“The U.S. continues to be a pace setter, driven by consistent consumer spending as well as tech investments in AI and data centers… But overall, while growth is cooling somewhat, and we’re keeping an eye on the labor market, America’s economic engine is indeed still humming.”

Jane Fraser, Citigroup CEO

Cartoon

Bubblicious

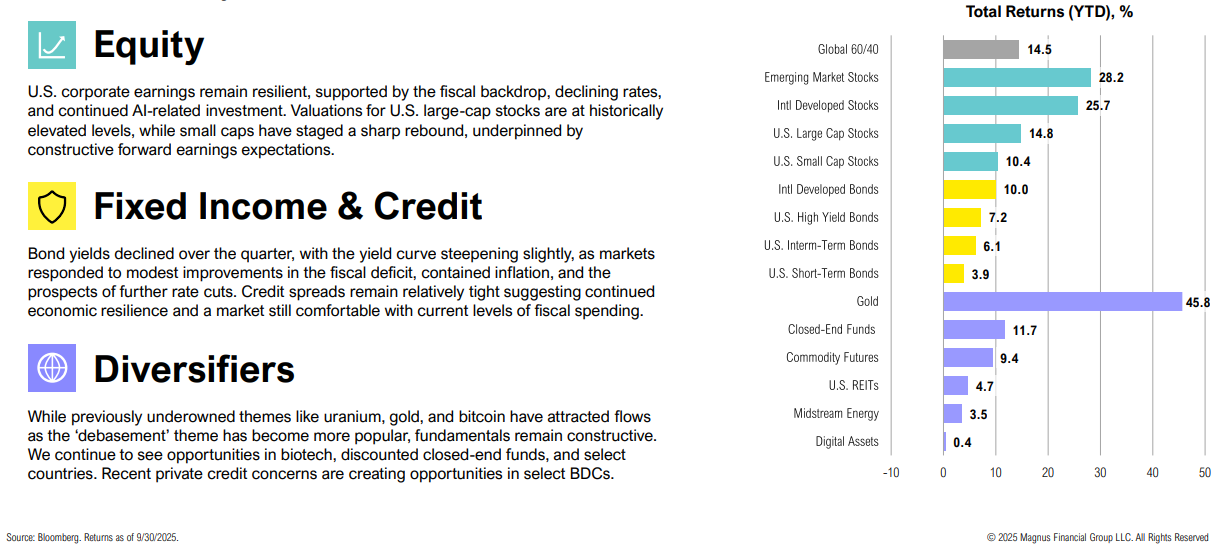

Summary

A concise review of the prior quarter, portfolio positioning and rationale, and an outline of the key themes and asset allocation priorities for the quarter ahead.

Market Commentary

Positioning

“Do I buy Treasuries when government owes $38tn, corporate bonds with spreads at 20-year lows, stocks trading on a 40x CAPE, or gold that’s just gone vertical? Tricky.”

Michael Hartnett, BofA/Merrill Lynch Chief Investment Strategist

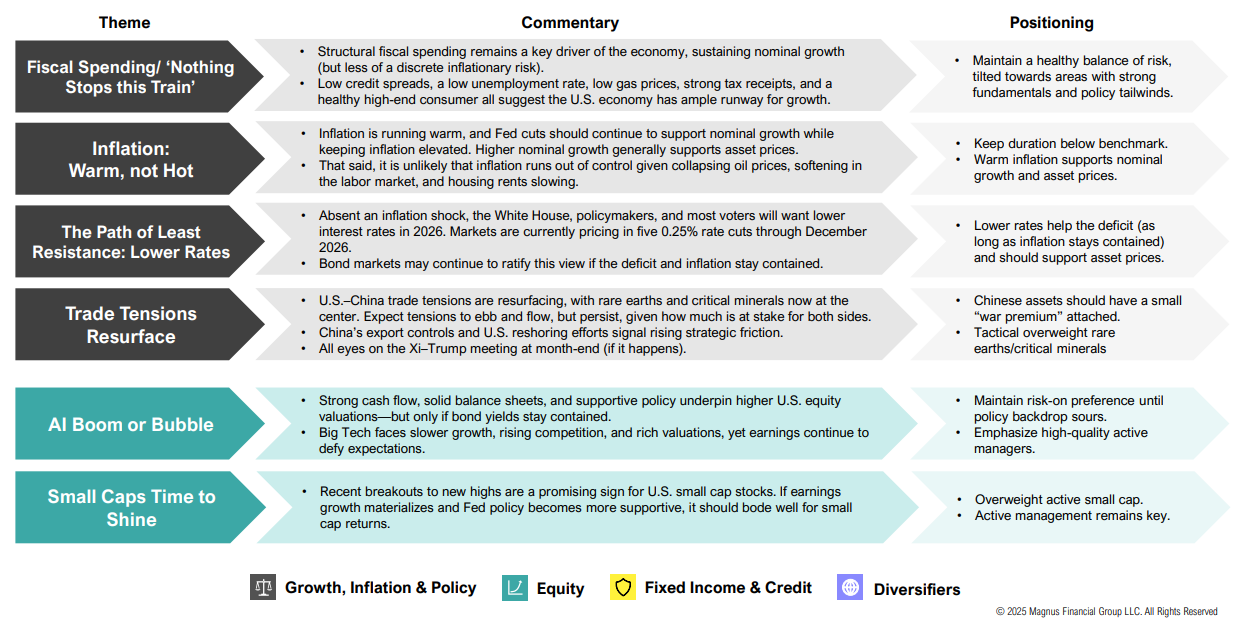

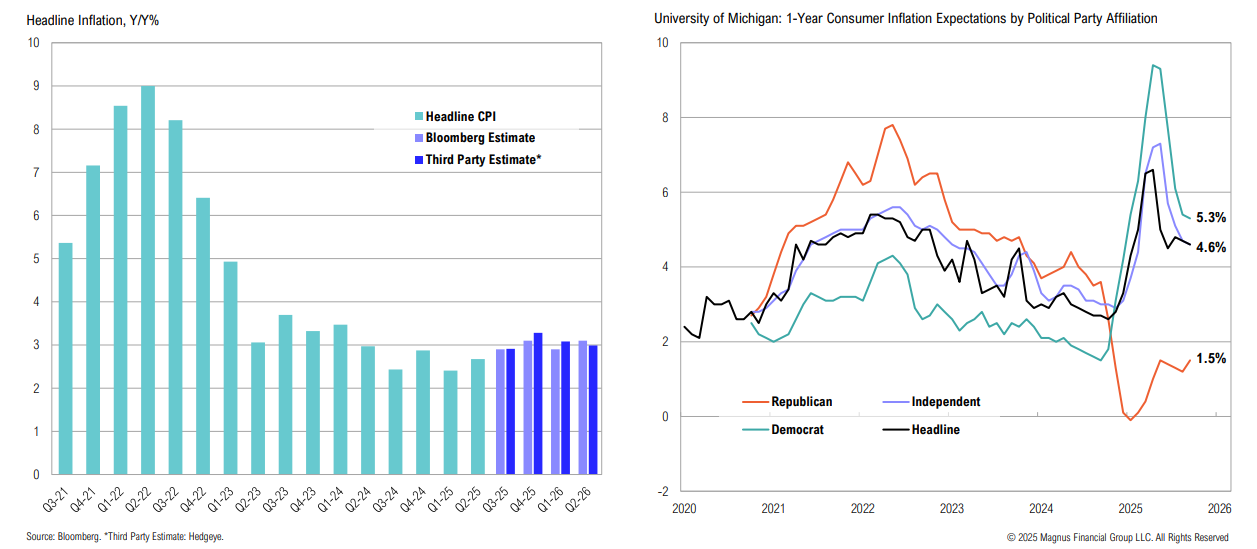

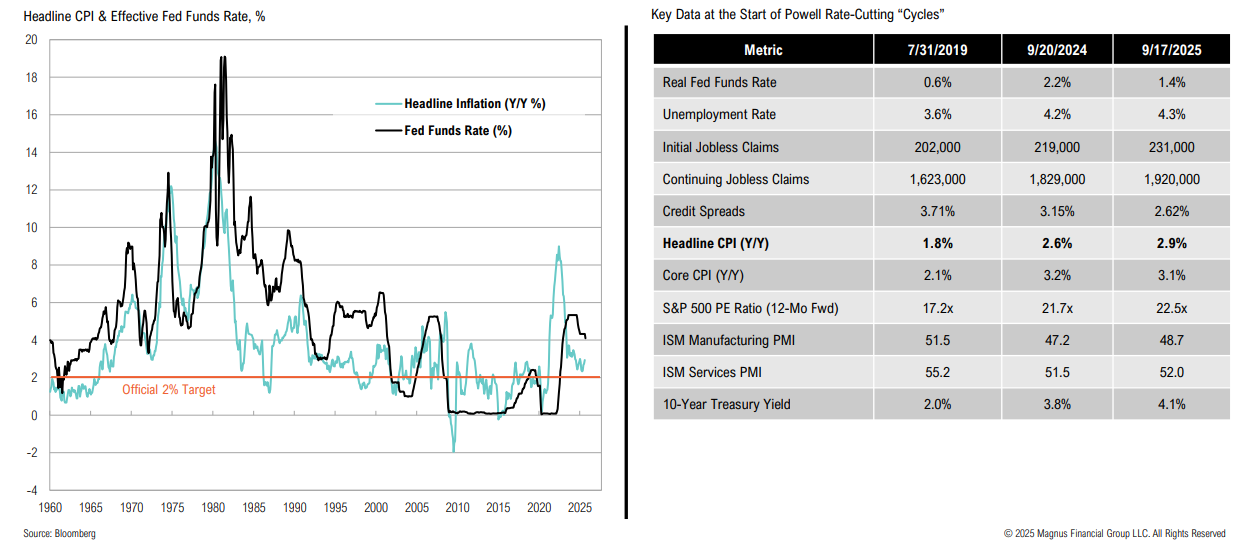

Growth, Inflation & Policy

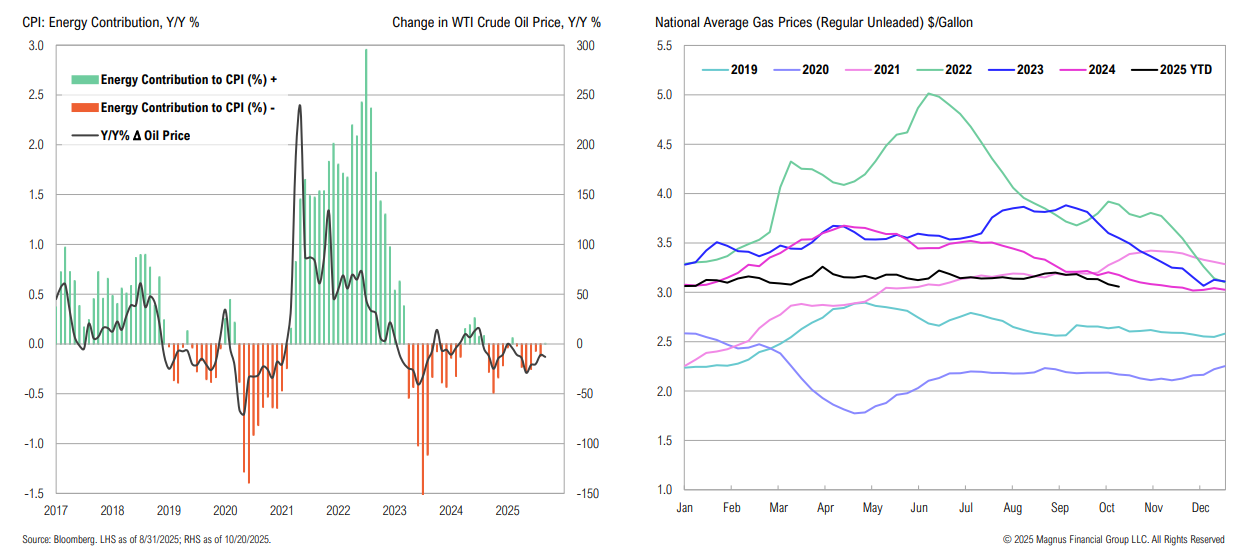

Structural fiscal spending remains a key driver of the economy, sustaining nominal growth—but with less of a discrete inflationary risk. While stimulative policy should keep inflation elevated, it is unlikely that inflation runs out of control given collapsing oil prices, softening in the labor market, and housing rents slowing. Monetary policy expected to ease dramatically in 2026.

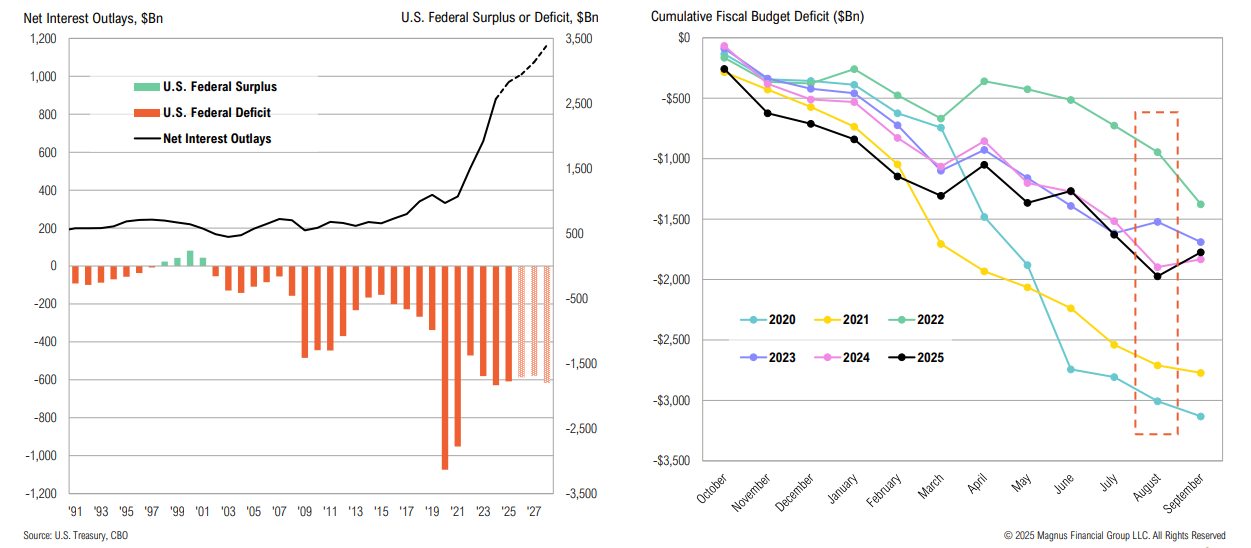

Fiscal Deficit

The fiscal deficit ended FY’25 at $1.78tn, less than the expected $1.94tn deficit, and a marginal improvement over FY’24

On a dollar basis, the U.S. is still running very large deficits, but as a percentage of GDP, it is starting to improve

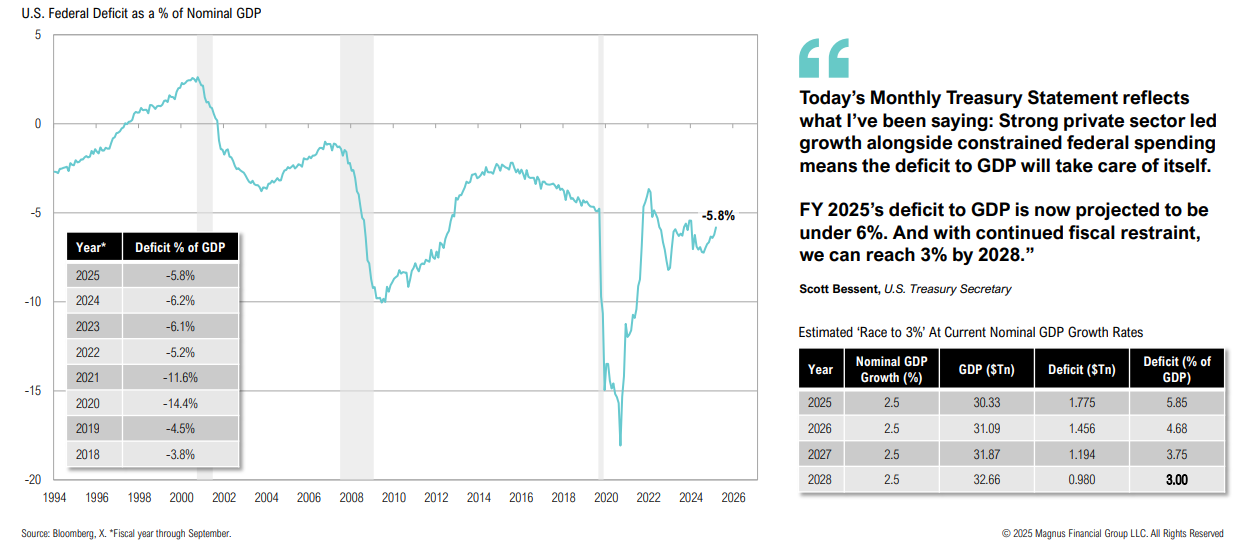

Tariff revenues contributed to the improvement in the U.S. fiscal deficit; the impact of tariffs on suppliers has been more manageable than initially expected

