“The U.S. economy has been resilient. Unemployment remains relatively low, and consumer spending stayed healthy, including during the holiday season. Businesses are more optimistic about the economy, and they are encouraged by expectations for a more pro-growth agenda and improved collaboration between government and business. However, two significant risks remain. Ongoing and future spending requirements will likely be inflationary, and therefore, inflation may persist for some time. Additionally, geopolitical conditions remain the most dangerous and complicated since WWII.”

Jamie Dimon, JPMorgan CEO

Cartoon

Vibes

Summary

Q4, 2024 Market Review

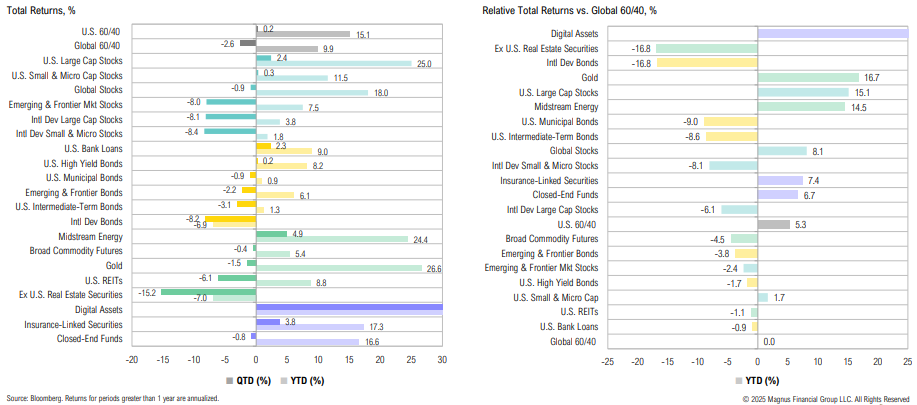

Major winners over Q4 included digital assets (+52.0%) and midstream energy (+4.9%) while ex-U.S. real estate (-15.2%) and international small cap stocks (-8.4%) lagged

Summary

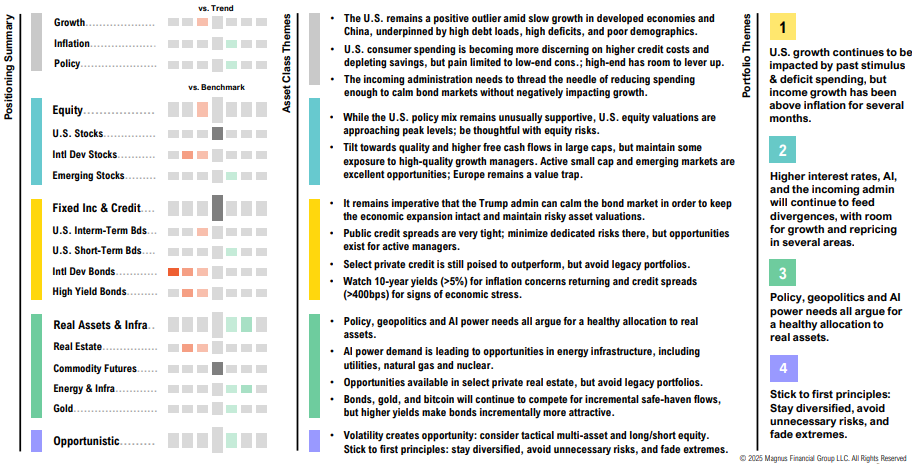

Asset Allocation Views

“This election cycle is the last chance for the U.S. to grow our way out of this mountain of

debt…”Scott Bessent, U.S. Treasury Secretary Nominee

“Well, I am concerned about fiscal sustainability, and I am sorry that we haven’t made more progress. I believe that the deficit needs to be brought down, especially now that we’re in an environment of higher interest rates.”

Janet Yellen, U.S. Treasury Secretary

Growth, Inflation & Policy

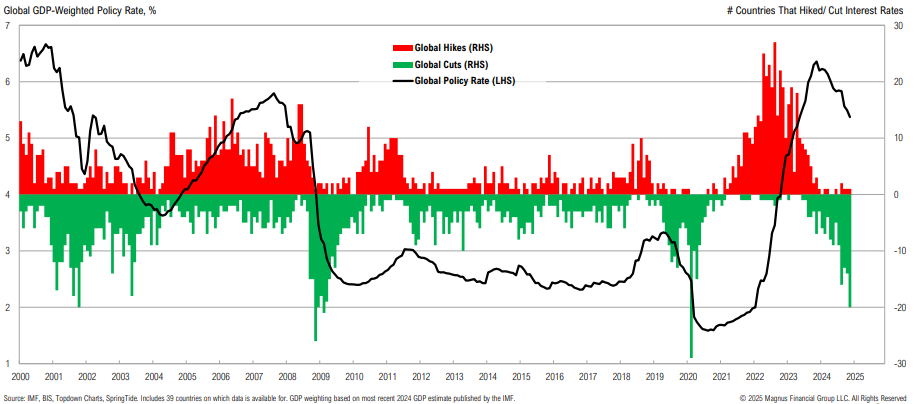

Global Policy Rates

Globally, December 2024 saw the highest number of interest rate cuts and the largest drop in policy rates outside of a major crisis or pandemic

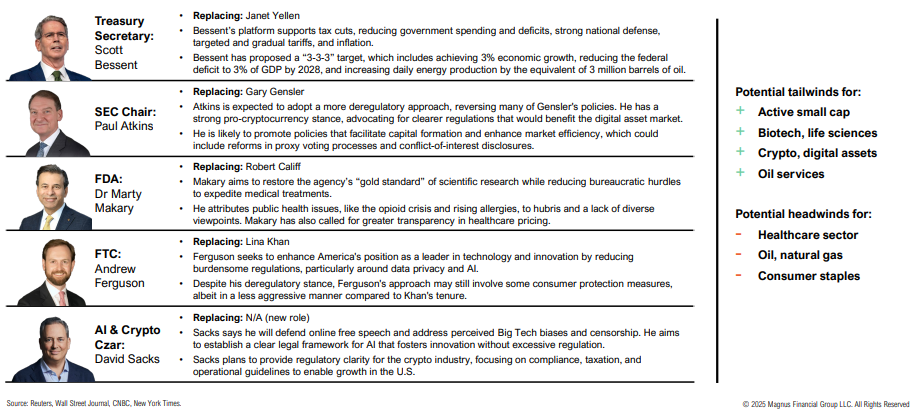

Incoming Administration

Recapping some of Trump’s picks for key White House and Cabinet jobs

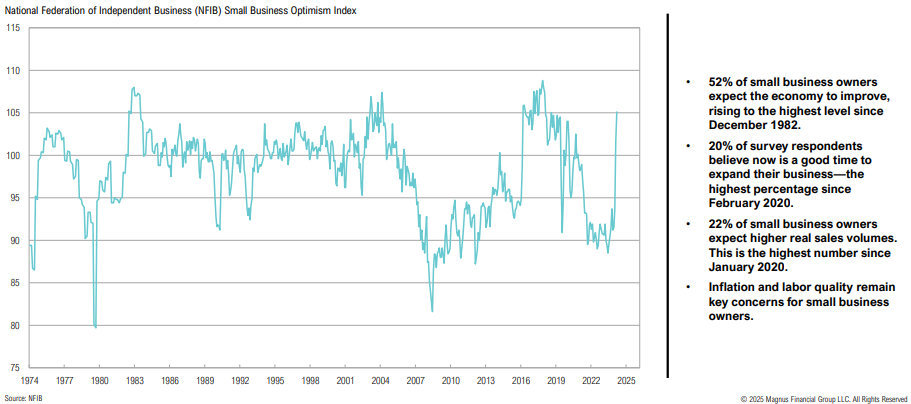

Small Business Optimism

Small business optimism jumped to a six-year high in December in anticipation of pro-business policies and legislation from the incoming administration

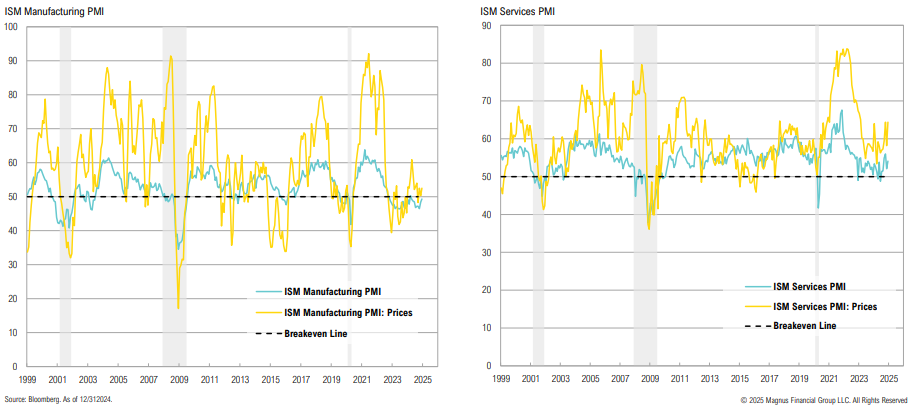

ISM PMIs

While the manufacturing sector remains in contractionary territory, the services sector remains strong; services prices paid continues to increase

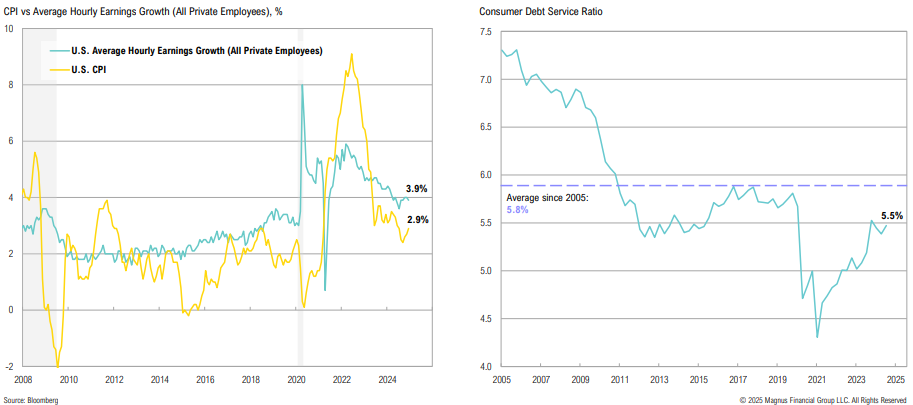

The U.S. Consumer

Hourly earnings continue to meaningfully diverge from CPI, rising 3.9% year-over- year in December; debt service ratios remain below average

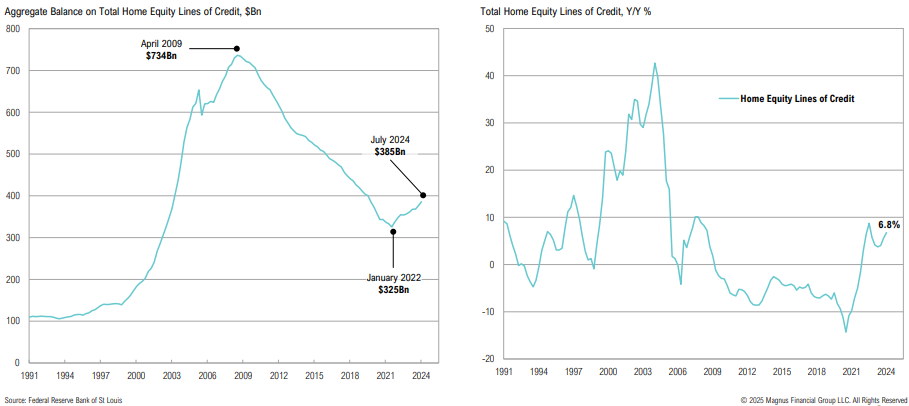

HELOCs

HELOC balances, which declined from 2009 to 2022, have started to climb higher again, and remain largely untapped as a source of consumer credit

