A New Bull’s Eye

While market valuations and credit spreads seem to reflect a rather benign economic outlook, we continue to be vigilant about potential tail risks. These tail risks are the same ones that we have mentioned before. The geopolitical situation remains complex and potentially the most dangerous since World War II — though its outcome and effect on the global economy remain unknown. Next, there has been some progress bringing inflation down, but there are still multiple inflationary forces in front of us: large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world. Therefore, inflation and interest rates may stay higher than the market expects. And finally, we still do not know the full effects of quantitative tightening on this scale.”

Jamie Dimon, JPMorgan CEO

Cartoon

Status Quo

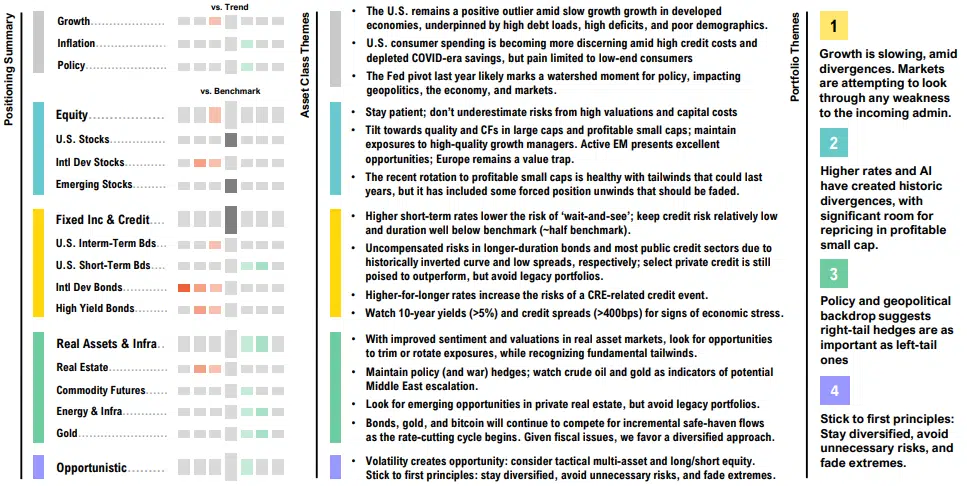

Summary

Q2, 2024 Market Review

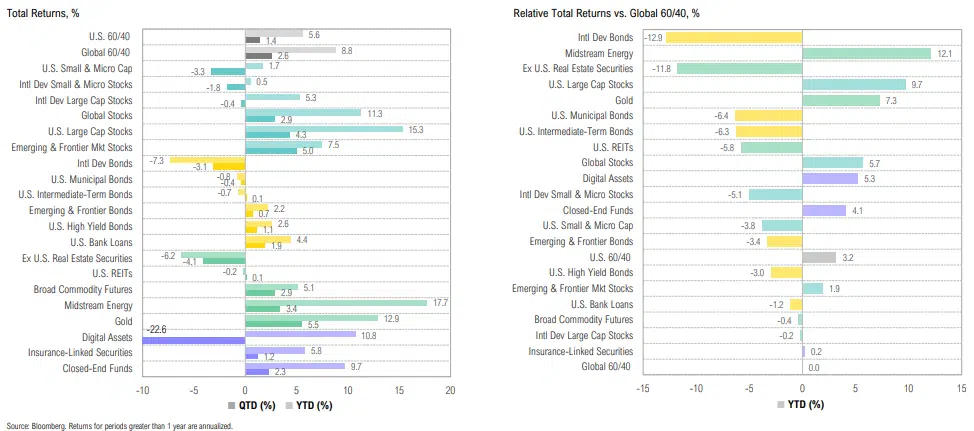

Most risky assets fared well over the second quarter, but equities’ market breadth remains narrow; interest rate-sensitive areas of the market lagged

Asset Allocation Views

Mark Mason, Citigroup Chairman

We’re well aware that if we go too soon, we could undo the good work we’ve done in bringing down inflation. And if we go too late, we could unnecessarily undermine the recession, the recovery, and the expansion. We’re aware that we have two-sided risks now, more so than we did a year ago.”

Jerome Powell, Federal Reserve Chairman

Growth, Inflation & Policy

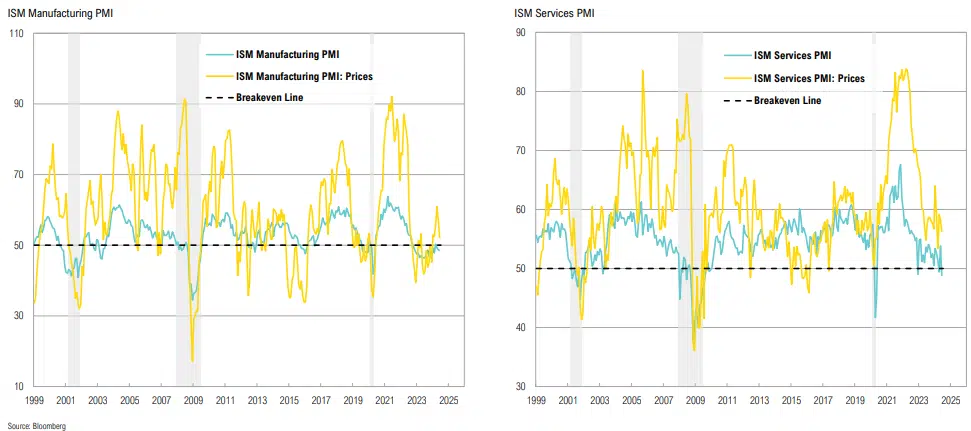

Growth: ISM PMIs

Both manufacturing and services sector activity are now in contractionary territory; ongoing high prices are weighing on both sectors’ growth, particularly in services

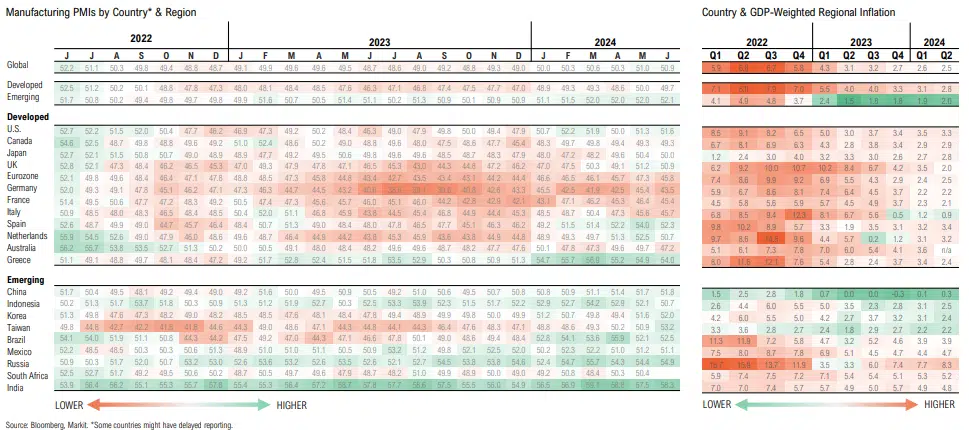

Global Growth

Overall, global manufacturing is expanding and inflation easing, but stark divergences between countries with the U.S. and select emerging markets faring much better than developed Europe

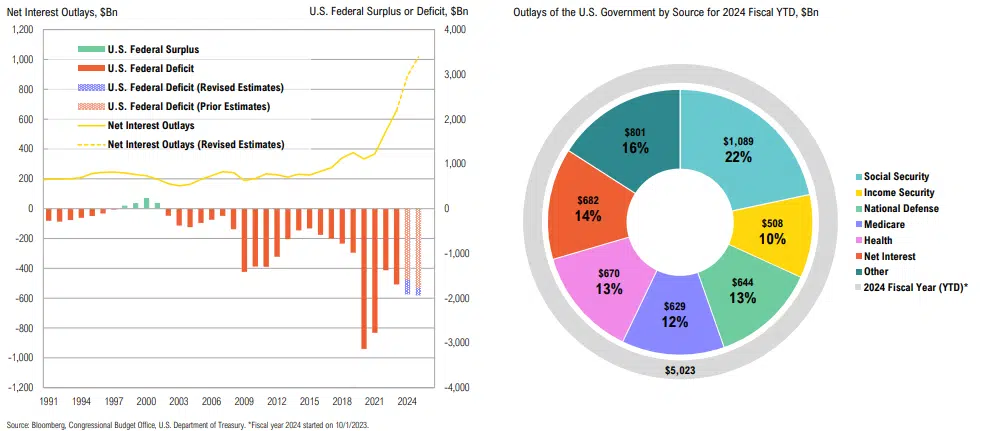

Federal Debt

Government spending continues unchecked: the fiscal budget deficit for this year is already at $1.27Tn, and the CBO has revised deficit estimates upwards for 2024 and 2025

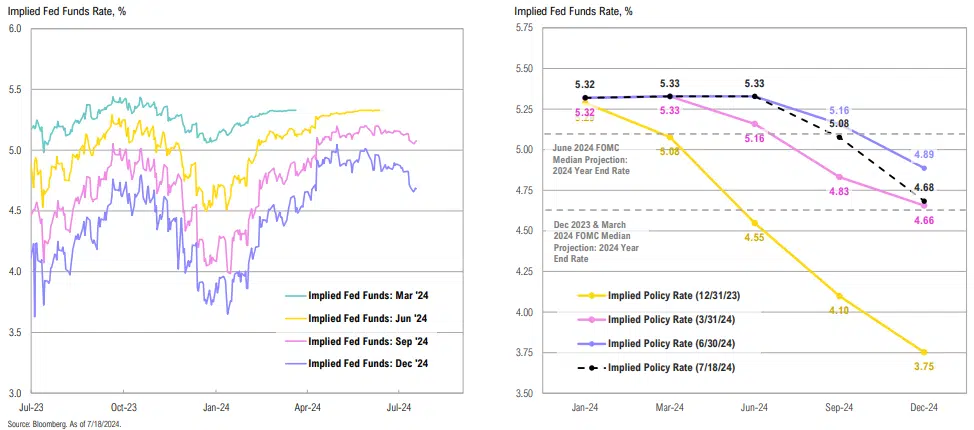

Implied Fed Funds

Following the June CPI report, rate cut expectations reverted to March levels; markets now expect the equivalent of three cuts for 2H 2024, with the first cut anticipated in September

Monetary Policy

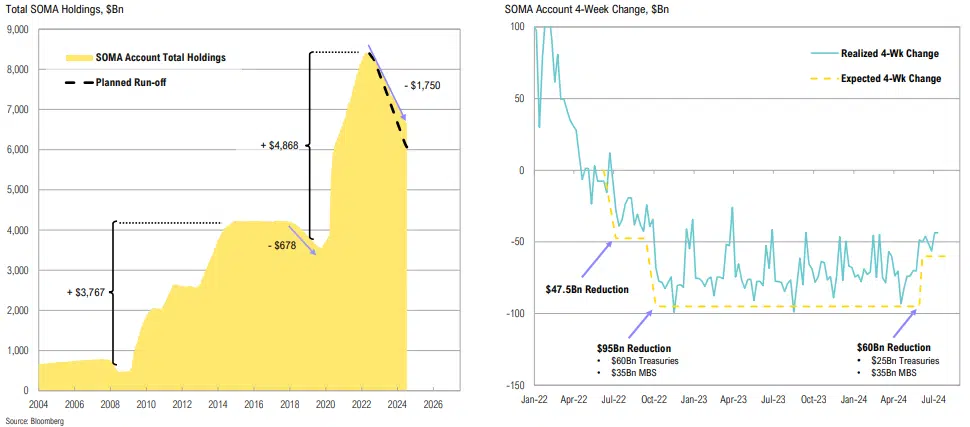

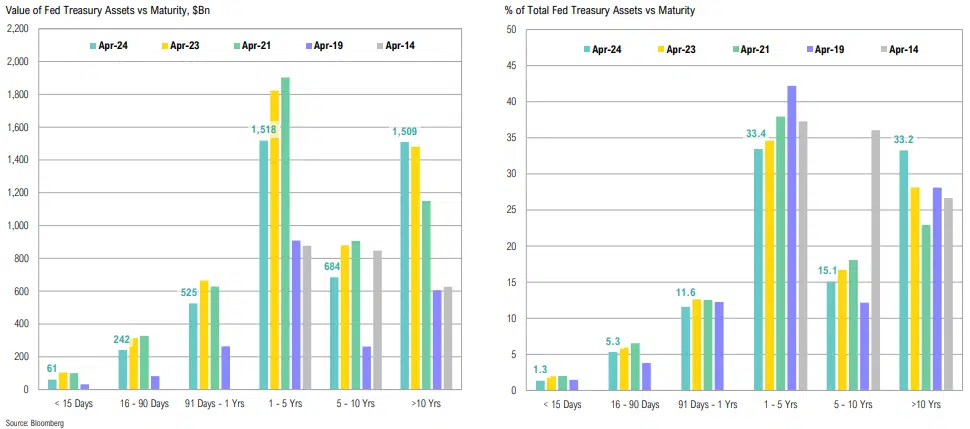

Despite inflation still above target, the Fed slowed the pace of QT on June 1; the balance sheet has been reduced by only 1/3 of what was added during COVID and lags its planned runoff by >$450bn

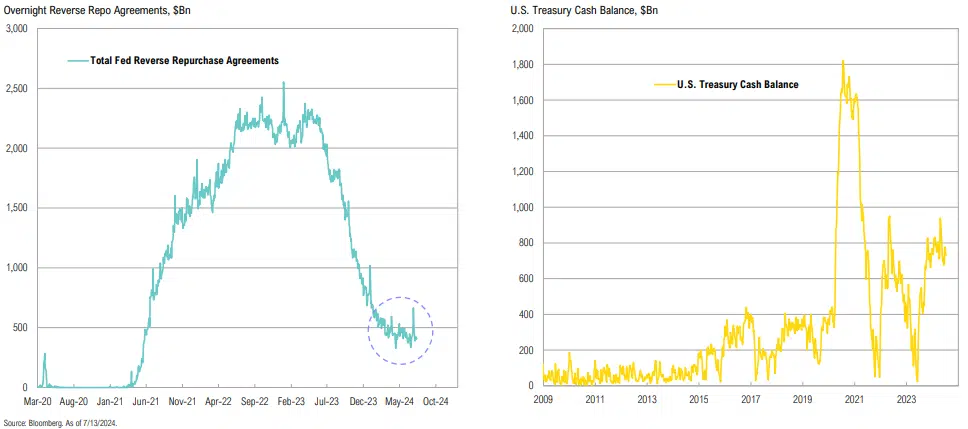

Other Sources of Liquidity

The Fed’s reverse repo facility (which has dampened the effects of QT), has stabilized at ~$400bn; Treasury cash balance is currently at $730bn and is expected to build to $850bn by September

