Rate Cuts and Deficits and Elections, Oh My!

“While inflation is slowing and the U.S. economy remains resilient, several critical issues remain, including large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world. While we hope for the best, these events and the prevailing uncertainty demonstrate why we must be prepared for any environment.”

Jamie Dimon, JPMorgan CEO

Cartoon

Rate Cuts and Deficits and Elections, Oh My!

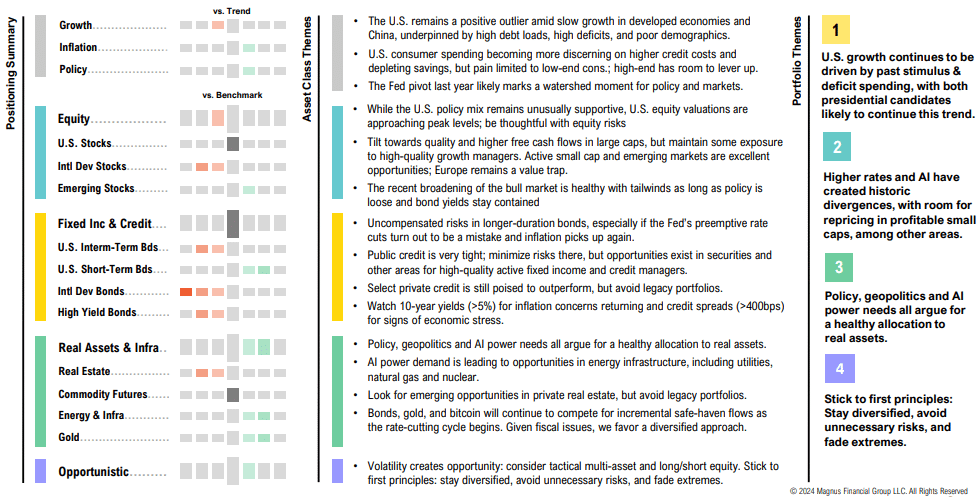

Summary

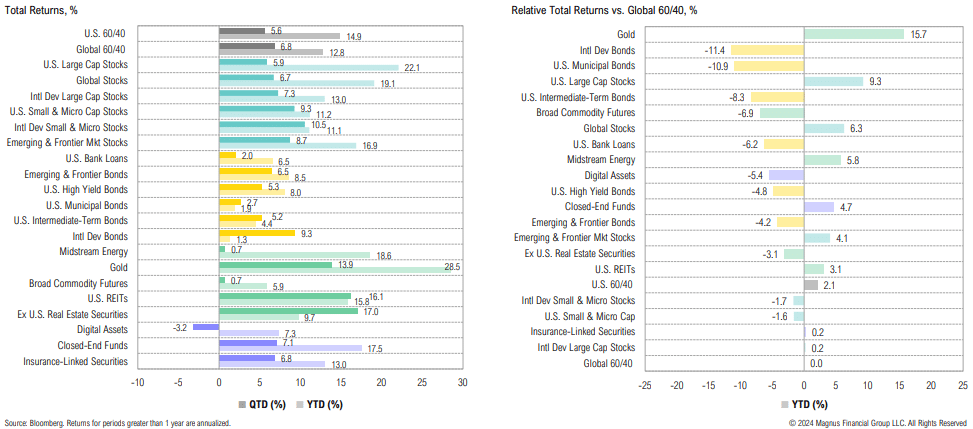

Q3, 2024 Market Review

Major winners over the third quarter include ex-U.S. real estate (+17.0%) and U.S. REITs (+16.1%) while digital assets (-3.2%) and broad commodities (+0.7%) lagged

Asset Allocation Views

“There is thinking that the time to support the labor market is when it’s strong and not when you begin to see the layoffs… We don’t think we need to see further loosening in labor market conditions to get inflation down to 2 percent.”

Jerome Powell, Federal Reserve Chairman

“So, I think what there is to say about consumer spend is a little bit boring in a sense, because what’s happened is that it’s become normal. Overall, we see the spending patterns as being sort of solid and consistent with the narrative that the consumer is on solid footing and consistent with the strong labor market.”

Jeremy Barnum, JPMorgan Chase CFO

Growth, Inflation & Policy

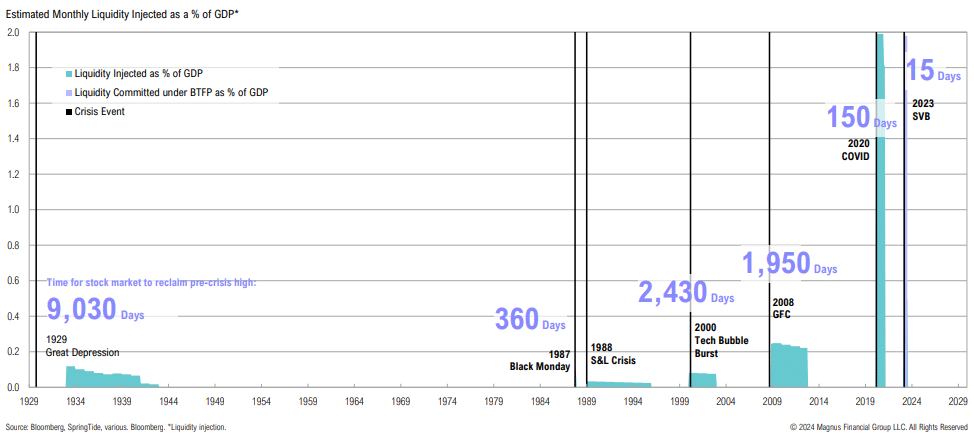

Liquidity Injections

Liquidity injections are becoming larger and faster, with faster transmission to markets

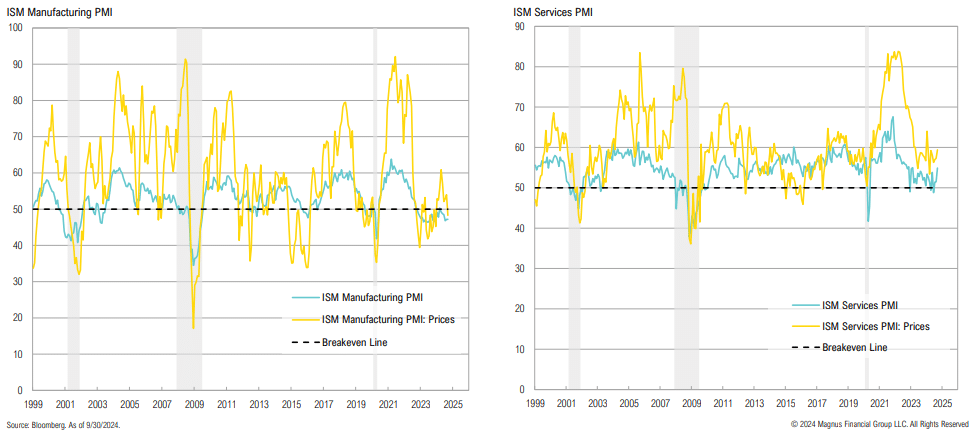

Growth: ISM PMIs

While the manufacturing sector remains in contractionary territory, the services sector remains strong; services prices paid in September rose to the highest level since January

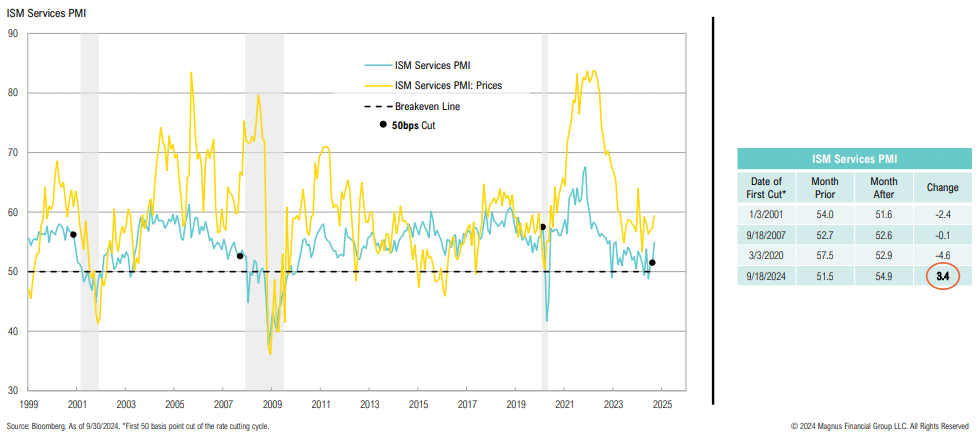

The Fed risks fueling a growing economy; this is the first time ISM Services PMI has increased in the month following a 50bps rate cut

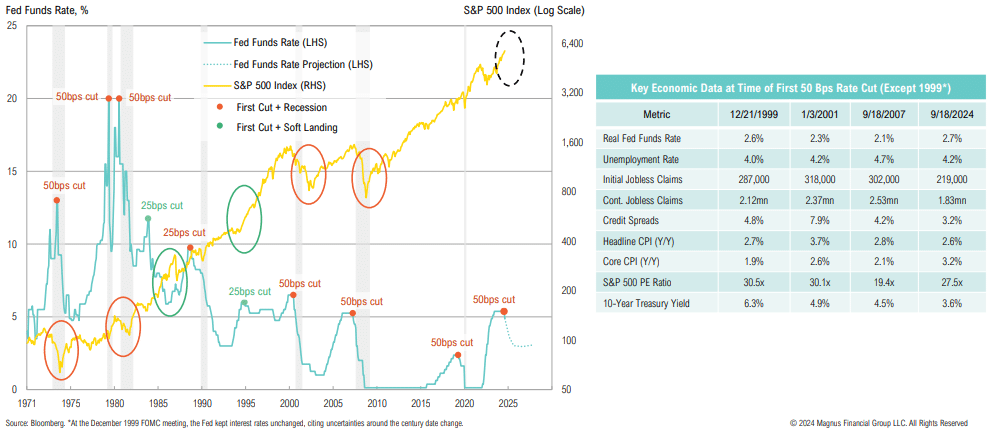

Policy: The 50bps Rate Cut

A 50bps cut usually only happens during times of crisis; history shows us if the first cut is 50bps, it’s usually been justified

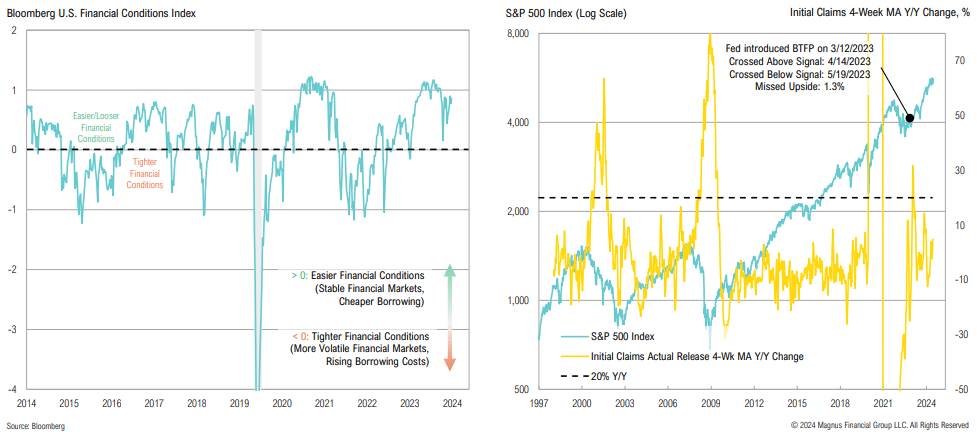

Policy: Financial Conditions & Labor Market

Financial conditions remain loose; initial jobless claims continue to indicate a stable labor market

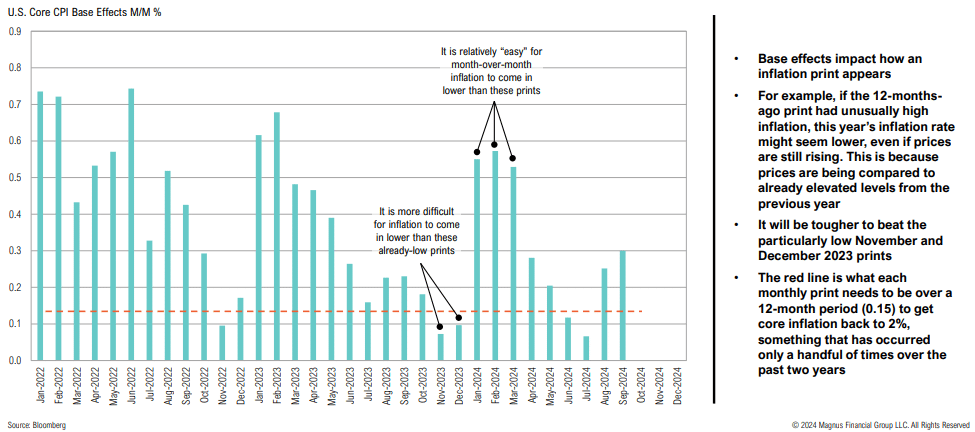

Policy: U.S. Inflation & Base Effects

Further, core inflation may remain sticky: base effects show the challenge to beat “easy” larger month-over-month prints becomes more challenging through year-end