Economic Growth

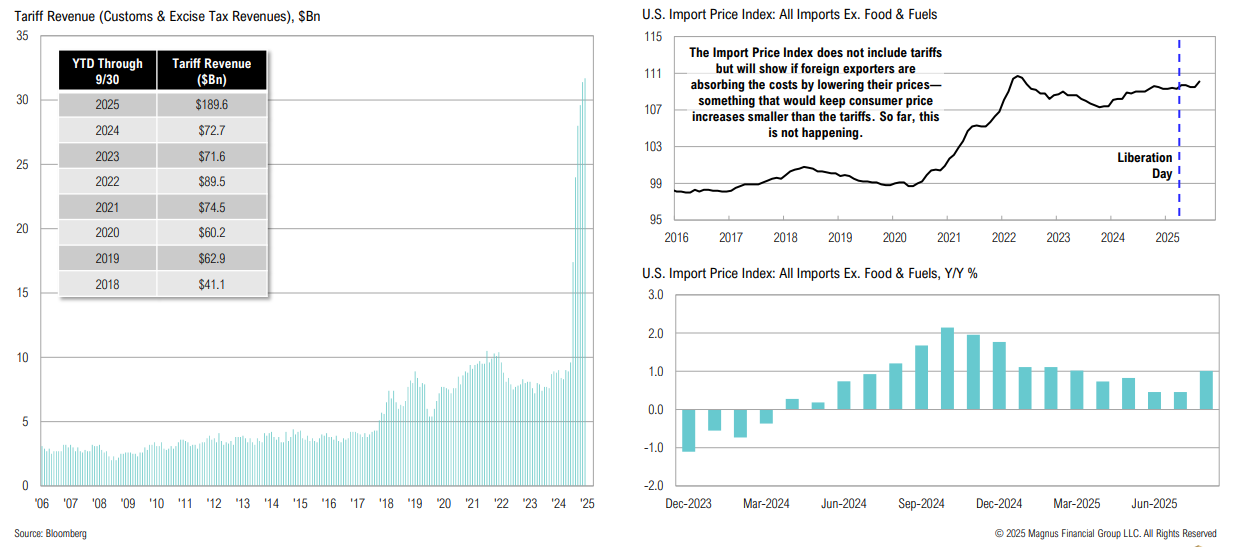

Retail sales remain strong; estimates show economic growth improving in Q1’26

Consumer

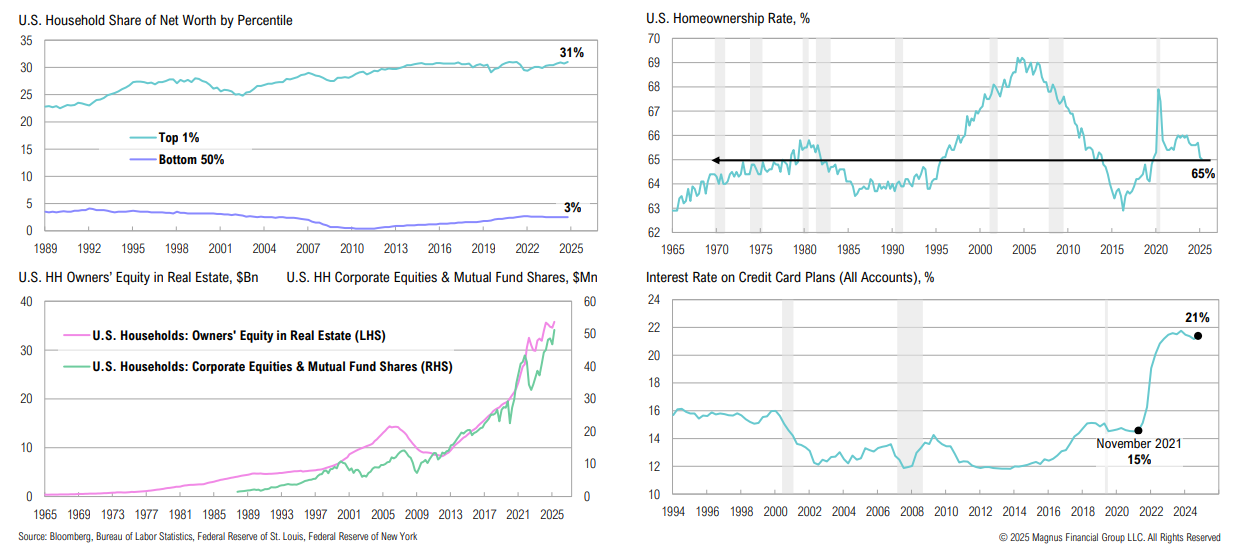

The K-shaped economy: those with wealth tied to stocks and rising home values are doing well, while others are struggling with high rates and affordability issues

Labor Market

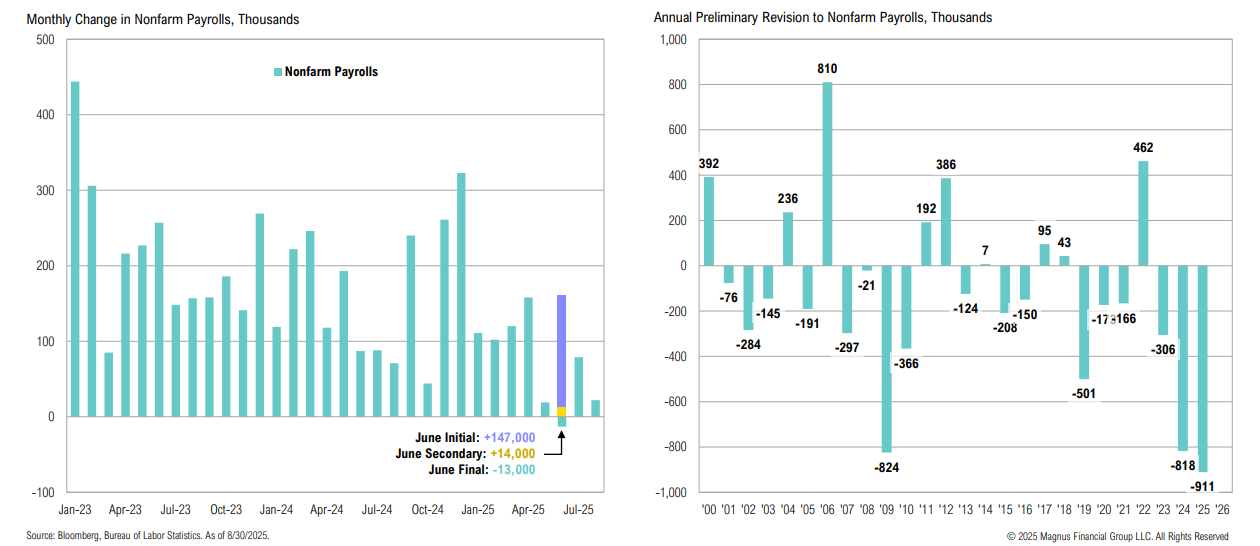

Recent notable downward revisions to labor market data (including the first monthly drop in employment since 2020) suggest the labor market is losing some momentum

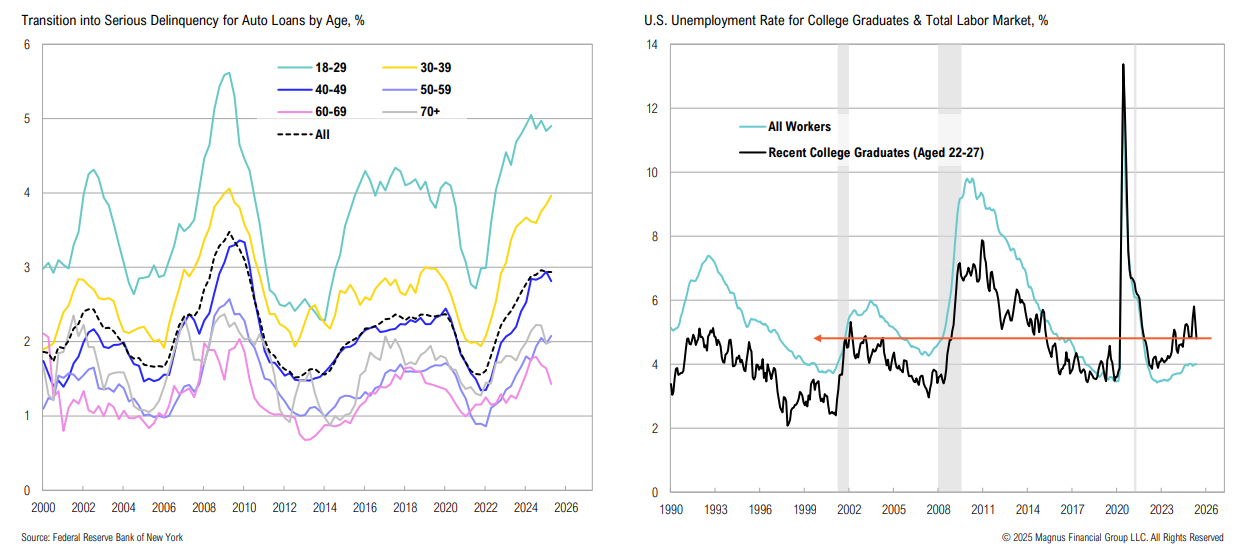

The collapse of First Brands and Tricolor highlights how rising auto loan delinquencies and weak consumer credit are rippling through the auto sector; delinquencies are highest among 18–29-year-olds, who also face elevated unemployment

Fed Policy

Inflation has been above the Fed’s official 2% target for 55 months and expectations are for it to remain there for the foreseeable future

The Powell Fed has cut rates twice with CPI >2%

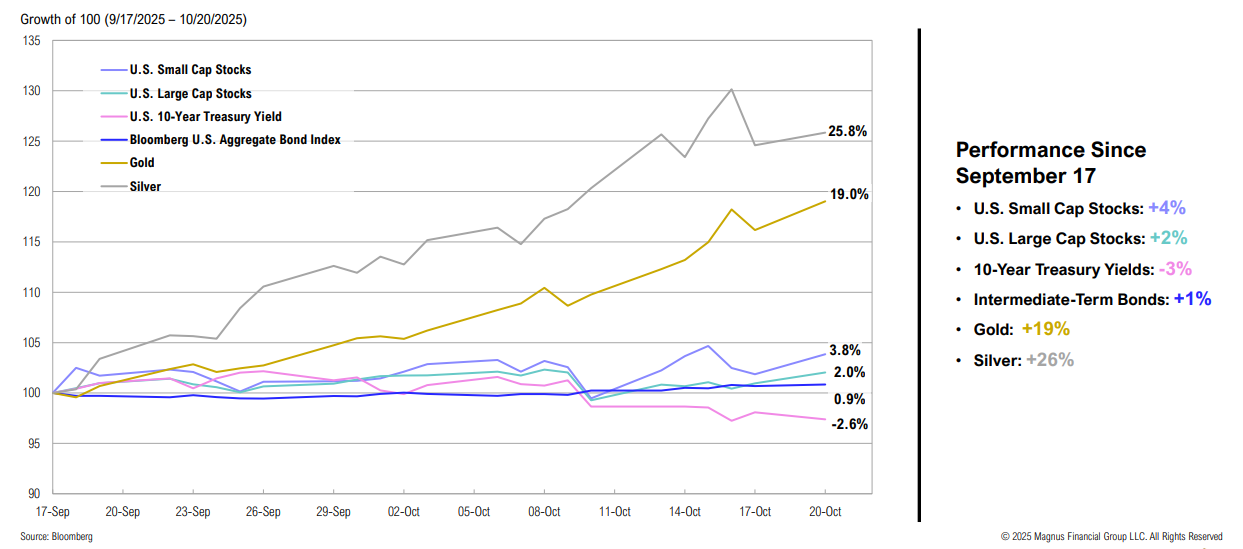

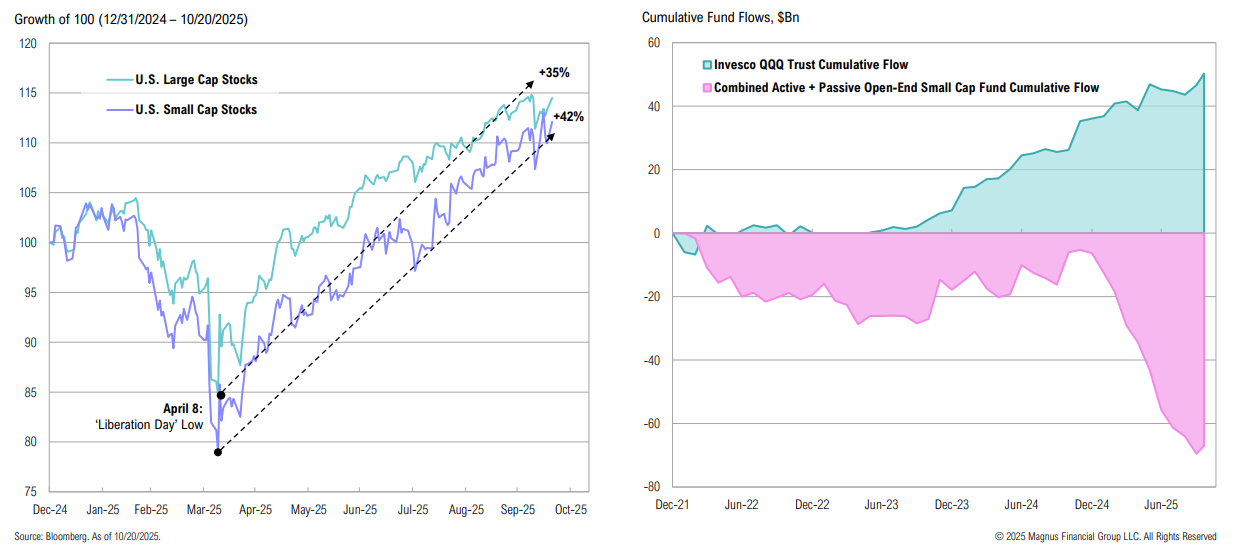

Since the Fed cut rates on September 17, markets have responded as if it were a meaningful pivot, with precious metals & small caps outperforming

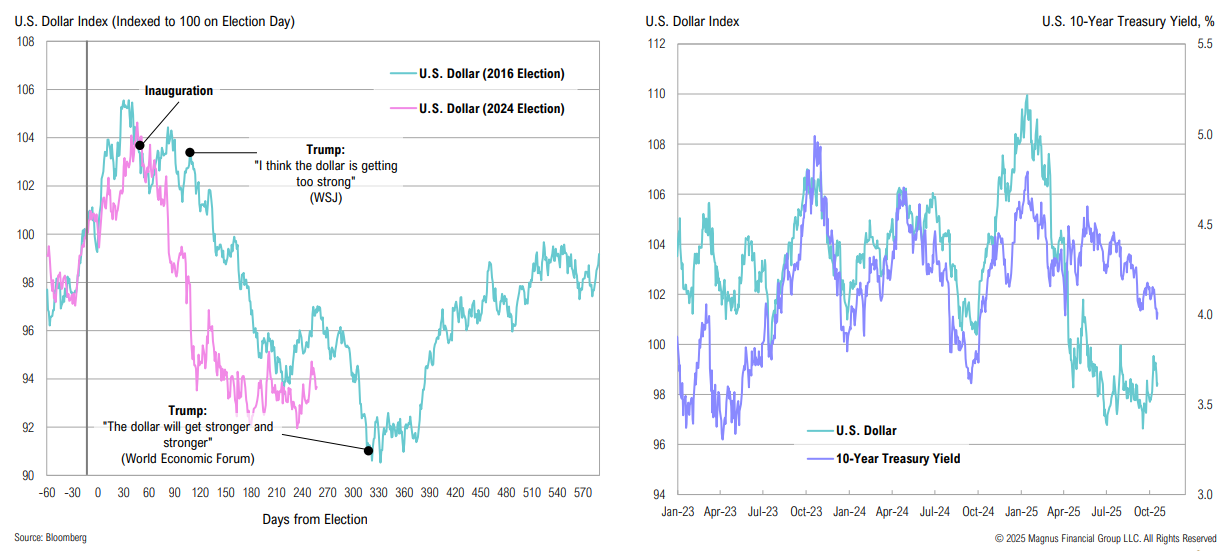

U.S. Dollar

A weaker dollar is also part of Trump’s policy preference (boost U.S. exports, support domestic manufacturing); the U.S. Dollar Index reached a three-year low on September 16

