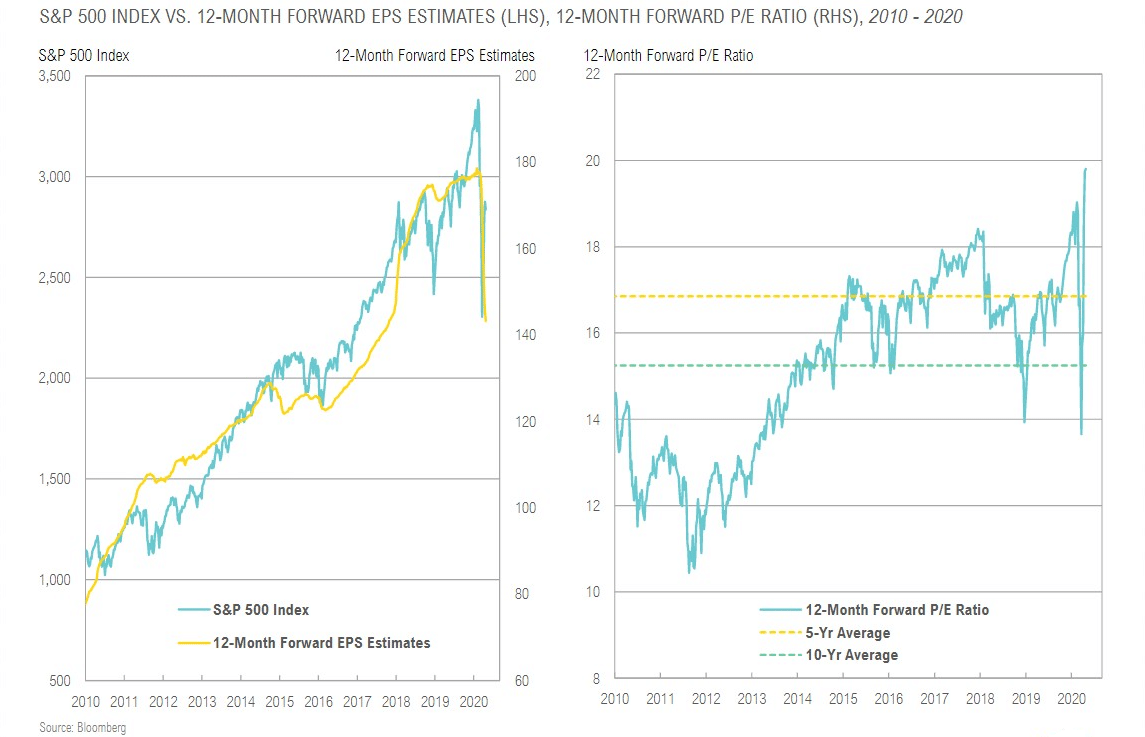

Decline in EPS Has Driven Valuations to Cycle Highs

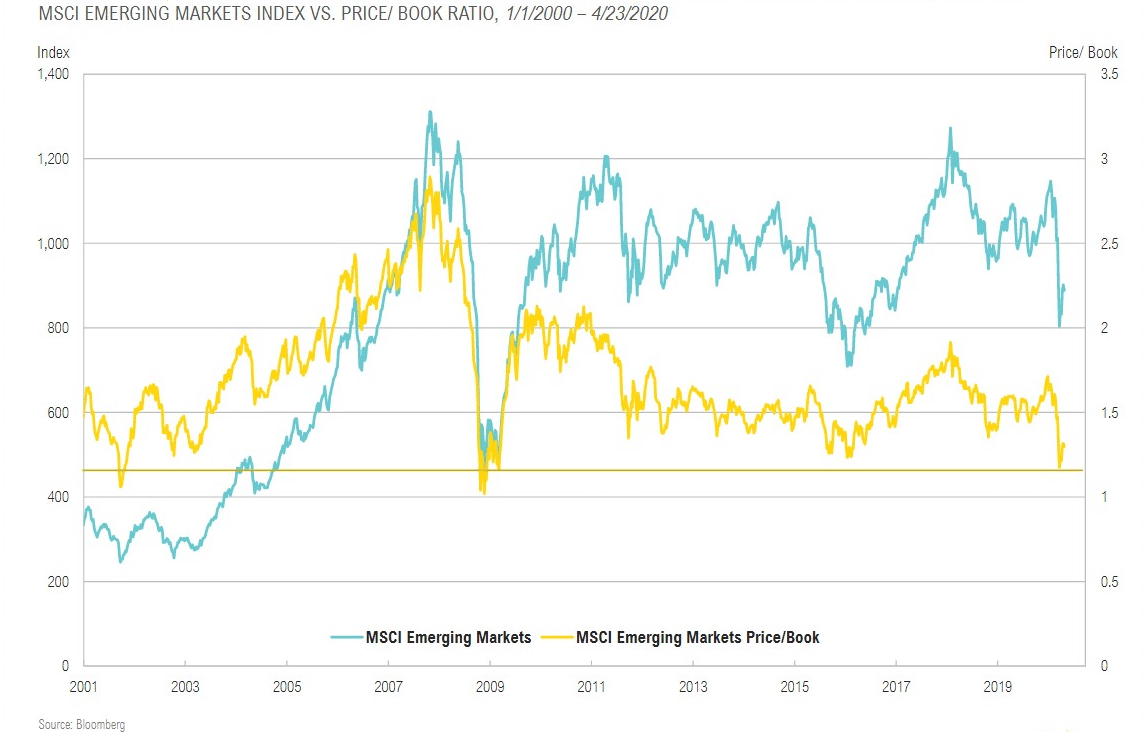

Emerging Mkt Equities Look Cheap Relative to Book Values, But…

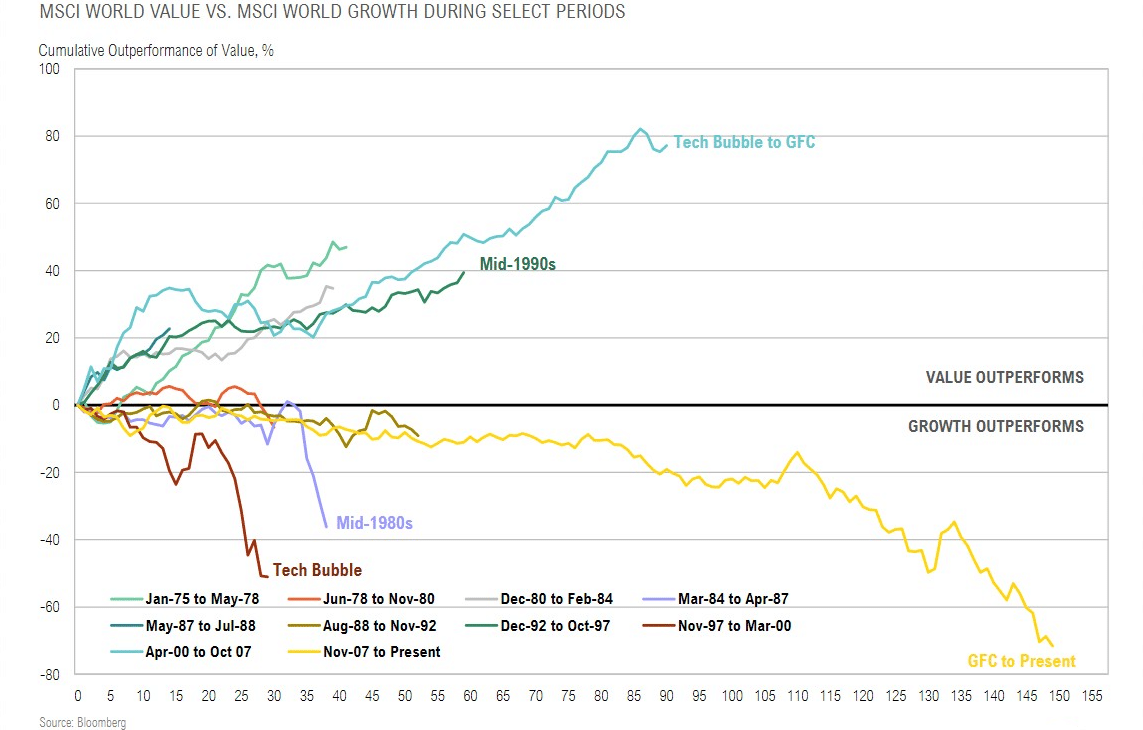

Current Growth Cycle at Extreme Levels

CB Balance Sheets and Global Stocks

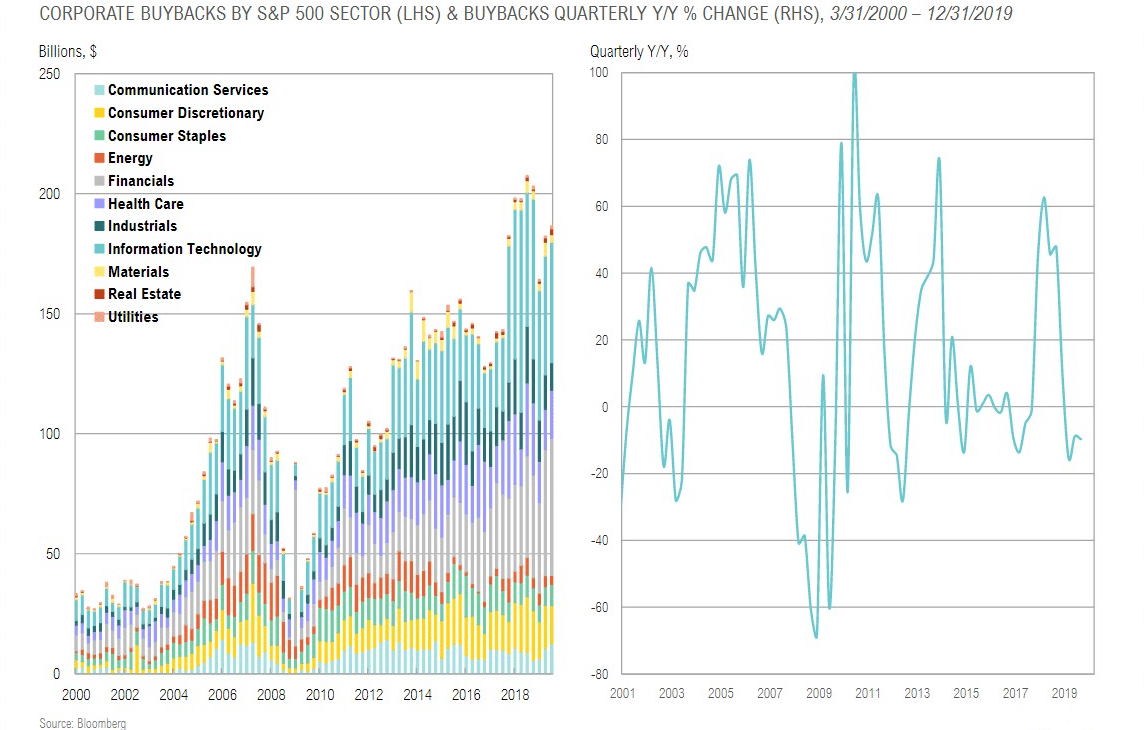

Buybacks: Large Source of Equity Demand Slowing

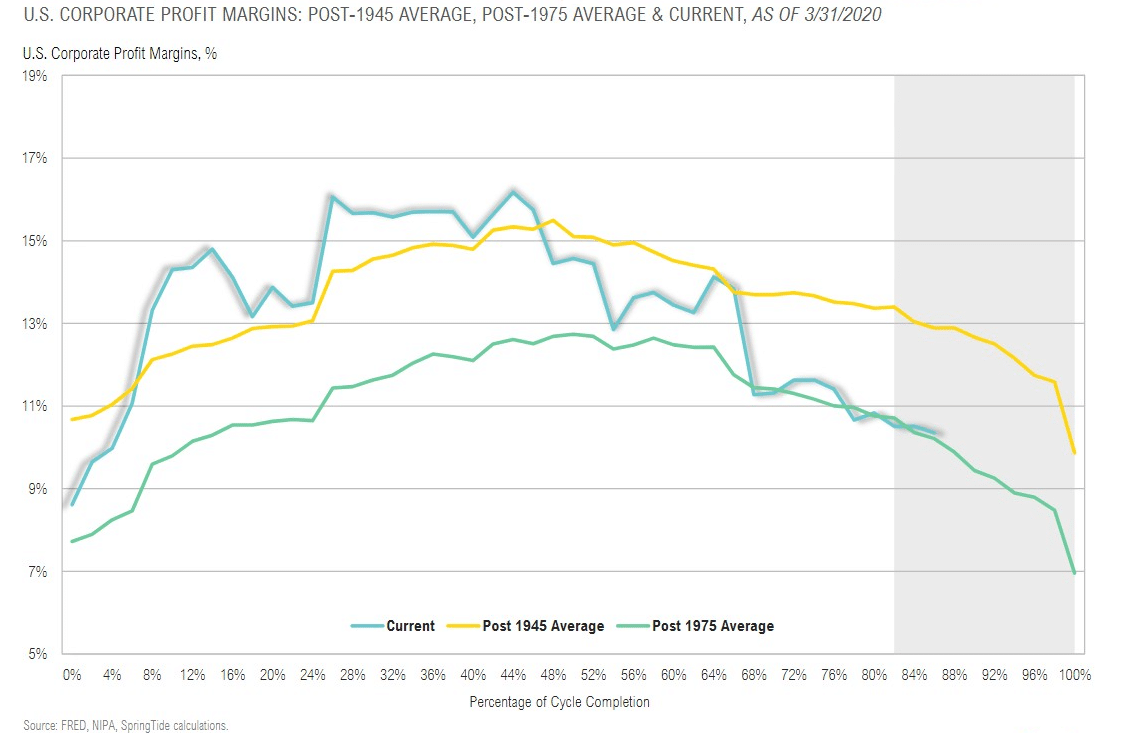

U.S. Corporate Profits Were Rolling Over Prior to Coronavirus

