Candyland

SUMMARY

Markets are like little kids. They want candy, and the minute you try to take the candy away, they have a tantrum.

– Mohamed El-Erian, Chief Economic Advisor at Allianz, 2021

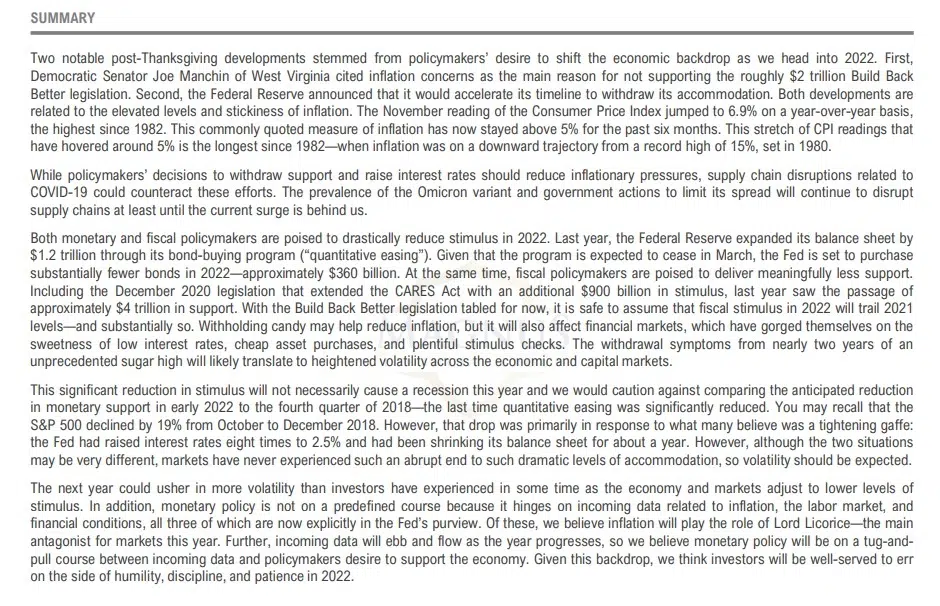

INFLATION THEME

The lifecycle of a theme: from “your fears are unjustified” to “why did almost no one see inflation coming?” in less than 12 months

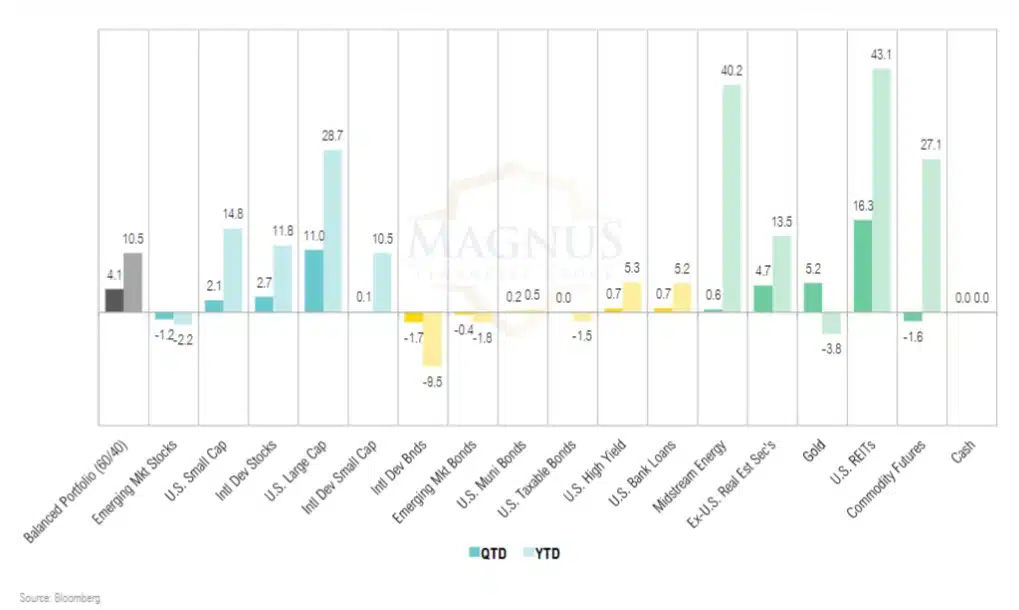

4Q, 2021 MARKET REVIEW

A generally strong quarter for risk assets, especially U.S. REITs and large cap stocks; balanced U.S. portfolios returned 4.1%

SUMMARY

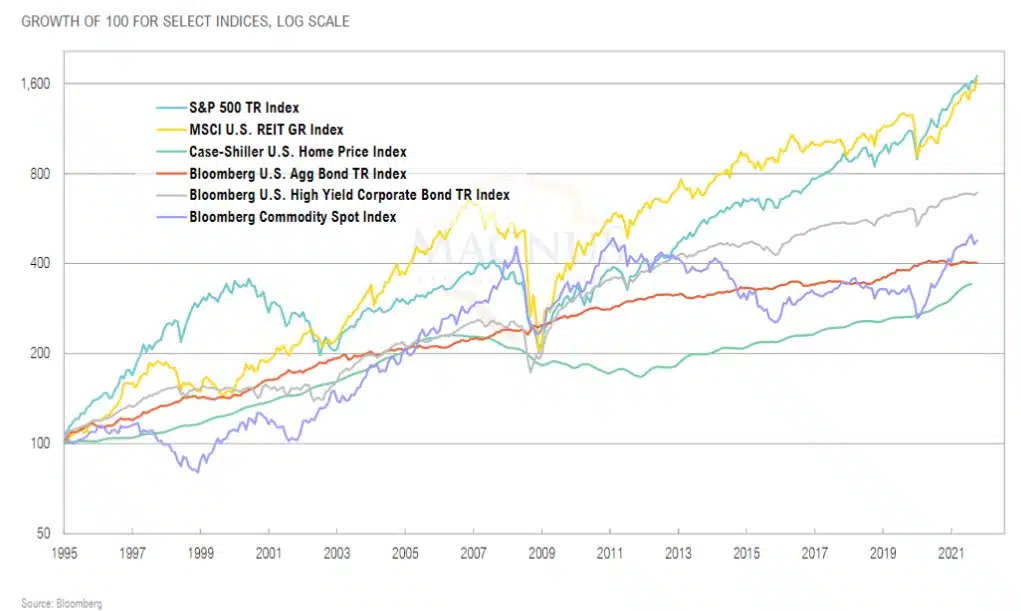

LONG-TERM ASSET CLASS RETURNS

Key markets near all-time highs with inflation running well above “target” exposes the impossible challenge policymakers face

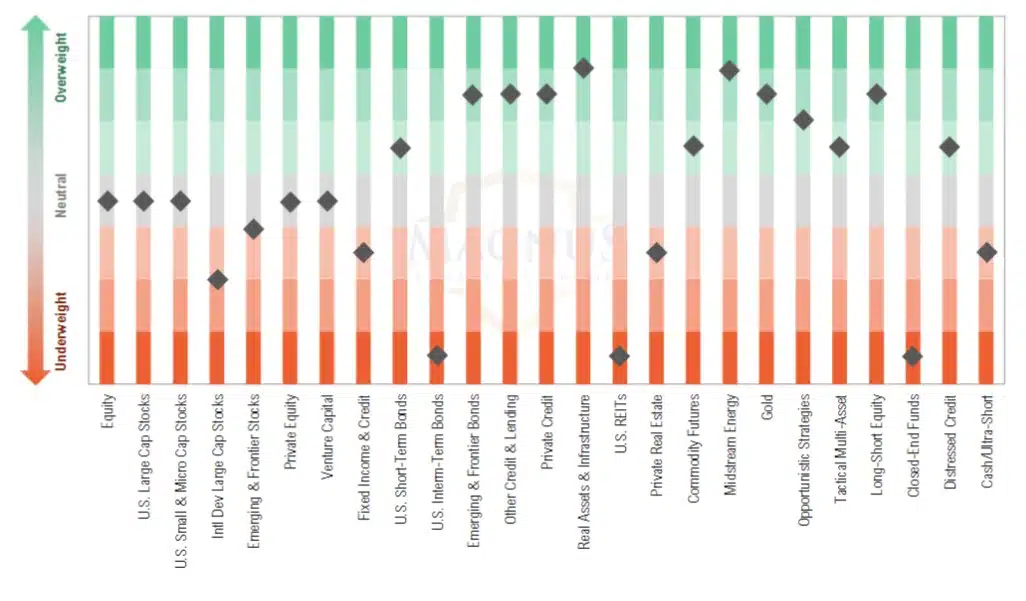

ASSET ALLOCATION VIEWS

Remain diversified and tilted for upside inflation risks (value equities, lower duration bonds, overweight real assets and opportunistic)

GROWTH, INFLATION & POLICY

My Democratic colleagues in Washington are determined to dramatically reshape our society in a way that leaves our country even more vulnerable to the threats we face. I cannot take that risk with a staggering debt of more than $29 trillion and inflation taxes that are real and harmful to every hard-working American at the gasoline pumps, grocery stores and utility bills with no end in sight.

– Joe Manchin, Unites States Senator and Democrat, West Virginia

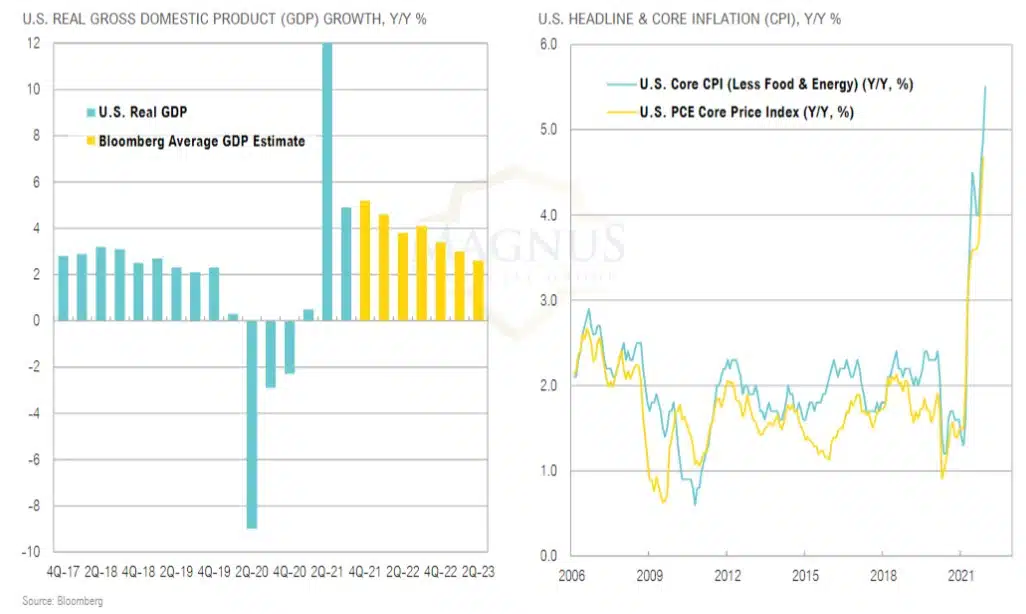

GDP & INFLATION

Growth and inflation both expected to slow, but to remain above average for next several quarters

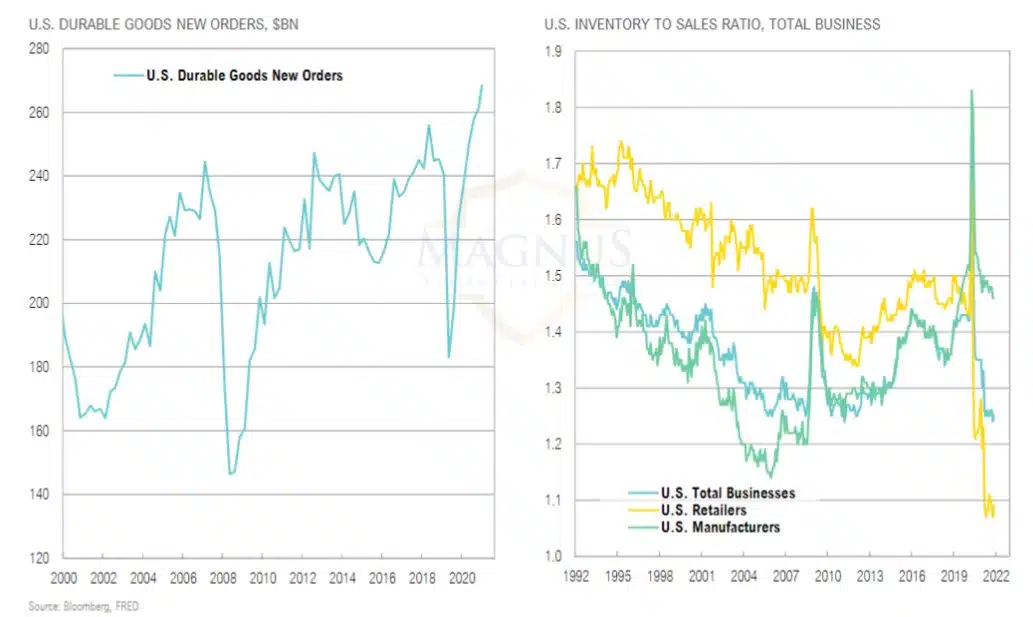

U.S. BUSINESSES

U.S. durable goods orders reached a record as demand remains strong; retailers have struggled to build inventories to match demand

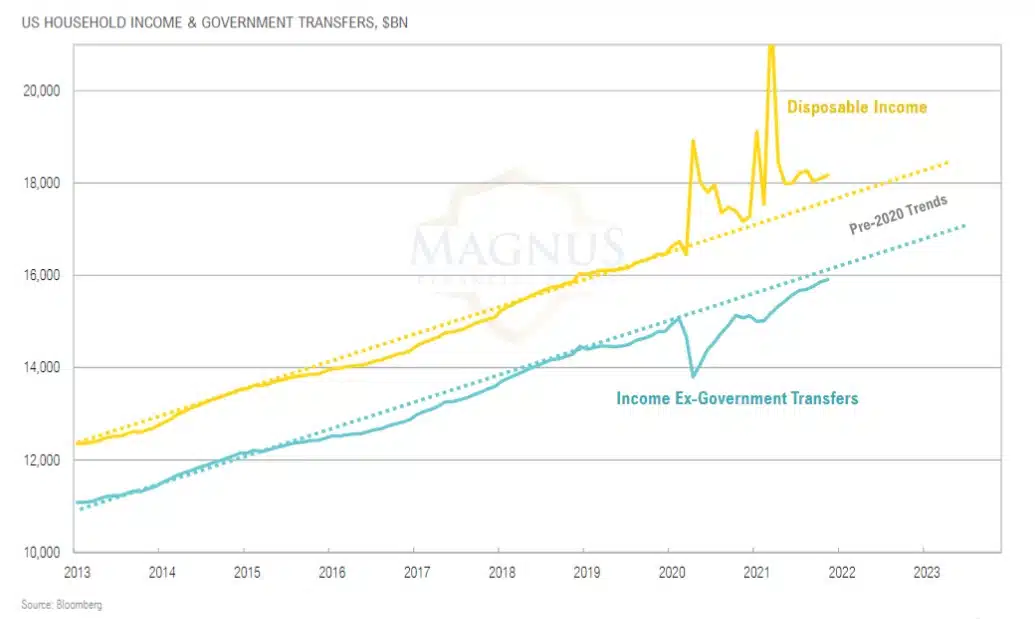

U.S. HOUSEHOLD INCOME & GOVERNMENT TRANSFERS

The reliance on government transfers over the last few years was astonishing; the hangover from this ending could be harsh

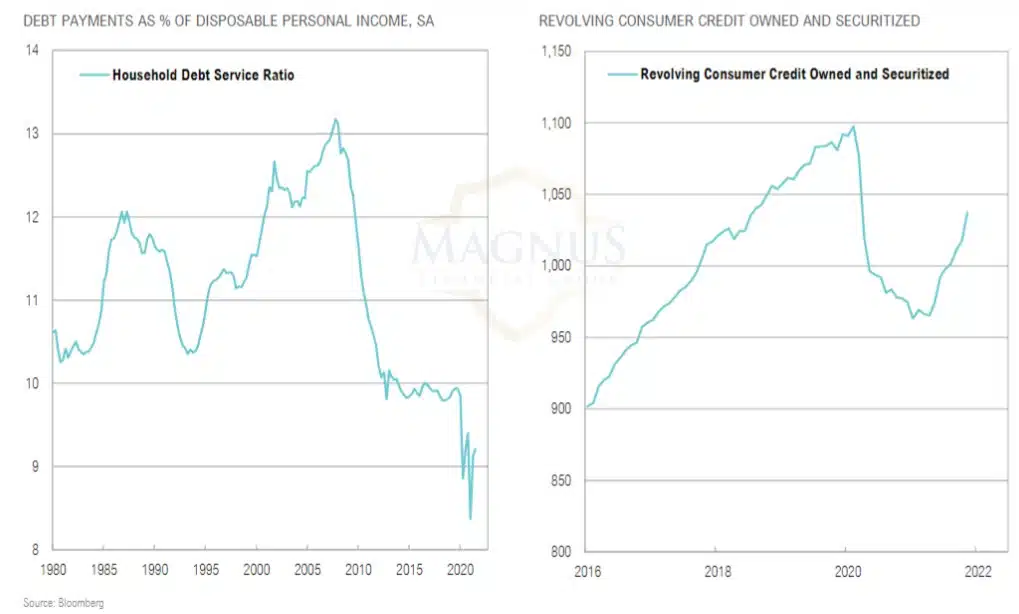

DEBT SERVICE & REVOLVING CREDIT

As transfer payments have waned, the consumer has started to dial up leverage, but plenty of room to go…