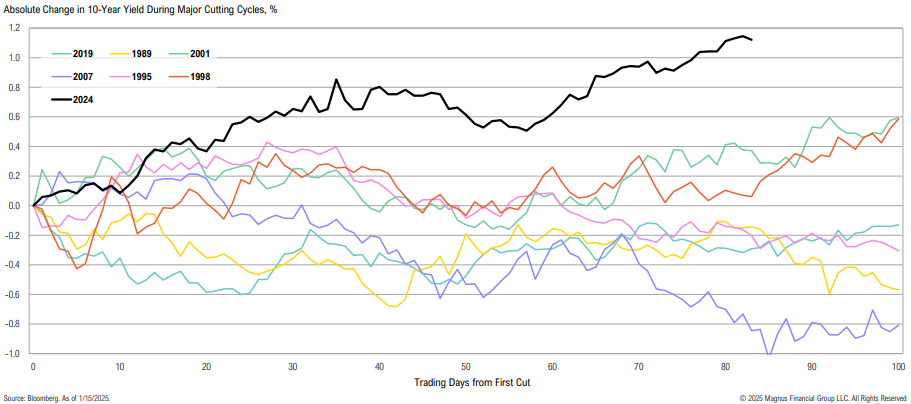

10-Year Treasury

Relative to prior major rate cutting cycles, the 10-year Treasury yield remains elevated since the first cut (more on this later)

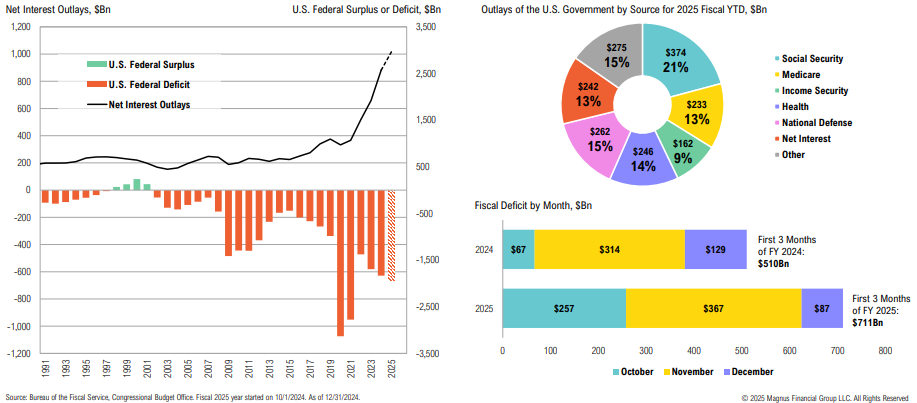

U.S. Fiscal Deficit

At $1.8 trillion, 2024 was the largest non-crisis/pandemic deficit on record; the CBO estimates the 2025 fiscal deficit to reach $1.9 trillion

U.S. Fiscal Deficit

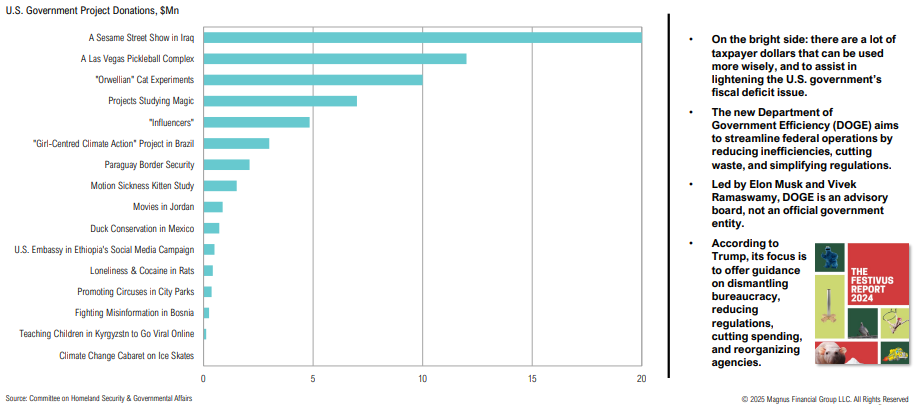

Room to trim? The U.S. government spent $1,008,313,329,626 on various non-essential projects and donations in 2024

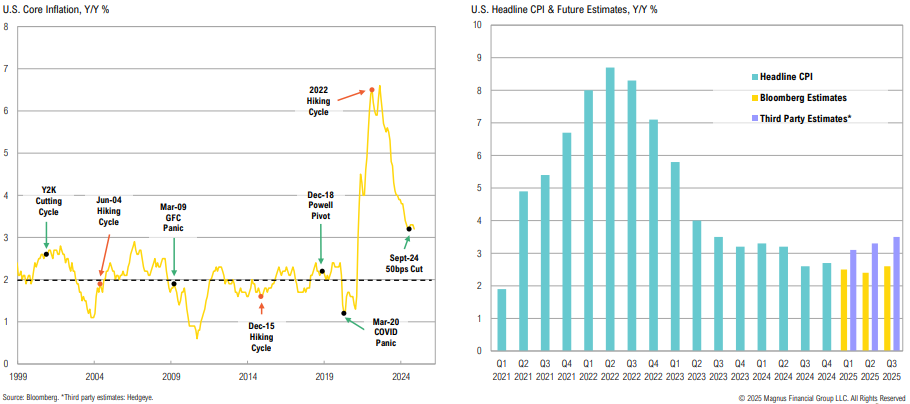

U.S. Inflation

Inflation’s last mile: At 3.2%, core inflation remains well above target; estimates show that headline inflation is likely to remain above 2% through the Q3 2025

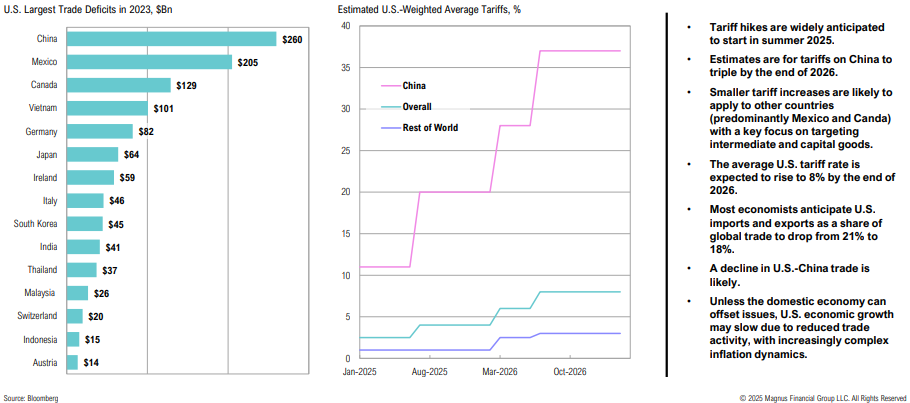

Trump Tariffs

It remains to be seen to what extent the universal tariffs proposed by Trump will be implemented

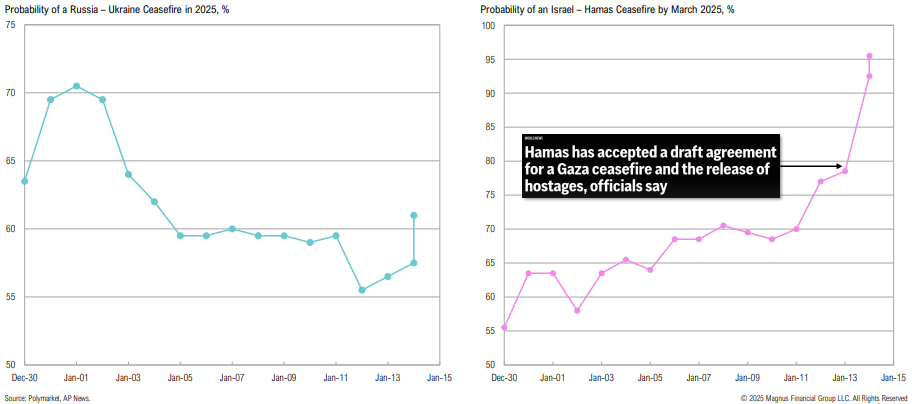

Global Conflict

Peace dividend returns in 2025?

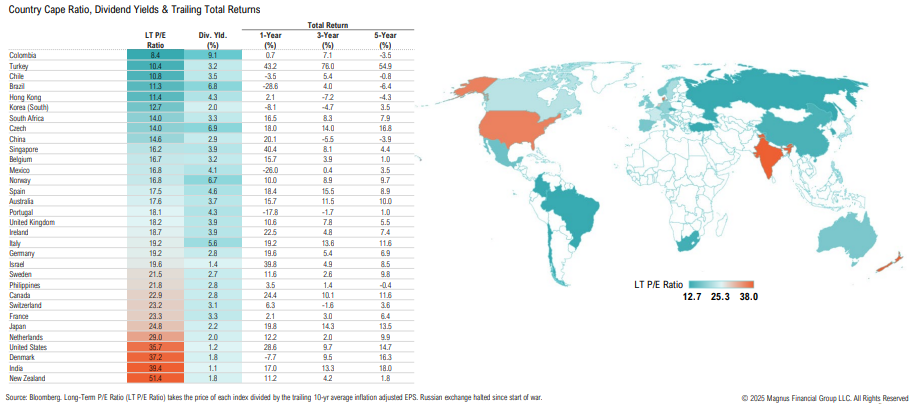

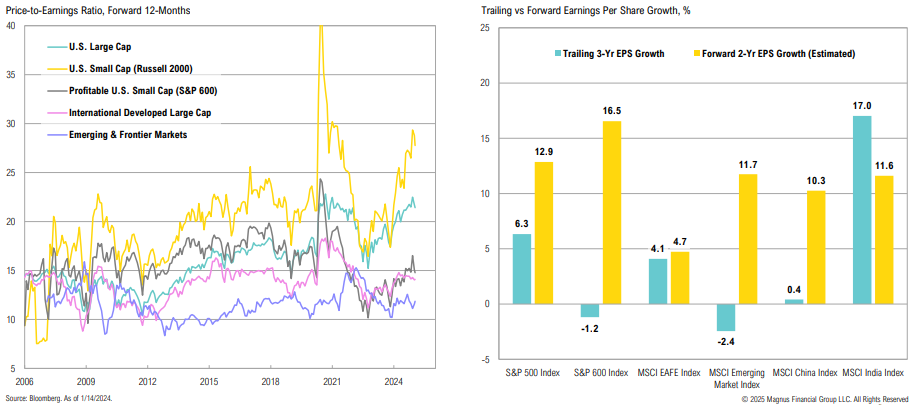

Global Equity Market Valuations

Divergence in global equity market valuations: U.S. valuations are among the highest, but potentially justifiably so, given the country’s stronger earnings growth

“Today’s S&P-leading companies are, in many ways, much better than the best companies of the past. They enjoy massive technological advantages. They have vast scale, dominant market shares, and thus above-average profit margins. And since their products are based on ideas more than metal, the marginal cost of producing an additional unit is low, meaning their marginal profitability is unusually high.”