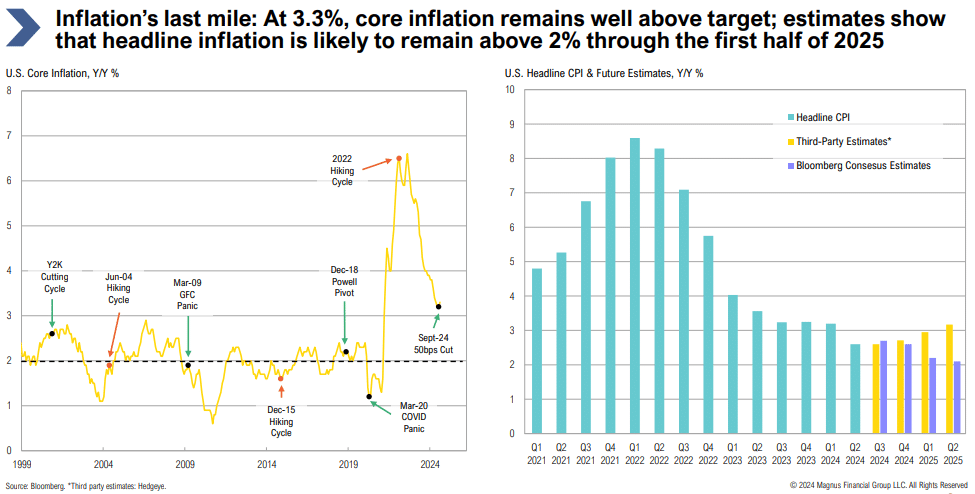

Policy: U.S. Inflation

Inflation’s last mile: At 3.3%, core inflation remains well above target; estimates show that headline inflation is likely to remain above 2% through the first half of 2025

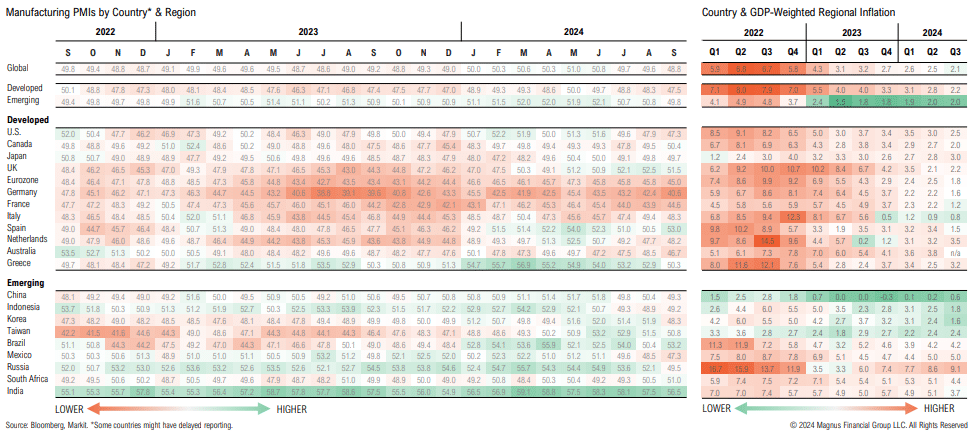

Policy: U.S. Inflation & Global Growth and Inflation

Globally, inflation has eased, but manufacturing activity has slowed; country divergences continue with Japan, Canada and select emerging markets faring better than the Euro area

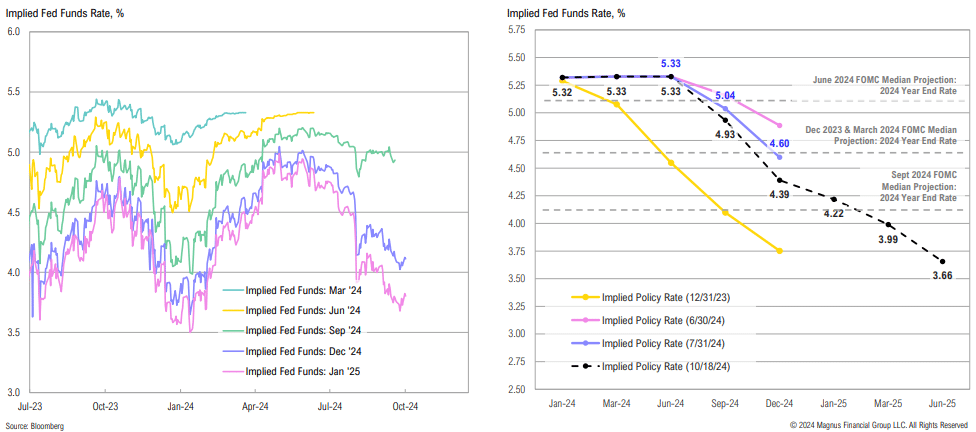

Policy: Implied Fed Funds

After last month’s 50bps rate cut, both markets and the Fed expect the equivalent of another 50bps in rate cuts before year end (a 25bps cut at each remaining FOMC meeting)

Policy: Monetary Policy

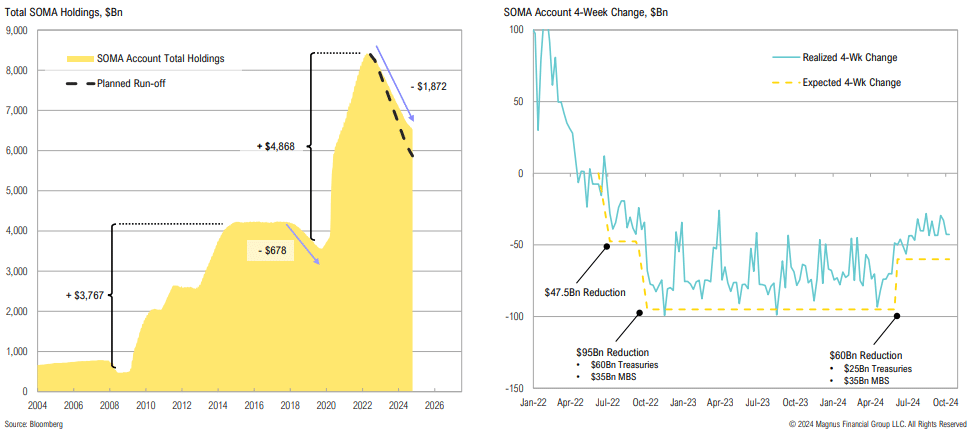

The Fed slowed the pace of QT on June 1, despite inflation remaining above target for >3 years, having reduced the balance sheet by only <40% of what was added during COVID and lagging its planned runoff by >$500bn

Policy: Fed Balance Sheet

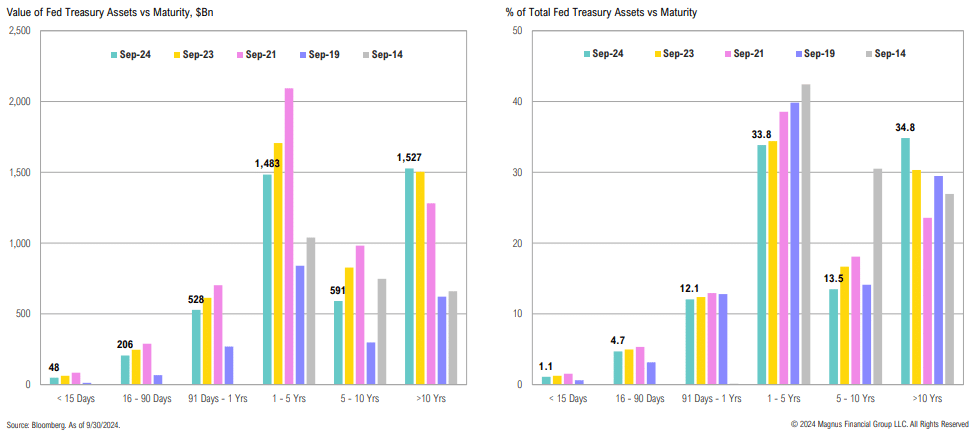

~18% ($780bn) of the Fed’s balance sheet assets are maturing within the next year—enough to hit the $25bn monthly roll-off target; this implies the Fed will purchase ~$500bn in Treasuries

U.S. Fiscal Deficit

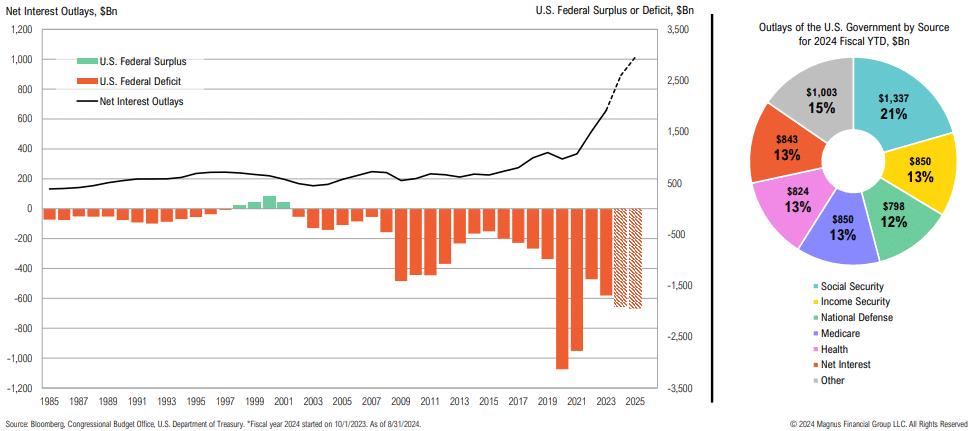

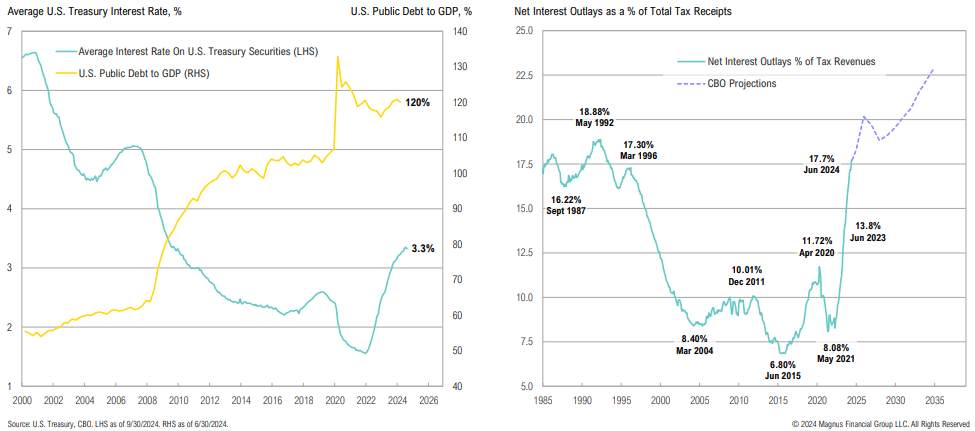

Government spending continues unchecked: through August, the fiscal budget deficit for 2024 was already at $1.9Tn; net interest outlays now exceed defense and health spending

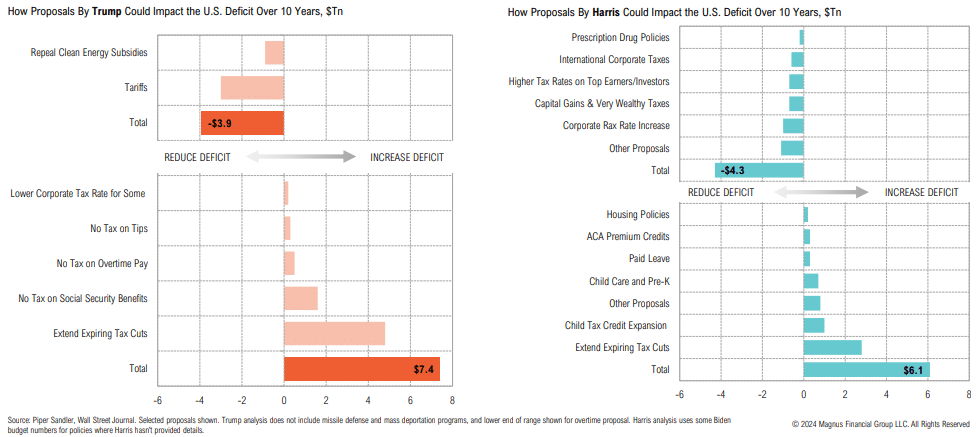

Both Trump’s and Harris’s fiscal policies would, on balance, increase the deficit over the next 10 years

