“It’s the K-shaped economy without question. You’re seeing significant stability and growth at the high end and some moderate signs of stress at the low end.”

Brendan Coughlin, Citizens Financial President

Cartoon

The “K” Divide

Summary

A concise review of the prior quarter, portfolio positioning and rationale, and an outline of the key themes and asset allocation priorities for the quarter ahead.

Market Commentary

Positioning

“As long as inflation is near 3%, they keep going, as long as the 10-year yield is 4.5% or lower, they keep going. And they’ll keep cutting as much as the internal dynamics allow them to. That’s how I think about where rates are going.”

Jon Hilsenrath, StoneX Senior Advisor & former Wall Street Journal editor

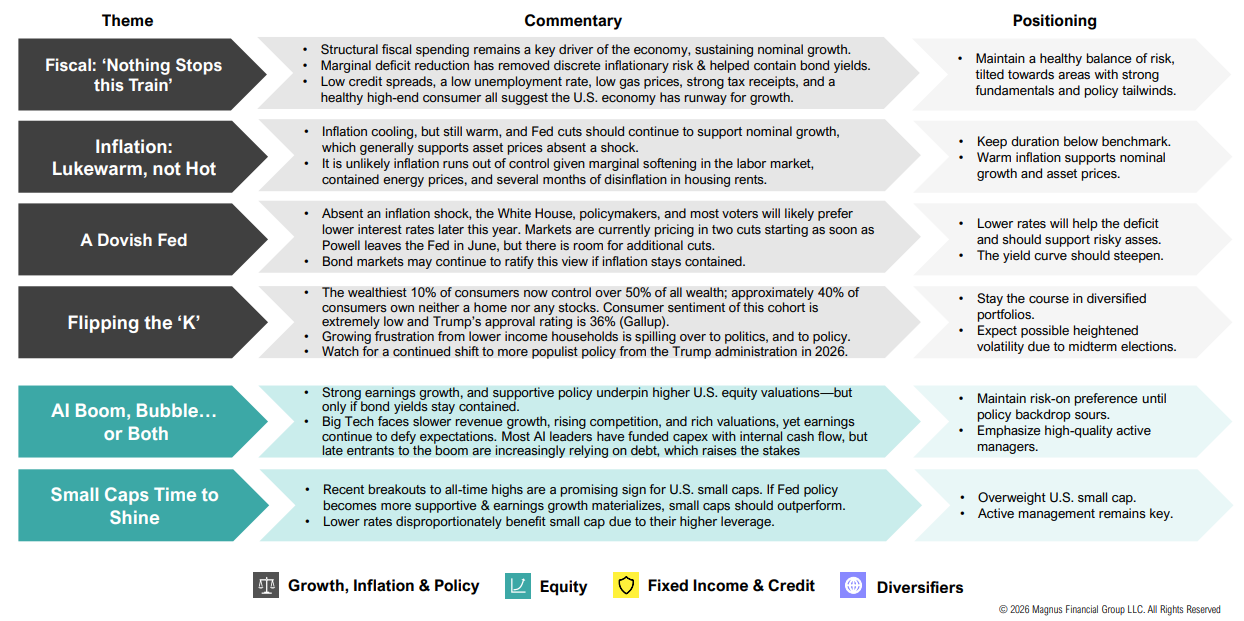

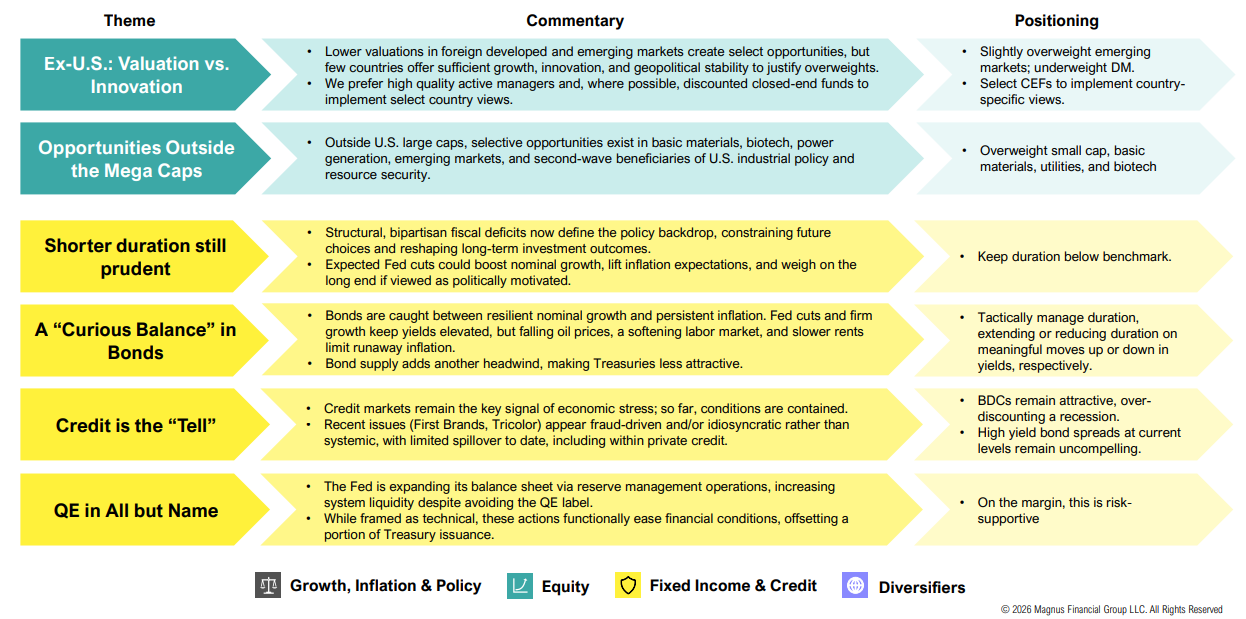

Growth, Inflation & Policy

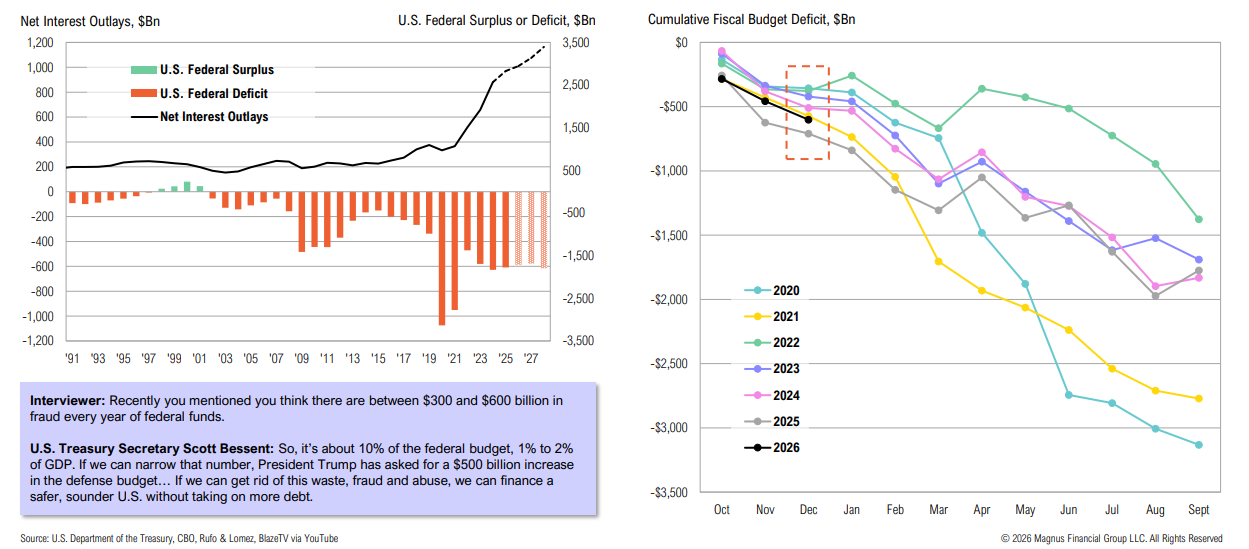

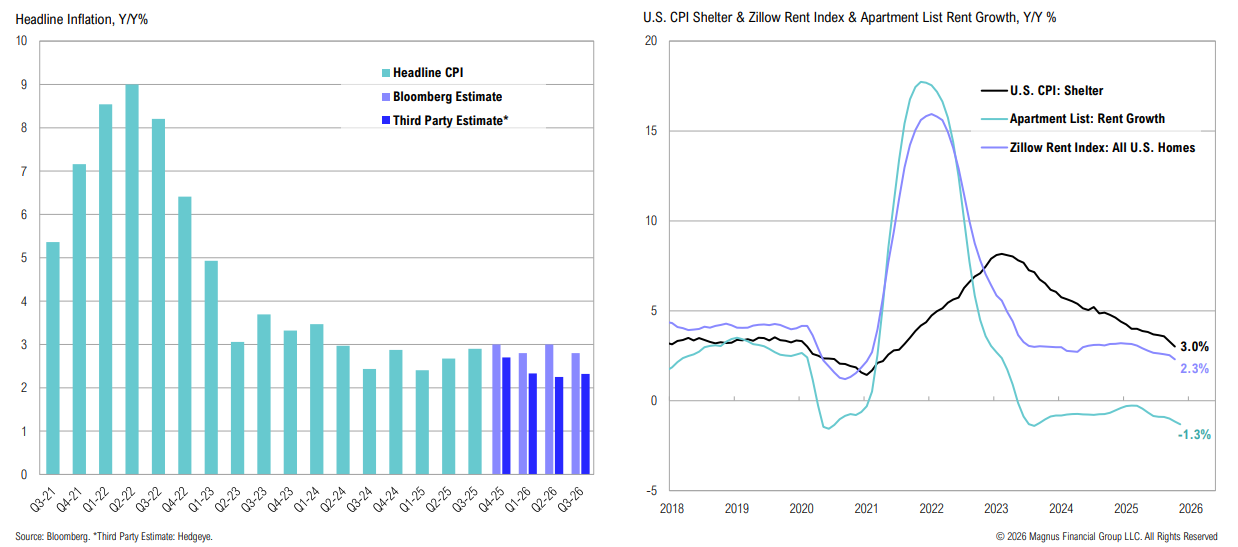

Structural fiscal spending remains a key driver of the economy, sustaining nominal growth— but with less of a discrete inflationary risk. While stimulative policy should keep inflation elevated, it is unlikely that inflation runs out of control given declining oil prices, softening in the labor market, and cooling shelter prices. Monetary policy expected to ease dramatically in 2026.

Fiscal Deficit

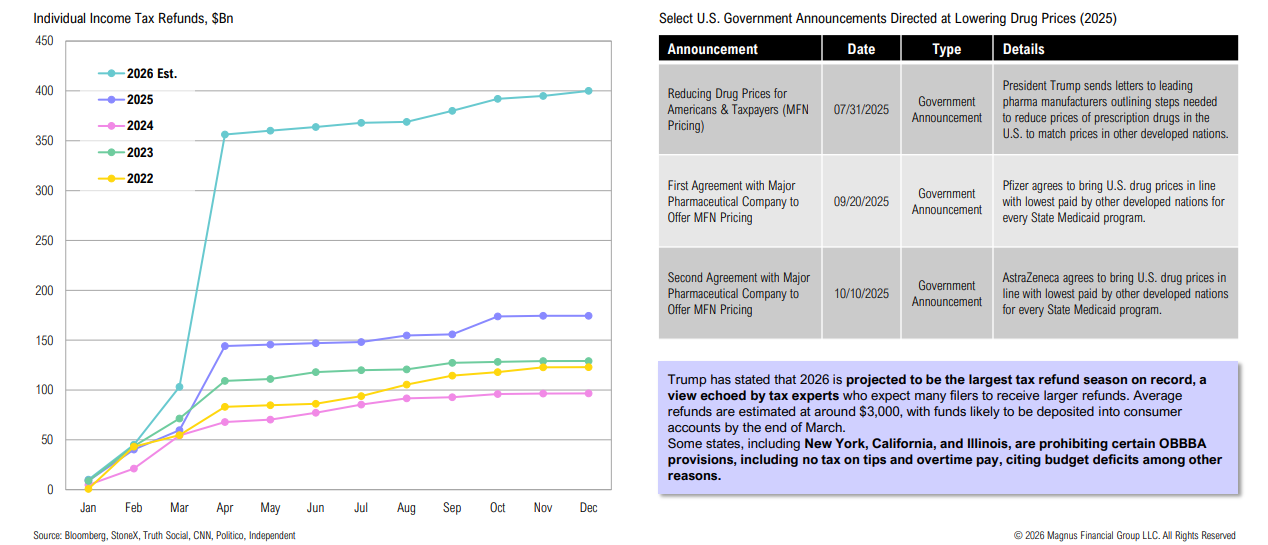

The deficit has risen to $602 billion in the first three months of the 2026 fiscal year; the deficit is expected to reach $1.7Tn in FY26

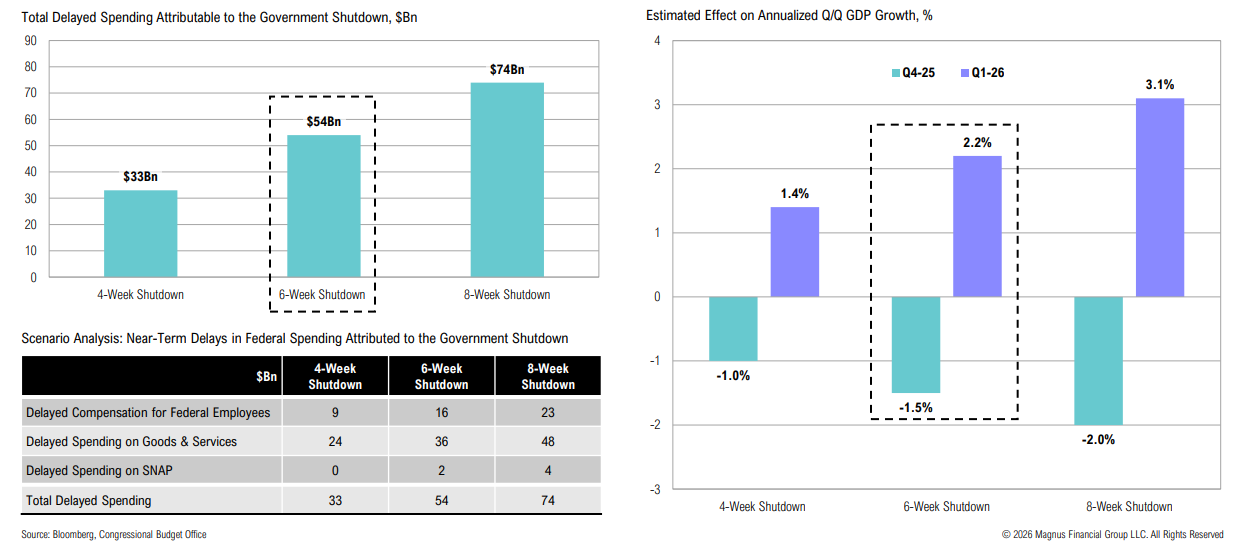

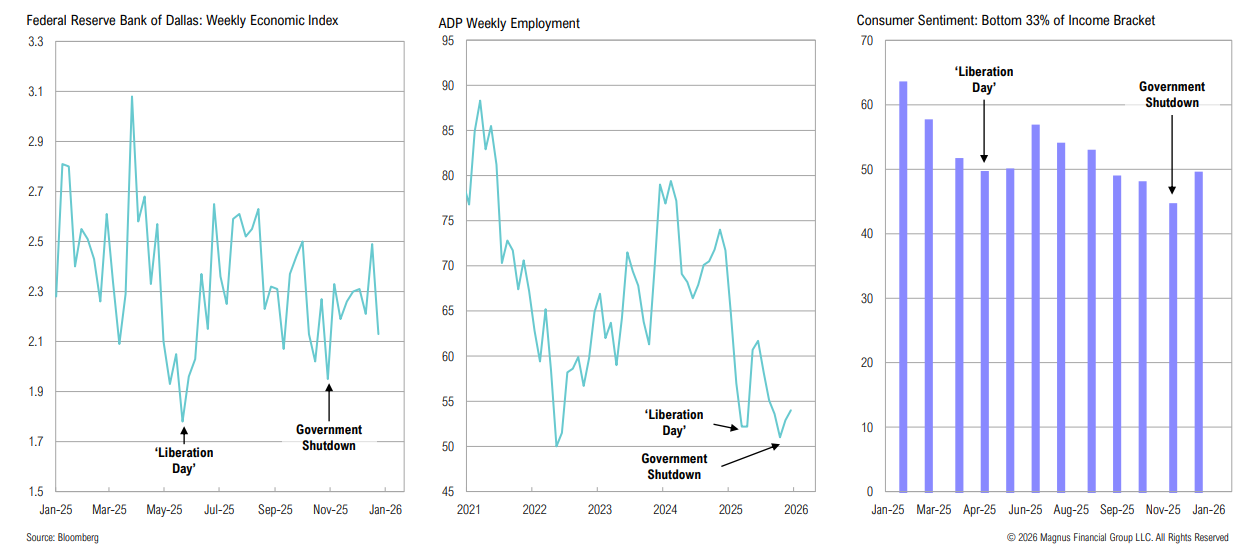

Snapback: The government shutdown is estimated to have a 1.5% drag on Q4 2025 GDP growth (annualized Q/Q), but is set to add +2.2% to Q1 2026