Howard Marks, Oaktree Capital Co-founder & Co-chairman

Equity

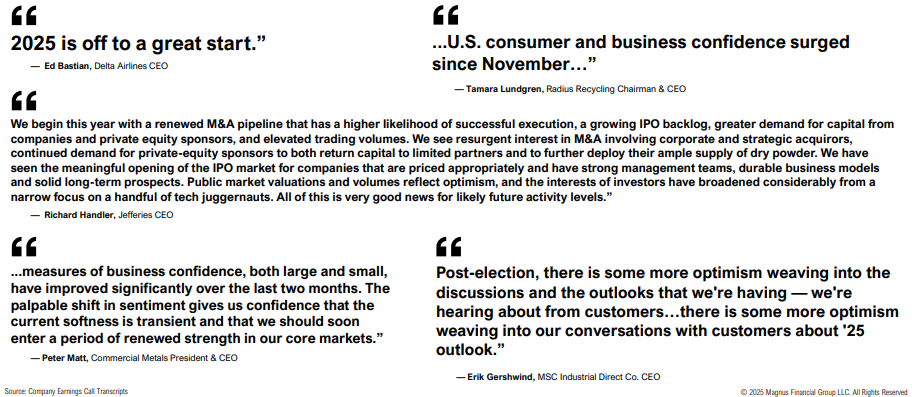

Vibes

The ‘vibes’ are real… will they translate?

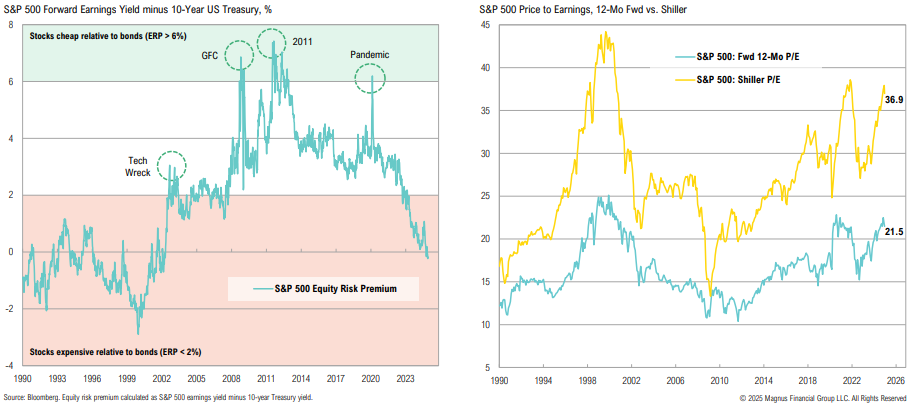

Market Valuations

Using a yield-to-earnings yield comparison (ERP), U.S. stocks are less attractively priced vis-à-vis bonds than at any point since the 1990s; valuations appear rich from both a Shiller and forward P/E perspective

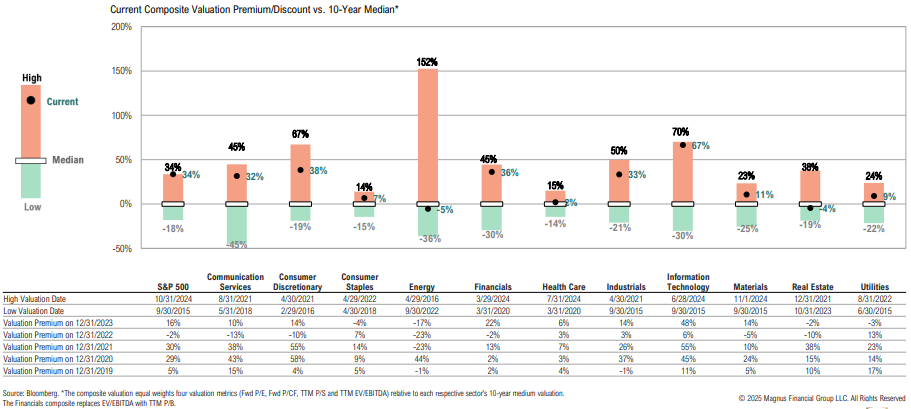

Market Valuations

S&P 500 composite valuations are at 10-year highs; most sectors are trading at premiums relative to their internal median valuations, with Tech and Financials near 10-year highs

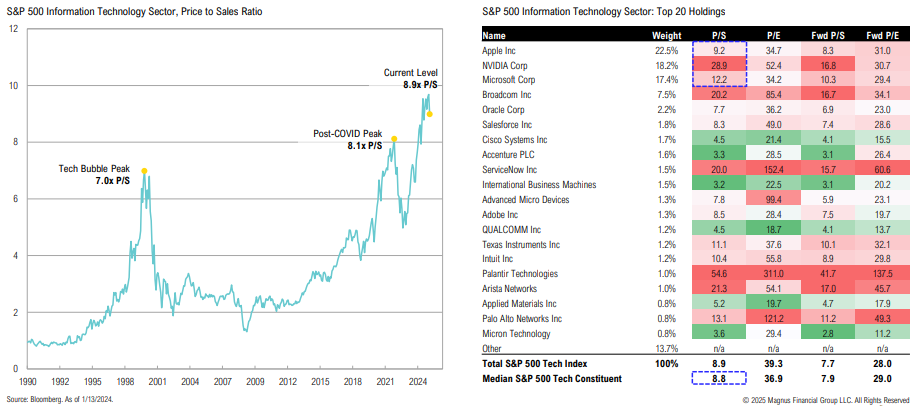

Market Valuations: Tech Sector

While off the peak, the tech sector P/S ratio remains nearly 30% higher than peak Tech Bubble levels; NVDA (28.9x), and MSFT (12.2x) account for ~40% of the sector

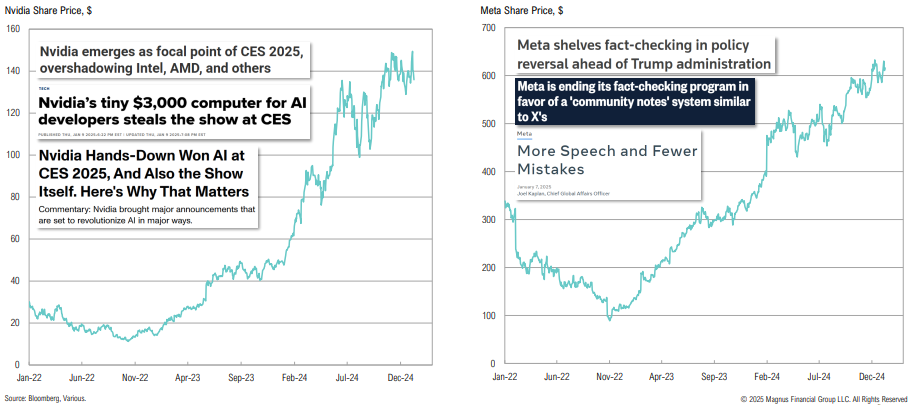

Magnificent 7

Mag 7 updates: Nvidia stole the show at CES 2025; Meta has announced policy changes, shifting to a free speech model similar to X

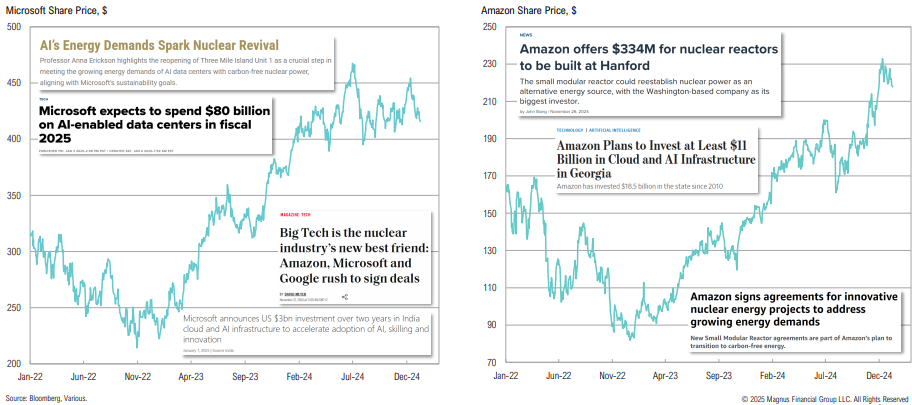

Magnificent 7

Mag 7 updates: Microsoft and Amazon both continue to invest in nuclear to meet rising energy demands stemming from AI developments

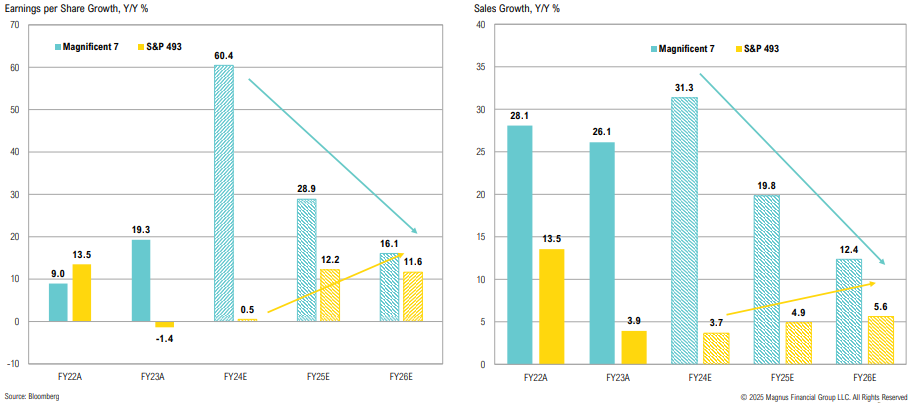

Earnings Growth Expectations

Are high valuations at least partially being driven by strong earnings growth? 2025 Mag 7 earnings are expected to grow by 28.9%, while S&P 493 earnings are expected to grow by 12.2%

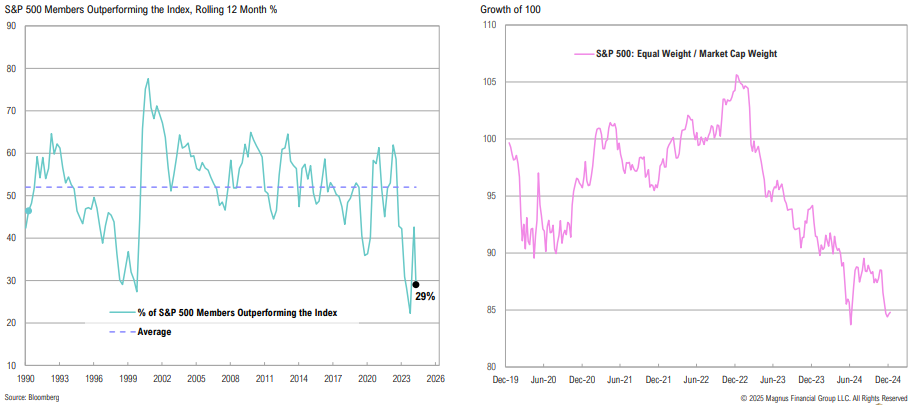

Market Breadth

Market breadth has narrowed with only 29% of S&P 500 constituents outperforming the index over the past year; the equal-weighted index has underperformed since early October

Market Performance

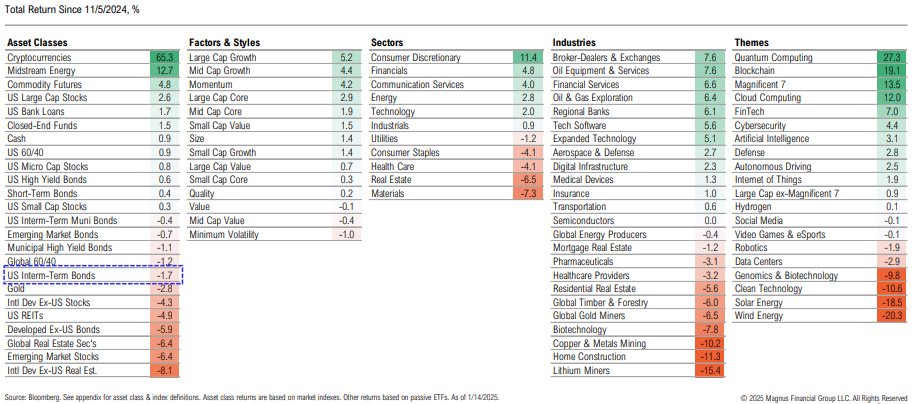

Post-election performance provides insight into the market’s expectations, but there are multiple cross-currents (how much was front-run, impact of rates, etc.)