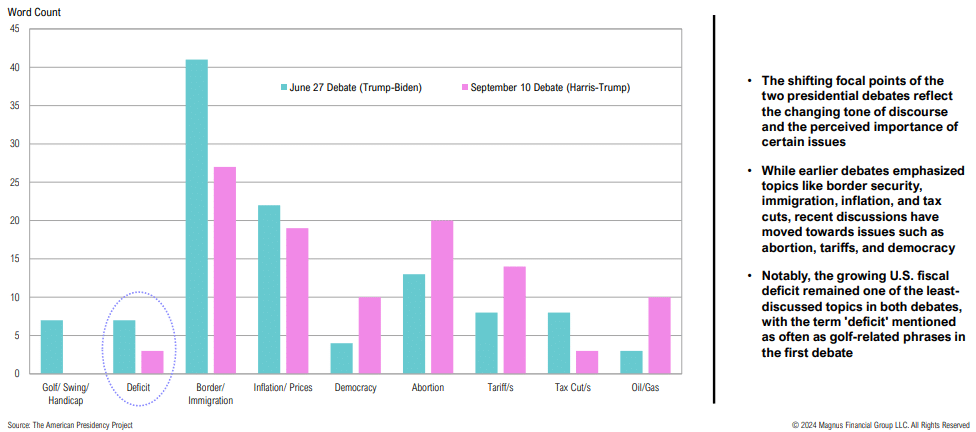

Word counts from the two presidential debates show a shift in focus—but the deficit remained one of the least-mentioned issues

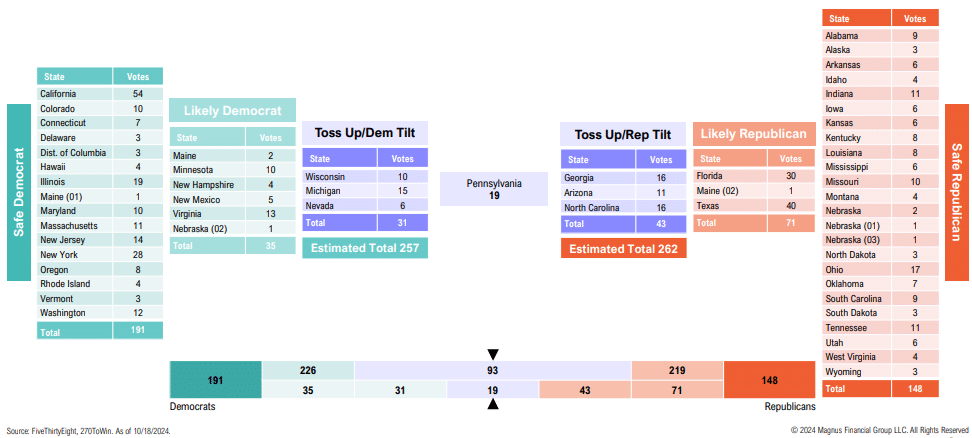

The Election

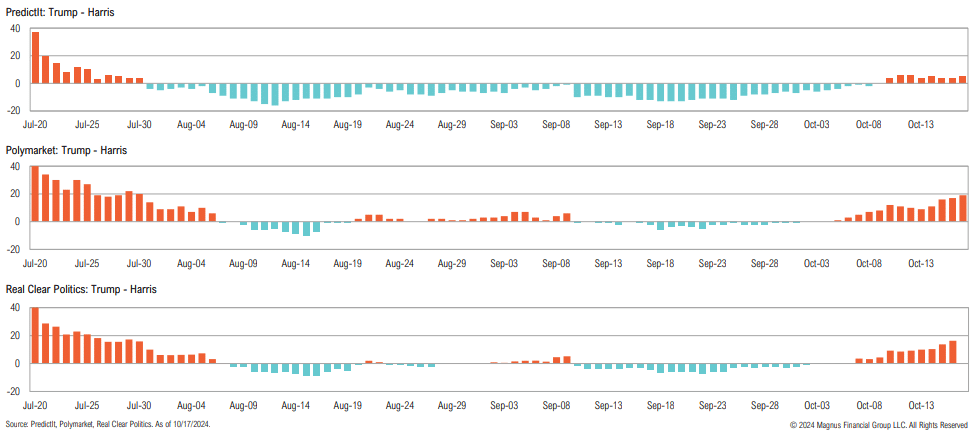

Betting markets have shifted to a Republican Presidential win next month

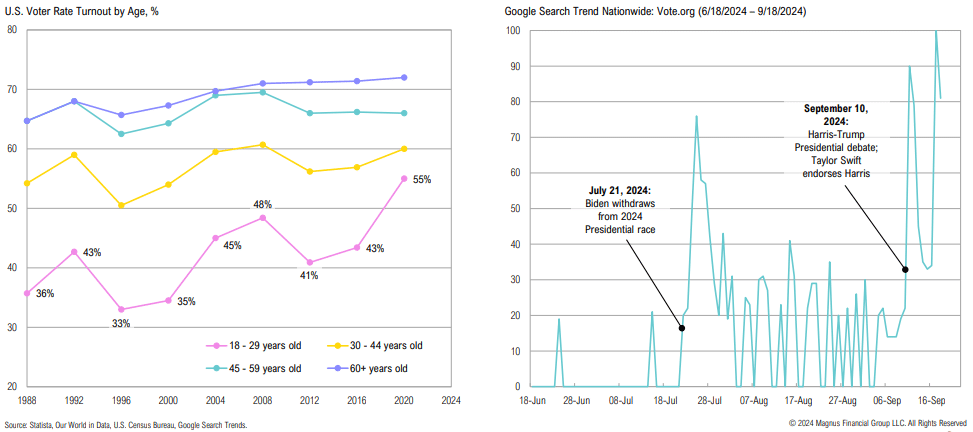

Young voters historically have had the lowest turnout, but increased participation may impact the election outcome; Taylor Swift’s Harris endorsement spiked Vote.org searches

The road to 270 electoral votes is looking unlikely for either candidate without Pennsylvania

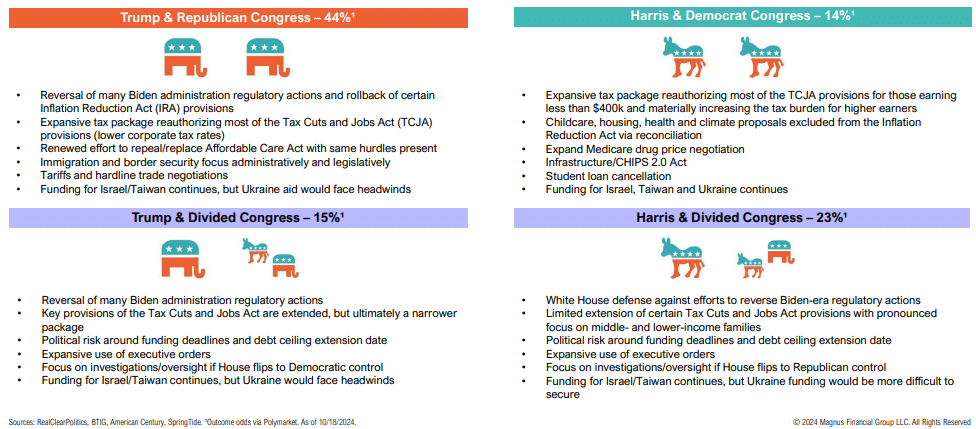

Scenario analysis of possible policy outcomes with betting market odds

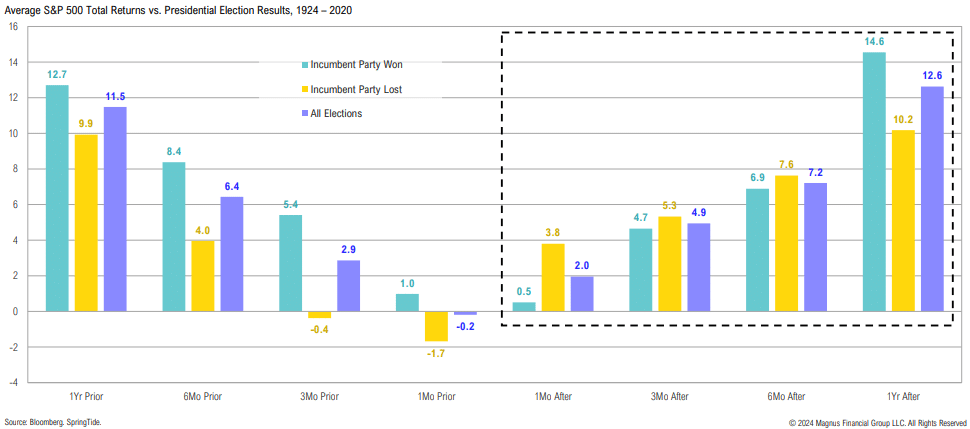

Short-term volatility aside, markets generally perform relatively well once election uncertainty clears

“…there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

Edwin LeFevre, American writer & journalist

“I’ve been quite clear that I think the future could be quite turbulent and asset prices in my view… are inflated. I don’t know if they’re extremely inflated or a little bit, but I prefer to wait.”

Jamie Dimon, JPMorgan Chase Chairman & CEO

Equity

Market Valuations

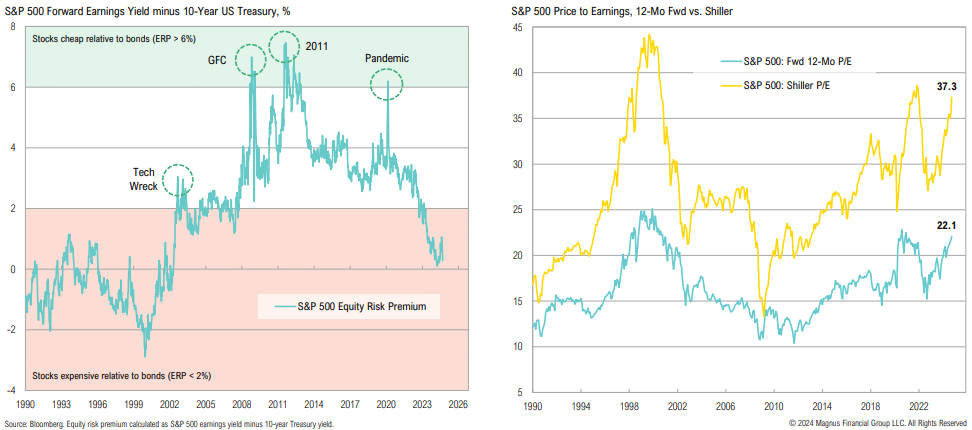

Using a yield-to-earnings yield comparison (ERP), U.S. stocks are less attractively priced vis-à-vis bonds than at any point since the 1990s; valuations appear rich from both a Shiller and forward P/E perspective

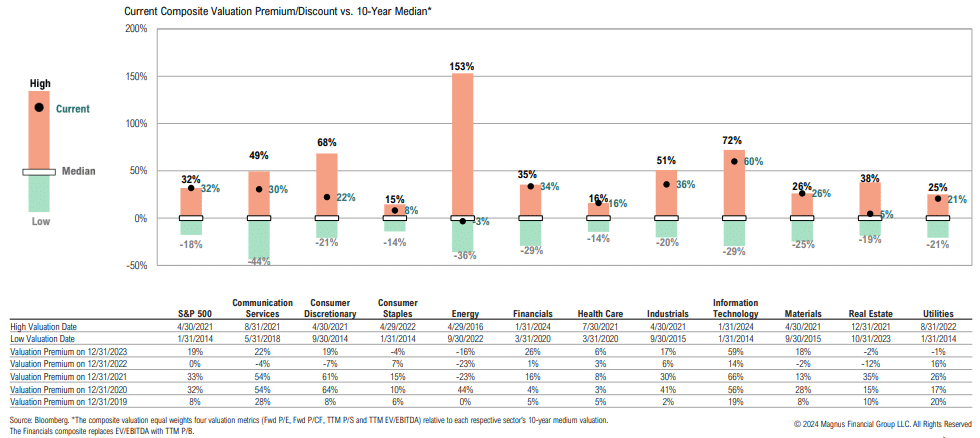

S&P 500 composite valuations are at 10-year highs; most sectors are trading at premiums relative to their internal median valuations, with Tech, Financials, Materials, and Health Care at or near 10-year highs

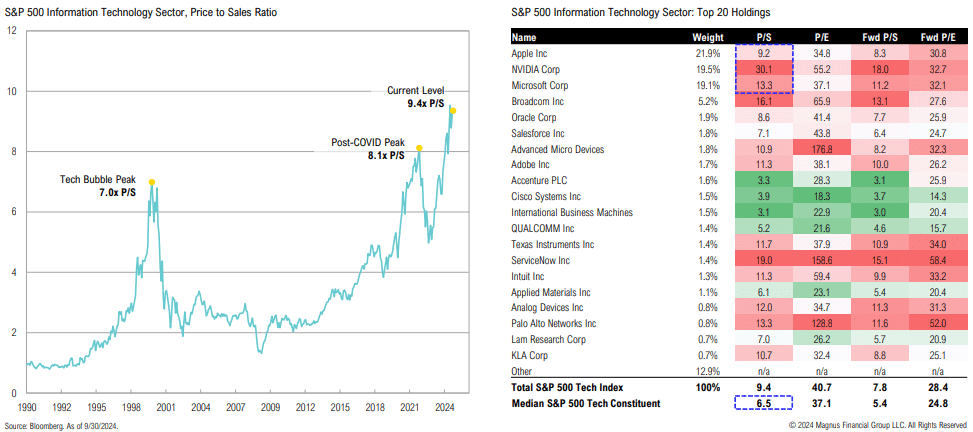

Market Valuations: Tech Sector

The tech sector P/S ratio is currently over 30% higher than peak Tech Bubble levels: NVDA (30.1x), and MSFT (13.3x) account for ~40% of the sector; the median tech stock trades at 6.5x P/S