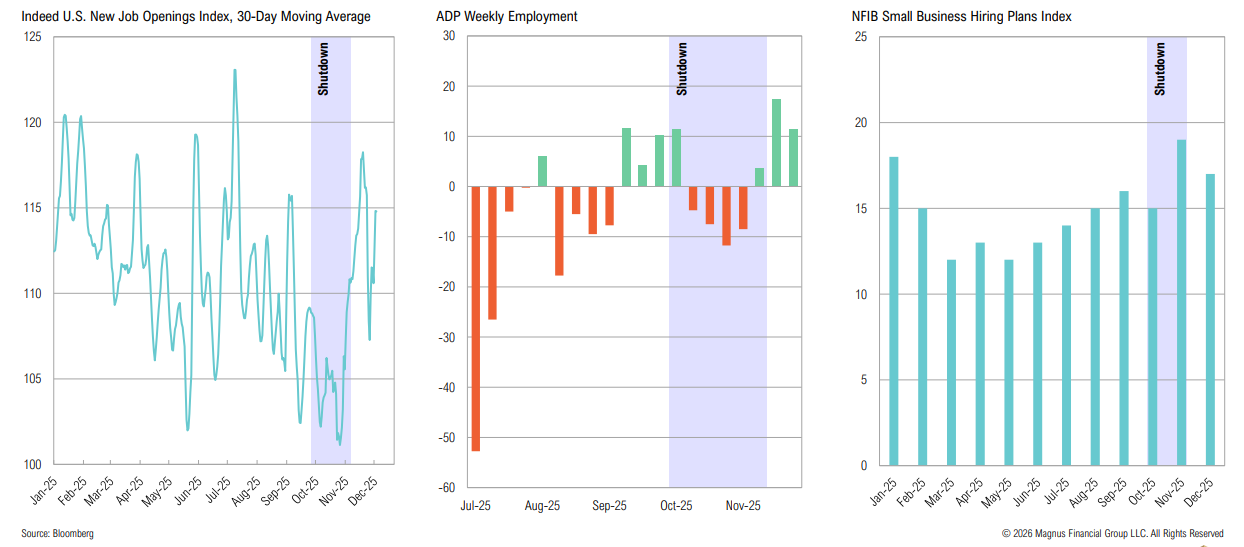

Government Shutdown

Measures of hiring and prospective hiring dropped during the government shutdown, but have largely rebounded as uncertainty resolved

Labor Market

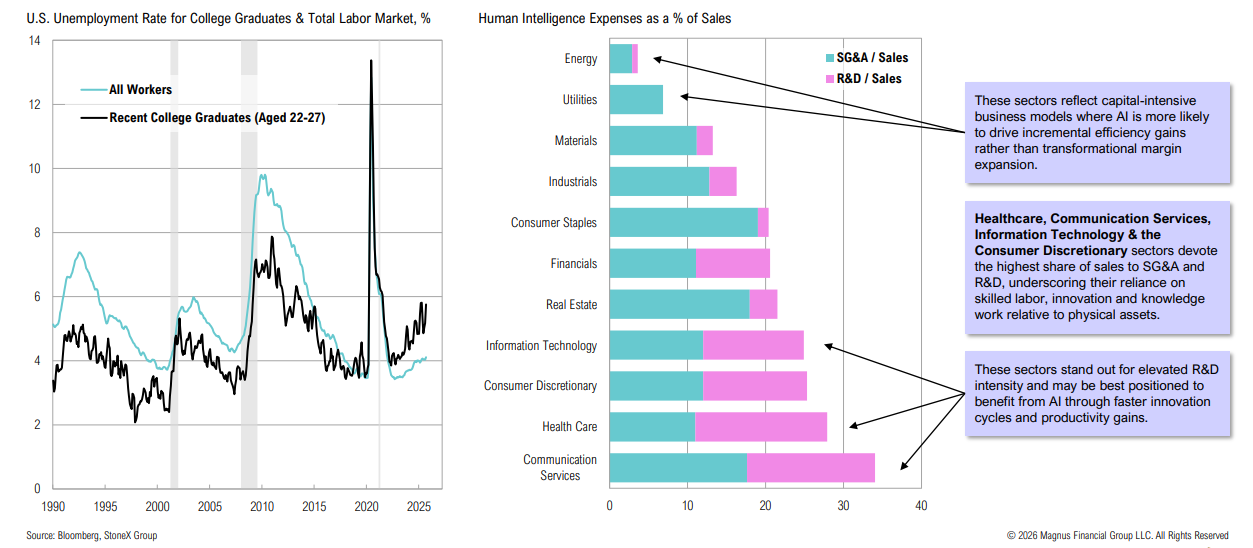

Is AI starting to cannibalize new hiring? The unemployment rate for recent college graduates is rising; some sectors may benefit more from AI advancements than others

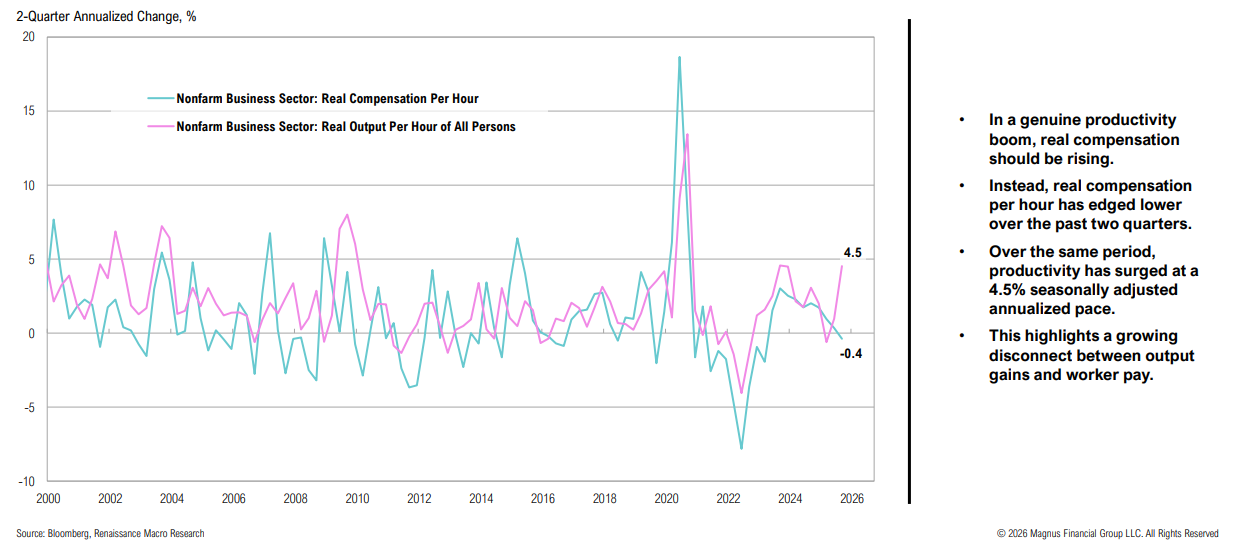

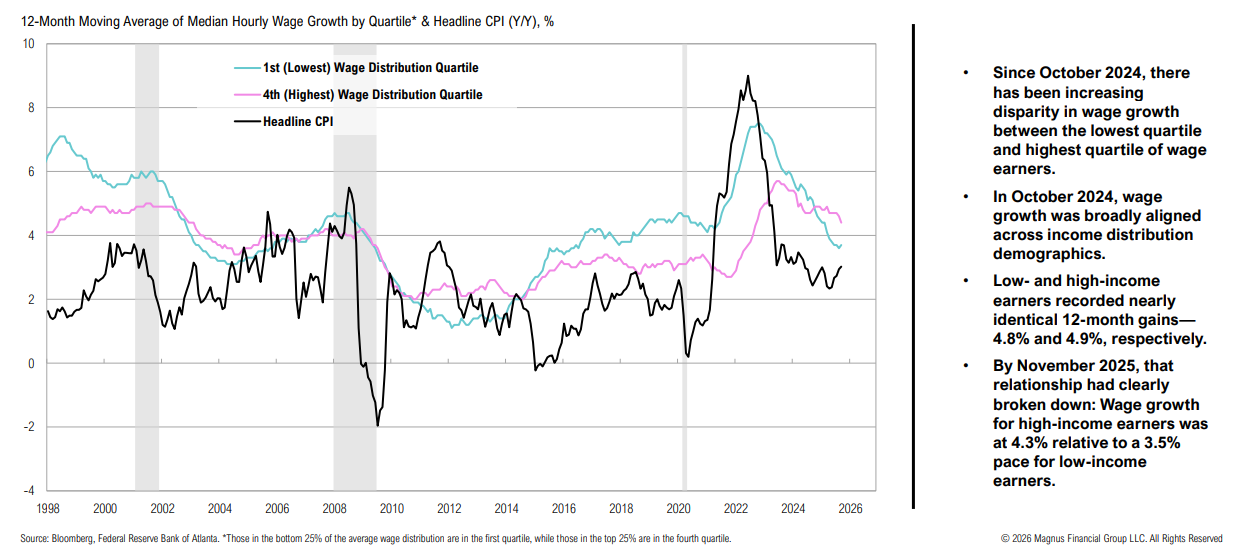

A K is emerging between output gains and worker pay: real hourly compensation has been edging lower while productivity has increased

Inflation

Inflation has been above the Fed’s official 2% target for 58 months but shows signs of continued cooling, led by shelter—yet structural inflationary forces remain

Inflation & Wage Growth

The K-shaped dynamic has also become increasingly visible in the labor market, particularly with wage growth

“Consumers at the lower end of the income distribution continued to reduce their discretionary spending, including on full-service restaurant dining, elective health care, entertainment, and beauty and personal services… Demand from consumers at the higher end of the income distribution was resilient.”

Federal Reserve Bank of San Francisco

“Our consumer, as you know, tends to be at the higher income deciles, and those consumers continue to do well.”

Hugh Johnston, Disney CFO

Midterms

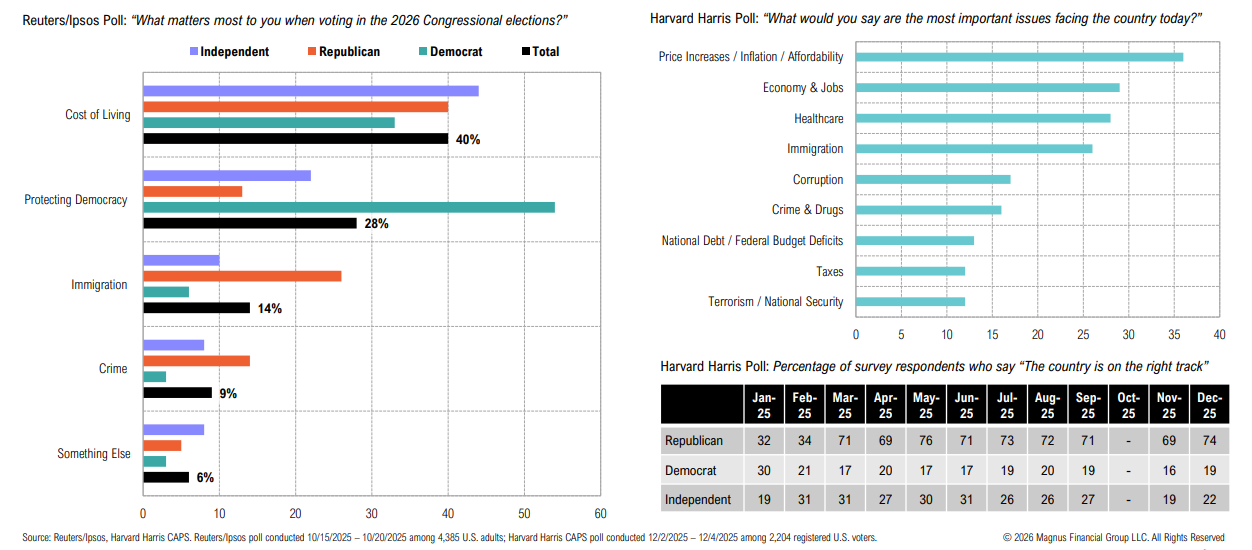

Affordability and the cost of living are key issues for U.S. voters

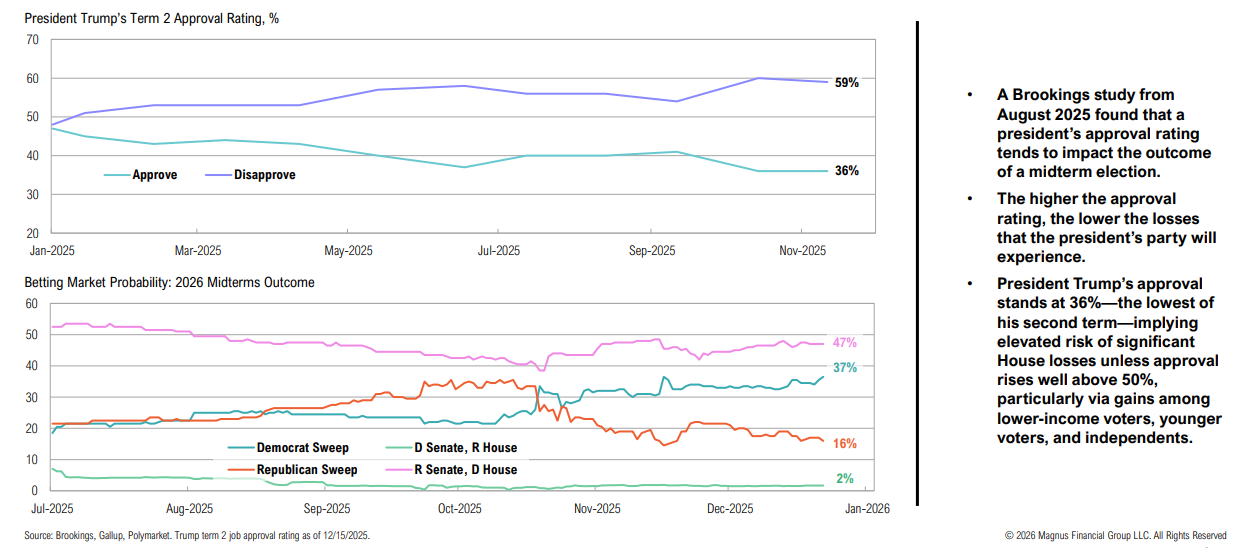

Approval ratings tend to have an impact on midterm outcomes; betting market odds currently point to the Republicans losing control of the House

Consumer

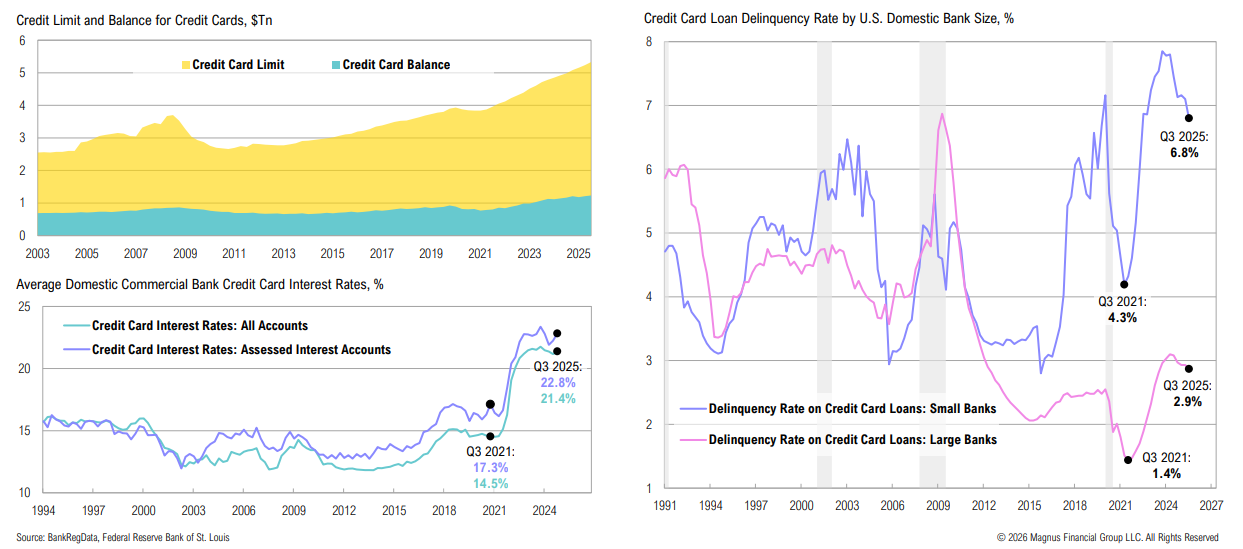

Materially higher household leverage, at elevated rates: U.S. consumer credit card capacity, balances, and interest rates are at record highs