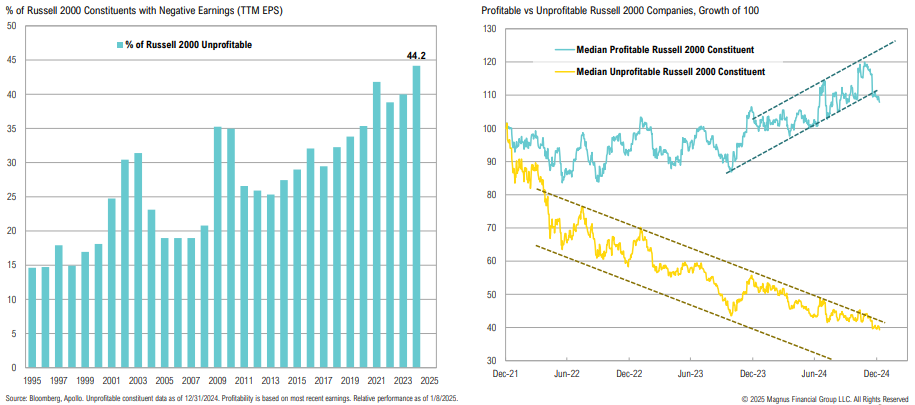

U.S. Small Cap Stocks

Profitable or not, small caps had started to break down as bond yields spiked

Emerging Markets

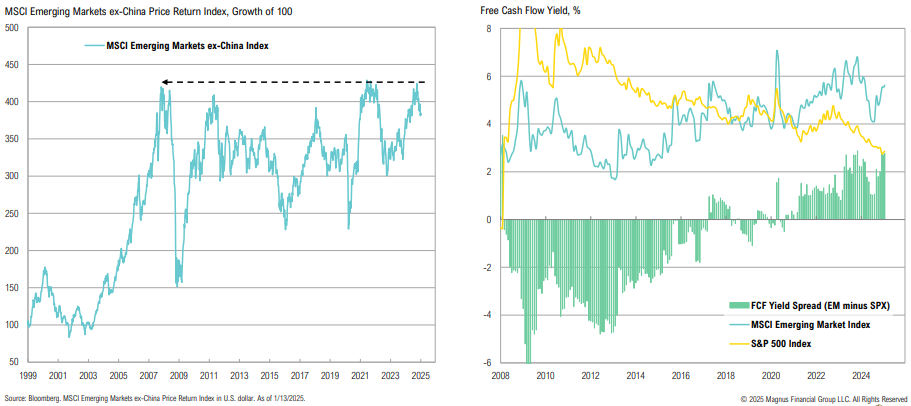

Emerging market stocks remain relatively cheap vs. developed markets; looking ahead, earnings growth for profitable U.S. small cap stocks look promising

Emerging Markets

While EM ex-China stocks failed to break out of a 16-year resistance, they still appear attractively valued compared to U.S. large cap stocks; EM free cash flow yields are 2.8% higher than the S&P 500

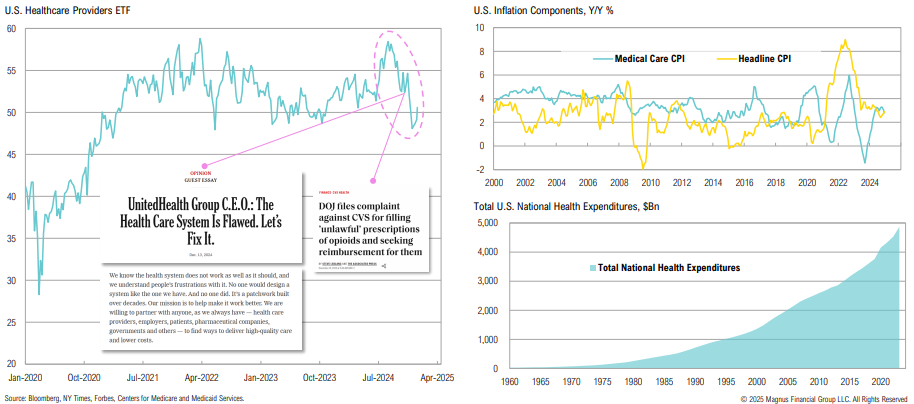

U.S. Healthcare

Healthcare stocks have been under pressure as various troubles plague the industry; government spending on health neared $5 trillion in 2023

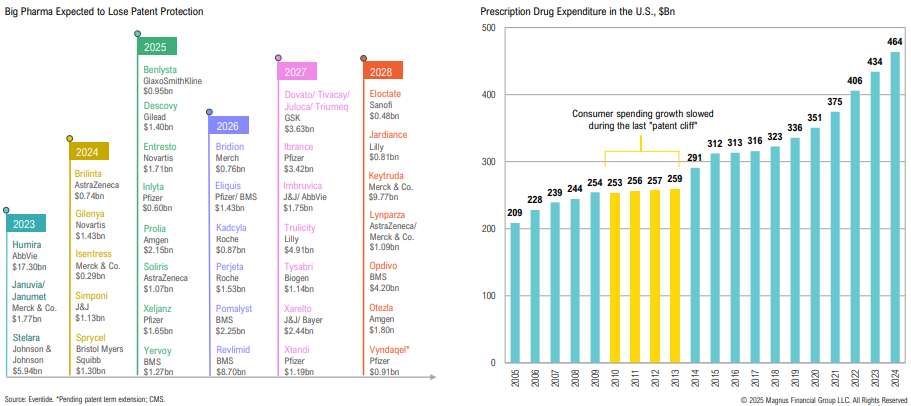

U.S. Healthcare

Big pharma faces a “patent cliff” which could impact more than $200Bn in annual revenue by 2030

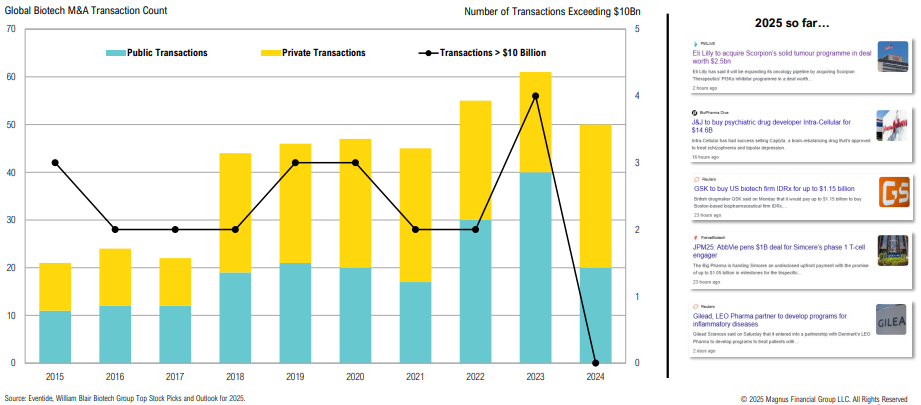

Biotech

While M&A activity in 2024 was relatively healthy, deal sizes were small, with none >$10bn; 2025 is off to a strong start, with multiple deals already announced, including J&J’s $14.6bn transaction

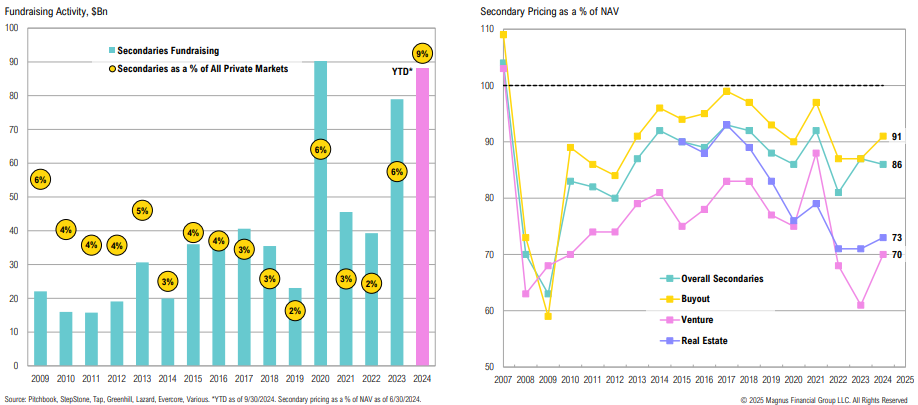

Secondaries Fundraising

Through September, secondaries fundraising nearly surpassed its best full year of fundraising, although it remains just a fraction of all private market fundraising

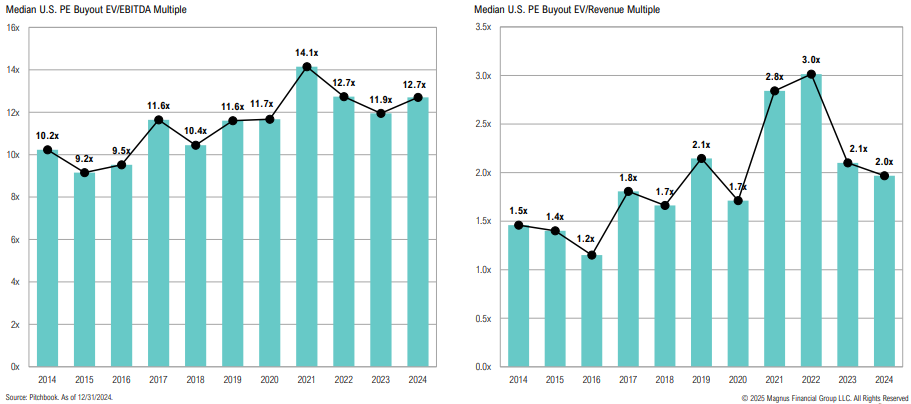

Private Equity: PE Buyout

Buyout EV/EBITDA multiples are elevated, while EV/Revenue multiples suggest these companies are struggling with profitability

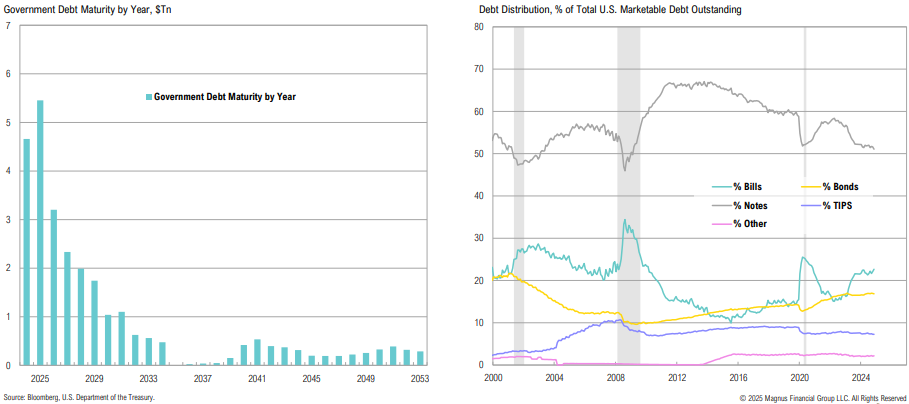

“Treasury Secretary Janet Yellen distorted Treasury markets by borrowing more than $1 trillion in more-expensive shorter-term debt compared with historical norms.”