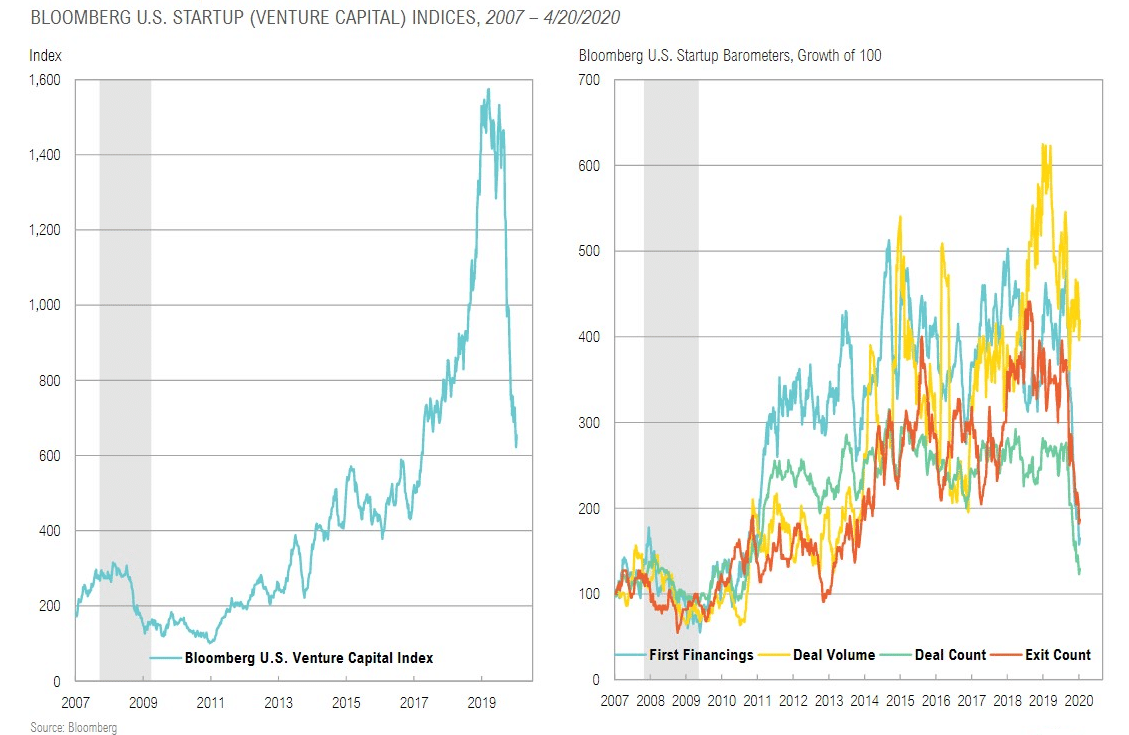

Venture Capital Washout

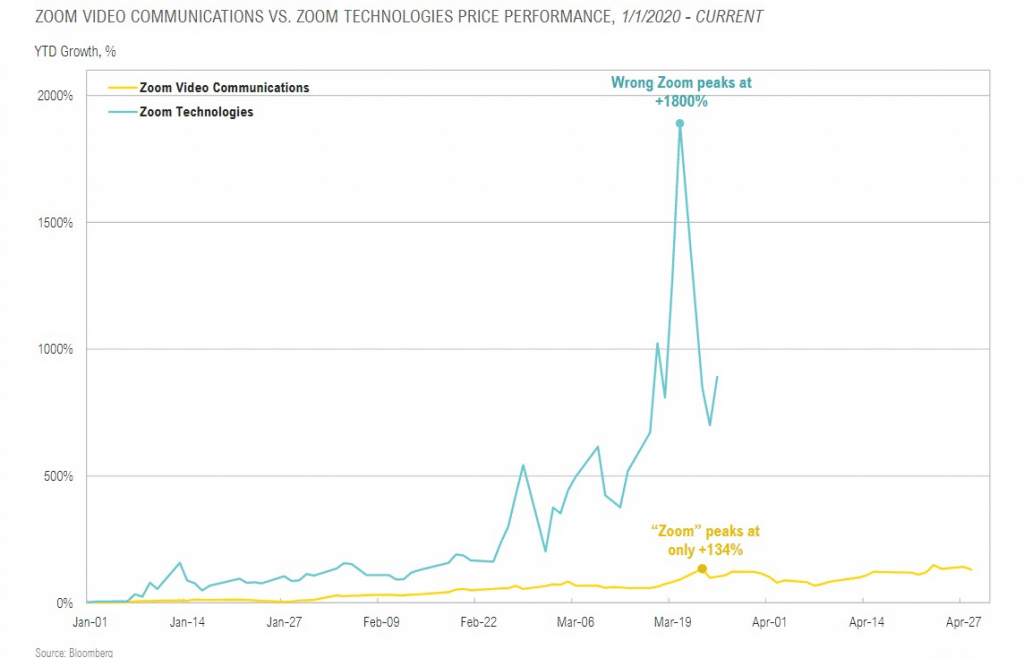

Markets Are Not Always as Efficient As We Think

FIXED INCOME & CREDIT

“We can do what we can do, and we will do it to the absolute limit of those powers… we will keep at it, and we will be at it with the legal authorities that we have until we get through this thing. We will keep using our authorities… but there are authorities that we don’t have and there may be a need for those authorities to be used as well as ours.”