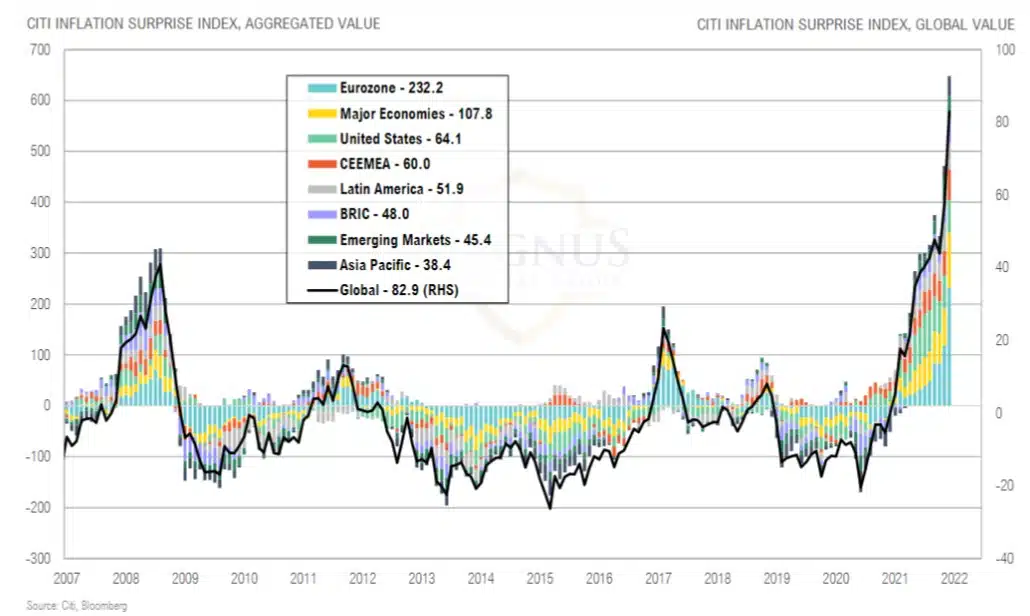

INFLATION TRENDS

Inflation is surprising forecasts on a global scale, a first since 2009

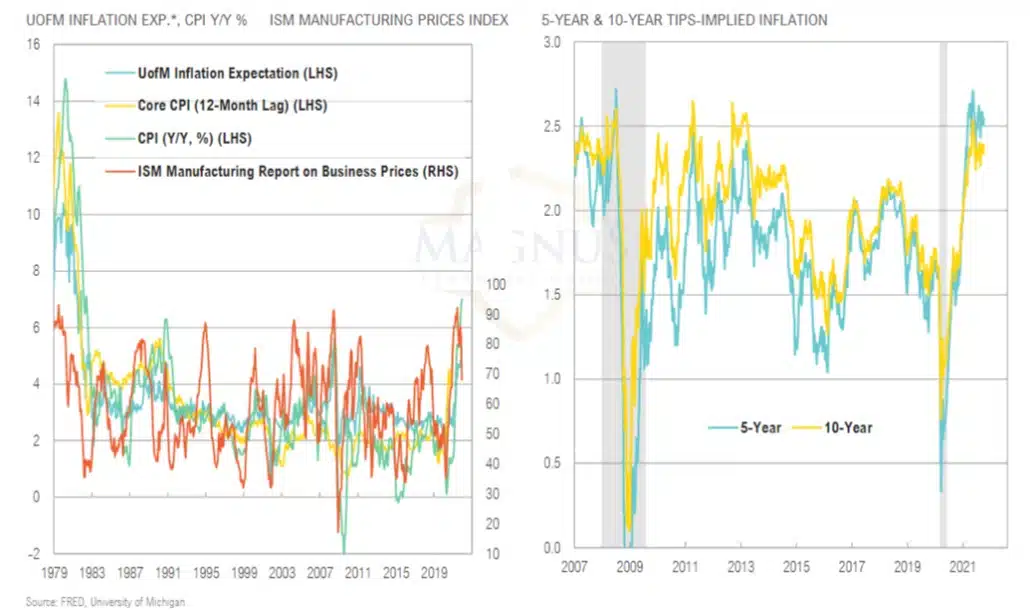

Inflation and inflation expectations are still somewhat contained, but any increases would pose a significant risk to the economy and markets

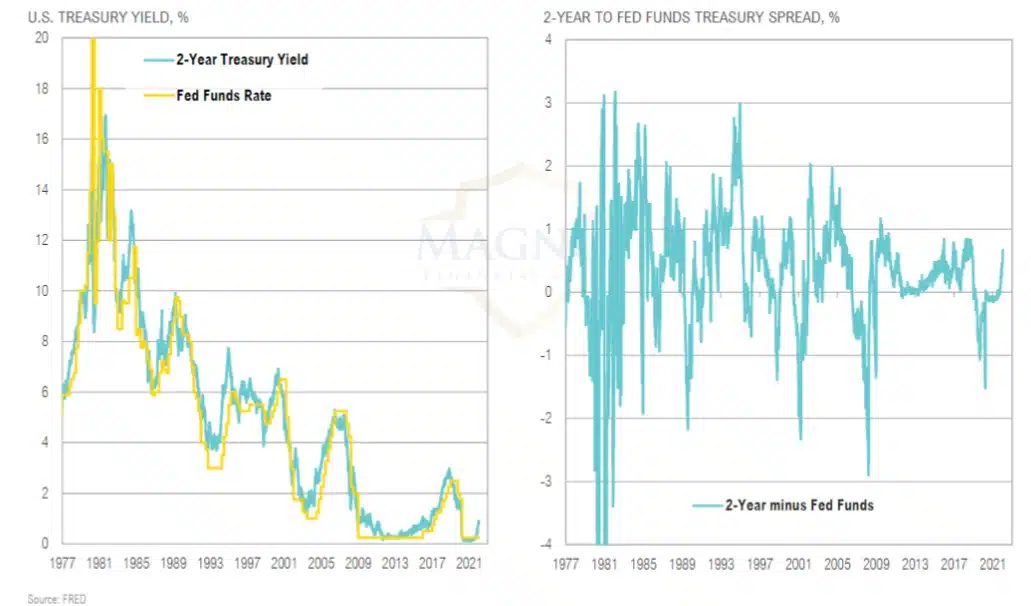

THE 2-YEAR TREASURY

Watch the Treasury market for policy changes: the 2-year Treasury tells you everything you need to know about pending Fed decisions

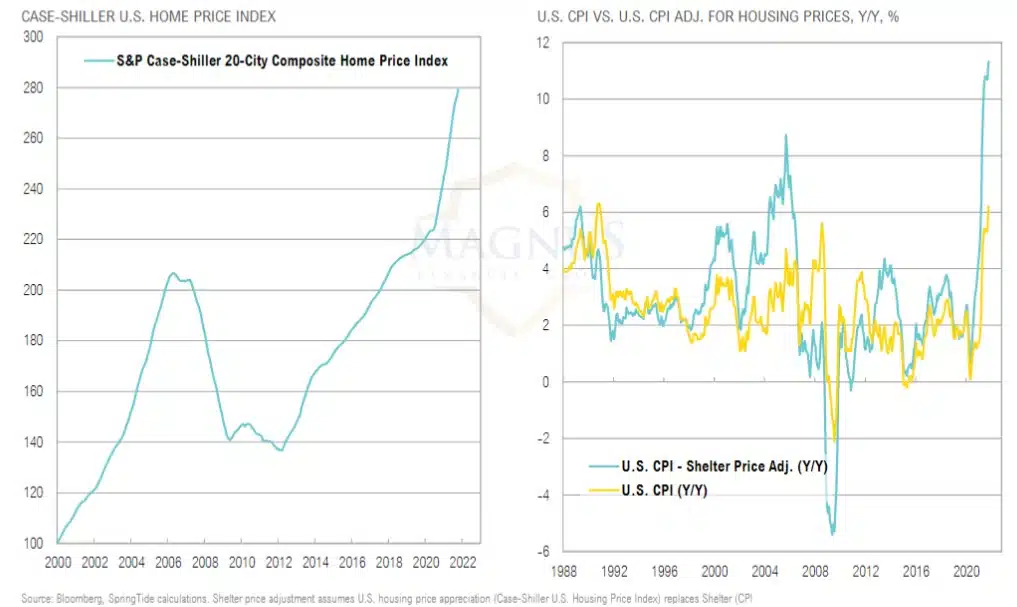

CPI & HOUSING

Adjusted for U.S. housing price appreciation, inflation would be significantly higher due to the lag in reporting of shelter in CPI

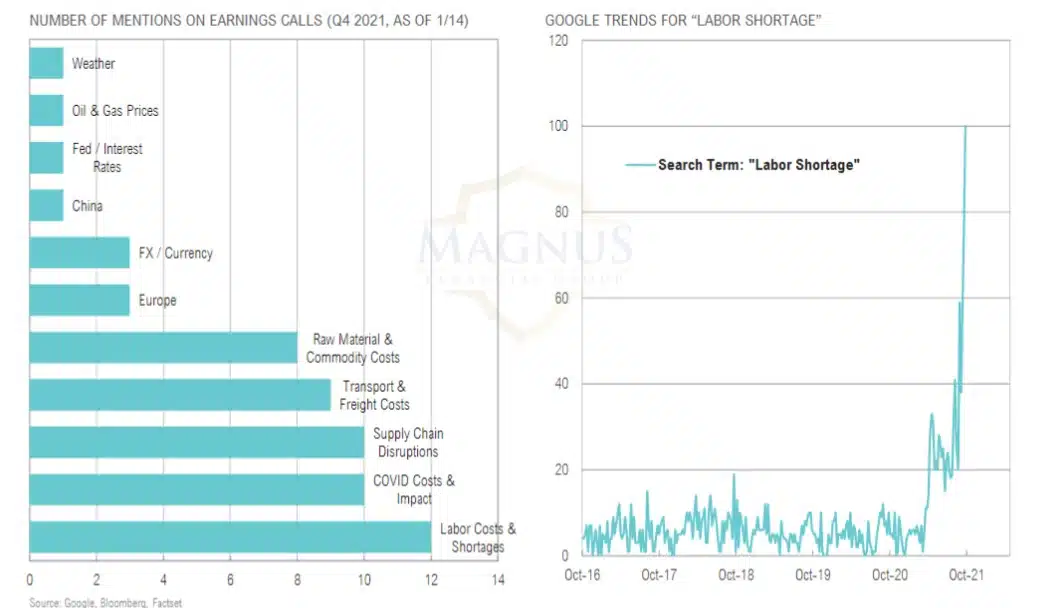

U.S. LABOR MARKET

Job quits rise, openings fall as restaurants struggle with COVID-19 policy response to rising cases

LABOR MARKET DYNAMICS

Companies getting creative in attempts to attract workers in a challenging labor market environment that is very different from the ‘09-’11 recovery

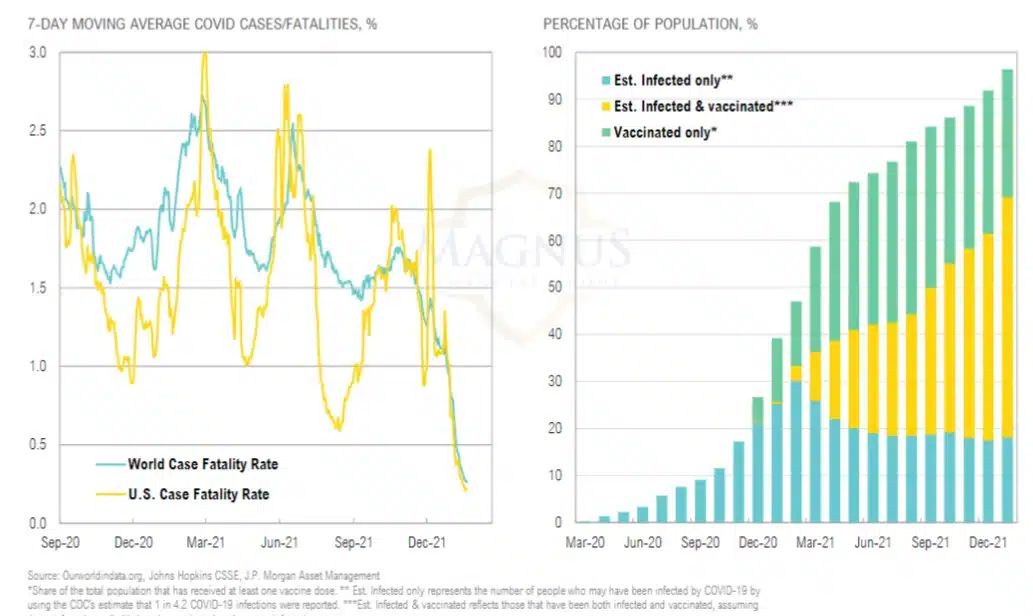

COVID ENDEMIC

Whether by vaccination, prior infection or both, more than 90% of the population could have a form of immunity

COVID TRENDS

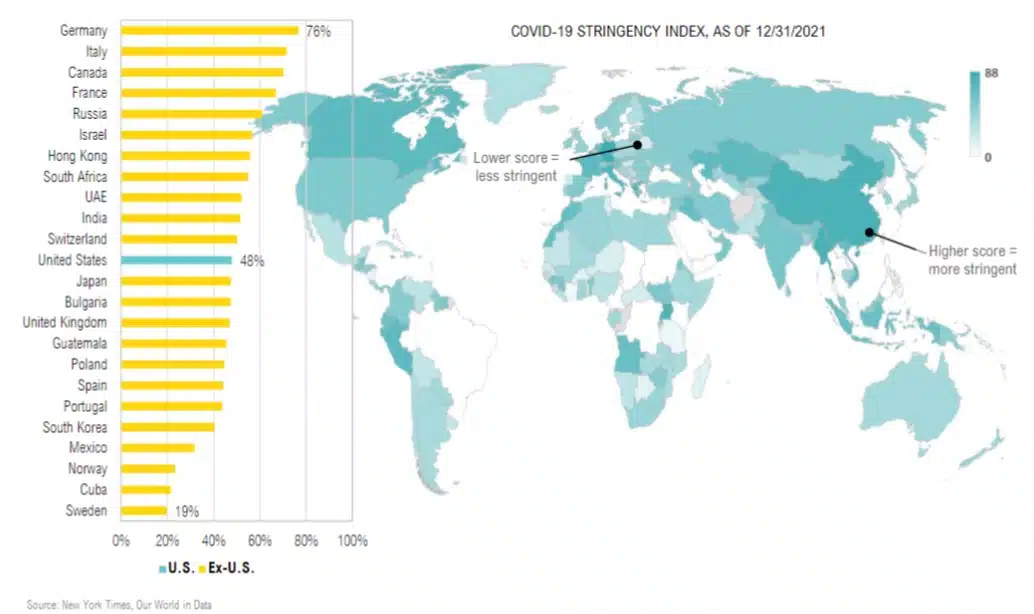

The reaction function and policy response to the pandemic has been significant and unpredictable; Omicron disruptions seem to be waning

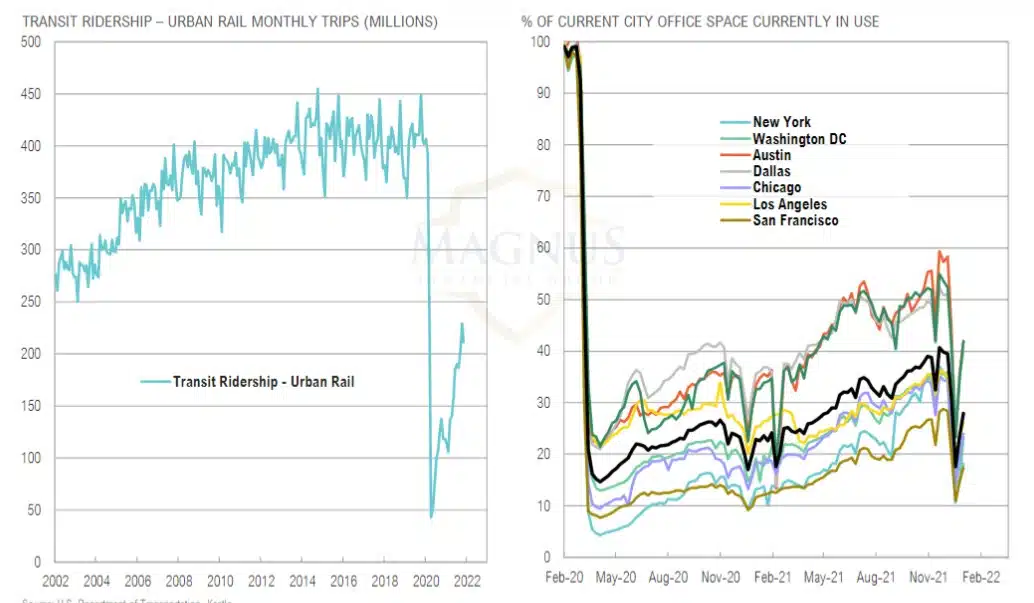

TRANSIT ACTIVITY

“Back to work” hasn’t gone according to plan

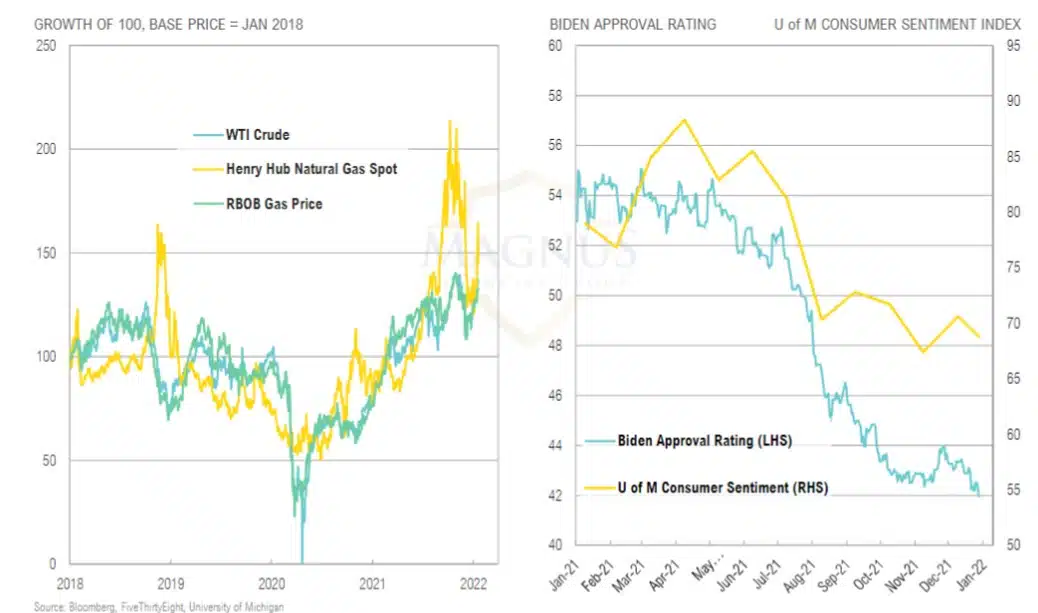

ENERGY PRICES & SENTIMENT

Rising energy prices will continue to be a hot topic for consumers and the current administration