Scott Bessent, Treasury Secretary Nominee

Fixed Income & Credit

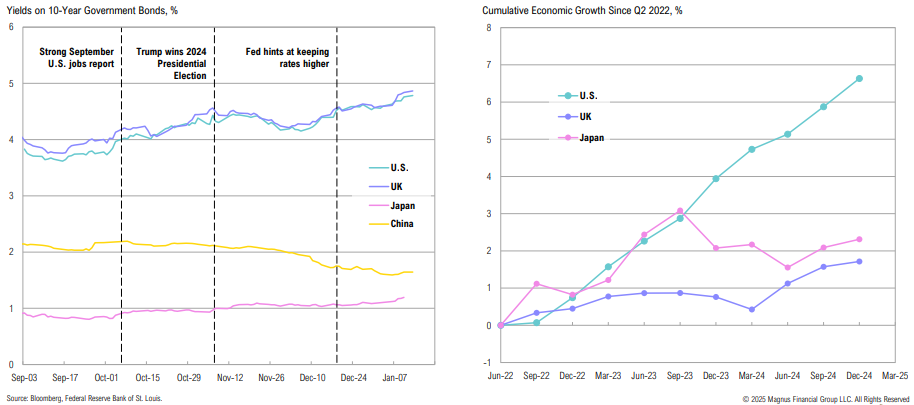

U.S. Treasury Yields

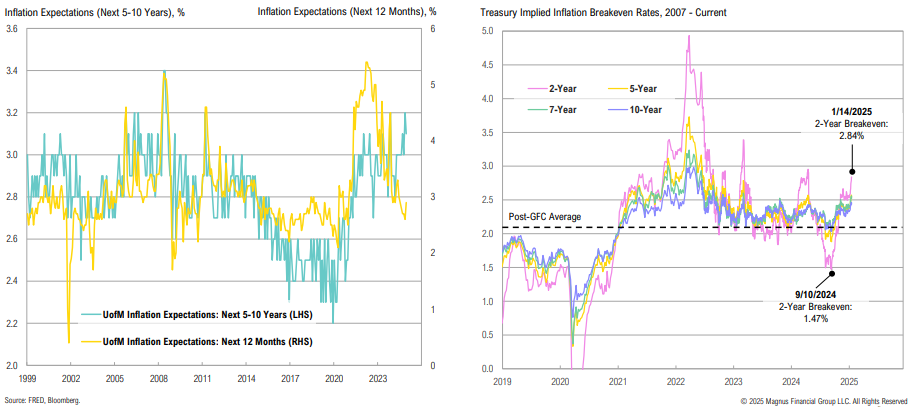

TIPS-implied inflation rates have been edging higher alongside declining 2025 rate cut expectations; short-and long-term inflation expectations have diverged

U.S. Treasury Yields

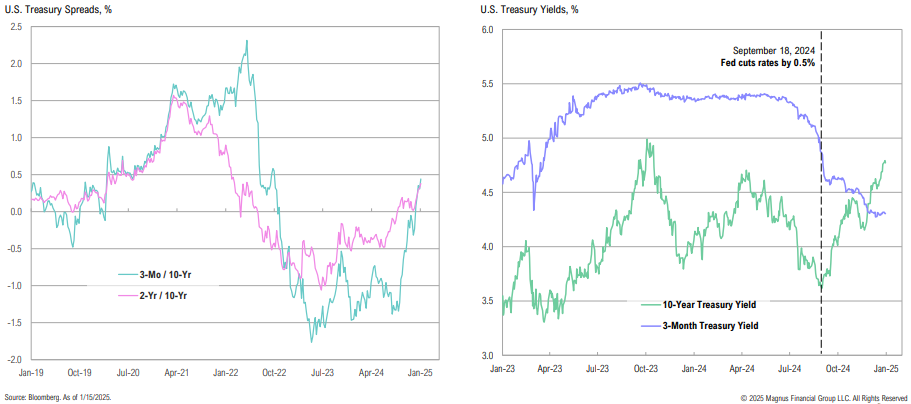

As evidenced by rising longer-term yields and simultaneously declining shorter-term yields, the Fed has little control over the long end

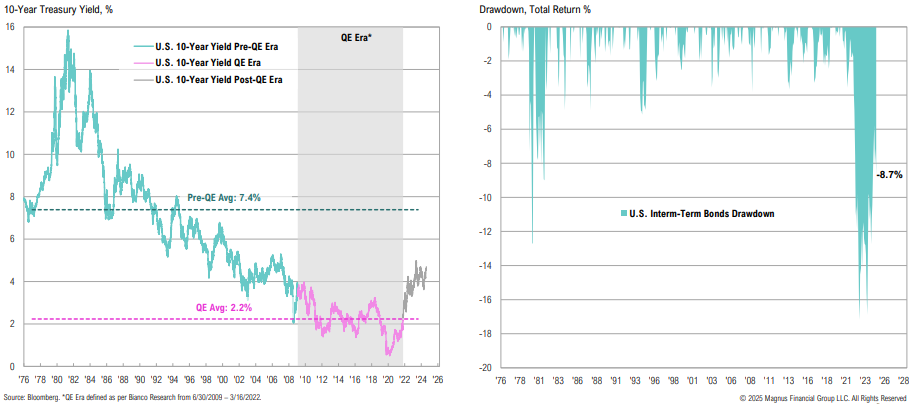

Treasury Market

We are in the biggest bond bear market of all time; bonds peaked in August 2020 and have yet to recover

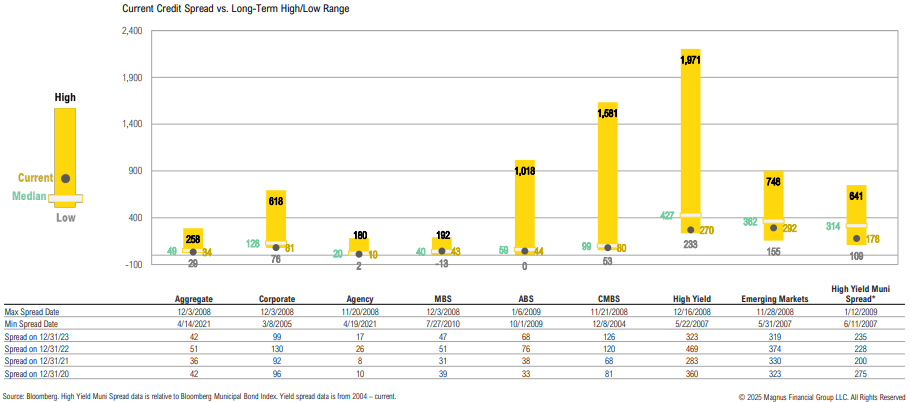

Spreads by Sector

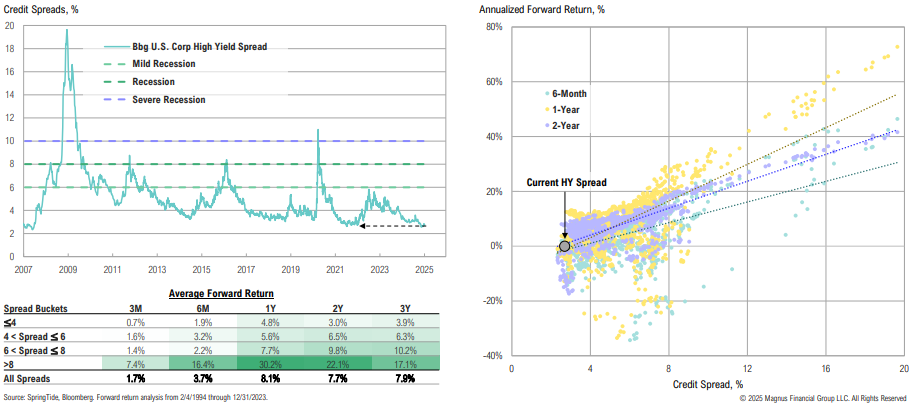

Credit spreads are near or below median across most sectors; high yield bond spreads at current levels continue to suggest that the economy may achieve a ‘soft landing’

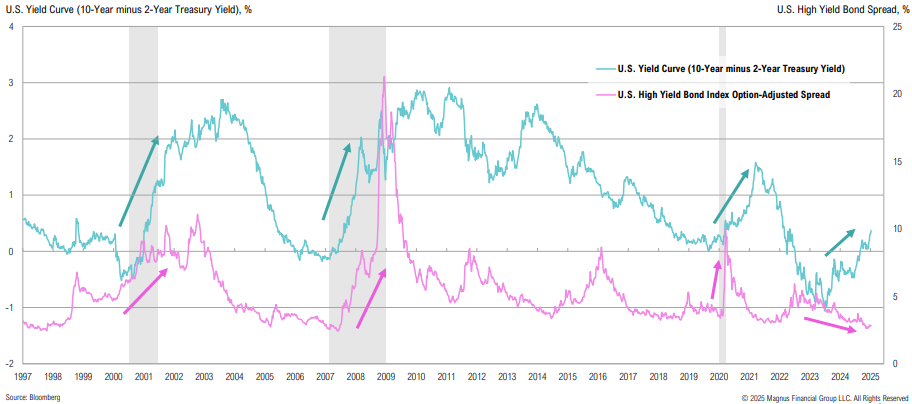

Yield Curve

One of these cycles does not look like the others: credit spreads are at new cycle lows, while the yield curve continues to steepen

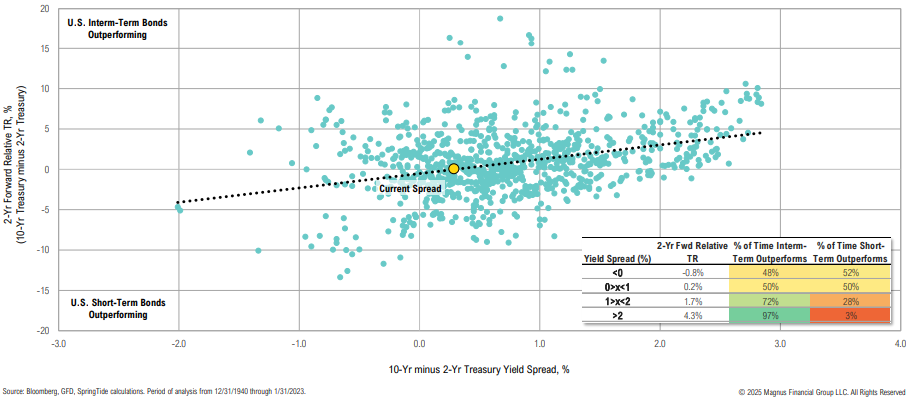

Yield Curve

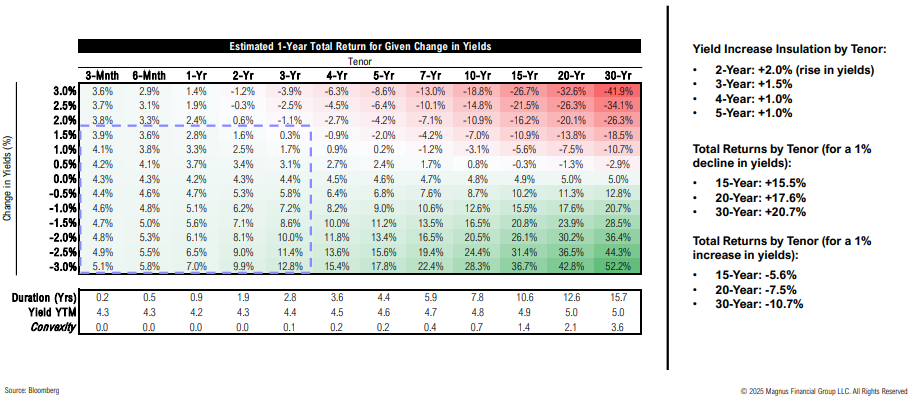

When the 2s10s spread is above 2%, investors should generally hold longer duration bonds; when it is between 1% and 2%, it is not a home run; and below 1% is a coin toss