Fed Balance Sheet

~18% ($800bn) of the Fed’s balance sheet assets are maturing within the next year—enough to hit the $25bn monthly roll-off target; this implies the Fed will purchase ~$500bn in Treasuries

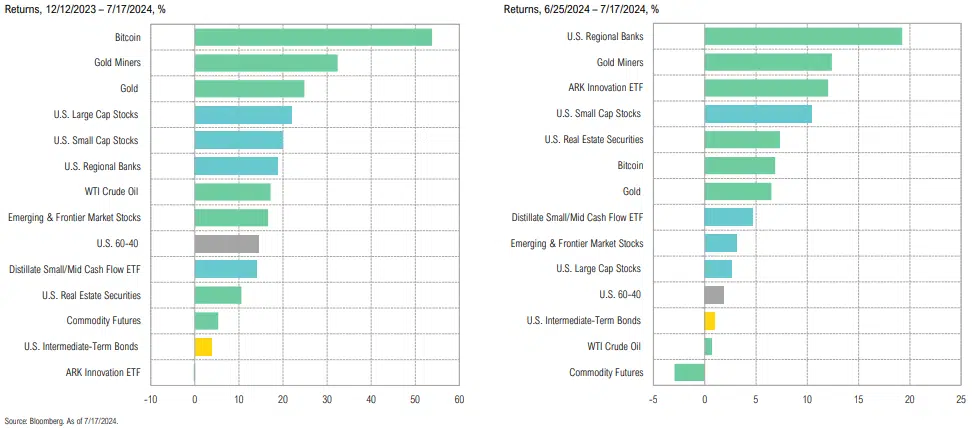

Fed Pivot and Returns

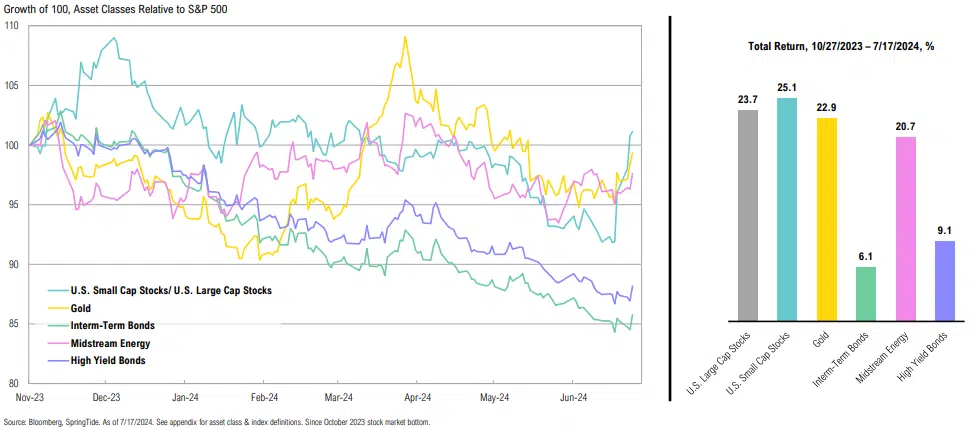

The market reaction since the December FOMC meeting is consistent with the Fed raising their inflation target; performance has recently started to broaden out

2024 Presidential Election

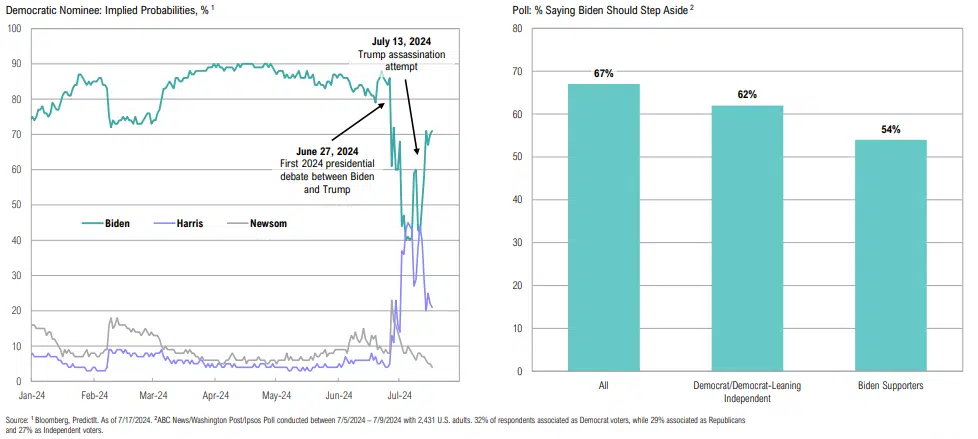

Biden’s position as Democrat nominee has been thrown into question post-debate; 62% of Democrats / Democrat-leaning voters now believe he should step aside

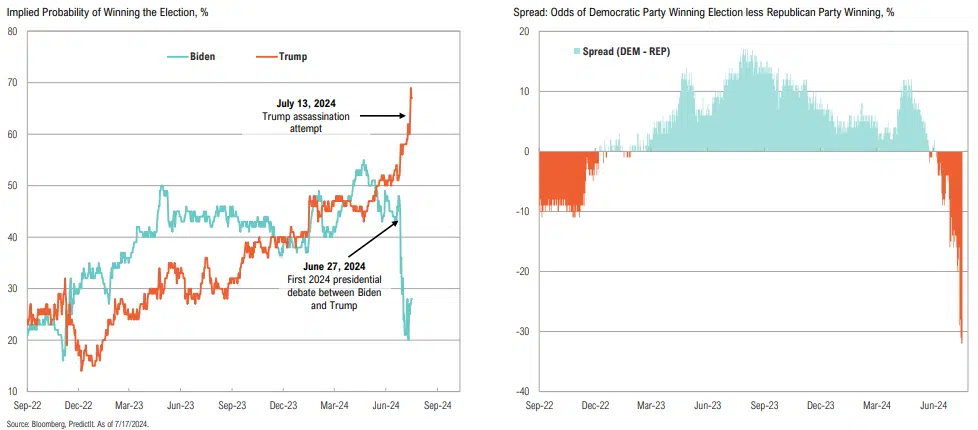

Trump’s probability of winning jumped post-debate and even more post-assassination attempt, with betting markets now clearly favoring a Republican win in November

U.S. Dollar & Other Trump Trades

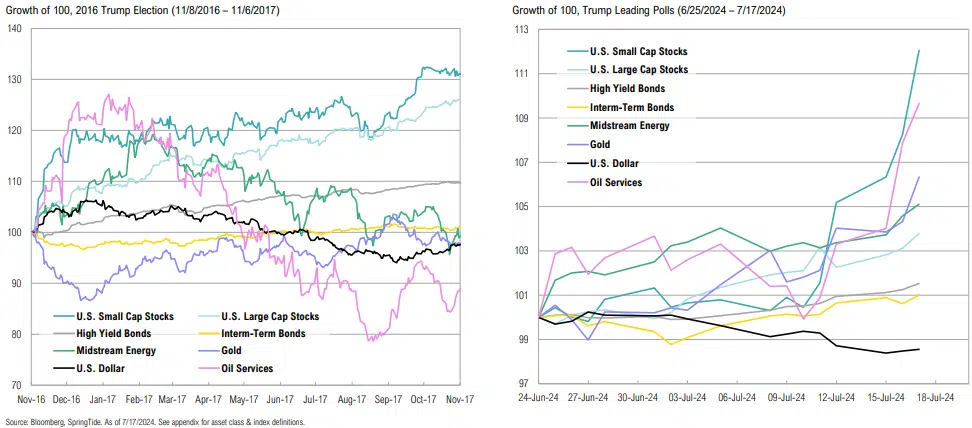

The initial impact of the Trump election in 2016 was a rally in energy and small cap stocks and a USD decline; as Trump leads the polls, 2024 seems to be playing out similarly

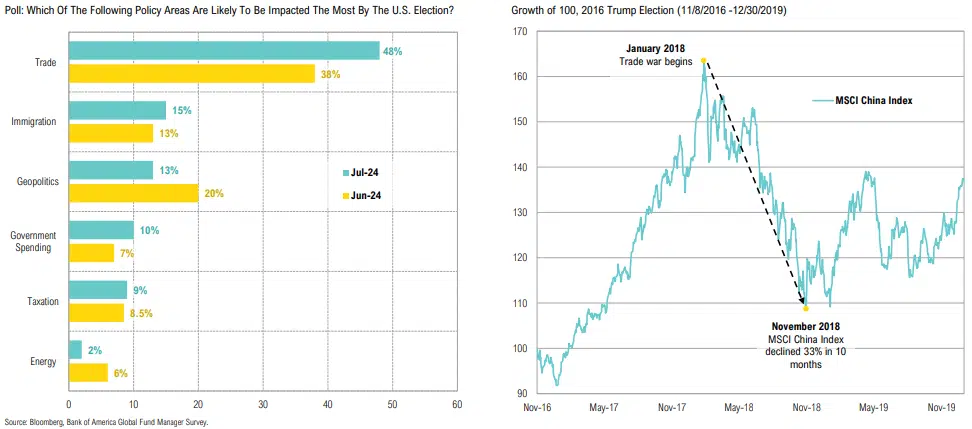

Investors view trade policy as the most likely to be impacted by the U.S. elections

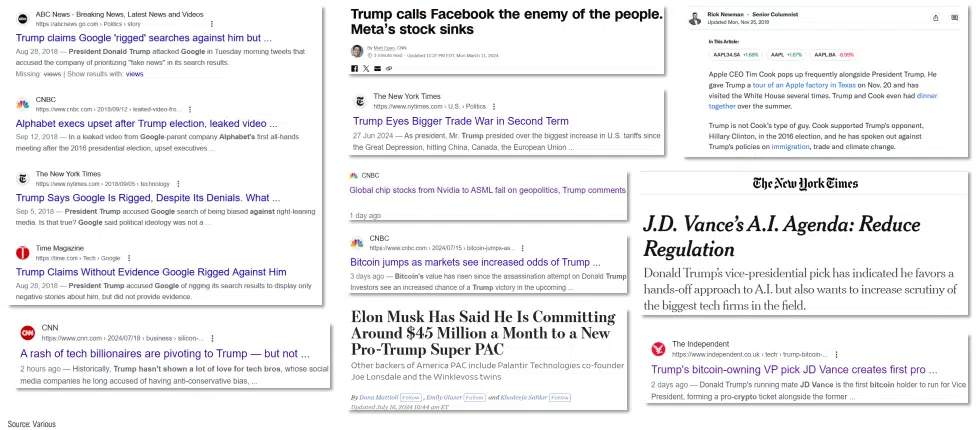

Trump and Vance view big tech firms negatively, are pro-Crypto and pro-trade tariffs

It truly is a moment of the cup half full or the cup half empty, depending on which bit of the world you want to look at…if you’re in the lower end of the income spectrum in the U.S., you’re under pressure from inflation. If you want to see the glass half full around the world, you’ve got places like Latin America, where the consumer is in great shape. Very strong growth. India, the same. So for every kind of slightly off-the-median story you want to look at, there’s one of the other side as well.”

James Quincey,Coca Cola CEO

What we have seen instead is a general perception that restaurants as a category have become expensive, introducing industry wide pressures regardless of a given restaurant’s relative value.”

Hajime Uba, Kura Sushi USA CEO

Equity

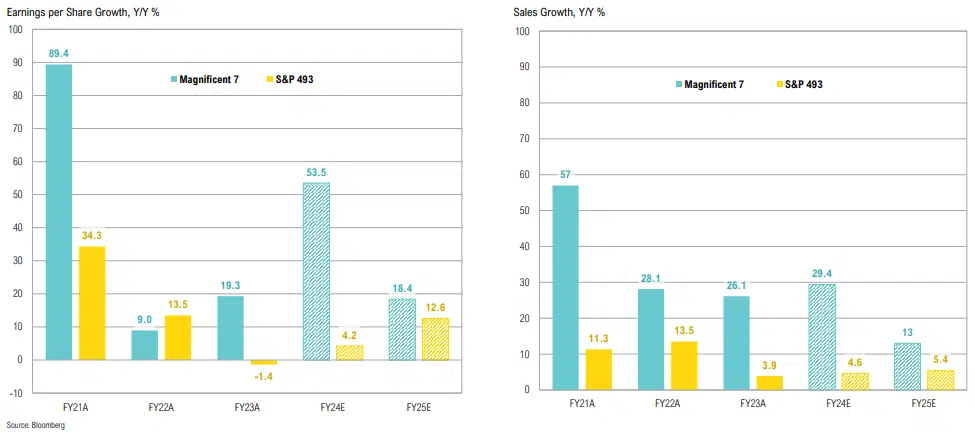

Earnings Growth Estimates

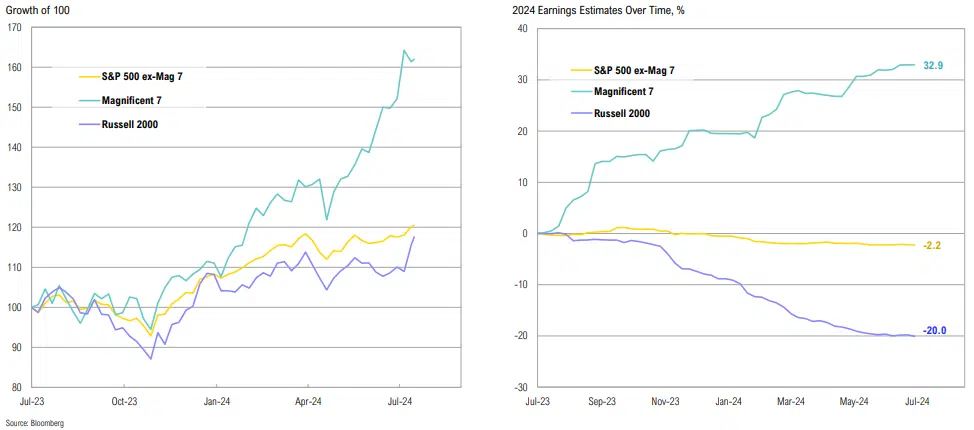

The outperformance of the Magnificent 7 over the S&P 500 and Russell 2000 in the past year has been somewhat justified by strong earnings revisions; will this continue?