MONETARY POLICY & GLOBAL STOCKS

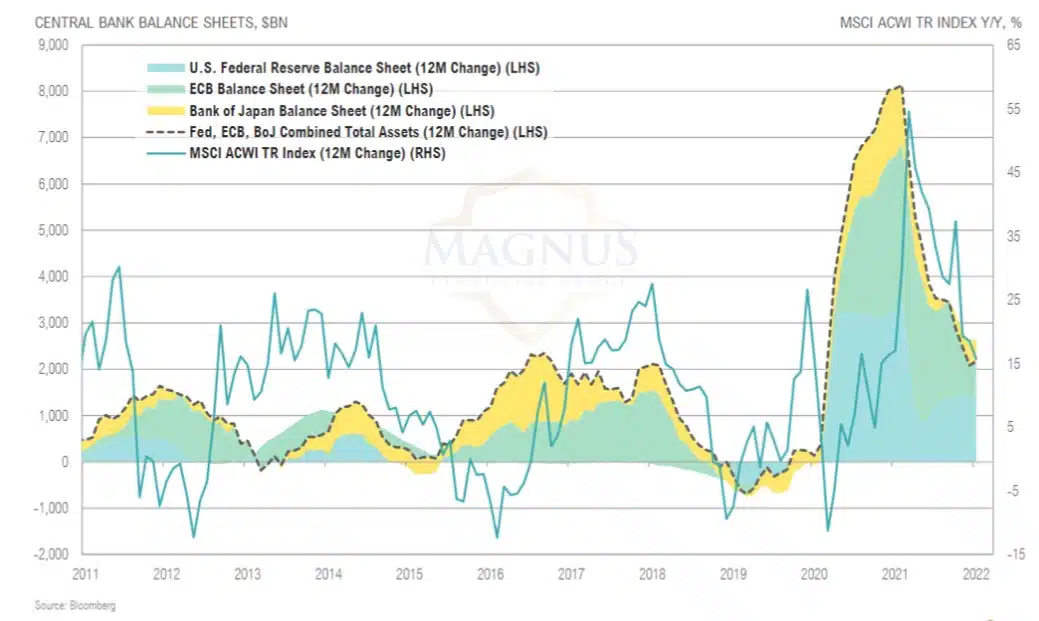

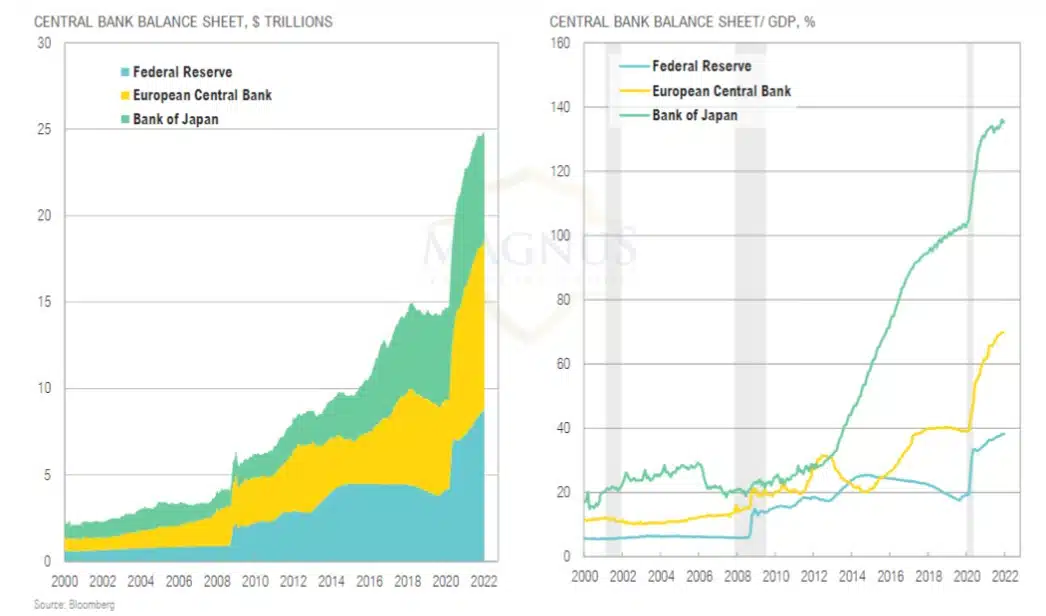

Global quantitative easing efforts supported the recent gains in global stocks

MONETARY POLICY

Thinking well ahead, if the Fed ever does need to reverse course, they have substantially more options than the ECB and BoJ

EQUITY

Right now, we’re in a raging mania.

– Stan Druckenmiller, Investor, 2021

MARKET RETURNS SUMMARY

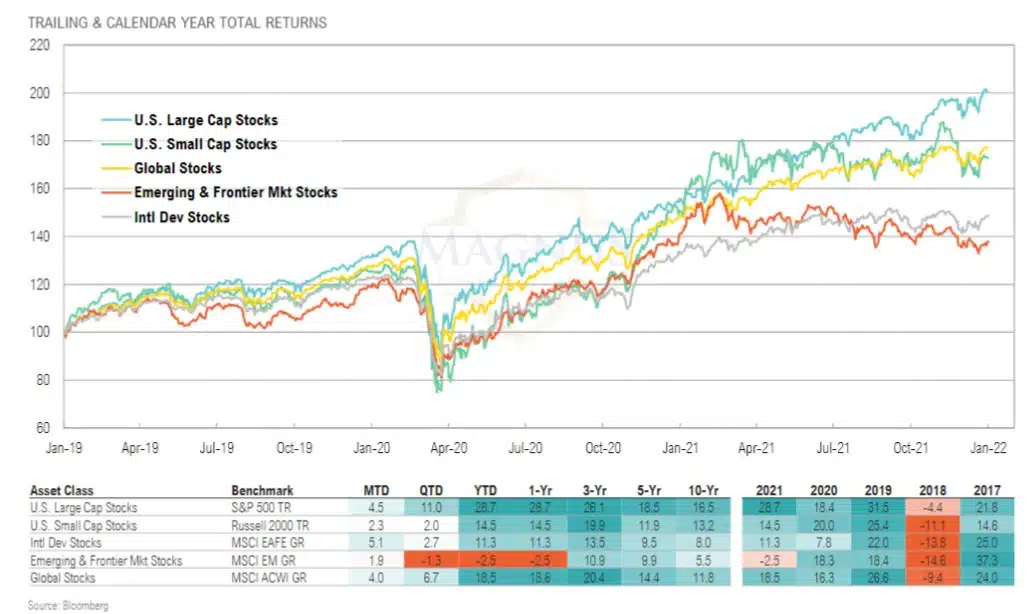

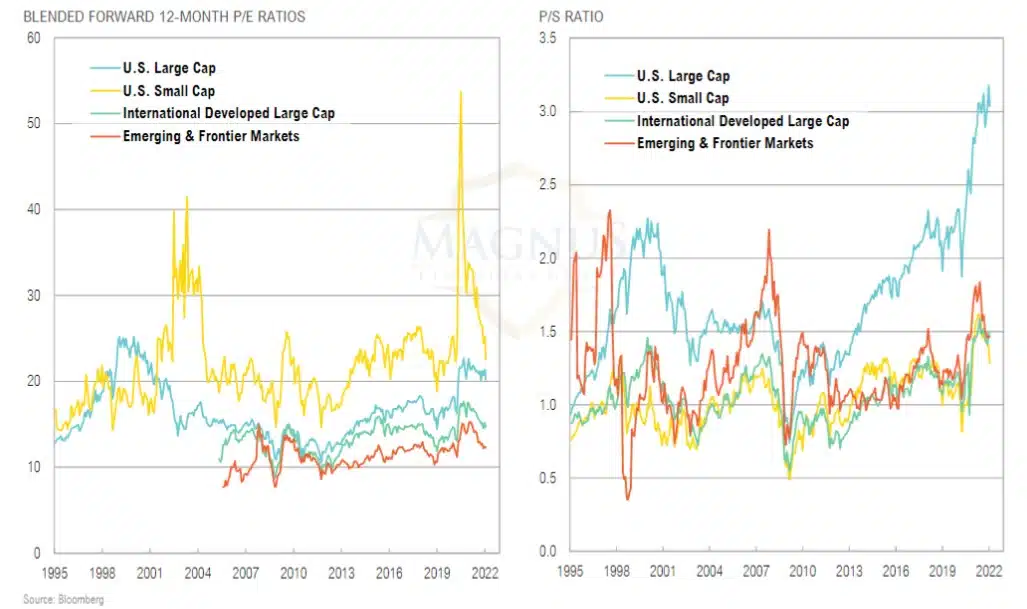

U.S. large cap stocks outperformed during the quarter; U.S. valuations remain higher than international and emerging markets

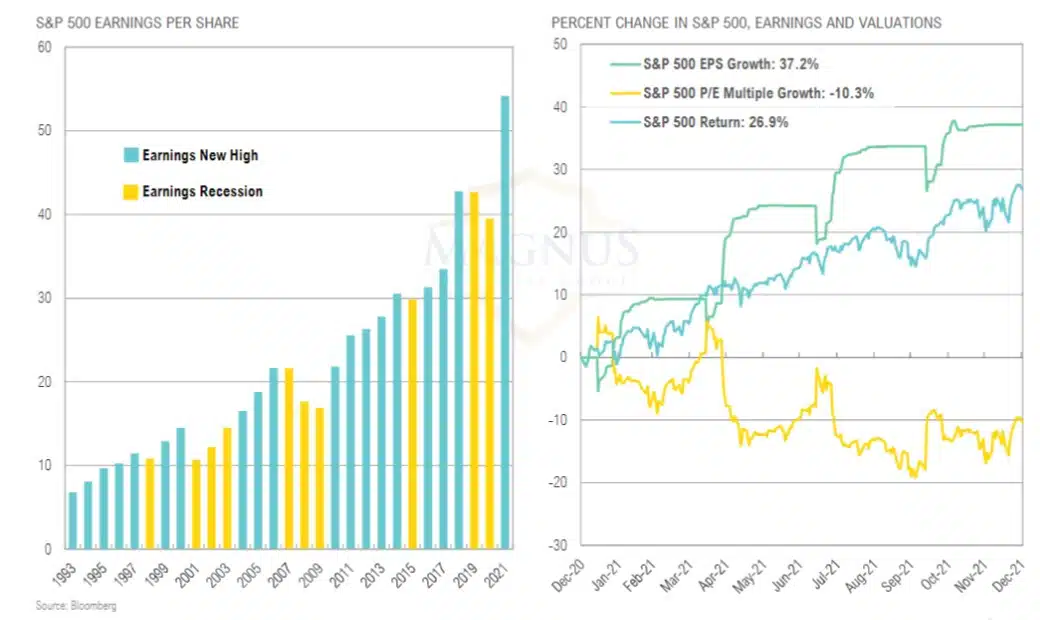

Earnings grew at a faster rate than returns in 2021, resulting in multiple compression in the S&P 500

GLOBAL EPS

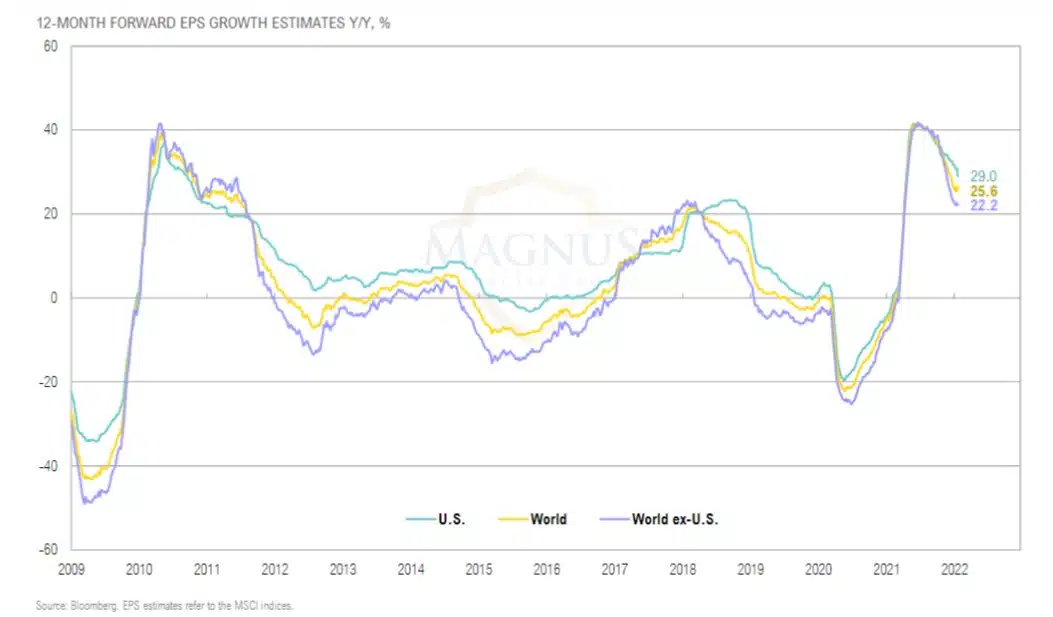

Global EPS growth expectations have slowed; U.S. growth is expected to be higher than the rest of the world in 2022

COVID TRADE

Quarantine stock basket now trails the broader U.S. stock market over 24 months

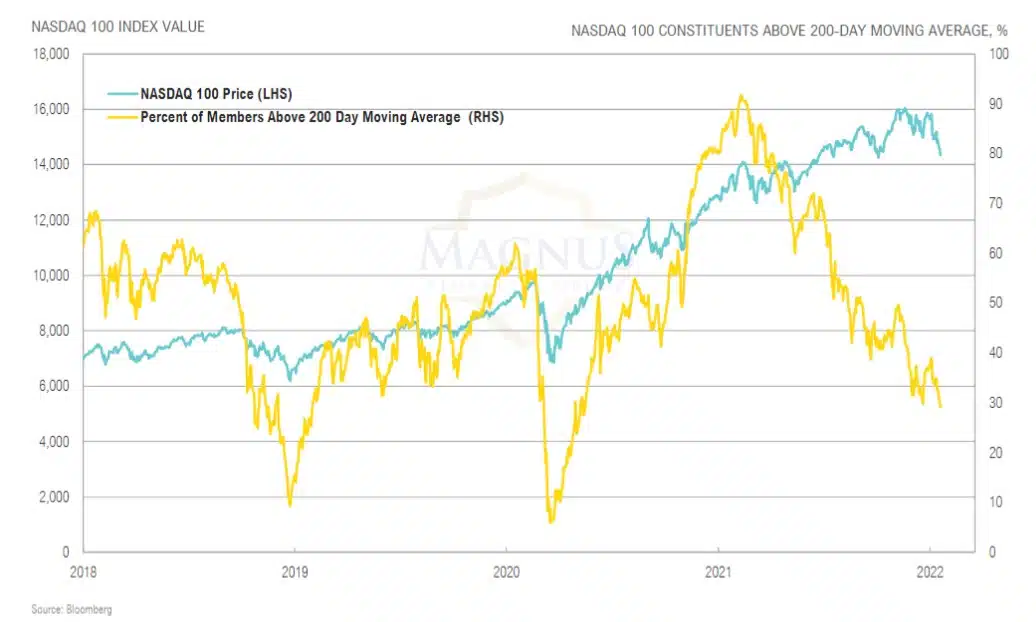

NASDAQ BREADTH

Just 30% of the NASDAQ 100 trades above their 200-day moving averages

VALUE VS GROWTH

Growth price optimism not supported by earnings

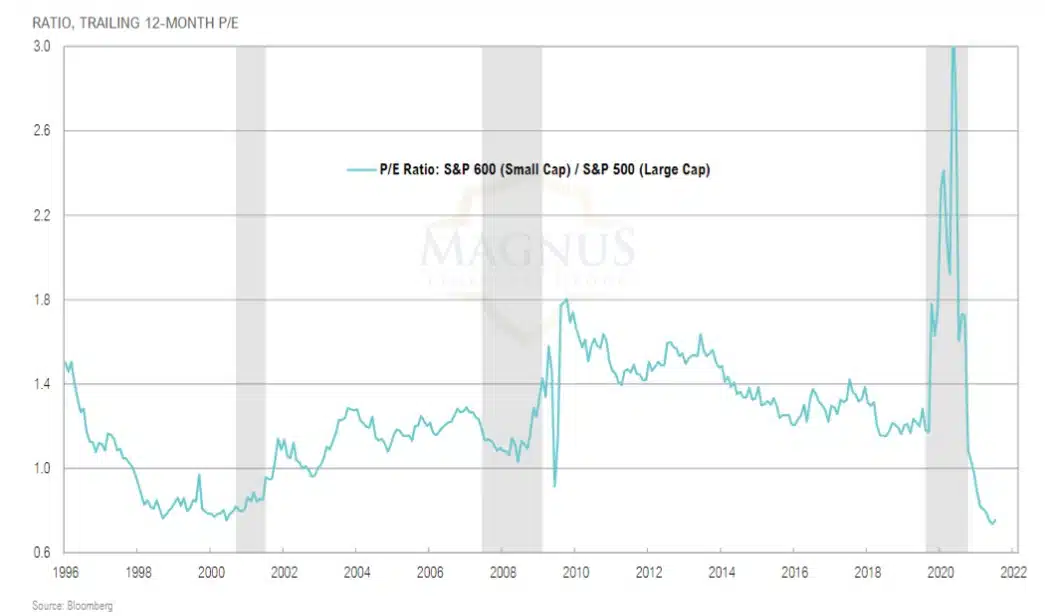

SMALL CAP VS LARGE CAP

Historically small cap has been more expensive than large cap, but small cap relative valuations are currently near the lowest levels in recent history