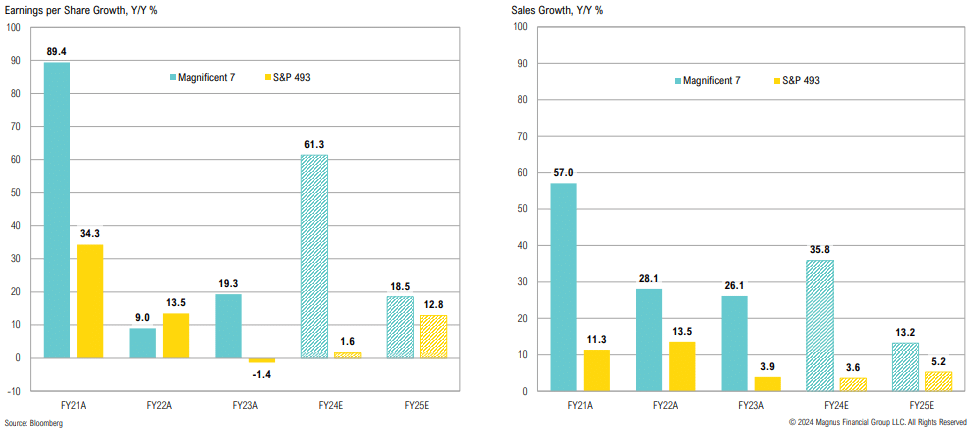

Market Valuations: Earnings Growth

Are high valuations at least partially being driven by strong earnings growth? FY 2024 Mag 7 earnings are expected to grow by 61.3%, while S&P 493 earnings are expected to grow by 1.6%

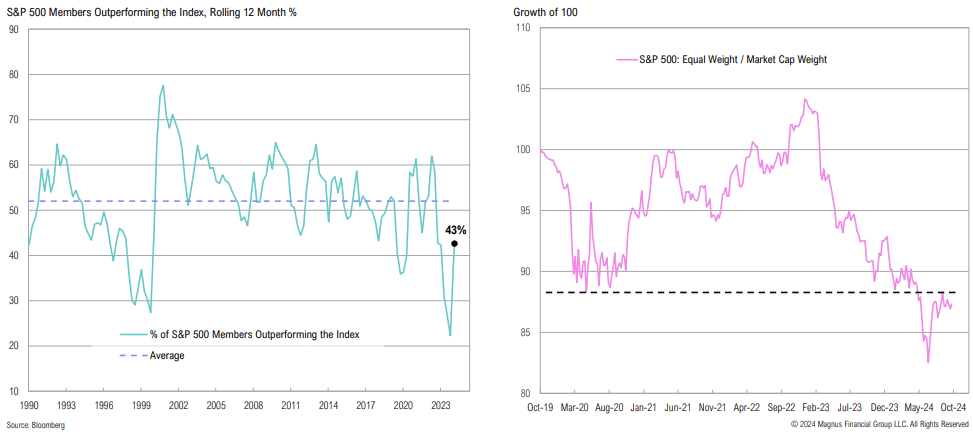

Market Valuations: Market Breadth

Market breadth continues to improve, with 43% of S&P 500 members outperforming the broader index and the equal weighted index outperforming since early July

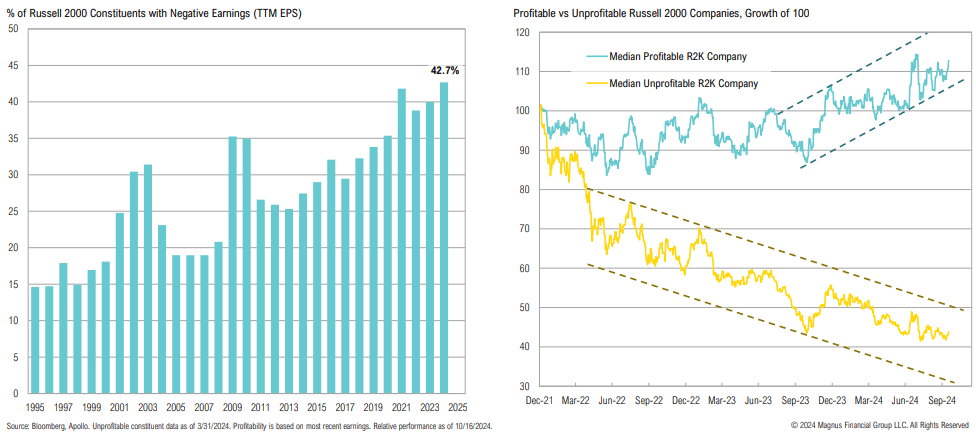

U.S. Small Cap Stocks

The market remains selective with U.S. small cap stocks: profitable companies are faring well, while unprofitable companies (~43% of the Russell 2000) continue to trend lower

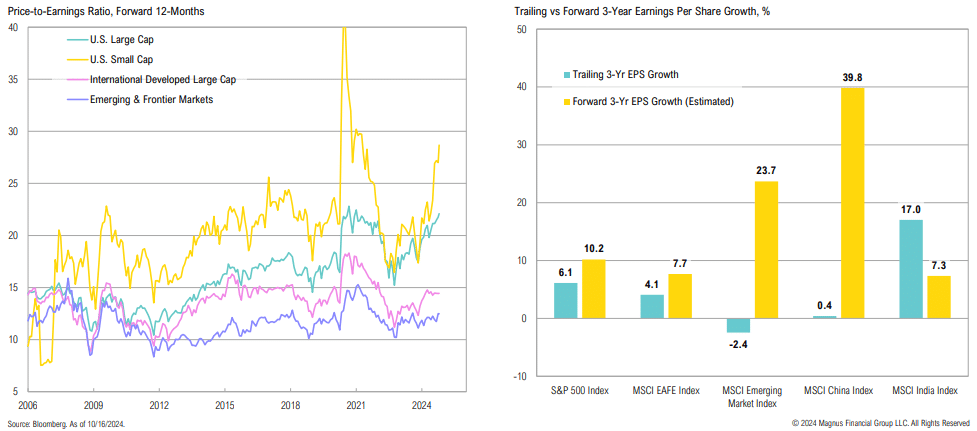

Emerging Markets

Emerging market stocks remain relatively cheap vs. developed markets; looking ahead, earnings growth for broader emerging markets and China look promising

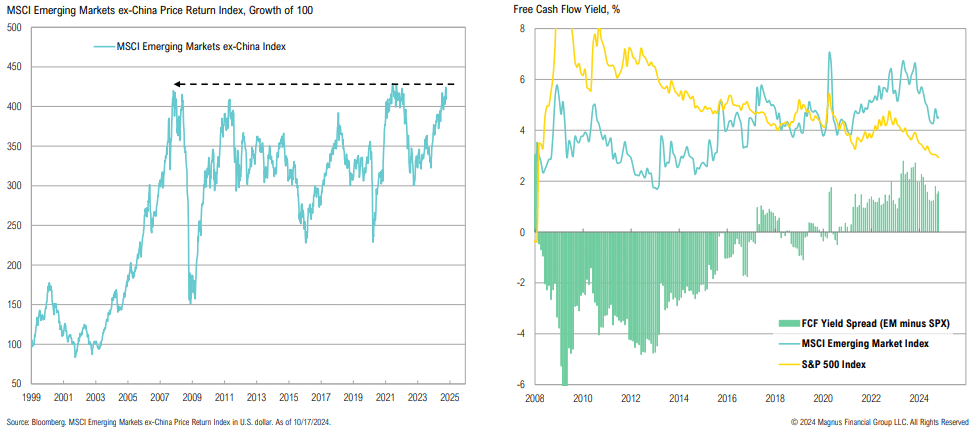

EM ex-China stocks are nearing a 16-year breakout; EM stocks look cheap compared to U.S. large-cap stocks, with free cash flow yields 1.6% higher than those of the S&P 500

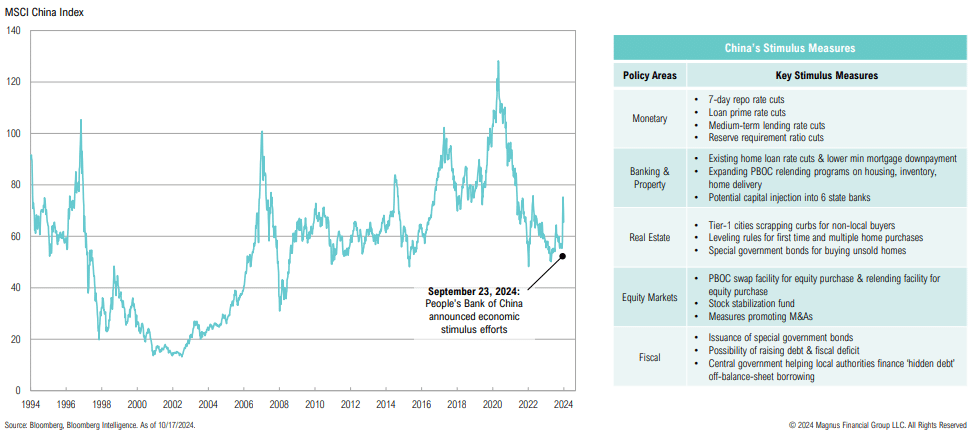

On September 23, the Chinese central bank announced a series of economic stimulus efforts; despite the recent rally, Chinese stocks remain nearly 50% below 2021 peak

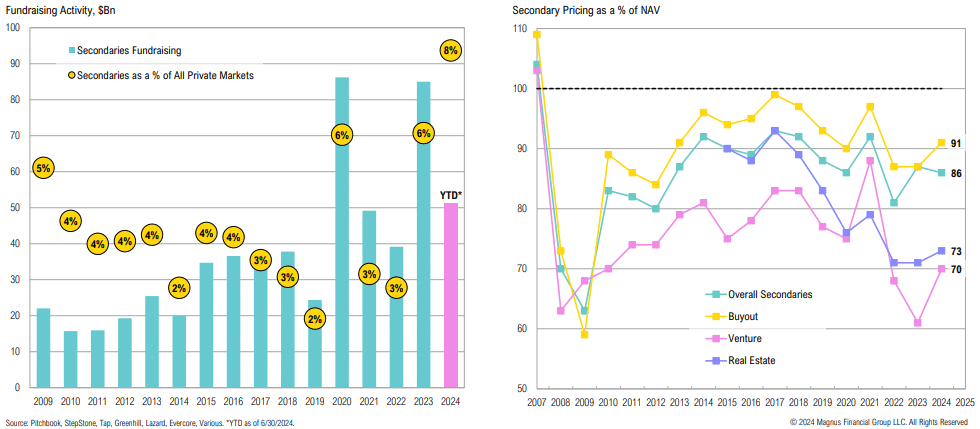

Private Markets: Secondaries Fundraising

Secondary fundraising is on pace for its largest year ever, both in terms of $ amount and as a % of total private markets, but remains only a fraction of overall private markets

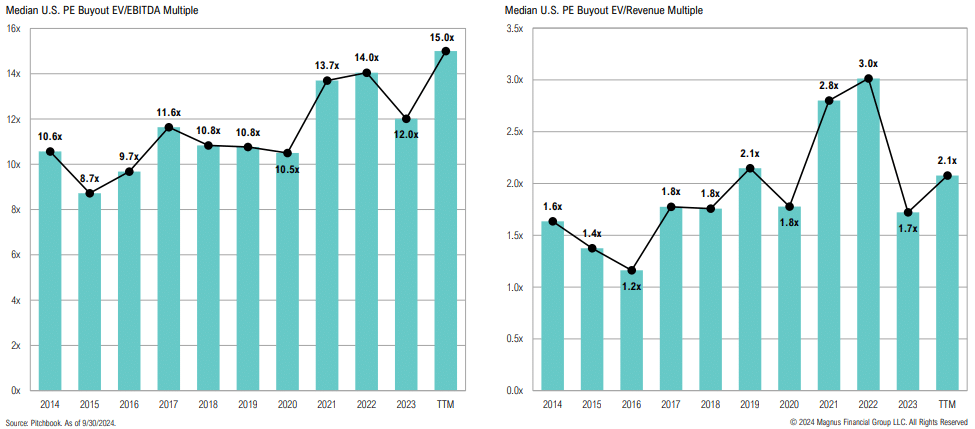

Private Equity: PE Buyout

Buyout EV/EBITDA multiples are elevated, while EV/Revenue multiples suggest these companies are struggling with profitability

“The U.S. acts as if it has a credit card with no limit on the balance and no requirement to pay it down. It does so because it’s been able to get away with it thus far, and our governing officials lack the will to spend less than they can.”