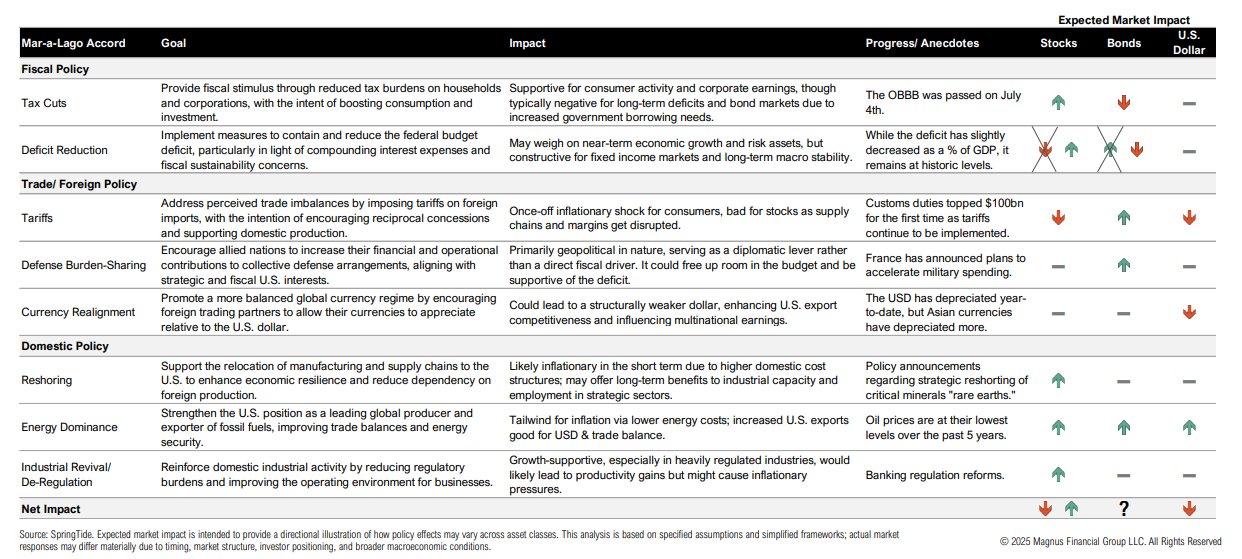

Mar-A-Lago Accord

Policy backdrop is mixed: several have the potential to be net positive for growth and risky assets over time, but almost all come with trade-offs and hinge on bond market ‘consent’

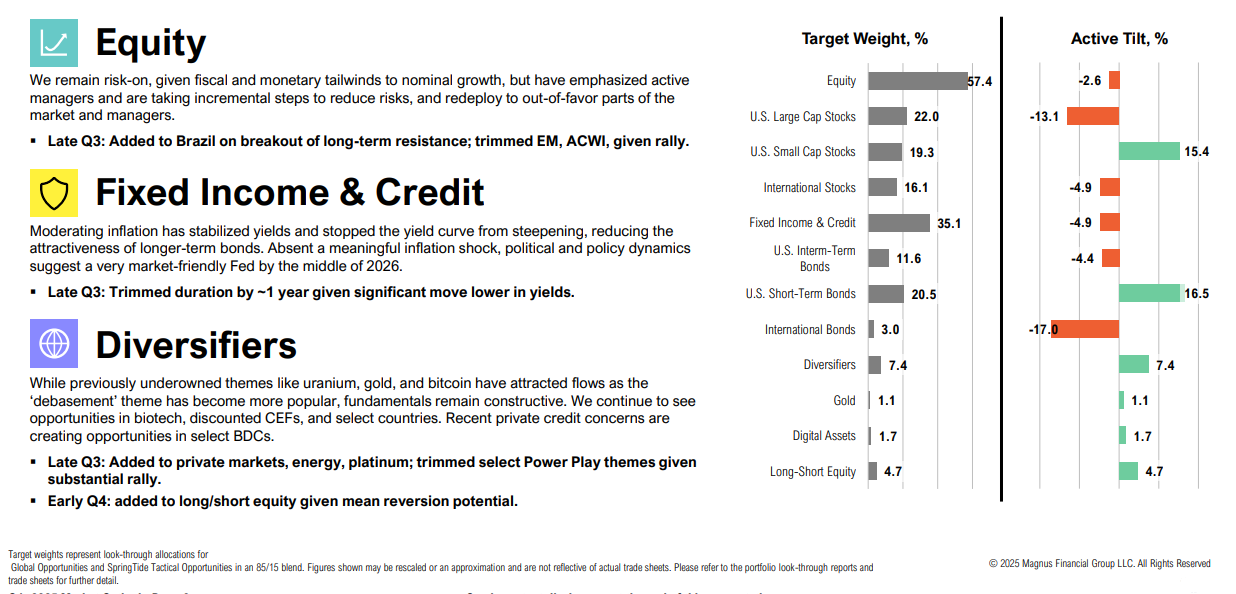

Equity

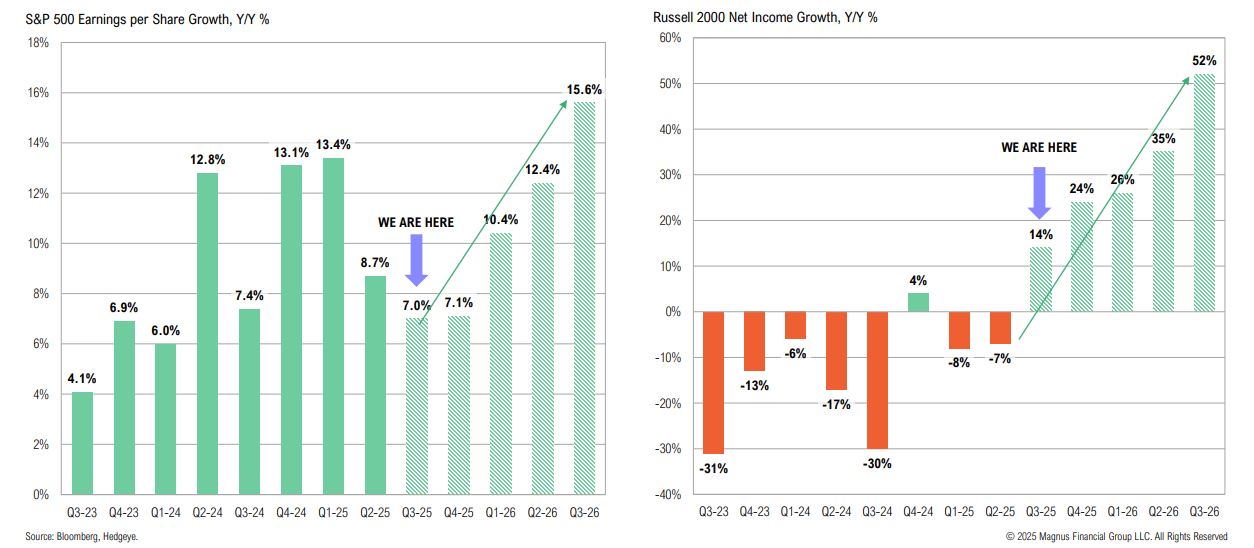

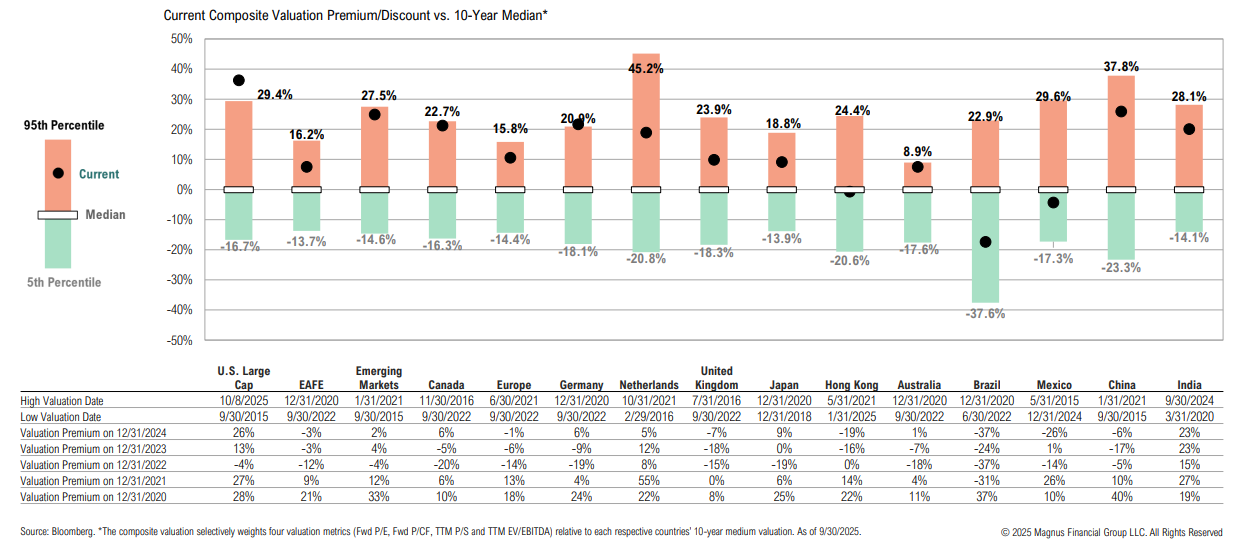

U.S. corporate earnings remain resilient, supported by continued AI-related investment, though trade tensions continue to inject volatility. Valuations for U.S. large-cap stocks are at historically elevated levels, while small caps have staged a sharp rebound, underpinned by constructive forward earnings expectations.

U.S. Large Cap Stocks

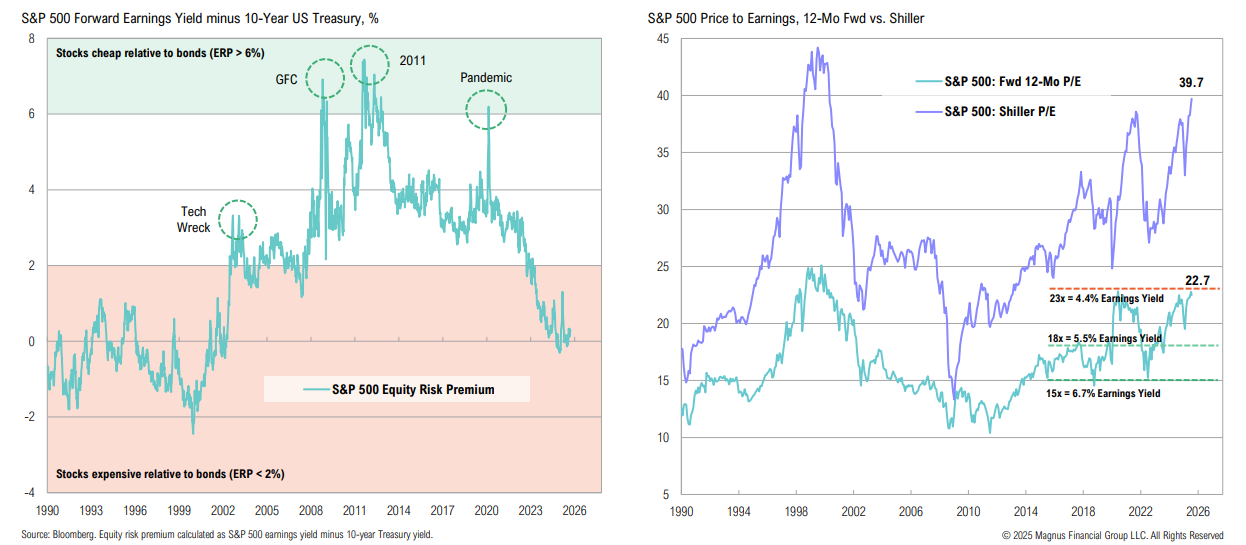

Using a simple yield-to-earnings yield comparison (ERP), U.S. stocks are less attractively priced vis-à-vis bonds than at any point since the 1990s; U.S. large cap valuations are nearing extremes

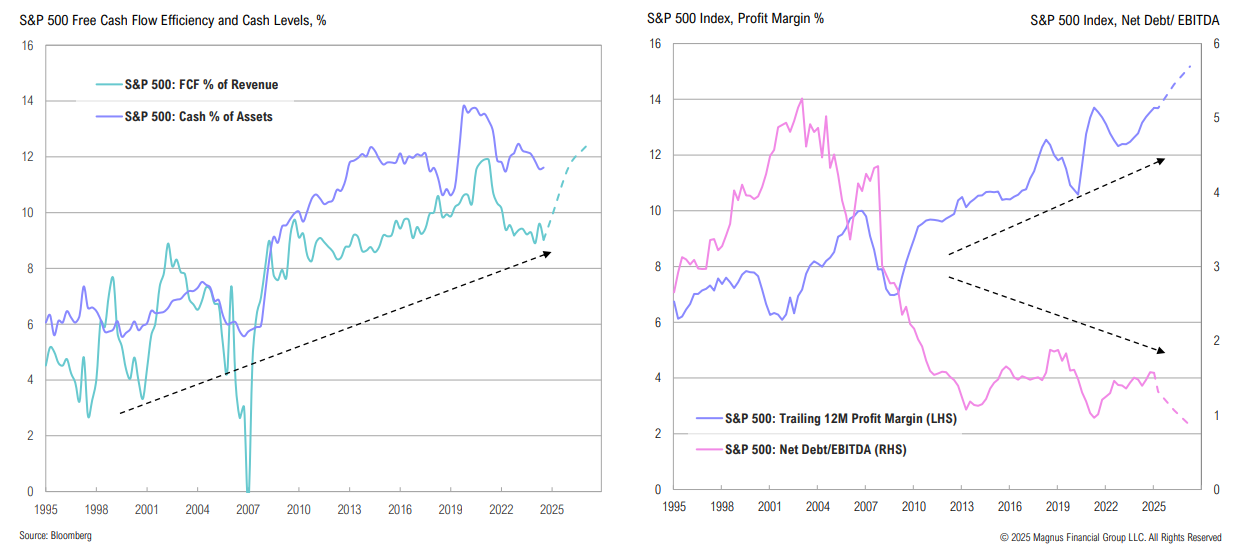

The corporate sector is strong by historical standards: capital expenditures, R&D, and tech investment have boosted scalability and efficiency, enabling improved margins and reducing debt

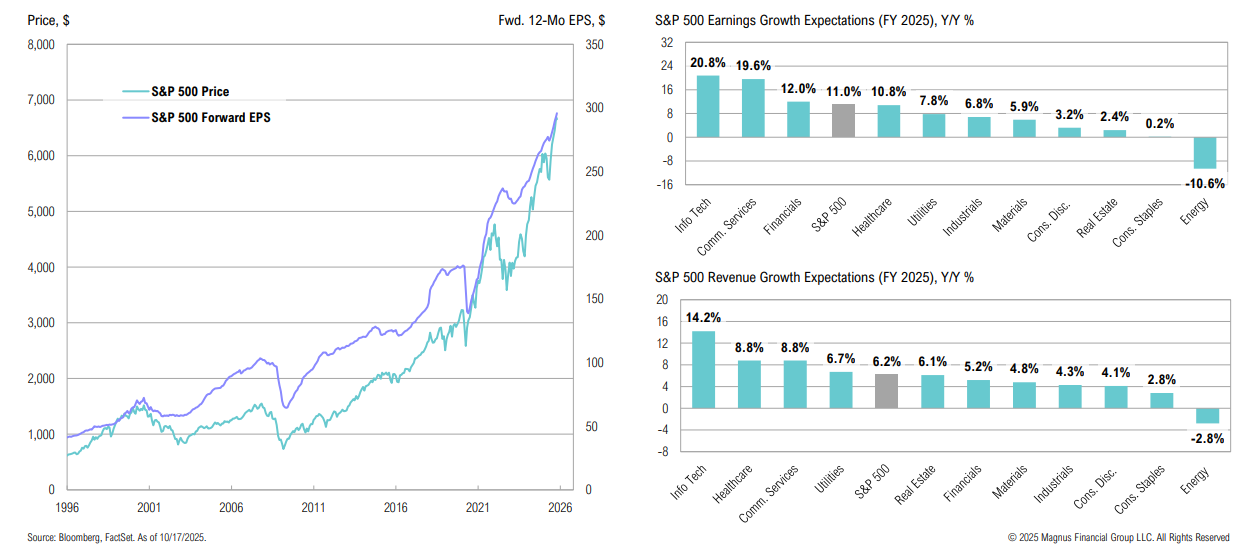

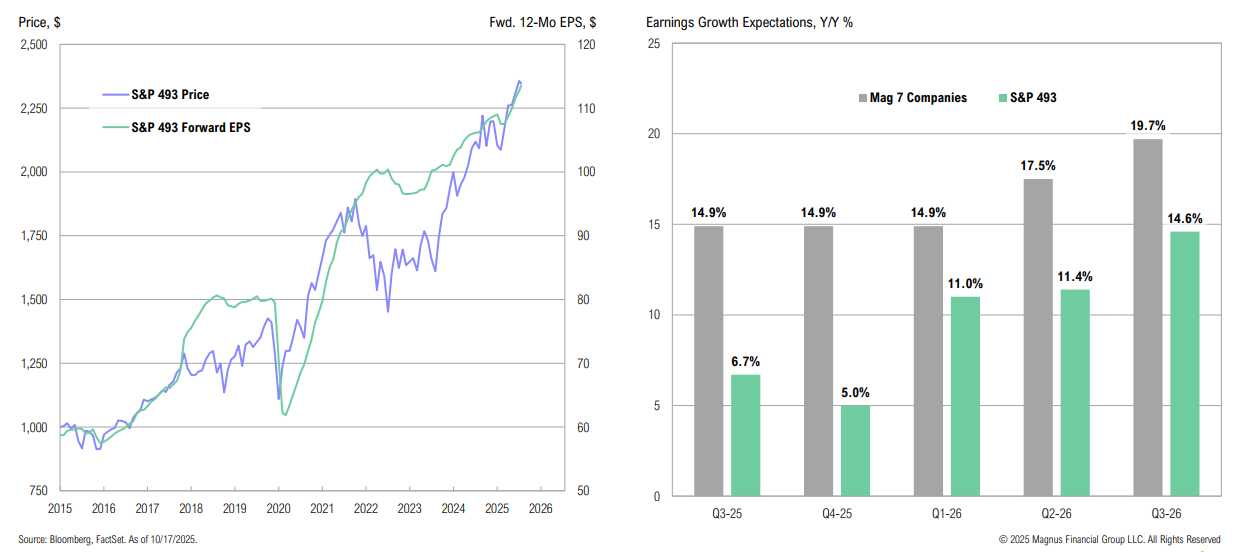

Stock prices tend to follow earnings—and both have been on an upward trajectory; strong earnings growth, particularly in tech, has been supported by revenue growth