Jerome “Jay” Powell, Federal Reserve Chairman

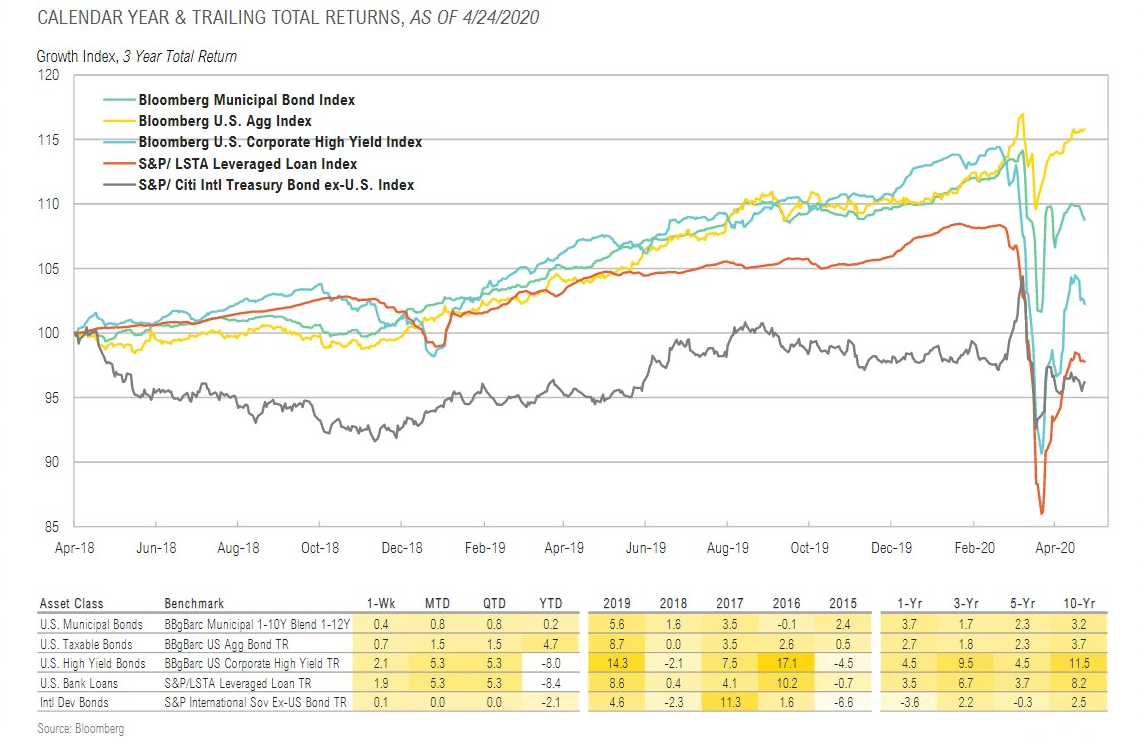

Fixed Income & Credit Returns

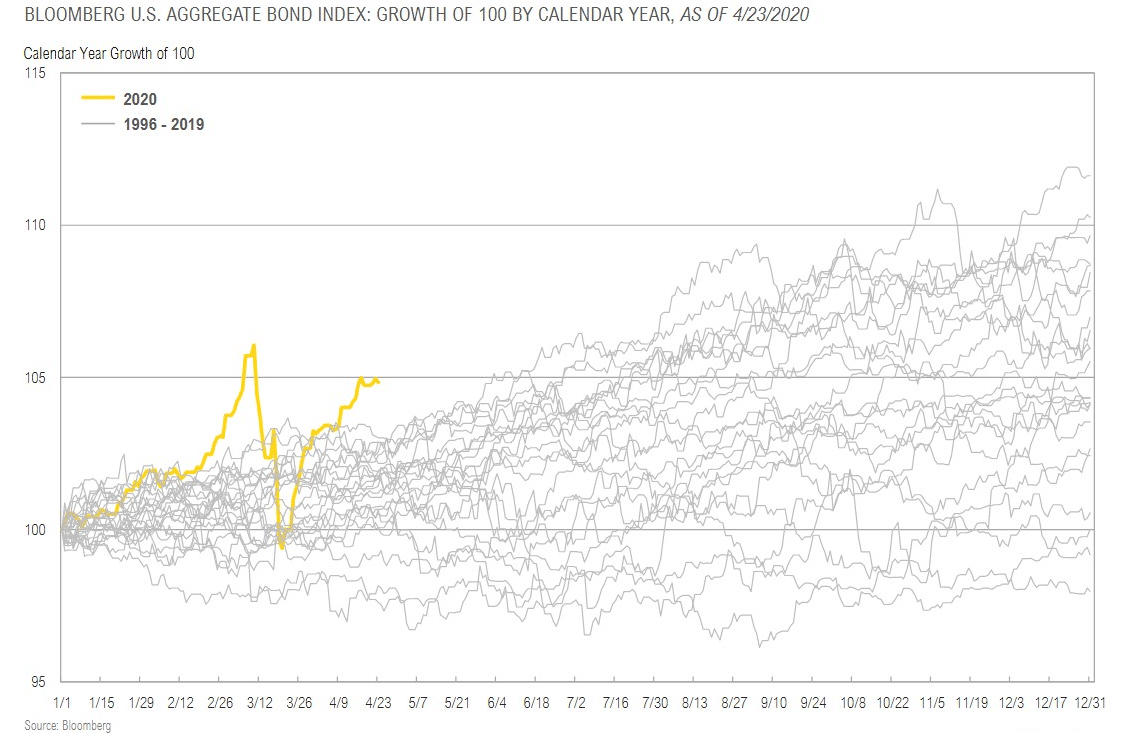

A Record Year for U.S. Core Bonds

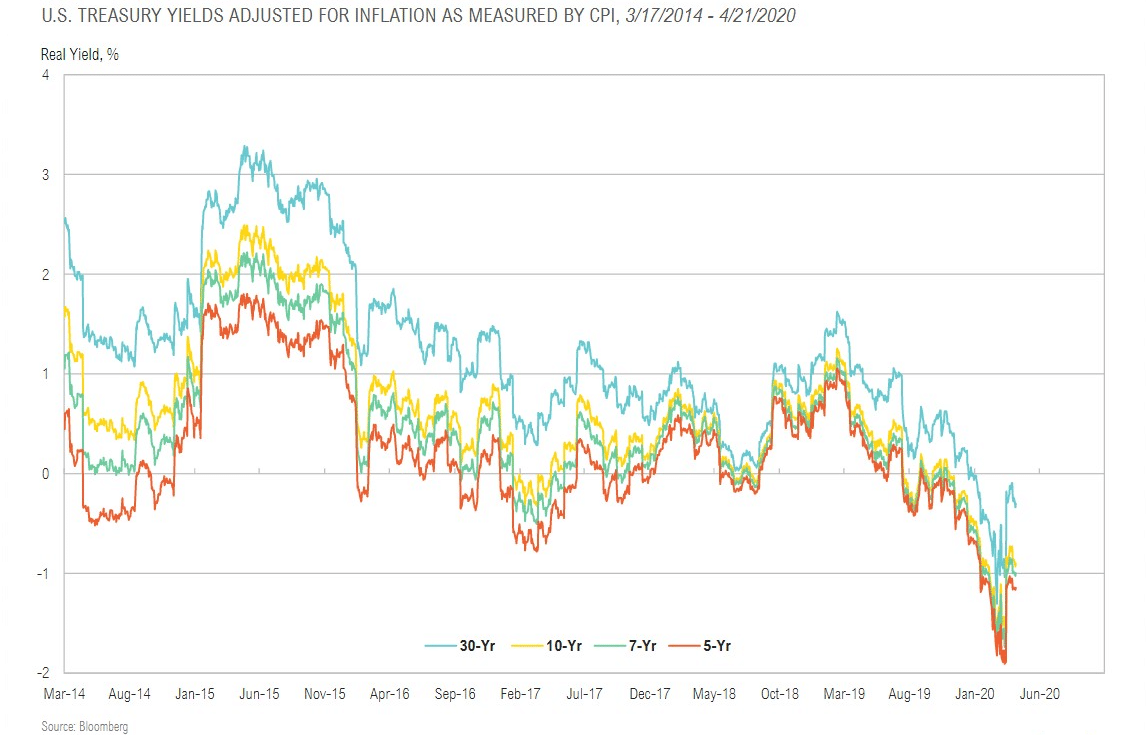

Negative Real Yields Across the Curve

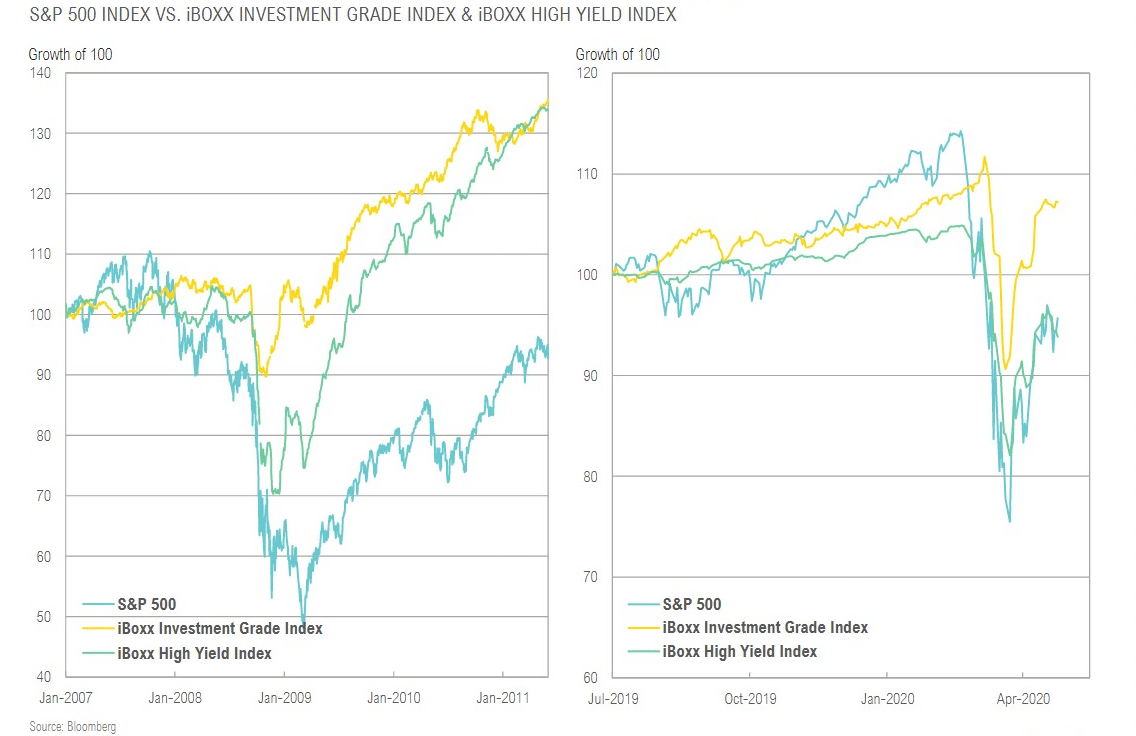

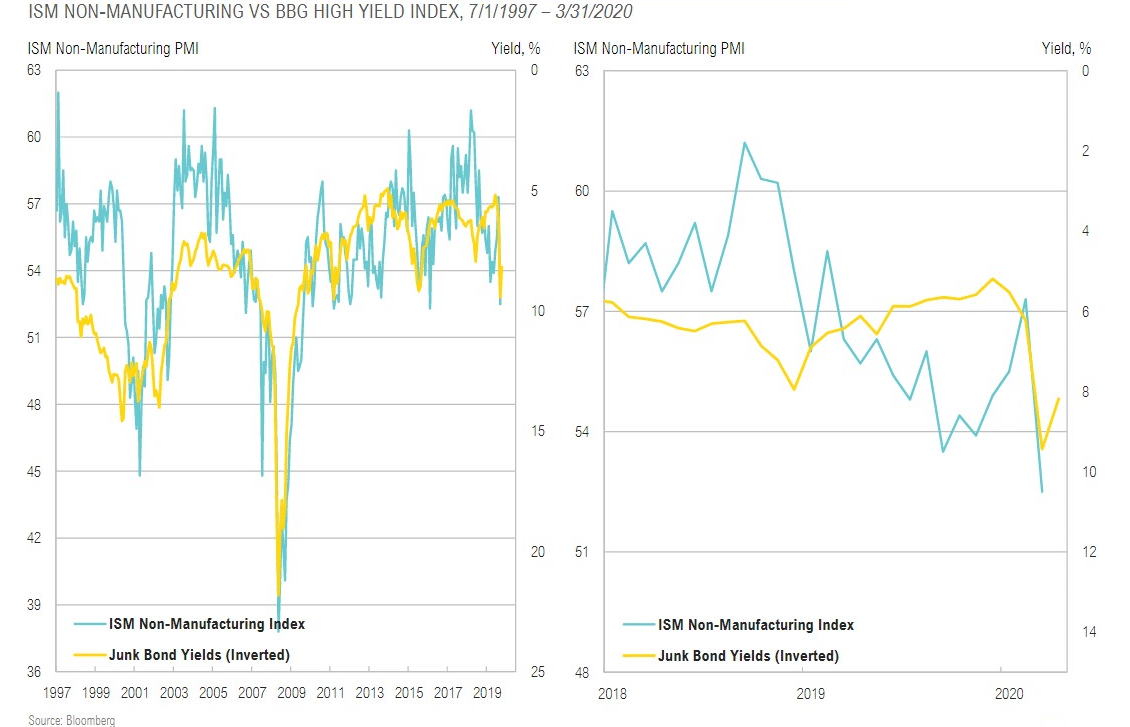

Watch Credit to Lead Equities On the Way Out

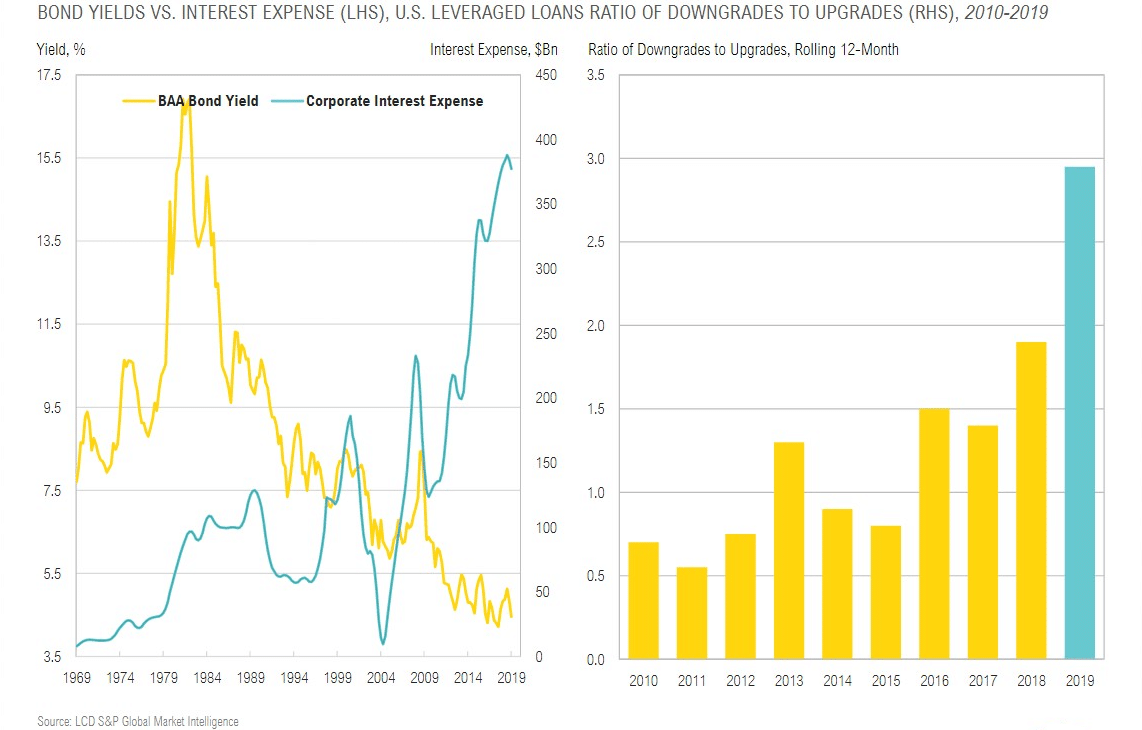

Credit Was Already Cracking Before the Crisis Started