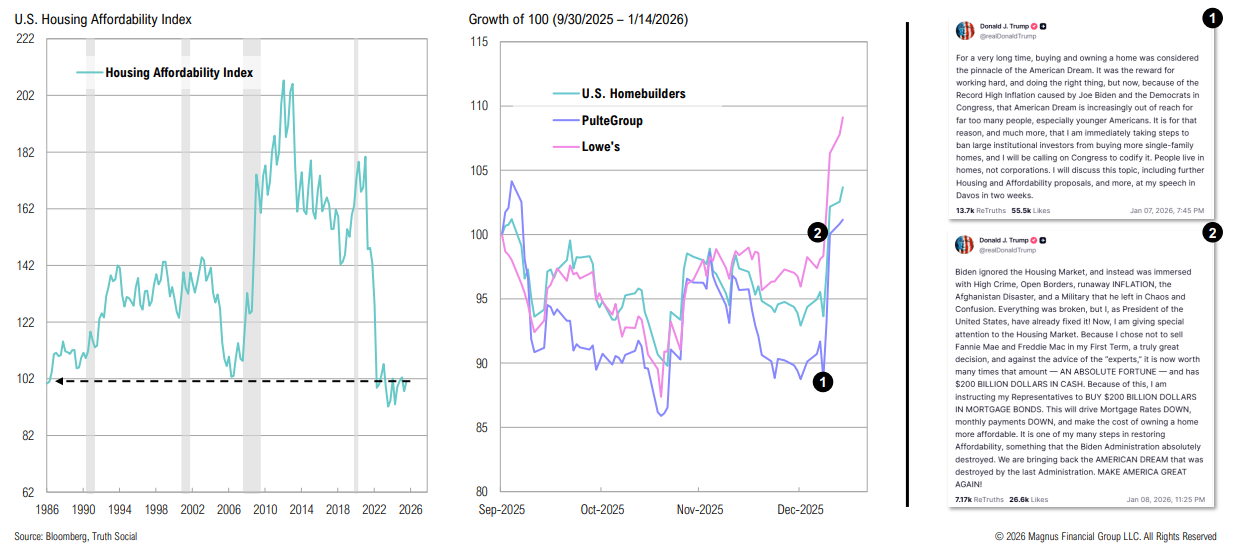

Affordability

The government will need to shift focus to “affordability” to win potential voters; evidence of this shift is already starting to show (OBBBA tax breaks, lower drug prices)

U.S. homebuilders responded well to Trump’s call to stop corporations from buying homes and his order for Fannie Mae and Freddie Mac to purchase $200bn worth of MBS

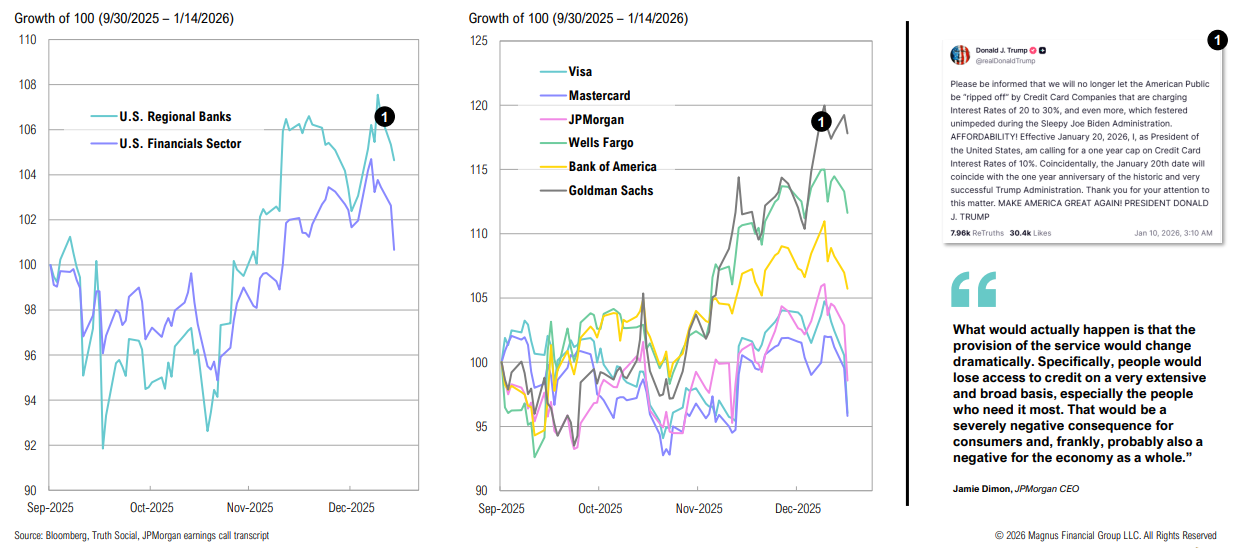

U.S. bank stocks did not respond well to Trump’s call for a one-year 10% cap on credit card interest rates

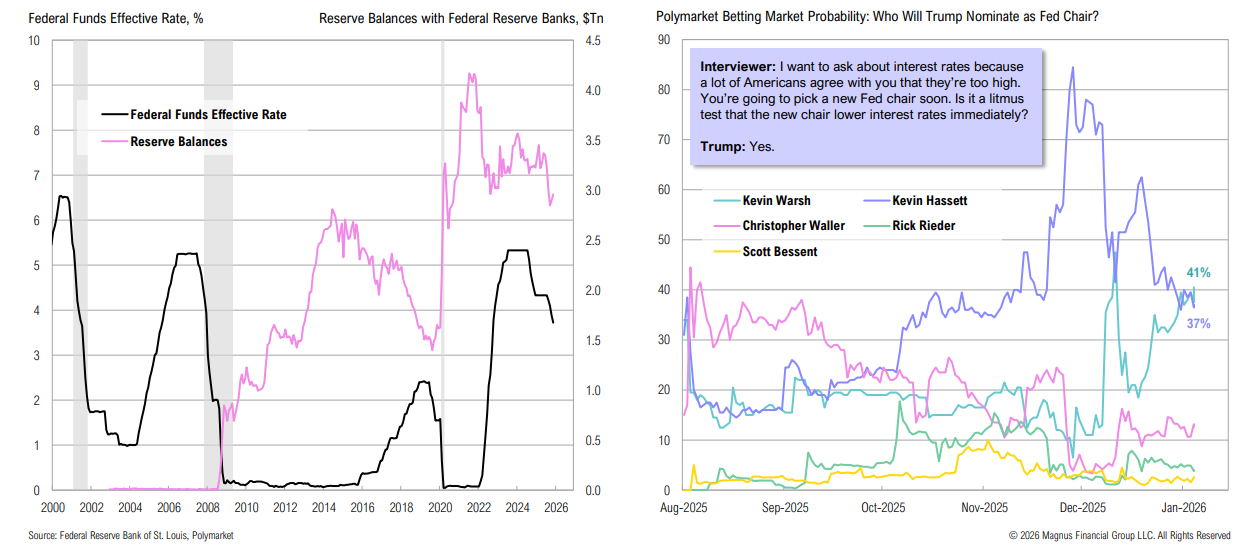

The Fed

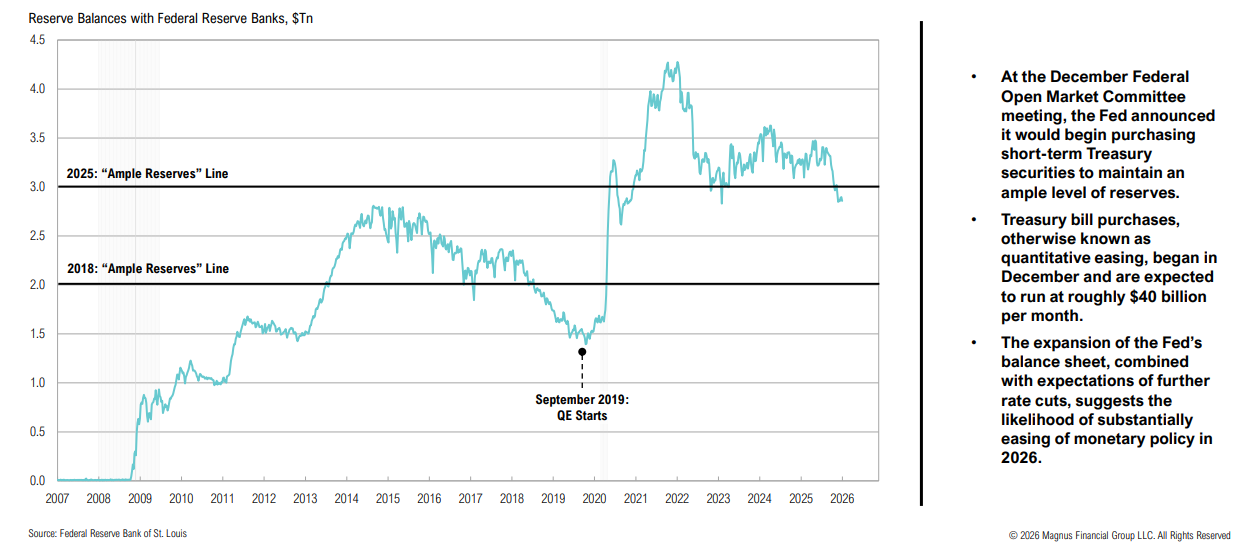

More K’s: the Fed is purchasing Treasuries while lowering interest rates, and a battle of the Kevins for the next Fed chair (per betting markets)

Monetary Policy

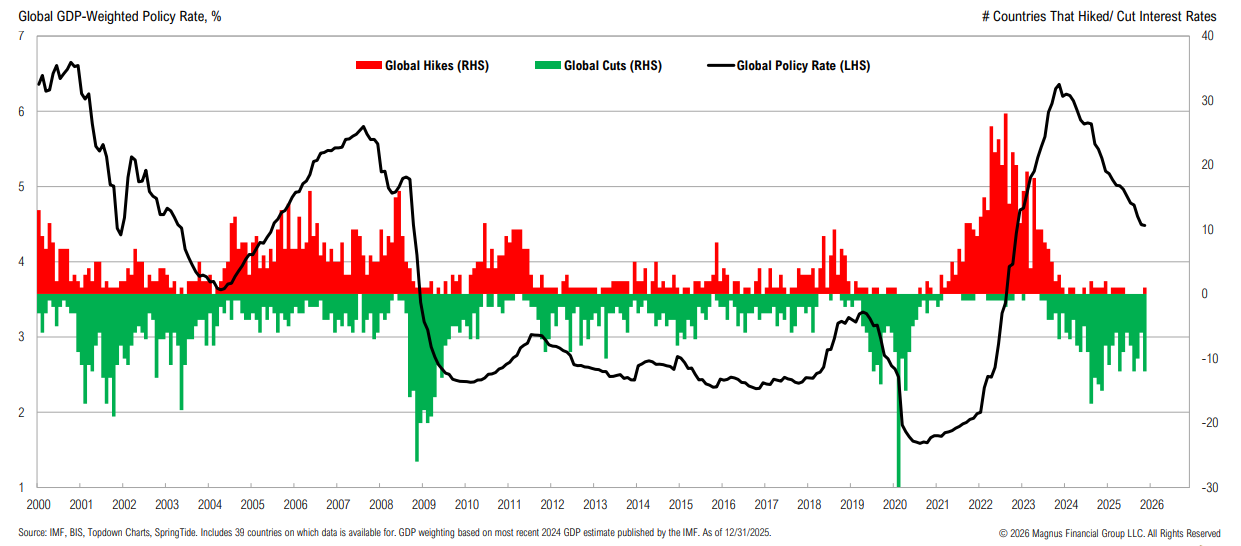

The global GDP-weighted policy rate now stands at 4.5% compared to 6.4% at the start of 2024

Monetary Policy

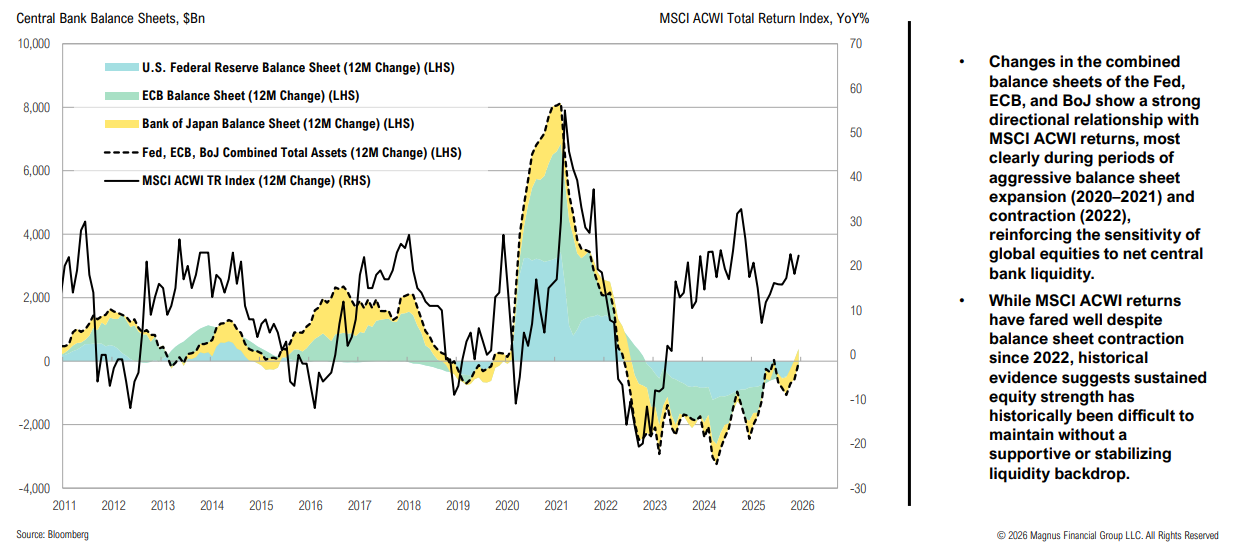

Renewed balance sheet expansion from central banks could further boost global stock performance

Sentiment

Will the administration’s attempts work? Consumer sentiment may be bottoming, and turning higher, albeit from low levels