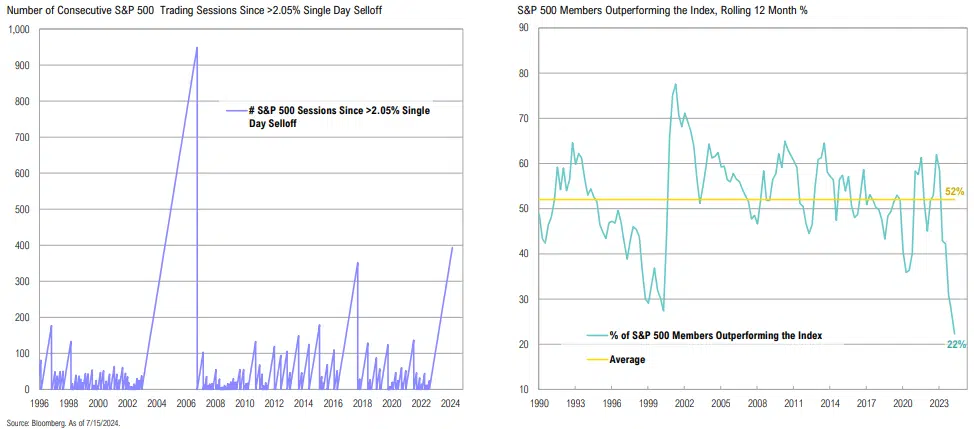

Market Breadth

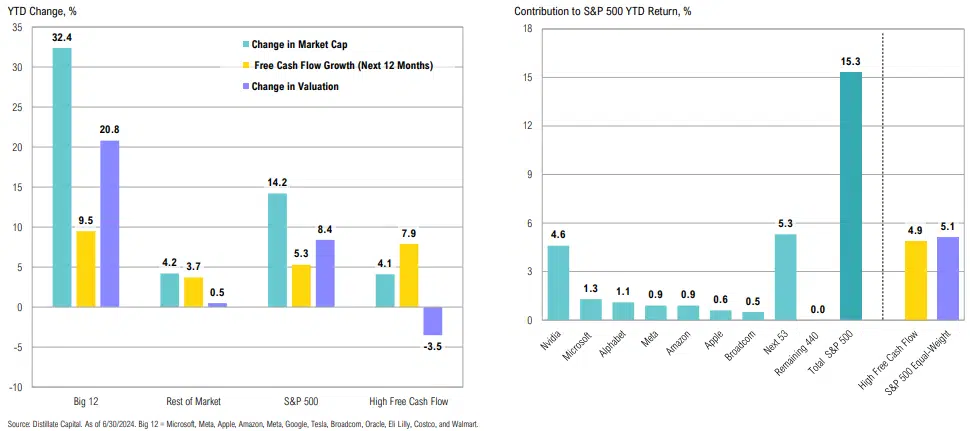

This is the longest period since pre-GFC without a daily decline of at least 2.05% in the S&P 500; only 22% of S&P 500 members are outperforming the broader index

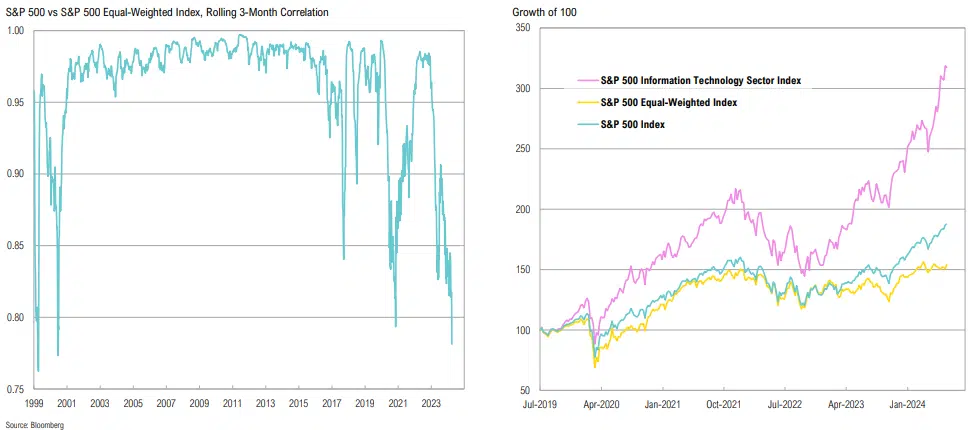

Correlation between the S&P 500 market cap and equal-weighted indices is among the lowest in 25 years; the tech sector has been notably outperforming the broader market

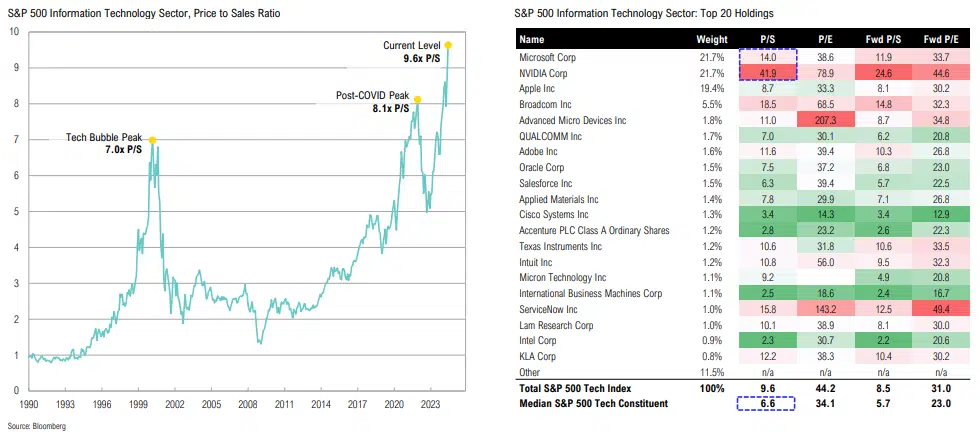

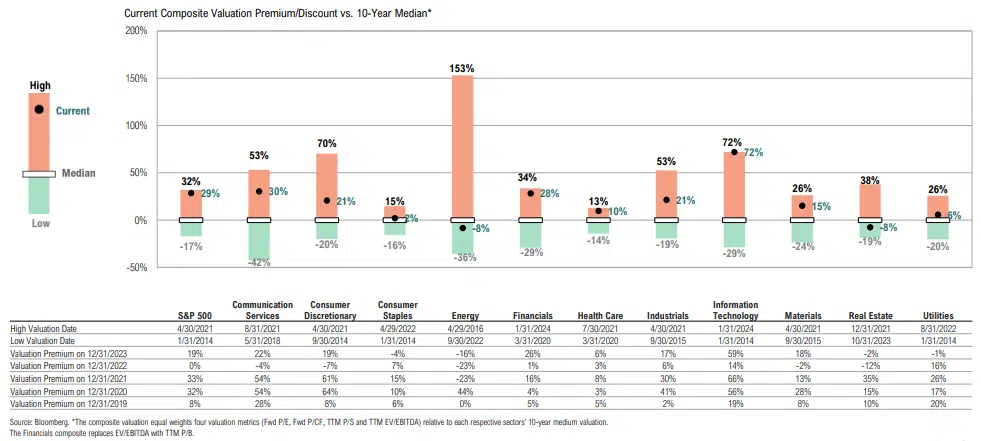

Tech Sector Valuations

The tech sector P/S ratio is currently 40% higher than peak Tech Bubble levels: NVDA (41.9x P/S) and MSFT(14.0x P/S) together account for >40% of the sector; the median tech stock trades at a 6.6x P/S

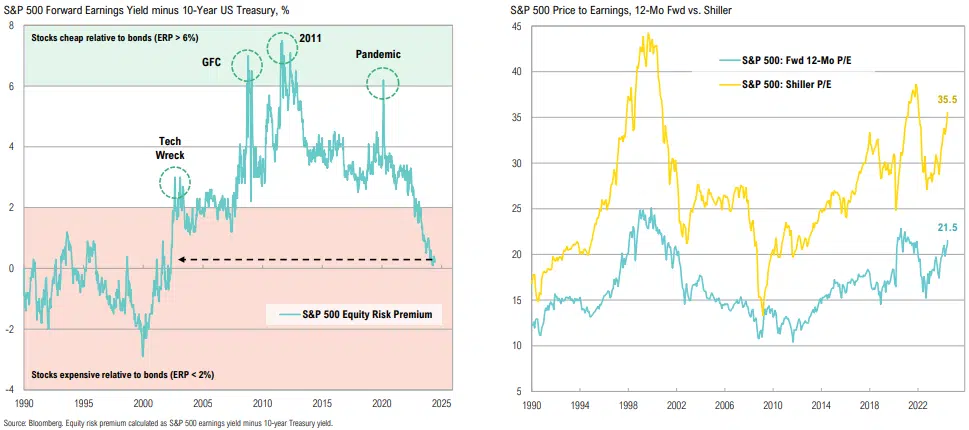

Market Valuations

Using a yield-to-earnings yield comparison (ERP), U.S. stocks are less attractively priced vis-à-vis bonds than at any point since the 1990s; valuations appear rich from both a Shiller and forward P/E perspective

Earnings Growth Estimates

Is market narrowness at least partially justified by earnings growth trends? FY 2024 Mag 7 earnings are expected to grow by 53.5%, while S&P 493 earnings are expected to grow by 4.2%

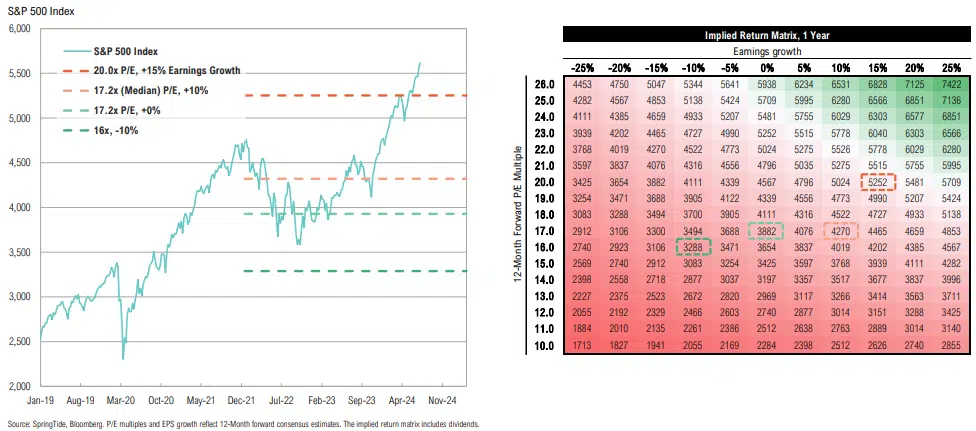

Market Valuations

Markets are currently pricing in 14.4% EPS growth for the S&P 500 over the next 12 months, implying a 21.5x P/E vs to the long-term average of 17.2x

Most sectors within the S&P 500 are trading at premiums relative to their internal median valuations, with Tech, Financials, and Health Care at or near 10-year highs

Manager Case Study

The market has rewarded a small subset of stocks while ignoring the rest, resulting in asymmetrical risk/reward for mega cap tech vs. other parts of the market

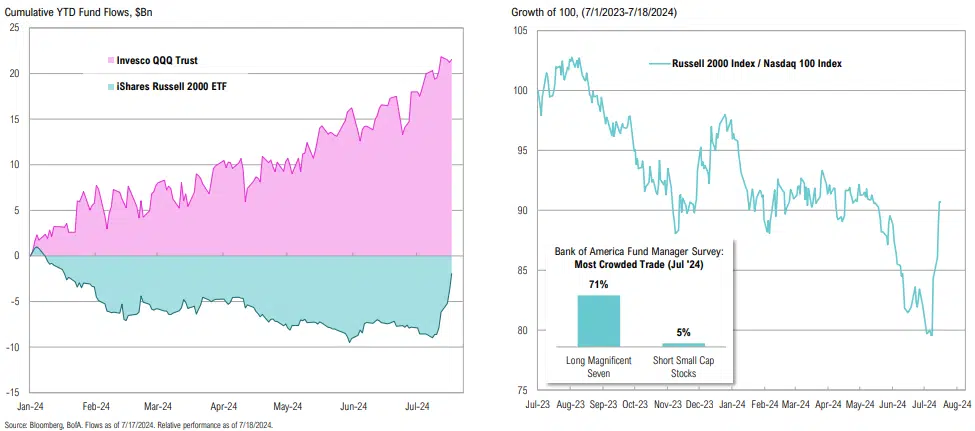

U.S. Small Cap Stocks

Is the recent move in all U.S. small cap stocks sustainable, or is it a forced unwind of extreme positioning that should be faded? We think a bit of both

Emerging Markets

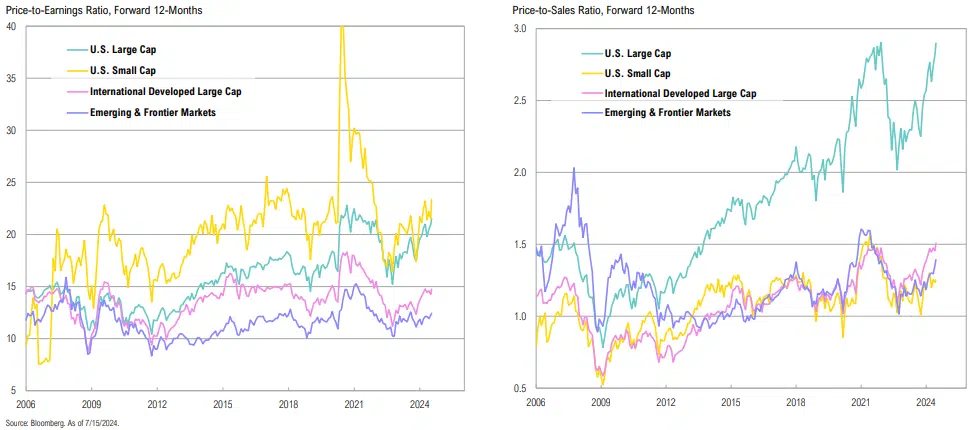

Emerging market stocks remain relatively cheap vs. developed markets

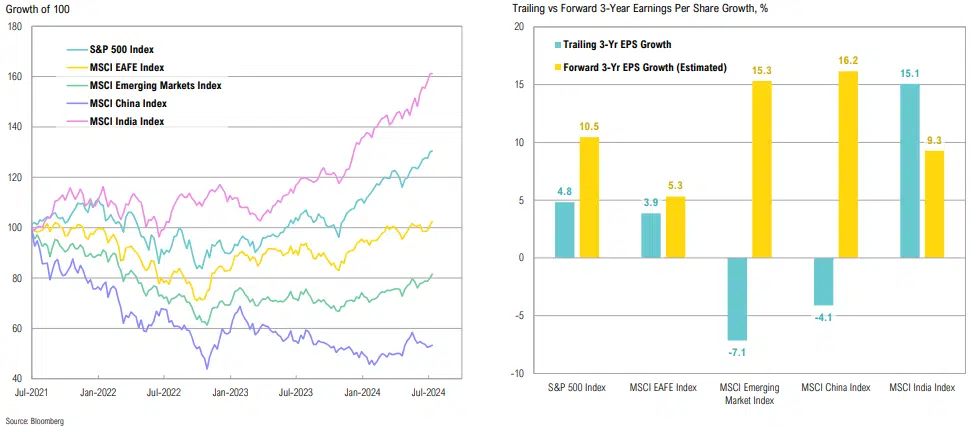

Bolstered by earnings growth, the U.S. and India have outperformed; looking ahead, earnings growth for broader emerging markets and China look promising