Credit Was Already Cracking Before the Crisis Started

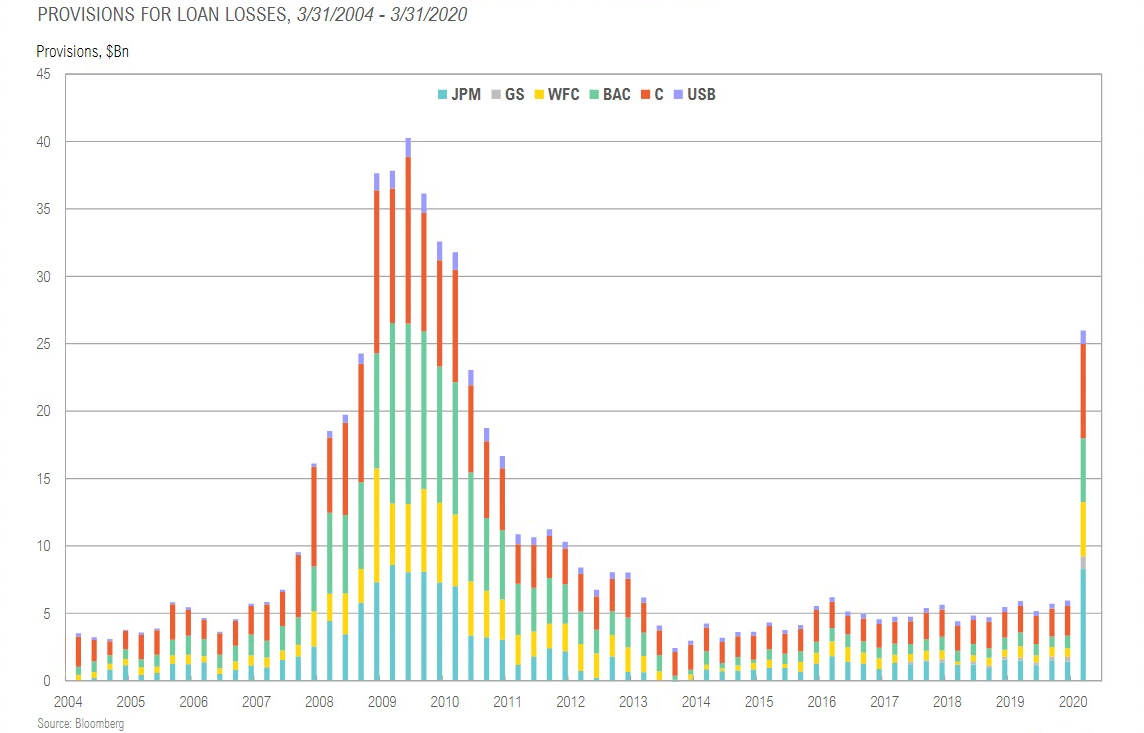

U.S. Bank Provisions for Loan Losses Jump

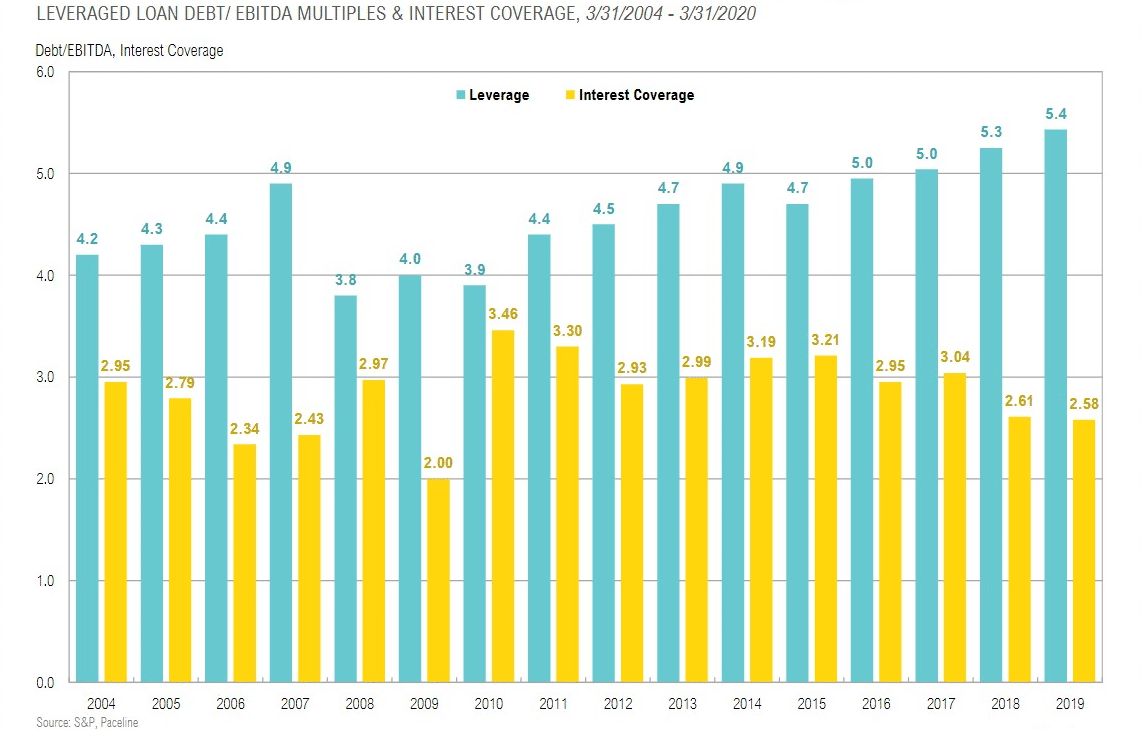

Prior to Crisis, Leverage Was Above Last Cycle Peak

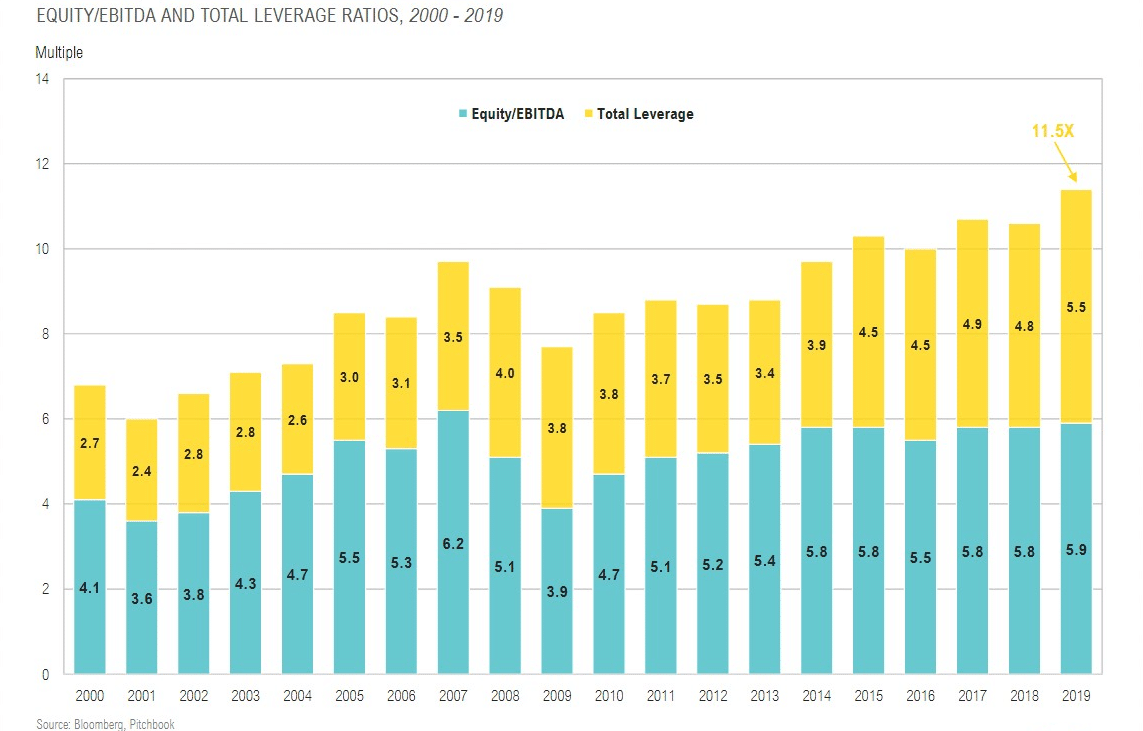

Leveraged Buyout Valuations

REAL ASSETS

“There is no safe store of value. Deficit spending is simply a scheme for the hidden confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights.”