VALUATIONS

Relative to earnings estimates, emerging & frontier market stocks are cheapest; relative to sales, U.S. Large Cap stocks appear very expensive

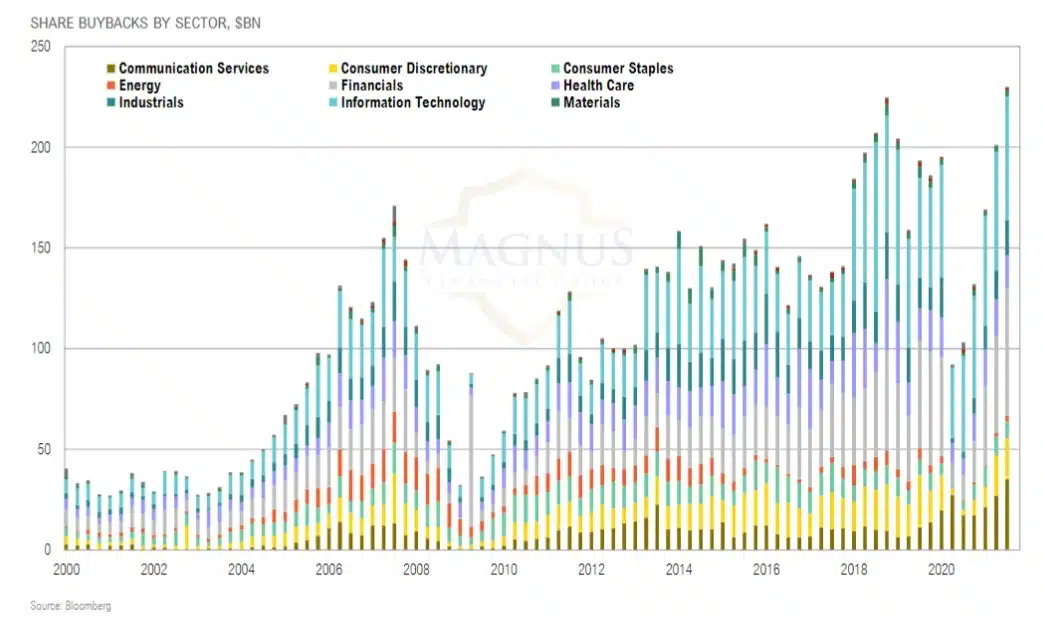

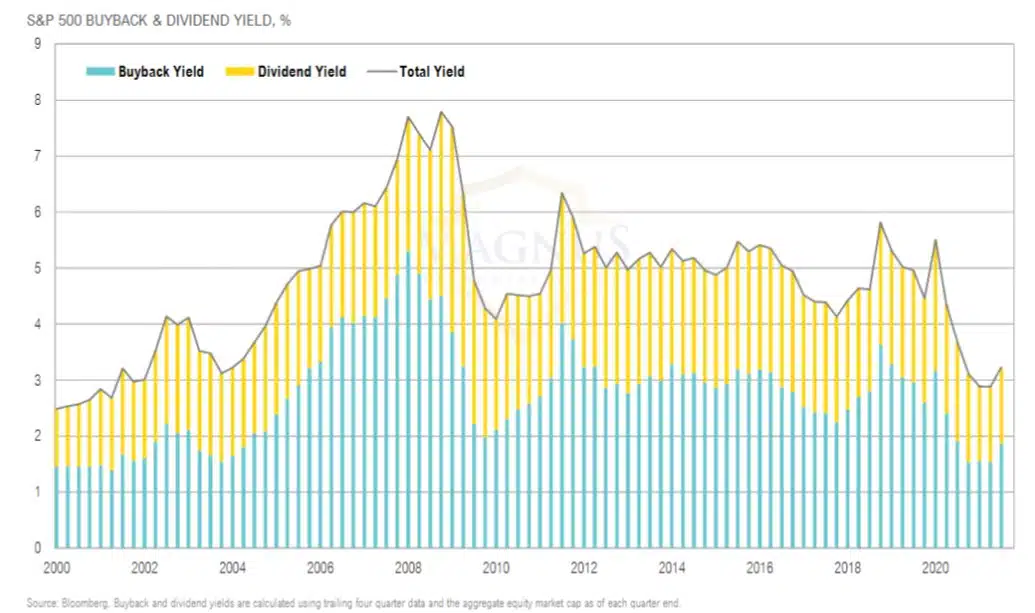

BUYBACKS

A record $230 billion of buybacks in Q3; financials and tech were the two leading sectors, repurchasing a combined $125 billion

BUYBACKS & DIVIDENDS

Buyback and dividend yields for U.S. large cap stocks rose in the third quarter as buybacks reached a record high

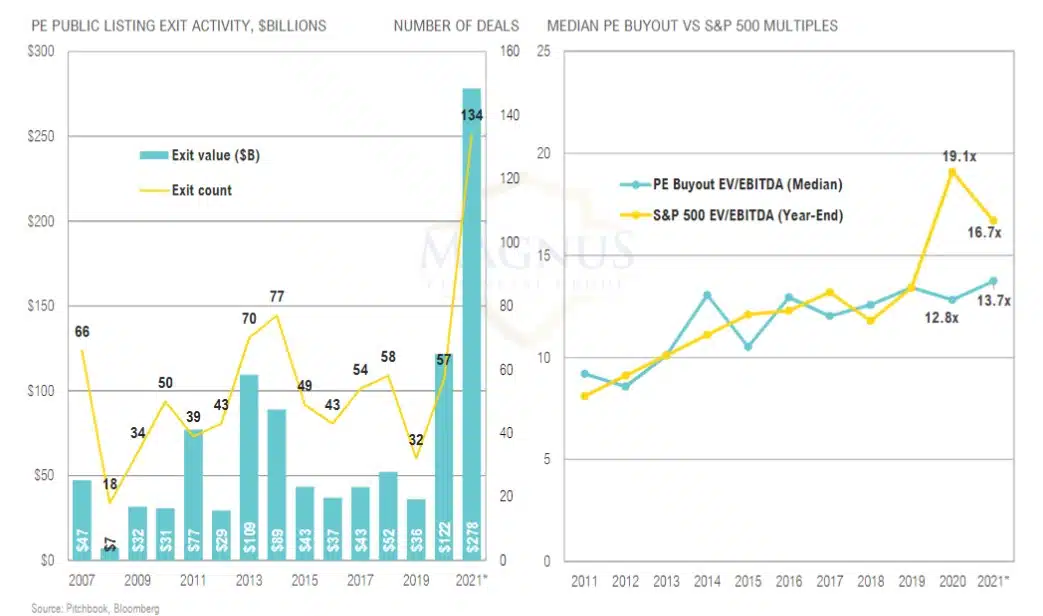

PRIVATE EQUITY BUYOUTS

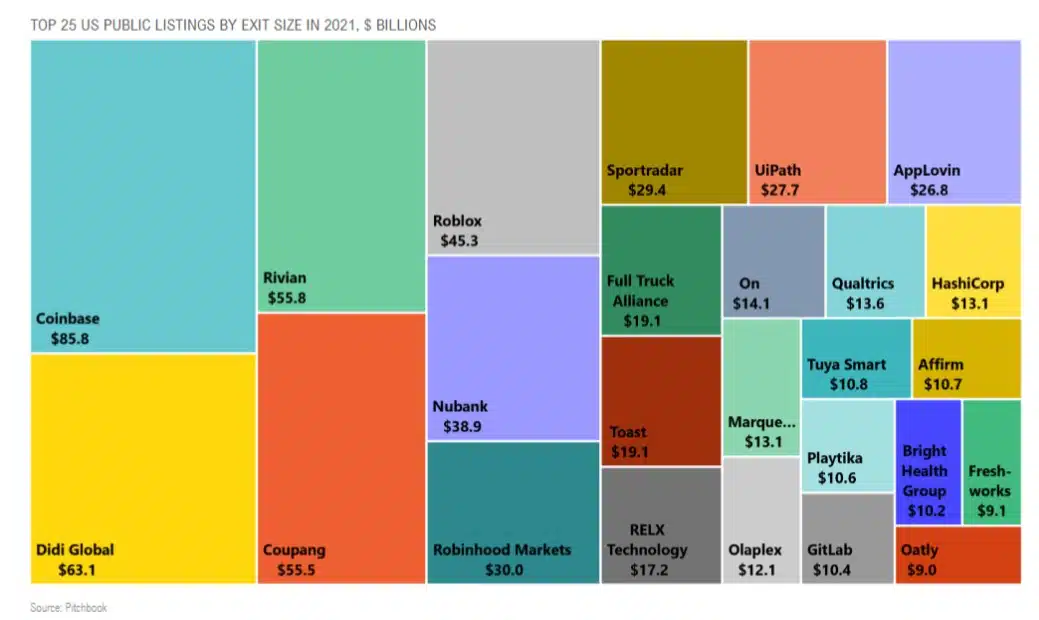

Frothy public markets lead to largest IPO year on record

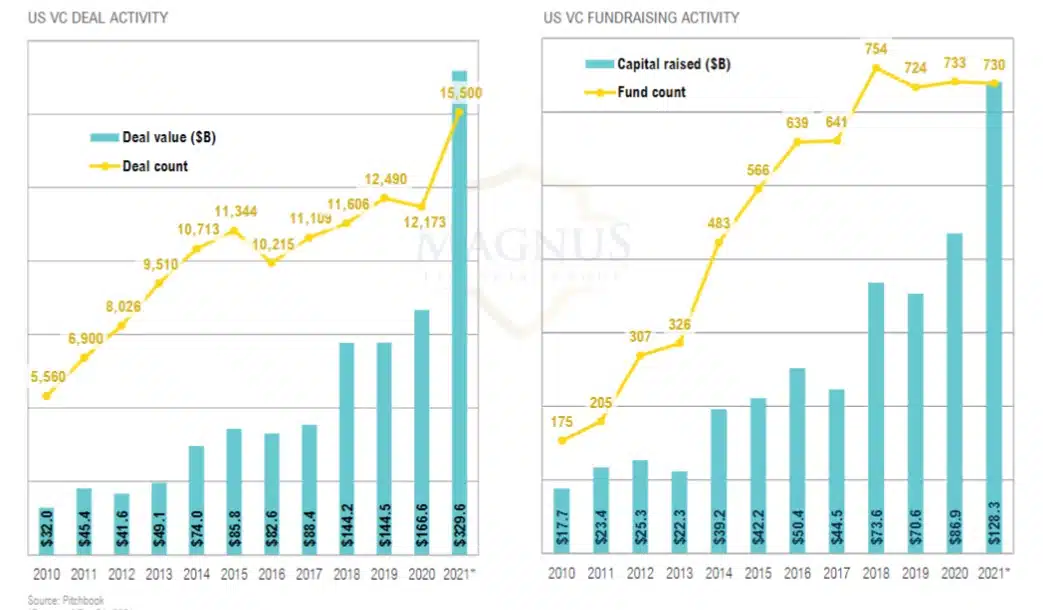

VENTURE CAPITAL

Pent-up pandemic demand has pushed 2021 venture activity to shatter previous records

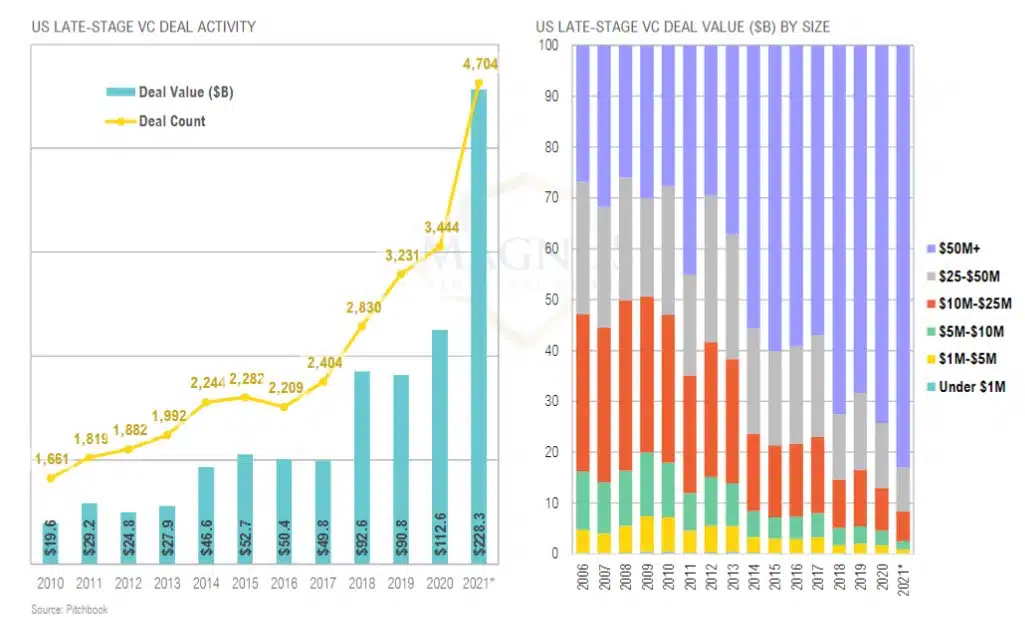

VENTURE CAPITAL DEAL ACTIVITY

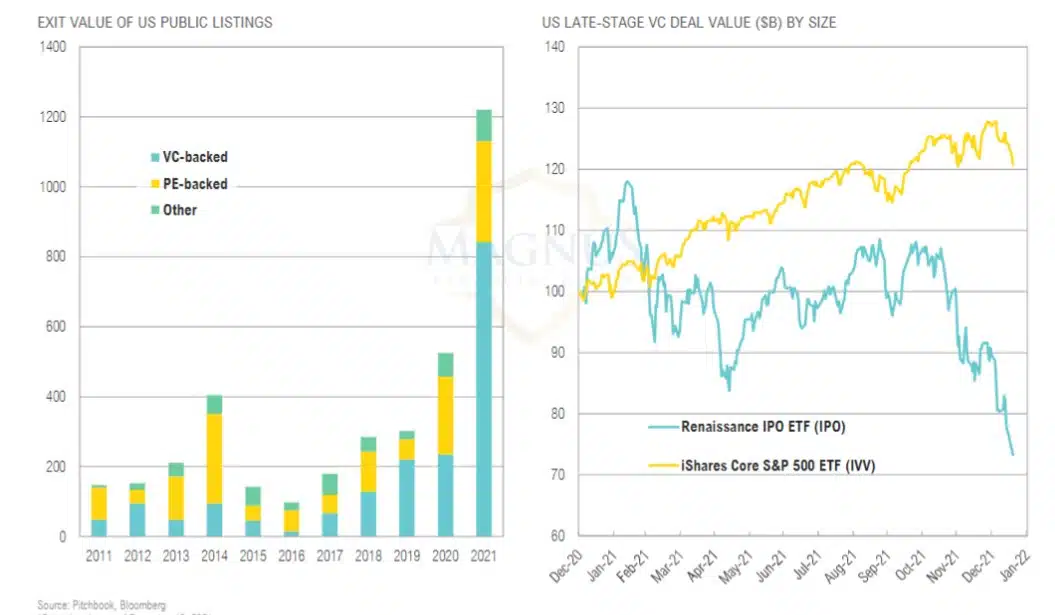

Momentum persists at late stage of venture activity

IPO MARKET

VC-backed tech unicorns were the belle of the IPO-ball in 2021…

…until they flopped in the public markets

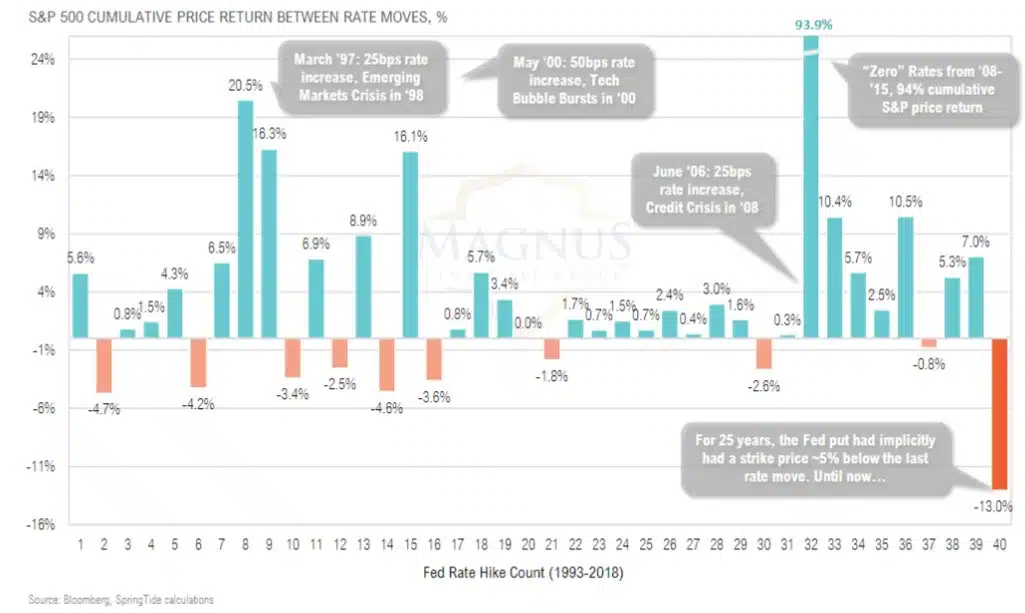

THE FED PUT

By leaving hikes so late in the cycle, the Fed’s predicament puts them at odds with a 30 year history of being accommodative

FIXED INCOME & CREDIT

What Fisher and other former Fed insiders told me is that the stock market rally was no accident. By design, the Fed’s QE program effectively lowered long-term interest rates, making safer investments like bonds less attractive and riskier assets like stocks more attractive. It was hard to argue with the results: Stock prices kept going up.