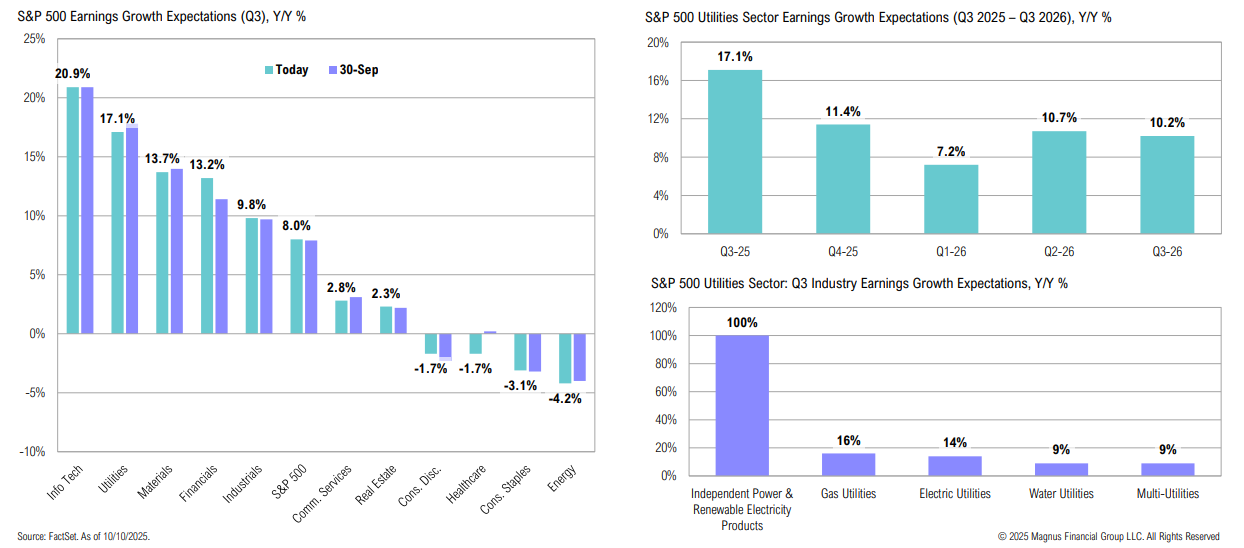

The utilities sector is expected to report the second-highest Q3 earnings growth rate (17.1%) of all 11 S&P 500 sectors, second only to tech

The Magnificent 7 remain key contributors to S&P 500 earnings growth, but their growth divergence from the rest of the market is expected to narrow into 2026

Is the stock market broadening just beginning?

Small cap stocks have outperformed large caps since the April 8 lows (by 7%); YTD, open-end small cap funds have seen $61Bn in outflows, while QQQ alone has seen $14bn in inflows

Innovation

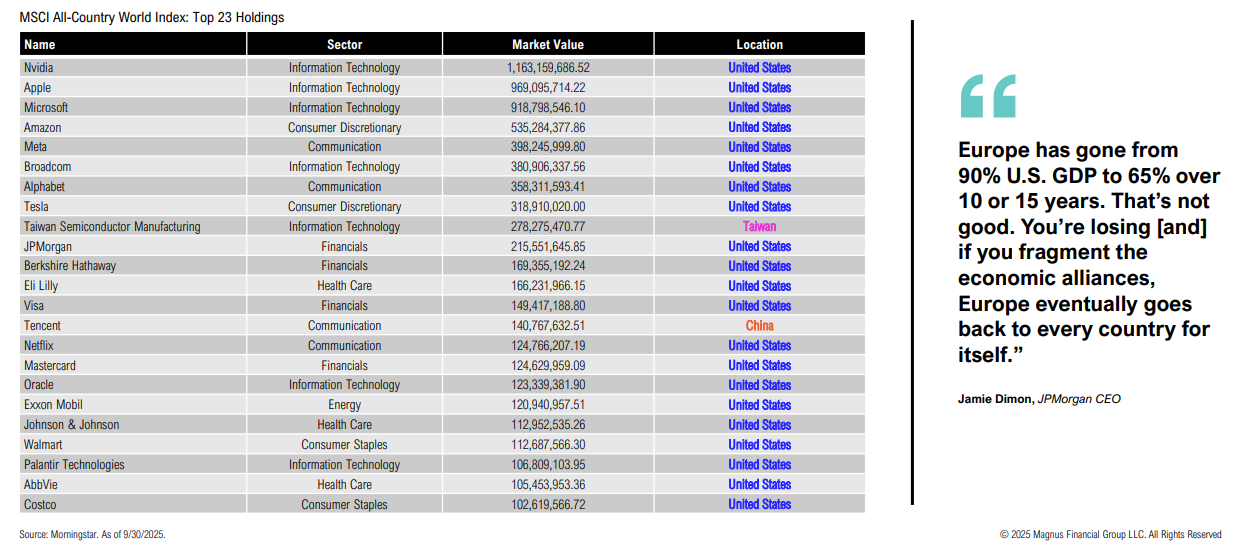

Capital flows to where it is treated best; the list of largest companies in the world is a reminder of where innovation is rewarded

AI

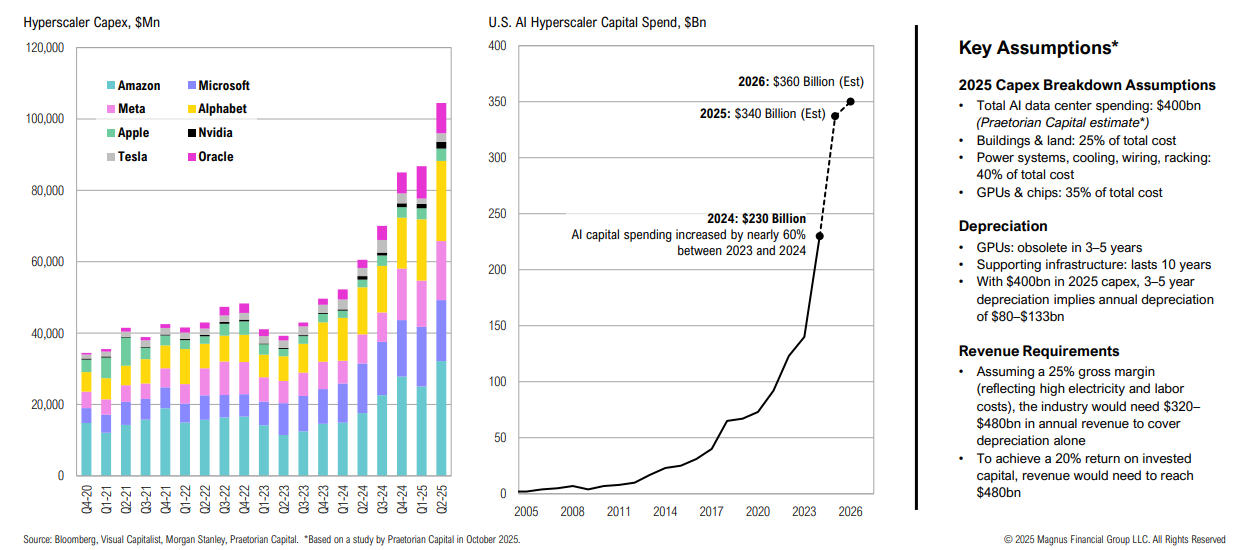

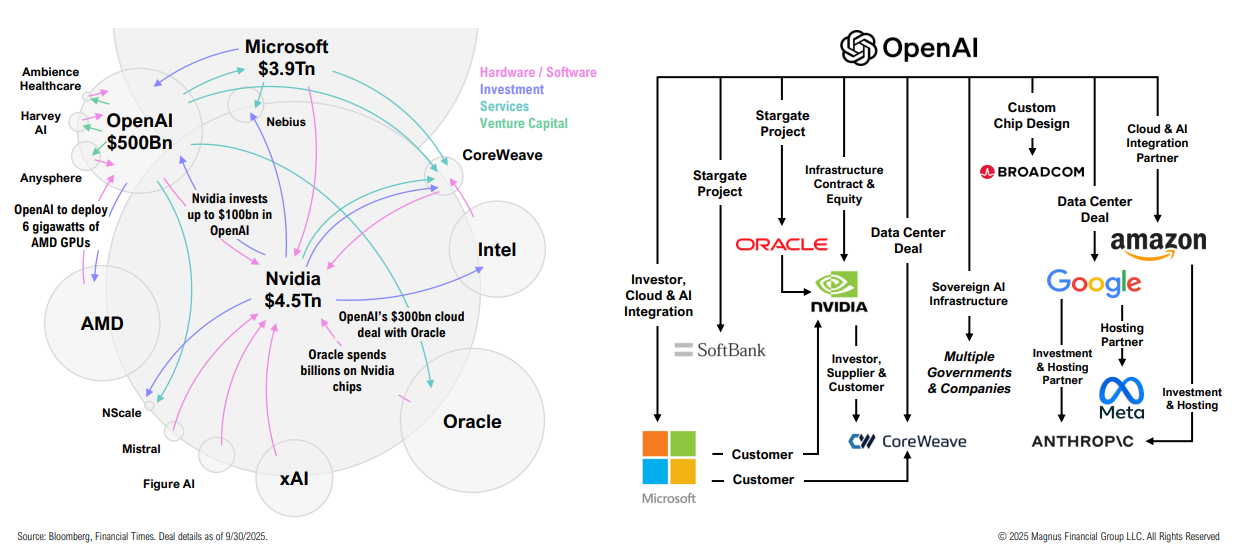

Estimates show the AI industry would need to generate $320bn or more in annual revenues for at least a decade just to break even on 2025’s capex investment—more than 10x current AI revenue levels

The circular nature of AI investments:

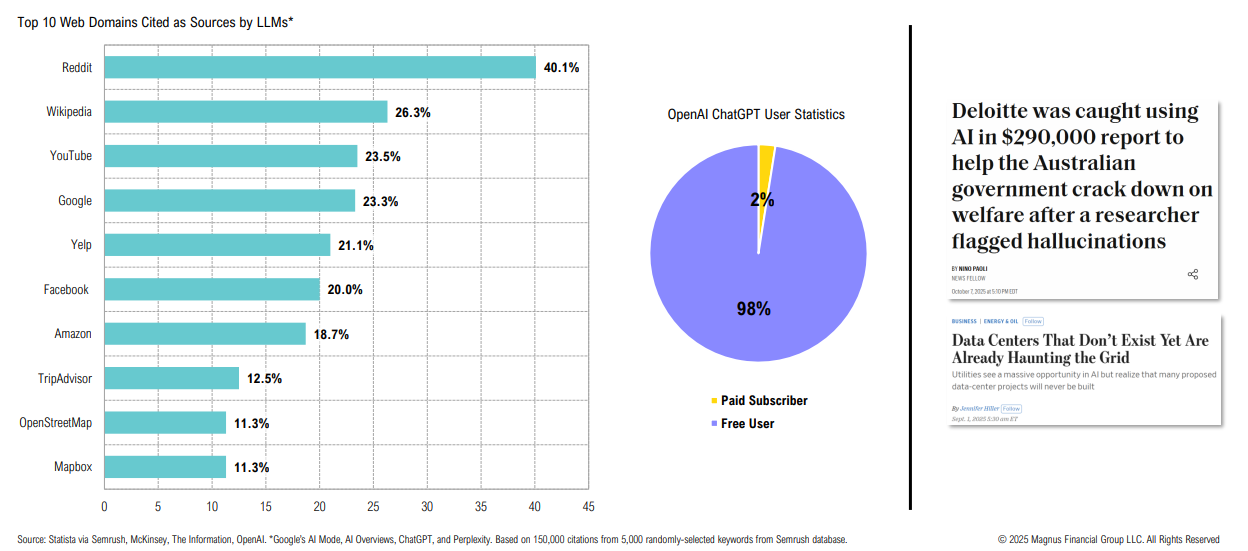

Despite the hype, there are some use concerns about LLMs such as ChatGPT (including source reliability); only 2% of all ChatGPT users pay for the service

“My guess is that I think all the ingredients are in place

for some kind of a blow off… History rhymes a lot, so

I would think some version of it is going to happen

again. If anything, now is so much more potentially

explosive than 1999.”

Paul Tudor Jones, U.S. Investor

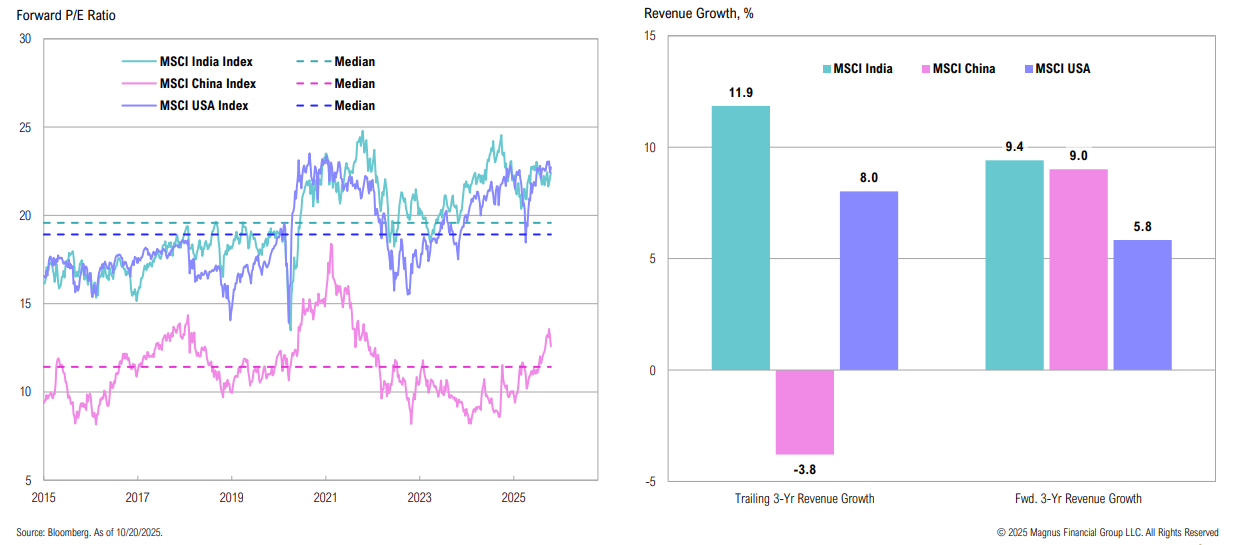

Global Valuations

U.S. large cap stocks have reached a new 10-year high valuation; Brazil & Mexico are the only countries trading below median, with Hong Kong at median valuations

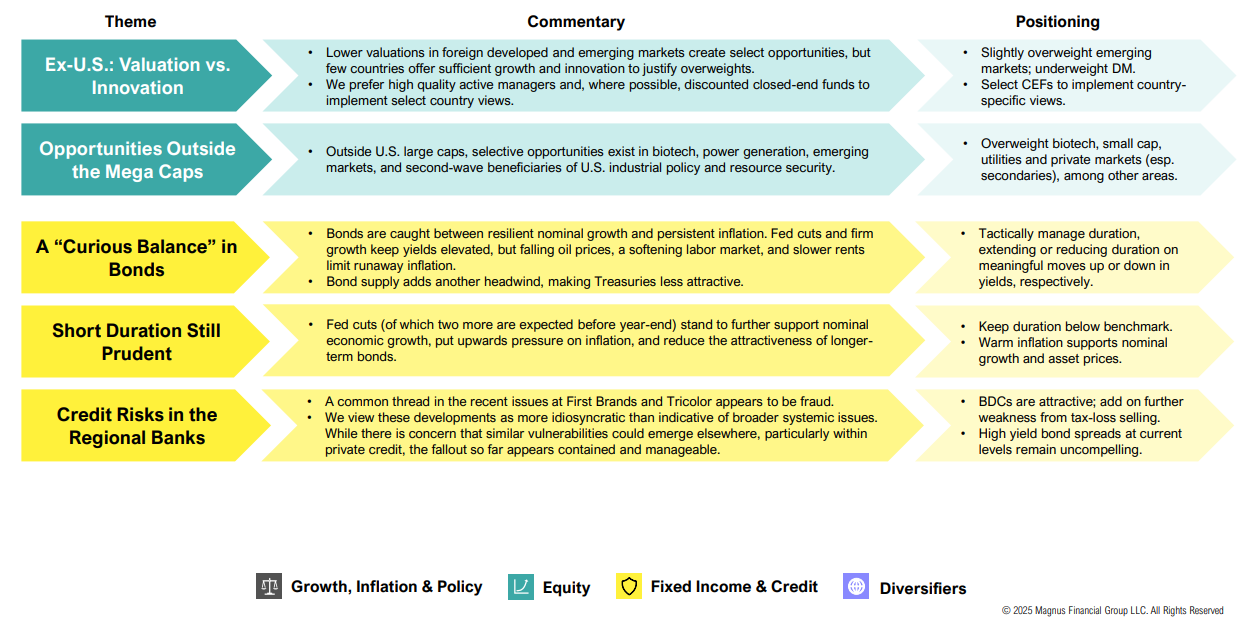

Emerging Markets

While India and China both trade above their 10-year average valuations, they remain attractive relative to the U.S., given stronger growth expectations in both regions