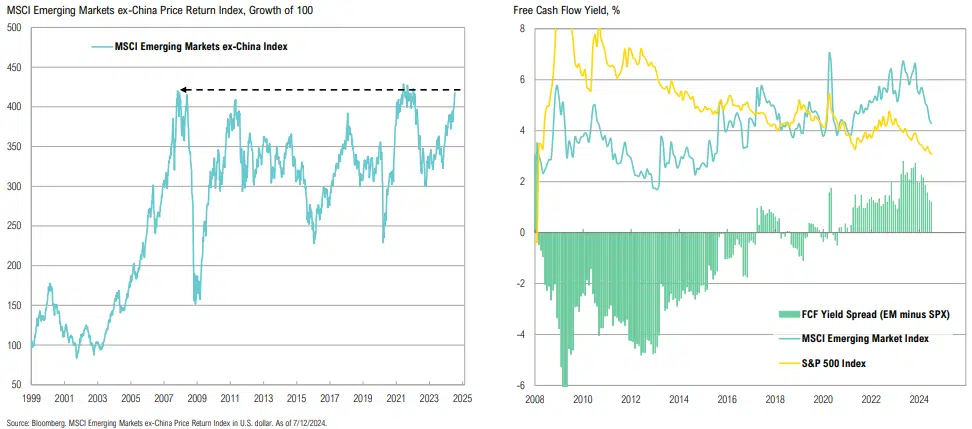

EM ex-China stocks are nearing a 16-year breakout; EM stocks look cheap compared to U.S. large-cap stocks, with free cash flow yields 1.2% higher than those of the S&P 500

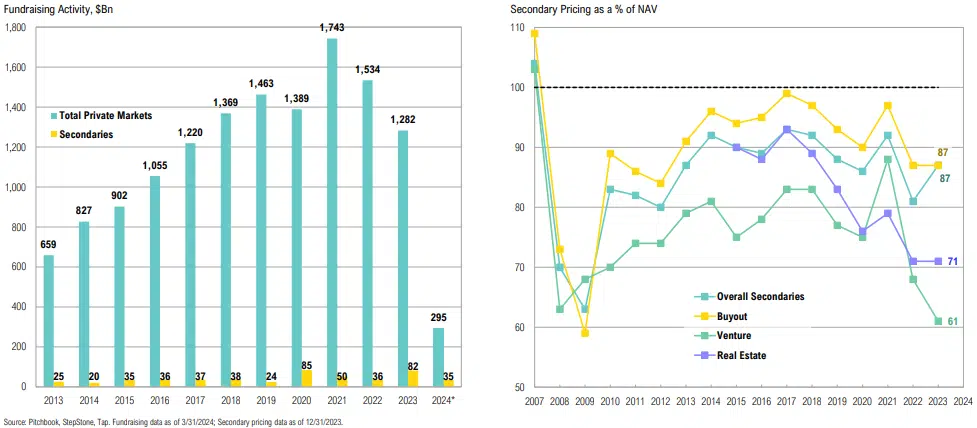

Private Markets: Secondaries Fundraising

Secondaries fundraising is on pace for its largest year ever, but is only 11% of all private market fundraising in Q1

Private Equity: PE Buyout

PE Buyout multiples continue to creep higher; elevated interest rates and looser covenants are deterring debt investors, causing equity share in new deals to climb above 50% for the first time ever

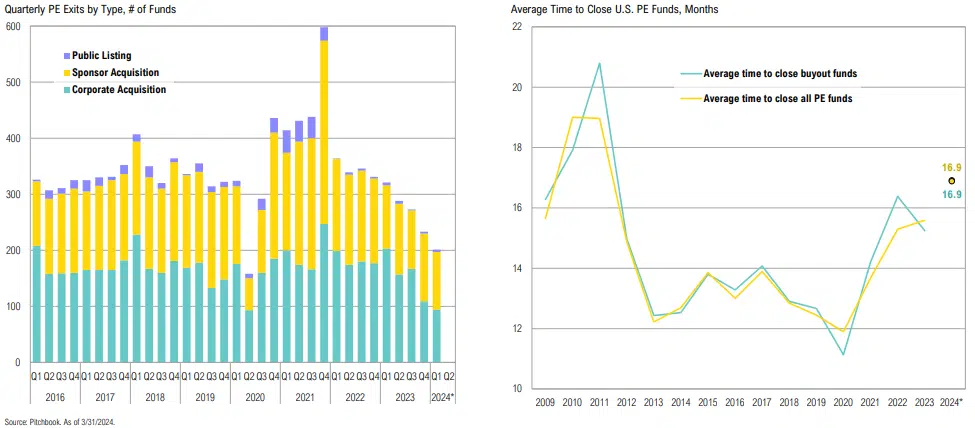

Private Equity

Exit activity continued to trend lower in the first quarter of 2024, implying PE firms are still struggling to find buyers at current valuations

Washington does not have a revenue problem, it has a spending problem. ”

Unknown

Fixed Income & Credit

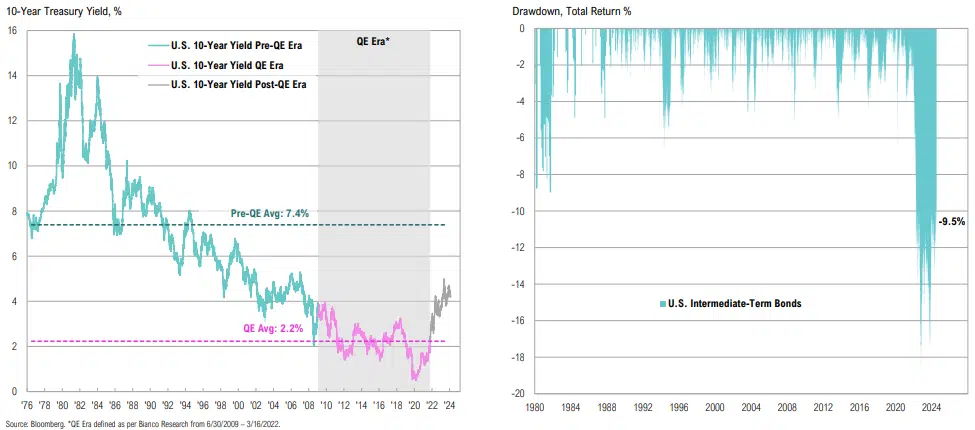

Treasury Market

The outperformance of the Magnificent 7 over the S&P 500 and Russell 2000 in the past year has been somewhat justified by strong earnings revisions; will this continue?

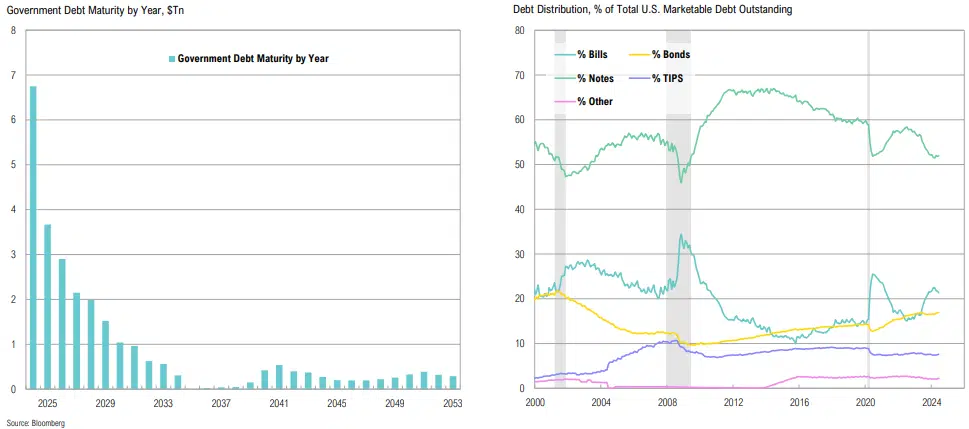

Treasury Issuance

2024 Treasury issuance is on track to surpass 2023 to become the highest after 2020, and the highest in a non-crisis year; the average cost of U.S. government debt continues to rise, now >3.2%

Government Debt

Over $8Tn in government debt is set to mature this year, and will be rolled at much higher rates; bill issuance has marginally declined, from 22.5% to 21.3% of total debt over the past quarter

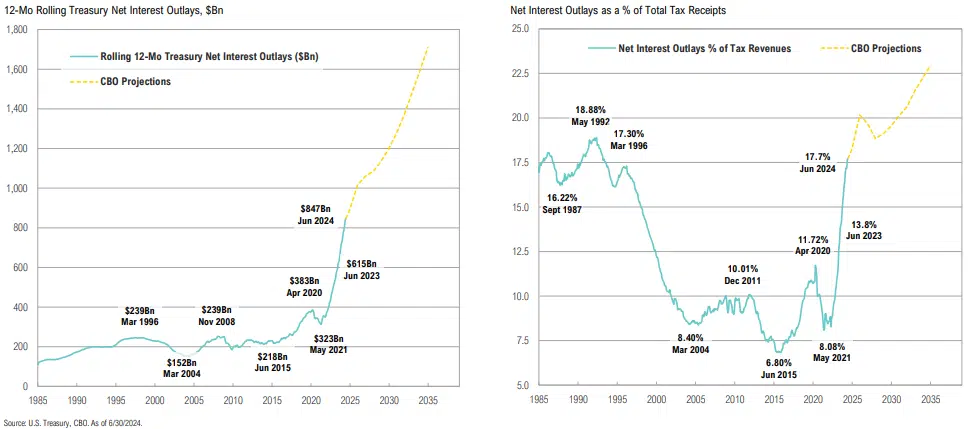

Net Interest Outlays

12-month Treasury net interest outlays rose over 37% to $847bn over the past year; tax receipts aren’t keeping pace, with nearly 18% of taxes going only to net interest payments

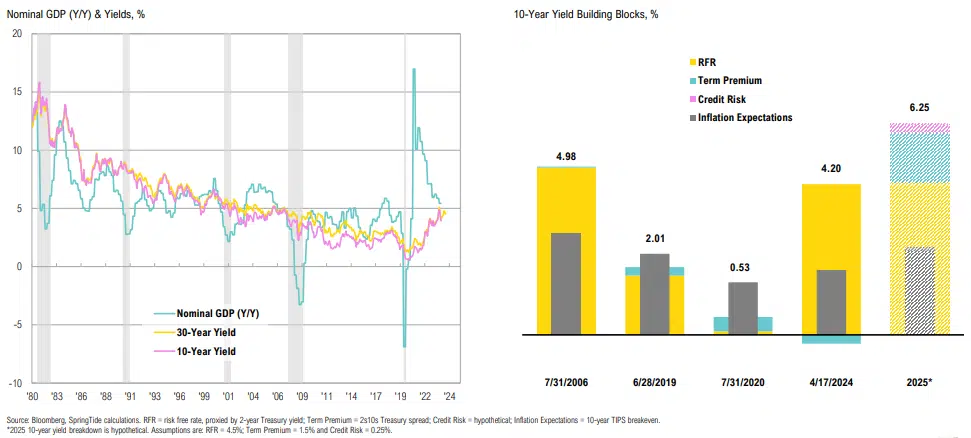

GDP & Treasury Yields

The fiscal balancing act: Historically, long-term yields tend to follow GDP, but what will happen in 2024 depends largely on policy

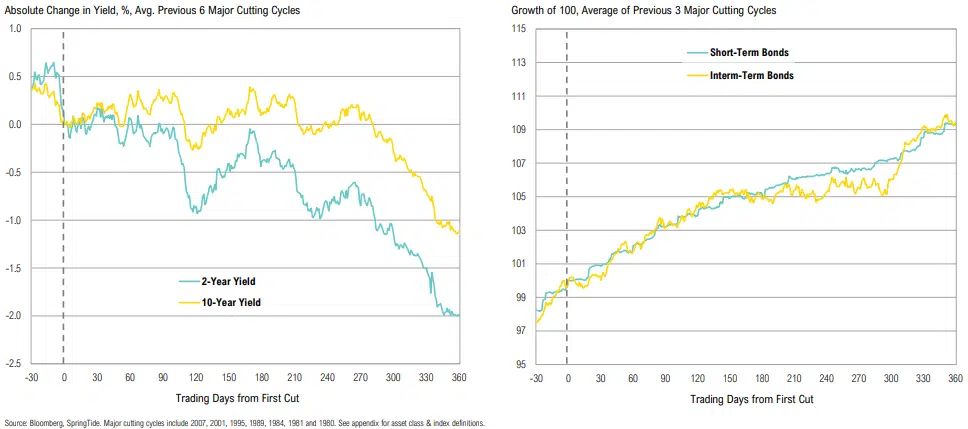

Treasury Market

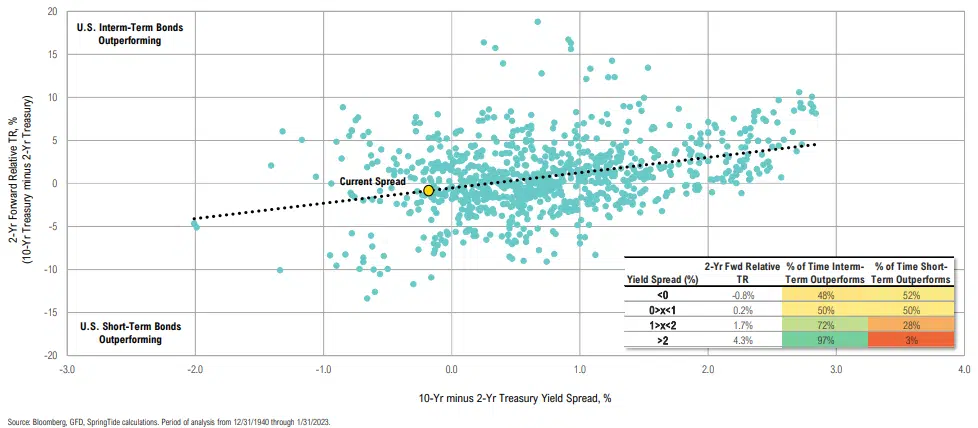

During cutting cycles, the shorter end of the yield curve responds more aggressively than the longer end; underweight duration is a good place to be