Howard Marks, Oaktree Capital Co-founder & Co-chairman

Fixed Income & Credit

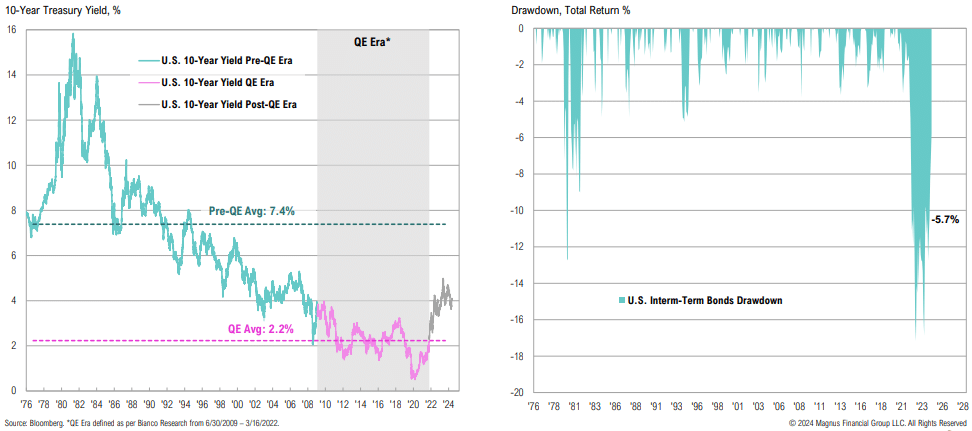

Treasury Market

We are in the biggest bond bear market of all time; bonds peaked in August 2020 and have yet to recover

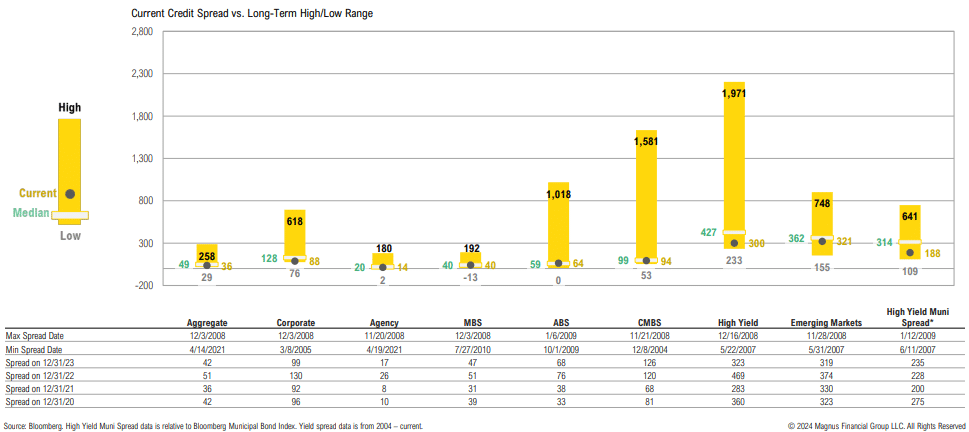

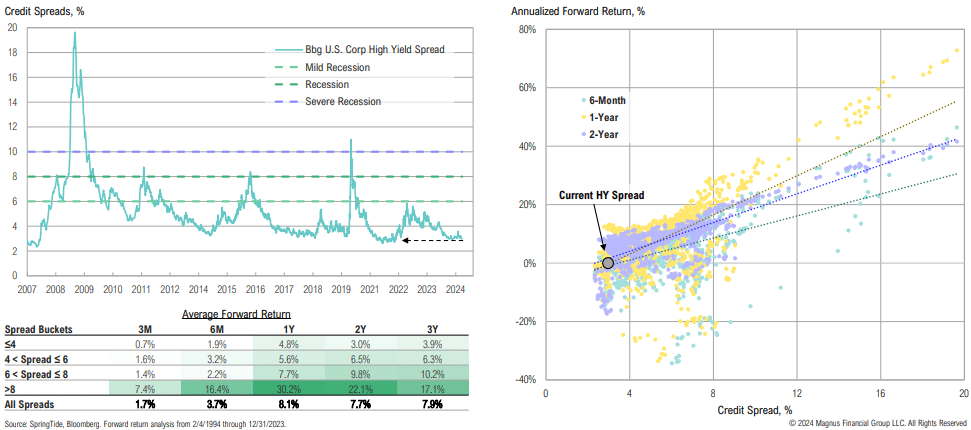

Spreads by Sector

Credit spreads are near or below median across most sectors; high-yield bond spreads at current levels suggest that the economy may achieve a ‘soft landing’

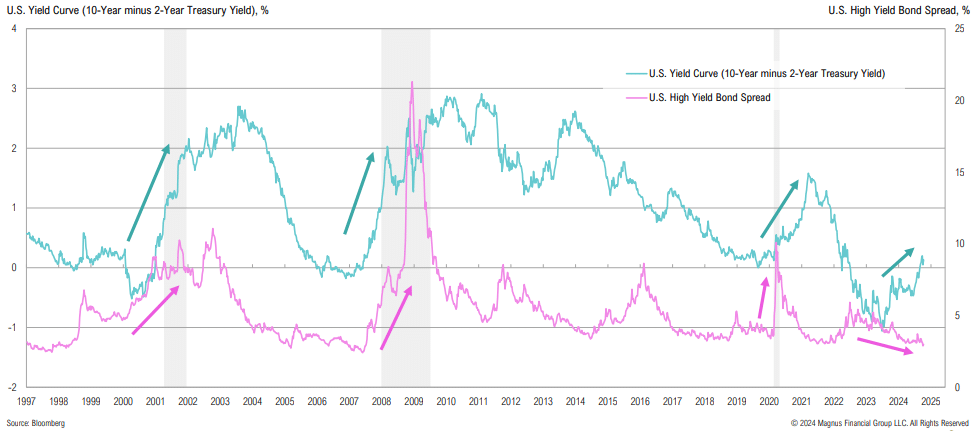

Yield Curve

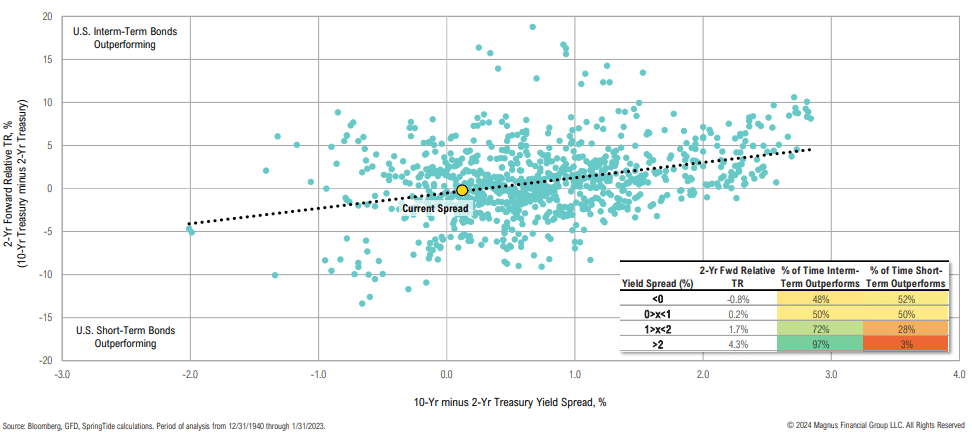

One of these cycles does not look like the others: credit spreads are at new cycle lows, while the yield curve is steepening

When the 2s10s spread is above 2%, investors should generally hold longer duration bonds; when it is between 1% and 2%, it is not a home run; and below 1% is a coin toss

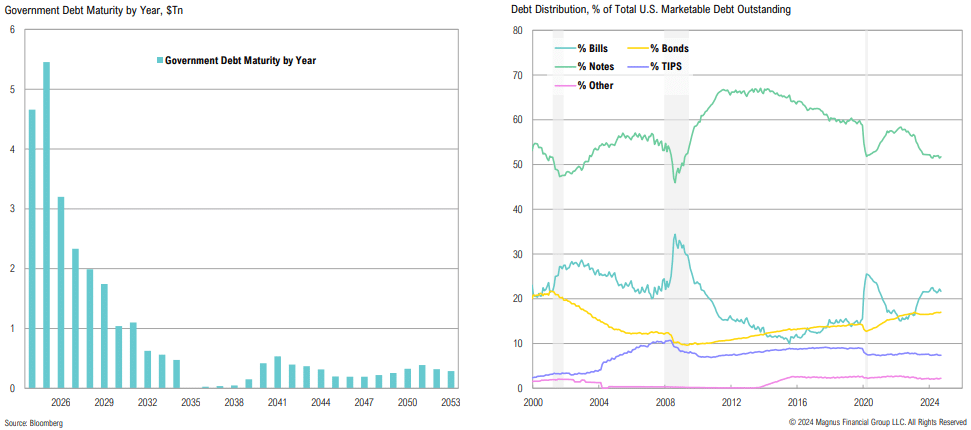

Government Debt

Over $10Tn in government debt will mature by the end of 2025 and be rolled at higher rates; bill issuance has plateaued with Treasury starting to increase bond issuance again

Net Interest Outlays

The average cost of Treasury debt outstanding has climbed to 3.32%, a level last seen when debt to GDP was ‘just’ 80%; tax receipts aren’t keeping pace, with nearly 18% of taxes going only to net interest payments

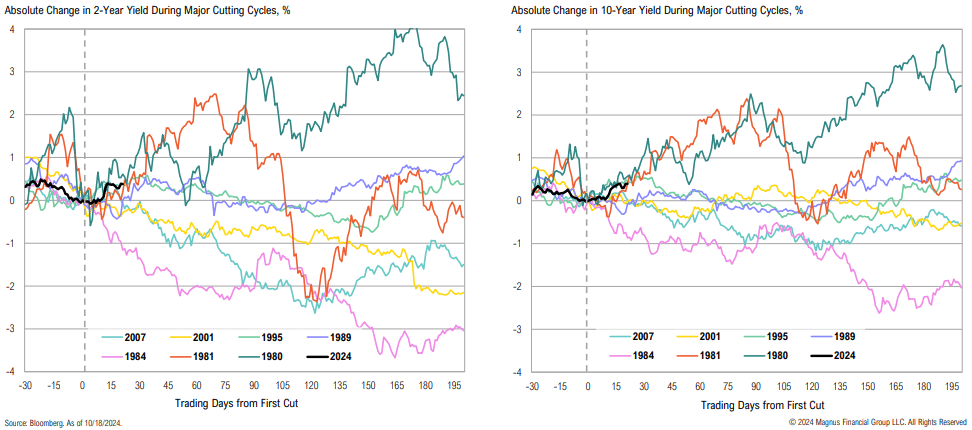

Yield Changes in Cutting Cycles

Yields rising following the first rate cut (as they are now) is reminiscent of what happened during the early 1980s (albeit when inflation was much higher at >10%)

GDP & Treasury Yields

Historically, long-term yields tend to follow nominal GDP; pro-growth policy that drives up nominal GDP may have implications for bond yields

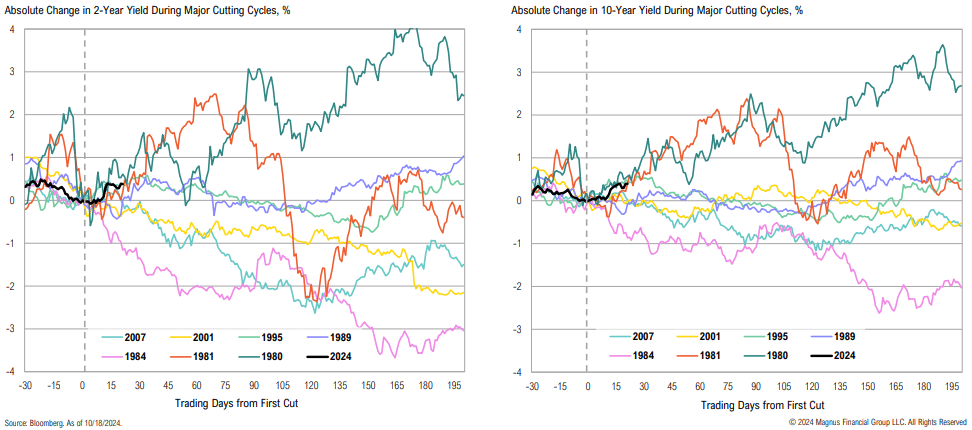

Treasury Payoff

The 2–4-year part of yield curve has an attractive risk-reward profile—yields could rise 1.0% in the next year and total returns would still be positive