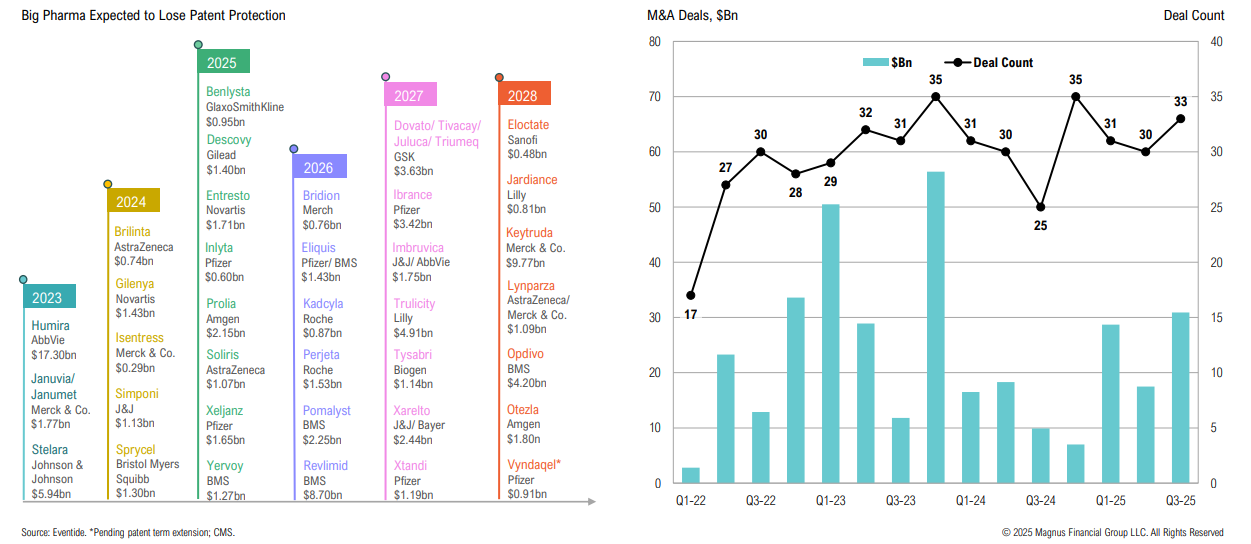

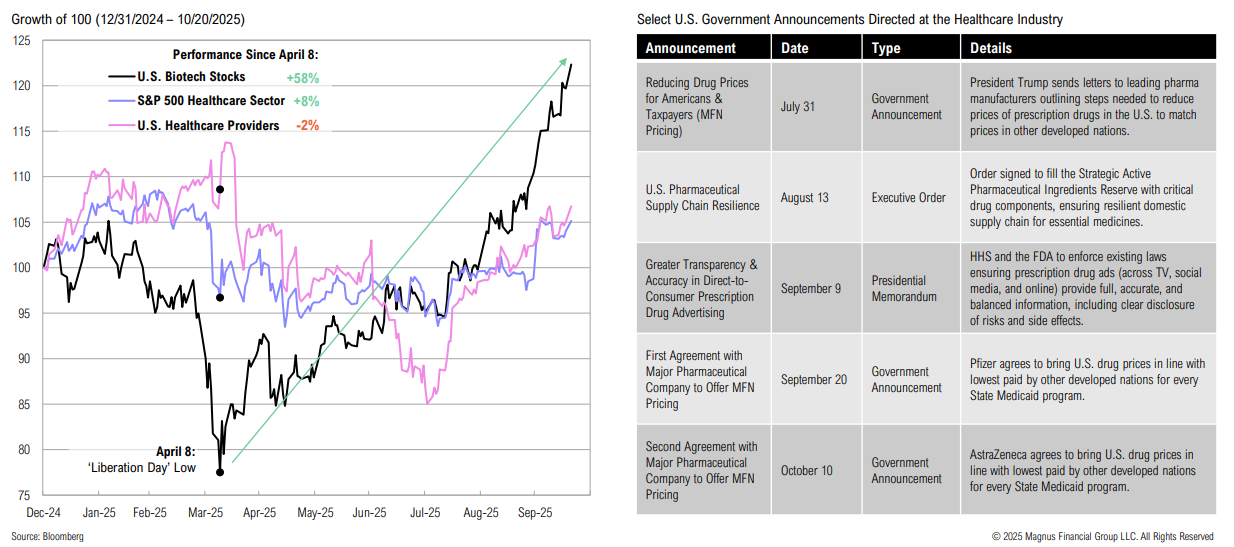

U.S. Healthcare

Big pharma faces a “patent cliff” which could impact more than $200Bn in annual revenue by 2030, which could position the biotech sector for further M&A activity

Biotech stocks have gained nearly 60% since the April 8 lows, far outpacing the broader healthcare sector, which continues to face pressure amid regulatory and market developments

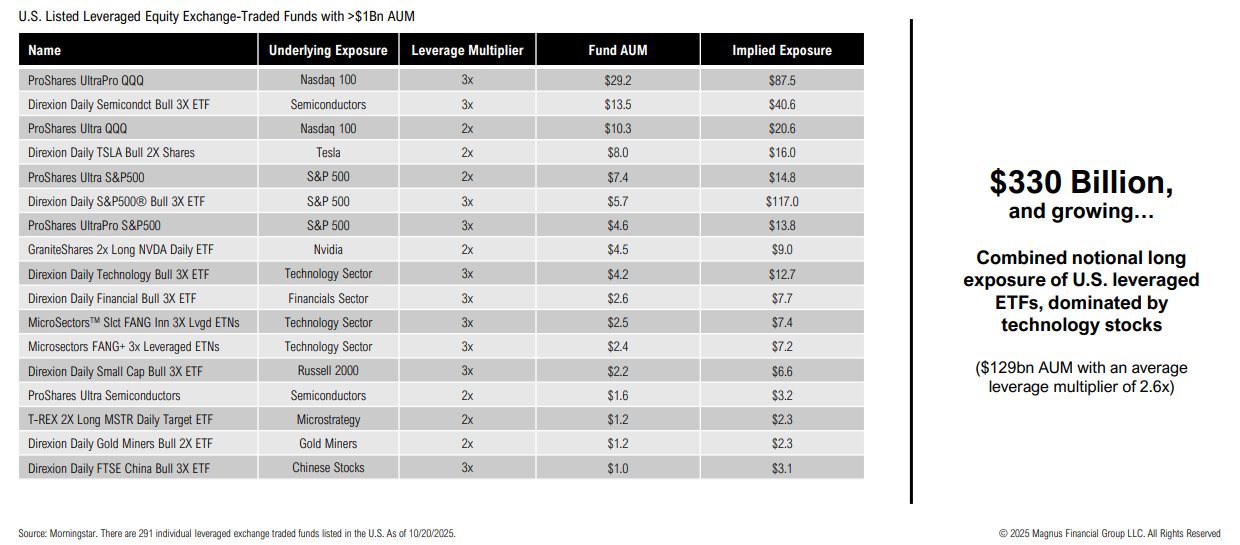

Leveraged ETFs

Key risk: leveraged ETFs have >$300bn in notional long exposure

Fixed Income & Credit

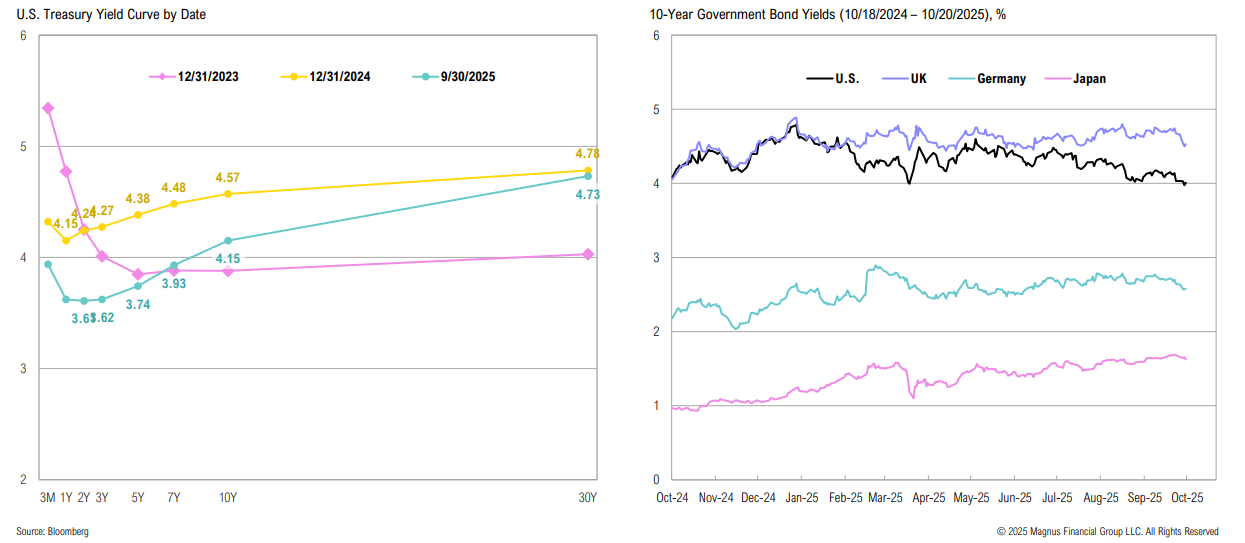

Bond yields declined over the quarter, with the yield curve steepening slightly, as markets responded to modest improvements in the fiscal deficit, contained inflation, and the prospects of further rate cuts. Credit spreads remain relatively tight suggesting continued economic resilience and a market still comfortable with current levels of fiscal spending.

Corporate Yields

Since the start of the year, U.S. Treasury yields have fallen across all maturities; U.S. bonds are one of the few among developed markets with yields lower today than a year ago

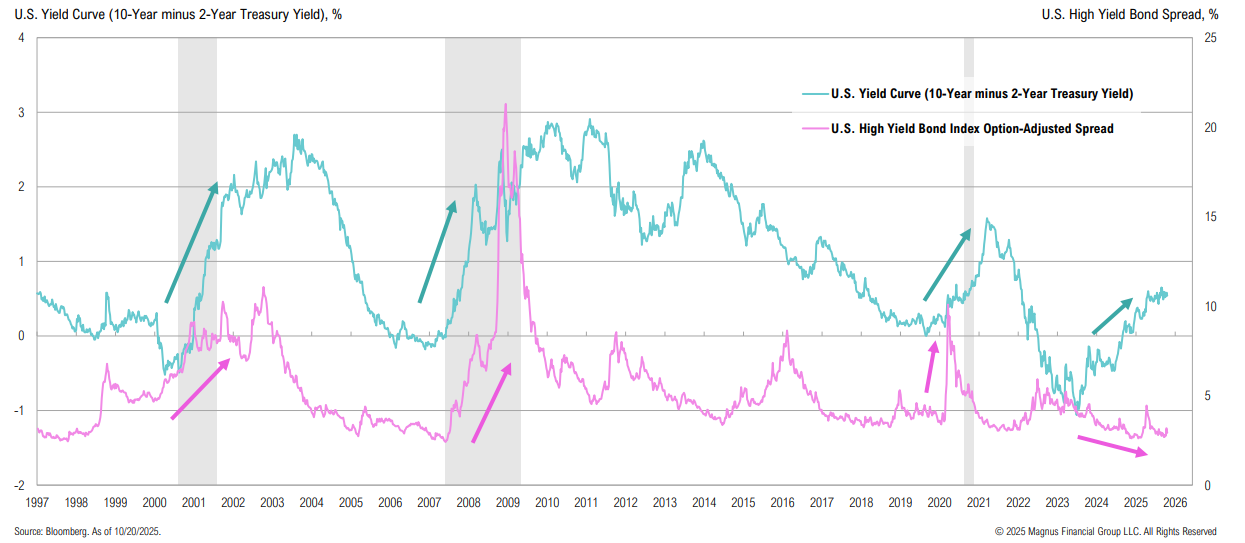

Yield Curve

While the yield curve continues to steepen, credit spreads remain low by any longterm standard, even despite the recent uptick (driven by renewed trade war concerns)

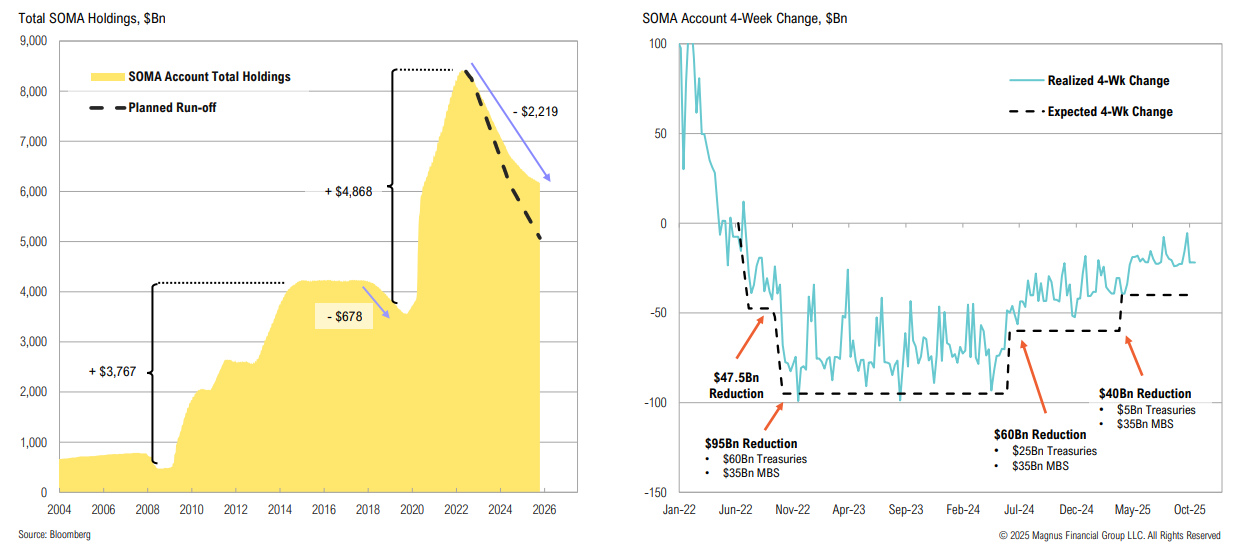

“Since June 2022, we have reduced the size of our balance sheet by $2.2 trillion—from 35 percent to just under 22 percent of GDP—while maintaining effective interest rate control. Our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions. We may approach that point in coming months, and we are closely monitoring a wide range of indicators to inform this decision…”

Jerome Powell, Chairman of the Federal Reserve (October 2025)

“Monetization would involve a permanent increase in the money supply to basically pay the government’s bills through money-creation. That is not what we are doing. What we are doing here is a temporary measure which will be reversed so that at the end of this process… the amount of the Fed’s balance sheet will be normalized and there will be no permanent increase, either in the Fed’s balance sheet, or in inflation.”