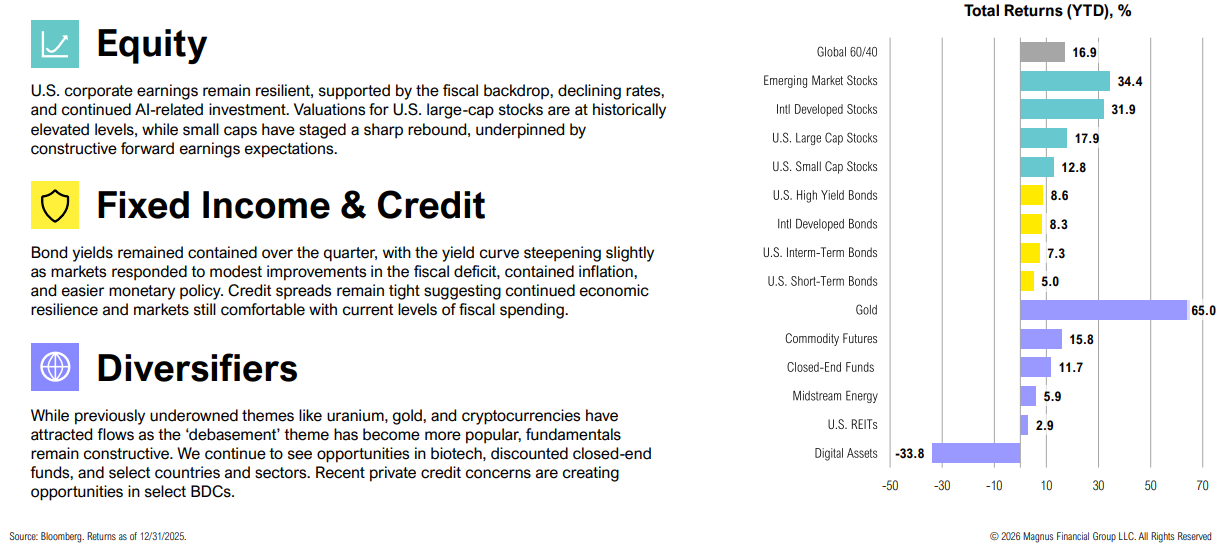

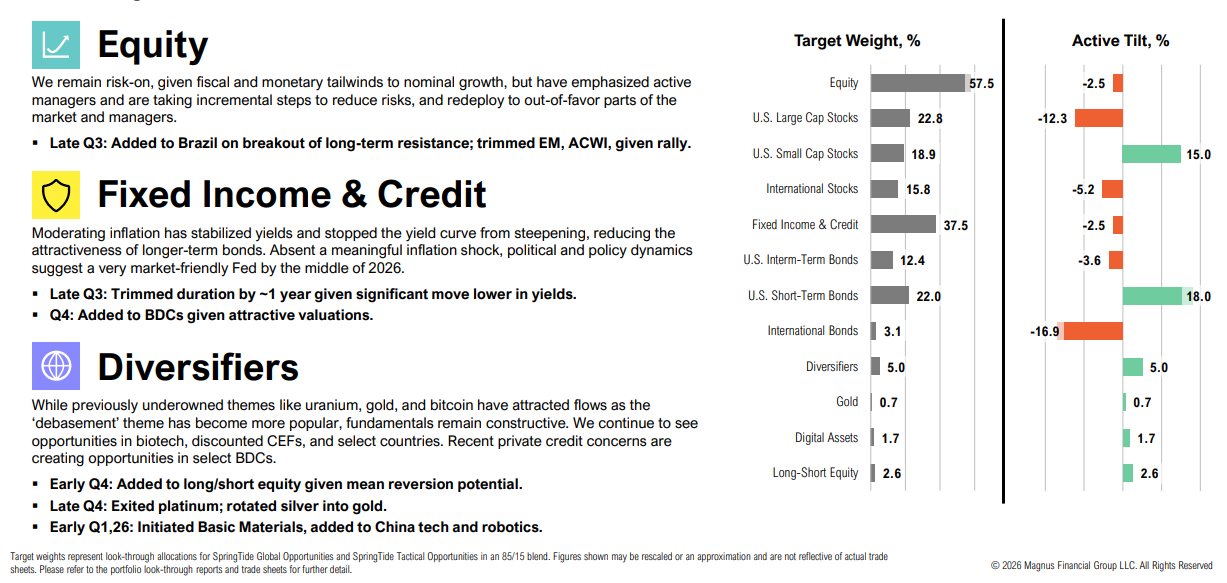

Equity

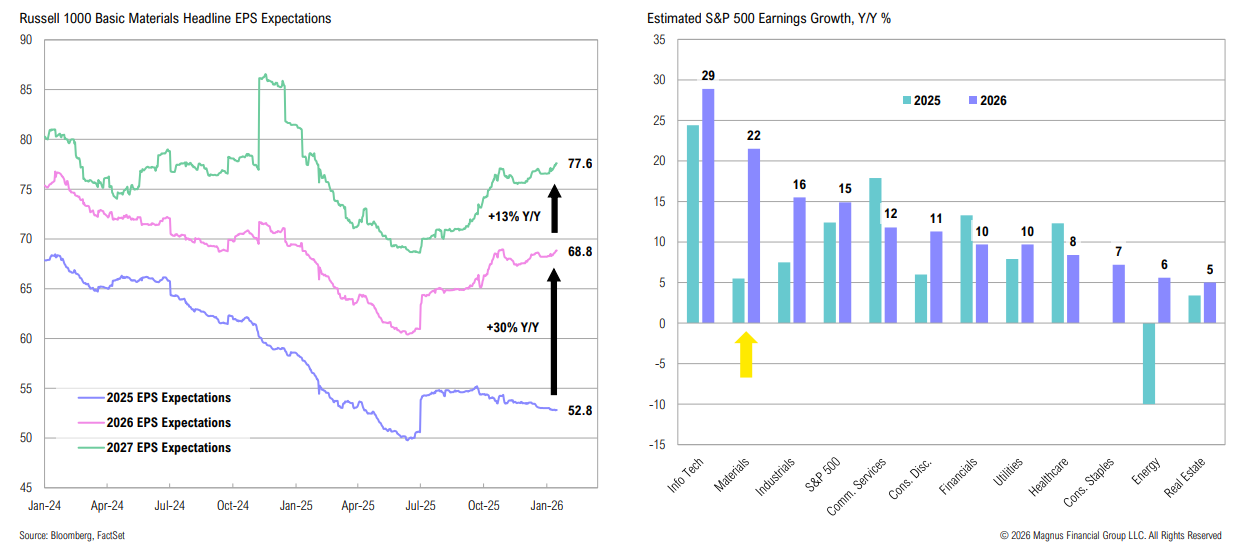

U.S. corporate earnings remain resilient, supported by continued AI-related investment. Valuations for U.S. large-cap stocks are at historically elevated levels, while small caps have staged a sharp rebound, underpinned by constructive forward earnings expectations.

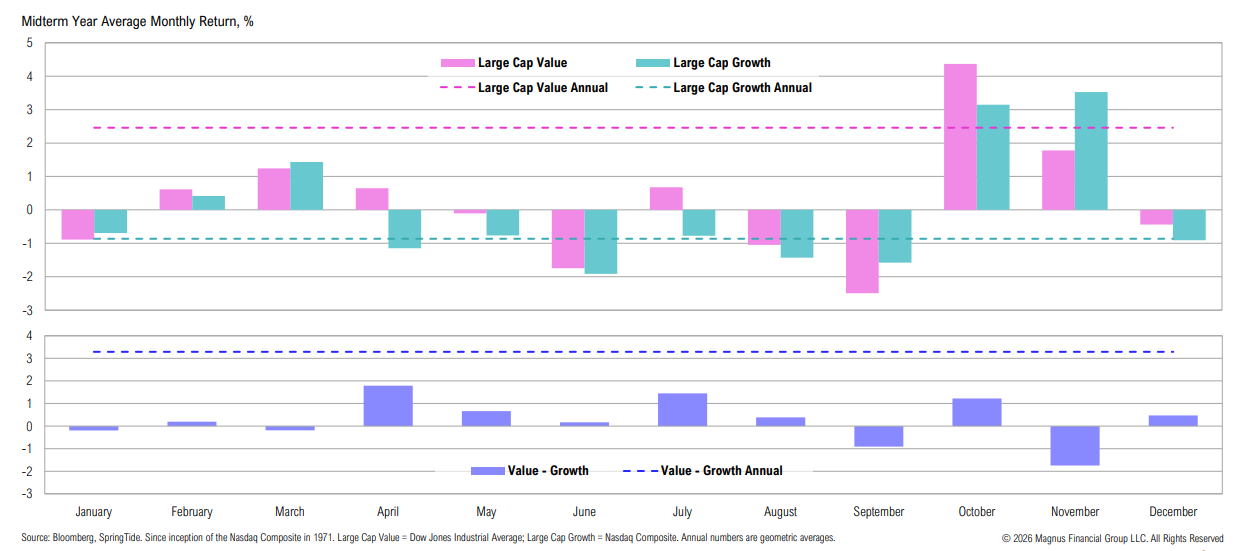

Midterm Volatility

Returns in midterm election years tend to be volatile early on, with performance typically improving later in the year

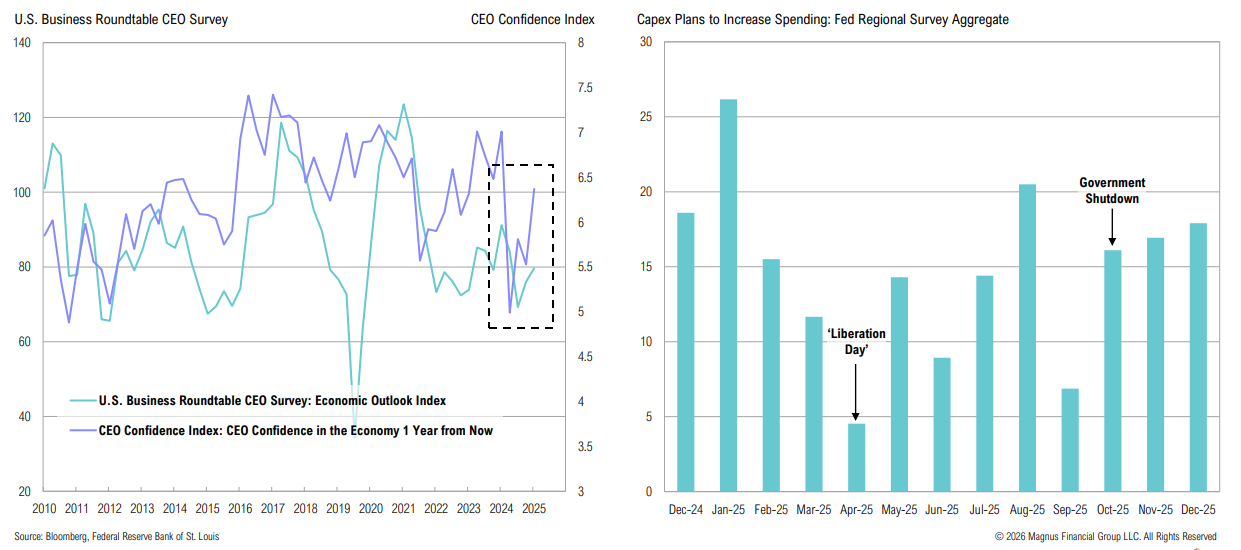

Corporate Sentiment

CEO confidence is rising, with broader (non-AI-related) capex spending plans increasing

U.S. Large Cap Stocks

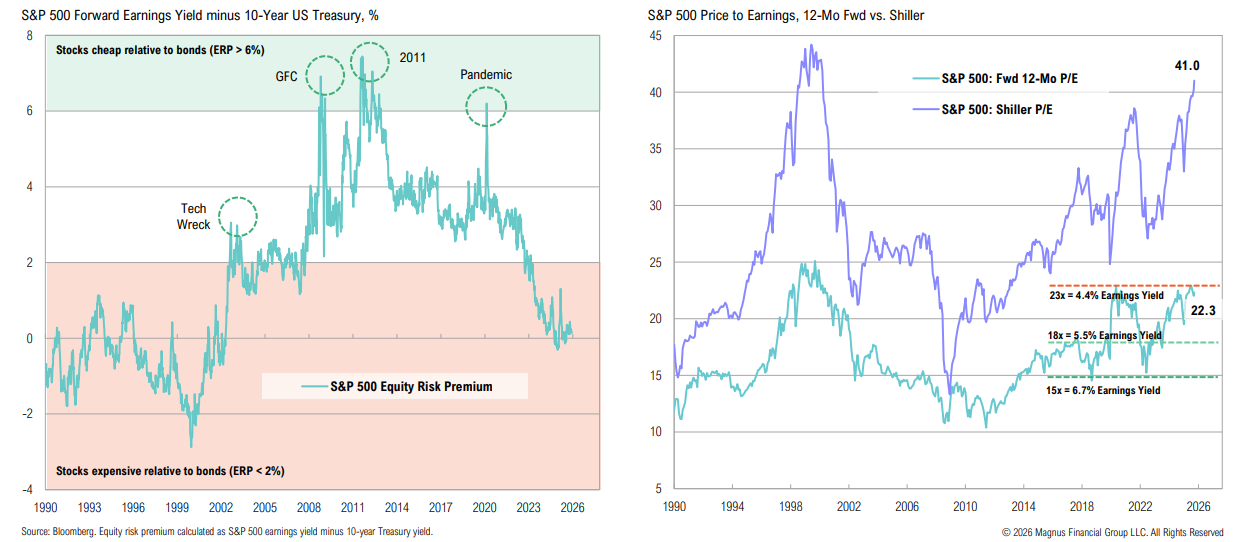

Using a simple yield-to-earnings yield comparison (ERP), U.S. stocks are less attractively priced vis-à-vis bonds than at any point since the 1990s; U.S. large cap valuations remain near extremes

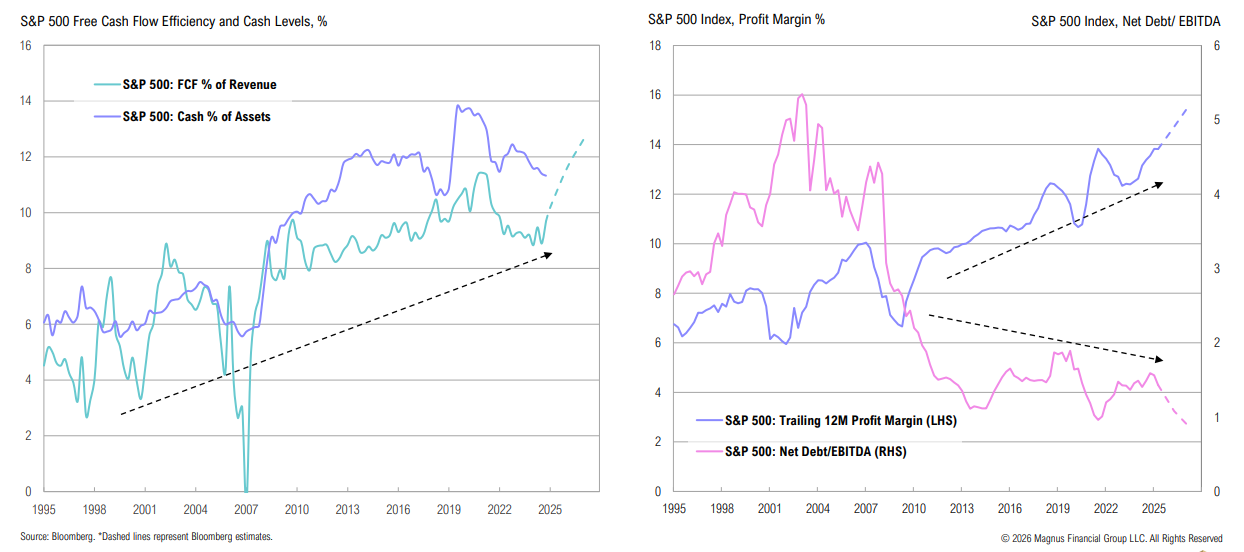

The corporate sector is strong by historical standards: capital expenditures, R&D, and tech investment have boosted scalability and efficiency, enabling improved margins and reducing debt

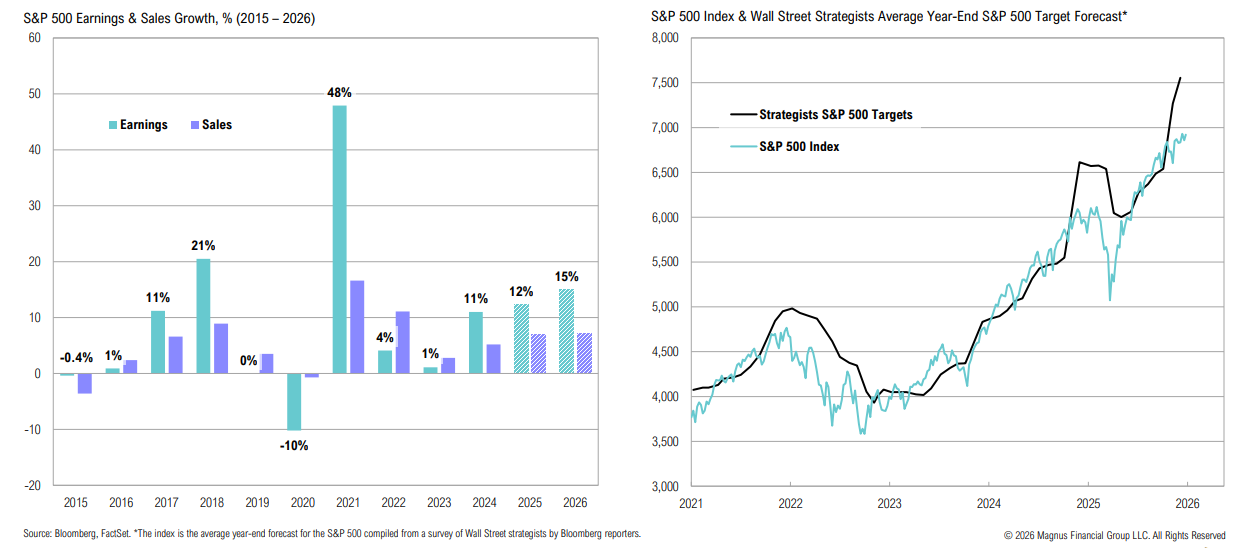

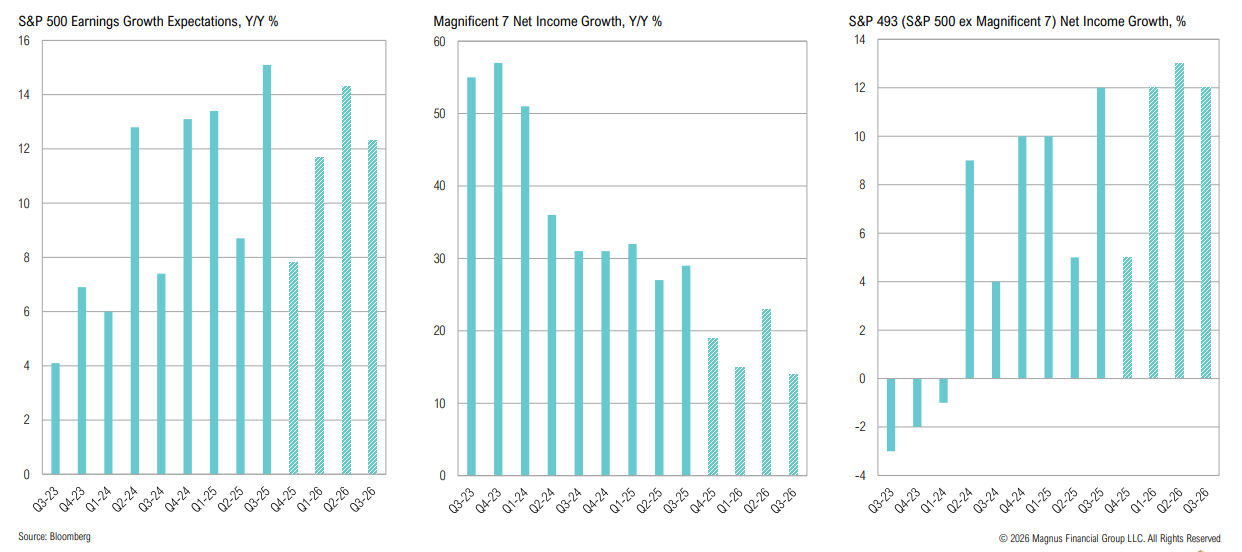

S&P 500 earnings are expected to grow 15% Y/Y, with net margins anticipated to reach the highest level since 2008; strategists have high hopes for 2026