Alan Greenspan, Economist & Former Fed Chairman, 1966

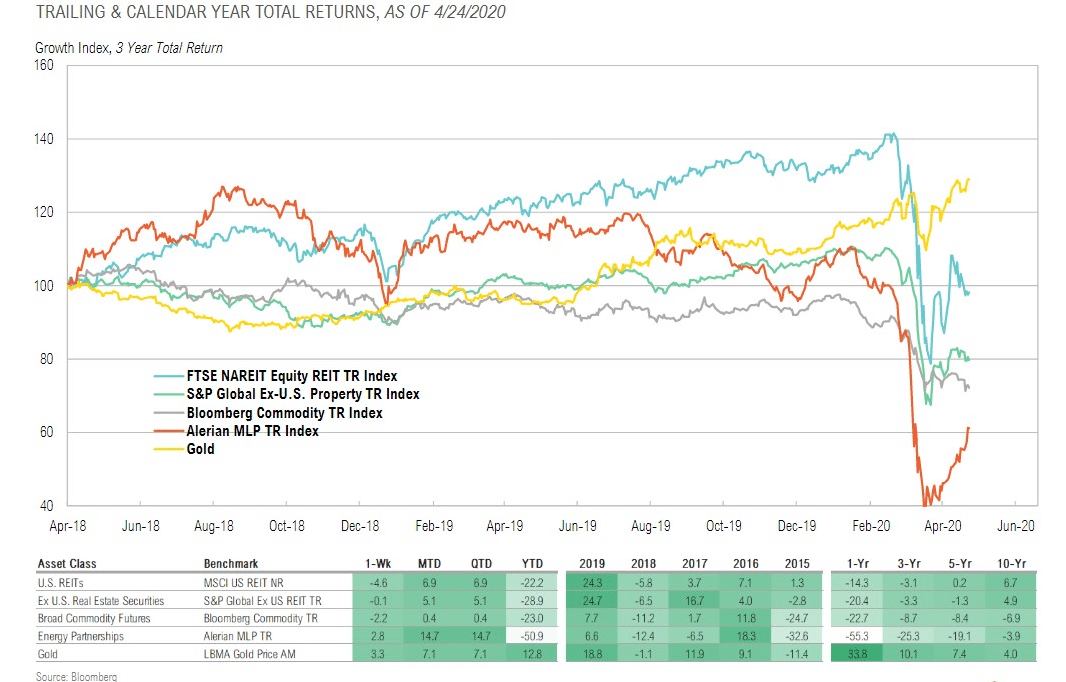

Real Asset Returns

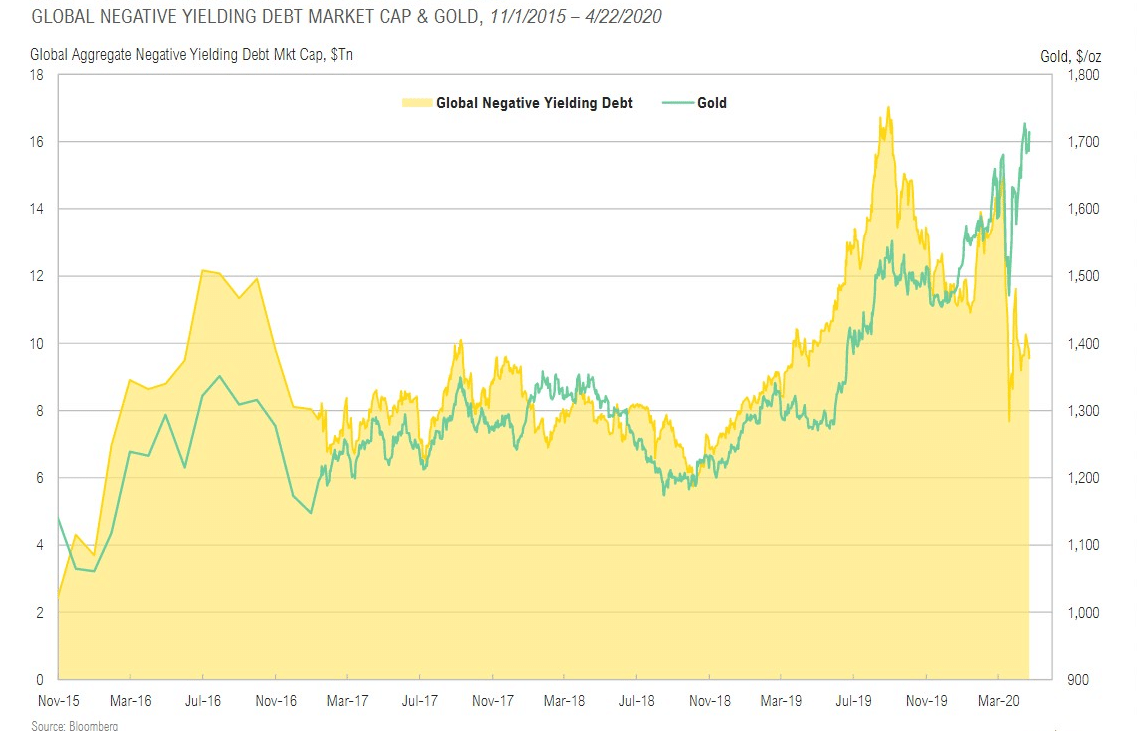

Negative Yielding Debt & Gold

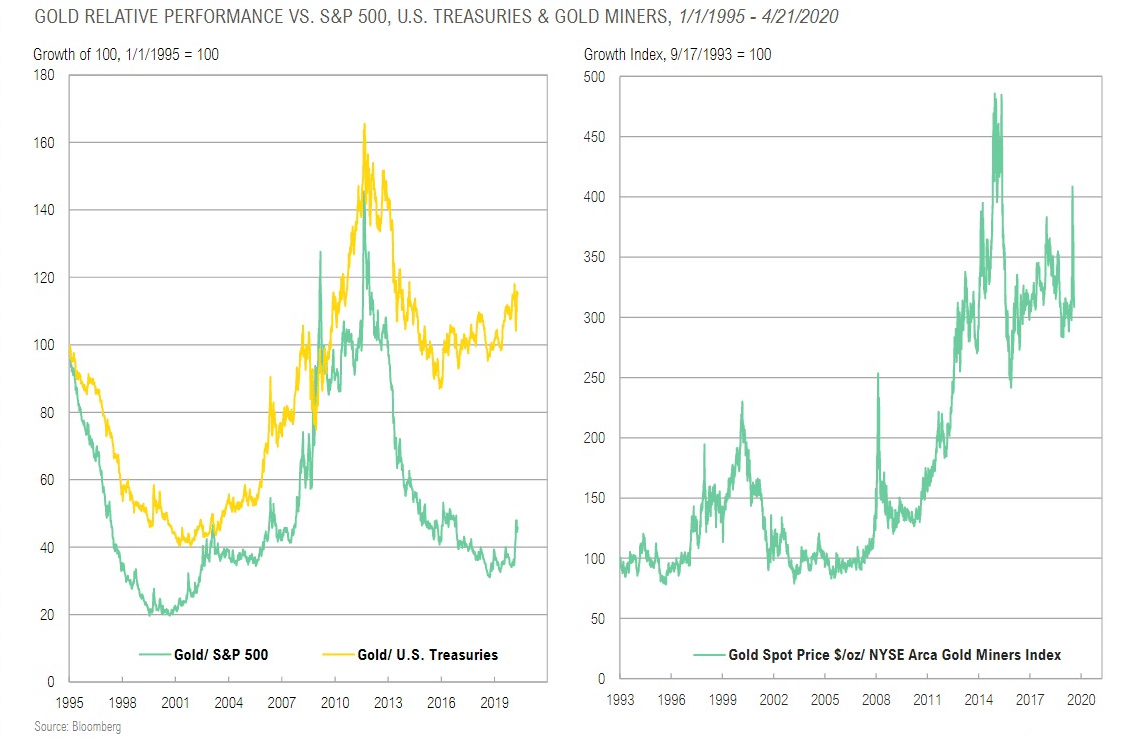

Gold vs. Core U.S. Stocks and Bonds

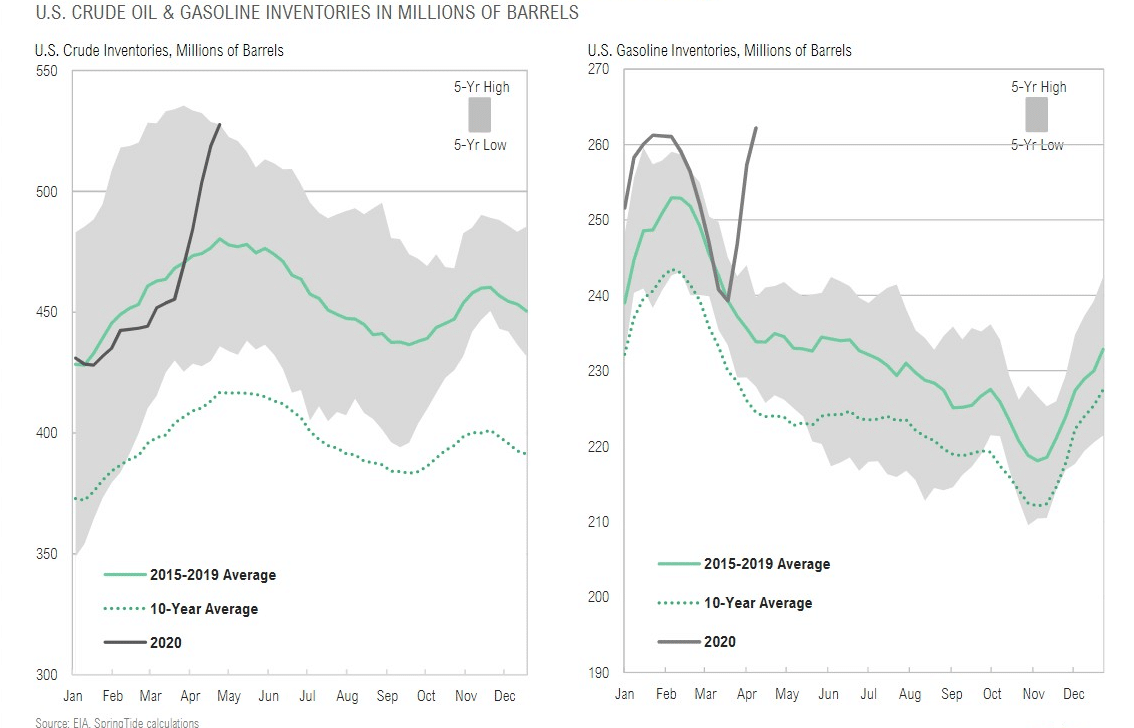

U.S. Crude Oil & Gasoline Inventories Jump

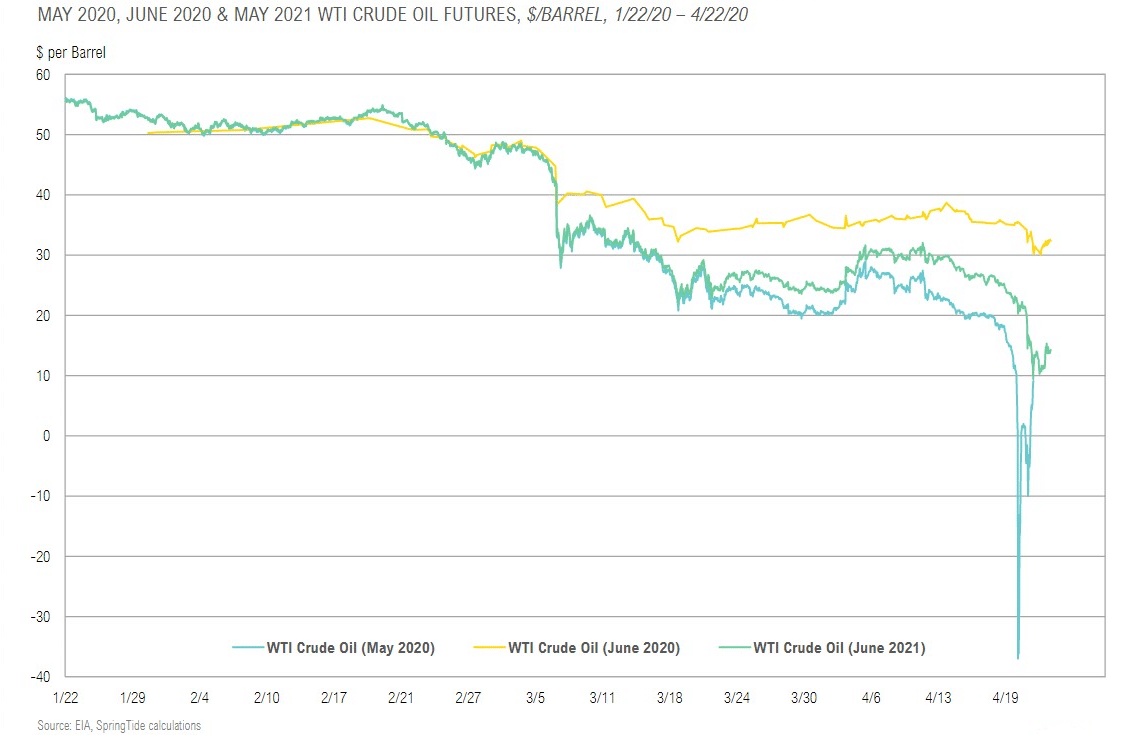

Crude Briefly Trades Below Negative $38 Per Barrel