Private Credit

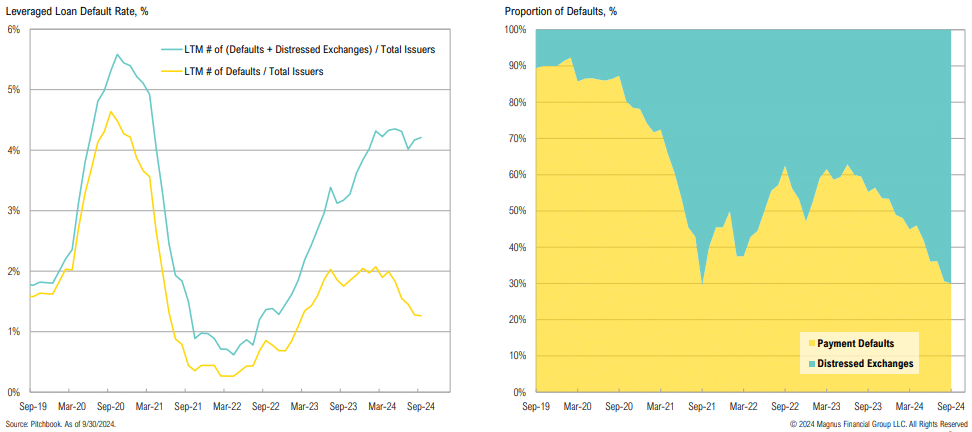

Distressed exchanges are replacing traditional defaults, masking issues

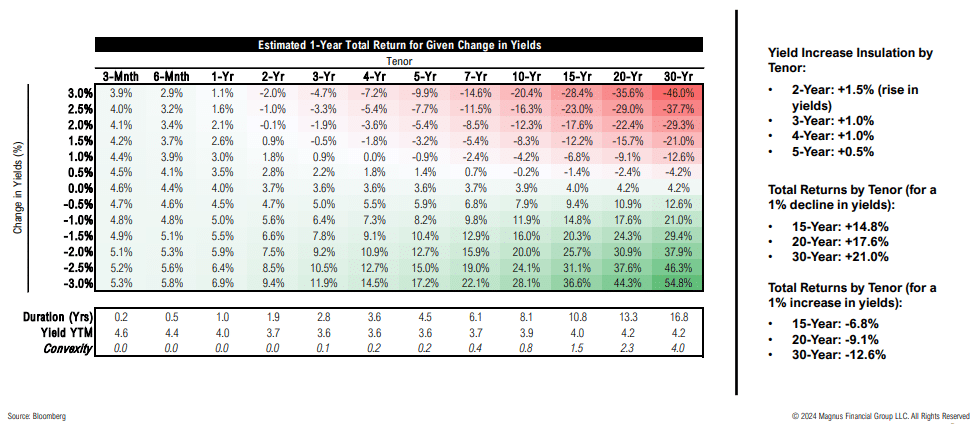

High-Yield Spreads

Not attractive: at ~298bps, credit spreads are in line with pre-COVID lows; low credit spreads continue to suggest runway for the economy (i.e., a ‘soft landing’)

“We believe that nuclear energy has a critical role to play in supporting our clean growth and helping to deliver on the progress of AI… We feel like nuclear can play an important role in helping to meet our demand, and helping meet our demand cleanly, in a way that’s more around the clock.”

Michael Terrell, Google Senior Director for Energy & Climate

Real Assets

Power Play

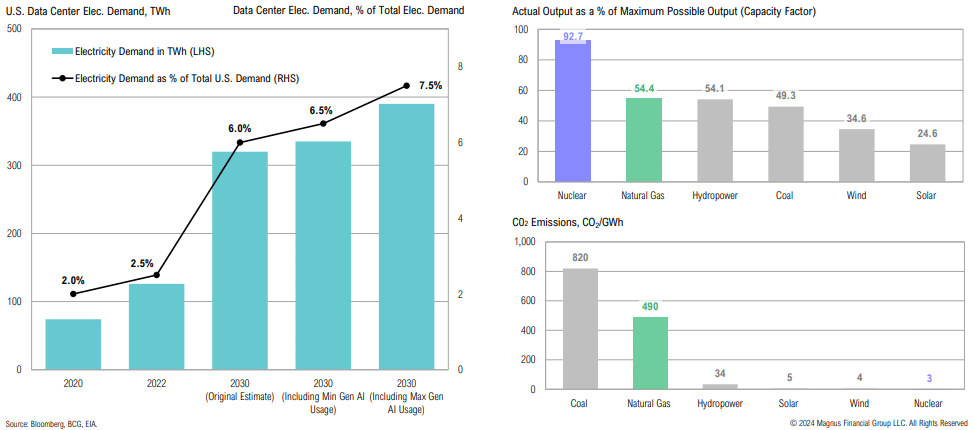

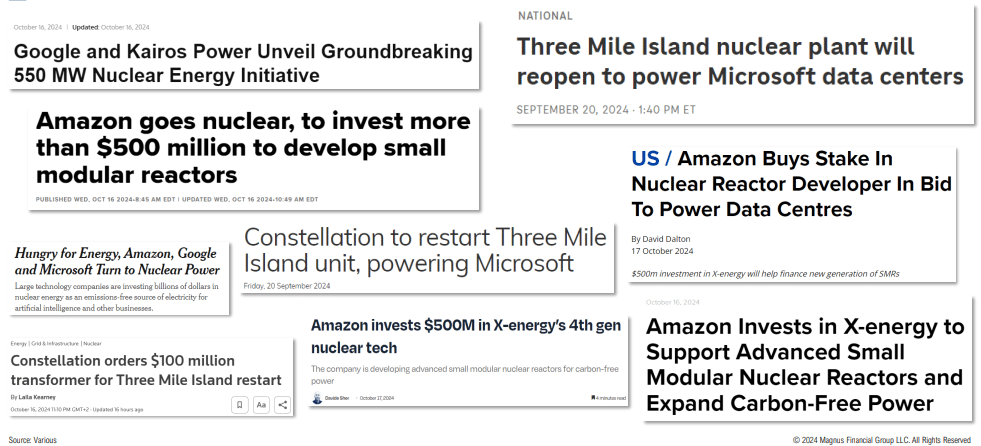

AI and data centers are expected to be key drivers of future U.S. power demand; given consistent output requirements for data centers, natural gas and nuclear are the best energy sources to meet demand

Big tech is going big on nuclear:

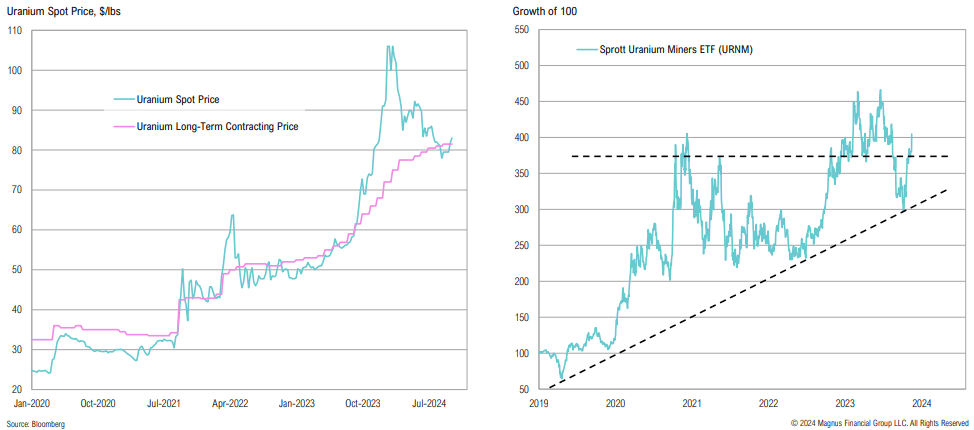

Uranium prices have been recovering, while long-term contracting prices (the prices negotiated between utilities and miners) continue to move higher; uranium miners recently broke through key technical resistance levels

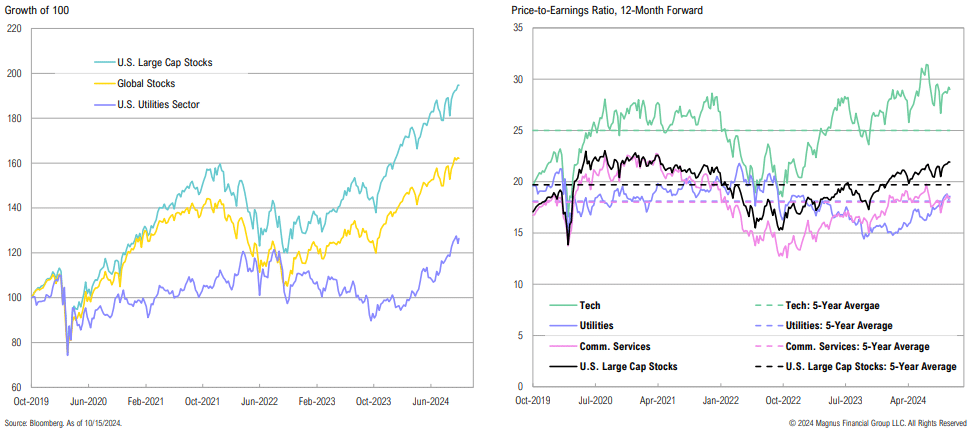

Despite the recent rally, U.S. utilities have notably lagged U.S. large-cap stocks and global stocks over the past five years; utility valuations are on par with their 5-year averages

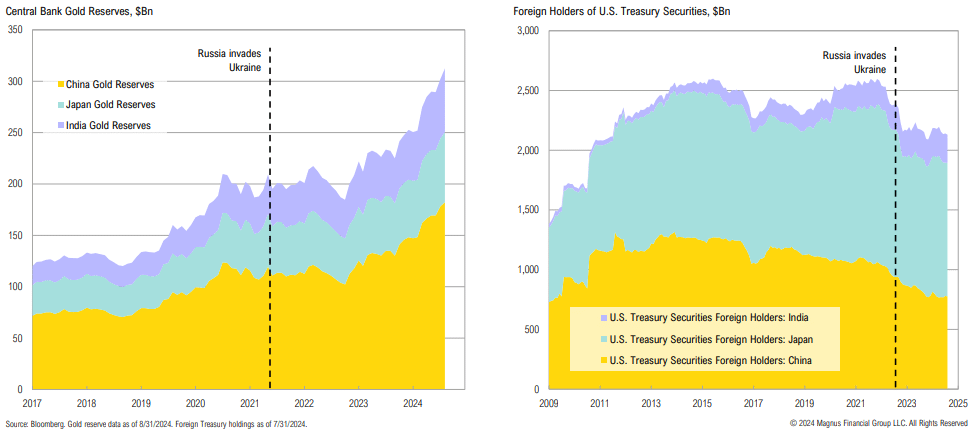

Gold Reserves vs. U.S. Treasury Holdings

Accompanied by ‘flight to safety’ (geopolitics, U.S. fiscal situation), gold’s resilience despite higher real rates is likely due to sovereigns favoring gold; whatever the reason, higher real rates remain a risk

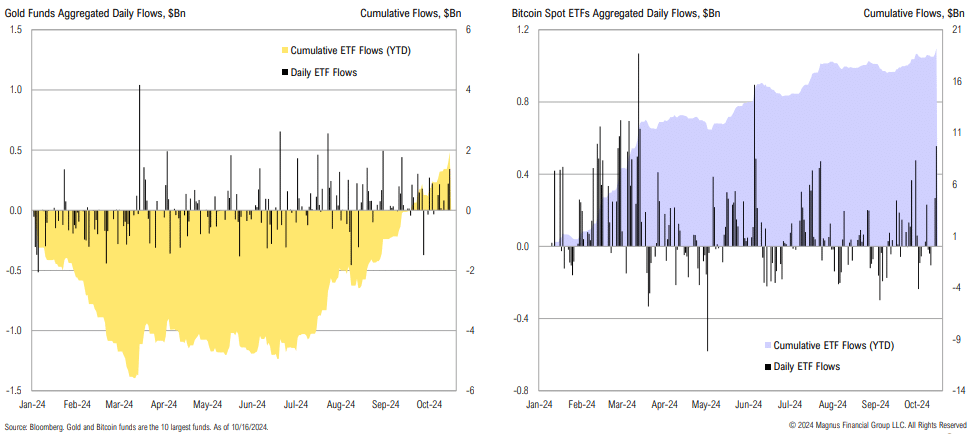

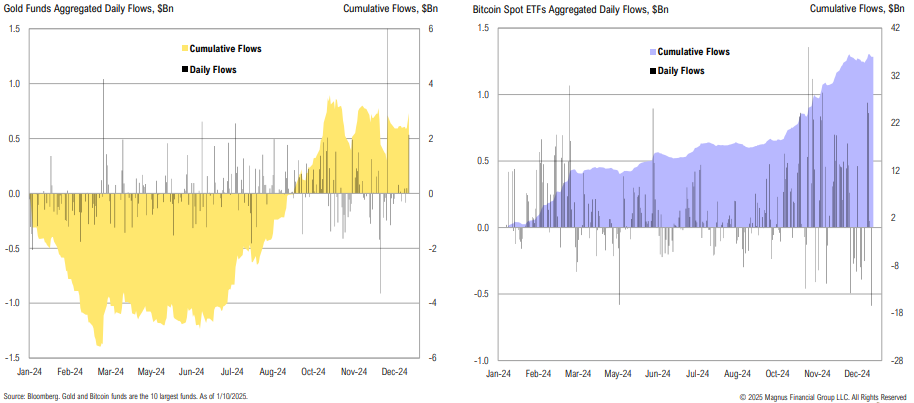

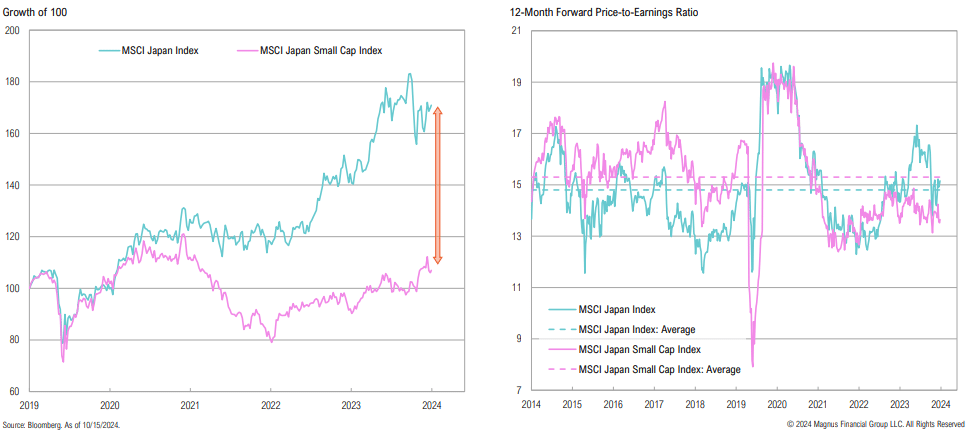

Gold vs Bitcoin ETF Flows

Gold fund flows have only recently begun to pick up; bitcoin flows have been more consistent and have recently accelerated