The earnings growth broadening momentum continues

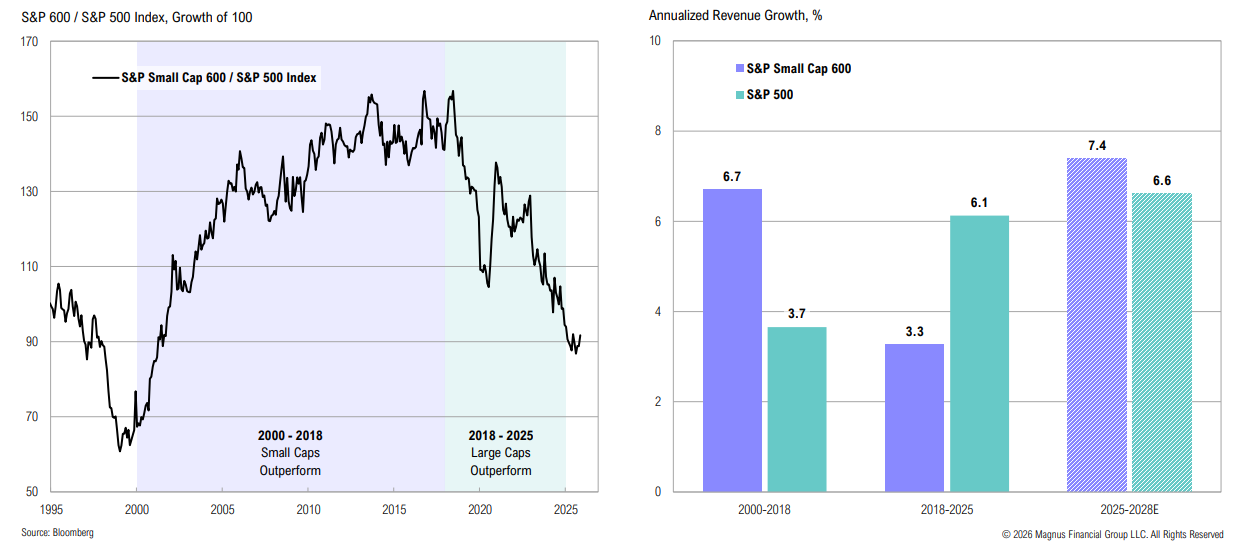

U.S. Large vs. Small Cap Stocks

Revenue growth has contributed to relative performance between small- and large-cap stocks, with small caps expected to outpace over the next three years

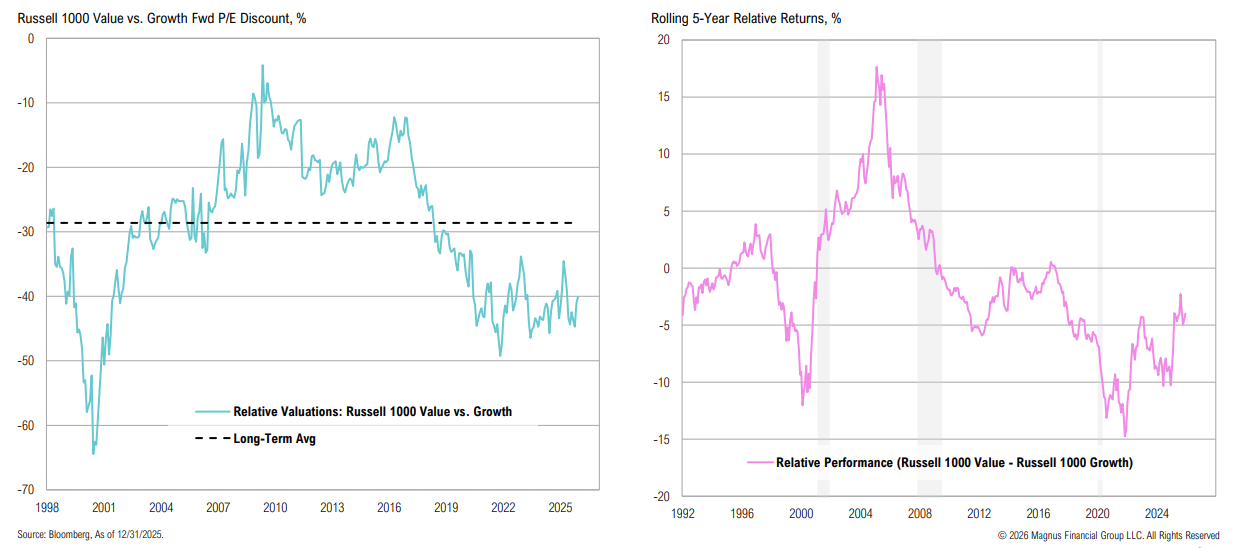

Growth vs. Value

Historically, U.S. large-cap growth and value stocks experience extended cycles of relative over- and underperformance; value currently trades at a 40% discount to growth versus a 29% LT average

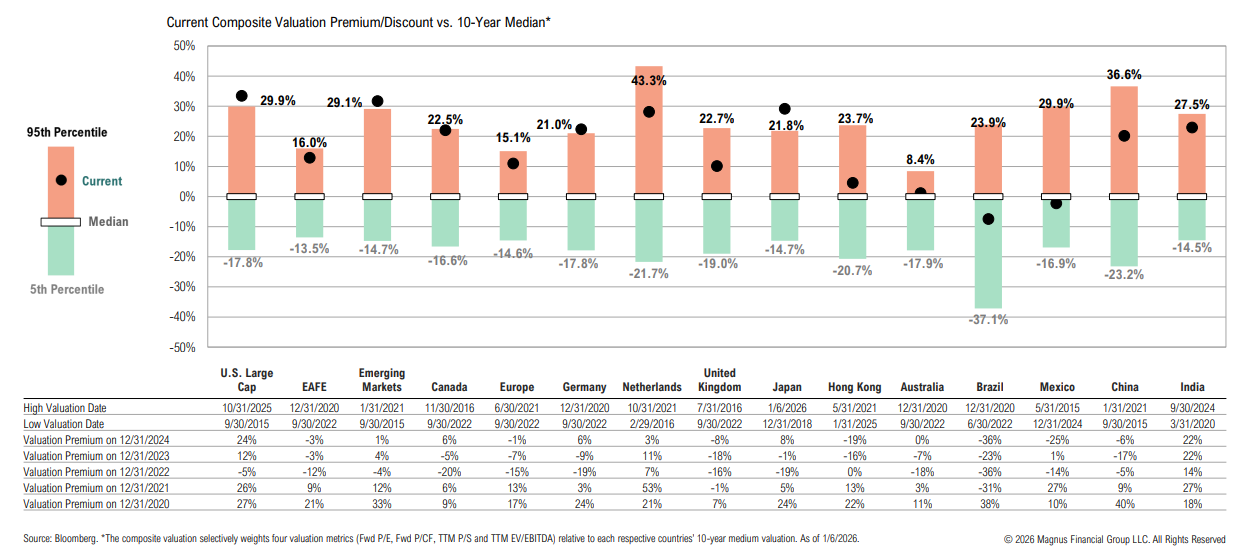

Global Valuations

Brazil & Mexico are the only countries trading below median, with Hong Kong and Australia near median valuations

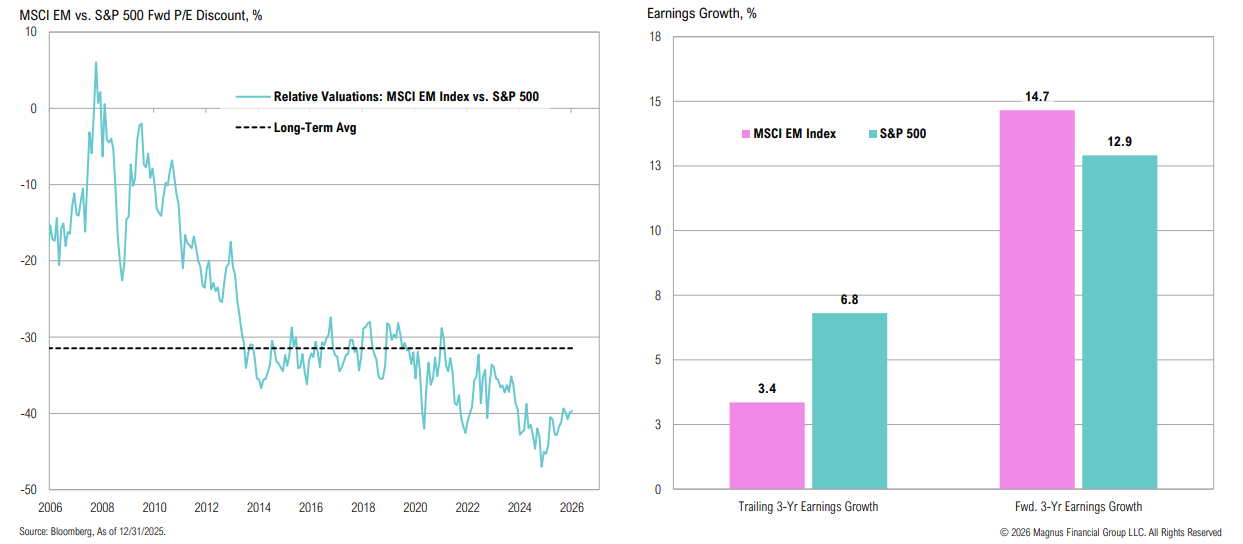

Emerging Markets

While EM stocks (like DM ex-US) trade at historically wide discounts to the S&P 500, earnings growth is expected to outpace U.S. equities over the next three years

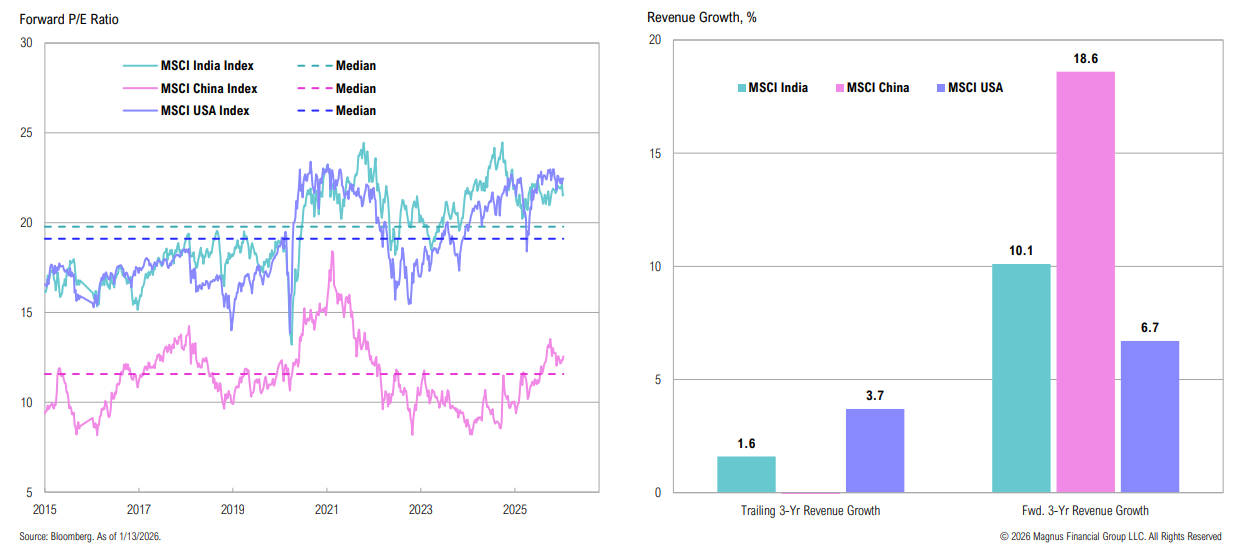

Emerging Markets

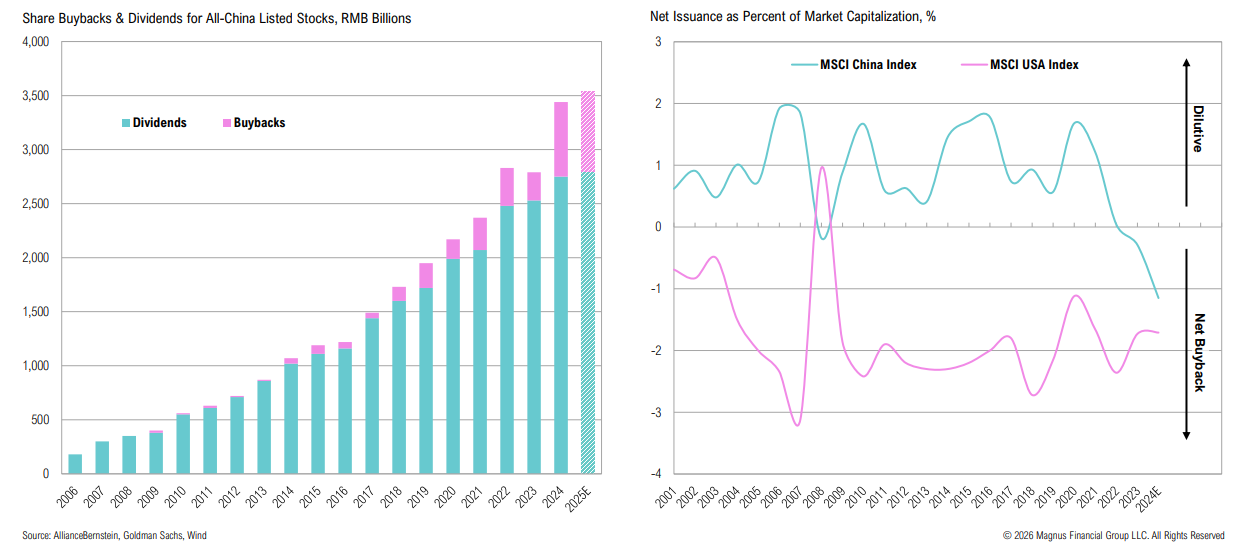

Like U.S. stocks, both India and China trade above their 10-year average valuations but have stronger growth expectations over the next three years

China is pushing companies to improve governance, and shareholder returns (like Korea and Japan); net buybacks have become accretive, boosting EPS