Government Debt

Over $5Tn in government debt matures in 2025, and will be rolled at much higher rates; bill issuance, which comprises over 22% of total debt, is expected to start declining this year

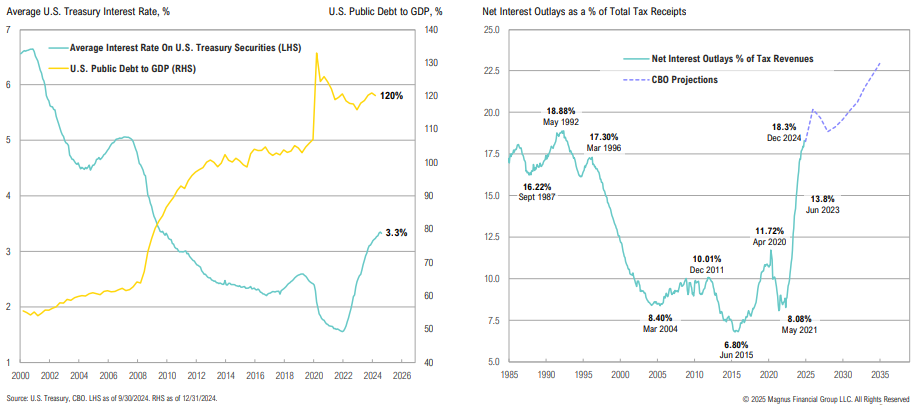

Net Interest Outlays

The average cost of Treasury debt outstanding has climbed to 3.3%, a level last seen when debt to GDP was ‘just’ 80%; tax receipts aren’t keeping pace, with over 18% of taxes going only to net interest payments

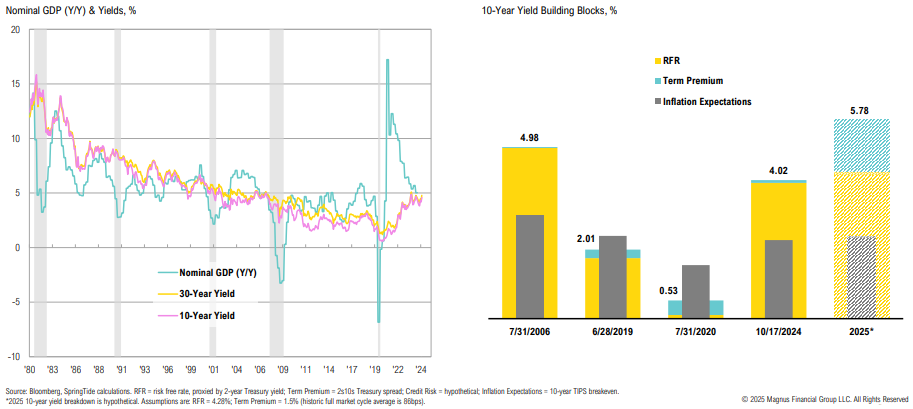

GDP & Treasury Yields

Historically, long-term yields tend to follow nominal GDP; pro-growth policy that drives up nominal GDP may have implications for bond yields

Treasury Payoff

The 2–3-year part of yield curve has an attractive risk-reward profile—yields could rise 1.5% in the next year and total returns would still be positive

High-Yield Spreads

Not attractive: at ~274bps, credit spreads are in line with pre-COVID lows; low credit spreads continue to suggest runway for the economy (i.e., a ‘soft landing’)

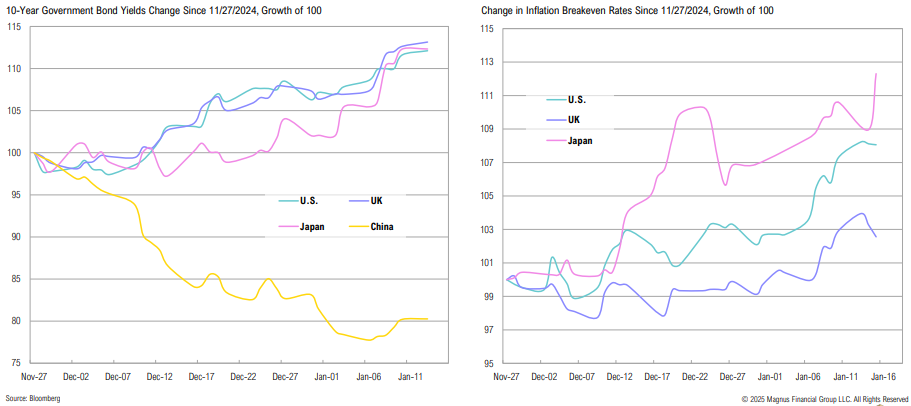

Global Bonds

The recent rise in global bond yields has primarily been driven by higher long-term inflation expectations

Global Bonds

Are rising U.S. Treasury yields also reflecting strong economic growth? Despite inflation well above target, U.S. economic growth has been far stronger than developed peers

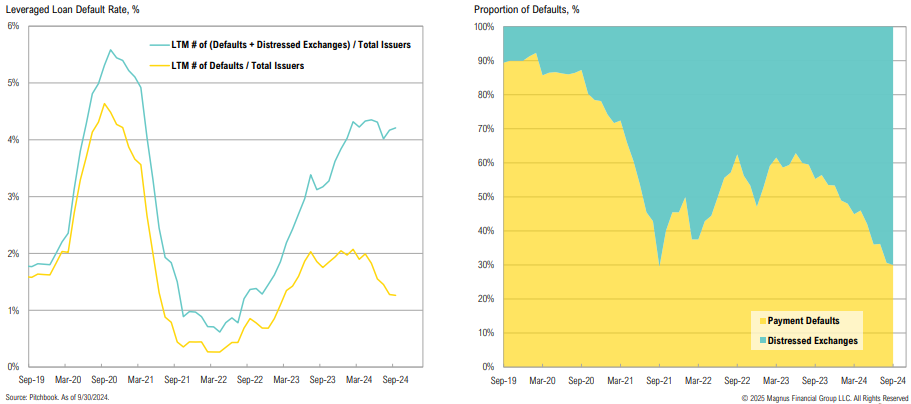

Private Credit

Distressed exchanges are replacing traditional defaults, masking issues

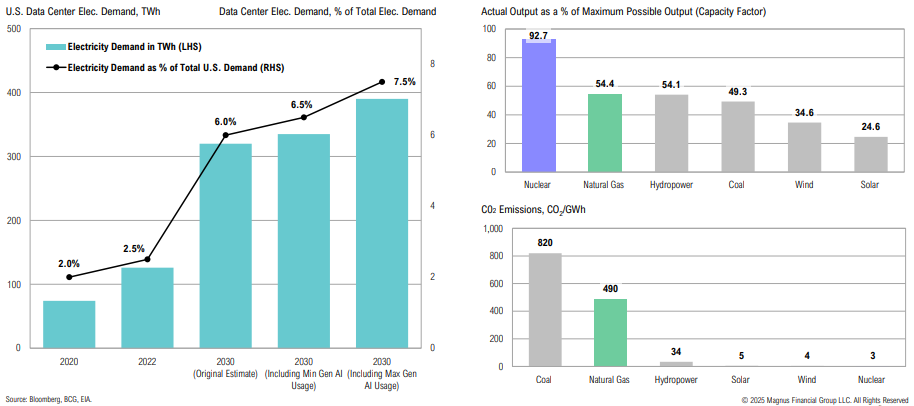

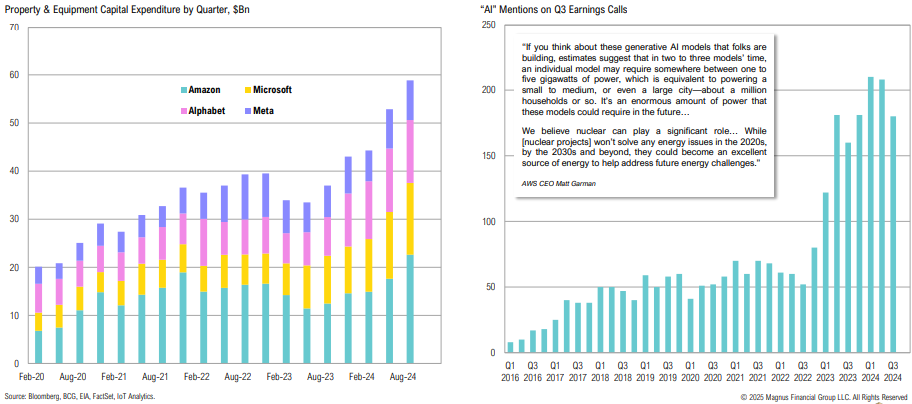

“If you think about these generative AI models that folks are building, estimates suggest that in two or three models’ time, an individual model may require somewhere between one to five gigawatts of power, which is equivalent to powering a small to medium, or even a large city—about a million households or so.”

Matt Garman, AWS CEO

Real Assets

Broad Commodities

The recent breakout in commodities, which is primarily being driven by oil & gas, is interesting with the backdrop of a very strong dollar and weakness in China

Power Play

AI and data centers are expected to be key drivers of future U.S. power demand; given consistent output requirements for data centers, natural gas and nuclear are the best energy sources to meet demand

Power Play

AI remains a priority for U.S. companies; AI-related investments (including data centers and nuclear power projects) have accelerated

Power Play

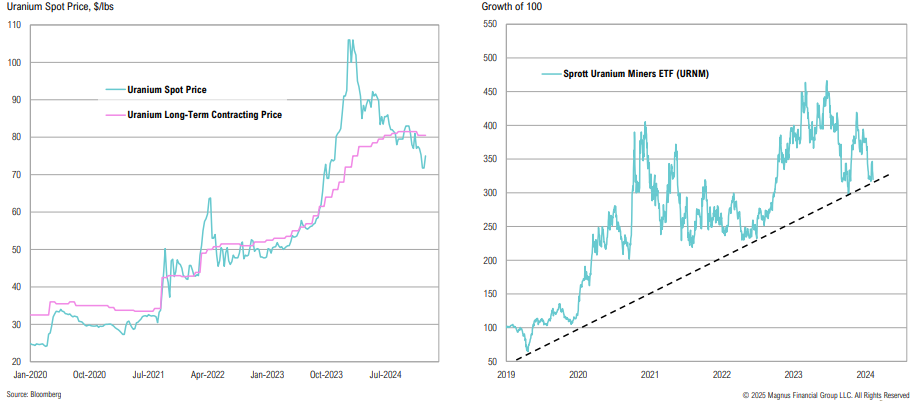

Spot uranium prices have recently dropped, despite long-term contracting prices (negotiated between utilities and miners) remaining stable; despite having little impact on miner profits, spot prices have been driving stock prices

Power Play

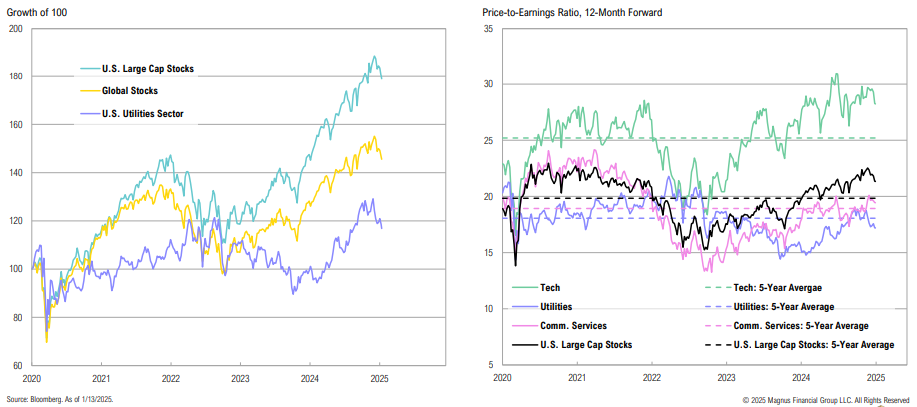

Despite rallying >23% in 2024, U.S. utilities have notably lagged both U.S. large cap stocks and global stocks over the past five years; utility valuations are below their 5-year averages