Ben Bernanke, Former Chairman of the Federal Reserve (June 2014)

SOMA Account

Since April 1, the Fed has slowed QT from $60 billion to $40 billion, with a maximum Treasury runoff of $5 billion per month

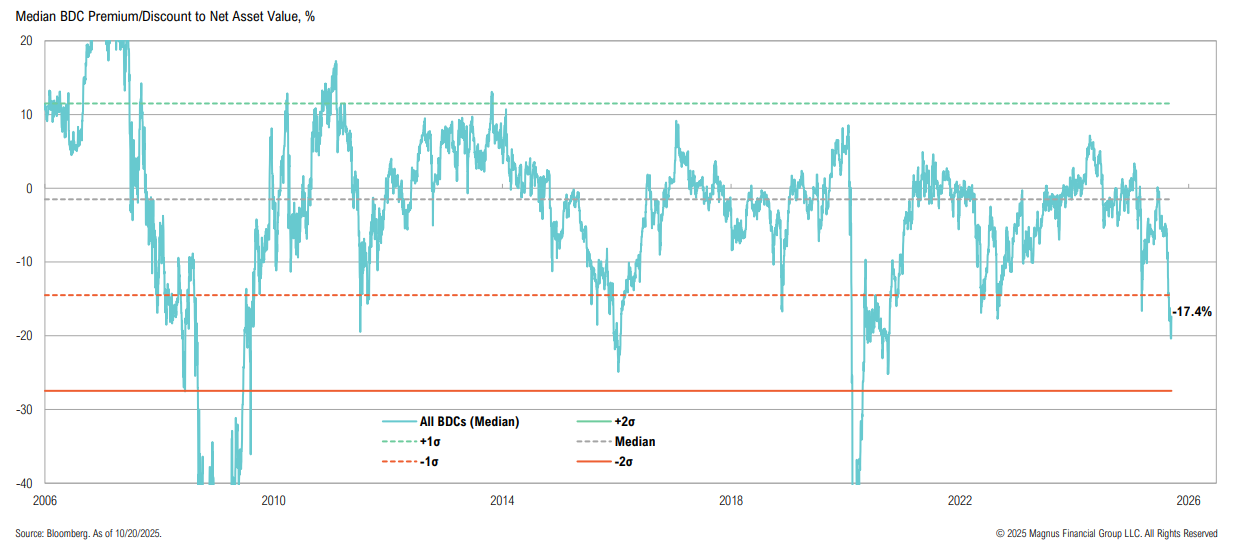

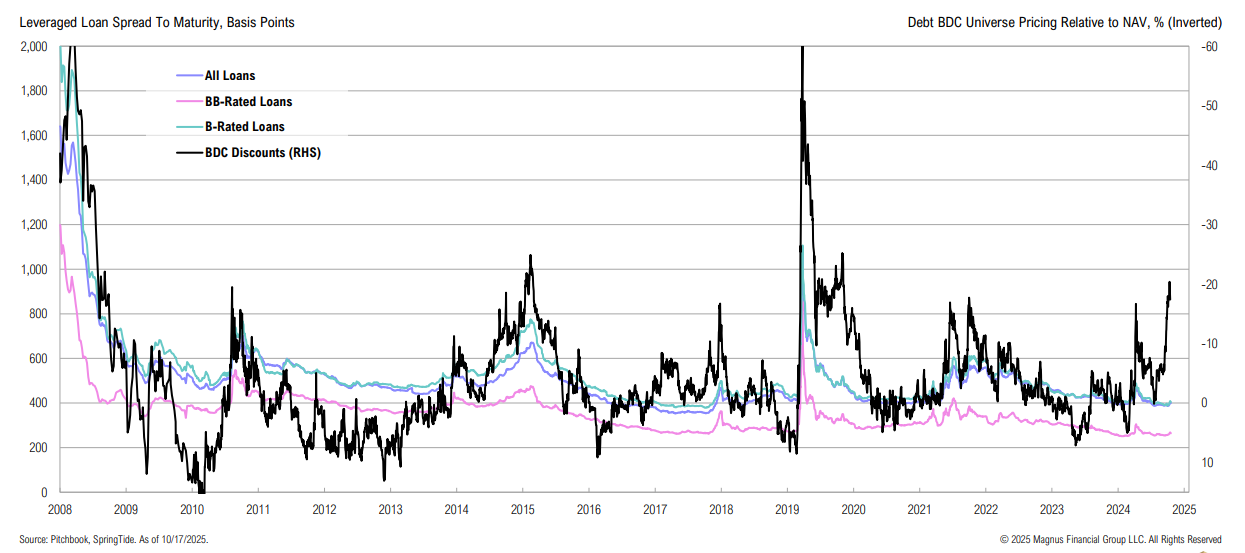

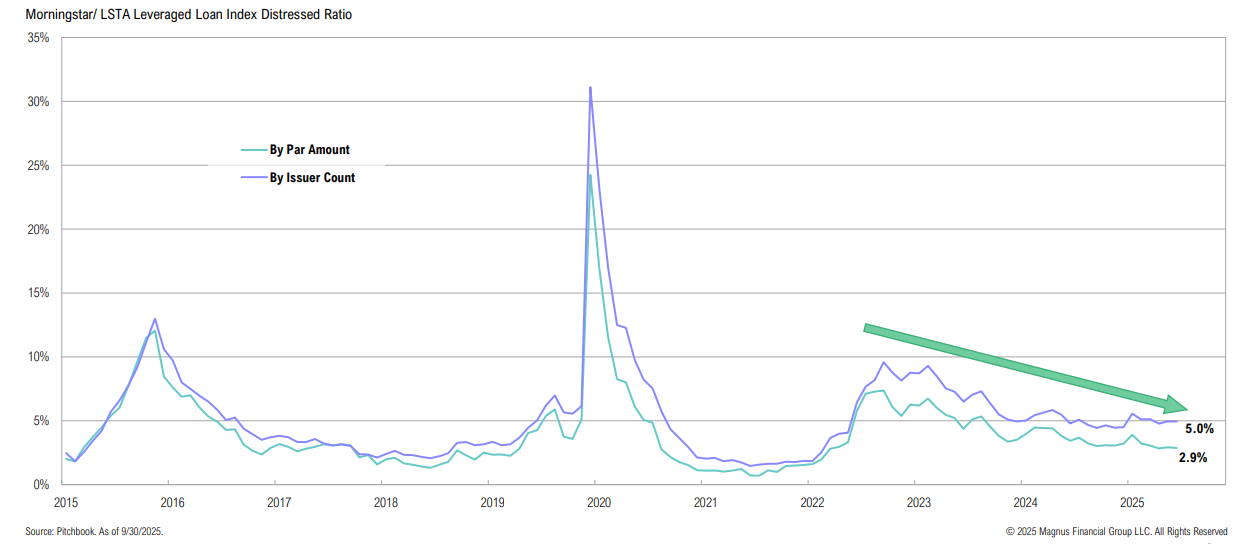

BDCs

Median discounts across the BDC universe widened over the quarter, providing compelling pockets of value

While BDC discounts have historically been more volatile than leveraged loan spreads, the current disconnect is unprecedented

Granular data about the leveraged loan market suggests that credit appears healthy

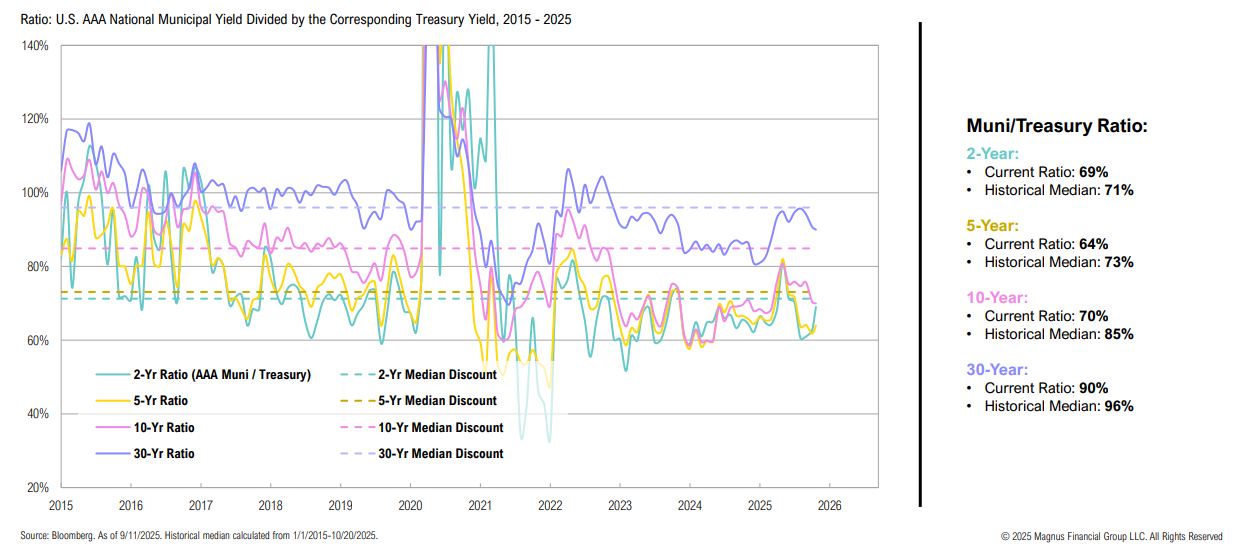

Municipal Yields

National municipal yield spreads to Treasuries are currently below their 10- year median levels but remain attractive on a tax-adjusted basis

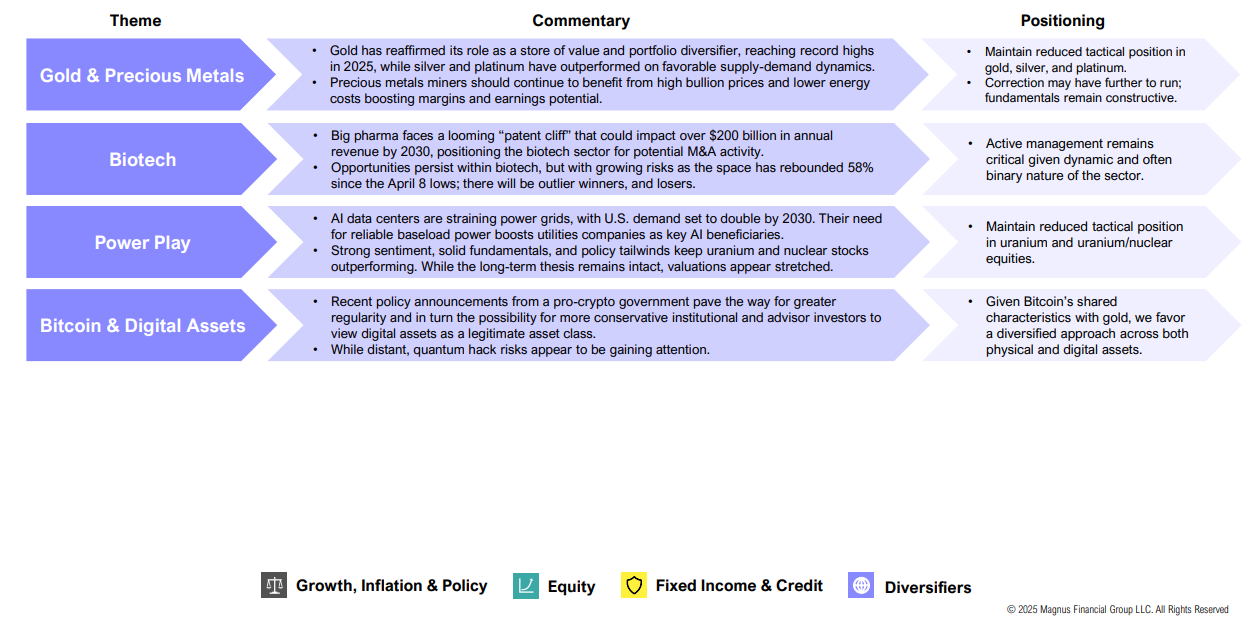

Diversifiers

With stock and bond correlations remaining elevated, opportunity remains to improve the risk-return profile of a portfolio by finding investment opportunities that have distinct return sources—such as gold, uranium, utilities, and more.

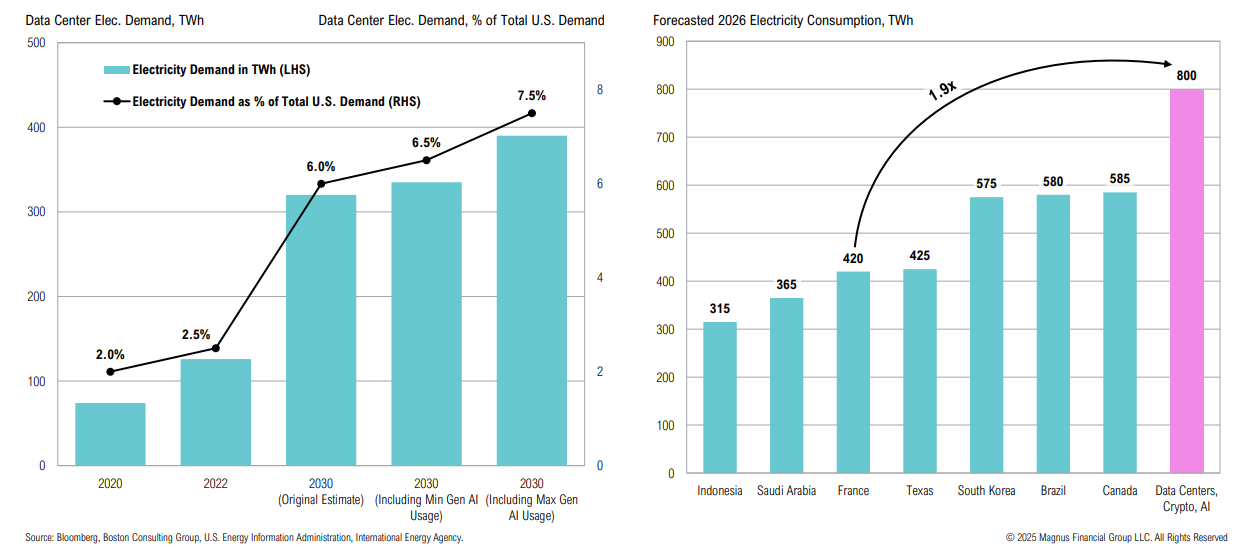

Power Play

AI and data centers are expected to drive U.S. power demand; in 2026, global data centers + AI + crypto energy consumption is estimated to be nearly double that of France

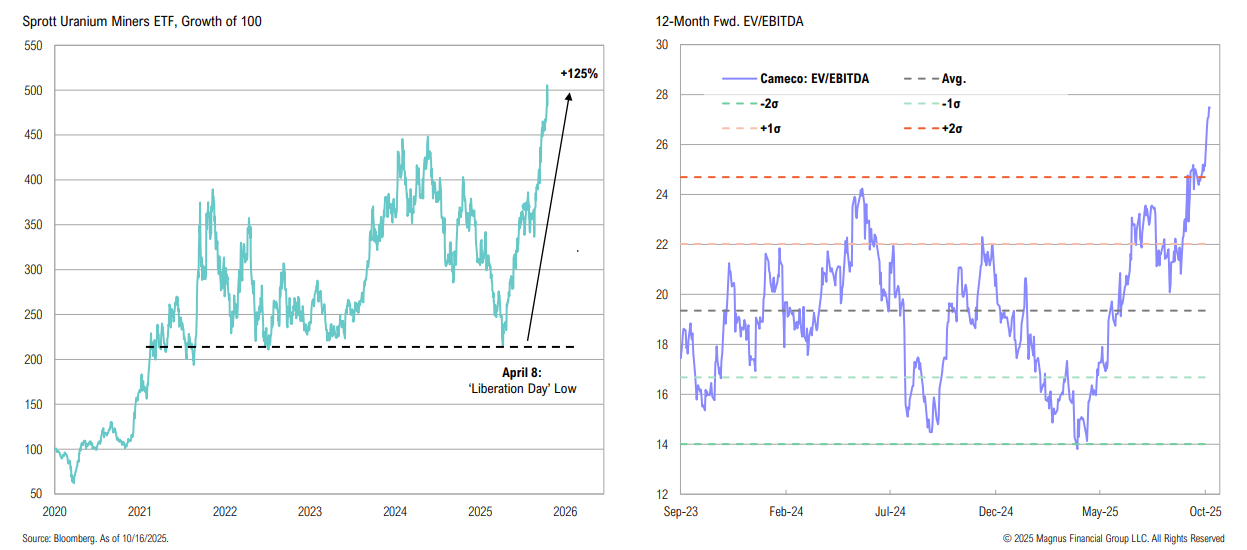

Uranium and nuclear stocks have rallied >125% from the “Liberation Day” lows, driven by strong sentiment, solid fundamentals, and ongoing policy support; while the long-term thesis remains intact, valuations appear stretched

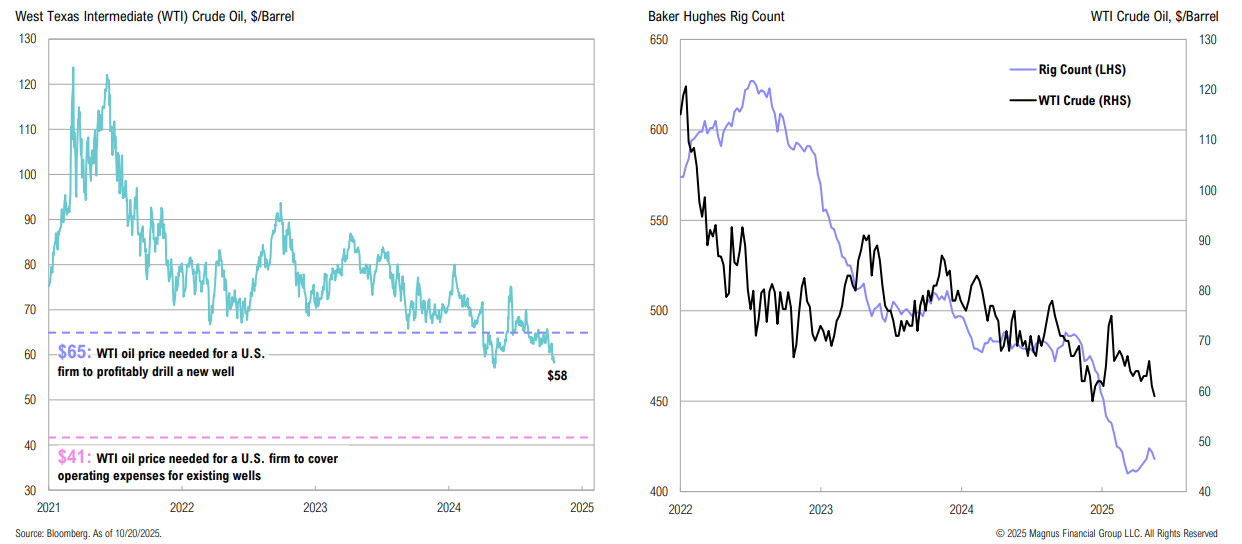

WTI Crude

At $58 per barrel, WTI crude is below the level needed for a U.S. firm to profitably drill a new well; rig counts are near the lowest levels in at least three years

Low oil prices = lower gas prices; lower energy prices detract from CPI

“You see some of the constraints and they exist in multiple places… The single biggest constraint is power.”