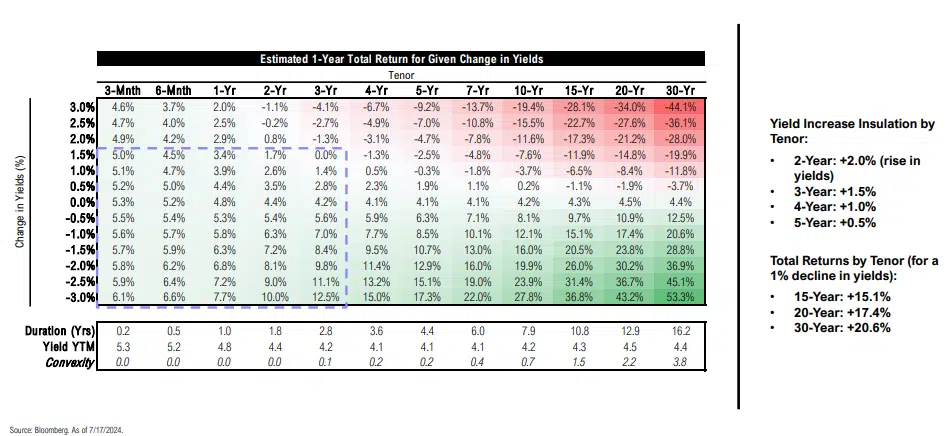

Treasury Payoff

The 2–3-year part of yield curve has an attractive risk-reward profile—yields could rise 1.5% in the next year and total returns would still be positive

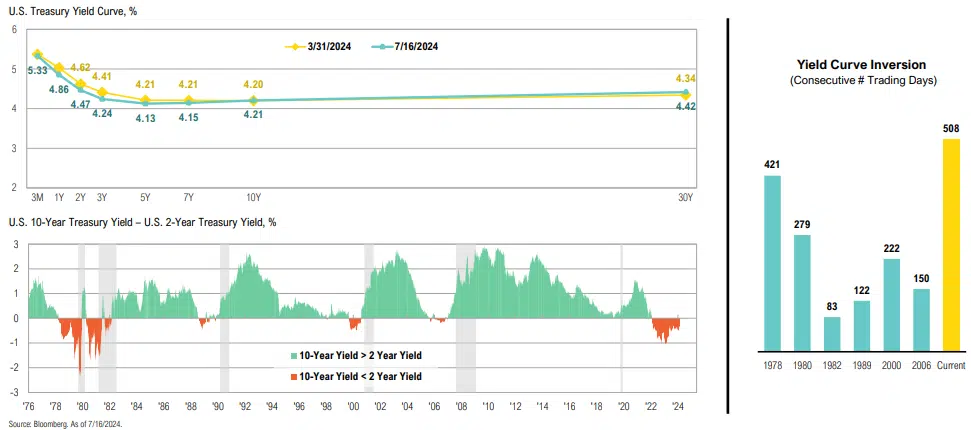

Yield Curve

The yield curve remained relatively unchanged over the quarter; it has now been more than 2 years since the yield curve inverted and remains inverted at -26bps

2s10s

When the 2s10s spread is above 2%, investors should generally hold longer duration bonds; when it is between 1% and 2%, it is not a home run; and below 1% is a coin toss

Private Credit

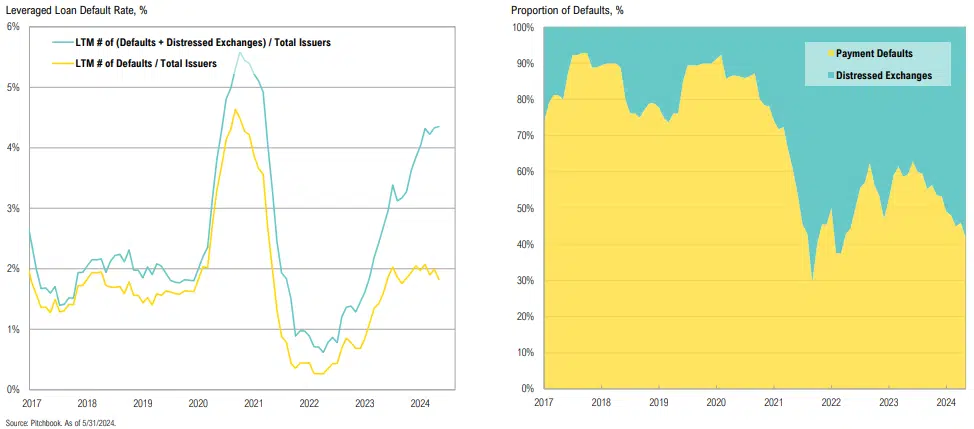

Distressed exchanges are replacing traditional defaults, masking issues

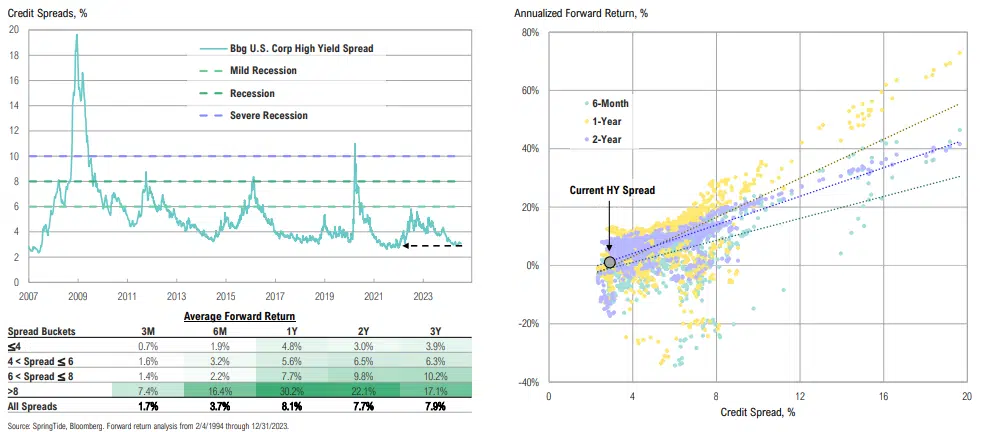

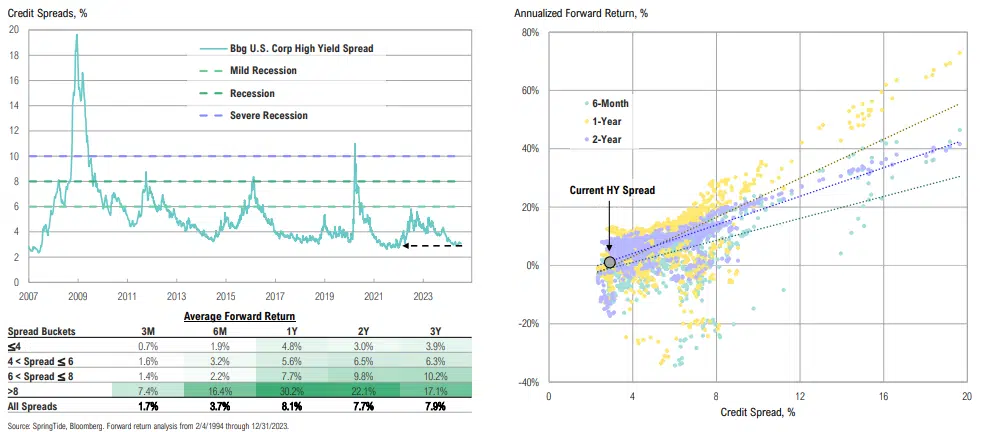

High-Yield Spreads

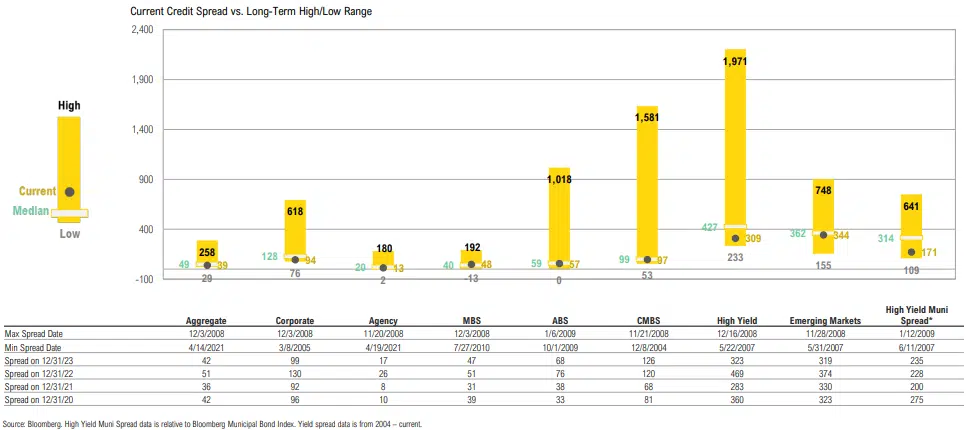

Not attractive: at ~307bps, credit spreads are in line with pre-COVID lows and even nearing 2021 levels; low credit spreads continue to suggest runway for the economy (i.e., a ‘soft landing’)

Spreads by Sector

Credit spreads are near or below median across most sectors; high-yield bond spreads at current levels suggest that the economy may achieve a ‘soft landing’

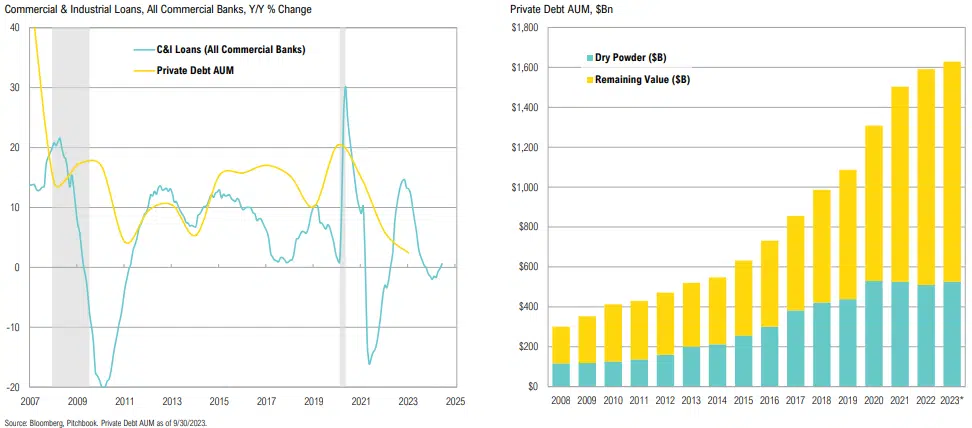

Private Credit and C&I

Private credit continues to grow, and is helping to fill the void left by declining commercial bank lending

Private Credit

Distressed exchanges are replacing traditional defaults, masking issues

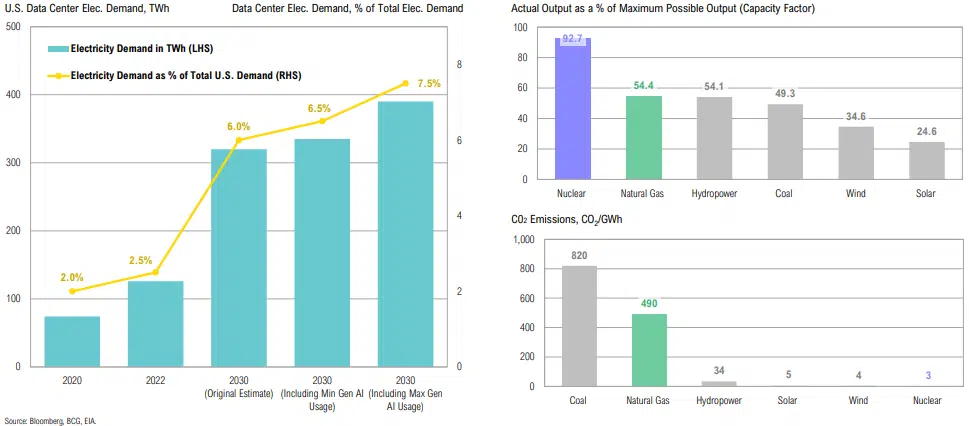

It is widely estimated that global electricity consumption from data centers will increase to approximately 10% of total electricity demand by 2030, up from approximately 2% today. To put this in context, this means that to satisfy the needs of data centers alone, which doesn’t factor in the penetration of EVs or broader economic electrification, the additional generation capacity required by data centers is equivalent to the size of the current U.S. power grid. ”

Connor Teskey, Managing Partner at Brookfield Renewable

Real Assets

Power Play

AI and data centers are expected to be key drivers of future U.S. power demand; given consistent output requirements for data centers, natural gas and nuclear are the best energy sources to meet demand

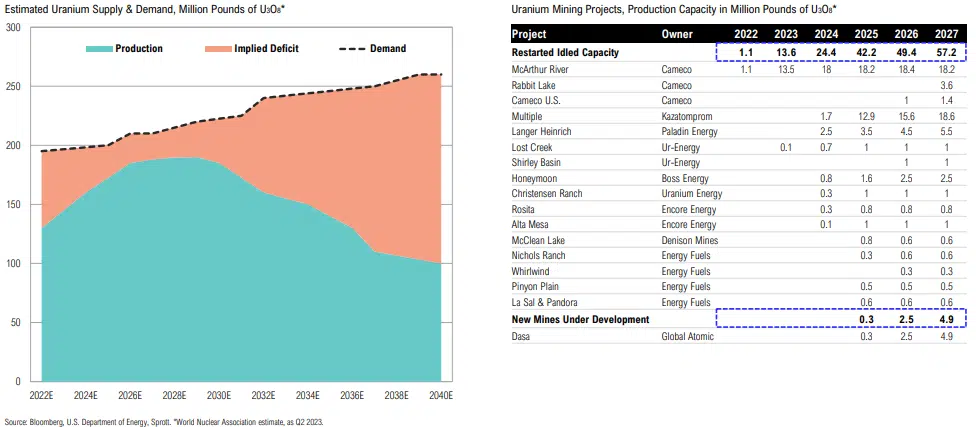

Uranium

Uranium production remains in a structural supply deficit; despite seeing a supply response from restarted idled mines, there needs to be meaningful investments in new projects to clear deficit (but this has yet to materialize)