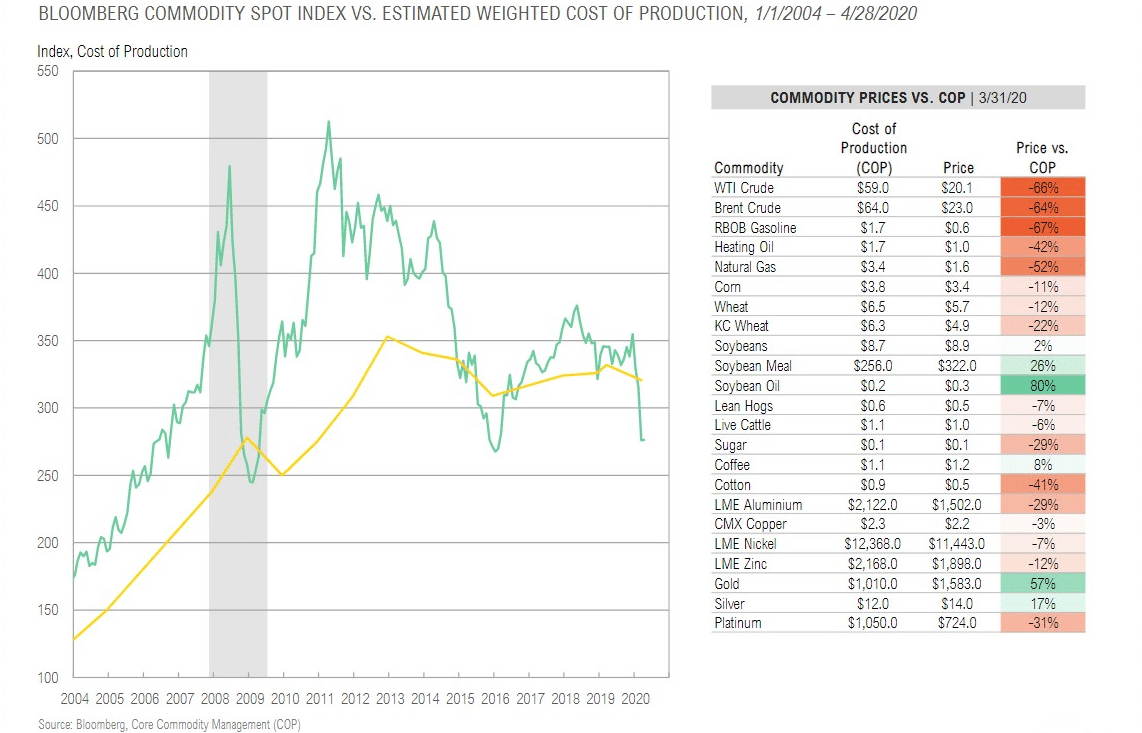

Commodities Below Cost of Production

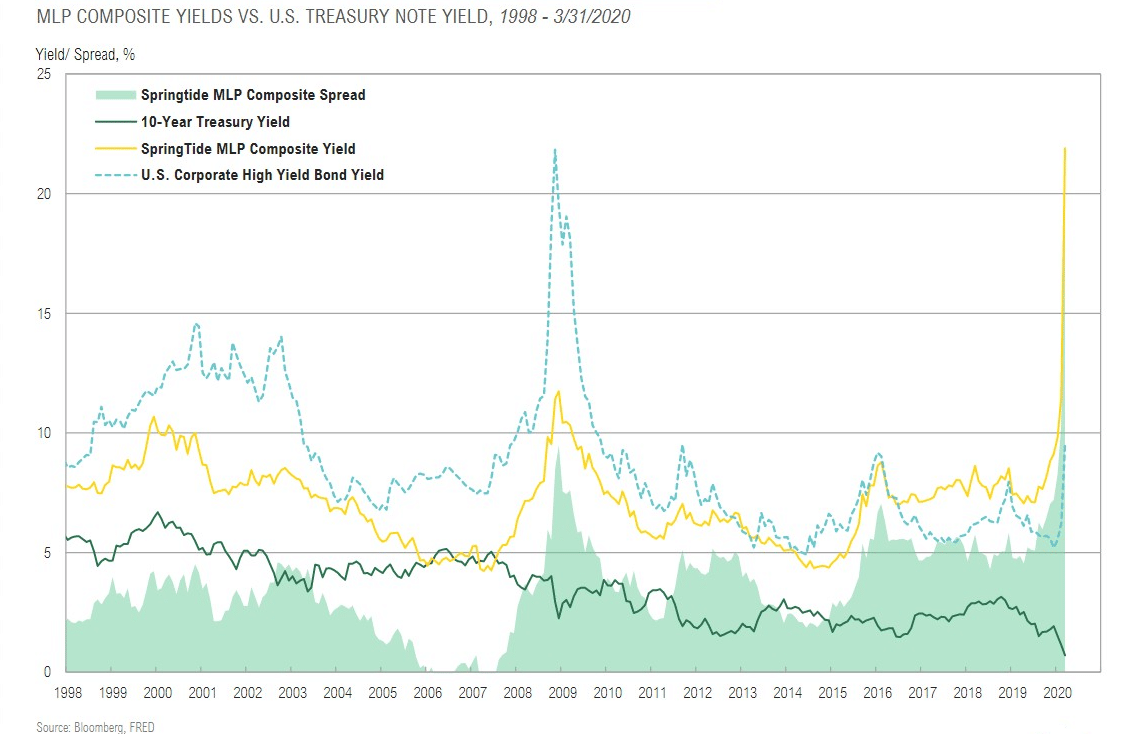

Midstream Energy: Survivors Should Thrive

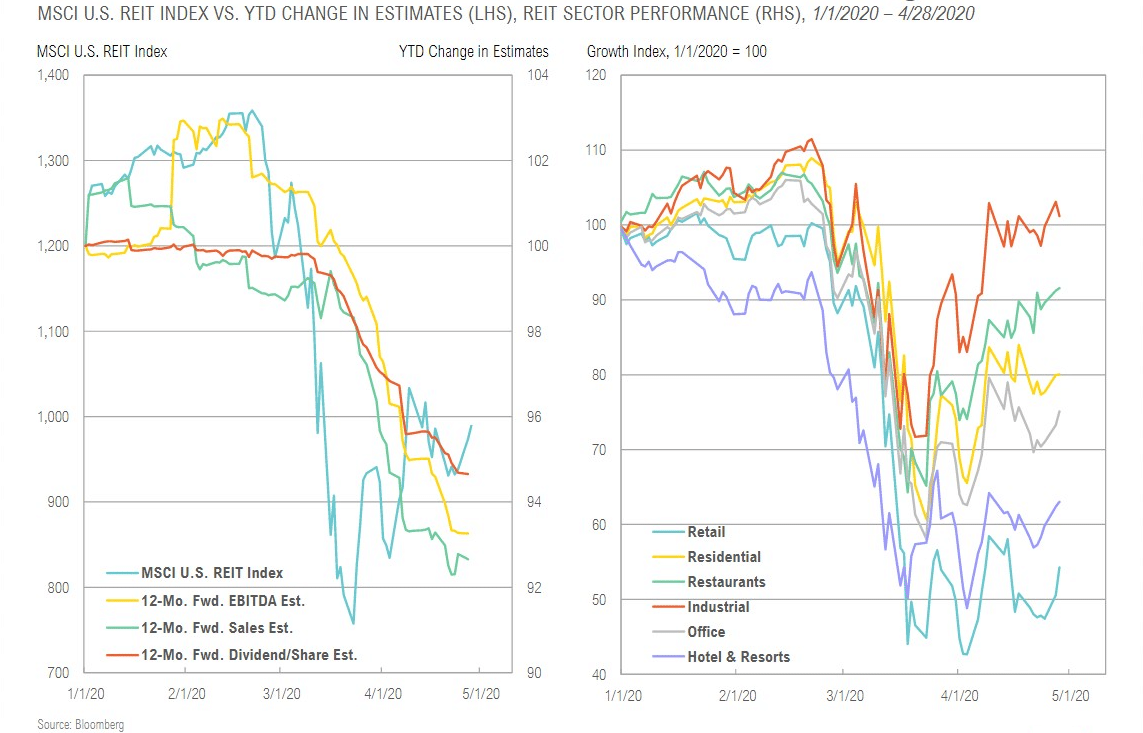

Retail, Hotel & Resort and Office REITs Remain Challenged

OPPORTUNISTIC

“Business are closing and people are unemployed through no fault of their own, and so moral hazard is not a relevant consideration”