– James Jacoby, Financial Commentator, Director, July 2021

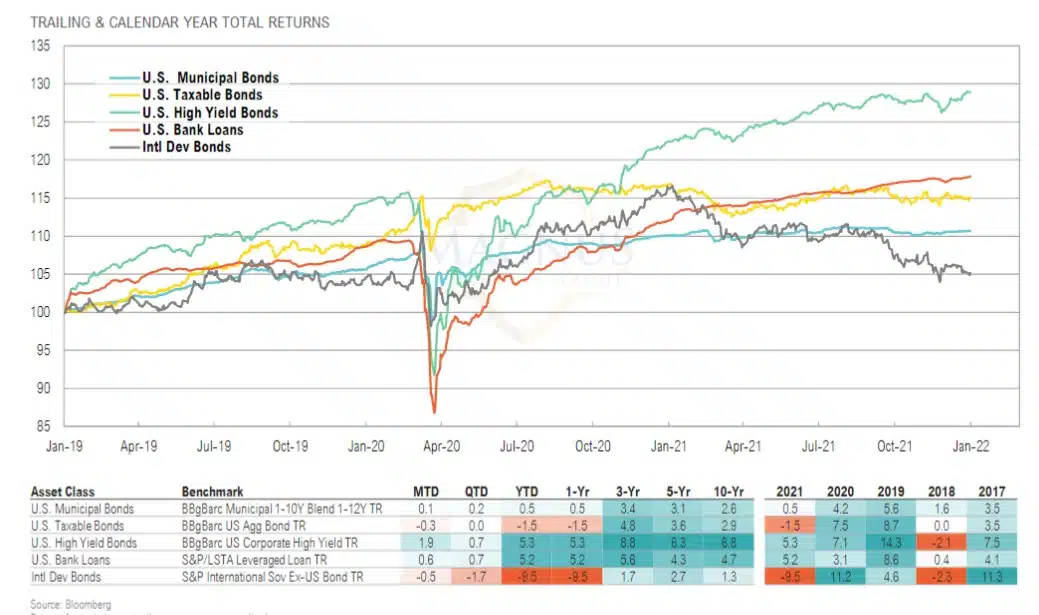

MARKET RETURNS SUMMARY

HYBs and bank loans were top performers; International Dev bonds were a major underperformer as “return-free risk” comes home to roost

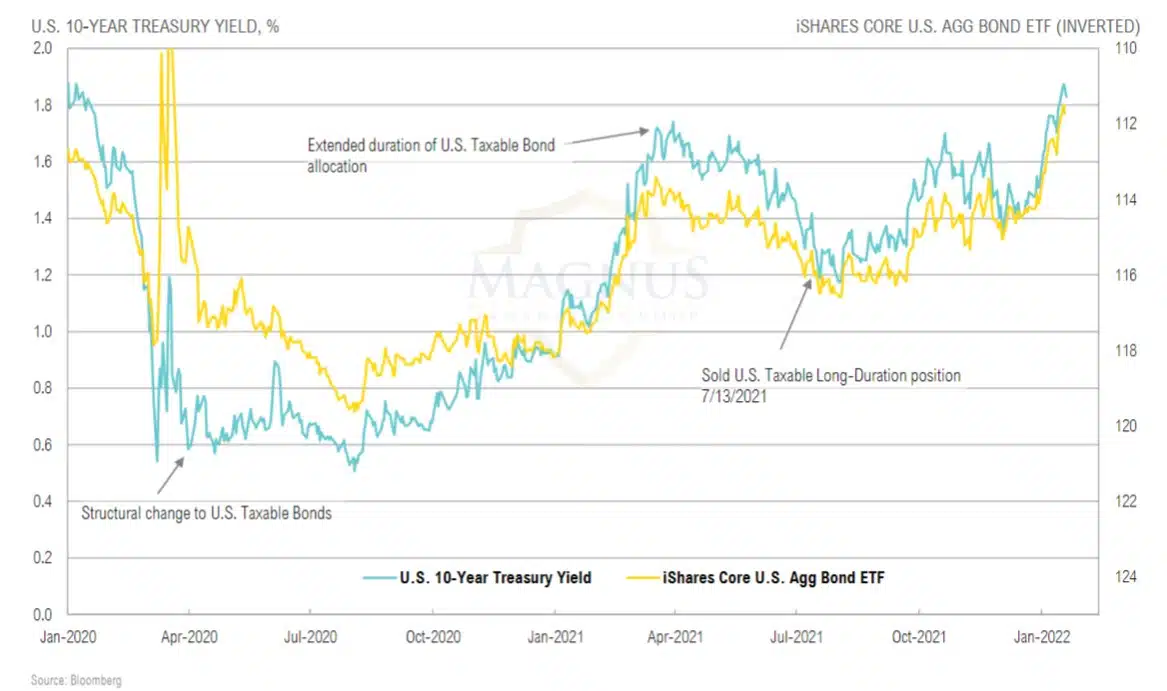

DURATION EXTENTION

In fixed income, we have been (reluctantly) more tactical over the last two years as a result of the pandemic

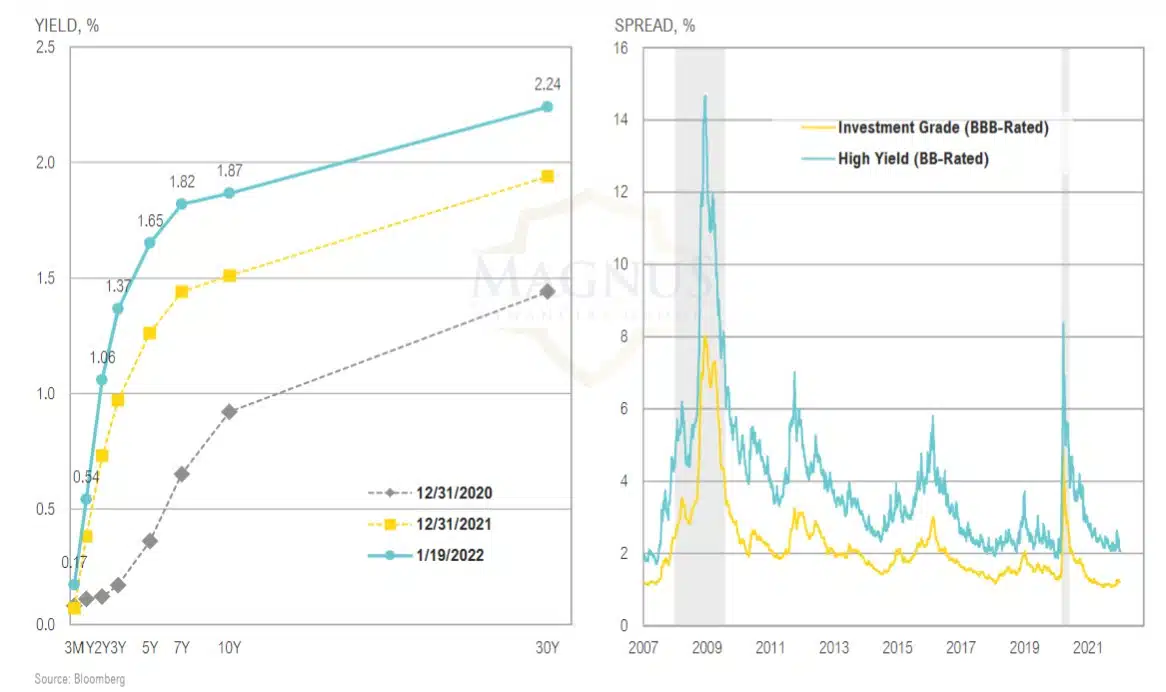

TREASURY YIELDS & CREDIT SPREADS

U.S. Treasury yield curve steepened significantly last year while credit spreads remain at or near historically tight levels

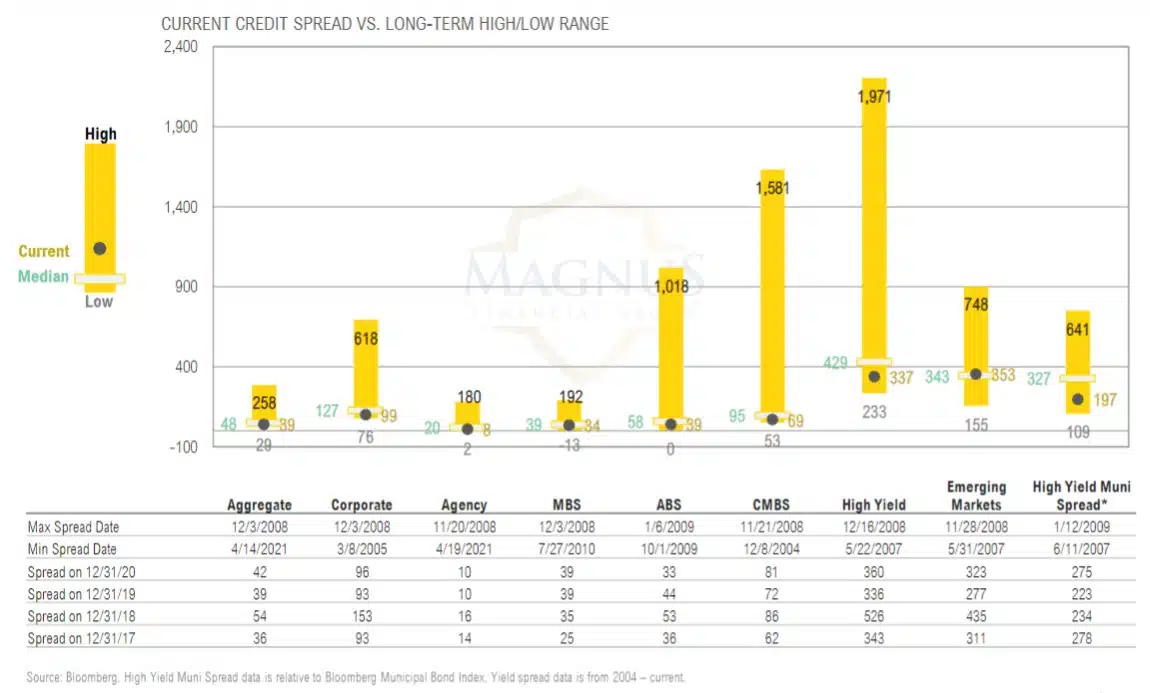

SPREADS BY SECTOR

Credit spreads near median across most sectors with limited pockets of opportunity starting to emerge

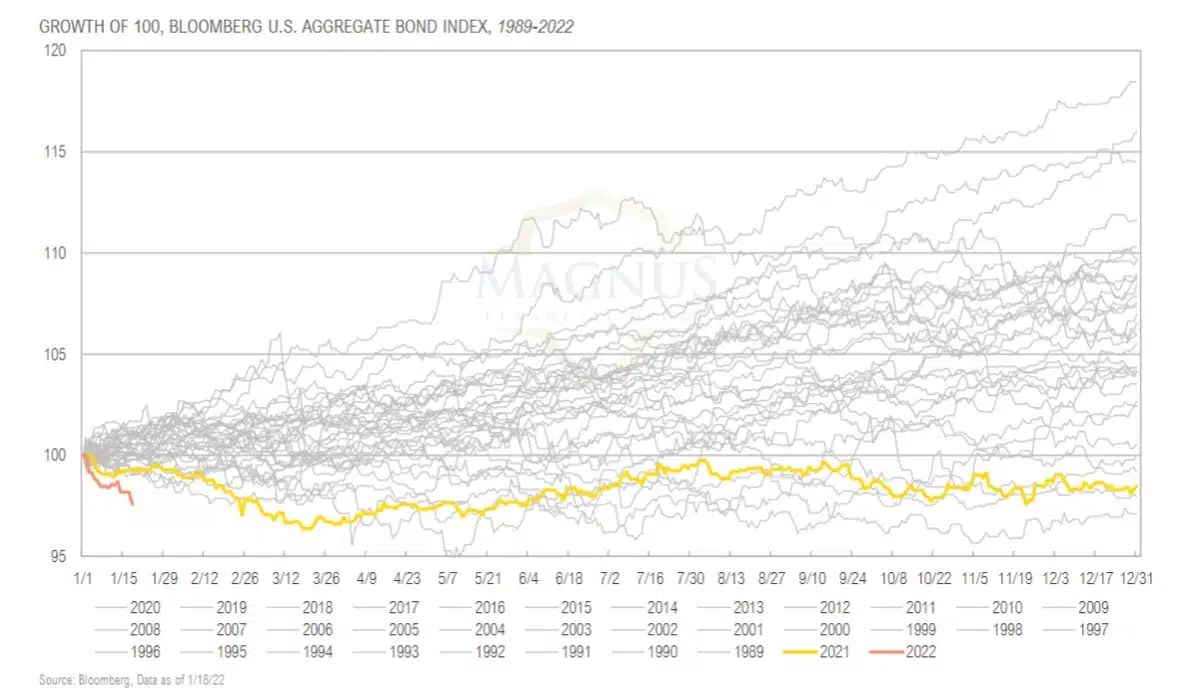

U.S. CORE BOND RETURNS

2021 was 3rd worst year for U.S. bonds since 1989 and 2022 is off to an even worse start

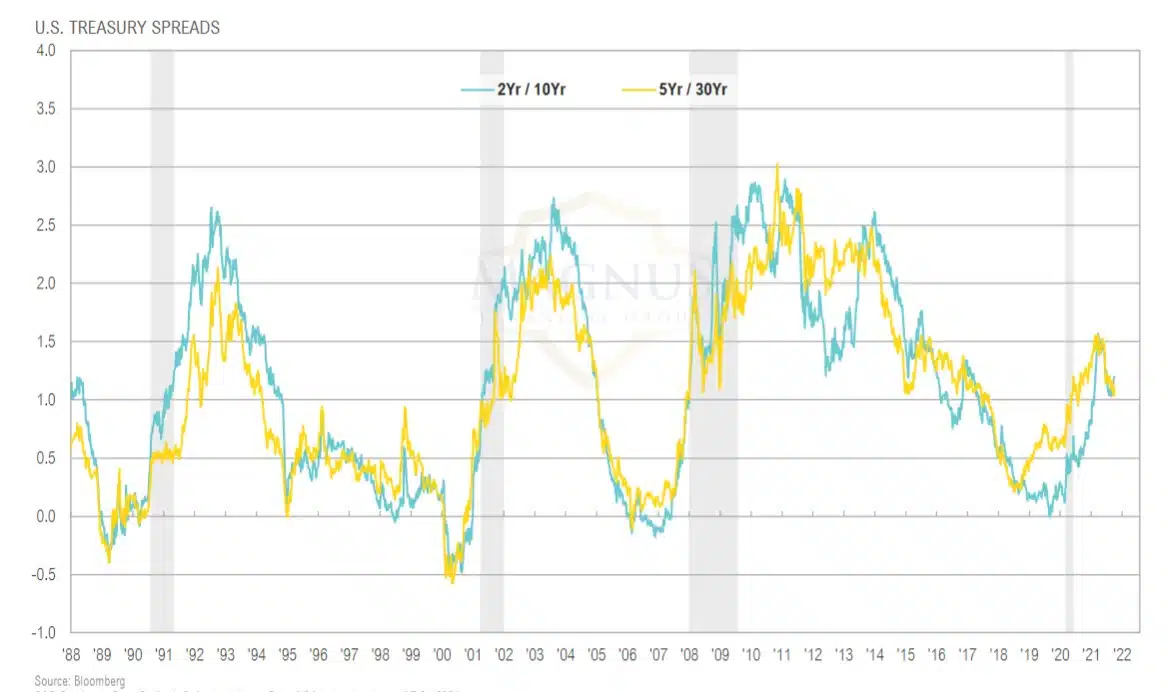

TREASURY SPREADS

Recent bear flattening, if it continues, could spell the end of this cycle via suggests potential trouble ahead for the Fed and the economy