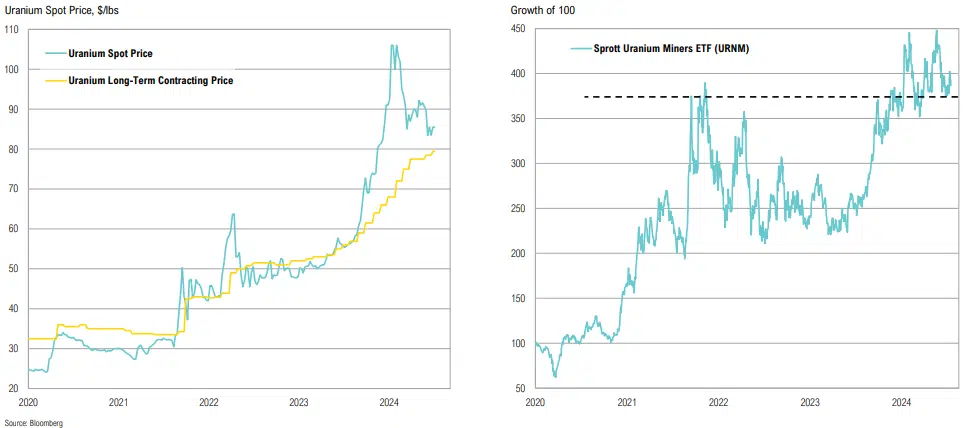

Spot uranium prices have pulled back since peaking in February, but long-term contracting prices (the prices negotiated between utilities and miners) continue to move higher; uranium miners are trading at/near key technical support levels

Power Play

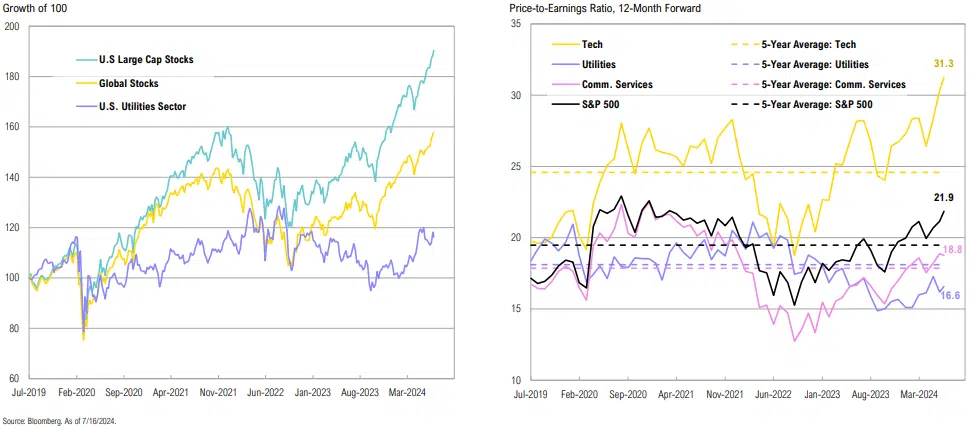

Despite the recent rally, U.S. utilities have significantly trailed U.S. large-cap stocks and global stocks over the past five years; unlike most sectors, utility valuations remain below their 5-year averages

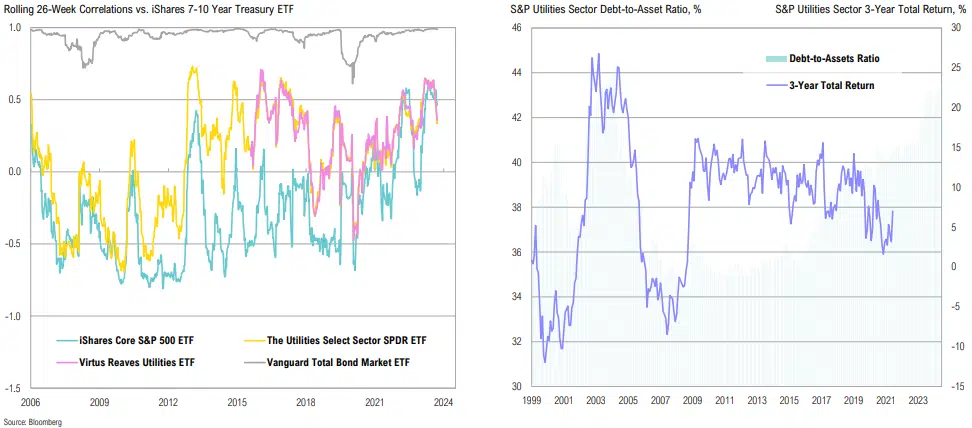

Utilities are now less correlated to bonds than the S&P 500, likely as markets realize their role in meeting future power demand; recent rising leverage is manageable as interest costs can be passed to customers

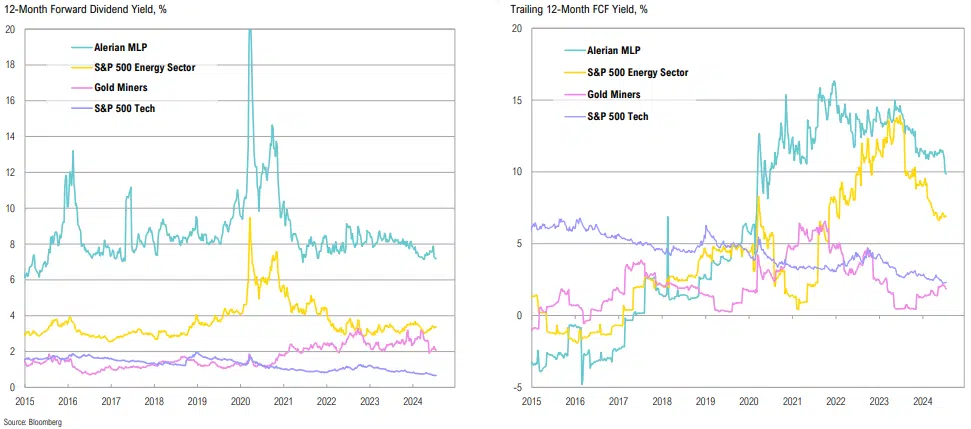

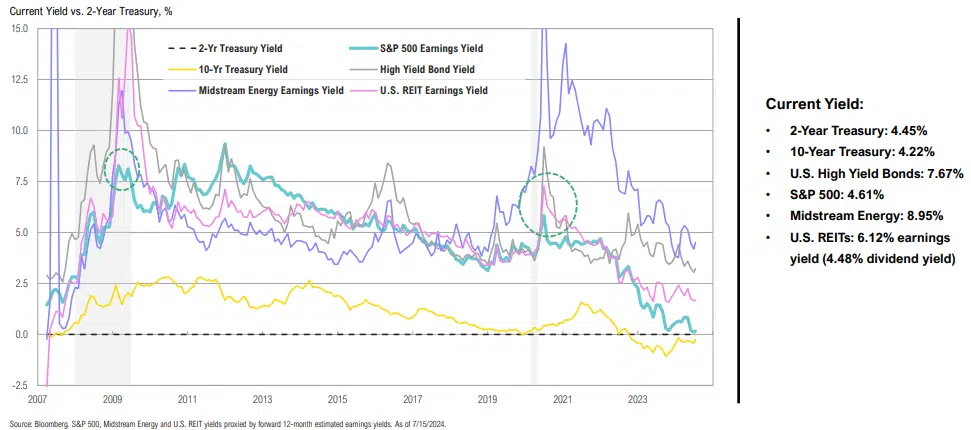

Relative Yields

Midstream energy’s yield premium has narrowed but remains attractive, supported by ongoing distribution increases; trailing free cash flow yields of the energy sector have declined

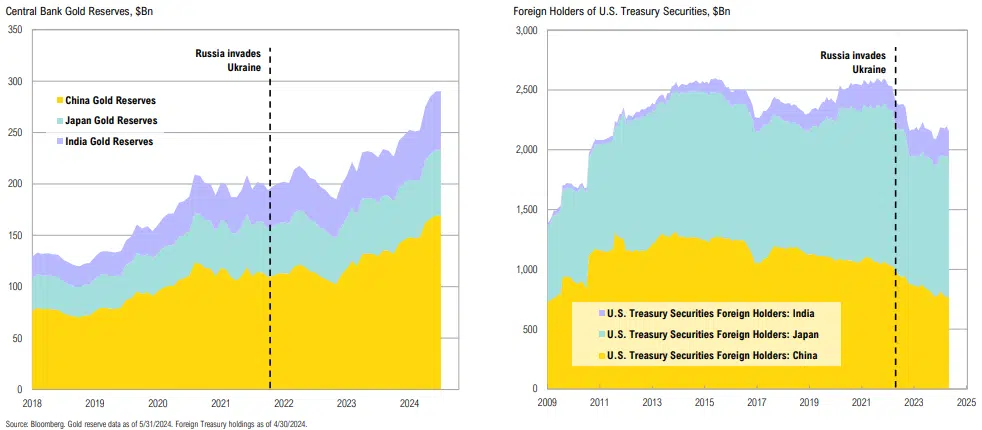

Gold Reserves vs. U.S. Treasury Holdings

Accompanied by ‘flight to safety’ (geopolitics, U.S. fiscal situation), gold’s resilience despite rising real rates is likely due to sovereigns favoring gold, even with China pausing buying in May; whatever the reason, higher real rates remain a risk

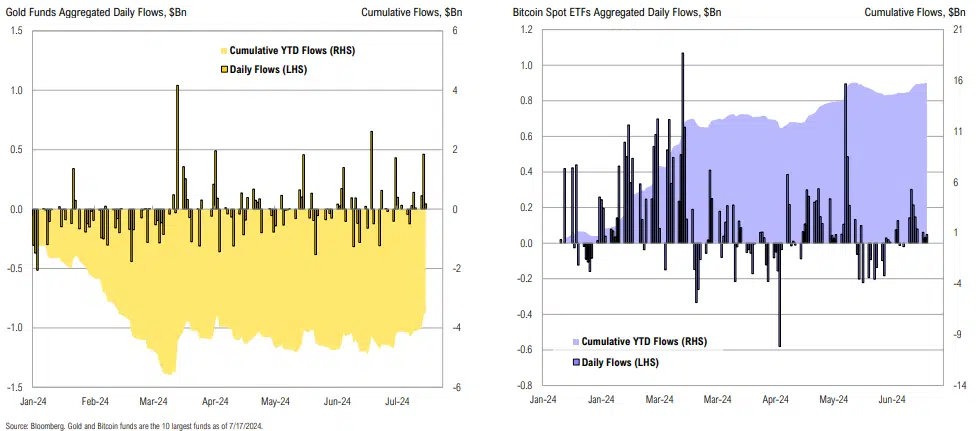

Gold vs Bitcoin ETF Flows

U.S. fund flows make a compelling case that bitcoin has been cannibalizing demand for precious metals, but we still think gold has a role

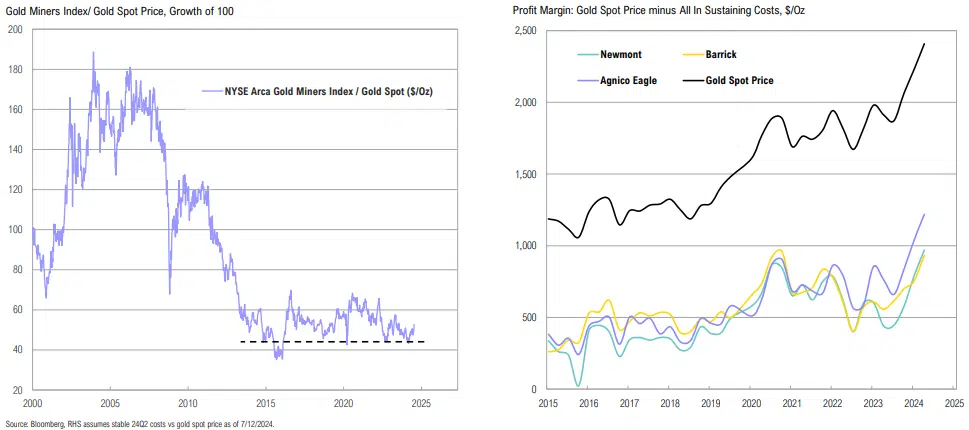

Gold Miners

On the surface, gold miners look attractive vs. physical, but miners have been plagued by rising costs, country-specific issues, and labor challenges, among other things

Copper

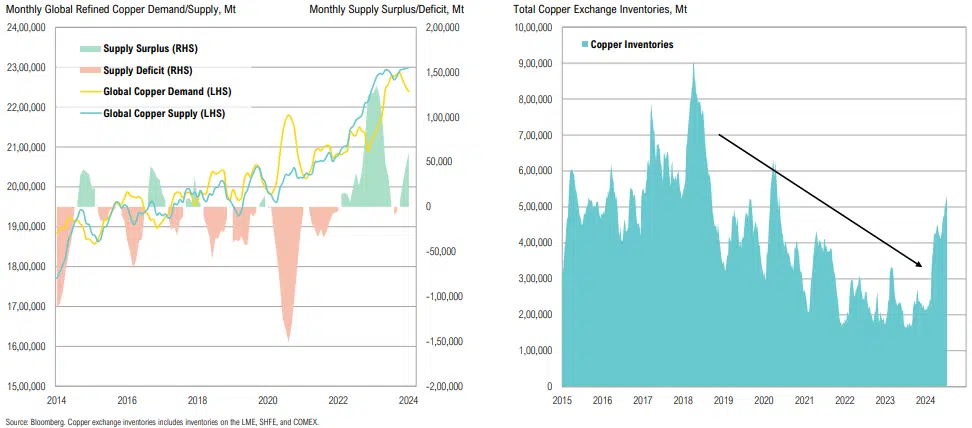

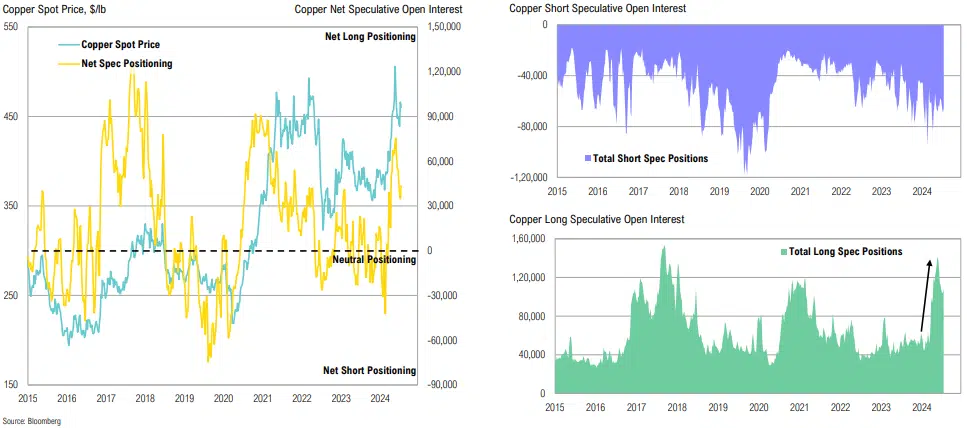

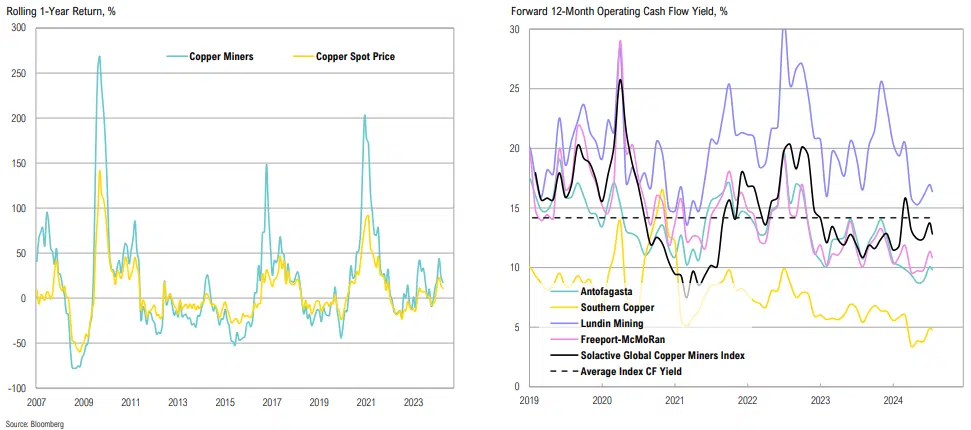

Surplus in global copper markets have increased while global copper inventories have soared, primarily driven by seasonal effects, supplier destocking, and soft global demand