Richard Clarida, Fed Vice Chairman

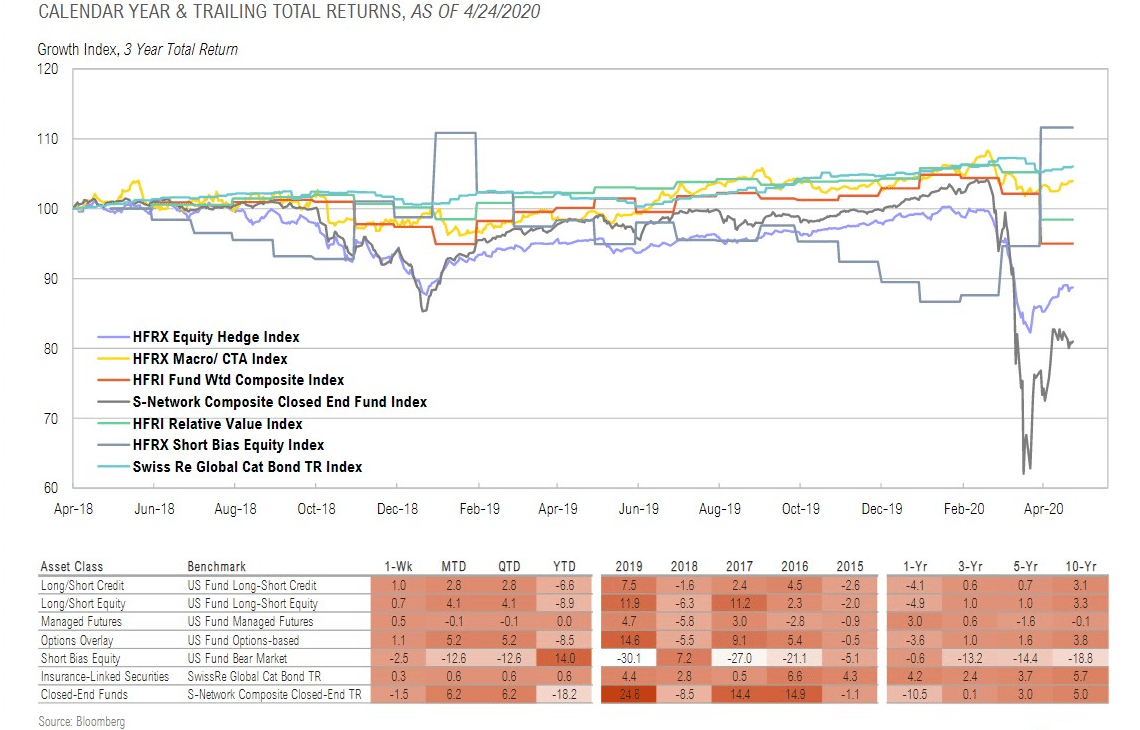

Opportunistic Strategy Returns

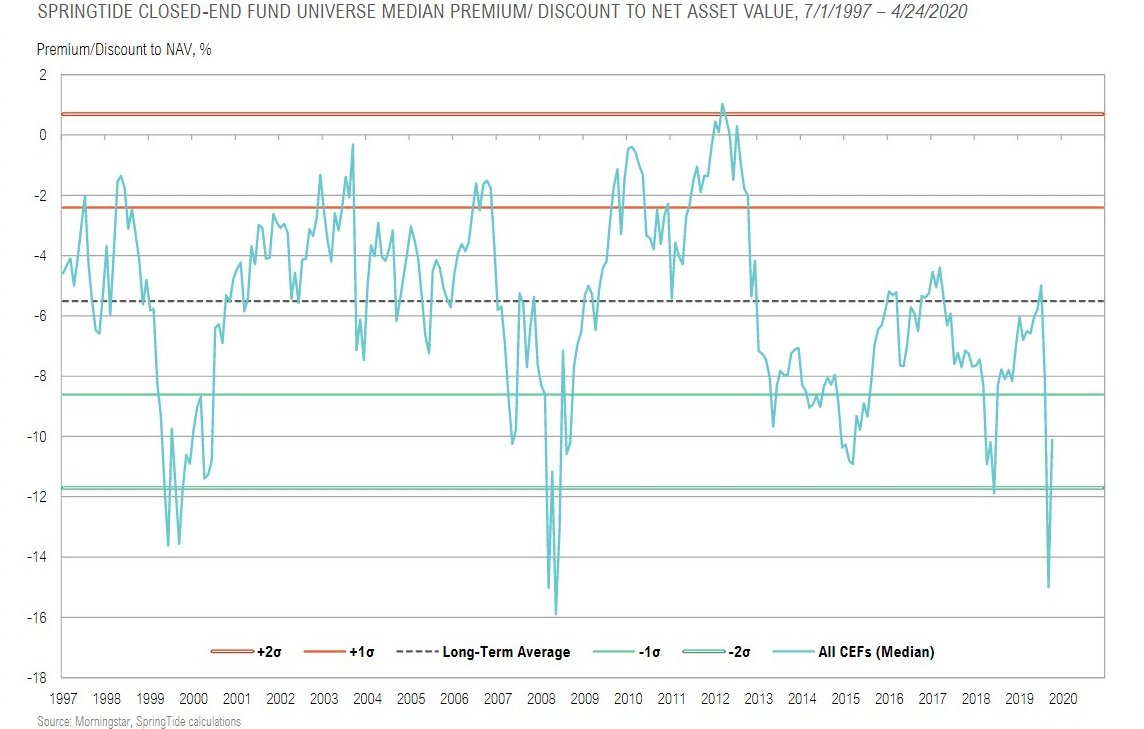

Closed-End Fund Discounts Got as Wide as the Financial Crisis

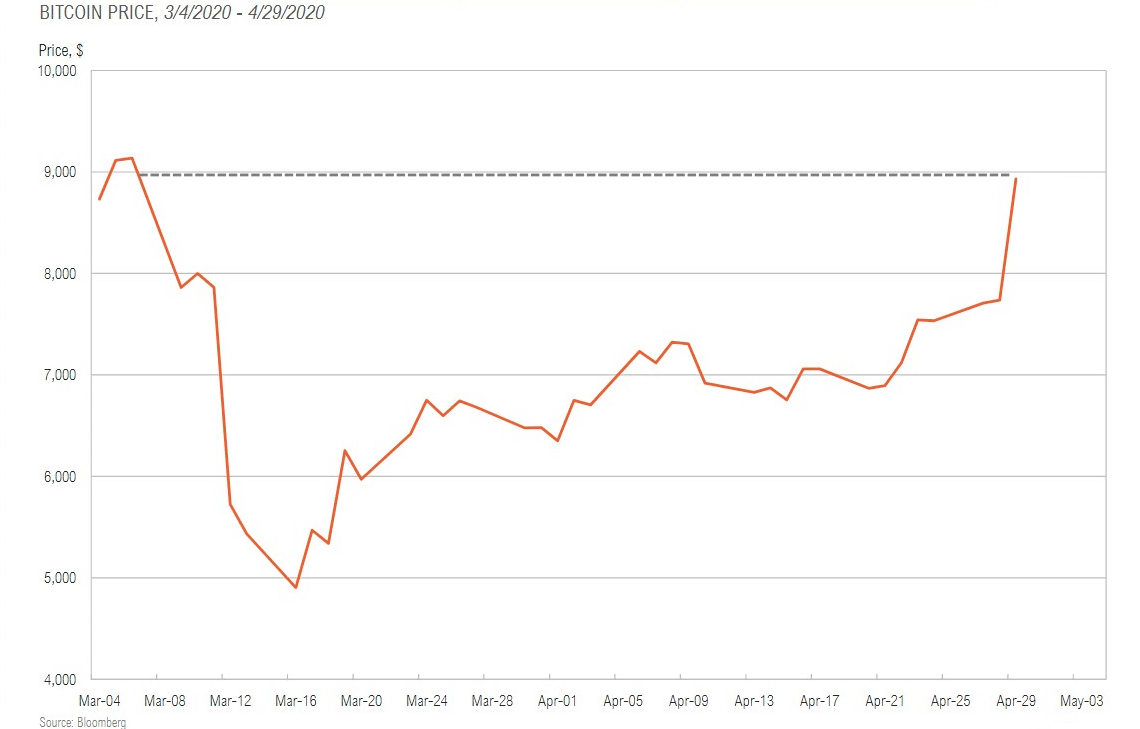

Like Gold, is Bitcoin Telling us Something About Macro Risk?

ASSET ALLOCATION

“An expert in any field will have an advantage over a rookie. But neither the veteran nor the