Oil & Gas

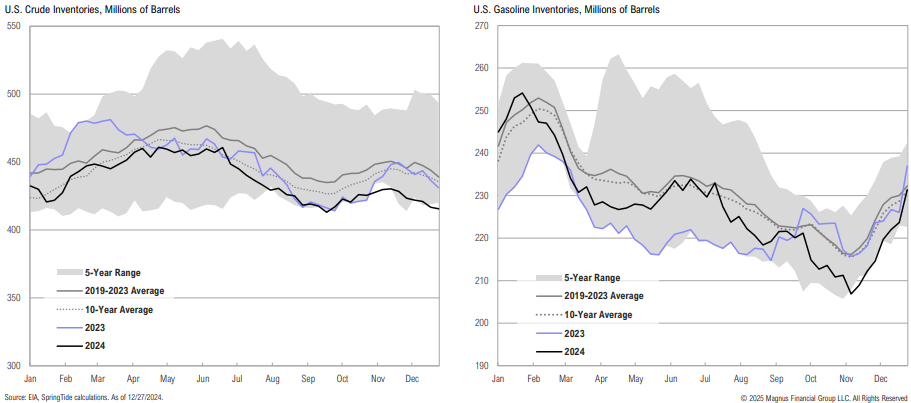

Crude inventories ended 2024 below the low end of their five-year range, while gasoline inventories ended in line with average levels due to higher refinery output

Oil & Gas

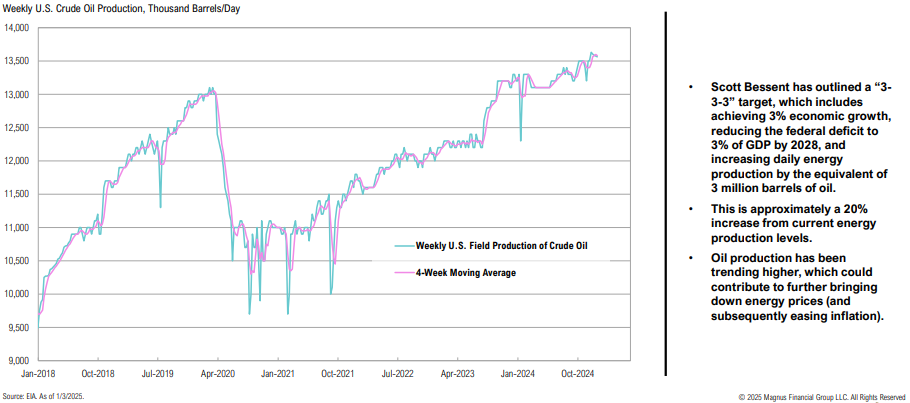

Part of the incoming administration’s plans are to increase U.S. energy production; oil production has been rising, once again surpassing pre-pandemic levels

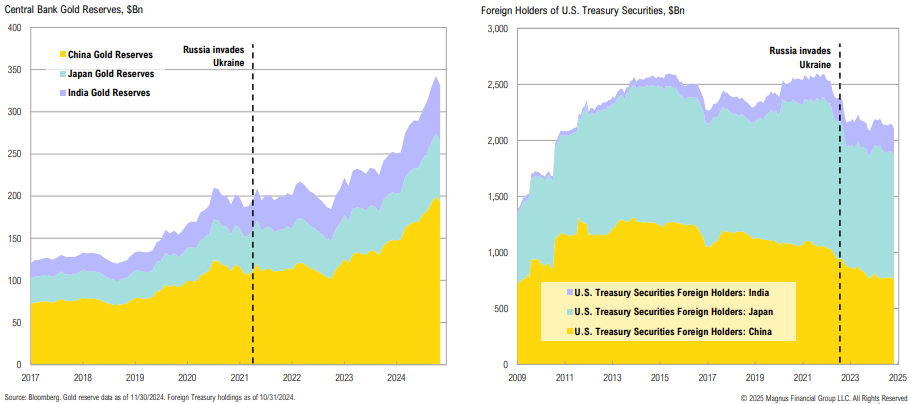

Gold Reserves vs. U.S. Treasury Holdings

Accompanied by ‘flight to safety’ (geopolitics, U.S. fiscal situation), gold’s resilience despite higher real rates likely reflects sovereigns favoring gold; higher real rates remain a risk

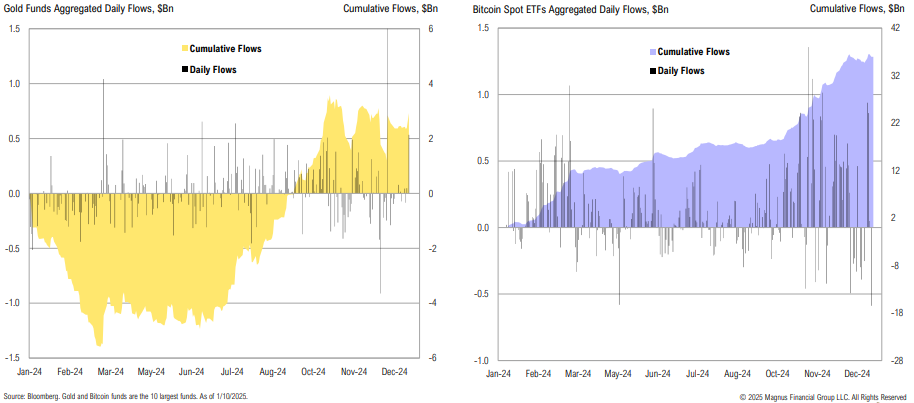

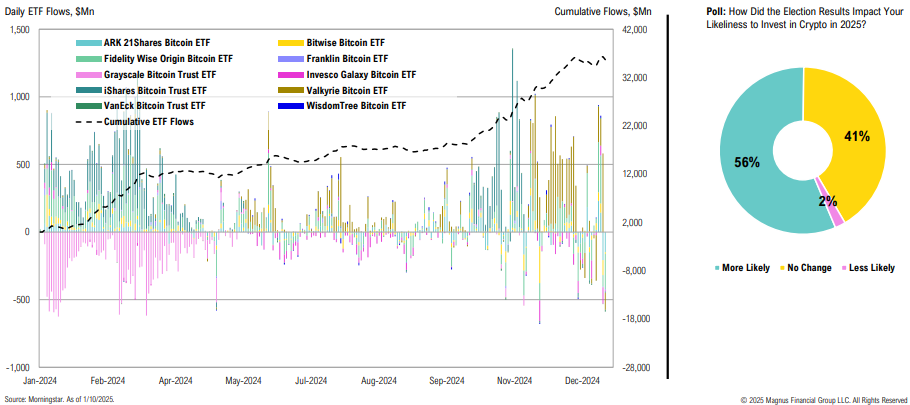

Gold vs Bitcoin ETF Flows

Gold fund flows started picking back up again in September; bitcoin flows have been more consistent and continue to rise as the price of bitcoin climbs

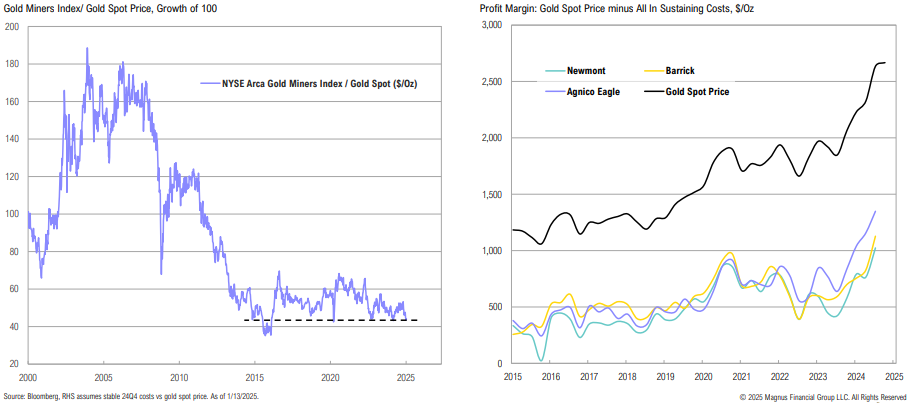

Gold Miners

Gold miners continue to look attractive vs. physical, but miners have been plagued by rising costs, country-specific issues, and labor challenges, among other things

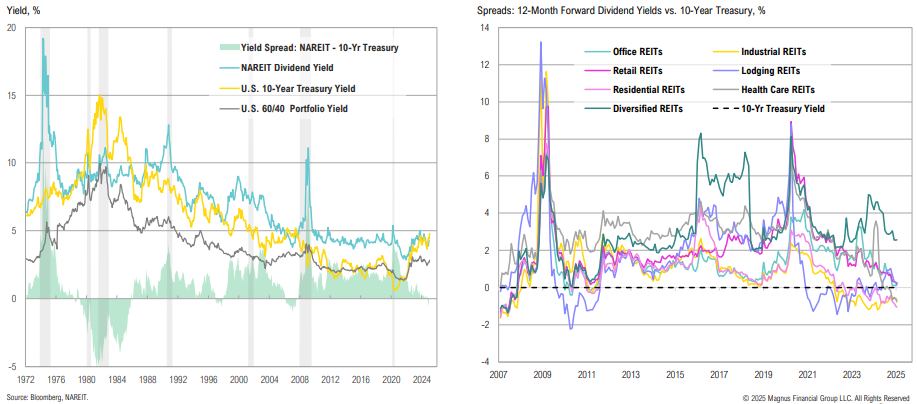

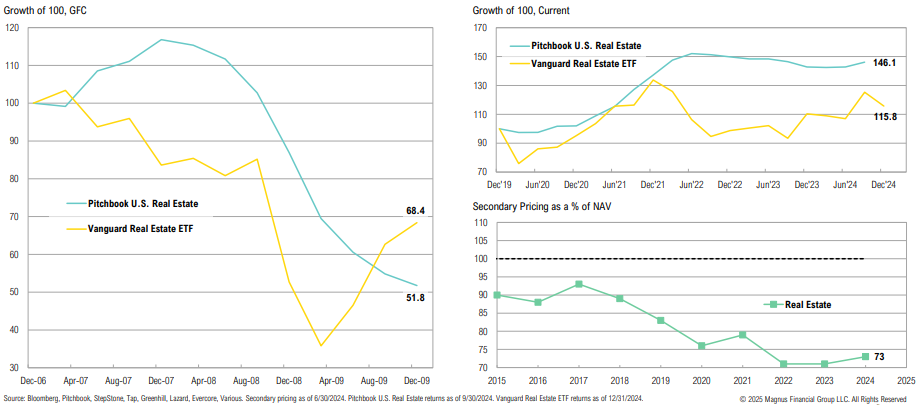

REITs

U.S. REITs are down >10% since the start of December, as higher yields have weighed on the asset class; despite the pullback, most REIT sectors still appear wholly unattractive on a relative yield basis

Private Real Estate Performance

Private real estate funds have not marked down properties – while the gap has closed with public markets, secondary transactions remain at deep discounts

“I’ve talked to a lot of our investors who tell me I’m completely missing the boat and tell me all the great things about crypto, and you know what? They’ve been right, not me, because it keeps going up… We will get into spot crypto when the regulatory environment changes, and we do anticipate that it will change, and we’re getting ready for that eventuality.”