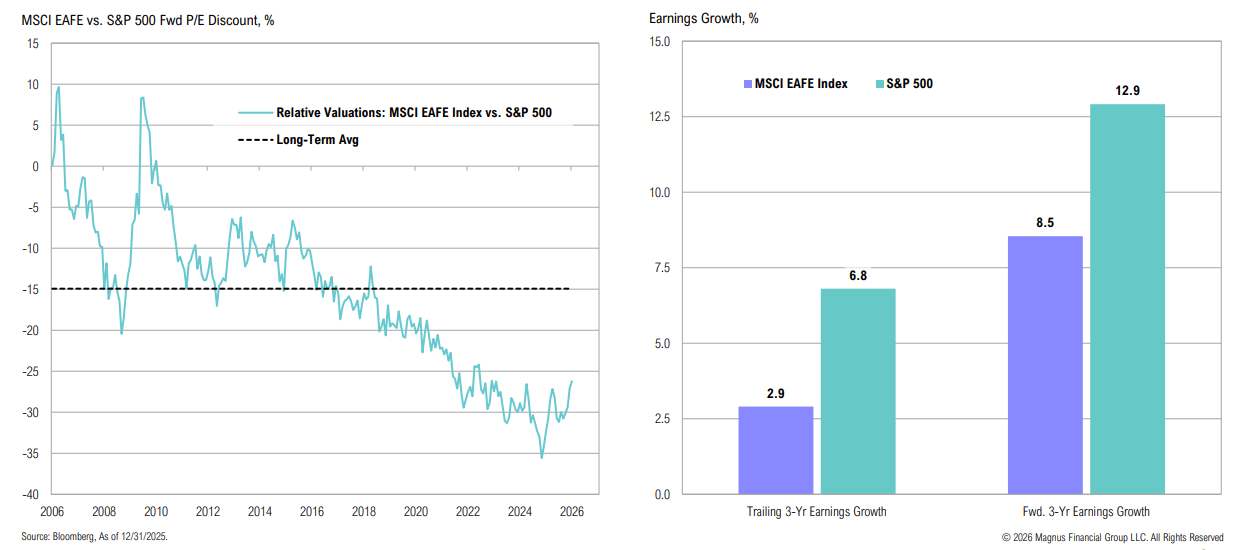

Ex-U.S. Developed Markets

While international developed market stocks continue to trade at historically wide discounts to the S&P 500, the dispersion in earnings growth (which has contributed to this discount) is expected to persist

Breakouts

Big Breakout Basket Recap: Since first discussed 6 months ago, the shift in policy towards industrialization/ onshoring has led to strong follow-through

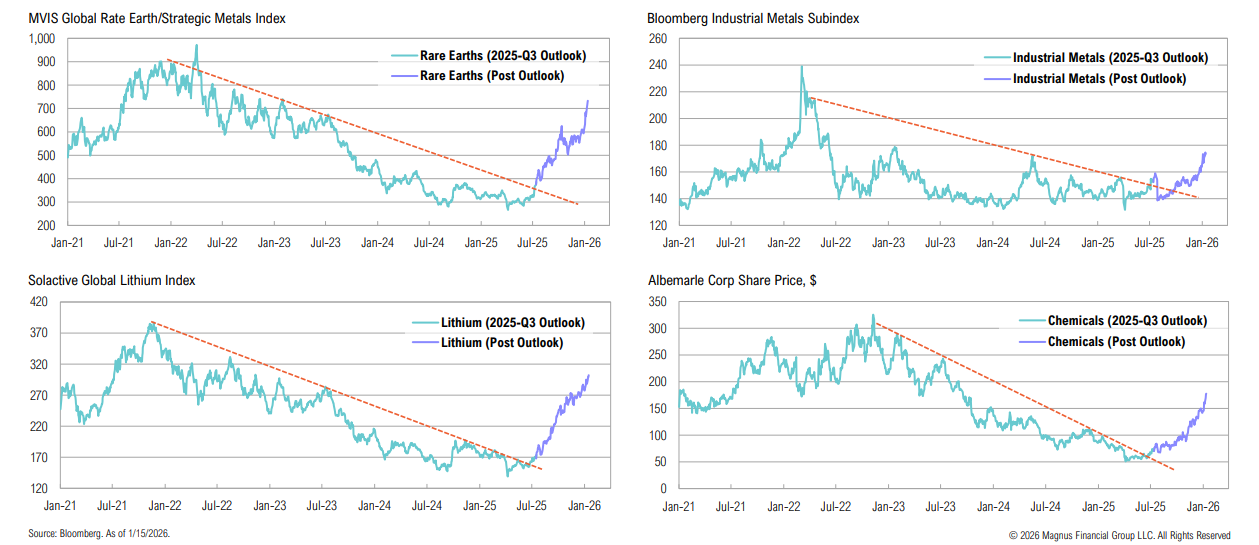

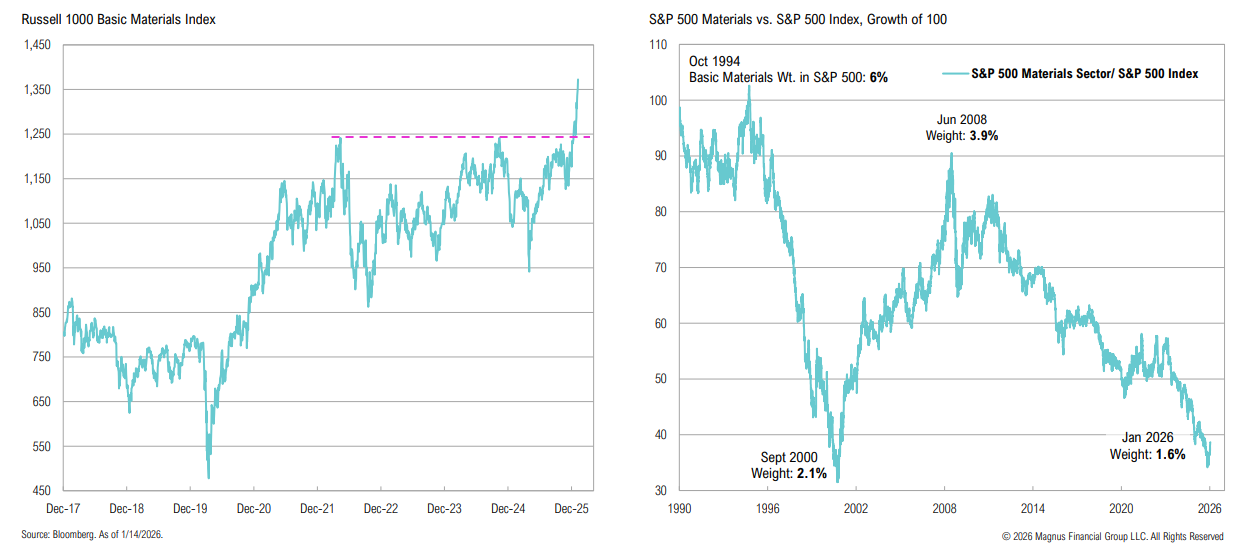

Materials

Back to basics: Basic materials have decisively broken out against 5-year resistance; the industry currently represents only 1.6% of the S&P 500

After trading sideways for nearly four years, basic materials have started to break out; the sector is expected to see the second-strongest earnings growth (after tech) in 2026

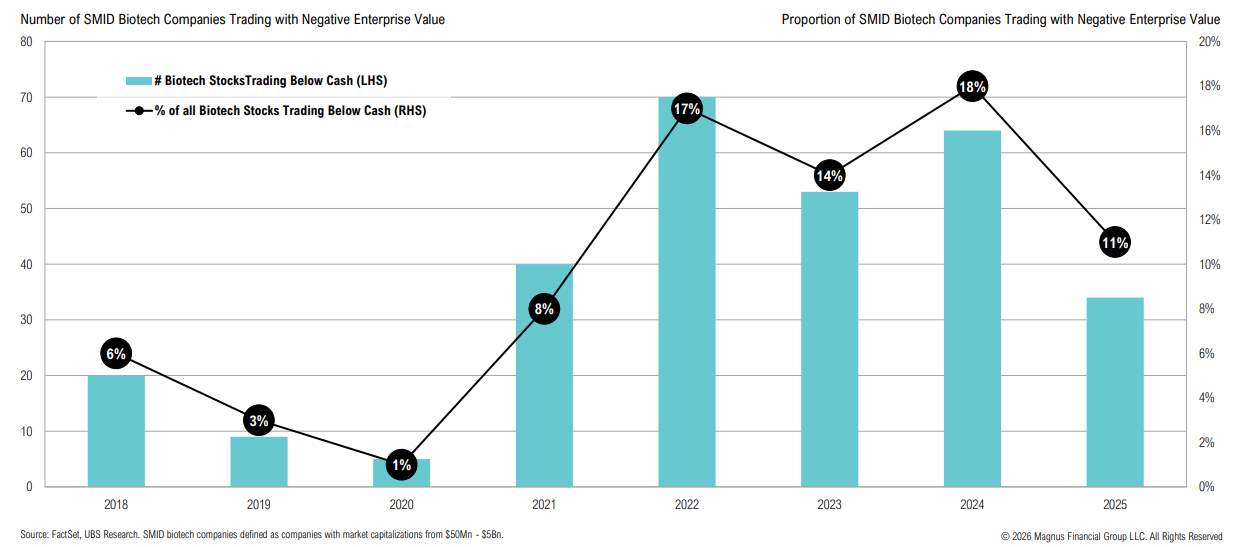

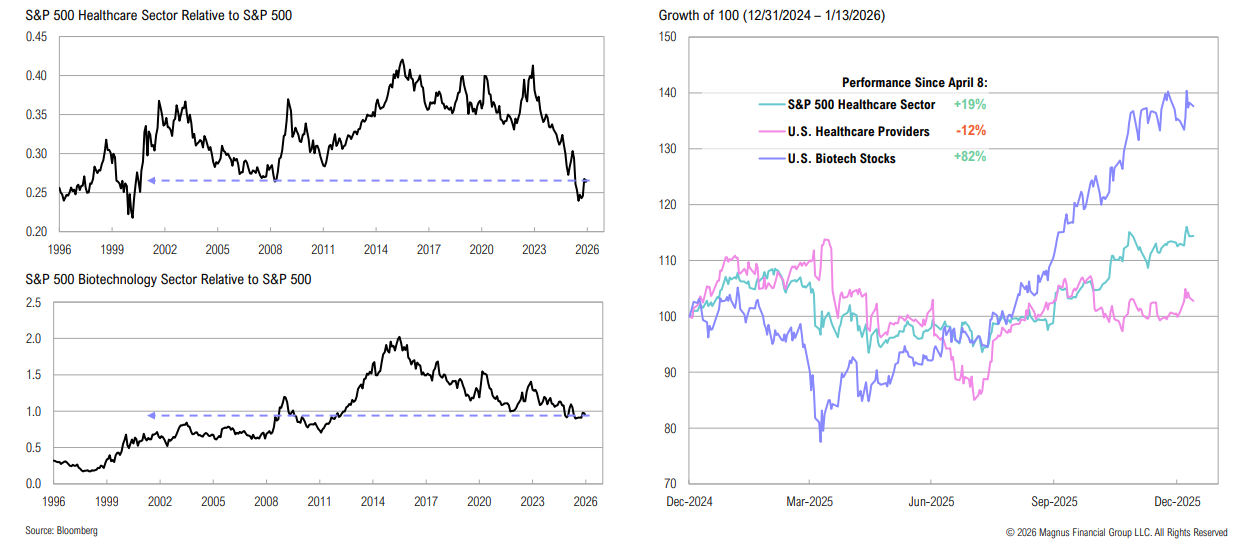

Biotech

The sharp rally in biotech stocks has resulted in fewer stocks trading below cash balances

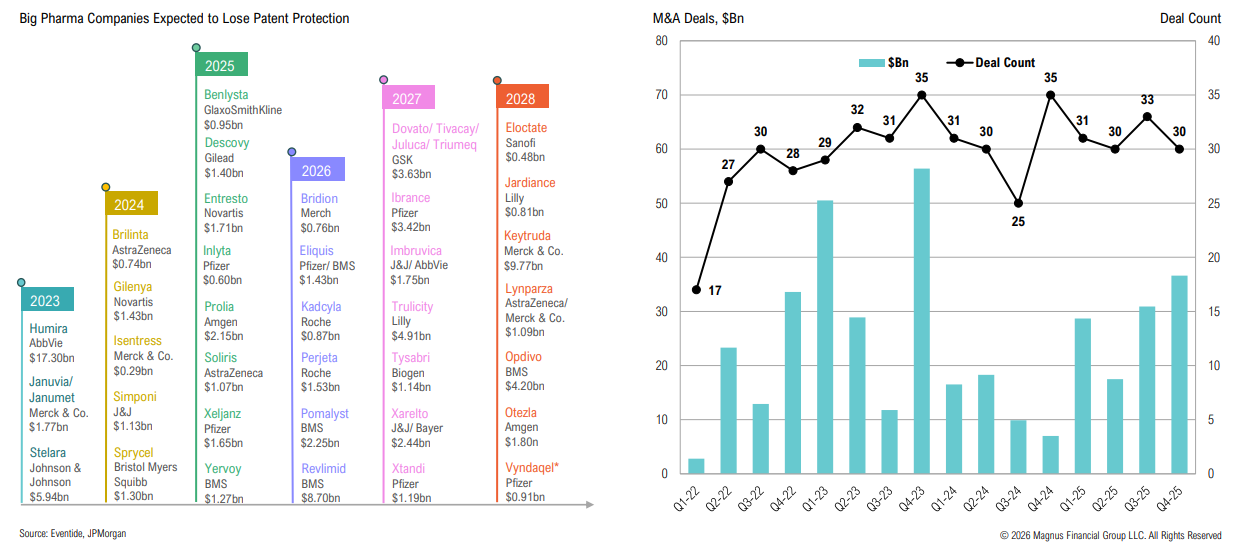

Despite recent strength, the healthcare sector continues to face structural headwinds from regulatory, financial, ethical pressures, and an ongoing patent cliff

Big pharma’s “patent cliff” is well under way, with an estimated $200Bn in annual revenue lost by 2030—this positions the sector well for further M&A

Fixed Income & Credit

Bond yields remained relatively contained over the quarter, with the yield curve steepening slightly as

markets responded to modest improvements in the fiscal deficit, contained inflation, and the prospects of easier monetary policy. Credit spreads remain tight suggesting continued economic resilience and a market still comfortable with current levels of fiscal spending.

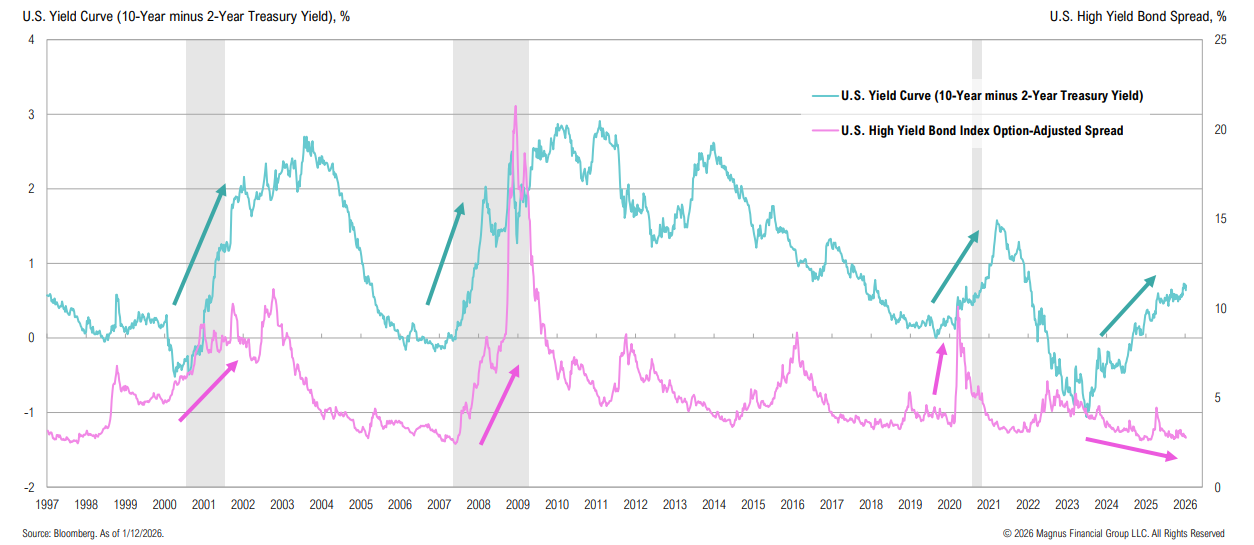

Yield Curve

Yet another K-shaped divergence: while the yield curve continues to steepen, credit spreads remain low by any long-term standard