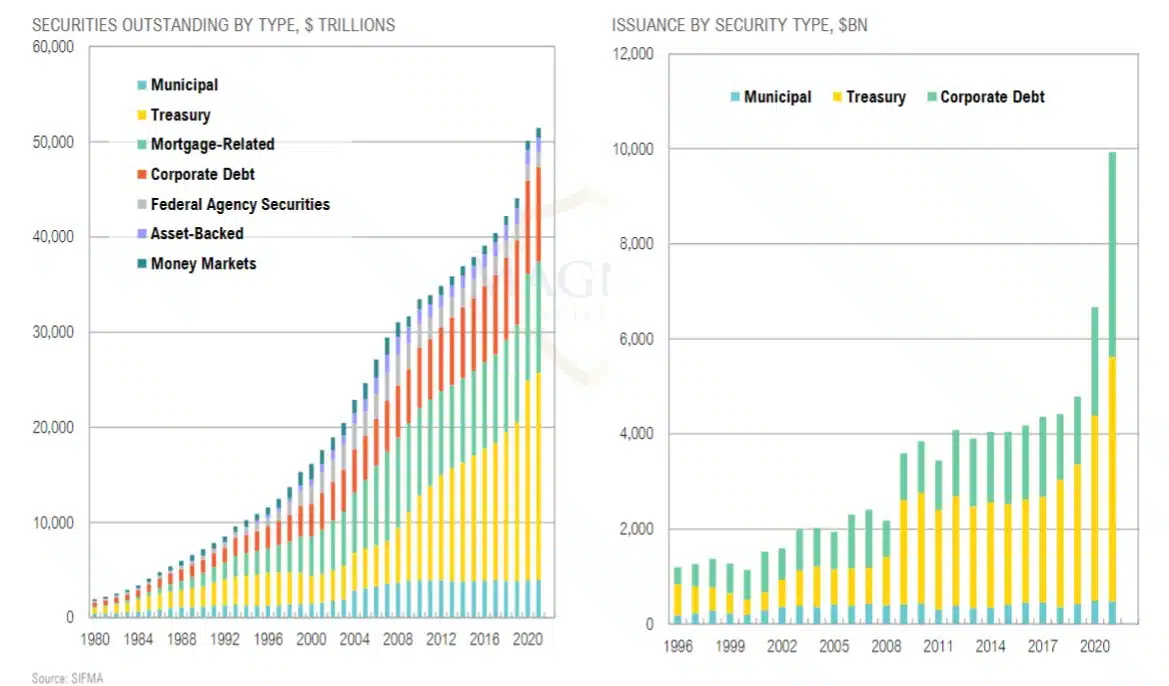

FIXED INCOME & CREDIT SECURITIES

Treasuries increasingly becoming the largest segment of the now $52 trillion fixed income and credit securities market

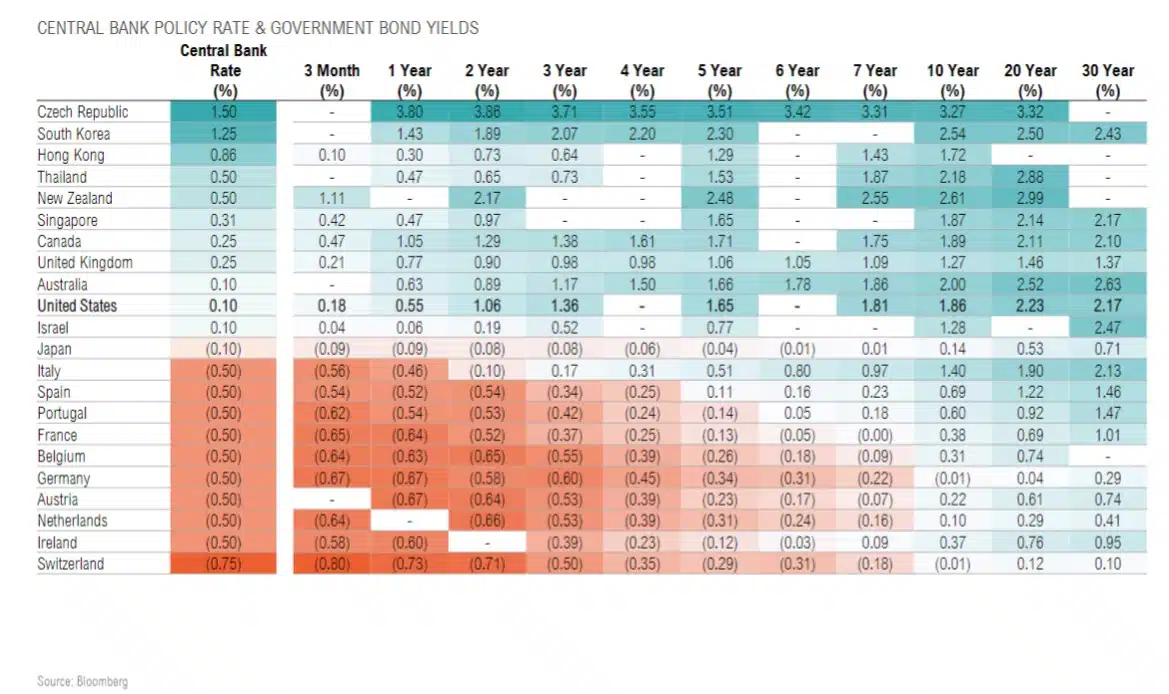

GLOBAL RATES

The U.S. bond market remains relatively higher yield, which could help keep U.S. rates somewhat contained

TREASURY MARKET

The treasury market has been an enabler of increasing deficit spending and debt levels… when will it become a “vigilante”?

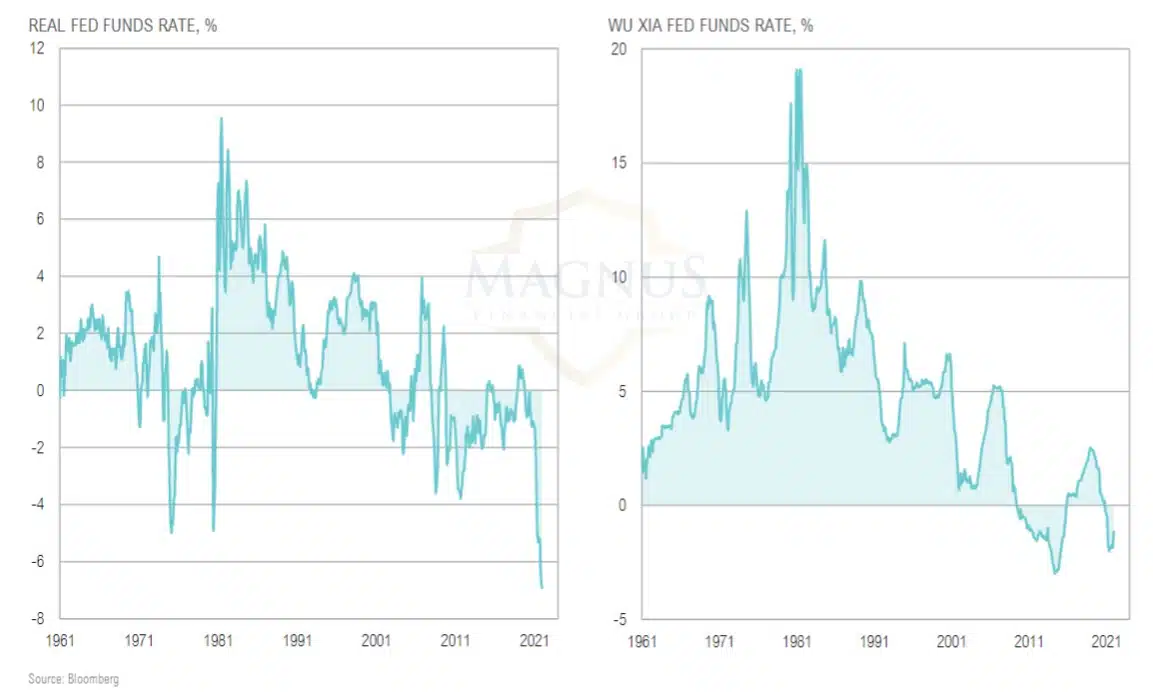

REAL INTEREST RATES

Powell is right: this time isn’t like the 1970s…from a capital allocation standpoint, it’s worse

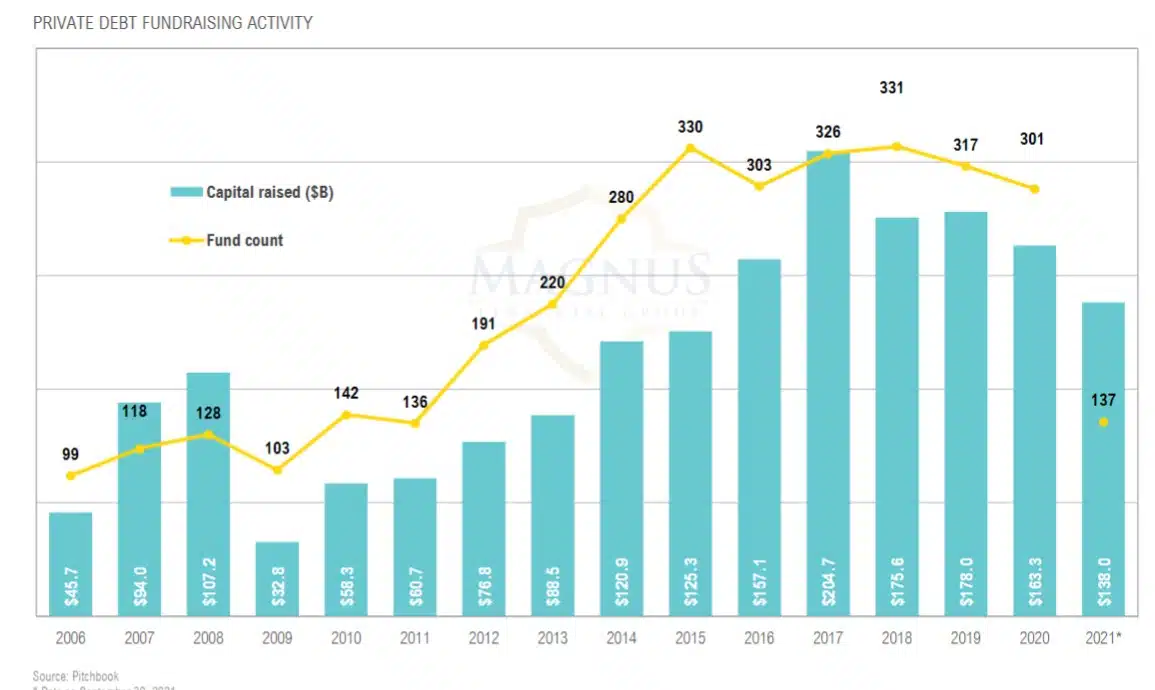

PRIVATE DEBT FUNDS

Private debt fundraising bounces back in Q3, but number of funds is on pace for lowest count since 2011

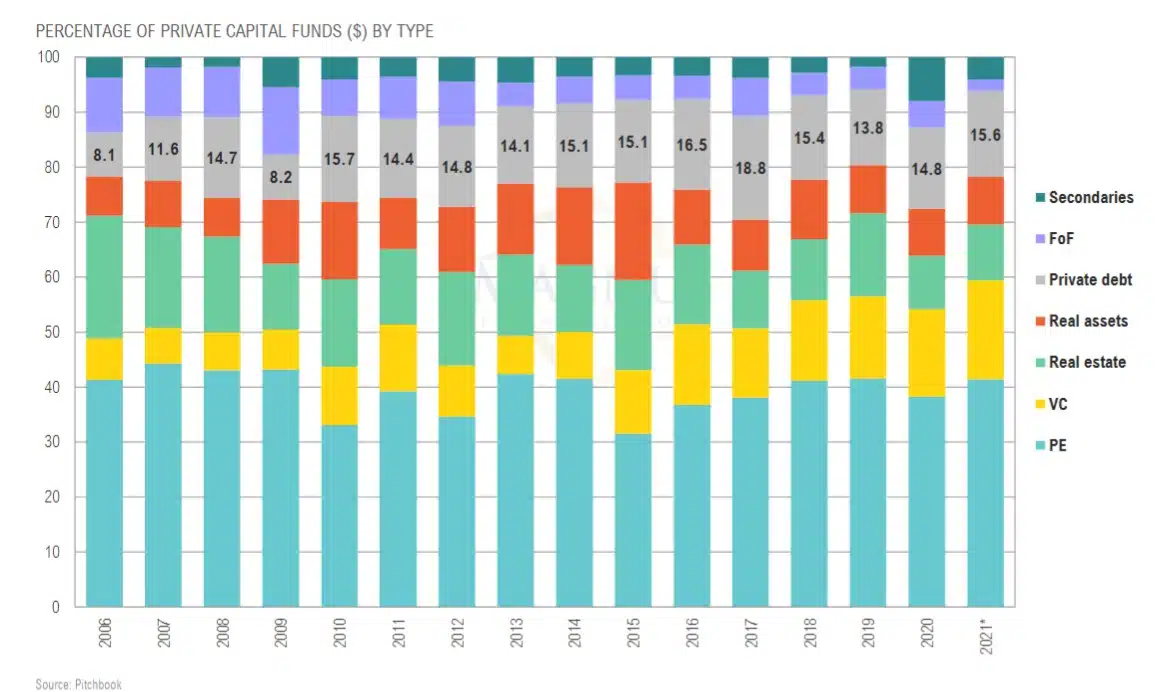

PRIVATE CAPITAL FUNDS

Private debt funds bounced back in Q3, now at more normal allocation levels

REAL ASSETS

We think the energy space is really cheap. What helps is we were not in the energy space before. The amount of capital available in the oil patch is disappearing… [It’s like the] real-estate industry in the early 1990s, where you had empty buildings all over the place, nobody had cash.

– Sam Zell, Equity Group Investments Founder, March 7, 2000

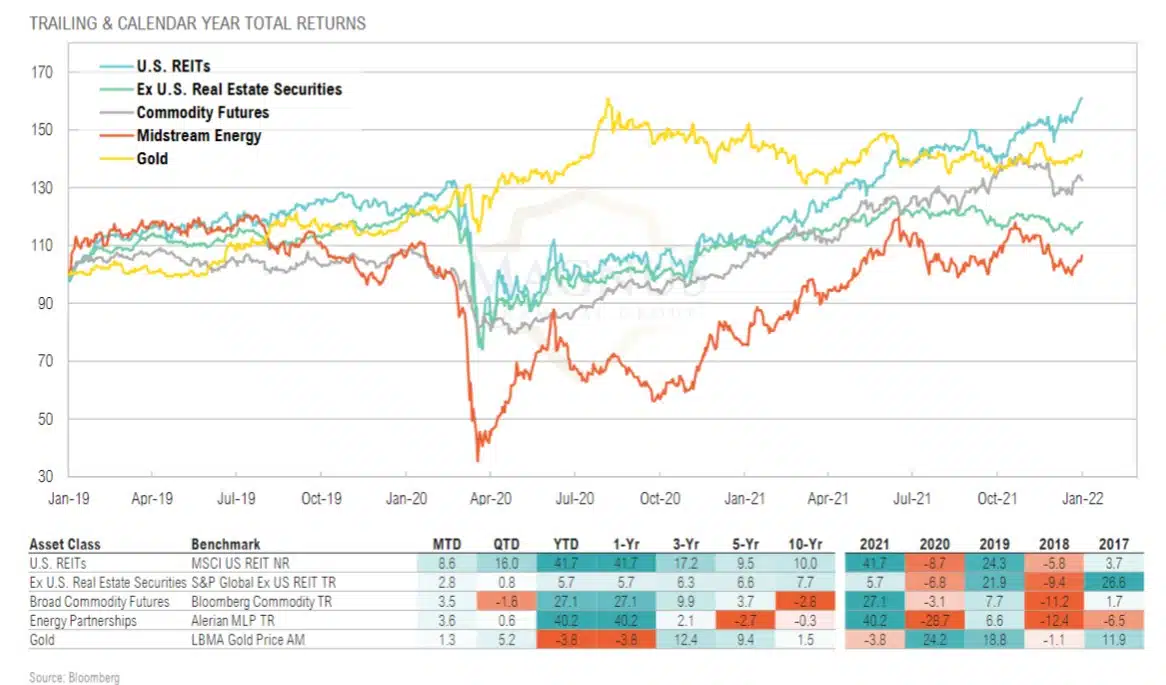

MARKET RETURNS SUMMARY

Real assets sold off in November initially on uncertainty around Covid restrictions and policy, but rallied into the end of the year