Copper markets have recently been driven by speculative demand rather than market fundamentals; spot prices rallied 38% from February to May but have since consolidated as fast money exits the market

Copper miners are highly sensitive to spot prices, making them appealing during copper bull markets; most miners are trading at a premium relative to their historical cash flow yields with valuations reflecting optimism

Commercial Real Estate

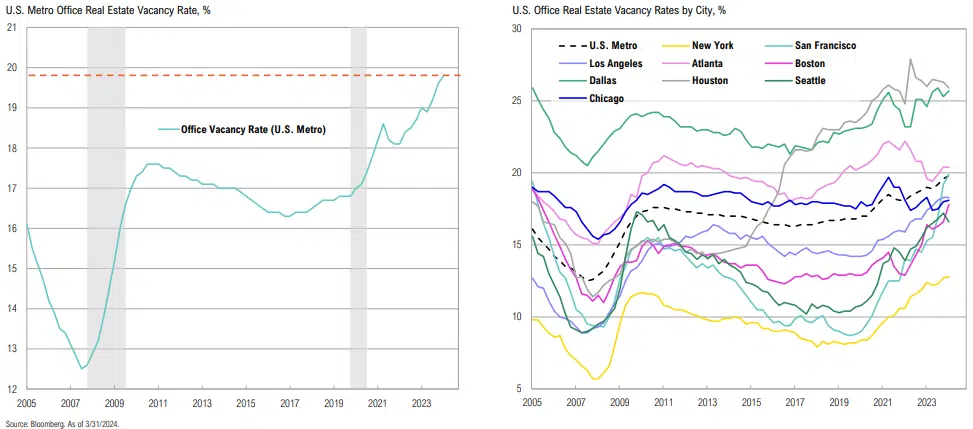

U.S. metro office vacancy rates are nearing 20%, far surpassing the GFC peak of 17.6%, vacancies in Boston, San Francisco, New York and Dallas continue to climb

REITs

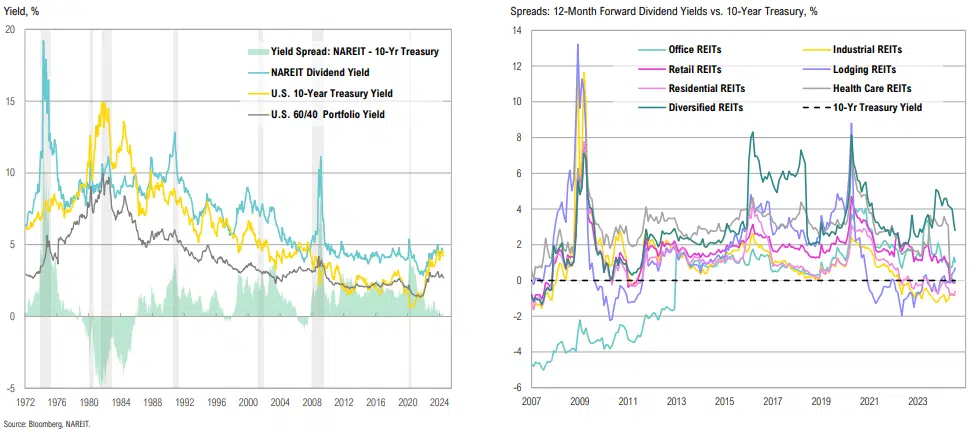

U.S. REITs rebounded 13% from their April lows as lower yields provided a reprieve for the asset class, despite the rebound, REITs still look wholly unattractive on a relative yield basis

Real Estate Valuations

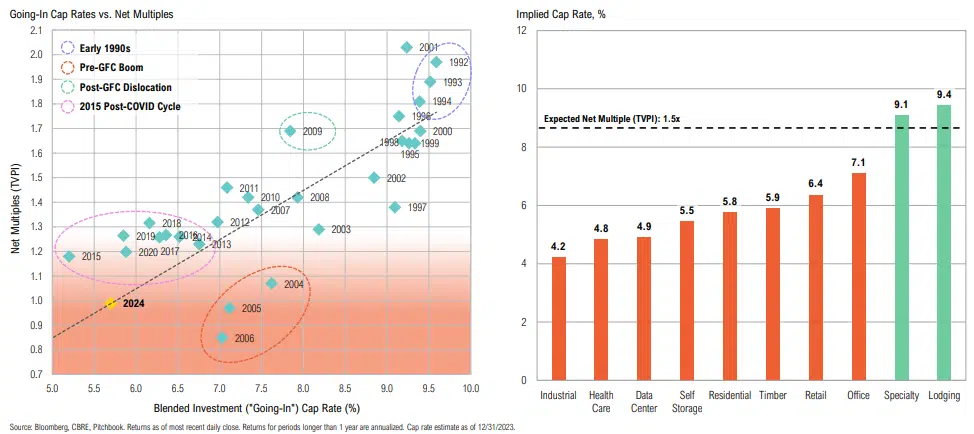

Implied cap rates are not attractive after the Q4 REIT rally, but the opportunity set is improving from a valuation perspective

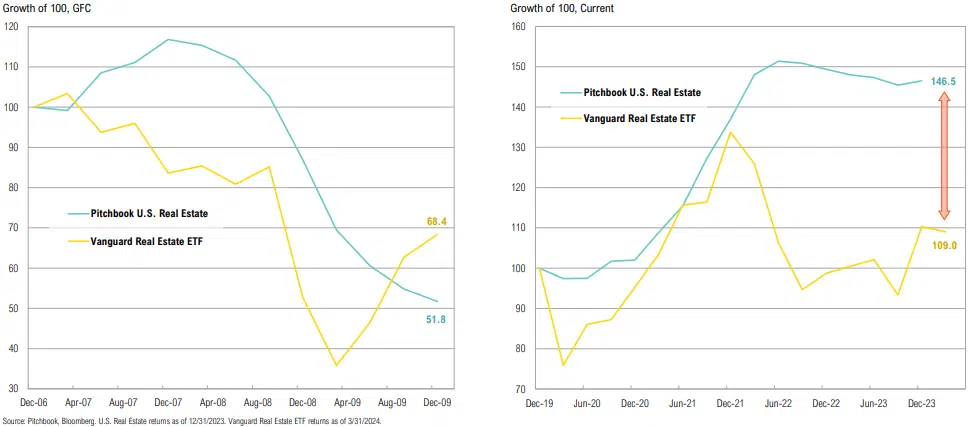

Private Real Estate Performance

Private real estate funds have not yet marked down properties, despite public markets struggling for more than 2 years

Residential Real Estate

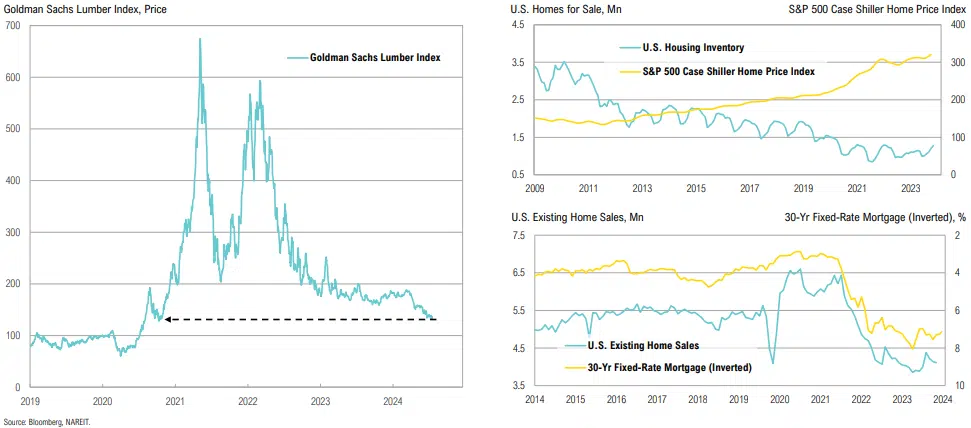

Lumber prices are back at October 2020 lows while residential home prices continue to climb and inventories remain subdued; home sales are declining, while mortgage rates remain above 7%

A New Bull’s Eye

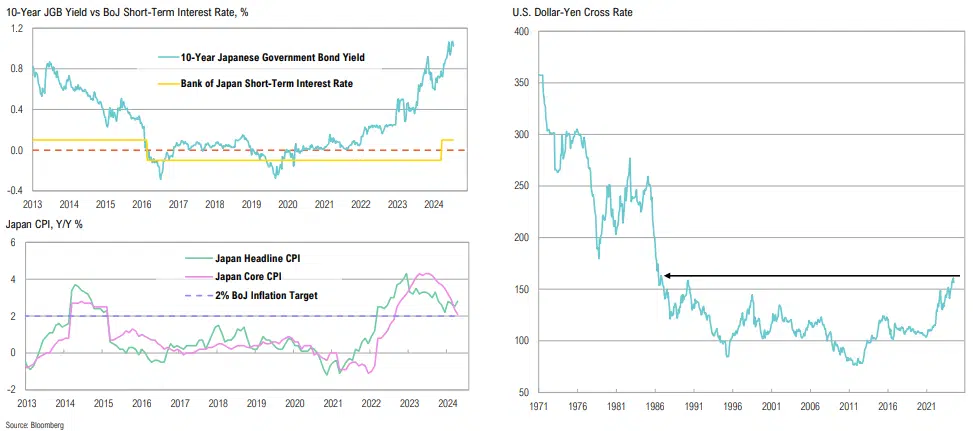

What we’ve really seen is a new Japan as a destination market. I think when the yen was ¥83 it was very difficult to be able to afford to see Japan and all the great things Japan has to offer. With the yen at ¥160, it’s a very different world for U.S. travelers, and they seem to be taking great advantage of it. ”

Glen Hauenstein, Delta Airlines President

Opportunistic

Yield Spreads

Most asset classes look unattractive relative to the 2-year Treasury yield

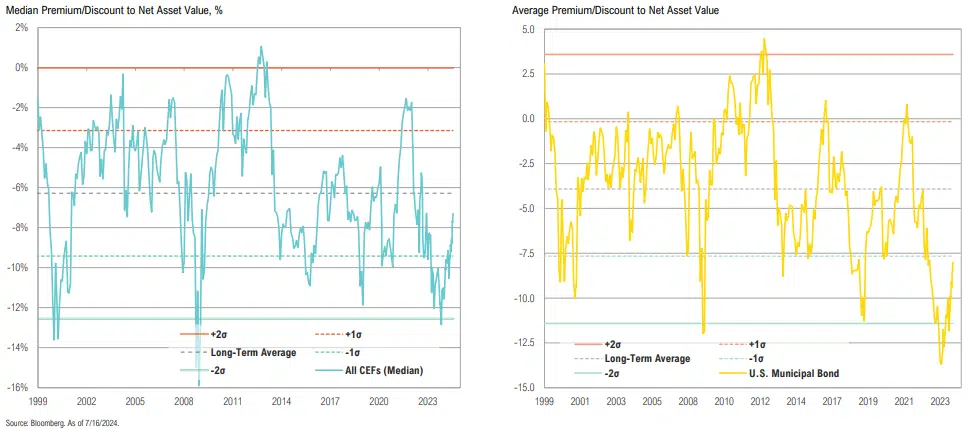

CEF Discounts

Median CEF discounts have been narrowing since October and are at the tightest discount since 2022; U.S. Muni CEF discounts are also less enticing, having narrowed from -13.7% to -8.0%

Bank of Japan

Japanese government bonds have climbed higher since the Bank of Japan hiked rates in March (the first hike in 17 years); the yen recently weakened to 4-decade lows

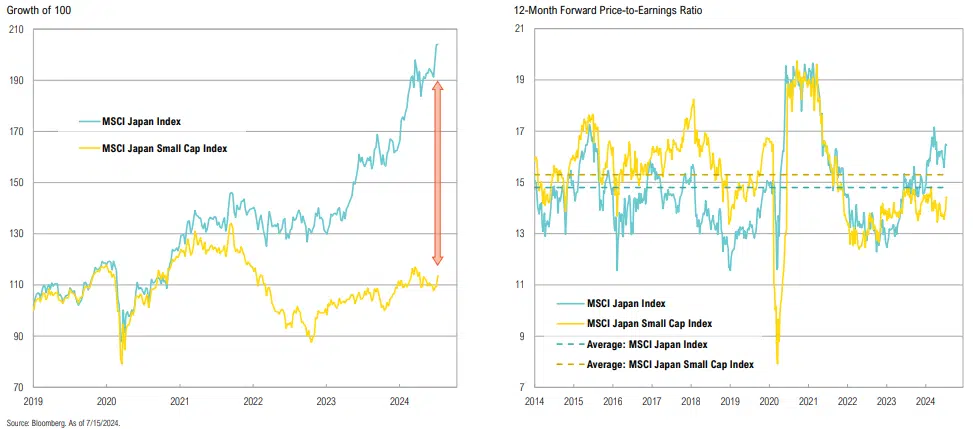

Japan Small Cap vs Large Cap

Japanese small cap stocks have lagged the broader index over the past 5 years; while still well below 10-year averages, small cap P/Es are starting to tick higher, likely due to incentives from TSE