rookie can be sure what the next flip will look like. The veteran will just have a better guess.”

Annie Duke, Thinking in Bets

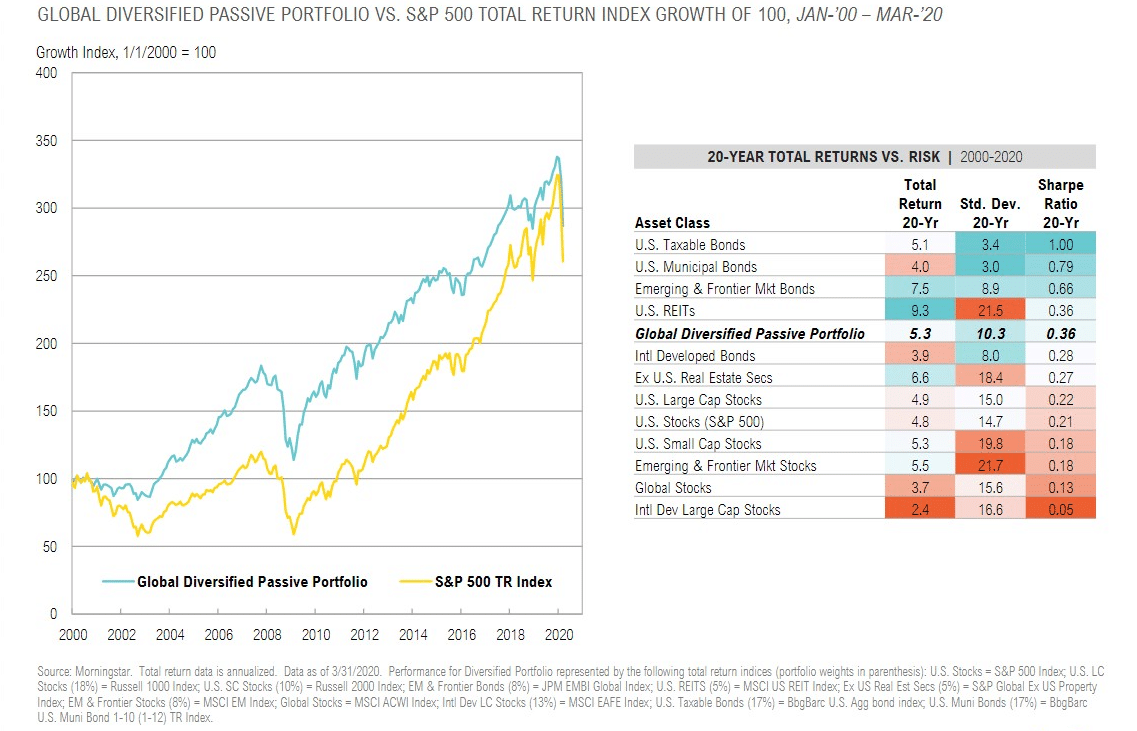

Diversification Still Works Over the Long-Term

60/40 Expected Returns Rise as U.S. Stocks Decline

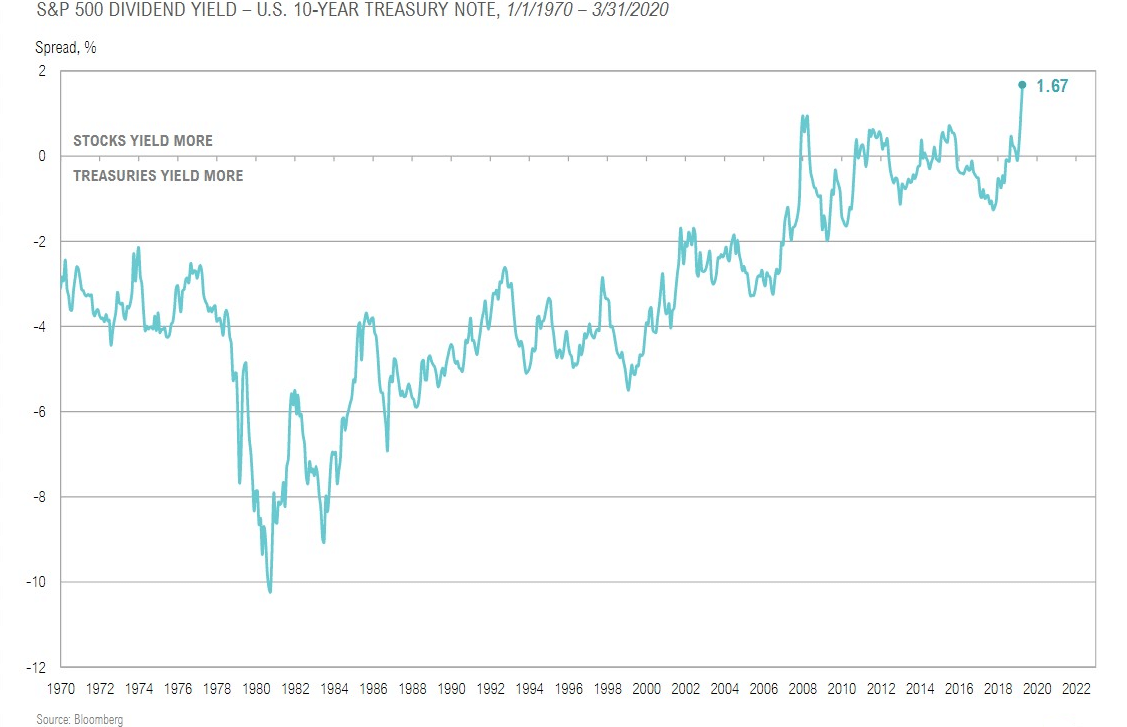

Equity Yields Still Competitive Relative to Bond Yields

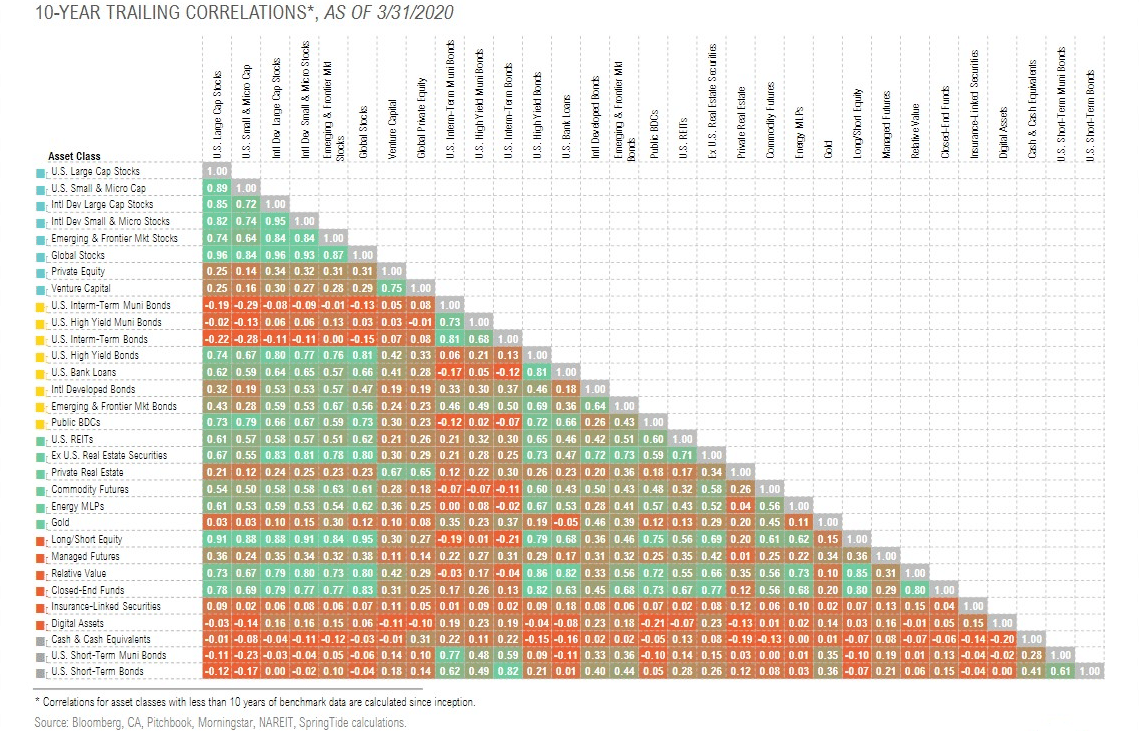

Asset Class Correlations