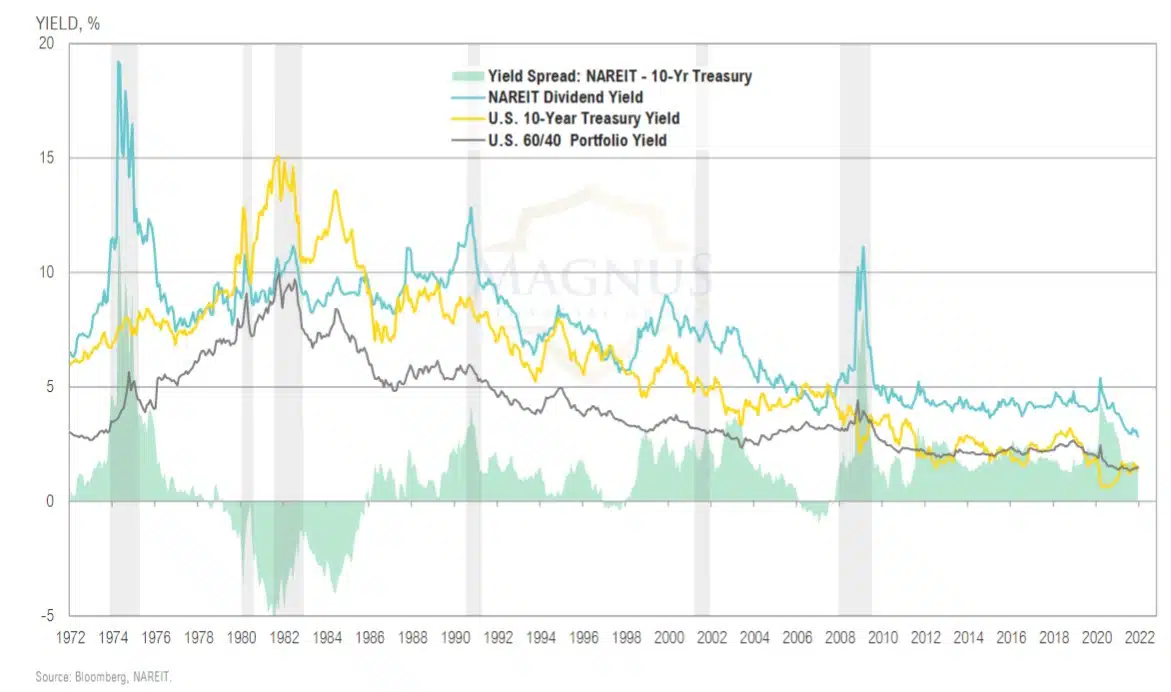

REITS

REIT yields may be currently attractive on a relative basis, but in keeping perspective they are at the lowest absolute levels in history

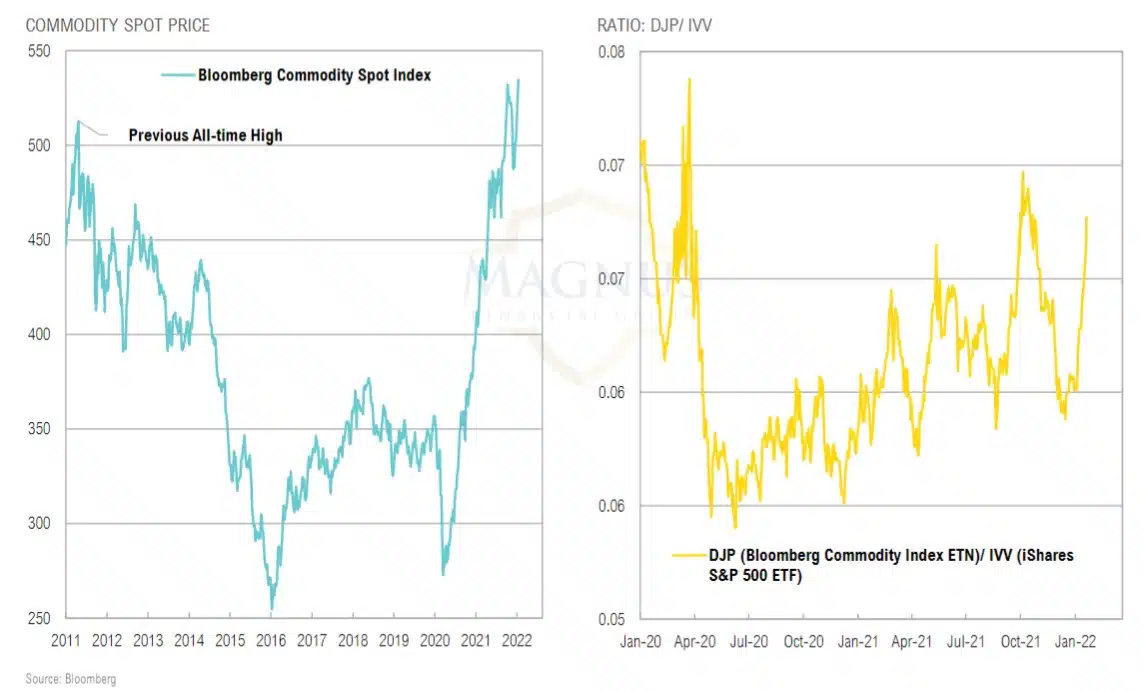

COMMODITIES VS. STOCKS

Commodities have outperformed stocks through the COVID-19 crisis

GOLD MINERS VS. STOCKS

We remain constructive on gold miners

OIL & NATURAL GAS

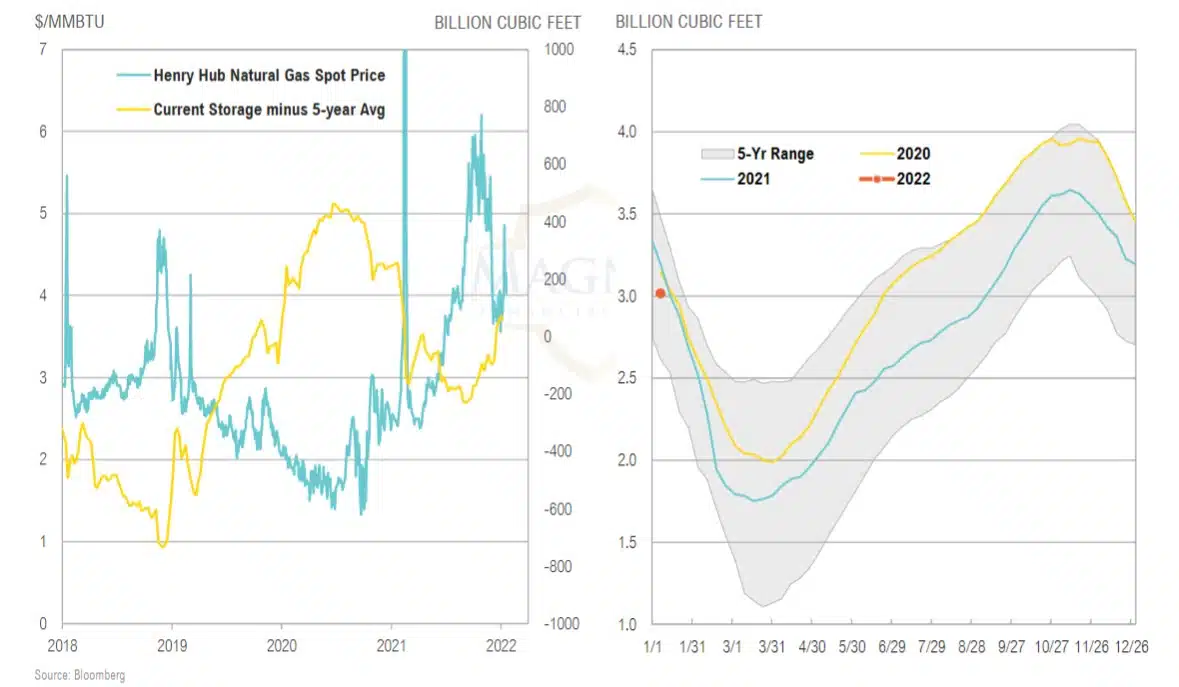

Oil and natural gas producers have been cautious to bring rigs back online despite rising prices

NATURAL GAS DEMAND

As natural gas inventories started to replenish, prices normalized, but remain elevated

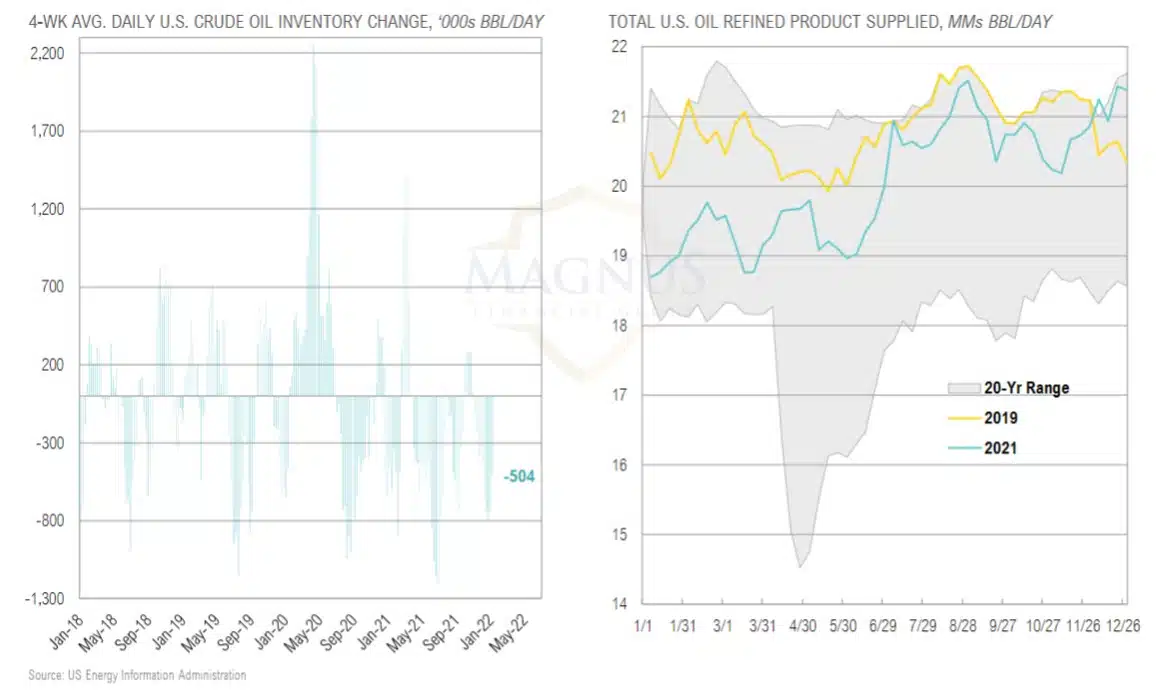

CRUDE OIL DEMAND

Crude oil inventories have been drawn down each week since November, demand for refined oil remains near multi-decade highs

YIELDS

Midstream yields remain substantially above REITs, free cash flow yields of real assets and infrastructure category remain attractive

GOLD MINER FUNDAMENTALS

Gold miner performance has diverged from fundamentals, the industry has seen broad deleveraging and improving cash generation

GOLD VS. NEGATIVE YIELDING DEBT & REAL YIELDS

Real yields rose modestly, and aggregate amount of global negative yielding debt continues to fall

OPPORTUNISTIC

Excesses in one direction will lead to an opposite excess in the other direction.

– Bob Farrell, Former Head of Research, Merrill Lynch

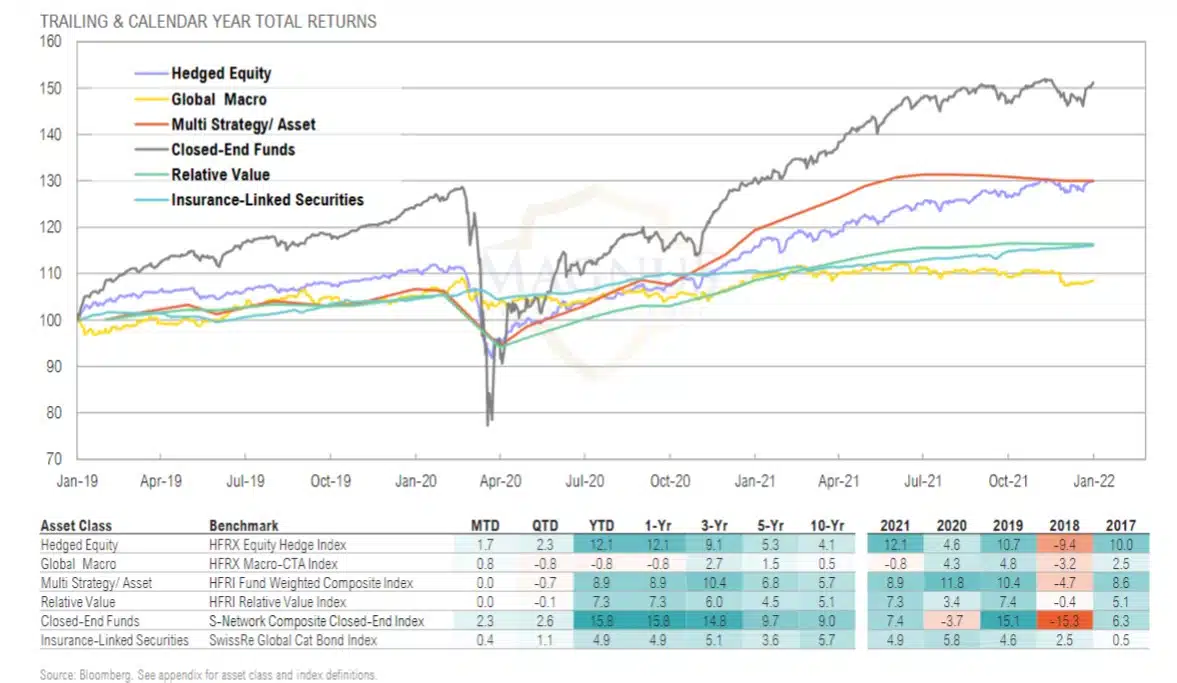

MARKET RETURNS SUMMARY

Closed-end funds and hedged equity outperformed for the quarter; global macro had a disappointing end to a lackluster year

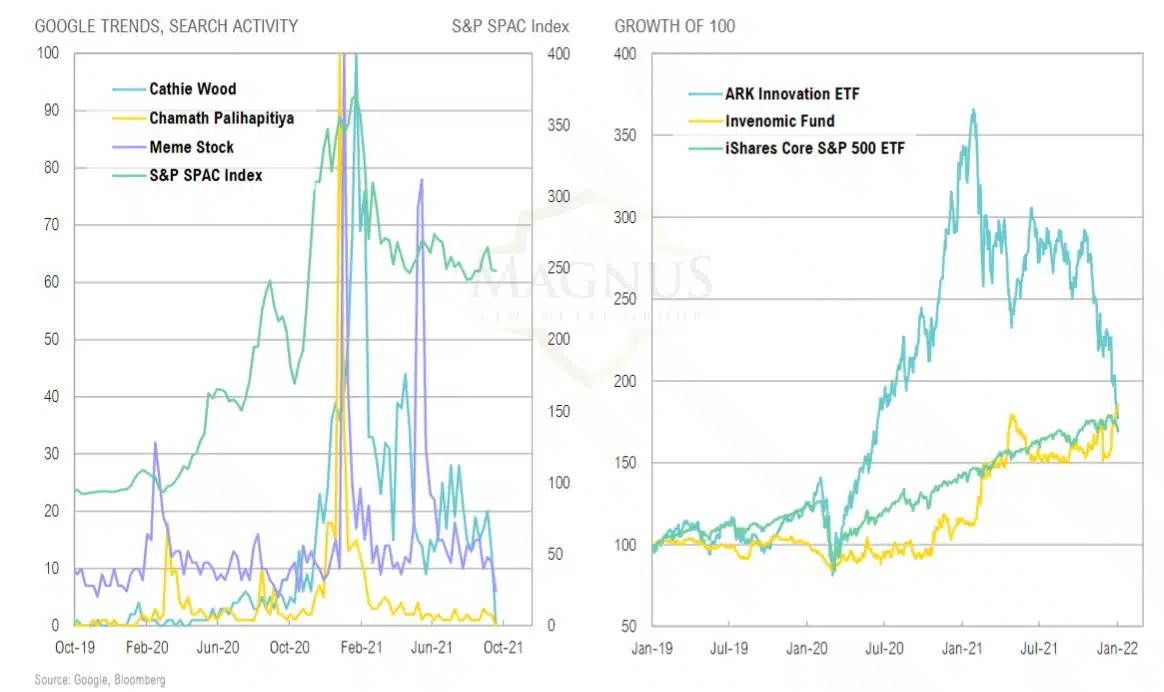

RETAIL MANIA

Retail mania has mostly faded for now

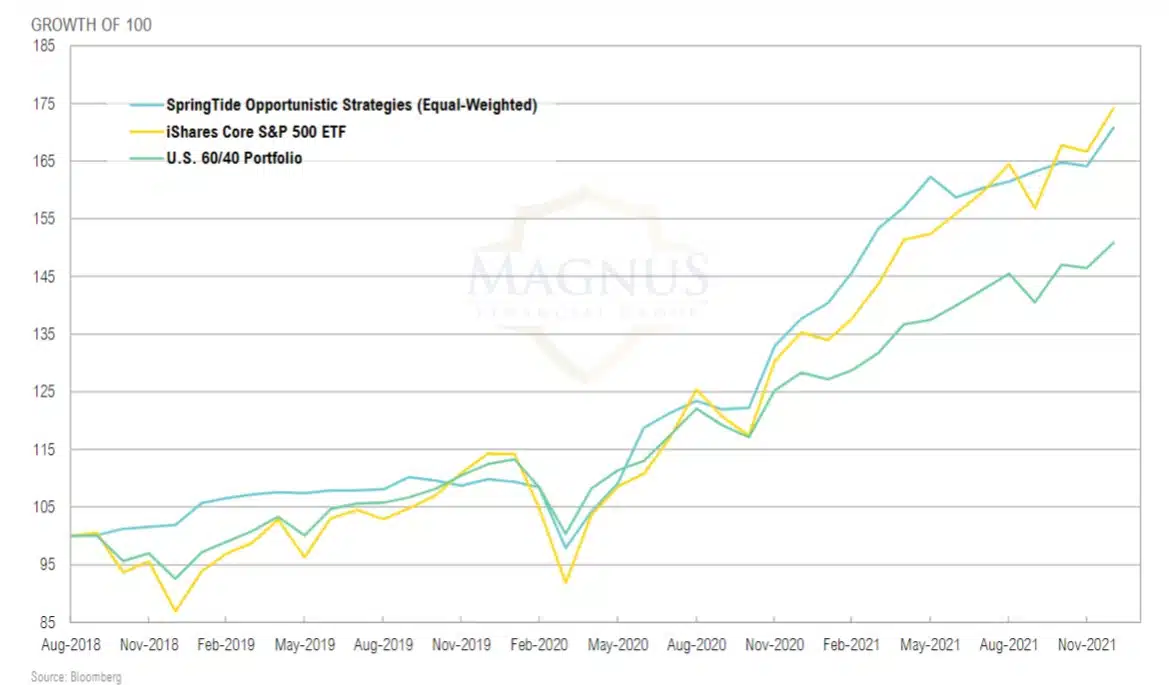

OPPORTUNISTIC BUCKET

Tactical opportunities have been working to mitigate volatility while keeping pace with the broader equity market