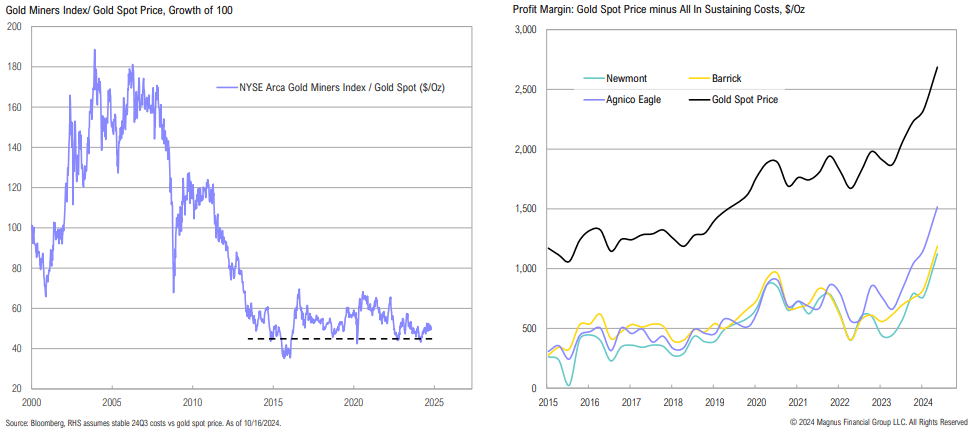

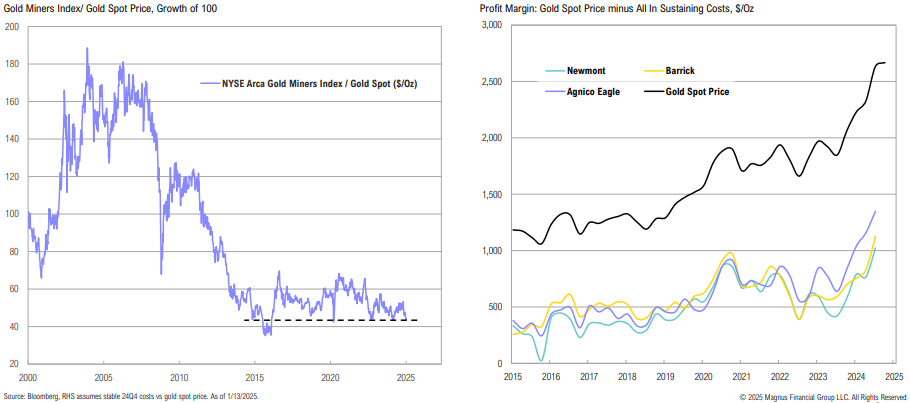

Gold Miners

Gold miners continue to look attractive vs. physical, but miners have been plagued by rising costs, country-specific issues, and labor challenges, among other things

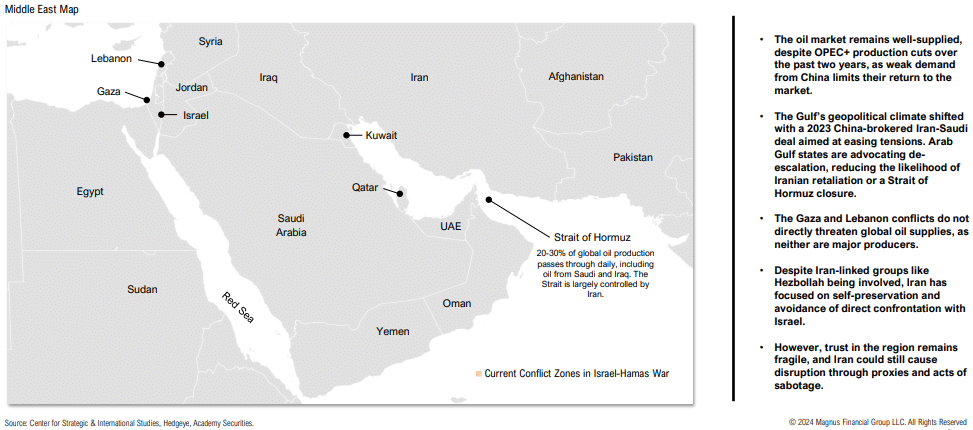

Geopolitical Tensions

Geopolitical tensions in the Middle East continue

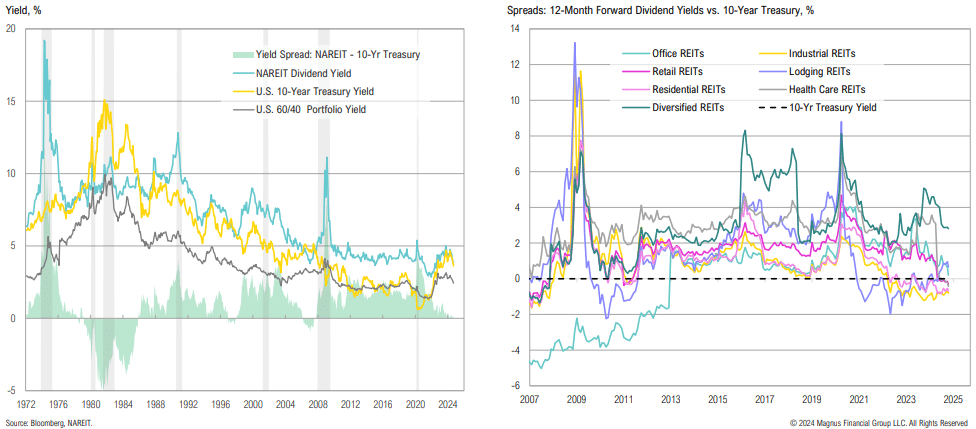

REITs

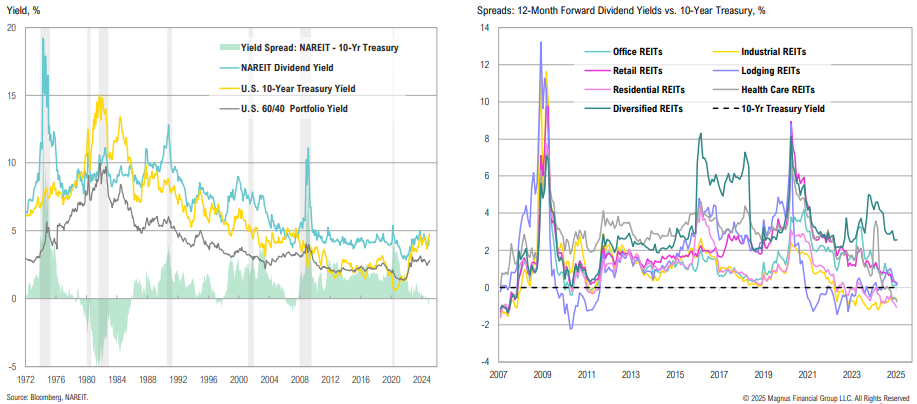

U.S. REITs have rebounded 26% from their April lows, as lower yields provided a reprieve for the asset class; despite the rebound, most REIT sectors still look wholly unattractive on a relative yield basis

Gold vs Bitcoin ETF Flows

Gold fund flows started picking back up again in September; bitcoin flows have been more consistent and continue to rise as the price of bitcoin climbs

Gold Miners

Gold miners continue to look attractive vs. physical, but miners have been plagued by rising costs, country-specific issues, and labor challenges, among other things

REITs

U.S. REITs are down >10% since the start of December, as higher yields have weighed on the asset class; despite the pullback, most REIT sectors still appear wholly unattractive on a relative yield basis

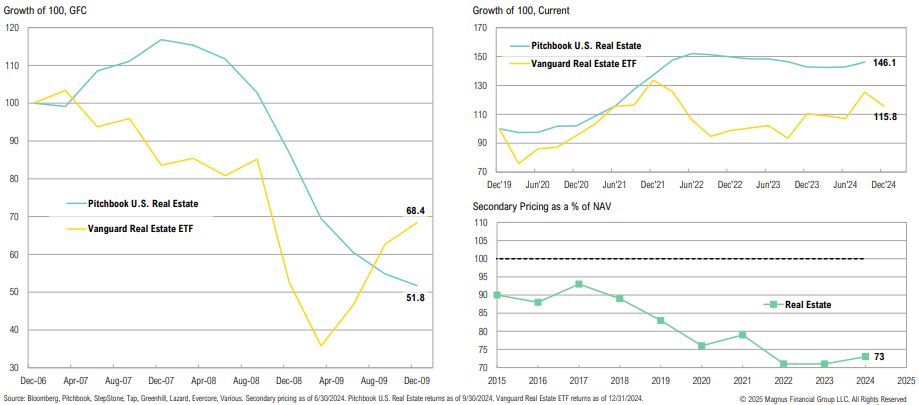

Private Real Estate Performance

Private real estate funds have not marked down properties – while the gap has closed with public markets, secondary transactions remain at deep discounts

“I’ve talked to a lot of our investors who tell me I’m completely missing the boat and tell me all the great things about crypto, and you know what? They’ve been right, not me, because it keeps going up… We will get into spot crypto when the regulatory environment changes, and we do anticipate that it will change, and we’re getting ready for that eventuality.”

Rick Wurster, Charles Schwab Incoming CEO

Opportunistic

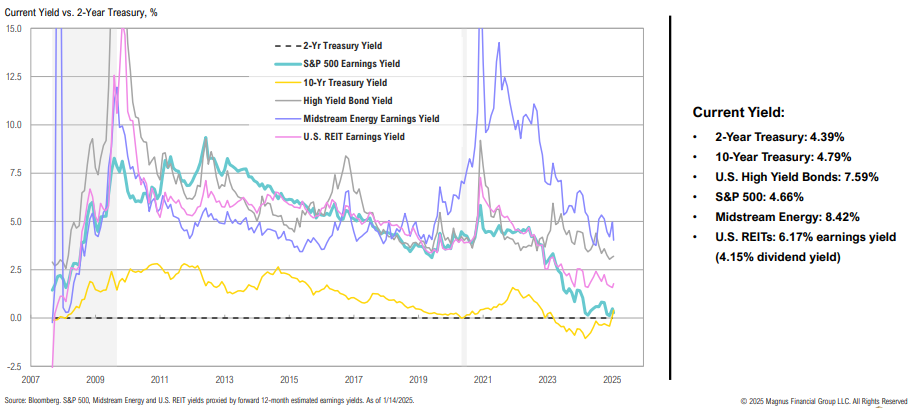

Yield Spreads

The relative yield case for high-yield bonds and REITs has been eroded by spread tightening/ higher Treasury yields

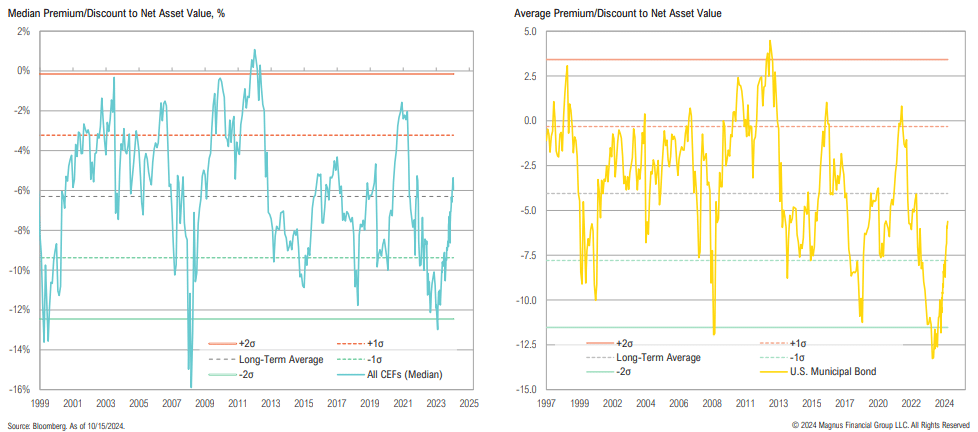

CEF Discounts

Median CEF discounts have been widening since last October and are now back below average levels; U.S. Muni CEF discounts are also more enticing, having widened from -5.3% to -9.1%