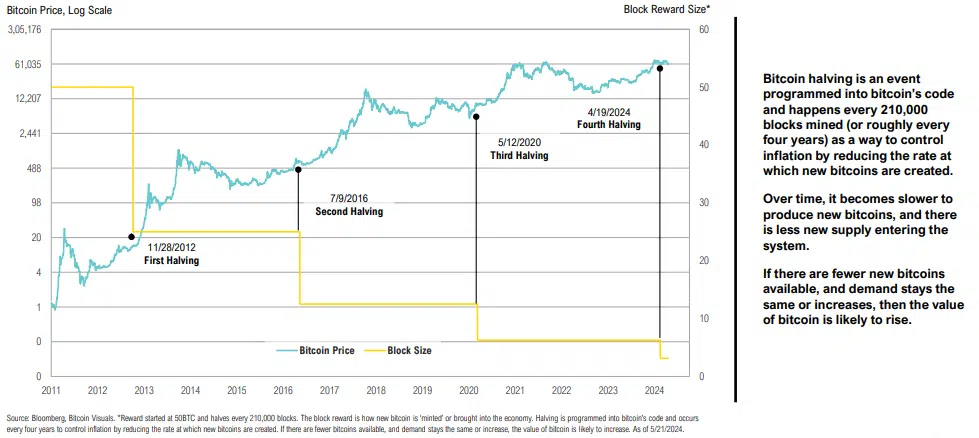

Bitcoin

The price of bitcoin tends to increase after each halving event, but has been flat since the fourth halving in mid-April, despite having a volatile few weeks

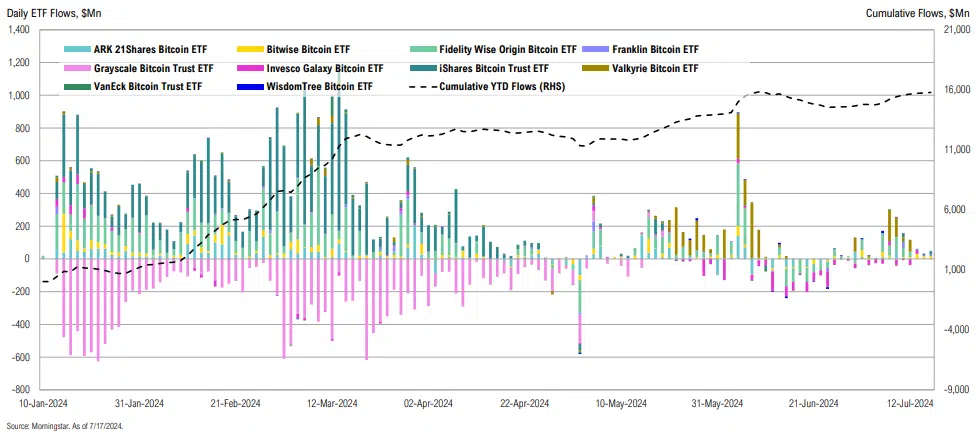

Bitcoin Spot ETF Flows

After accumulating nearly $16bn, flows into (and out of) bitcoin spot ETFs have stabilized somewhat; GBTC is no longer seeing meaningful outflows

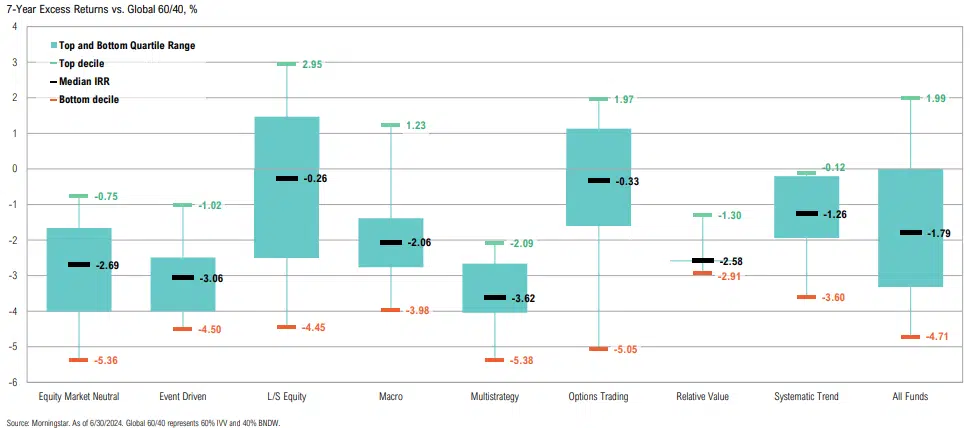

Category Performance

Keep it simple: expensive liquid alternatives have underperformed other than a select few categories, underpinning critical role of manager selection

A New Bull’s Eye

By not moving, we are tightening. And it’s starting from a level of restrictiveness that is as high as it’s been in decades. The reason to be as restrictive as that and the reason to tighten in real terms would be if you thought the economy was overheating. This is not my view of what an overheating economy looks like. ”

Austan Goolsbee, Chicago Federal Reserve Bank President

Asset Allocation

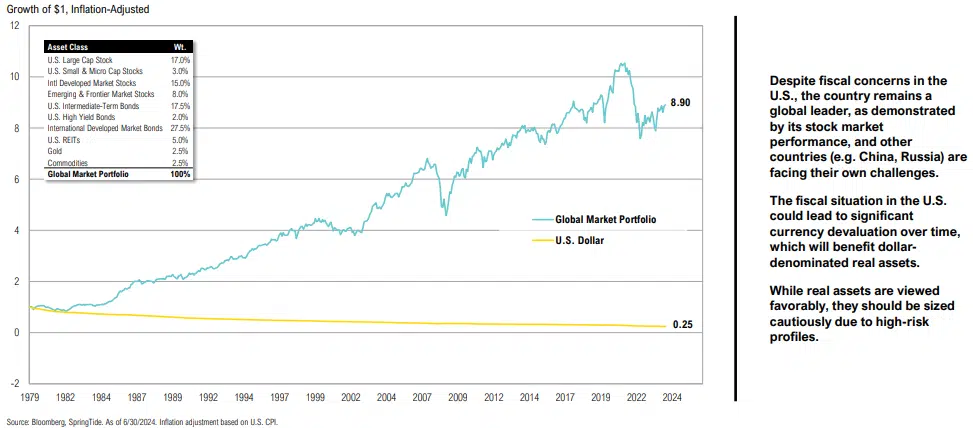

U.S. Dollar

The U.S. dollar is likely to remain the ‘cleanest shirt in the laundry’ for the foreseeable future, but it will gradually lose its value vs. real and productive financial assets over time

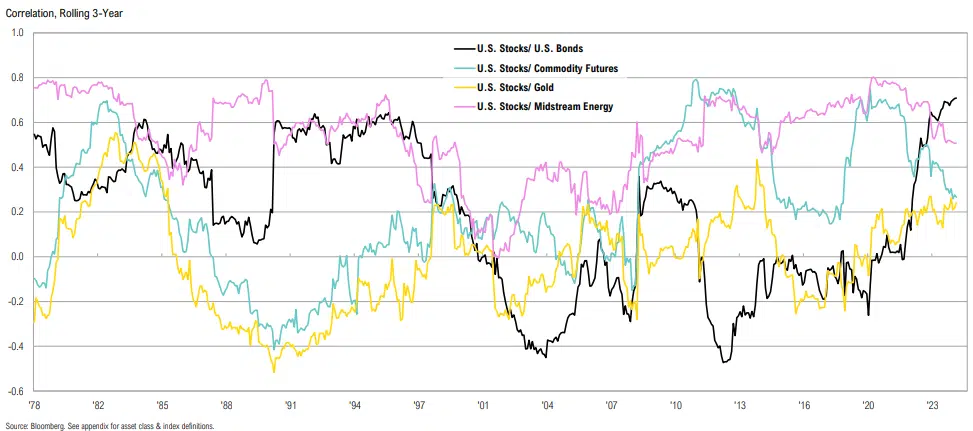

Stock & Bond Correlation

While some asset classes have been able to keep up with U.S. large cap stocks, most have lagged, suggesting there might be overlooked opportunities elsewhere

Correlations

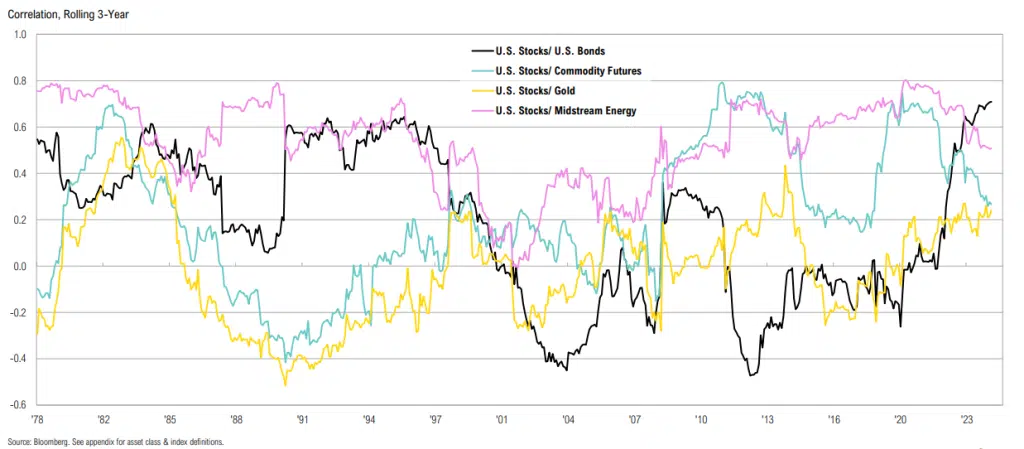

Bonds have recently provided less diversification benefits to stocks than other asset classes

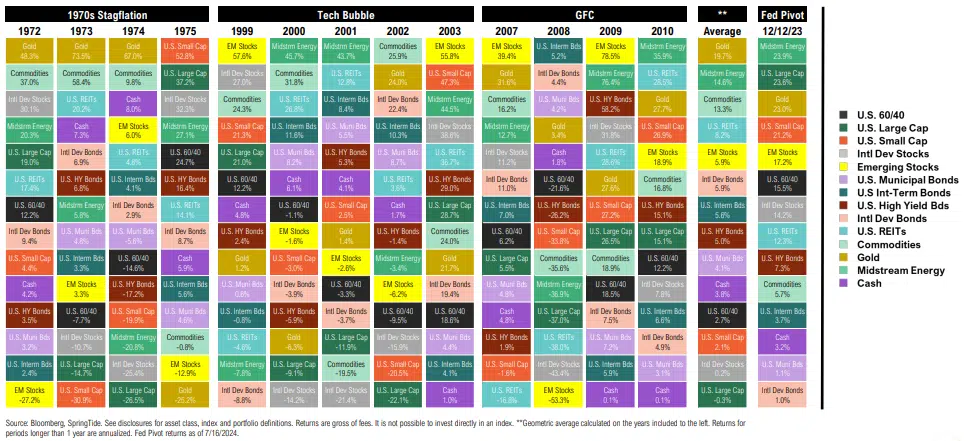

Analogies

Even if not base case, returns during periods of stress (stagflation, bubble unwinds, banking crisis) contrast so starkly with the last 15 years that they should be considered

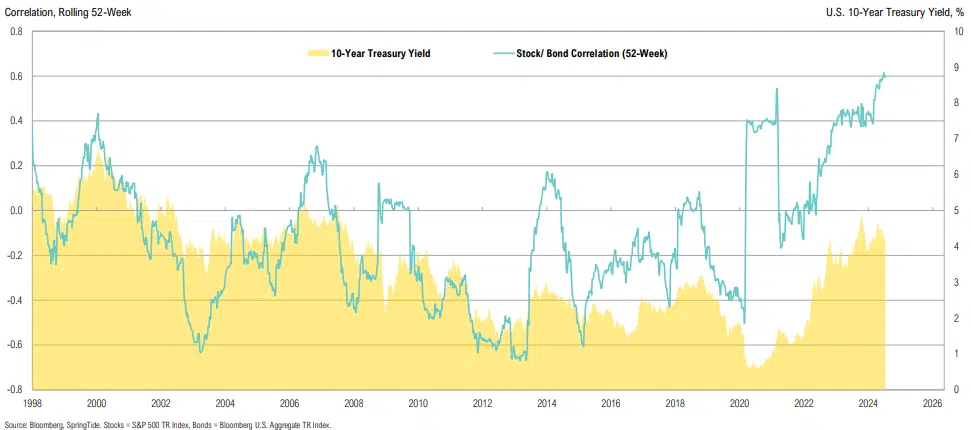

Stock & Bond Correlation

Stocks and bonds remain highly correlated in this higher-rate environment

Correlations

Bonds have recently provided less diversification benefits to stocks than other asset classes

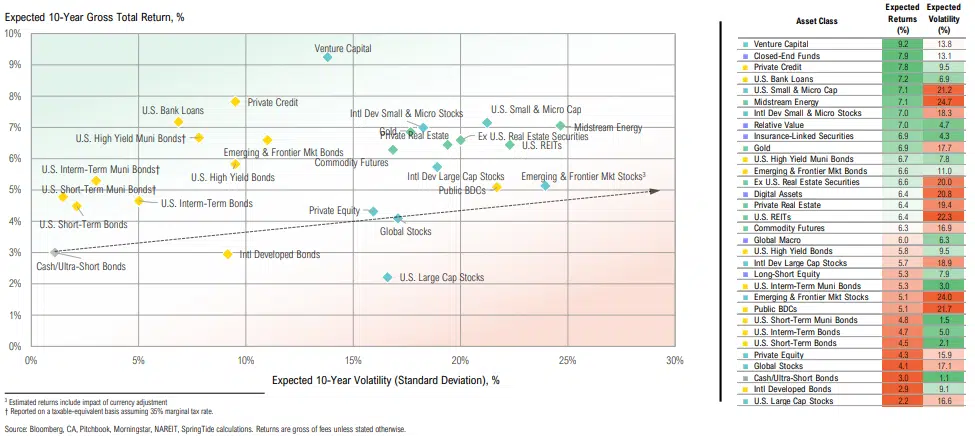

CMEs (As of 6/30/2024)

Expected returns for large cap stocks continue to decline, while small cap stocks look more attractive due to better fundamentals