Rick Wurster, Charles Schwab Incoming CEO

Opportunistic

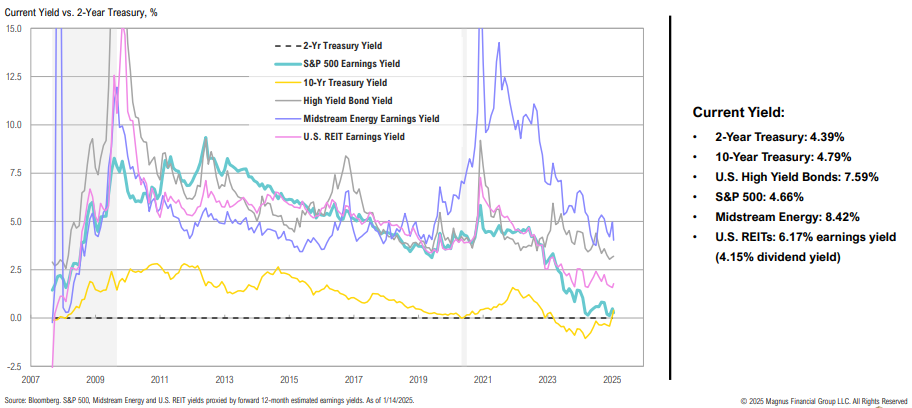

Yield Spreads

The relative yield case for high-yield bonds and REITs has been eroded by spread tightening/ higher Treasury yields

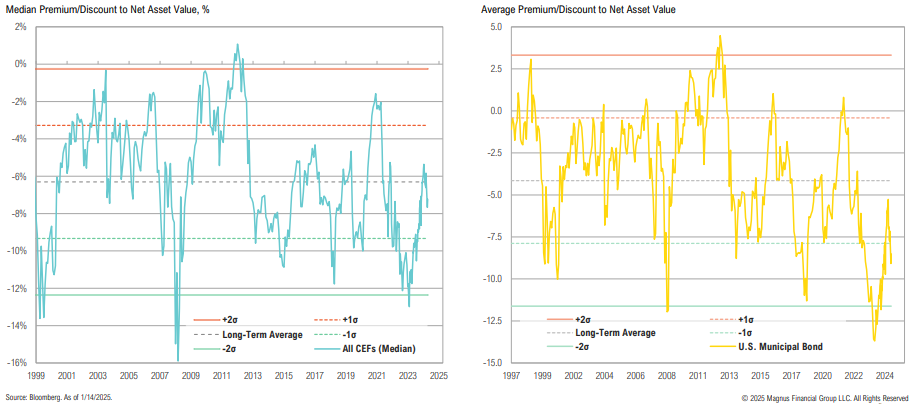

CEF Discounts

Median CEF discounts have been widening since last October and are now back below average levels; U.S. Muni CEF discounts are also more enticing, having widened from -5.3% to -9.1%

Bitcoin Spot ETF Flows

Bitcoin spot ETFs have stabilized and are moving higher again; the election outcome increased investor willingness to invest in crypto

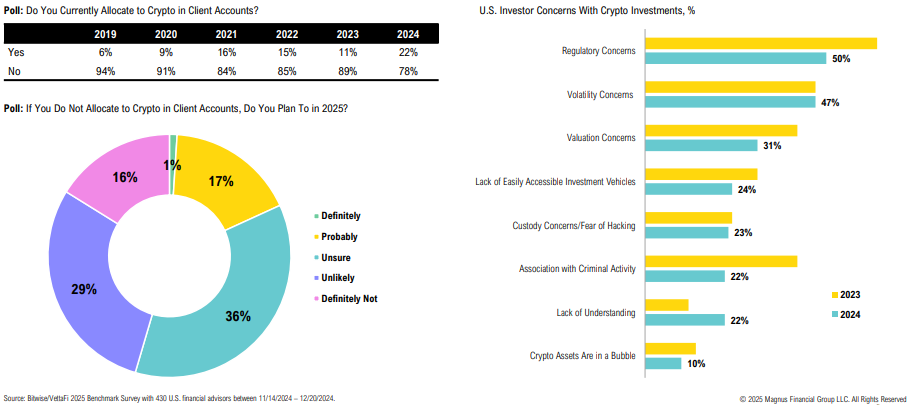

Crypto

Is crypto starting to be recognized as a real asset class? Despite increased investment, financial advisors remain skeptical, with regulations and volatility key concerns

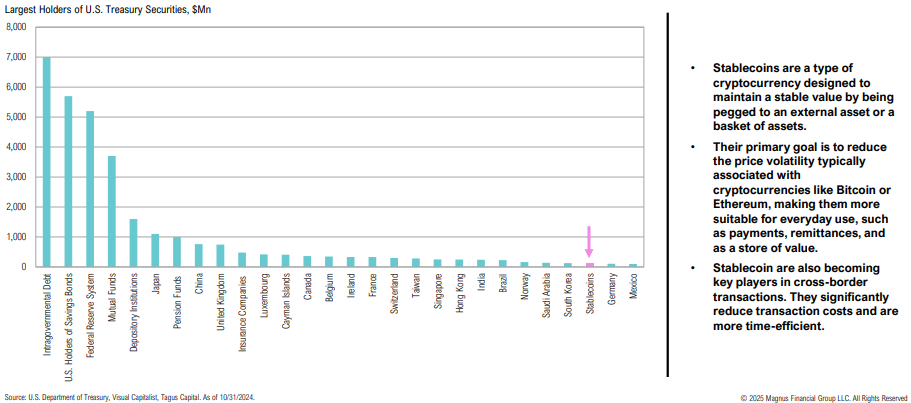

Crypto

Stablecoins (at $120 billion) are the 26th largest holder of U.S. Treasury securities

“Risk and time are opposite sides of the same coin, for if there were no tomorrow there would be no risk. Time transforms risk, and the nature of risk is shaped by the time horizon: the future is the playing field.”

Peter L. Bernstein, Investor & Economist

Asset Allocation

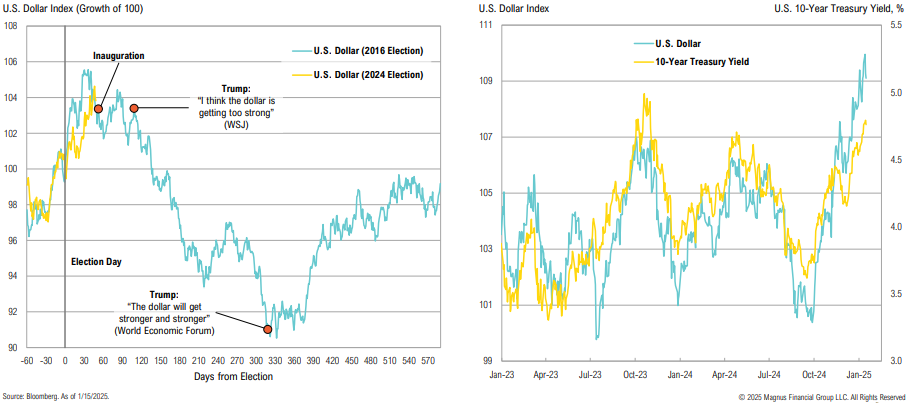

U.S. Dollar

The USD reaction to this election is similar to what happened in 2016; a declining USD would likely require lower interest rates

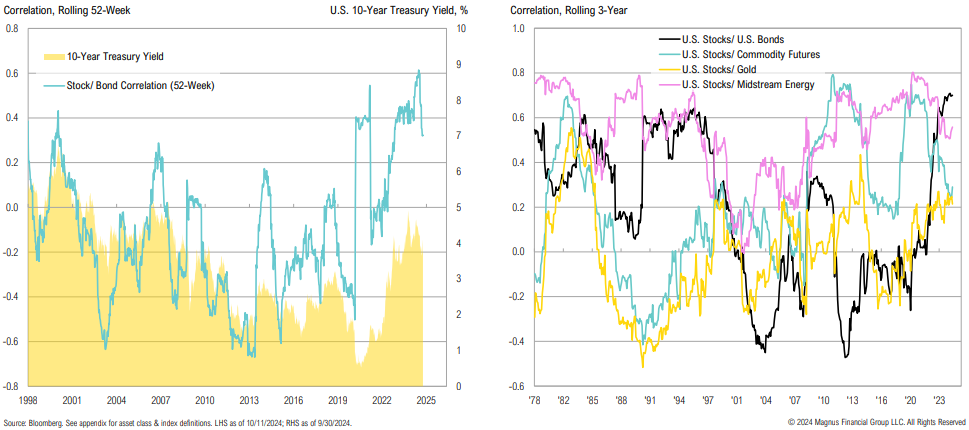

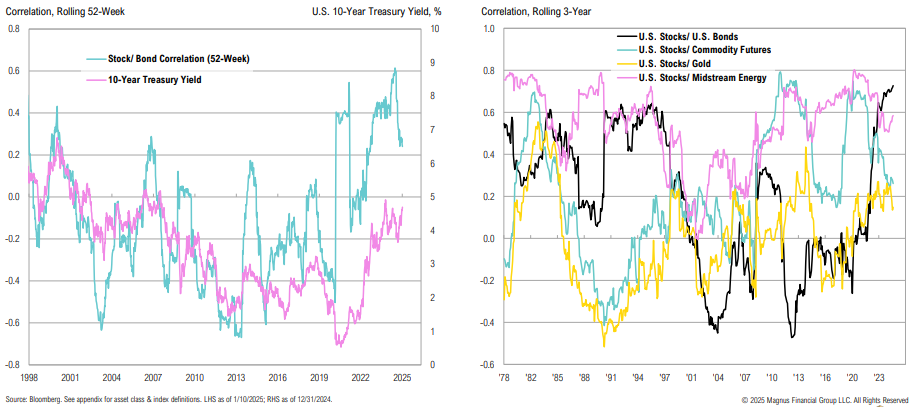

Stock & Bond Correlation

Bonds have recently provided less diversification benefits to stocks than other asset classes

Stock & Bond Correlation

Bonds have recently provided less diversification benefits to stocks than other asset classes; this would likely require hard-landing fears to change

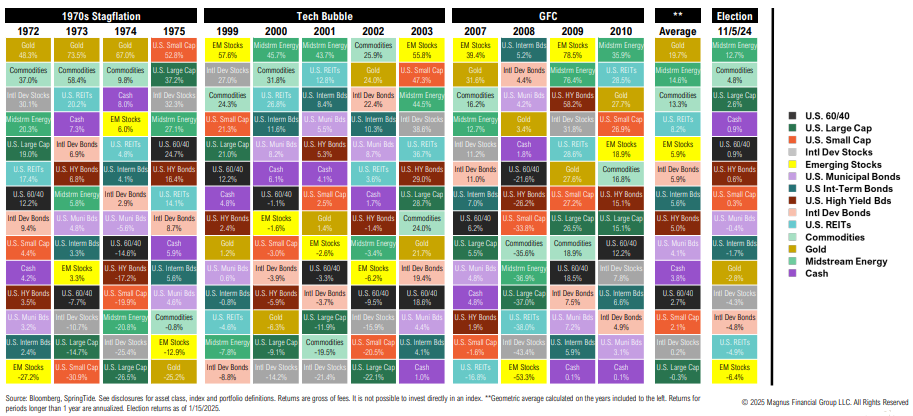

Analogies

Even if not base case, returns during periods of stress (stagflation, bubble unwinds, banking crisis) contrast so starkly with the last 15 years that they should be considered