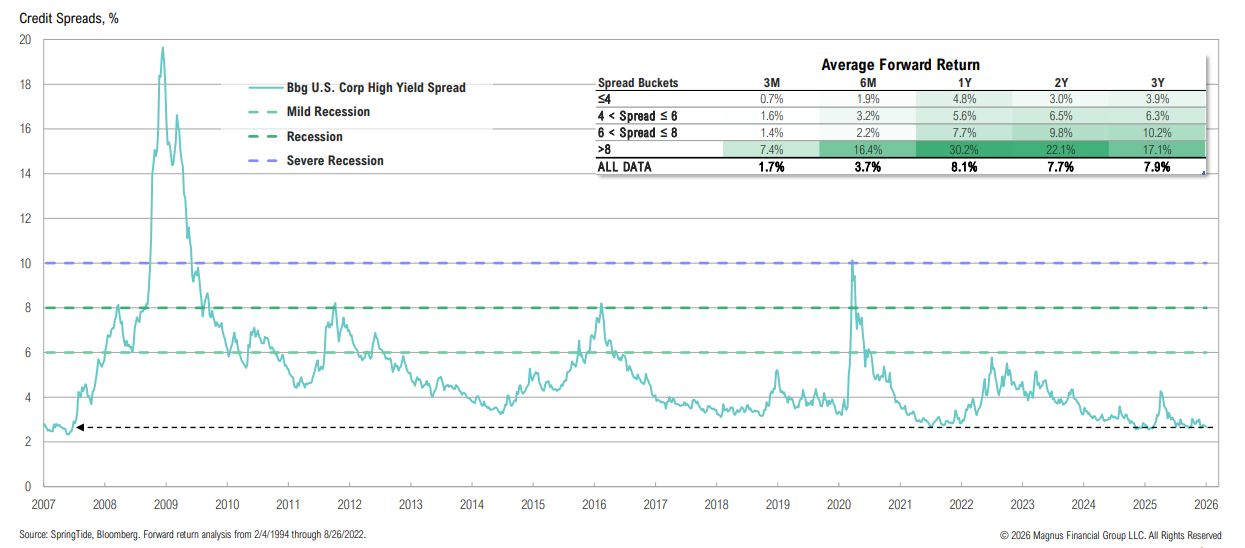

Credit Spreads

Credit spreads remain tight relative to history, ending 2025 at 2.7%; forward returns from these spreads have historically been lackluster

Fed Balance Sheet Expansion

The expansion of the Fed’s balance sheet, combined with expectations of further rate cuts, suggests the likelihood of substantially easing of monetary policy in 2026

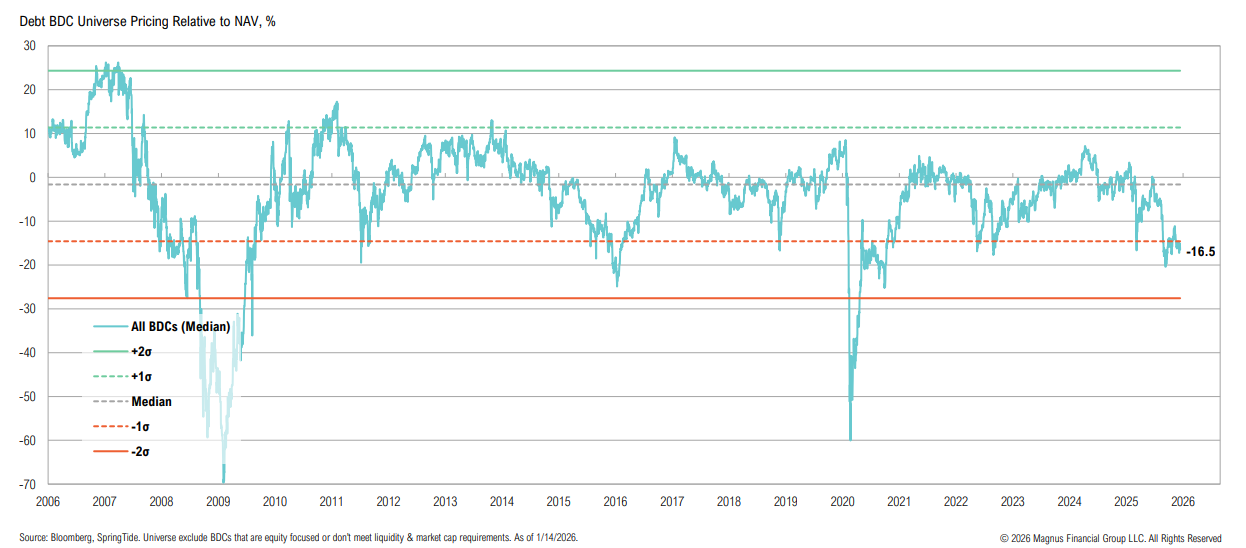

BDCs

While median discounts are at -16.5%, select funds are trading at even wider discounts, akin to recession levels

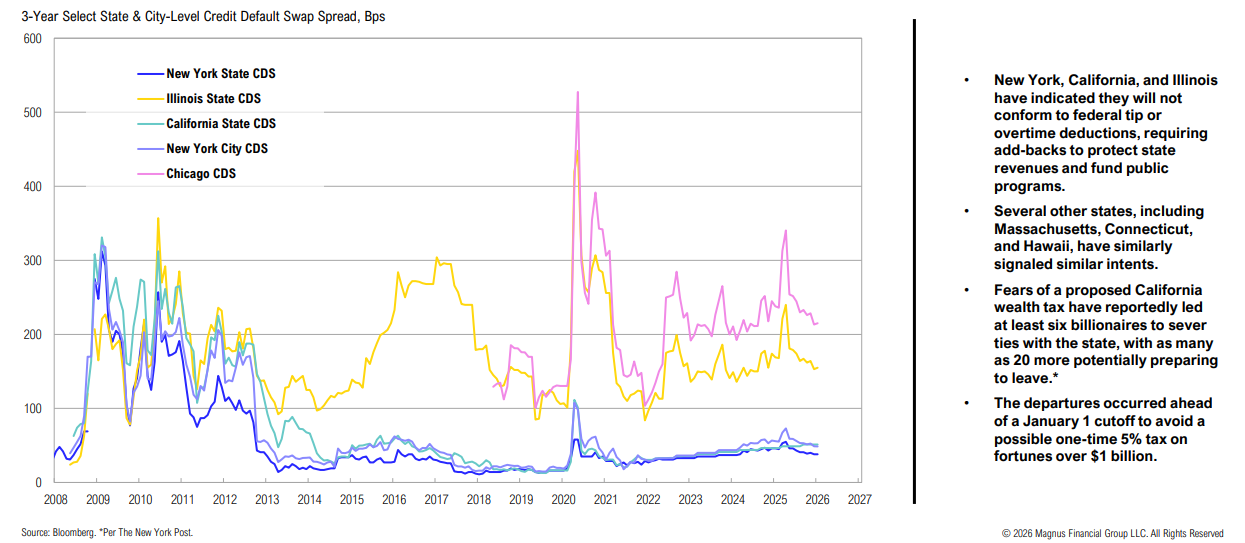

Munis

The state of some states…

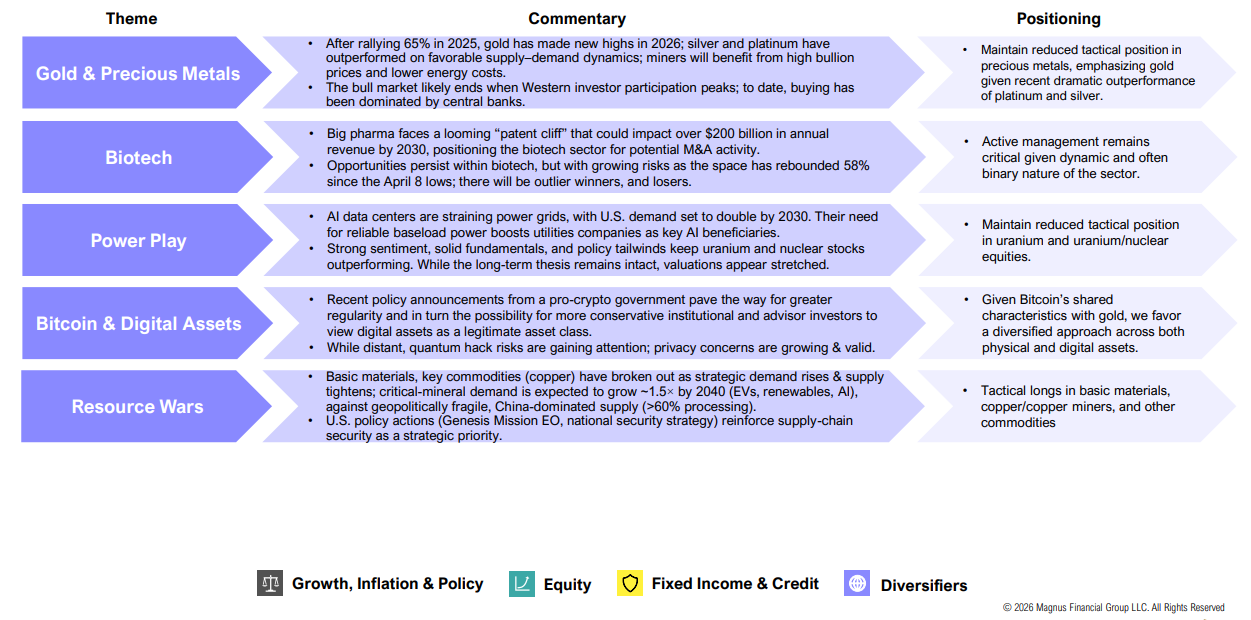

Diversifiers

With stock and bond correlations remaining elevated, opportunity remains to improve the risk-return profile of a portfolio by finding investment opportunities that have distinct return sources—such as gold, uranium, utilities, and more.

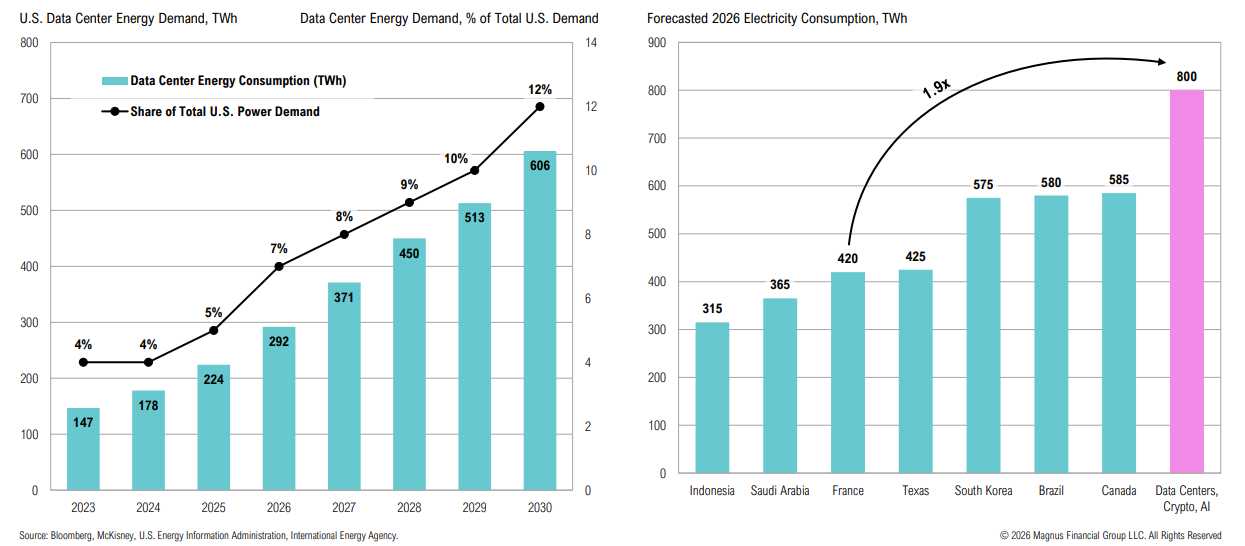

Power Play

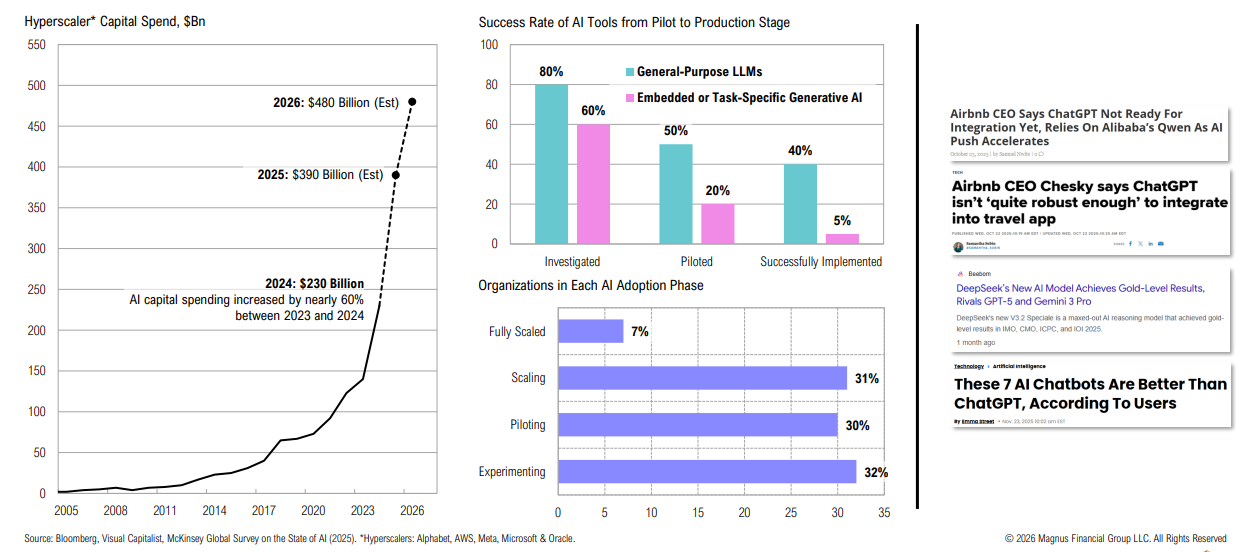

Data centers are expected to drive U.S. power demand; in 2026, global data centers+ AI + crypto energy consumption is estimated to be nearly double that of France

“The biggest issue we are now having is not a compute glut, but it’s power.”

Satya Nadella, Microsoft CEO

“Meta is planning to build tens of gigawatts this decade, and hundreds of gigawatts or more over time. How we engineer, invest, and partner to build this infrastructure will become a strategic advantage.”

Mark Zuckerberg, Meta CEO

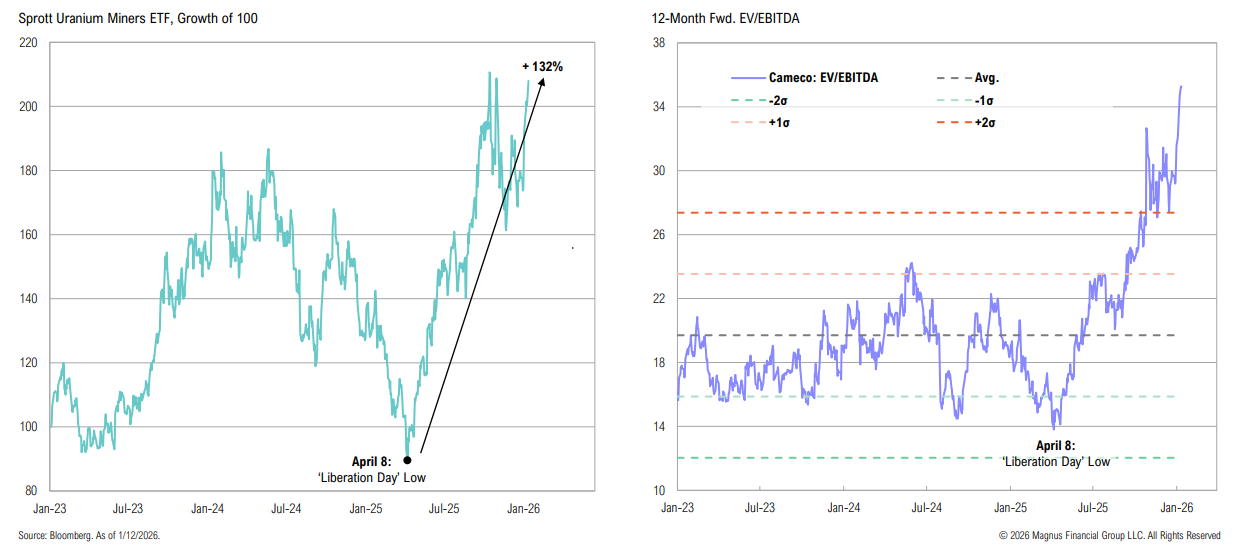

Uranium and nuclear stocks have rallied >130% from the “Liberation Day” lows, driven by strong sentiment, solid fundamentals, and ongoing policy support; while the long-term thesis remains intact, valuations appear stretched

AI

Despite skyrocketing spending, the overall success rate of AI tools and adoption remains somewhat muted; what if access to the most advanced chips and models isn’t necessary?