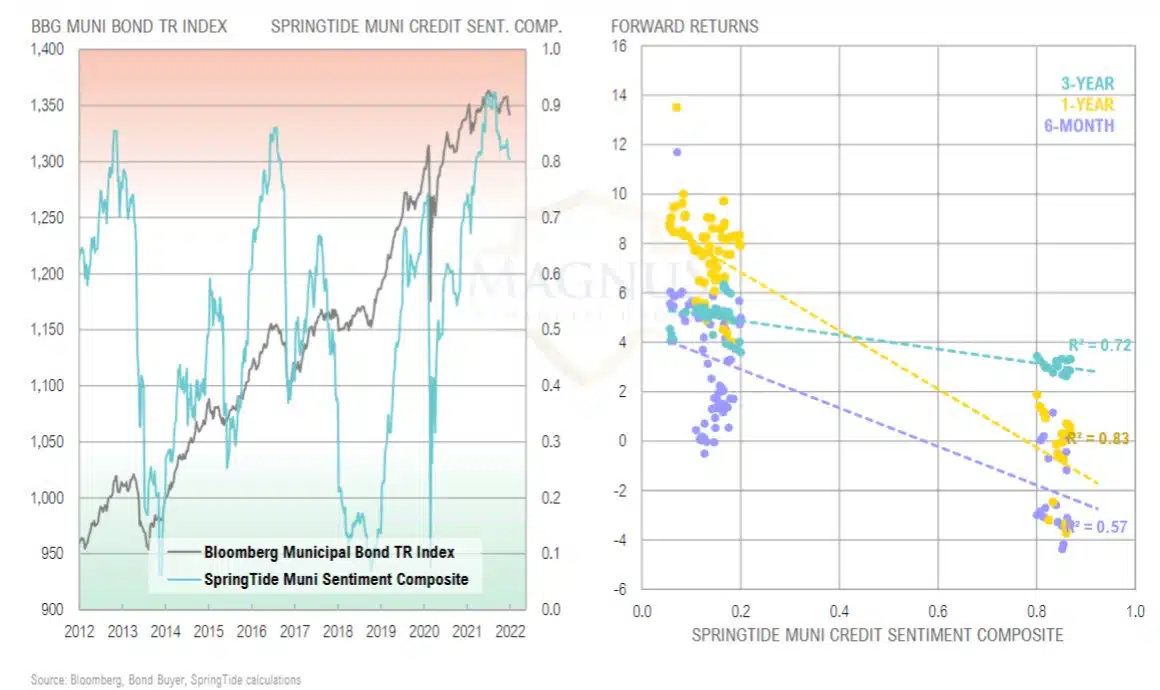

OPP MUNI CREDIT

Muni credit sentiment remains elevated, historically associated with lower-than-average forward returns

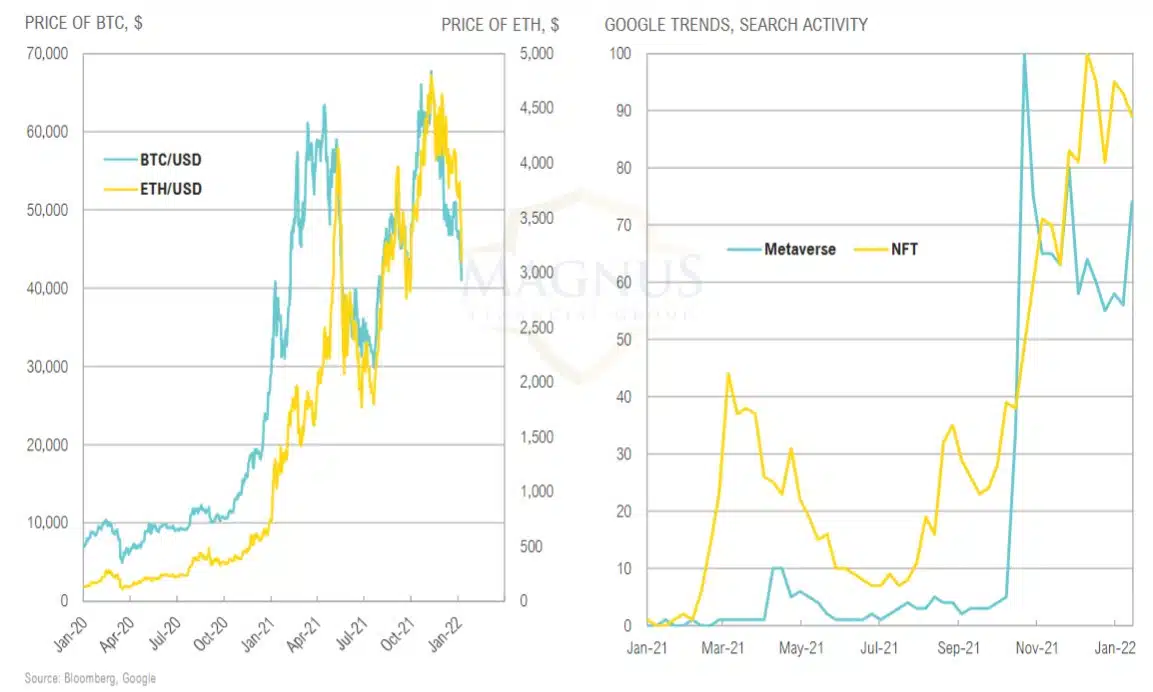

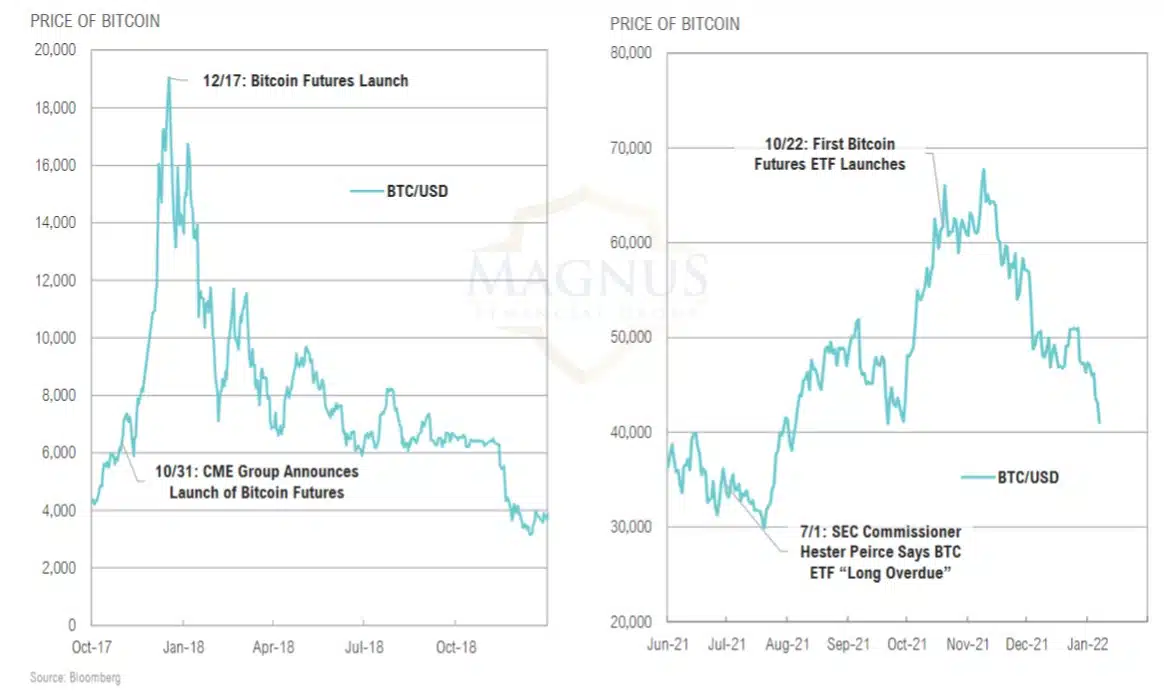

CRYPTOCURRENCIES

While higher profile digital asset prices have cooled off, interest remains high in underlying themes

Bitcoin ETF launch was another “buy the rumor, sell the news” event

ASSET ALLOCATION

Nobody knows how this is going to turn out. This is an experiment.

– Howard Marks, Co-chairman, Founder Oaktree Capital Management, 2021

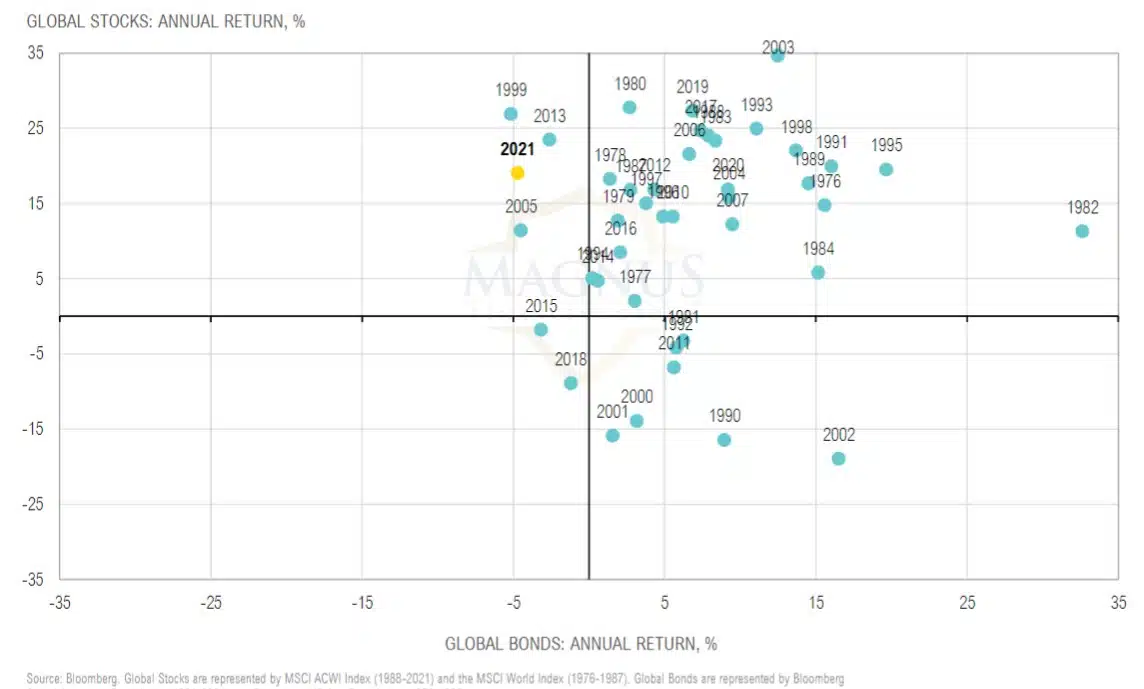

STOCKS & BONDS

2021 was an unusual year for global stocks and bonds (and again highlighting the unusual predicament the Fed is in)

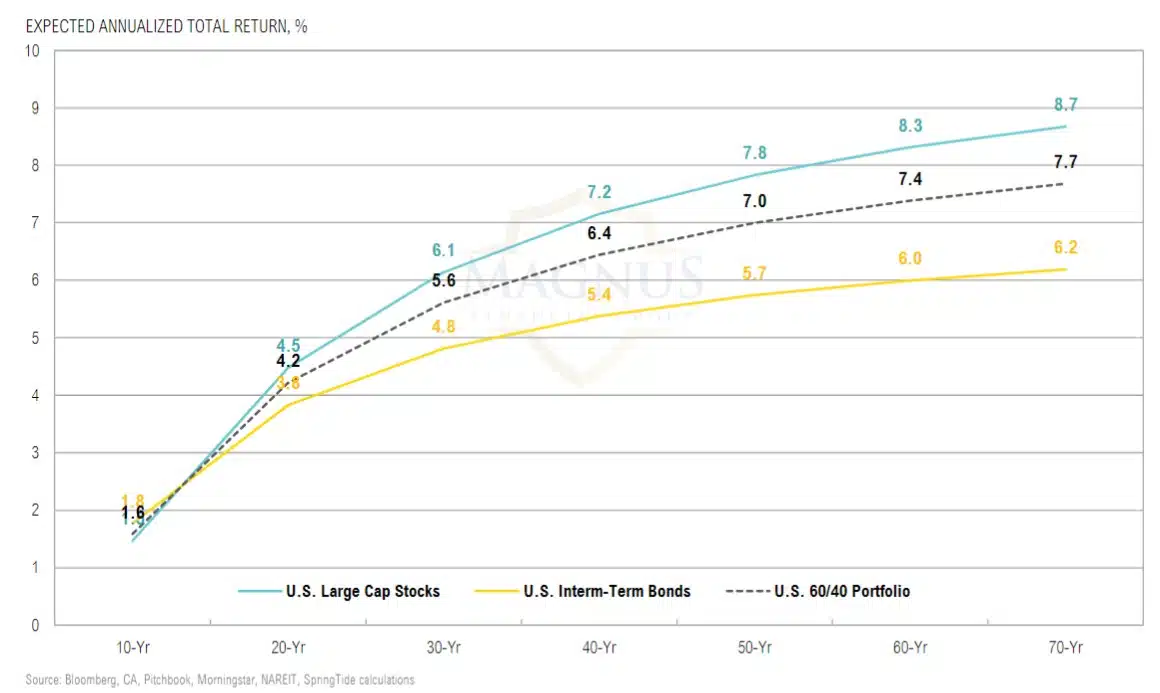

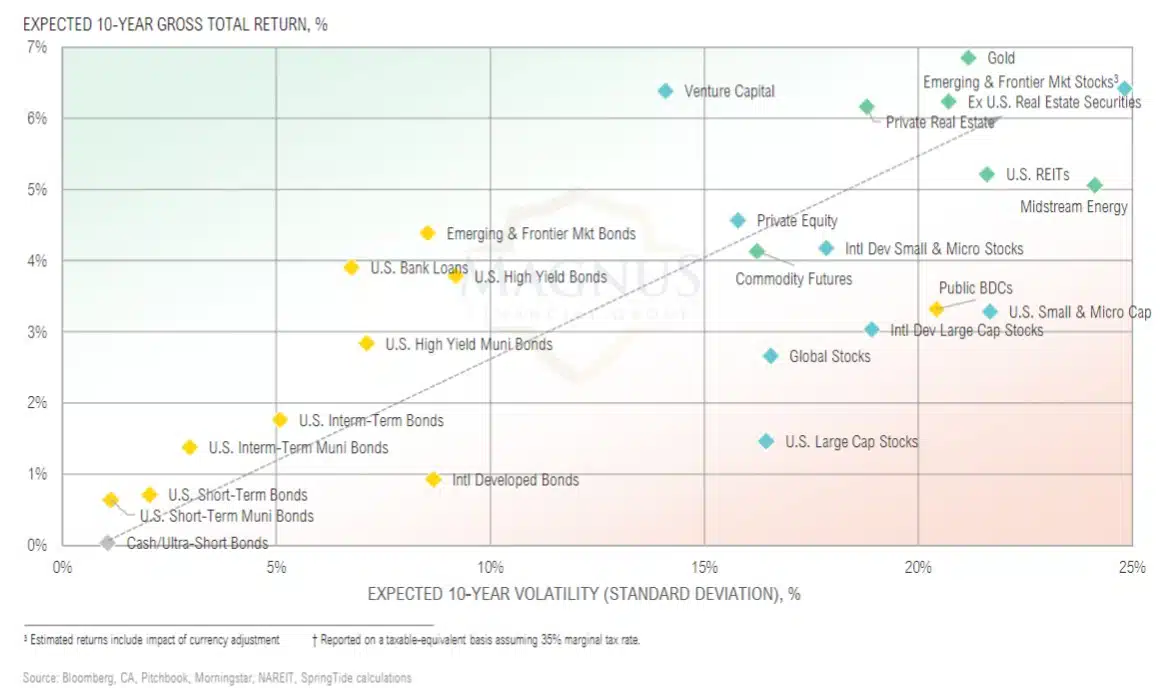

CMEs

Expected 10-year returns for domestic equities fell modestly as valuations rose while expected returns for bonds rose with yields

Some good news: longer-term return expectations hold relatively stable as the mean reversion of higher valuations is distributed over a longer time frame