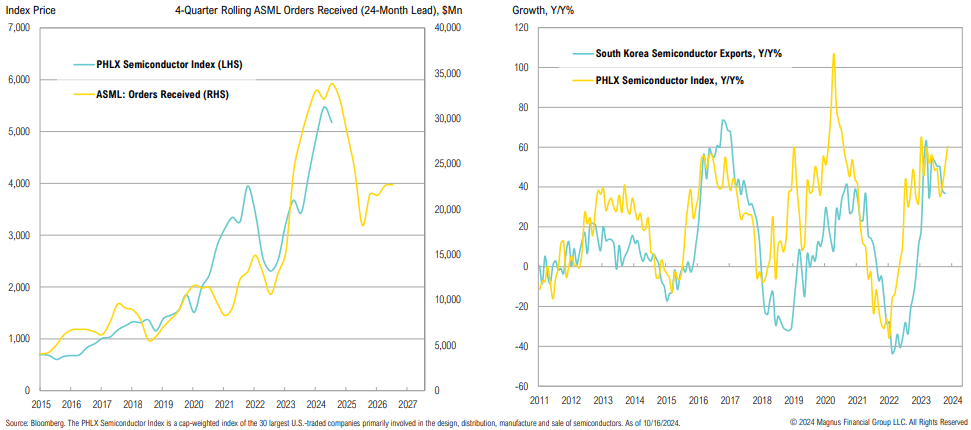

Japan

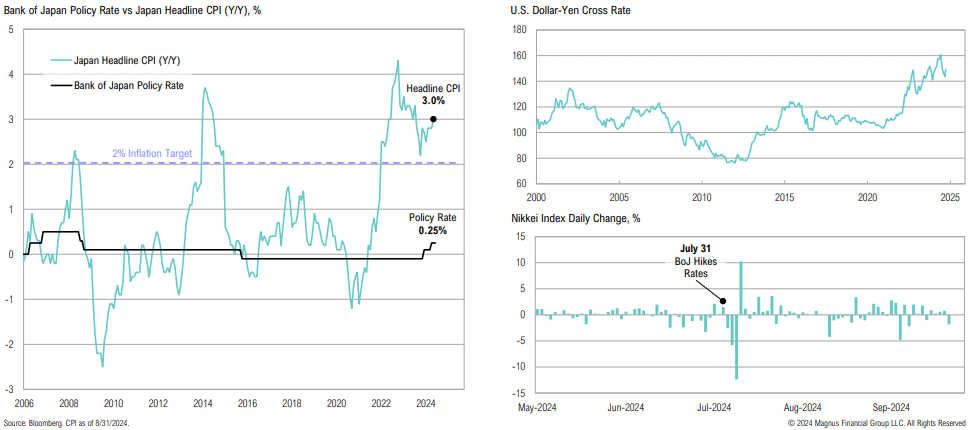

Japanese stocks have recovered from the early August yen carry trade unwind meltdown; the Bank of Japan has signaled a willingness to hike rates further if economic data allows

Japan: Small Cap vs Large Cap

Japanese small cap stocks have lagged the broader index over the past 5 years; small cap P/Es have recently been trending lower, despite incentives from the TSE

Bitcoin Spot ETF Flows

After accumulating nearly $19bn, flows into (and out of) bitcoin spot ETFs have stabilized somewhat

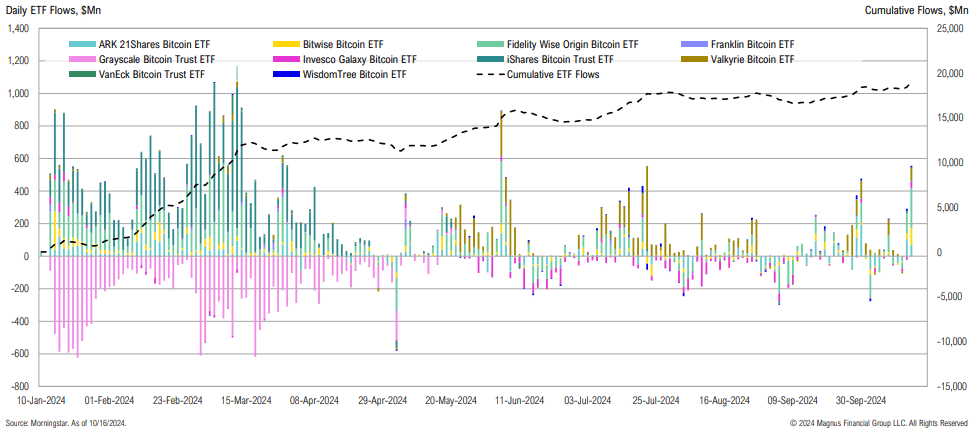

Semiconductors

ASML’s new orders have been a leading indicator of semiconductor demand and are signaling a potential industry slowdown; South Korean semiconductor exports also appear to be rolling over

“Diversification is a safety factor that is essential because we

should be humble enough to admit we can be wrong.”

John Templeton, Investor & Banker

Asset Allocation

U.S. Dollar

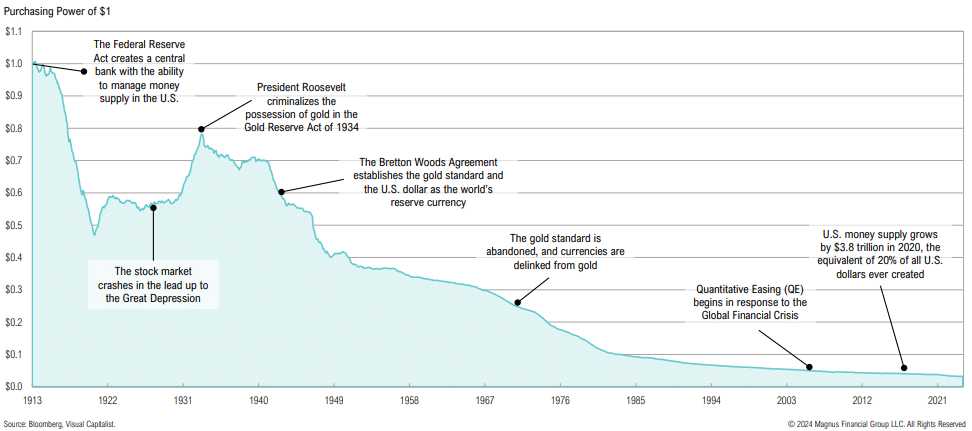

Over the last century, the purchasing power of the U.S. dollar has steadily eroded as a result of ongoing inflation

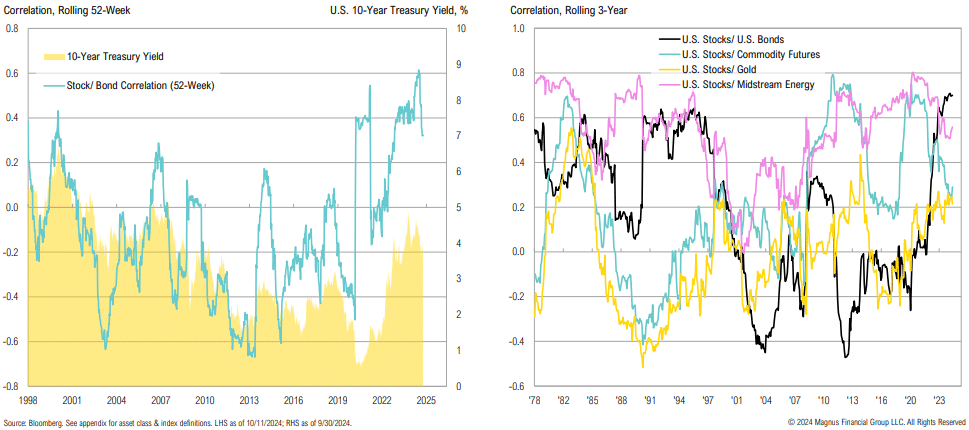

Stock & Bond Correlation

Bonds have recently provided less diversification benefits to stocks than other asset classes

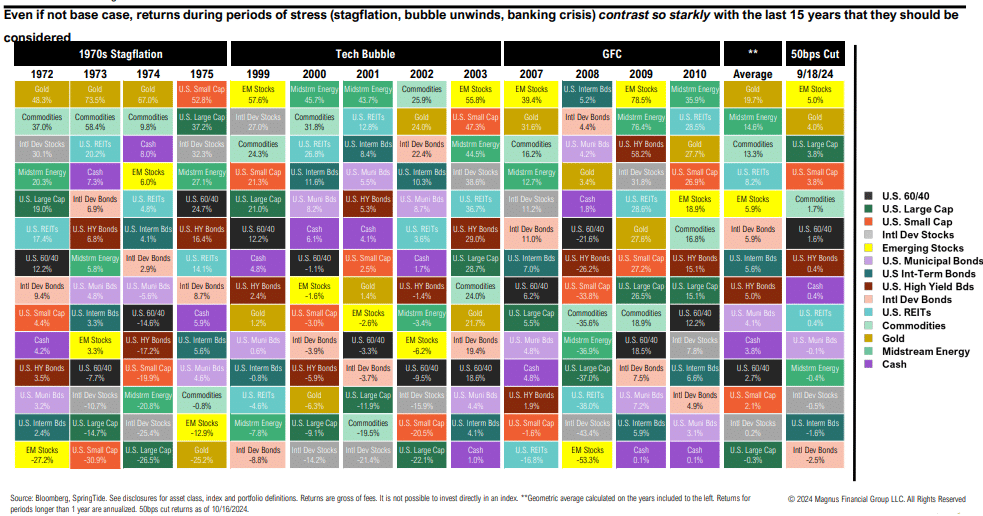

Analogies

Bonds have recently provided less diversification benefits to stocks than other asset classes

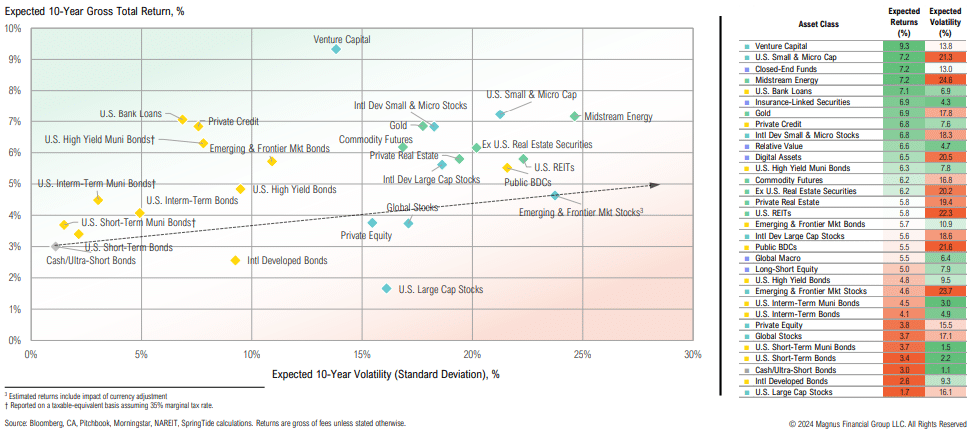

CMEs (As of 9/30/2024)

Expected returns for large cap stocks continue to decline, while small cap stocks look more attractive due to better fundamentals

Appendix:

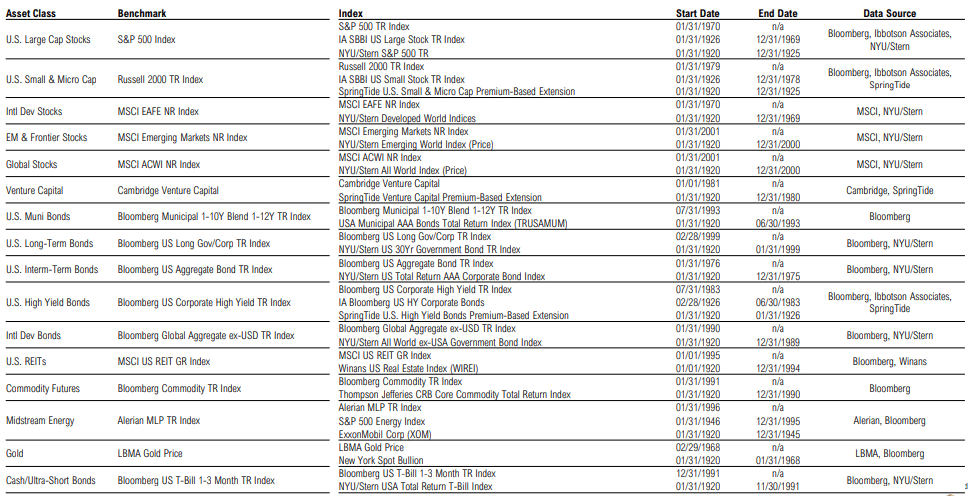

Asset Class Definitions