Andy Jassy, Amazon CEO

“One thing is clear, the benefits of nuclear energy for families, for local communities, for states and the economy as a whole is something we can all agree on.”

Joseph Dominguez, Constellation Energy CEO

Precious Metals & Gold

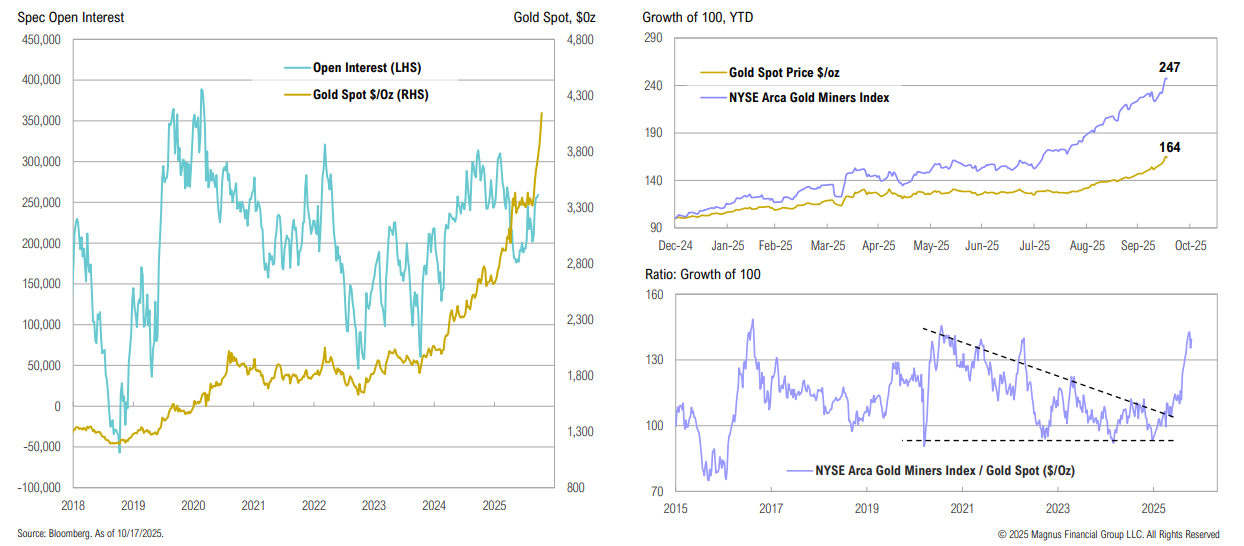

Despite record gold prices, spec positioning remains below recent peaks (albeit no new data since the government shutdown); while gold miners have seen strong YTD outperformance, fundamentals remain constructive

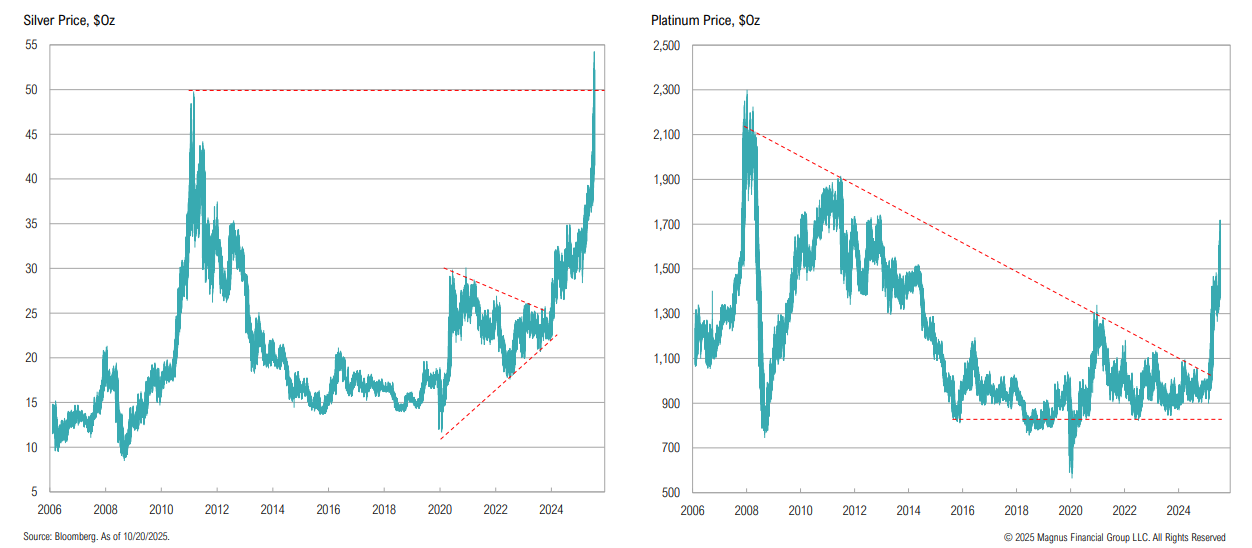

Both silver and platinum have experienced a major breakout; silver has broken through its 2011 high, while platinum remains 35% below the 2008 peak

Copper

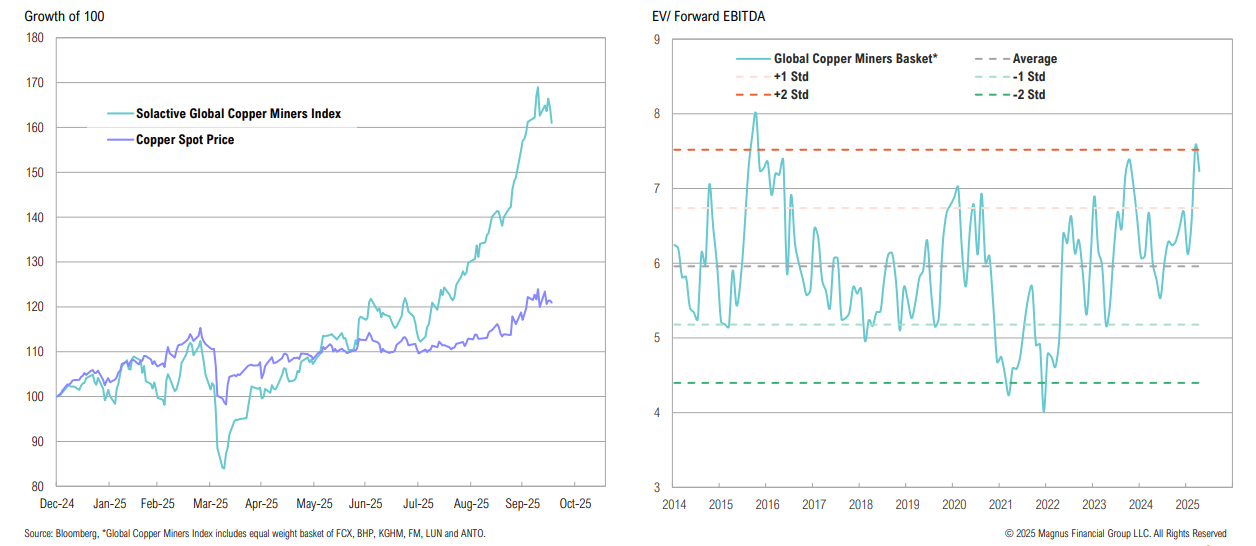

Copper prices are ‘only’ 20% higher since the start of the year, yet miners have rallied more than 60%; despite the constructive backdrop, copper miner valuations are looking stretched

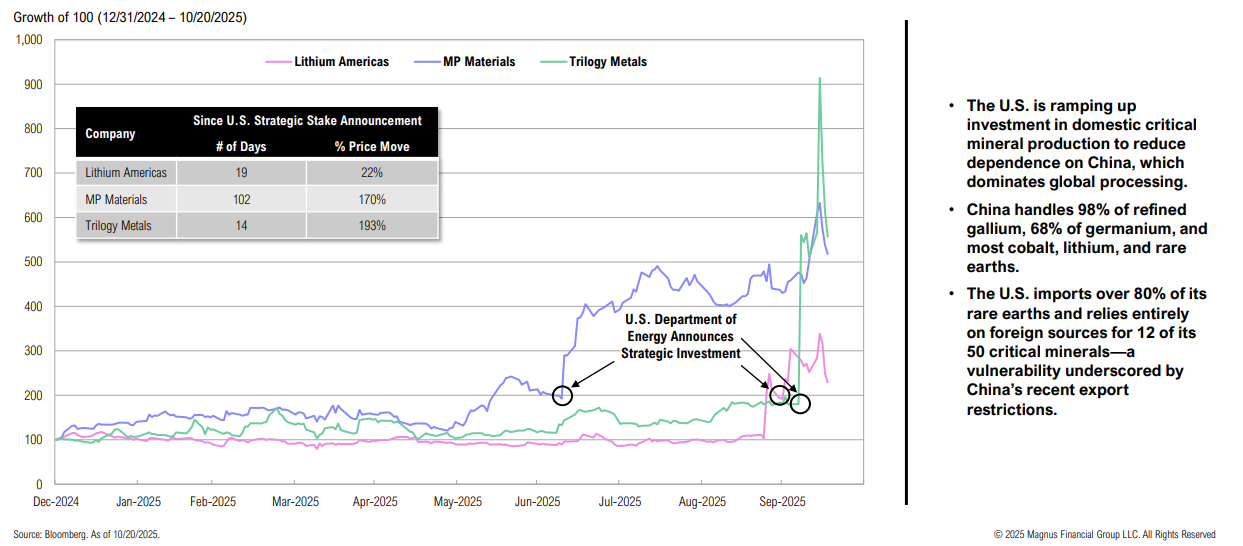

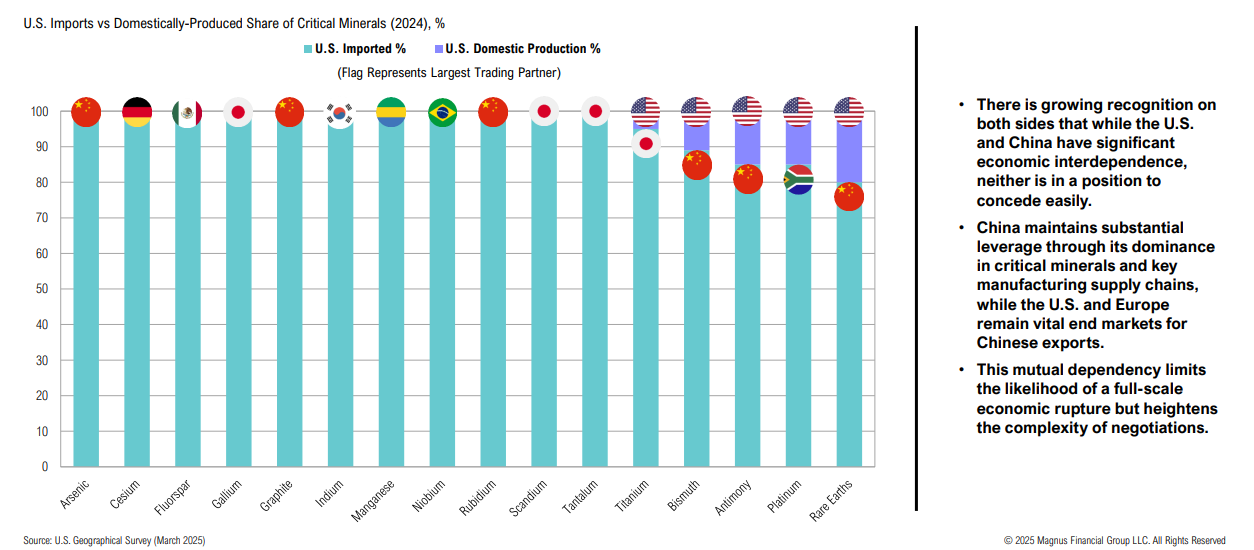

Critical Minerals

The U.S. government has been offering both policy support for the domestic critical minerals industry and taking strategic stakes in various businesses in efforts to reshore the domestic supply chain

President Trump and Chinese President Xi Jinping are expected to meet at the end of this month to seal a ‘fair’ trade deal; critical minerals will be a significant part of the deal

“Private assets need public buyers.”

Matt Levine, Bloomberg Columnist

“There is, across the entire economy, a real surge in business investment taking place right now, and in

artificial intelligence & other areas in the technology space that is helping to propel growth.”

Ken Griffin, Citadel Founder

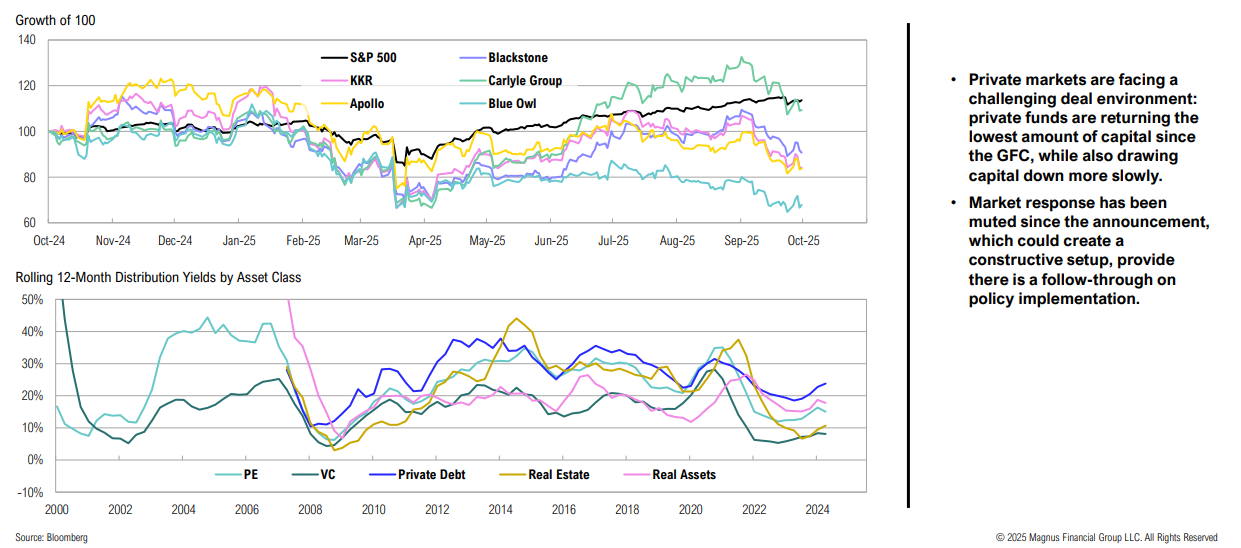

Private Markets

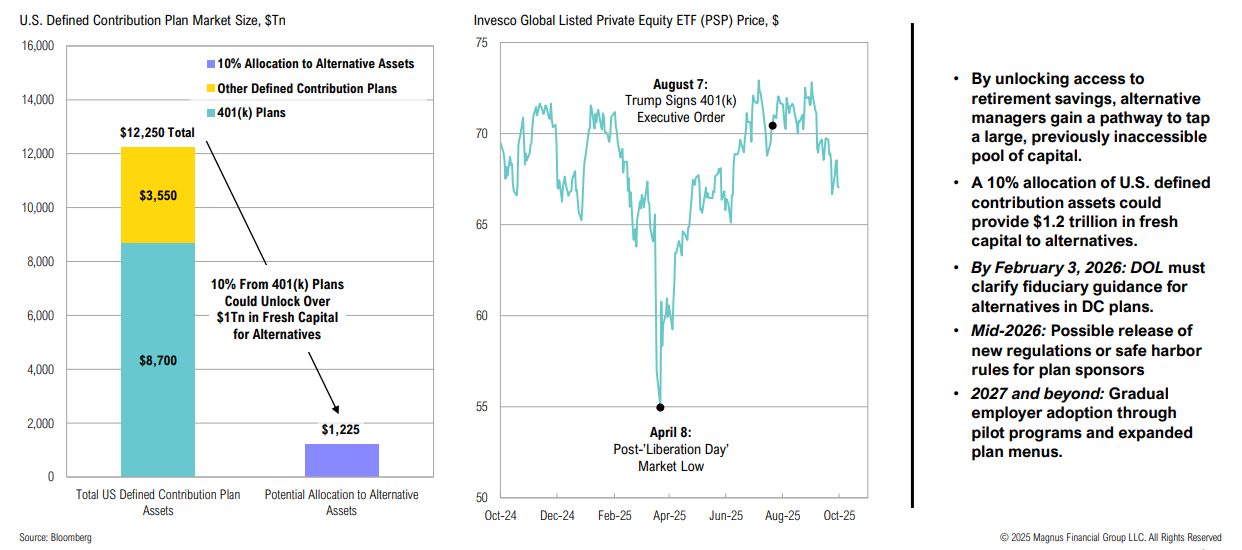

On August 7, 2025, President Trump signed an Executive Order aimed at broadening retirement investment options by easing restrictions on 401(k) plans to invest in alternative investments