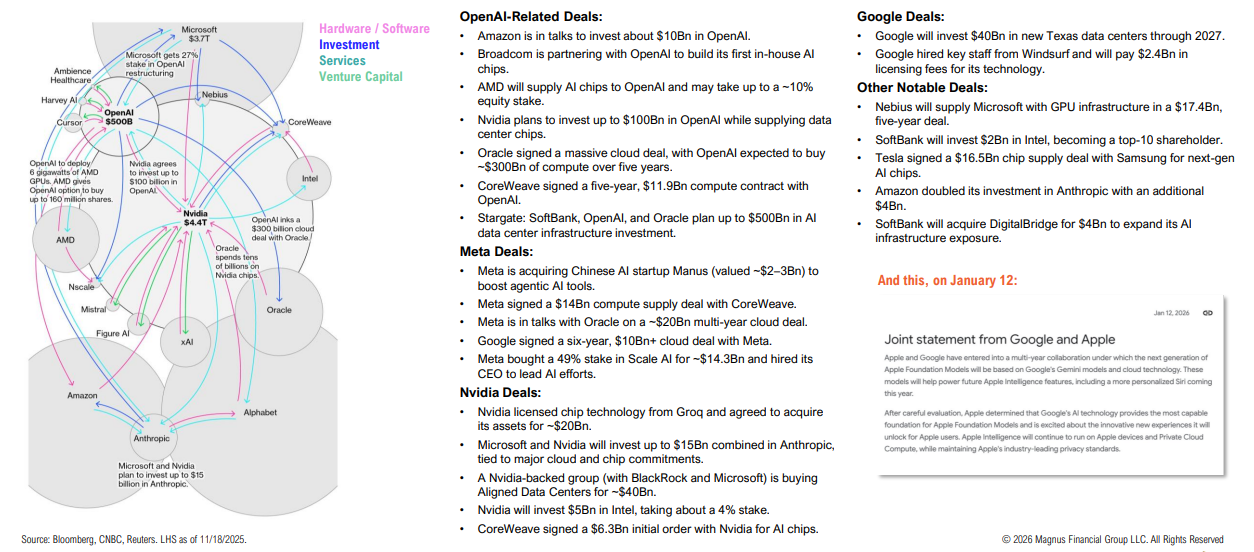

The circularity of AI investments continues to grow

Precious Metals & Gold

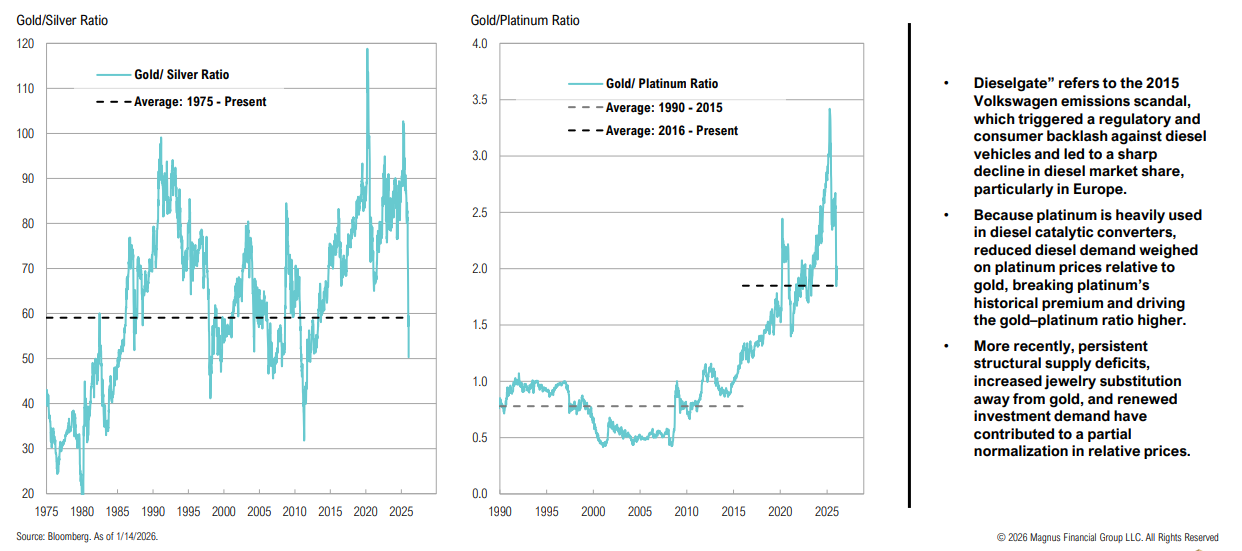

After a parabolic December and YTD rally, silver has declined below its 50-year average vs. gold; the gold–platinum ratio (disrupted by “Dieselgate” in 2015) is back in line with its 10-year average

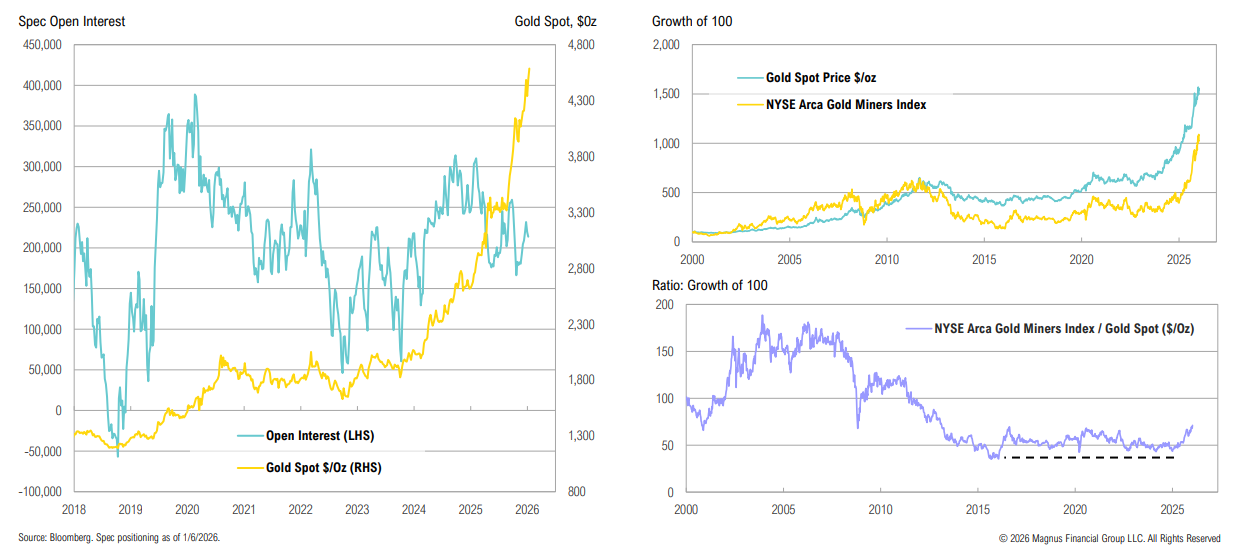

Despite gold spot prices reaching a new record high in December, spec positioning remains contained; even after rallying over 150% in 2025, gold miner fundamentals remain compelling

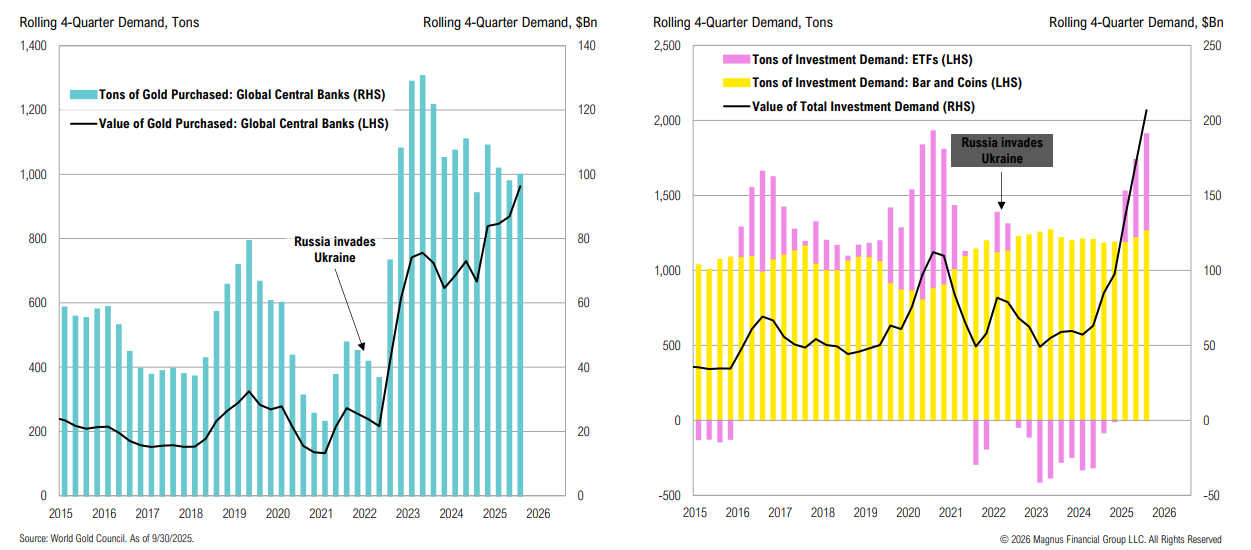

Central banks have been a key demand driver of gold since Russia invaded Ukraine, with little slowdown evident; ETF investment demand only began ramping in Q1’25 and remains well below prior peaks (in oz)

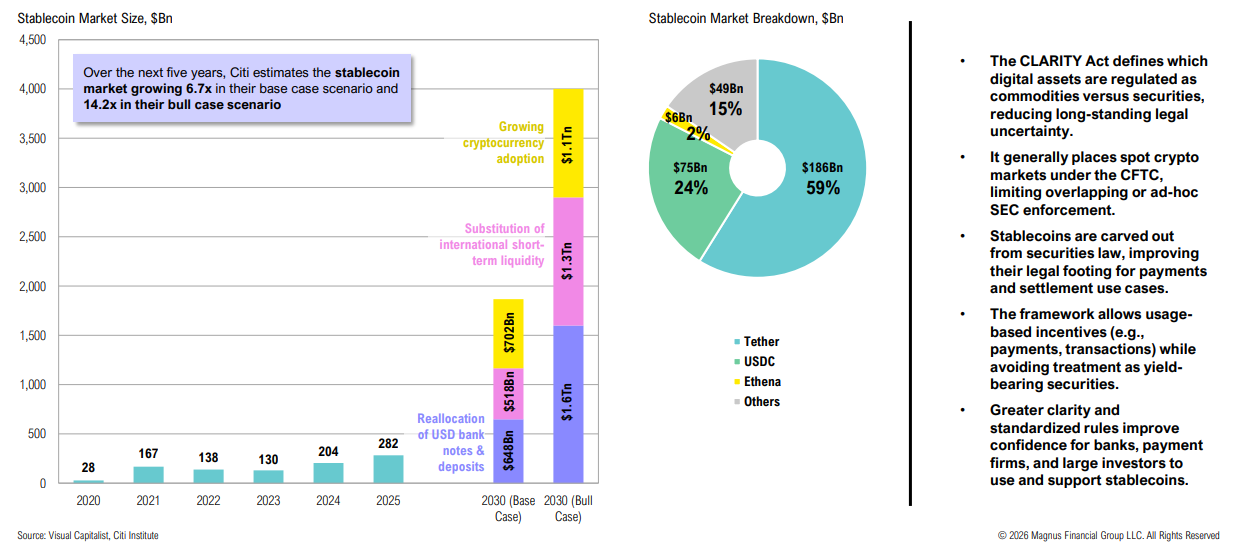

Stablecoins

Stablecoins could benefit from growing crypto adoption and substitution of international short-term liquidity; a markup session for the CLARITY Act is set for early January

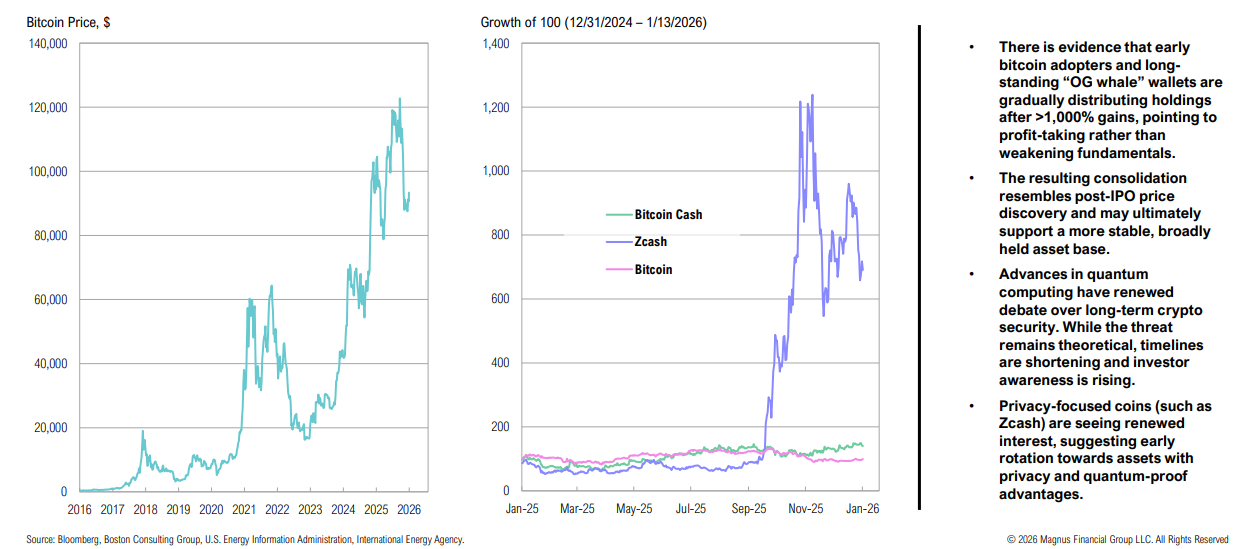

Cryptocurrencies

Is bitcoin having its ‘IPO’ moment or are privacy and theoretical quantum risks gaining relevance? Other coins (like Zcash) act as hedges against potential risks

Appendix

Supporting materials, including Capital Market Expectations and additional research referenced throughout the Market Outlook.

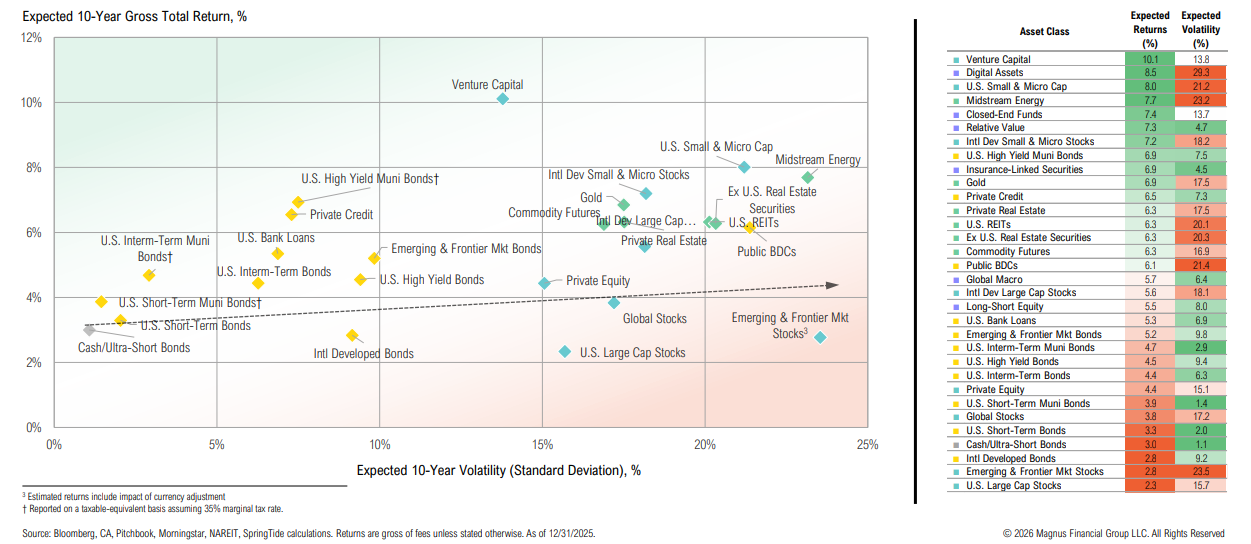

CMEs

With global valuations broadly stretched across asset classes, longer-term return assumptions have declined