The executive order effectively opens the door for partnerships between traditional and alternative managers—a development that could help private markets

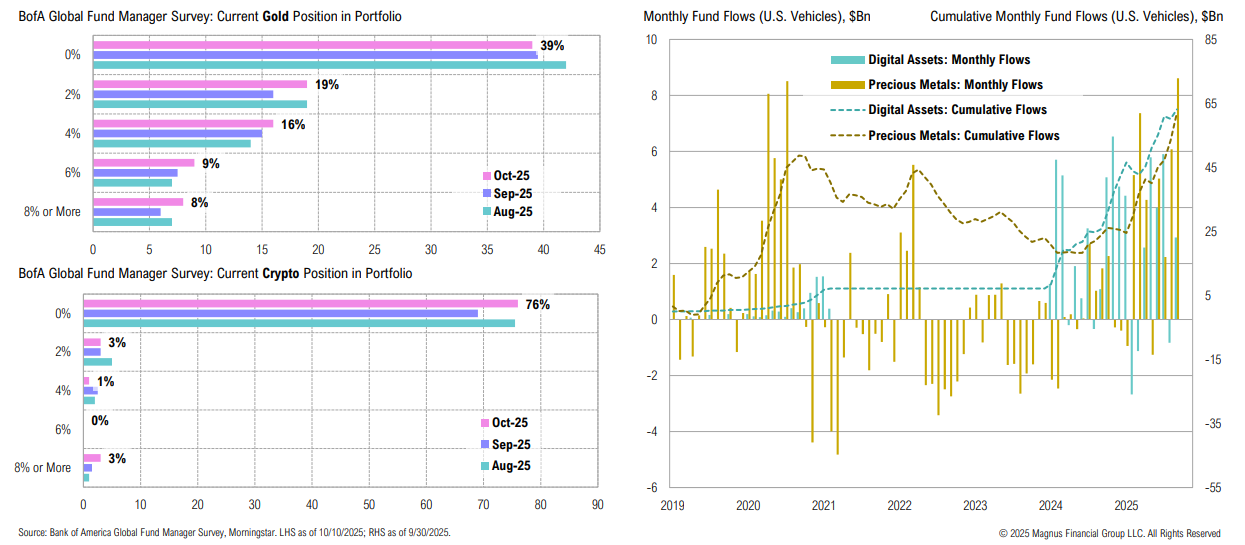

Gold & Bitcoin

Gold and bitcoin (which share several key characteristics) both continue to have limited allocations in portfolios, despite recent increase in ETF flows

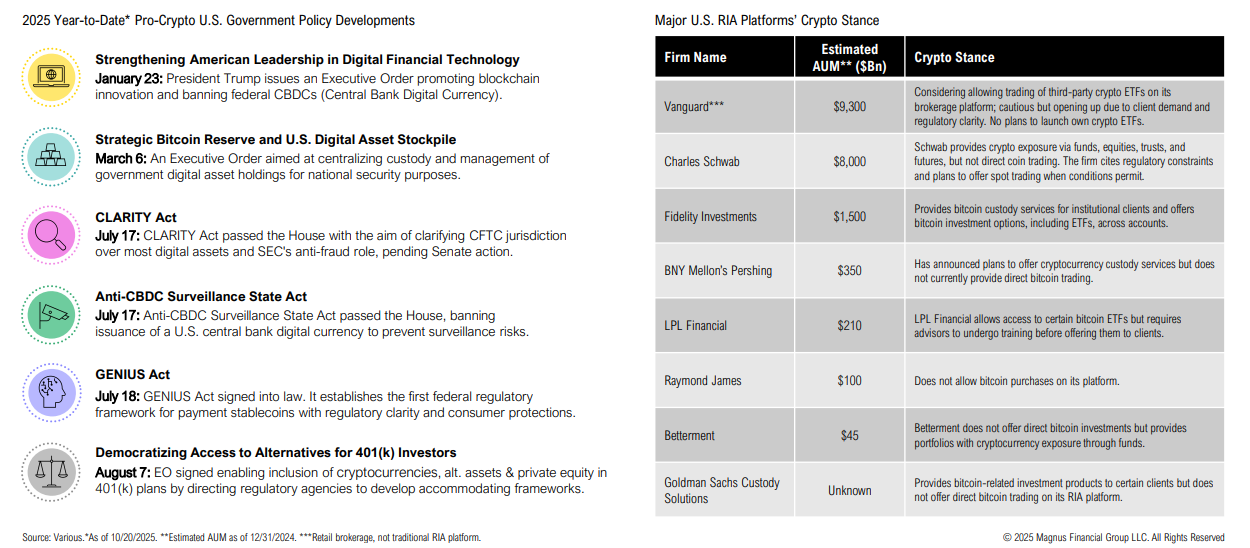

Cryptocurrencies

As the pro-crypto government advances clearer regulations, major U.S. RIAs and investment platforms have started to ease their stance on crypto

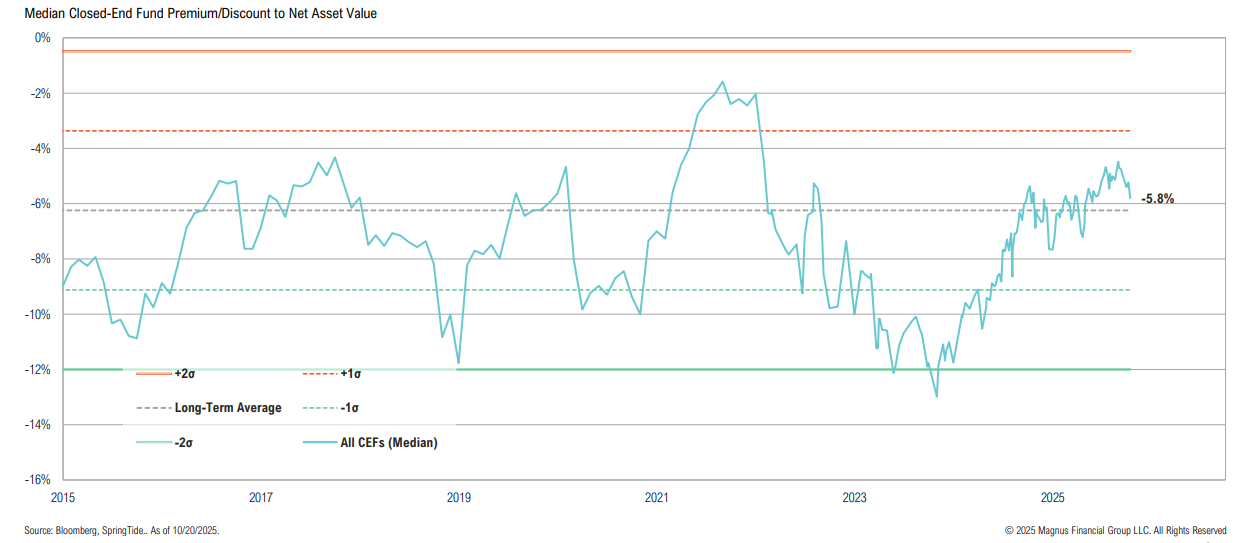

CEFs

Although median discounts across the closed-end fund universe remain relatively tight, we continue to find compelling pockets of value

Appendix

Supporting materials, including Capital Market Expectations and additional research referenced throughout the Market Outlook.

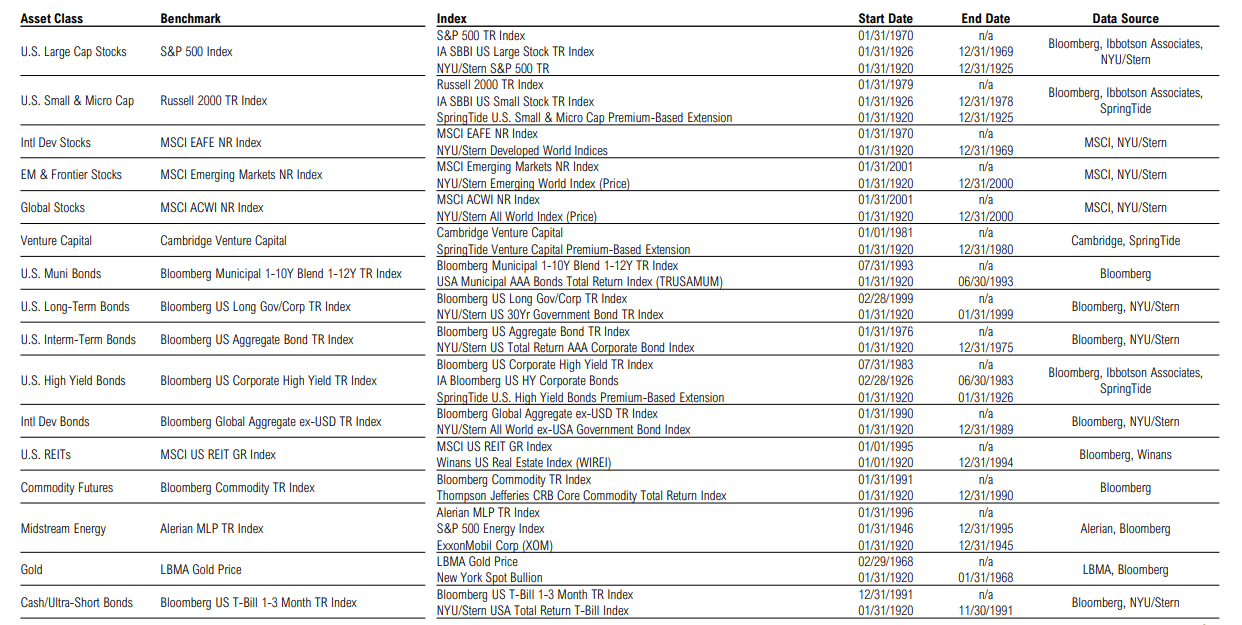

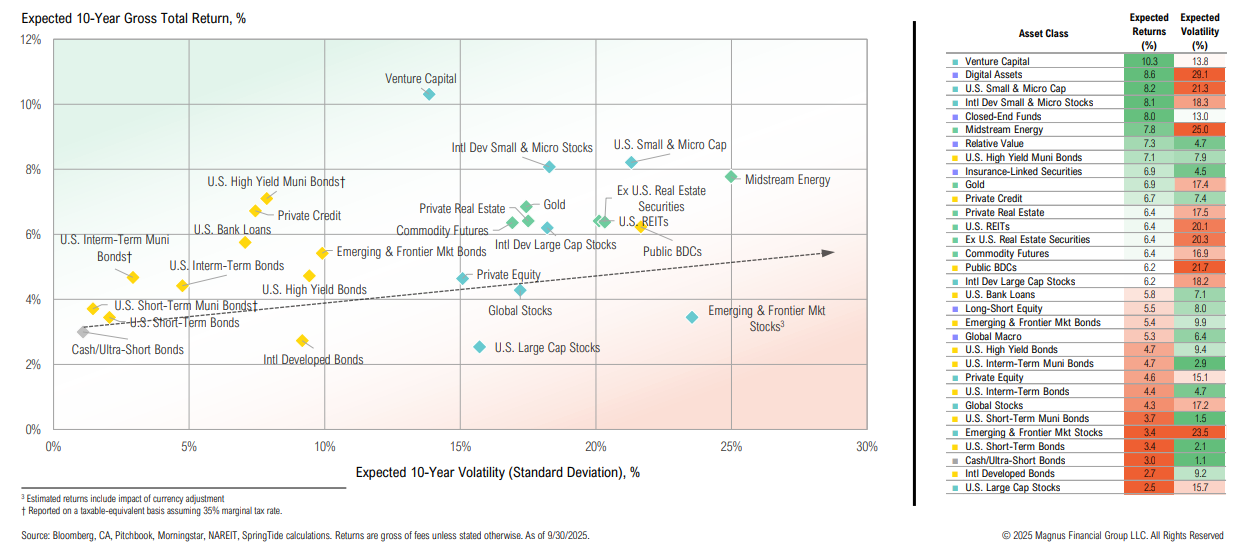

CMEs

With equity valuations expanding and yields falling, longer-term U.S. return assumptions have declined marginally

Education

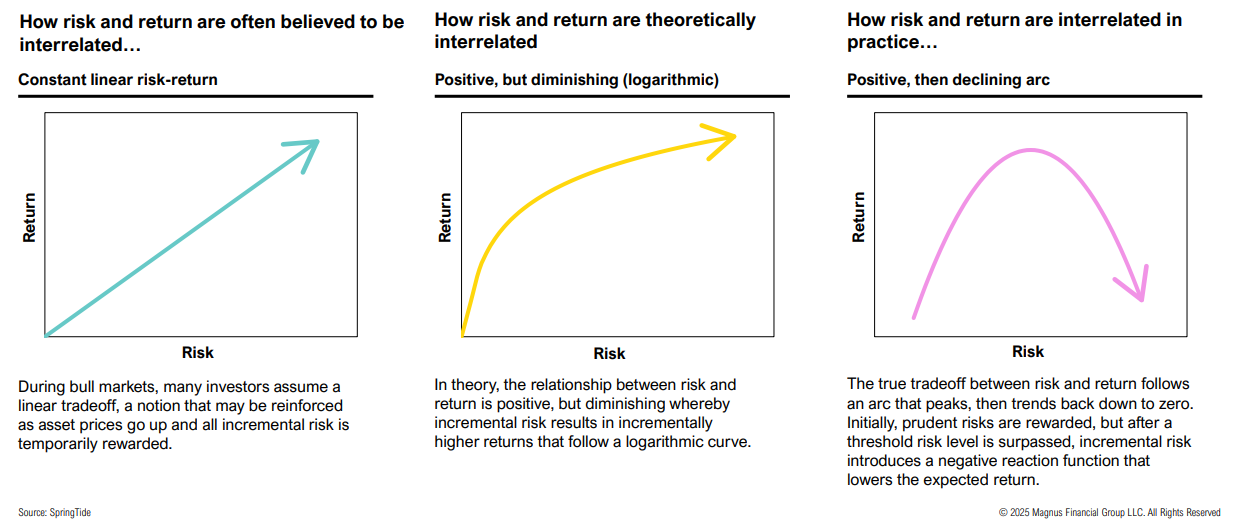

Setting a strategic risk tolerance is about finding the optimal level of risk that can operationally and emotionally be assumed without incentivizing harmful behavior

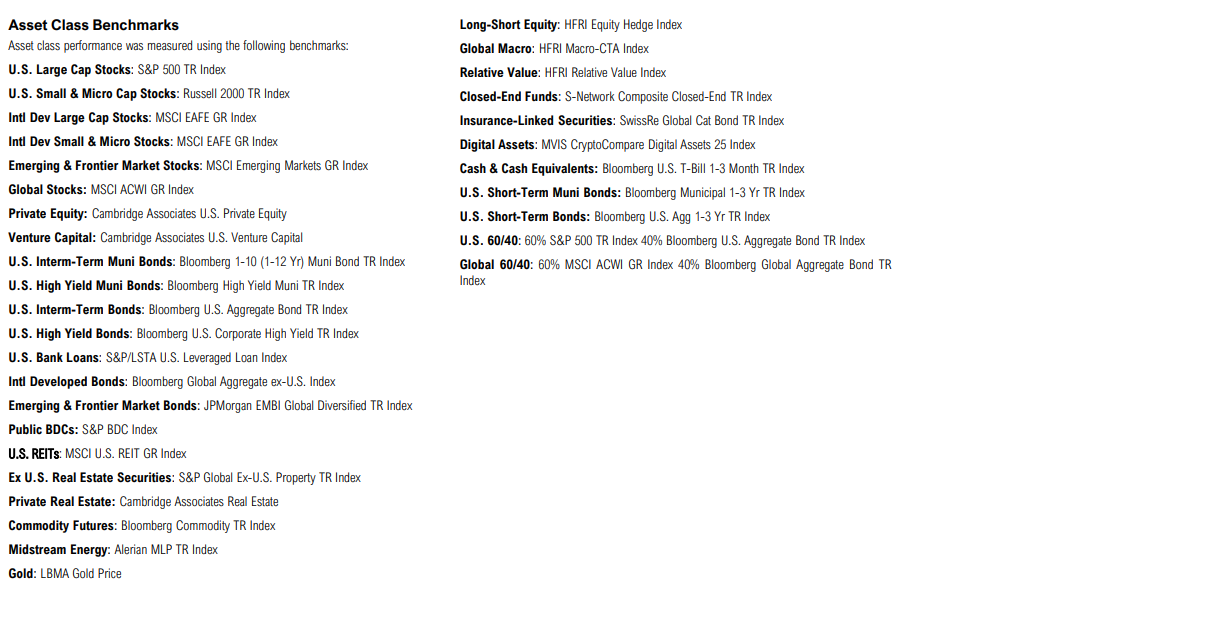

Appendix

Asset Class Definitions